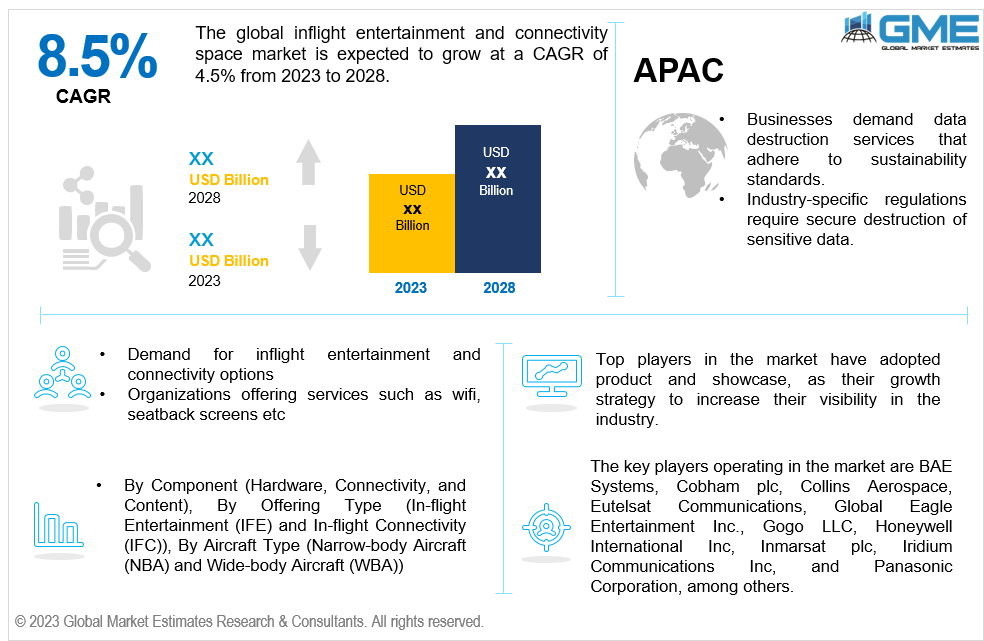

Global Inflight Entertainment and Connectivity Space Market Size, Trends & Analysis - Forecasts to 2028 By Component (Hardware, Connectivity, and Content), By Offering Type (In-flight Entertainment (IFE) and In-flight Connectivity (IFC)), By Aircraft Type (Narrow-Body Aircraft (NBA) and Wide-Body Aircraft (WBA)), and By Region (North America, Asia Pacific, Central & South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global inflight entertainment and connectivity space market is expected to grow at a CAGR of 8.5% from 2023 to 2028. The global inflight entertainment and connectivity space market comprises hardware, software, and connectivity solutions that enable passengers to access entertainment content, stay connected to the internet, and use various interactive services during their flights. Seatback displays, wireless streaming, in-flight Wi-Fi, on-demand movie and audio, gaming, and connectivity for portable electronic devices are some of the features it offers.

The market size of the global inflight entertainment and connectivity space is influenced by various factors such as increasing air travel, passenger demand for enhanced onboard entertainment and connectivity, advancements in technology, and the adoption of wireless solutions by airlines.

Airlines collaborate with content providers and licensors to offer a wide selection of movies, TV shows, music, games, and other digital content. Partnerships with streaming platforms and studios ensure a diverse and updated library of entertainment options for passengers. The global inflight entertainment and connectivity space services pave way for opportunities arising from ancillary revenue for airlines. They can generate revenue through paid Wi-Fi plans, advertising, sponsorships, and premium content offerings, contributing to their overall profitability.

The global inflight entertainment and connectivity space market is significantly competitive, with key players constantly brainstorming and introducing new technologies and services. The market is characterized by a range of offerings, including seatback screens, wireless streaming, on-demand content, live TV, in-flight Wi-Fi, and interactive applications. Airlines prioritize global inflight entertainment and connectivity space investments to improve the passenger experience, differentiate their brand, and retain customer loyalty.

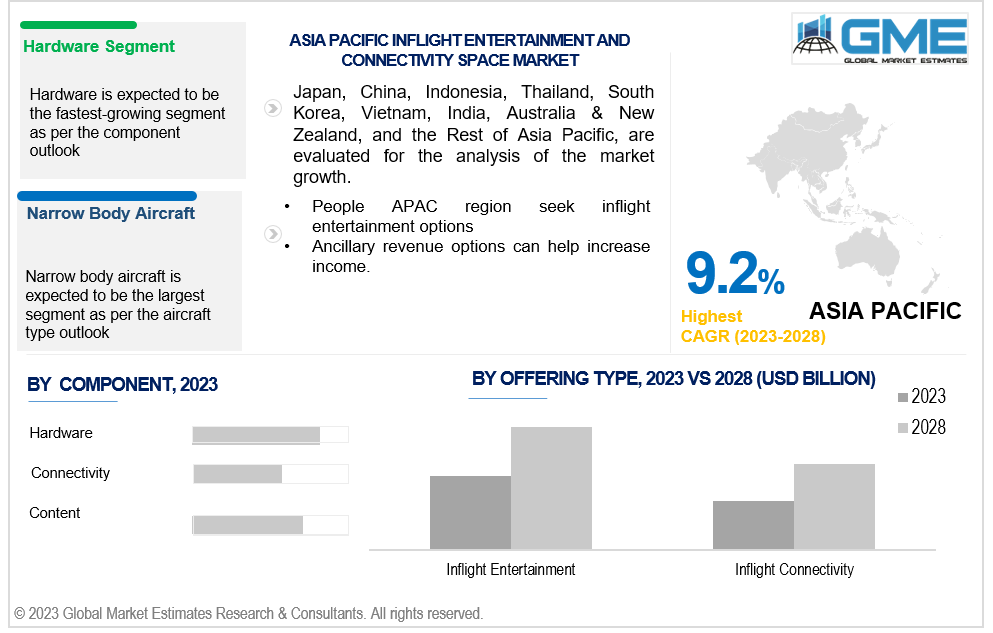

Based on the components, the market is primarily divided into categories namely hardware, connectivity, and content. The inflight entertainment market’s hardware segment mainly has portable and non-portable good classification. Due to aircraft rules put in place by various aviation authorities, the non-portable category, which currently holds a monopoly in the market, will experience moderate growth. Furthermore, the industry will see a significant increase due to the growing technological advancement for improving passenger experience.

Based on offering type, the market offers in-flight entertainment and in-flight connectivity (IFC). Major carriers provide a range of services, including seatback screens, wireless streaming, and in-flight Wi-Fi. This allows passengers to enjoy a range of entertainment content, access the web and stay connected while on a flights. The industry is being pushed by increased air travel, the growth of low-cost airlines, and the rising demand for connection and entertainment aboard aeroplanes. Regulations, the make-up of the aircraft fleet, and passenger demographics may also have an impact on the availability of inflight entertainment and connection services on particular routes or within particular geographic areas.

Based on aircraft type, the market is segmented into narrow-body aircraft (NBA) and wide-body aircraft (WBA). The narrow body segment is expected to dominate the market during the forecast period. The demand for narrow-body aircraft and the expansion of the aircraft fleet are to blame for the segment's rise.

The installation of additional inflight entertainment space in wide body aircraft in accordance with total seating and aircraft class type is what has caused the category to develop.

North America is analysed to be the largest region in the global inflight entertainment and connectivity space market during the forecast period. North America is a key market for inflight entertainment and connectivity, driven by the presence of major airlines and technological advancements in the region. The demand for enhanced passenger experiences and connectivity options during flights is high. Many airlines in North America offer in-flight Wi-Fi services and a wide range of entertainment options, including streaming services and seatback screens.

Asia Pacific is witnessing significant growth in the global inflight entertainment and connectivity space market, fuelled by the increasing number of air passengers, growing middle-class population, and expanding airline networks. The region has a large market potential, with several emerging economies and a growing demand for enhanced in-flight experiences. Airlines in the region are investing in inflight entertainment and connectivity technologies to cater to the preferences of tech-savvy passengers.

The market dynamics and trends in the inflight entertainment and connectivity space varies within each region, influenced by factors such as airline preferences, passenger demographics, regulatory environment, and technological advancements.

The key players operating in the market are BAE Systems, Cobham plc, Collins Aerospace, Eutelsat Communications, Global Eagle Entertainment Inc., Gogo LLC, Honeywell International Inc, Inmarsat plc, Iridium Communications Inc, and Panasonic Corporation, among others. While most of these and other players offer common options such as seatback screens and Wi-Fi, some also choose provide customized and tailored connectivity solutions to their clients. These key players, along with several other companies in the industry, collaborate with airlines to deliver innovative inflight entertainment and connectivity solutions that enhance the passenger experience and meet the evolving demands of the aviation industry. They invest in research and development to advance technology, improve connectivity, and deliver compelling content options for airlines and their passengers.

Please note: This is not an exhaustive list of companies profiled in the report.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics

3 GLOBAL INFLIGHT ENTERTAINMENT AND CONNECTIVITY SPACE MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL INFLIGHT ENTERTAINMENT AND CONNECTIVITY SPACE MARKET, BY COMPONENT

4.1 Introduction

4.2 Inflight Entertainment and Connectivity Space Market: Component Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Hardware

4.4.1 Hardware Market Estimates and Forecast, 2020-2028 (USD Billion)

4.5 Connectivity

4.5.1 Connectivity Market Estimates and Forecast, 2020-2028 (USD Billion)

4.6 Content

4.6.1 Content Market Estimates and Forecast, 2020-2028 (USD Billion)

5 GLOBAL INFLIGHT ENTERTAINMENT AND CONNECTIVITY SPACE MARKET, BY OFFERING TYPE

5.1 Introduction

5.2 Inflight Entertainment and Connectivity Space Market : Offering Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 In-flight Entertainment (IFE)

5.4.1 In-flight Entertainment (IFE) Market Estimates and Forecast, 2020-2028 (USD Billion)

5.5 In-flight Connectivity (IFC)

5.5.1 In-flight Connectivity (IFC) Market Estimates and Forecast, 2020-2028 (USD Billion)

6 GLOBAL INFLIGHT ENTERTAINMENT AND CONNECTIVITY SPACE MARKET, BY AIRCRAFT TYPE

6.1 Introduction

6.2 Inflight Entertainment and Connectivity Space Market: Aircraft Type Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4 Narrow-body Aircraft (NBA)

6.4.1 Narrow-body Aircraft (NBA) Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5 Wide-body Aircraft (WBA)

6.5.1 Wide-body Aircraft (WBA) Market Estimates and Forecast, 2020-2028 (USD Billion)

7 GLOBAL INFLIGHT ENTERTAINMENT AND CONNECTIVITY SPACE MARKET, BY REGION

7.1 Introduction

7.2 North America Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.2.1 By Component

7.2.2 By Offering Type

7.2.3 By Aircraft Type

7.2.4 By Country

7.2.4.1 U.S. Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.2.4.1.1 By Component

7.2.4.1.2 By Offering Type

7.2.4.1.3 By Aircraft Type

7.2.4.2 Canada Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.2.4.2.1 By Component

7.2.4.2.2 By Offering Type

7.2.4.2.3 By Aircraft Type

7.2.4.3 Mexico Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.2.4.3.1 By Component

7.2.4.3.2 By Offering Type

7.2.4.3.3 By Aircraft Type

7.3 Europe Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.1 By Component

7.3.2 By Offering Type

7.3.3 By Aircraft Type

7.3.4 By Country

7.3.4.1 Germany Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.1.1 By Component

7.3.4.1.2 By Offering Type

7.3.4.1.3 By Aircraft Type

7.3.4.2 U.K. Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.2.1 By Component

7.3.4.2.2 By Offering Type

7.3.4.2.3 By Aircraft Type

7.3.4.3 France Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.3.1 By Component

7.3.4.3.2 By Offering Type

7.3.4.3.3 By Aircraft Type

7.3.4.4 Italy Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.4.1 By Component

7.3.4.4.2 By Offering Type

7.2.4.4.3 By Aircraft Type

7.3.4.5 Spain Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.5.1 By Component

7.3.4.5.2 By Offering Type

7.2.4.5.3 By Aircraft Type

7.3.4.6 Netherlands Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.6.1 By Component

7.3.4.6.2 By Offering Type

7.2.4.6.3 By Aircraft Type

7.3.4.7 Rest of Europe Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.7.1 By Component

7.3.4.7.2 By Offering Type

7.2.4.7.3 By Aircraft Type

7.4 Asia Pacific Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.1 By Component

7.4.2 By Offering Type

7.4.3 By Aircraft Type

7.4.4 By Country

7.4.4.1 China Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.1.1 By Component

7.4.4.1.2 By Offering Type

7.4.4.1.3 By Aircraft Type

7.4.4.2 Japan Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.2.1 By Component

7.4.4.2.2 By Offering Type

7.4.4.2.3 By Aircraft Type

7.4.4.3 India Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.3.1 By Component

7.4.4.3.2 By Offering Type

7.4.4.3.3 By Aircraft Type

7.4.4.4 South Korea Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.4.1 By Component

7.4.4.4.2 By Offering Type

7.4.4.4.3 By Aircraft Type

7.4.4.5 Singapore Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.5.1 By Component

7.4.4.5.2 By Offering Type

7.4.4.5.3 By Aircraft Type

7.4.4.6 Malaysia Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.6.1 By Component

7.4.4.6.2 By Offering Type

7.4.4.6.3 By Aircraft Type

7.4.4.7 Thailand Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.7.1 By Component

7.4.4.7.2 By Offering Type

7.4.4.7.3 By Aircraft Type

7.4.4.8 Indonesia Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.8.1 By Component

7.4.4.8.2 By Offering Type

7.4.4.8.3 By Aircraft Type

7.4.4.9 Vietnam Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.9.1 By Component

7.4.4.9.2 By Offering Type

7.4.4.9.3 By Aircraft Type

7.4.4.10 Taiwan Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.10.1 By Component

7.4.4.10.2 By Offering Type

7.4.4.10.3 By Aircraft Type

7.4.4.11 Rest of Asia Pacific Inflight Entertainment and Connectivity Market Space Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.11.1 By Component

7.4.4.11.2 By Offering Type

7.4.4.11.3 By Aircraft Type

7.5 Middle East and Africa Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.1 By Component

7.5.2 By Offering Type

7.5.3 By Aircraft Type

7.5.4 By Country

7.5.4.1 Saudi Arabia Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.4.1.1 By Component

7.5.4.1.2 By Offering Type

7.5.4.1.3 By Aircraft Type

7.5.4.2 U.A.E. Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.4.2.1 By Component

7.5.4.2.2 By Offering Type

7.5.4.2.3 By Aircraft Type

7.5.4.3 Israel Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.4.3.1 By Component

7.5.4.3.2 By Offering Type

7.5.4.3.3 By Aircraft Type

7.5.4.4 South Africa Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.4.4.1 By Component

7.5.4.4.2 By Offering Type

7.5.4.4.3 By Aircraft Type

7.5.4.5 Rest of Middle East and Africa Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.4.5.1 By Component

7.5.4.5.2 By Offering Type

7.5.4.5.2 By Aircraft Type

7.6 Central & South America Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.6.1 By Component

7.6.2 By Offering Type

7.6.3 By Aircraft Type

7.6.4 By Country

7.6.4.1 Brazil Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.6.4.1.1 By Component

7.6.4.1.2 By Offering Type

7.6.4.1.3 By Aircraft Type

7.6.4.2 Argentina Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.6.4.2.1 By Component

7.6.4.2.2 By Offering Type

7.6.4.2.3 By Aircraft Type

7.6.4.3 Chile Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.6.4.3.1 By Component

7.6.4.3.2 By Offering Type

7.6.4.3.3 By Aircraft Type

7.6.4.4 Rest of Central & South America Inflight Entertainment and Connectivity Space Market Estimates and Forecast, 2020-2028 (USD Billion)

7.6.4.4.1 By Component

7.6.4.4.2 By Offering Type

7.6.4.4.3 By Aircraft Type

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 BAE Systems

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Cobham plc.

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Collins Aerospace

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Eutelsat Communications

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Global Eagle Entertainment Inc.

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 Gogo LLC

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Honeywell International Inc

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Inmarsat plc

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Iridium Communications Inc

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Panasonic Corporation

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Inflight Entertainment and Connectivity Space MARKET, By Component, 2020-2028 (USD Billion)

2 Hardware MARKET, By Region, 2020-2028 (USD Billion)

3 Connectivity Market, By Region, 2020-2028 (USD Billion)

4 Content Market, By Region, 2020-2028 (USD Billion)

5 Global Inflight Entertainment and Connectivity Space MARKET, By Offering Type, 2020-2028 (USD Billion)

6 In-flight Entertainment (IFE) MARKET, By Region, 2020-2028 (USD Billion)

7 In-flight Connectivity (IFC) MARKET, By Region, 2020-2028 (USD Billion)

8 Global Inflight Entertainment and Connectivity Space MARKET, By Aircraft Type, 2020-2028 (USD Billion)

9 Narrow-Body Aircraft (NBA) MARKET, By Region, 2020-2028 (USD Billion)

10 Wide-Body Aircraft (WBA) MARKET, By Region, 2020-2028 (USD Billion)

11 Regional Analysis, 2020-2028 (USD Billion)

12 North America Inflight Entertainment and Connectivity Space MARKET, By Component, 2020-2028 (USD Billion)

13 North America Inflight Entertainment and Connectivity Space MARKET, By Offering Type, 2020-2028 (USD Billion)

14 North America Inflight Entertainment and Connectivity Space MARKET, By Aircraft Type, 2020-2028 (USD Billion)

15 North America Inflight Entertainment and Connectivity Space MARKET, By Country, 2020-2028 (USD Billion)

16 U.S Inflight Entertainment and Connectivity Space MARKET, By Component, 2020-2028 (USD Billion)

17 U.S Inflight Entertainment and Connectivity Space MARKET, By Offering Type, 2020-2028 (USD Billion)

18 U.S Inflight Entertainment and Connectivity Space MARKET, By Aircraft Type, 2020-2028 (USD Billion)

19 Canada Inflight Entertainment and Connectivity Space MARKET, By Component, 2020-2028 (USD Billion)

20 Canada Inflight Entertainment and Connectivity Space MARKET, By Offering Type, 2020-2028 (USD Billion)

21 Canada Inflight Entertainment and Connectivity Space MARKET, By Aircraft Type, 2020-2028 (USD Billion)

22 Mexico Inflight Entertainment and Connectivity Space MARKET, By Component, 2020-2028 (USD Billion)

23 Mexico Inflight Entertainment and Connectivity Space MARKET, By Offering Type, 2020-2028 (USD Billion)

24 Mexico Inflight Entertainment and Connectivity Space MARKET, By Aircraft Type, 2020-2028 (USD Billion)

25 Europe Inflight Entertainment and Connectivity Space MARKET, By Component, 2020-2028 (USD Billion)

26 Europe Inflight Entertainment and Connectivity Space MARKET, By Offering Type, 2020-2028 (USD Billion)

27 Europe Inflight Entertainment and Connectivity Space MARKET, By Aircraft Type, 2020-2028 (USD Billion)

28 Europe Inflight Entertainment and Connectivity Space MARKET, By country, 2020-2028 (USD Billion)

29 Germany Inflight Entertainment and Connectivity Space MARKET, By Component, 2020-2028 (USD Billion)

30 Germany Inflight Entertainment and Connectivity Space MARKET, By Offering Type, 2020-2028 (USD Billion)

31 Germany Inflight Entertainment and Connectivity Space MARKET, By Aircraft Type, 2020-2028 (USD Billion)

32 UK Inflight Entertainment and Connectivity Space MARKET, By Component, 2020-2028 (USD Billion)

33 UK Inflight Entertainment and Connectivity Space MARKET, By Offering Type, 2020-2028 (USD Billion)

34 UK Inflight Entertainment and Connectivity Space MARKET, By Aircraft Type, 2020-2028 (USD Billion)

35 France Inflight Entertainment and Connectivity Space MARKET, By Component, 2020-2028 (USD Billion)

36 France Inflight Entertainment and Connectivity Space MARKET, By Offering Type, 2020-2028 (USD Billion)

37 France Inflight Entertainment and Connectivity Space MARKET, By Aircraft Type, 2020-2028 (USD Billion)

38 Italy Inflight Entertainment and Connectivity Space MARKET, By Component, 2020-2028 (USD Billion)

39 Italy Inflight Entertainment and Connectivity Space MARKET, By T Offering Type Type, 2020-2028 (USD Billion)

40 Italy Inflight Entertainment and Connectivity Space MARKET, By Aircraft Type, 2020-2028 (USD Billion)

41 Spain Inflight Entertainment and Connectivity Space MARKET, By Component, 2020-2028 (USD Billion)

42 Spain Inflight Entertainment and Connectivity Space MARKET, By Offering Type, 2020-2028 (USD Billion)

43 Spain Inflight Entertainment and Connectivity Space MARKET, By Aircraft Type, 2020-2028 (USD Billion)

44 Rest Of Europe Inflight Entertainment and Connectivity Space MARKET, By Component, 2020-2028 (USD Billion)

45 Rest Of Europe Inflight Entertainment and Connectivity Space MARKET, By Offering Type, 2020-2028 (USD Billion)

46 Rest of Europe Inflight Entertainment and Connectivity Space MARKET, By Aircraft Type, 2020-2028 (USD Billion)

47 Asia Pacific Inflight Entertainment and Connectivity Space MARKET, By Component, 2020-2028 (USD Billion)

48 Asia Pacific Inflight Entertainment and Connectivity Space MARKET, By Offering Type, 2020-2028 (USD Billion)

49 Asia Pacific Inflight Entertainment and Connectivity Space MARKET, By Aircraft Type, 2020-2028 (USD Billion)

50 Asia Pacific Inflight Entertainment and Connectivity Space MARKET, By Country, 2020-2028 (USD Billion)

51 China Inflight Entertainment and Connectivity Space MARKET, By Component, 2020-2028 (USD Billion)

52 China Inflight Entertainment and Connectivity Space MARKET, By Offering Type, 2020-2028 (USD Billion)

53 China Inflight Entertainment and Connectivity Space MARKET, By Aircraft Type, 2020-2028 (USD Billion)

54 India Inflight Entertainment and Connectivity Space MARKET, By Component, 2020-2028 (USD Billion)

55 India Inflight Entertainment and Connectivity Space MARKET, By Offering Type, 2020-2028 (USD Billion)

56 India Inflight Entertainment and Connectivity Space MARKET, By Aircraft Type, 2020-2028 (USD Billion)

57 Japan Inflight Entertainment and Connectivity Space MARKET, By Component, 2020-2028 (USD Billion)

58 Japan Inflight Entertainment and Connectivity Space MARKET, By Offering Type, 2020-2028 (USD Billion)

59 Japan Inflight Entertainment and Connectivity Space MARKET, By Aircraft Type, 2020-2028 (USD Billion)

60 South Korea Inflight Entertainment and Connectivity Space MARKET, By Component, 2020-2028 (USD Billion)

61 South Korea Inflight Entertainment and Connectivity Space MARKET, By Offering Type, 2020-2028 (USD Billion)

62 South Korea Inflight Entertainment and Connectivity Space MARKET, By Aircraft Type, 2020-2028 (USD Billion)

63 Middle East and Africa Inflight Entertainment and Connectivity Space MARKET, By Component, 2020-2028 (USD Billion)

64 Middle East and Africa Inflight Entertainment and Connectivity Space MARKET, By Offering Type, 2020-2028 (USD Billion)

65 Middle East and Africa Inflight Entertainment and Connectivity Space MARKET, By Aircraft Type, 2020-2028 (USD Billion)

66 Middle East and Africa Inflight Entertainment and Connectivity Space MARKET, By Country, 2020-2028 (USD Billion)

67 Saudi Arabia Inflight Entertainment and Connectivity Space MARKET, By Component, 2020-2028 (USD Billion)

68 Saudi Arabia Inflight Entertainment and Connectivity Space MARKET, By Offering Type, 2020-2028 (USD Billion)

69 Saudi Arabia Inflight Entertainment and Connectivity Space MARKET, By Aircraft Type, 2020-2028 (USD Billion)

70 UAE Inflight Entertainment and Connectivity Space MARKET, By Component, 2020-2028 (USD Billion)

71 UAE Inflight Entertainment and Connectivity Space MARKET, By Offering Type, 2020-2028 (USD Billion)

72 UAE Inflight Entertainment and Connectivity Space MARKET, By Aircraft Type, 2020-2028 (USD Billion)

73 Central & South America Inflight Entertainment and Connectivity Space MARKET, By Component, 2020-2028 (USD Billion)

74 Central & South America Inflight Entertainment and Connectivity Space MARKET, By Offering Type, 2020-2028 (USD Billion)

75 Central & South America Inflight Entertainment and Connectivity Space MARKET, By Aircraft Type, 2020-2028 (USD Billion)

76 Central & South America Inflight Entertainment and Connectivity Space MARKET, By Country, 2020-2028 (USD Billion)

77 Brazil Inflight Entertainment and Connectivity Space MARKET, By Component, 2020-2028 (USD Billion)

78 Brazil Inflight Entertainment and Connectivity Space MARKET, By Offering Type, 2020-2028 (USD Billion)

79 Brazil Inflight Entertainment and Connectivity Space MARKET, By Aircraft Type, 2020-2028 (USD Billion)

80 BAE Systems Technology Co., Ltd: Products & Services Offering

81 Cobham plc.: Products & Services Offering

82 Collins Aerospace: Products & Services Offering

83 Eutelsat Communications: Products & Services Offering

84 Global Eagle Entertainment Inc.: Products & Services Offering

85 GOGO LLC: Products & Services Offering

86 Honeywell International Inc: Products & Services Offering

87 Inmarsat plc: Products & Services Offering

88 Iridium Communications Inc: Products & Services Offering

89 Panasonic Corporation: Products & Services Offering

90 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Inflight Entertainment and Connectivity Space Market Overview

2 Global Inflight Entertainment and Connectivity Space Market Value From 2020-2028 (USD Billion)

3 Global Inflight Entertainment and Connectivity Space Market Share, By Component (2022)

4 Global Inflight Entertainment and Connectivity Space Market Share, By Offering Type (2022)

5 Global Inflight Entertainment and Connectivity Space Share Market, By Aircraft Type (2022)

6 Global Inflight Entertainment and Connectivity Space Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Inflight Entertainment and Connectivity Space Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Inflight Entertainment and Connectivity Space Market

11 Impact Of Challenges On The Global Inflight Entertainment and Connectivity Space Market

12 Porter’s Five Forces Analysis

13 Global Inflight Entertainment and Connectivity Space Market: By Component Scope Key Takeaways

14 Global Inflight Entertainment and Connectivity Space Market, By Component Segment: Revenue Growth Analysis

15 Hardware Market, By Region, 2020-2028 (USD Billion)

16 Connectivity Market, By Region, 2020-2028 (USD Billion)

17 Content Market, By Region, 2020-2028 (USD Billion)

18 Global Inflight Entertainment and Connectivity Space Market: By Offering Type Scope Key Takeaways

19 Global Inflight Entertainment and Connectivity Space Market, By Offering Type Segment: Revenue Growth Analysis

20 In-flight Entertainment (IFE) Market, By Region, 2020-2028 (USD Billion)

21 In-flight Connectivity (IFC) Market, By Region, 2020-2028 (USD Billion)

22 Global Inflight Entertainment and Connectivity Space Market: By Aircraft Type Scope Key Takeaways

23 Global Inflight Entertainment and Connectivity Space Market, By Aircraft Type Segment: Revenue Growth Analysis

24 Narrow-body Aircraft (NBA) Market, By Region, 2020-2028 (USD Billion)

25 Wide-body Aircraft (WBA) Market, By Region, 2020-2028 (USD Billion)

26 Regional Segment: Revenue Growth Analysis

27 Global Inflight Entertainment and Connectivity Space Market: Regional Analysis

28 North America Inflight Entertainment and Connectivity Space Market Overview

29 North America Inflight Entertainment and Connectivity Space Market, By Component

30 North America Inflight Entertainment and Connectivity Space Market, By Offering Type

31 North America Inflight Entertainment and Connectivity Space Market, By Aircraft Type

32 North America Inflight Entertainment and Connectivity Space Market, By Country

33 U.S. Inflight Entertainment and Connectivity Space Market, By Component

34 U.S. Inflight Entertainment and Connectivity Space Market, By Offering Type

35 U.S. Inflight Entertainment and Connectivity Space Market, By Aircraft Type

36 Canada Inflight Entertainment and Connectivity Space Market, By Component

37 Canada Inflight Entertainment and Connectivity Space Market, By Offering Type

38 Canada Inflight Entertainment and Connectivity Space Market, By Aircraft Type

39 Mexico Inflight Entertainment and Connectivity Space Market, By Component

40 Mexico Inflight Entertainment and Connectivity Space Market, By Offering Type

41 Mexico Inflight Entertainment and Connectivity Space Market, By Aircraft Type

42 Four Quadrant Positioning Matrix

43 Company Market Share Analysis

44 BAE Systems Technology Co., Ltd: Company Snapshot

45 BAE Systems Technology Co., Ltd: SWOT Analysis

46 BAE Systems Technology Co., Ltd: Geographic Presence

47 Cobham plc.: Company Snapshot

48 Cobham plc.: SWOT Analysis

49 Cobham plc.: Geographic Presence

50 Collins Aerospace: Company Snapshot

51 Collins Aerospace: SWOT Analysis

52 Collins Aerospace: Geographic Presence

53 Eutelsat Communications: Company Snapshot

54 Eutelsat Communications: Swot Analysis

55 Eutelsat Communications: Geographic Presence

56 Global Eagle Entertainment Inc.: Company Snapshot

57 Global Eagle Entertainment Inc.: SWOT Analysis

58 Global Eagle Entertainment Inc.: Geographic Presence

59 Gogo LLC: Company Snapshot

60 Gogo LLC: SWOT Analysis

61 Gogo LLC: Geographic Presence

62 Honeywell International Inc: Company Snapshot

63 Honeywell International Inc: SWOT Analysis

64 Honeywell International Inc: Geographic Presence

65 Inmarsat plc: Company Snapshot

66 Inmarsat plc: SWOT Analysis

67 Inmarsat plc: Geographic Presence

68 Iridium Communications Inc.: Company Snapshot

69 Iridium Communications Inc.: SWOT Analysis

70 Iridium Communications Inc.: Geographic Presence

71 Panasonic Corporation: Company Snapshot

72 Panasonic Corporation: SWOT Analysis

73 Panasonic Corporation: Geographic Presence

74 Other Companies: Company Snapshot

75 Other Companies: SWOT Analysis

76 Other Companies: Geographic Presence

The Global Inflight Entertainment and Connectivity Space Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Inflight Entertainment and Connectivity Space Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS