Global Industrial Automation Market Size, Trends & Analysis - Forecasts to 2026 By Component (Industrial Sensors, Industrial Robots, Industrial 3D Printers, Machine Vision Systems, Process Analysers, Field Instruments, Human-Machine Interface, Industrial PC, and Vibration Monitoring), By Solution (Supervisory Control and Data Acquisition (SCADA), Pulse-Amplitude Modulation (PAM), Programmable Logic Controller (PLC), Distributed Control System (DCS), Manufacturing Execution Systems (MES), and Industrial Safety), By Industry (Process Industries [Oil & Gas, Chemicals, Pharmaceuticals, Energy & Power, Metals & Mining, Pulp & Paper, Food & Beverages, Others] and Discrete Industries [Automotive, Aerospace & Defense, Semiconductor & Electronics, Machine Manufacturing, Medical Devices, Others]), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

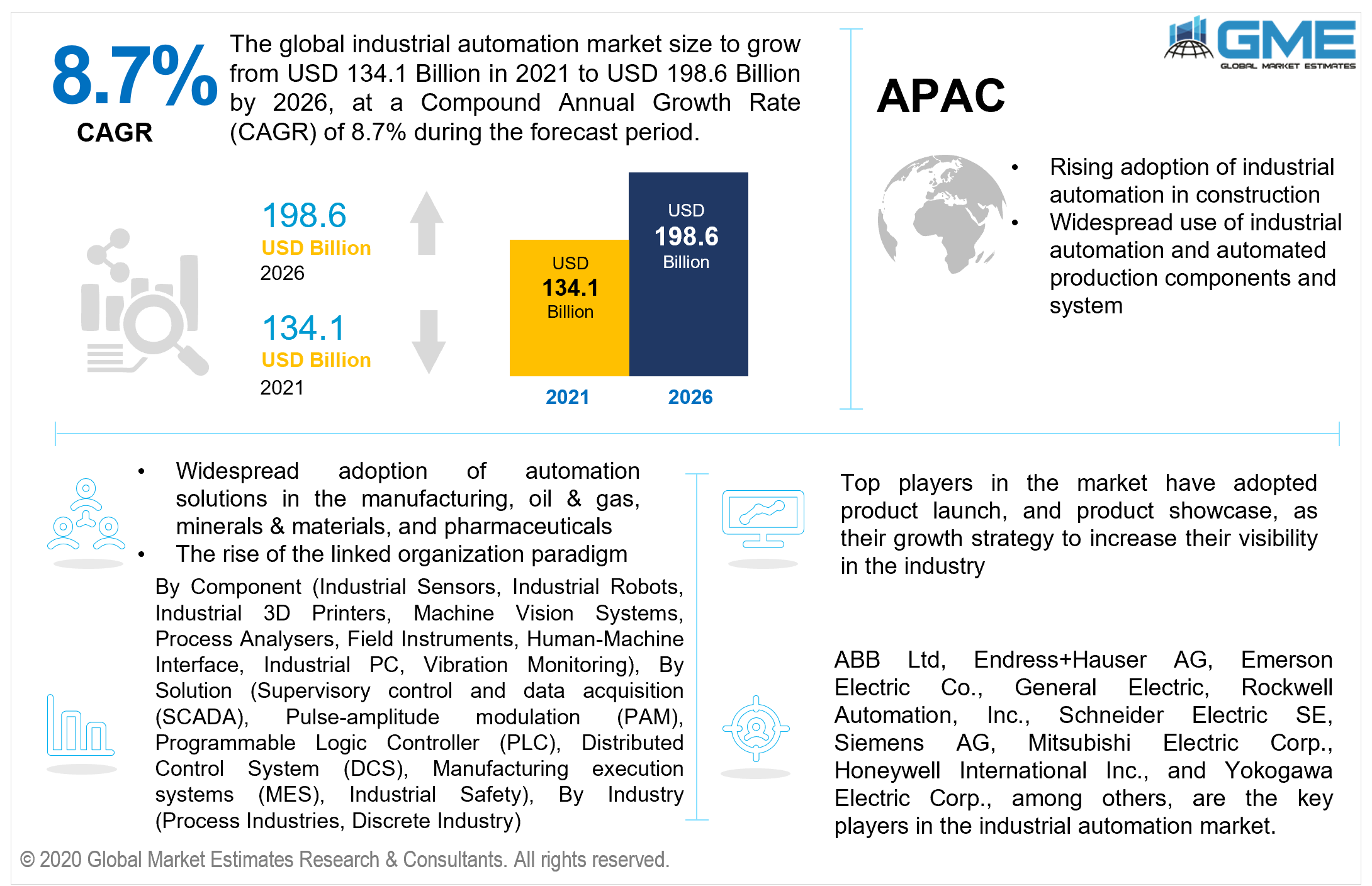

The global industrial automation market is projected to grow from USD 134.1 billion in 2021 to USD 198.6 billion by 2026 at a CAGR value of 8.7% from 2021 to 2026. Automation in the industrial workplace improves performance and efficiency by minimizing duplication and waste, enhancing the quality of life, and giving the industrial process more flexibility. Industrial automation, in the end, results in improved security, durability, and productivity.

The widespread adoption of automation solutions in the manufacturing, oil & gas, minerals & materials, and pharmaceuticals, is causing the industrial automation industry to boom rapidly. With the help of industrial automation, companies can dramatically cut operational and labor expenses by implementing robotic components such as sensors, robotics, machine laser scanners, and organizational management expertise. Manufacturing organizations are rapidly investing in industrial automation technology to increase system accuracy and availability, as well as to remove human labor-related production mistakes thereby, expanding demand for industrial automation during the forecast period.

The rise of the linked organization model is propelling the worldwide industrial control and factory automation market forward coupled with supportive government initiatives that are encouraging industrial automation demand. Additionally, the implementation of burgeoning technologies such as IoT and AI in manufacturing sectors, the increased focus on industry 4.0, and optimized resource utilization, are among the factors contributing to the growth of the industrial control & factory automation market.

Unfortunate incidents or technological breakdowns can result in fatal incidents throughout the production process. As a result, it is critical for the industrial sector to implement safety precautions utilizing automation technology to avoid workplace mishaps. Products that automate safety behavior reduce the likelihood of accidents. As per Occupational Safety and Health Administration (OSHA), the implementation of safety components and factory equipment, the prevalence of catastrophic occupational injuries and illnesses has decreased dramatically to 3.3 per 100 workers from 2018 to 2019 in the United States.

COVID-19 had a negative impact on the industrial factory automation and advanced manufacturing market in 2020, resulting in lower shipments of industrial control and automated production components and revenues. As a result, the market's growth trajectory in the first half of 2020 was slow. This trend is likely to end in the second half of the year, as demand is expected to rise as people become more concerned about intelligent automation, fuel efficiency, and economization.

Industrial equipment and devices use a variety of interfaces, technologies, and protocols to communicate. Due to the sheer lack of standardization in different communications interfaces and standards, data may be misrepresented. Another issue that industrial software system developers encounter is a lack of availability to plant data. However, as a result of various businesses' efforts to improve production rates, the exchange of critical inputs for manufacturing operations is projected to rise in the coming decades.

Based on the component, the market is segmented into industrial sensors, industrial robots, industrial 3D printers, machine vision systems, process analyzers, field instruments, human-machine interface, industrial PC, and vibration monitoring.

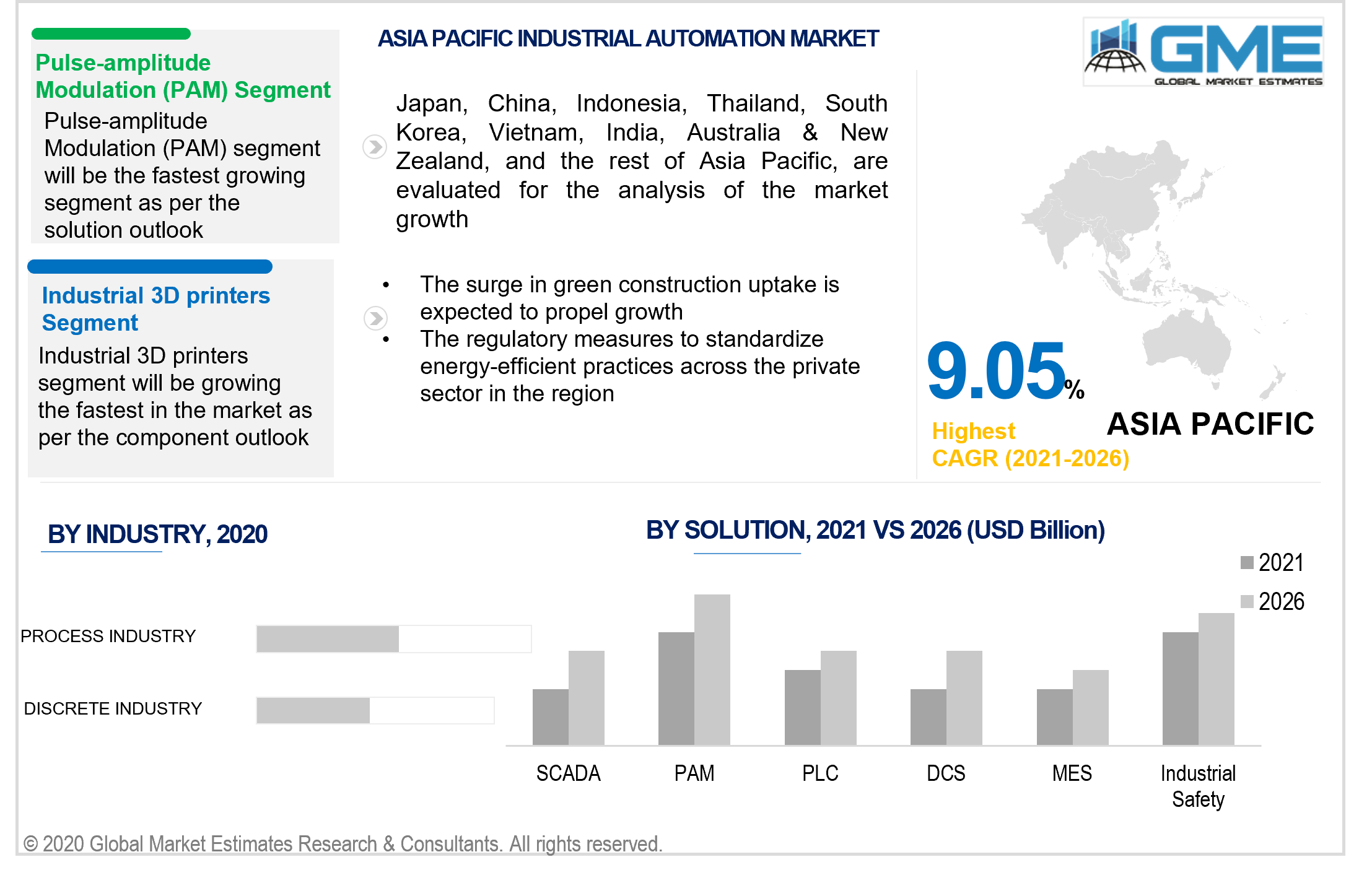

The industrial 3D printers segment is expected to have the largest share in the market during the forecast period. The growing application of 3D printers in industries such as automotive, aviation, food & refreshments, and semiconducting & electronics, as well as the potential of 3D printers to yield lighter weight, cost-effective components with good accuracy, has made it a preferred option for the aerospace sector, resulting in increased use.

Based on the solution, the market is divided into supervisory control and data acquisition (SCADA), pulse-amplitude modulation (PAM), programmable logic controller (PLC), distributed control system (DCS), manufacturing execution systems (MES), and industrial safety.

The pulse-amplitude modulation (PAM) segment is anticipated to have the largest share in the market during the forecast period. The rising adoption of PAM systems in processing and discrete sectors to construct a comprehensive information repository connected to varied equipment deployed in these operations, from downtime performance to lifecycle assessment, might be attributed to the growth of this segment.

Based on industry, the market is segmented into process industries and discrete industries segments. The process industries segment is sub-divided into oil & gas, chemicals, pharmaceuticals, energy & power, metals & mining, pulp & paper, food & beverages, and others. Under the process industry segment, the mining & metals sub-segment is forecasted to grow rapidly as metal processing machinery necessitates efficient, reliable, and economical metal mobility, which is accomplished via drives and PLCs. PLCs bring flexibility to metallurgical processes, whereas drives provide precise speed and torque control. Automation has gained considerable momentum, improved safety, minimized wear, and enhanced product reliability and quality in the mining and metals business.

The discrete industry segment is further fragmented into automotive, aerospace & defense, semiconductor & electronics, machine manufacturing, medical devices, and others (printing, packaging, consumer goods & consumer electronics, jewelry, solar panel manufacturing, and textile). Under the discrete industry segment, the medical devices sub-segment is forecasted to grow rapidly as a result of the development of cutting-edge medical gadgets using revolutionary technologies. Commercial control and industrial manufacturing technologies aid in the improvement of manufacturing methods, management, innovation, third-party solutions, and online assistance in the medical device business.

???????

???????

Based on region, the market can be broken into various regions such as North America, Europe, Central, and South America, the Middle East and Africa, and Asia Pacific regions.

The Asia Pacific region is expected to have a lion’s share in the market during the forecast period, since the construction sector, which is the key end-user of industry control & manufacturing automation, is increasing at a robust pace. APAC has been a major contributor to the growth of the industrial control & factory automation market. The use of industrial automation and automated production components and systems, such as SCADA, DCS, industrial sensors, and robotic systems, is aided by the enormous population in this region's emerging countries, as well as environmental protection. The implementation of industrial control and automation systems in the region is being aided by the surge in green construction uptake and regulatory measures to standardize energy-efficient practices across the private sector.

The North American region is also expected to become the dominant region during the forecast period. To mitigate the financial consequences of the COVID-19 outbreak and other possible economic issues, factories are increasingly relying on automation and digitalization for long-term production. To ensure the safety of workers from infections, manufacturers are limiting human contact and installing device barriers between workers, which is predicted to increase the demand for automated devices and systems. Organizations across all sectors in North America are laying the groundwork for development by raising their automation levels.

ABB Ltd, Endress+Hauser AG, Emerson Electric Co., General Electric, Rockwell Automation, Inc., Schneider Electric SE, Siemens AG, Mitsubishi Electric Corp., Honeywell International Inc., and Yokogawa Electric Corp., among others, are the key players in the industrial automation market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Industrial Automation Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Component Overview

2.1.3 Solution Overview

2.1.4 Industry Overview

2.1.6 Regional Overview

Chapter 3 Industrial Automation Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 The widespread adoption of automation solutions in the manufacturing, oil & gas, minerals & materials, and pharmaceuticals

3.3.2 End-User Challenges

3.3.2.1 Lack of standardisation in different communications interfaces and standards

3.4 Prospective Growth Scenario

3.4.1 Component Growth Scenario

3.4.2 Solution Growth Scenario

3.4.3 Industry Growth Scenario

3.5 COVID-19 Influence over End-User Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Industry Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Industrial Automation Market, By Component

4.1 Component Outlook

4.2 Industrial Sensors, Industrial Robots, Industrial 3D Printers, Machine Vision Systems, Process Analysers, Field Instruments, Human-Machine Interface, Industrial PC, Vibration Monitoring

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Industrial Robots

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Industrial 3D Printers

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Machine Vision Systems

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

4.6 Process Analysers

4.6.1 Market Size, By Region, 2020-2026 (USD Billion)

4.7 Field Instruments

4.7.1 Market Size, By Region, 2020-2026 (USD Billion)

4.8 Human-Machine Interface

4.8.1 Market Size, By Region, 2020-2026 (USD Billion)

4.9 Industrial PC

4.9.1 Market Size, By Region, 2020-2026 (USD Billion)

4.10 Vibration Monitoring

4.10.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Industrial Automation Market, By Solution

5.1 Solution Outlook

5.2 Supervisory control and data acquisition (SCADA)

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Pulse-amplitude modulation (PAM)

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Programmable Logic Controller (PLC)

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Distributed Control System (DCS)

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Manufacturing execution systems (MES),

5.6.1 Market Size, By Region, 2020-2026 (USD Billion)

5.7 Industrial Safety

5.7.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Industrial Automation Market, By Industry

6.1 Process Industry

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Discrete Industry

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Industrial Automation Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Component, 2020-2026 (USD Billion)

7.2.3 Market Size, By Solution, 2020-2026 (USD Billion)

7.2.4 Market Size, By Industry, 2020-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Component, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By Solution, 2020-2026 (USD Billion)

7.2.4.3 Market Size, By Industry, 2020-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Component, 2020-2026 (USD Billion)

7.2.7.2 Market Size, By Solution, 2020-2026 (USD Billion)

7.2.7.3 Market Size, By Industry, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Component, 2020-2026 (USD Billion)

7.3.3 Market Size, By Solution, 2020-2026 (USD Billion)

7.3.4 Market Size, By Industry, 2020-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Component, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Solution, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By Industry, 2020-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Component, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Solution, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Industry, 2020-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Component, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Solution, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Industry, 2020-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Component, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Solution, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By Industry, 2020-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Component, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Solution, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By Industry, 2020-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Component, 2020-2026 (USD Billion)

7.3.11.2 Market Size, By Solution, 2020-2026 (USD Billion)

7.3.11.3 Market Size, By Industry, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Component, 2020-2026 (USD Billion)

7.4.3 Market Size, By Solution, 2020-2026 (USD Billion)

7.4.4 Market Size, By Industry, 2020-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Component, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Solution, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By Industry, 2020-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Component, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Solution, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Industry, 2020-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Component, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Solution, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Industry, 2020-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Component, 2020-2026 (USD Billion)

7.4.9.2 Market size, By Solution, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By Industry, 2020-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Component, 2020-2026 (USD Billion)

7.4.10.2 Market Size, By Solution, 2020-2026 (USD Billion)

7.4.10.3 Market Size, By Industry, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Component, 2020-2026 (USD Billion)

7.5.3 Market Size, By Solution, 2020-2026 (USD Billion)

7.5.4 Market Size, By Industry, 2020-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Component, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Solution, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By Industry, 2020-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Component, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Solution, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Industry, 2020-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Component, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Solution, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Industry, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Component, 2020-2026 (USD Billion)

7.6.3 Market Size, By Solution, 2020-2026 (USD Billion)

7.6.4 Market Size, By Industry, 2020-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Component, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Solution, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By Industry, 2020-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Component, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Solution, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Industry, 2020-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Component, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Solution, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Industry, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 ABB Ltd

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Infographic Analysis

8.3 Endress+Hauser AG

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Infographic Analysis

8.4 Emerson Electric Co

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Infographic Analysis

8.5 General Electric

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Infographic Analysis

8.6 Rockwell Automation, Inc.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Infographic Analysis

8.7 Schneider Electric SE

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Infographic Analysis

8.8 Siemens AG

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.9 Mitsubishi Electric Corp

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.10 Honeywell International Inc

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Infographic Analysis

8.11 Yokogawa Electric Corp

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Infographic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Infographic Analysis

The Global Industrial Automation Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Industrial Automation Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS