Global Industrial Seals Market Size, Trends & Analysis - Forecasts to 2026 By Type (Axial Seals, Radial Seals, and Mechanical Seals [Pusher, Non-Pusher, Conventional Seals, Balanced Seals, Unbalanced Seals, Cartridge Seals]), By Material (Fiber, Fluorosilicone, PTFE, Rubber, Other Materials), By End-User (Mining, Food & Beverages, Oil & Gas, Energy & Power, Aerospace, Marine, Construction, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

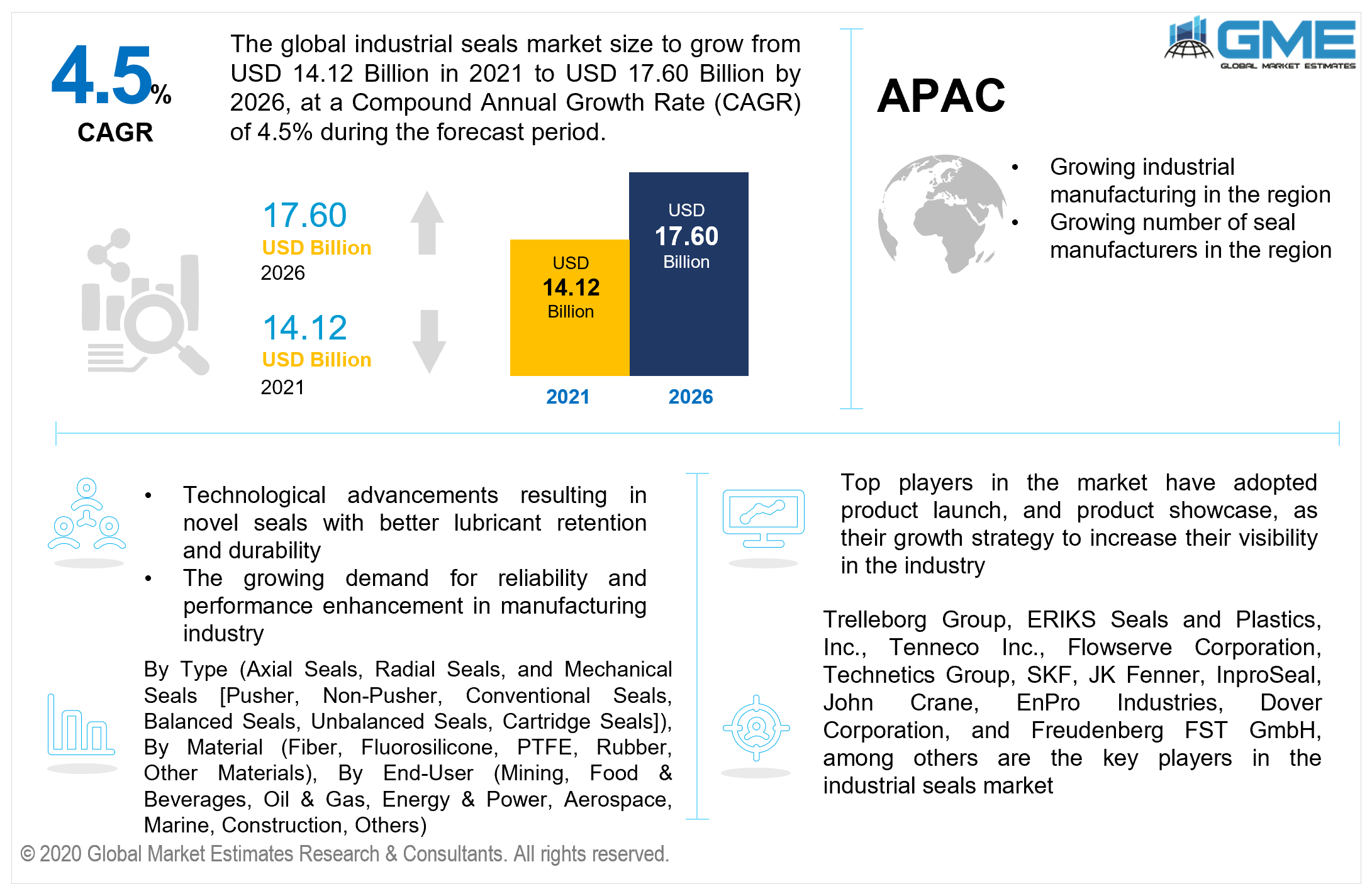

The global industrial seals market is projected to grow from USD 14.12 billion in 2021 to USD 17.60 billion by 2026 at a CAGR value of 4.5% between 2021 to 2026. Industrial seals are used in manufacturing industries as they can strengthen the machine’s performance through improved reliability and efficiency. Such seals allow to boost the machine efficiency through increased lubrication retention and prevent contamination of the bearings thereby reducing machine downtimes and ensuring machines can continue working in suboptimal conditions.

The market is driven by the growing demand for seals from the oil and gas industry as well as the chemical and petrochemical industry. The burgeoning demand for stable and durable seals with high thermal resistance is envisaged to become instrumental in the development of the market during the forecast period. Manufacturing units in industries are required to have long run times which leads to increased temperature build-up in the machinery. The increased temperatures require the use of seals with good thermal resistance to improve the optimization and efficiency of the machinery. The growing manufacturing industry across the globe is expected to enhance the demand for industrial seals.

Industrial seal manufacturers are also beginning to focus on developing novel seals with better durability using elastomers, which is also expected to have a positive influence on the demand for these products. Technological advancements in the industry have also had a crucial role to enact in the development of new advanced seals with better performance from novel material compositions.

The COVID-19 pandemic has had a massive impact on the market especially in 2020. Government regulations forced manufacturing units to suspend production activities which led to supply chain issues such as lack of availability of raw materials and created fluctuations in raw material prices. With the suspension of production, industries suffered from cash flow constraints and reduced the exports and imports of products. These effects are expected to be a short-term constraint as industries resume production. The overall market is envisaged to bounce back in 2021.

The market is tied up with manufacturing units, stagnant industrialization as that experienced by the automobile industry will act as restraints to the growth of the market. The high labor costs and maintenance requirements have resulted in consumers beginning to prefer seal-less driving shafts. The growth of seal-less shafts is expected to hamper the growth of the market during the forecast period.

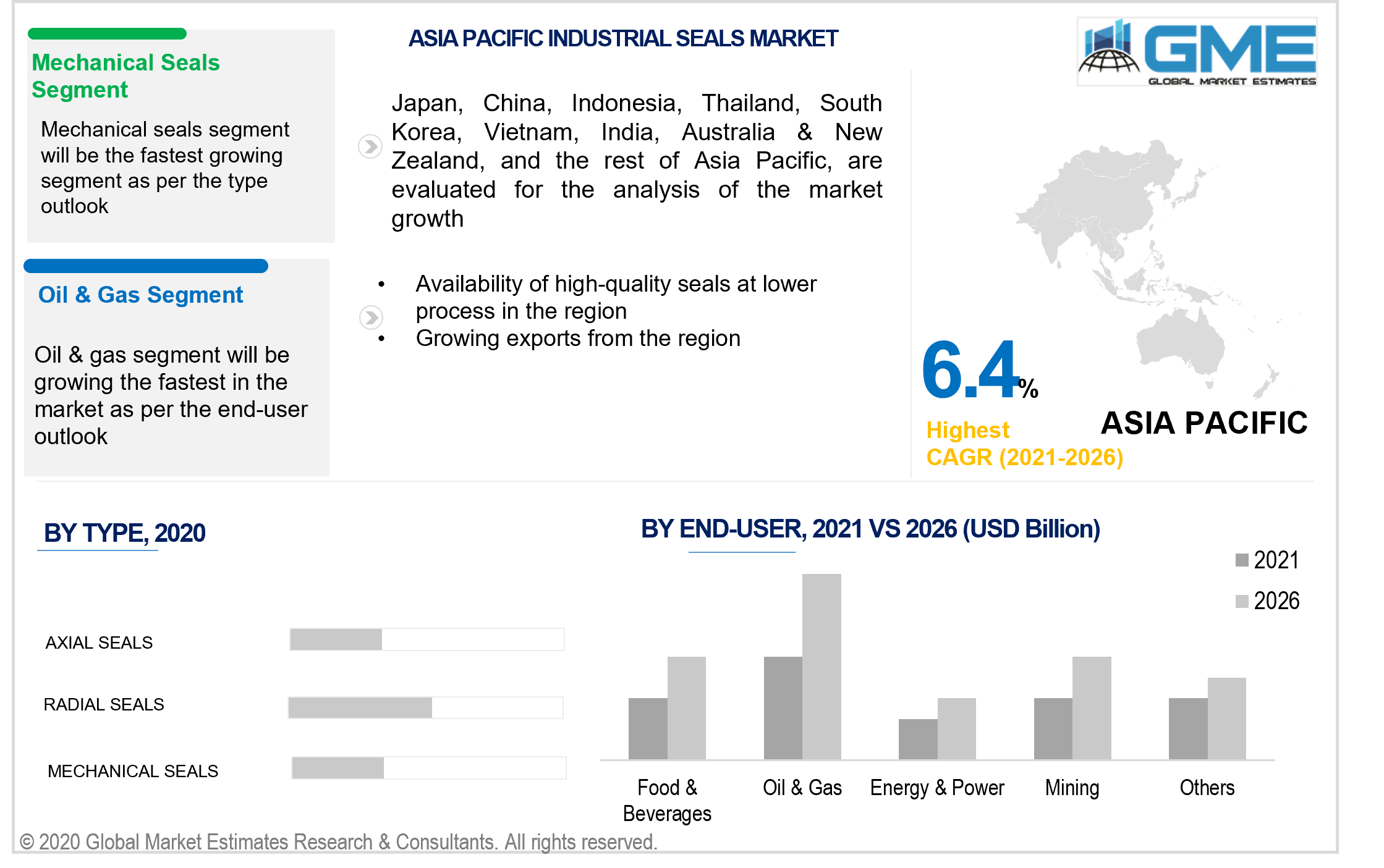

Based on the type, the market is segmented into axial seals, radial seals, and mechanical seals. The radial seals segment is envisaged to hold the dominant share of the market in terms of revenue. The radial shaft segment is driven by the growing inclination of manufacturers towards contacting seals in various industries. The mechanical seal's segment is expected to show better growth rates than the other segments during the forecast period. Growing usage of small diameter shafts and large diameter shafts by various end-use industries are expected to enhance the demand for mechanical seals. The growing industrial sector in developing nations is expected to have a positive influence on the growth of the mechanical seal's segment.

Based on the various materials that are used to manufacture seals, the market is segmented into the fiber, fluorosilicone, PTFE, rubber, and other materials. The PTFE segment held the lion's share of the market revenues during the forecast period. PTFE seals are self-lubricating which makes them ideal for application involving dry and abrasive media. They offer lower friction and therefore have a longer lifespan. PTFE is an inert material that makes them resistant to various chemicals and acids. This segment is also expected to grow at a faster growth rate than the other segments during the forecast period.

Based on the end-user, the market is segmented into mining, food & beverages, oil & gas, energy & power, aerospace, marine, construction, and others. The oil & gas segment is expected to hold the dominant share of the market during the forecast period. Growing demand for energy across various industries is expected to have a positive influence on the growth of the market. The oil & gas segment is envisaged to become the fastest-growing segment. Seals allow for lubrication retention and enhance the reliability of machinery used in the oil & gas industry thereby increasing the demand for seals in this industry. The need for long-running hours and shorter maintenance periods in this industry is instrumental to the growth of this segment during the forecast period.

Based on region, the market is segmented into regions such as North America, Europe, Central & South America, Middle East & North Africa, and Asia Pacific regions. The APAC region is expected to hold the lion’s share of the market while also growing at the fastest growth rates during the forecast period. Countries like China, India, and Indonesia are becoming increasingly industrialized and are turning major exporters of various industrial machinery and products. The progression of the industrial sector in these countries is expected to enhance the growth of the market in the region.

The growing number of seal manufacturers combined with the increasing availability of skilled labor in the region is anticipated to improve the APAC market. The competitive nature of the APAC market has increased the availability of high-quality seals at competitive prices in the region which has increased regional sales.

Trelleborg Group, ERIKS Seals and Plastics, Inc., Tenneco Inc., Flowserve Corporation, Technetics Group, SKF, JK Fenner, InproSeal, John Crane, EnPro Industries, Dover Corporation, and Freudenberg FST GmbH, among others are the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Industrial Seals Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Material Overview

2.1.4 End-User Overview

2.1.6 Regional Overview

Chapter 3 Global Industrial Seals Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing demand for improving reliability and reducing downtimes in manufacturing industries

3.3.2 Industry Challenges

3.3.2.1 Growing demand for seal-less shafts among industrial manufacturers

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Material Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Industry Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Industrial Seals Market, By Type

4.1 Type Outlook

4.2 Axial Seals

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Radial Seals

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Mechanical Seals

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Global Industrial Seals Market, By Material

5.1 Material Outlook

5.2 Fiber

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Fluorosilicone

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 PTFE

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Rubber

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Other Materials

5.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Global Industrial Seals Market, By End-User

6.1 Mining

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Food & Beverages

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Oil & Gas

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Energy & Power

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

6.5 Aerospace

6.5.1 Market Size, By Region, 2020-2026 (USD Billion)

6.6 Marine

6.6.1 Market Size, By Region, 2020-2026 (USD Billion)

6.7 Construction

6.7.1 Market Size, By Region, 2020-2026 (USD Billion)

6.8 Others

6.8.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Global Industrial Seals Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Type, 2020-2026 (USD Billion)

7.2.3 Market Size, By Material, 2020-2026 (USD Billion)

7.2.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By Material, 2020-2026 (USD Billion)

7.2.4.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.2.7.2 Market Size, By Material, 2020-2026 (USD Billion)

7.2.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Type, 2020-2026 (USD Billion)

7.3.3 Market Size, By Material, 2020-2026 (USD Billion)

7.3.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Material, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Material, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Material, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Material, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Material, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.11.2 Market Size, By Material, 2020-2026 (USD Billion)

7.3.11.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Type, 2020-2026 (USD Billion)

7.4.3 Market Size, By Material, 2020-2026 (USD Billion)

7.4.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Material, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Material, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Material, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.9.2 Market size, By Material, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.10.2 Market Size, By Material, 2020-2026 (USD Billion)

7.4.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Type, 2020-2026 (USD Billion)

7.5.3 Market Size, By Material, 2020-2026 (USD Billion)

7.5.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Material, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Material, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Material, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Type, 2020-2026 (USD Billion)

7.6.3 Market Size, By Material, 2020-2026 (USD Billion)

7.6.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Material, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Material, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Material, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Trelleborg Group

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 ERIKS Seals and Plastics, Inc.

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Tenneco Inc.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Flowserve Corporation

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Technetics Group

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 SKF

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 JK Fenner

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 InproSeal

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 John Crane

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 EnPro Industries

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Dover Corporation

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

8.13 Freudenberg FST GmbH

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Info Graphic Analysis

8.14 Other Companies

8.14.1 Company Overview

8.14.2 Financial Analysis

8.14.3 Strategic Positioning

8.14.4 Info Graphic Analysis

The Global Industrial Seals Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Industrial Seals Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS