Global Insurance Platform Market Size, Trends & Analysis - Forecasts to 2030 By Insurance Type (Life Insurance, Health Insurance, Property Insurance, Automobile Insurance, and Travel Insurance), By Deployment Model (On-premise, Cloud-based, and Hybrid), By Functionality (Claims Management, Policy Management, Billing Management, Customer Management, and Risk Management), By User Type (Individual Users, Small and Medium Enterprises (SMEs), and Large Enterprises), By Technology Adoption (Traditional Platforms, Digital Platforms, AI-Driven Platforms, and Blockchain-Based Platforms), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

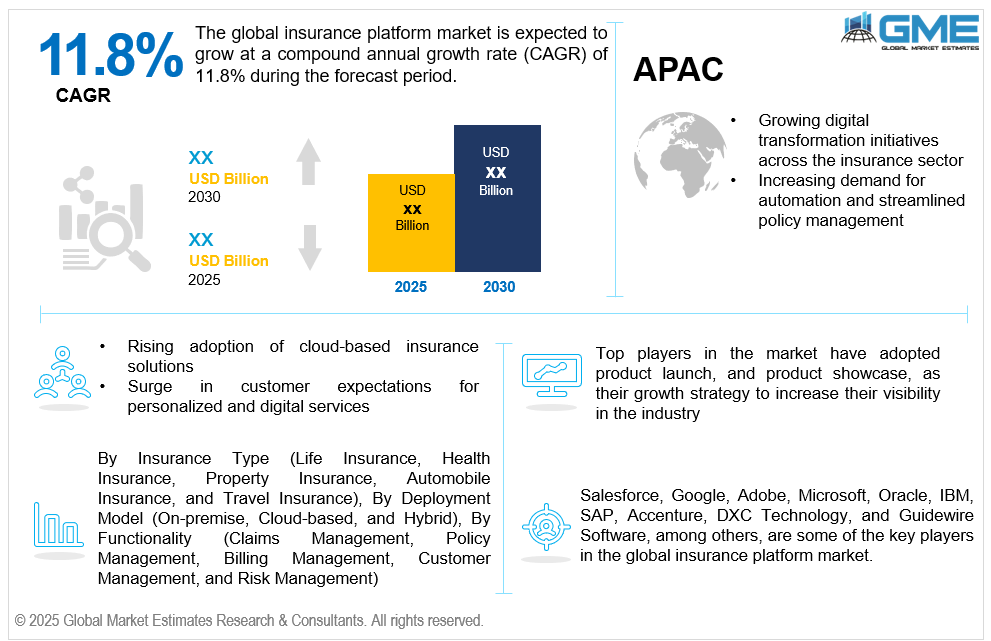

The global insurance platform market is estimated to exhibit a CAGR of 11.8% from 2025 to 2030.

The growing digital transformation initiatives across the insurance sector and the increasing demand for automation and streamlined policy management are the primary factors propelling the market growth. There is ongoing demand on insurers to increase client satisfaction, lower administrative expenses, and improve operational efficiency. Automation enables seamless processing of claims, underwriting, and policy issuance, reducing manual errors and turnaround times. Streamlined policy management systems allow insurers to easily manage customer data, track policy lifecycles, and implement changes with minimal disruption. These capabilities not only improve internal productivity but also enable quicker response times and more personalized service for policyholders. Furthermore, as customer expectations shift towards real-time digital experiences, insurers are increasingly adopting cloud-based platforms with integrated automation tools to stay competitive. This trend is particularly strong among insurers looking to modernize legacy systems and introduce agility into their operations.

The rising adoption of cloud-based insurance solutions and the surge in customer expectations for personalized and digital services are expected to support the market growth. Today’s consumers demand seamless, user-friendly, and tailored insurance experiences, similar to those offered by leading digital service providers in other industries. This shift is compelling insurers to adopt advanced platforms that leverage data analytics, AI, and machine learning to deliver personalized product recommendations, dynamic pricing, and real-time support. Additionally, the preference for digital channels—such as mobile apps, chatbots, and self-service portals—has led to a rise in cloud-based insurance platforms capable of providing 24/7 access and multichannel engagement. These technologies not only enhance customer satisfaction and loyalty but also allow insurers to gain deeper insights into customer behavior and preferences.

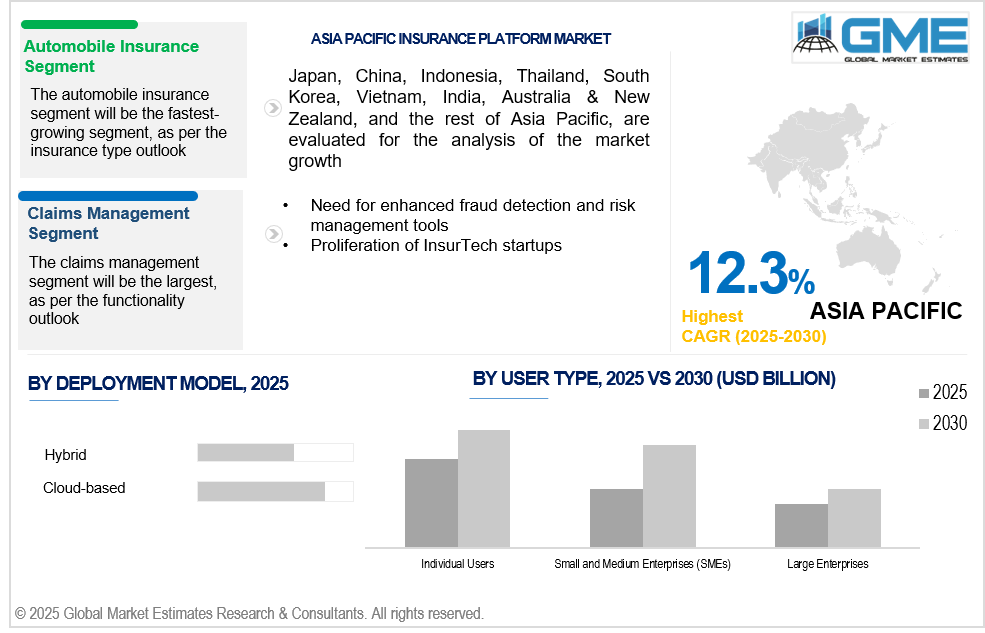

The need for enhanced fraud detection and risk management tools, coupled with the proliferation of InsurTech startups, is propelling market growth. InsurTech companies are using cutting-edge technologies like blockchain, AI, machine learning, and the Internet of Things to expedite risk assessment, customer onboarding, claims processing, and underwriting. By offering user-friendly interfaces, personalized products, and faster services, InsurTech firms are reshaping customer expectations and pressuring traditional insurers to modernize their legacy systems. This has led to increased investments in cloud-based insurance platforms that enable real-time data processing, automation, and enhanced customer experiences. Additionally, InsurTech startups often focus on underserved segments and micro-insurance, expanding market reach and inclusivity.

There’s a growing opportunity to develop open APIs that integrate with third-party services like payment gateways, health apps, and CRM systems. This allows insurance platforms to offer flexible, personalized services and foster ecosystem-driven innovation across the insurance value chain. Additionally, the rise of IoT and telematics brings an opportunity to expand usage-based insurance models, particularly in the auto and health segments. These models offer real-time pricing based on behavior, increasing fairness, customer engagement, and reducing fraudulent claims. However, stringent data protection regulations and a lack of standardization between different insurance systems and platforms hinder market growth.

The life insurance segment is expected to hold the largest share of the market over the forecast period. Life insurance policies tend to be higher in value and more complex than other insurance types, requiring robust platforms for underwriting, claims, and risk management. The need for digital solutions that guarantee regulatory compliance and optimize operations is fueled by this complexity.

The automobile insurance segment is expected to be the fastest-growing segment in the market from 2025 to 2030. Many countries mandate automobile insurance for vehicle registration and road use. These legal requirements drive consistent demand, presenting a strong growth opportunity for digital platforms that simplify compliance, policy issuance, claim filings, and customer onboarding at scale.

The cloud-based segment is expected to hold the largest share of the market over the forecast period. Cloud solutions support easy integration with third-party applications, APIs, and data sources. This interoperability is essential for insurers adopting AI, telematics, and fintech tools, helping them build smarter ecosystems and improve user experience across multiple channels.

The hybrid segment is anticipated to be the fastest-growing segment in the market from 2025 to 2030. Hybrid platforms support step-by-step modernization, helping insurers transition legacy systems into digital environments over time. This reduces risks and costs associated with full migrations, making the hybrid approach a fast-growing choice for insurers embracing digital transformation cautiously.

The claims management segment is expected to hold the largest share of the market over the forecast period. Processing claims entails a number of parties, records, and procedures, from FNOL (First Notice of Loss) until settlement. The need to automate and manage these complex workflows across departments and geographies pushes insurers to invest more in claims-specific functionalities.

The customer management segment is anticipated to be the fastest-growing segment in the market from 2025 to 2030. Analytics tools, marketing automation, and CRM systems are frequently combined with customer management features. This synergy allows insurers to track leads, manage campaigns, and analyze customer lifetime value, pushing widespread platform adoption across departments.

The individual users segment is expected to hold the largest share of the market over the forecast period. With smartphone penetration rising across all demographics, individual users demand mobile-first insurance solutions. Platforms that cater to this trend have seen explosive growth, driving the dominance of individual users in terms of daily platform interactions and transactions.

The small and medium enterprises (SMEs)segment is anticipated to be the fastest-growing segment in the market from 2025 to 2030. SMEs are increasingly recognizing the importance of insuring against operational risks, cyber threats, and employee health liabilities. As they formalize operations, more SMEs are turning to insurance platforms for accessible, customizable, and affordable insurance solutions tailored to their business needs.

The AI-driven platforms segment is expected to hold the largest share of the market over the forecast period. AI uses pattern recognition and behavioral analytics to detect anomalies in claims and policy data. These predictive algorithms minimize fraud losses, making AI-driven platforms a top investment priority for insurers looking to protect profits and ensure claim integrity.

The blockchain-based platforms segment is anticipated to be the fastest-growing segment in the market from 2025 to 2030. Insurance fraud, especially in claims and identity falsification, is a major concern. Blockchain reduces fraud by ensuring verifiable and traceable records for every transaction, policy, or identity, accelerating the shift toward blockchain platforms in high-risk insurance environments.

North America is expected to be the largest region in the global market. North America has some of the world’s highest insurance penetration rates across life, health, auto, property, and cyber insurance. The sheer volume of policies and transactions necessitates robust, scalable digital platforms, making the region a dominant user of insurance tech.

Asia Pacific is anticipated to witness rapid growth during the forecast period. Asia-Pacific has the highest mobile phone penetration globally. This provides a huge market for mobile-first insurance platforms. The region's adoption of mobile technology enables insurers to reach underserved populations, leading to the rapid growth of digital insurance services.

Salesforce, Google, Adobe, Microsoft, Oracle, IBM, SAP, Accenture, DXC Technology, and Guidewire Software, among others, are some of the key players in the global insurance platform market.

Please note: This is not an exhaustive list of companies profiled in the report.

In March 2025, Accenture acquired Altus Consulting to expand its services for UK insurance and financial clients. Accenture can manage end-to-end transformation projects more effectively due to this acquisition, especially in the areas of distribution, risk, and regulatory compliance.

In March 2025, with the launch of DXC Assure BPM powered by ServiceNow, DXC Technology broadened its strategic alliance with ServiceNow. By automating intricate workflows throughout the policy lifecycle, this AI-enabled platform combines ServiceNow's capabilities with DXC's insurance knowledge to modernize insurance procedures, lower operating costs, and improve customer satisfaction.

REPORT CONTENT

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Functionality Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL INSURANCE PLATFORM MARKET, BY USER TYPE

4.1 Introduction

4.2 Insurance Platform Market: User Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2024 & 2030

4.4 Individual Users

4.4.1 Individual Users Market Estimates and Forecast, 2022-2030 (USD Million)

4.5 Small and Medium Enterprises (SMEs)

4.5.1 Small and Medium Enterprises (SMEs) Market Estimates and Forecast, 2022-2030 (USD Million)

4.6 Large Enterprises

4.6.1 Large Enterprises Market Estimates and Forecast, 2022-2030 (USD Million)

5 GLOBAL INSURANCE PLATFORM MARKET, BY INSURANCE TYPE

5.1 Introduction

5.2 Insurance Platform Market: Insurance Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2024 & 2030

5.4 Life Insurance

5.4.1 Life Insurance Market Estimates and Forecast, 2022-2030 (USD Million)

5.5 Health Insurance

5.5.1 Health Insurance Market Estimates and Forecast, 2022-2030 (USD Million)

5.6 Property Insurance

5.6.1 Property Insurance Market Estimates and Forecast, 2022-2030 (USD Million)

5.7 Automobile Insurance

5.7.1 Automobile Insurance Market Estimates and Forecast, 2022-2030 (USD Million)

5.8 Travel Insurance

5.8.1 Travel Insurance Market Estimates and Forecast, 2022-2030 (USD Million)

6 GLOBAL INSURANCE PLATFORM MARKET, BY DEPLOYMENT MODEL

6.1 Introduction

6.2 Insurance Platform Market: Deployment Model Scope Key Takeaways

6.3 Revenue Growth Analysis, 2024 & 2030

6.4 Cloud-based

6.4.1 Cloud-based Market Estimates and Forecast, 2022-2030 (USD Million)

6.5 On-premise

6.5.1 On-premise Market Estimates and Forecast, 2022-2030 (USD Million)

6.6 Hybrid

6.6.1 Hybrid Market Estimates and Forecast, 2022-2030 (USD Million)

7 GLOBAL INSURANCE PLATFORM MARKET, BY FUNCTIONALITY

7.1 Introduction

7.2 Insurance Platform Market: Functionality Scope Key Takeaways

7.3 Revenue Growth Analysis, 2024 & 2030

7.4 Claims Management

7.4.1 Claims Management Market Estimates and Forecast, 2022-2030 (USD Million)

7.5 Policy Management

7.5.1 Policy Management Market Estimates and Forecast, 2022-2030 (USD Million)

7.6 Billing Management

7.6.1 Billing Management Market Estimates and Forecast, 2022-2030 (USD Million)

7.7 Customer Management

7.7.1 Customer Management Market Estimates and Forecast, 2022-2030 (USD Million)

7.8 Risk Management

7.8.1 Risk Management Market Estimates and Forecast, 2022-2030 (USD Million)

8 GLOBAL INSURANCE PLATFORM MARKET, BY TECHNOLOGY ADOPTION

8.1 Introduction

8.2 Insurance Platform Market: Technology Adoption Scope Key Takeaways

8.3 Revenue Growth Analysis, 2024 & 2030

8.4 Traditional Platforms

8.4.1 Traditional Platforms Market Estimates and Forecast, 2022-2030 (USD Million)

8.5 Digital Platforms

8.5.1 Digital Platforms Market Estimates and Forecast, 2022-2030 (USD Million)

8.6 AI-Driven Platforms

8.6.1 AI-Driven Platforms Market Estimates and Forecast, 2022-2030 (USD Million)

8.7 Blockchain-Based Platforms

8.7.1 Blockchain-Based Platforms Market Estimates and Forecast, 2022-2030 (USD Million)

9 GLOBAL INSURANCE PLATFORM MARKET, BY REGION

9.1 Introduction

9.2 North America Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.2.1 By User Type

9.2.2 By Insurance Type

9.2.3 By Deployment Model

9.2.4 By Functionality

9.2.5 By Technology Adoption

9.2.6 By Country

9.2.6.1 U.S. Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.2.6.1.1 By User Type

9.2.6.1.2 By Insurance Type

9.2.6.1.3 By Deployment Model

9.2.6.1.4 By Functionality

9.2.6.1.5 By Technology Adoption

9.2.6.2 Canada Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.2.6.2.1 By User Type

9.2.6.2.2 By Insurance Type

9.2.6.2.3 By Deployment Model

9.2.6.2.4 By Functionality

9.2.6.2.5 By Technology Adoption

9.2.6.3 Mexico Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.2.6.3.1 By User Type

9.2.6.3.2 By Insurance Type

9.2.6.3.3 By Deployment Model

9.2.6.3.4 By Functionality

9.2.6.3.5 By Technology Adoption

9.3 Europe Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.3.1 By User Type

9.3.2 By Insurance Type

9.3.3 By Deployment Model

9.3.4 By Functionality

9.3.5 By Technology Adoption

9.3.6 By Country

9.3.6.1 Germany Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.3.6.1.1 By User Type

9.3.6.1.2 By Insurance Type

9.3.6.1.3 By Deployment Model

9.3.6.1.4 By Functionality

9.3.6.1.5 By Technology Adoption

9.3.6.2 U.K. Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.3.6.2.1 By User Type

9.3.6.2.2 By Insurance Type

9.3.6.2.3 By Deployment Model

9.3.6.2.4 By Functionality

9.3.6.2.5 By Technology Adoption

9.3.6.3 France Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.3.6.3.1 By User Type

9.3.6.3.2 By Insurance Type

9.3.6.3.3 By Deployment Model

9.3.6.3.4 By Functionality

9.3.6.3.5 By Technology Adoption

9.3.6.4 Italy Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.3.6.4.1 By User Type

9.3.6.4.2 By Insurance Type

9.3.6.4.3 By Deployment Model

9.3.6.4.4 By Functionality

9.3.6.4.5 By Technology Adoption

9.3.6.5 Spain Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.3.6.5.1 By User Type

9.3.6.5.2 By Insurance Type

9.3.6.5.3 By Deployment Model

9.3.6.5.4 By Functionality

9.3.6.5.5 By Technology Adoption

9.3.6.6 Netherlands Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.3.6.6.1 By User Type

9.3.6.6.2 By Insurance Type

9.3.6.6.3 By Deployment Model

9.3.6.6.4 By Functionality

9.3.6.6.5 By Technology Adoption

9.3.6.7 Rest of Europe Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.3.6.7.1 By User Type

9.3.6.7.2 By Insurance Type

9.3.6.7.3 By Deployment Model

9.3.6.7.4 By Functionality

9.3.6.7.5 By Technology Adoption

9.4 Asia Pacific Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.4.1 By User Type

9.4.2 By Insurance Type

9.4.3 By Deployment Model

9.4.4 By Functionality

9.4.5 By Technology Adoption

9.4.6 By Country

9.4.6.1 China Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.4.6.1.1 By User Type

9.4.6.1.2 By Insurance Type

9.4.6.1.3 By Deployment Model

9.4.6.1.4 By Functionality

9.4.6.1.5 By Technology Adoption

9.4.6.2 Japan Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.4.6.2.1 By User Type

9.4.6.2.2 By Insurance Type

9.4.6.2.3 By Deployment Model

9.4.6.2.4 By Functionality

9.4.6.2.5 By Technology Adoption

9.4.6.3 India Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.4.6.3.1 By User Type

9.4.6.3.2 By Insurance Type

9.4.6.3.3 By Deployment Model

9.4.6.3.4 By Functionality

9.4.6.3.5 By Technology Adoption

9.4.6.4 South Korea Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.4.6.4.1 By User Type

9.4.6.4.2 By Insurance Type

9.4.6.4.3 By Deployment Model

9.4.6.4.4 By Functionality

9.4.6.4.5 By Technology Adoption

9.4.6.5 Singapore Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.4.6.5.1 By User Type

9.4.6.5.2 By Insurance Type

9.4.6.5.3 By Deployment Model

9.4.6.5.4 By Functionality

9.4.6.5.5 By Technology Adoption

9.4.6.6 Malaysia Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.4.6.6.1 By User Type

9.4.6.6.2 By Insurance Type

9.4.6.6.3 By Deployment Model

9.4.6.6.4 By Functionality

9.4.6.6.5 By Technology Adoption

9.4.6.7 Thailand Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.4.6.7.1 By User Type

9.4.6.7.2 By Insurance Type

9.4.6.7.3 By Deployment Model

9.4.6.7.4 By Functionality

9.4.6.7.5 By Technology Adoption

9.4.6.8 Indonesia Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.4.6.8.1 By User Type

9.4.6.8.2 By Insurance Type

9.4.6.8.3 By Deployment Model

9.4.6.8.4 By Functionality

9.4.6.8.5 By Technology Adoption

9.4.6.9 Vietnam Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.4.6.9.1 By User Type

9.4.6.9.2 By Insurance Type

9.4.6.9.3 By Deployment Model

9.4.6.9.4 By Functionality

9.4.6.9.5 By Technology Adoption

9.4.6.10 Taiwan Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.4.6.10.1 By User Type

9.4.6.10.2 By Insurance Type

9.4.6.10.3 By Deployment Model

9.4.6.10.4 By Functionality

9.4.6.10.5 By Technology Adoption

9.4.6.11 Rest of Asia Pacific Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.4.6.11.1 By User Type

9.4.6.11.2 By Insurance Type

9.4.6.11.3 By Deployment Model

9.4.6.11.4 By Functionality

9.4.6.11.5 By Technology Adoption

9.5 Middle East and Africa Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.5.1 By User Type

9.5.2 By Insurance Type

9.5.3 By Deployment Model

9.5.4 By Functionality

9.5.5 By Technology Adoption

9.5.6 By Country

9.5.6.1 Saudi Arabia Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.5.6.1.1 By User Type

9.5.6.1.2 By Insurance Type

9.5.6.1.3 By Deployment Model

9.5.6.1.4 By Functionality

9.5.6.1.5 By Technology Adoption

9.5.6.2 U.A.E. Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.5.6.2.1 By User Type

9.5.6.2.2 By Insurance Type

9.5.6.2.3 By Deployment Model

9.5.6.2.4 By Functionality

9.5.6.12.5 By Technology Adoption

9.5.6.3 Israel Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.5.4.3.1 By User Type

9.5.4.3.2 By Insurance Type

9.5.4.3.3 By Deployment Model

9.5.6.3.4 By Functionality

9.5.6.3.5 By Technology Adoption

9.5.6.4 South Africa Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.5.6.4.1 By User Type

9.5.6.4.2 By Insurance Type

9.5.6.4.3 By Deployment Model

9.5.6.4.4 By Functionality

9.5.6.4.5 By Technology Adoption

9.5.6.5 Rest of Middle East and Africa Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.5.6.5.1 By User Type

9.5.6.5.2 By Insurance Type

9.5.6.5.2 By Deployment Model

9.5.6.5.4 By Functionality

9.5.6.5.5 By Technology Adoption

9.6 Central & South America Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.6.1 By User Type

9.6.2 By Insurance Type

9.6.3 By Deployment Model

9.6.4 By Functionality

9.6.5 By Technology Adoption

9.6.6 By Country

9.6.6.1 Brazil Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.6.6.1.1 By User Type

9.6.6.1.2 By Insurance Type

9.6.6.1.3 By Deployment Model

9.6.6.1.4 By Functionality

9.6.6.1.5 By Technology Adoption

9.6.6.2 Argentina Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.6.6.2.1 By User Type

9.6.6.2.2 By Insurance Type

9.6.6.2.3 By Deployment Model

9.6.6.2.4 By Functionality

9.6.6.2.5 By Technology Adoption

9.6.6.3 Chile Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.6.6.3.1 By User Type

9.6.6.3.2 By Insurance Type

9.6.6.3.3 By Deployment Model

9.6.6.3.4 By Functionality

9.6.6.3.5 By Technology Adoption

9.6.6.4 Rest of Central & South America Insurance Platform Market Estimates and Forecast, 2022-2030 (USD Million)

9.6.6.4.1 By User Type

9.6.6.4.2 By Insurance Type

9.6.6.4.3 By Deployment Model

9.6.6.4.4 By Functionality

9.6.6.4.5 By Technology Adoption

10 COMPETITIVE LANDCAPE

10.1 Company Market Share Analysis

10.2 Four Quadrant Positioning Matrix

10.2.1 Market Leaders

10.2.2 Market Visionaries

10.2.3 Market Challengers

10.2.4 Niche Market Players

10.3 Vendor Landscape

10.3.1 North America

10.3.2 Europe

10.3.3 Asia Pacific

10.3.4 Rest of the World

10.4 Company Profiles

10.4.1 Google

10.4.1.1 Business Description & Financial Analysis

10.4.1.2 SWOT Analysis

10.4.1.3 Poducts & Services Offered

10.4.1.4 Strategic Alliances between Business Partners

10.4.2 IBM

10.4.2.1 Business Description & Financial Analysis

10.4.2.2 SWOT Analysis

10.4.2.3 Poducts & Services Offered

10.4.2.4 Strategic Alliances between Business Partners

10.4.3 Adobe

10.4.3.1 Business Description & Financial Analysis

10.4.3.2 SWOT Analysis

10.4.3.3 Poducts & Services Offered

10.4.3.4 Strategic Alliances between Business Partners

10.4.4 Salesforce

10.4.4.1 Business Description & Financial Analysis

10.4.4.2 SWOT Analysis

10.4.4.3 Poducts & Services Offered

10.4.4.4 Strategic Alliances between Business Partners

10.4.5 Microsoft

10.4.5.1 Business Description & Financial Analysis

10.4.5.2 SWOT Analysis

10.4.5.3 Poducts & Services Offered

10.4.5.4 Strategic Alliances between Business Partners

10.4.6 ORACLE

10.4.6.1 Business Description & Financial Analysis

10.4.6.2 SWOT Analysis

10.4.6.3 Poducts & Services Offered

10.4.6.4 Strategic Alliances between Business Partners

10.4.7 SAP

10.4.7.1 Business Description & Financial Analysis

10.4.7.2 SWOT Analysis

10.4.7.3 Poducts & Services Offered

10.4.7.4 Strategic Alliances between Business Partners

10.4.8 Accenture

10.4.8.1 Business Description & Financial Analysis

10.4.8.2 SWOT Analysis

10.4.8.3 Poducts & Services Offered

10.4.8.4 Strategic Alliances between Business Partners

10.4.9 DXC Technology

10.4.9.1 Business Description & Financial Analysis

10.4.9.2 SWOT Analysis

10.4.9.3 Poducts & Services Offered

10.4.9.4 Strategic Alliances between Business Partners

10.4.10 Guidewire Software

10.4.10.1 Business Description & Financial Analysis

10.4.10.2 SWOT Analysis

10.4.10.3 Poducts & Services Offered

10.4.10.4 Strategic Alliances between Business Partners

10.4.11 Other Companies

10.4.11.1 Business Description & Financial Analysis

10.4.11.2 SWOT Analysis

10.4.11.3 Poducts & Services Offered

10.4.11.4 Strategic Alliances between Business Partners

11 RESEARCH METHODOLOGY

11.1 Market Introduction

11.1.1 Market Definition

11.1.2 Market Scope & Segmentation

11.2 Information Procurement

11.2.1 Secondary Research

11.2.1.1 Purchased Databases

11.2.1.2 GMEs Internal Data Repository

11.2.1.3 Secondary Resources & Third Party Perspectives

11.2.1.4 Company Information Sources

11.2.2 Primary Research

11.2.2.1 Various Types of Respondents for Primary Interviews

11.2.2.2 Number of Interviews Conducted throughout the Research Process

11.2.2.3 Primary Stakeholders

11.2.2.4 Discussion Guide for Primary Participants

11.2.3 Expert Panels

11.2.3.1 Expert Panels Across 30+ Industry

11.2.4 Paid Local Experts

11.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

11.3 Market Estimation

11.3.1 Top-Down Approach

11.3.1.1 Macro-Economic Indicators Considered

11.3.1.2 Micro-Economic Indicators Considered

11.3.2 Bottom Up Approach

11.3.2.1 Company Share Analysis Approach

11.3.2.2 Estimation of Potential Technology Adoption Sales

11.4 Data Triangulation

11.4.1 Data Collection

11.4.2 Time Series, Cross Sectional & Panel Data Analysis

11.4.3 Cluster Analysis

11.5 Analysis and Output

11.5.1 Inhouse AI Based Real Time Analytics Tool

11.5.2 Output From Desk & Primary Research

11.6 Research Assumptions & Limitations

11.7.1 Research Assumptions

11.7.2 Research Limitations

LIST OF TABLES

1 Global Insurance Platform Market, By User Type, 2022-2030 (USD Mllion)

2 Individual Users Market, By Region, 2022-2030 (USD Mllion)

3 Small and Medium Enterprises (SMEs) Market, By Region, 2022-2030 (USD Mllion)

4 Large Enterprises Market, By Region, 2022-2030 (USD Mllion)

5 Global Insurance Platform Market, By Insurance Type, 2022-2030 (USD Mllion)

6 Life Insurance Market, By Region, 2022-2030 (USD Mllion)

7 Health Insurance Market, By Region, 2022-2030 (USD Mllion)

8 Property Insurance Market, By Region, 2022-2030 (USD Mllion)

9 Automobile Insurance Market, By Region, 2022-2030 (USD Mllion)

10 Travel Insurance Market, By Region, 2022-2030 (USD Mllion)

11 Global Insurance Platform Market, By Deployment Model, 2022-2030 (USD Mllion)

12 Cloud-based Market, By Region, 2022-2030 (USD Mllion)

13 On-premise Market, By Region, 2022-2030 (USD Mllion)

14 Hybrid Market, By Region, 2022-2030 (USD Mllion)

15 Global Insurance Platform Market, By FUNCTIONALITY, 2022-2030 (USD Mllion)

16 Claims Management Market, By Region, 2022-2030 (USD Mllion)

17 Policy Management Market, By Region, 2022-2030 (USD Mllion)

18 Billing Management Market, By Region, 2022-2030 (USD Mllion)

19 Customer Management Market, By Region, 2022-2030 (USD Mllion)

20 Risk Management Market, By Region, 2022-2030 (USD Mllion)

21 Global Insurance Platform Market, By Technology Adoption, 2022-2030 (USD Mllion)

22 Traditional Platforms Market, By Region, 2022-2030 (USD Mllion)

23 Digital Platforms Market, By Region, 2022-2030 (USD Mllion)

24 AI-Driven Platforms Market, By Region, 2022-2030 (USD Mllion)

25 Blockchain-Based Platforms Market, By Region, 2022-2030 (USD Mllion)

26 Regional Analysis, 2022-2030 (USD Mllion)

27 North America Insurance Platform Market, By User Type, 2022-2030 (USD Million)

28 North America Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

29 North America Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

30 North America Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

31 North America Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

32 North America Insurance Platform Market, By Country, 2022-2030 (USD Million)

33 U.S. Insurance Platform Market, By User Type, 2022-2030 (USD Million)

34 U.S. Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

35 U.S. Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

36 U.S. Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

37 U.S. America Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

38 Canada Insurance Platform Market, By User Type, 2022-2030 (USD Million)

39 Canada Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

40 Canada Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

41 CANADA Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

42 CANADA Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

43 Mexico Insurance Platform Market, By User Type, 2022-2030 (USD Million)

44 Mexico Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

45 Mexico Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

46 mexico Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

47 MEXICO Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

48 Europe Insurance Platform Market, By User Type, 2022-2030 (USD Million)

49 Europe Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

50 Europe Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

51 europe Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

52 EUROPE Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

53 EUROPE Insurance Platform Market, By COUNTRY, 2022-2030 (USD Million)

54 Germany Insurance Platform Market, By User Type, 2022-2030 (USD Million)

55 Germany Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

56 Germany Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

57 germany Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

58 GERMANY Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

59 UK Insurance Platform Market, By User Type, 2022-2030 (USD Million)

60 UK Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

61 UK Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

62 U.k Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

63 U.K Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

64 France Insurance Platform Market, By User Type, 2022-2030 (USD Million)

65 France Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

66 France Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

67 france Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

68 FRANCE Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

69 Italy Insurance Platform Market, By User Type, 2022-2030 (USD Million)

70 Italy Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

71 Italy Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

72 italy Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

73 ITALY Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

74 Spain Insurance Platform Market, By User Type, 2022-2030 (USD Million)

75 Spain Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

76 Spain Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

77 spain Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

78 SPAIN Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

79 NETHERLANDS Insurance Platform Market, By User Type, 2022-2030 (USD Million)

80 NETHERLANDS Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

81 NETHERLANDS Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

82 NETHERLANDS Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

83 NETHERLANDS Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

84 Rest Of Europe Insurance Platform Market, By User Type, 2022-2030 (USD Million)

85 Rest Of Europe Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

86 Rest of Europe Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

87 REST OF EUROPE Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

88 REST OF EUROPE Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

89 Asia Pacific Insurance Platform Market, By User Type, 2022-2030 (USD Million)

90 Asia Pacific Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

91 Asia Pacific Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

92 asia Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

93 ASIA PACIFIC Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

94 Asia Pacific Insurance Platform Market, By Country, 2022-2030 (USD Million)

95 China Insurance Platform Market, By User Type, 2022-2030 (USD Million)

96 China Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

97 China Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

98 china Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

99 CHINA Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

100 India Insurance Platform Market, By User Type, 2022-2030 (USD Million)

101 India Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

102 India Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

103 india Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

104 INDIA Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

105 Japan Insurance Platform Market, By User Type, 2022-2030 (USD Million)

106 Japan Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

107 Japan Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

108 japan Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

109 JAPAN Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

110 South Korea Insurance Platform Market, By User Type, 2022-2030 (USD Million)

111 South Korea Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

112 South Korea Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

113 south korea Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

114 SOUTH KOREA Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

115 SINGAPORE Insurance Platform Market, By User Type, 2022-2030 (USD Million)

116 SINGAPORE Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

117 SINGAPORE Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

118 SINGAPORE Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

119 SINGAPORE Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

120 Thailand Insurance Platform Market, By User Type, 2022-2030 (USD Million)

121 Thailand Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

122 Thailand Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

123 Thailand Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

124 THAILAND Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

125 Malaysia Insurance Platform Market, By User Type, 2022-2030 (USD Million)

126 Malaysia Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

127 Malaysia Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

128 Malaysia Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

129 MALAYSIA Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

130 Indonesia Insurance Platform Market, By User Type, 2022-2030 (USD Million)

131 Indonesia Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

132 Indonesia Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

133 Indonesia Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

134 INDONESIA Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

135 VIETNAM Insurance Platform Market, By User Type, 2022-2030 (USD Million)

136 VIETNAM Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

137 VIETNAM Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

138 VIETNAM Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

139 VIETNAM Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

140 Taiwan Insurance Platform Market, By User Type, 2022-2030 (USD Million)

141 Taiwan Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

142 Taiwan Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

143 Taiwan Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

144 TAIWAN Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

145 Rest of APAC Insurance Platform Market, By User Type, 2022-2030 (USD Million)

146 Rest of APAC Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

147 Rest of APAC Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

148 Rest of APAC Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

149 REST OF APAC Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

150 Middle East and Africa Insurance Platform Market, By User Type, 2022-2030 (USD Million)

151 Middle East and Africa Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

152 Middle East and Africa Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

153 MIDDLE EAST AND AFRICA Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

154 MIDDLE EAST AND AFRICA Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

155 Middle East and Africa Insurance Platform Market, By Country, 2022-2030 (USD Million)

156 Saudi Arabia Insurance Platform Market, By User Type, 2022-2030 (USD Million)

157 Saudi Arabia Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

158 Saudi Arabia Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

159 saudi arabia Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

160 SAUDI ARABIA Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

161 UAE Insurance Platform Market, By User Type, 2022-2030 (USD Million)

162 UAE Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

163 UAE Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

164 uae Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

165 UAE Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

166 ISRAEL Insurance Platform Market, By User Type, 2022-2030 (USD Million)

167 ISRAEL Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

168 ISRAEL Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

169 ISRAEL Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

170 ISRAEL Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

171 South Africa Insurance Platform Market, By User Type, 2022-2030 (USD Million)

172 South Africa Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

173 South Africa Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

174 South Africa Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

175 SOUTH AFRICA Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

176 REST OF MIDDLE EAST AND AFRICA Insurance Platform Market, By User Type, 2022-2030 (USD Million)

177 REST OF MIDDLE EAST AND AFRICA Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

178 REST OF MIDDLE EAST AND AFRICA Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

179 REST OF MIDDLE EAST AND AFRICA Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

180 REST OF MIDDLE EAST AND AFRICA Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

181 Central & South America Insurance Platform Market, By User Type, 2022-2030 (USD Million)

182 Central & South America Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

183 Central & South America Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

184 CENTRAL & SOUTH AMERICA Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

185 CENTRAL & SOUTH AMERICA Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

186 Central & South America Insurance Platform Market, By Country, 2022-2030 (USD Million)

187 Brazil Insurance Platform Market, By User Type, 2022-2030 (USD Million)

188 Brazil Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

189 Brazil Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

190 brazil Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

191 BRAZIL Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

192 CHILE Insurance Platform Market, By User Type, 2022-2030 (USD Million)

193 CHILE Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

194 CHILE Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

195 CHILE Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

196 CHILE Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

197 Argentina Insurance Platform Market, By User Type, 2022-2030 (USD Million)

198 Argentina Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

199 Argentina Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

200 Argentina Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

201 ARGENTINA Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

202 REST OF CENTRAL AND SOUTH AMERICA Insurance Platform Market, By User Type, 2022-2030 (USD Million)

203 REST OF CENTRAL AND SOUTH AMERICA Insurance Platform Market, By Insurance Type, 2022-2030 (USD Million)

204 REST OF CENTRAL AND SOUTH AMERICA Insurance Platform Market, By Deployment Model, 2022-2030 (USD Million)

205 REST OF CENTRAL AND SOUTH AMERICA Insurance Platform Market, By Functionality, 2022-2030 (USD Million)

206 REST OF CENTRAL AND SOUTH AMERICA Insurance Platform Market, By TECHNOLOGY ADOPTION, 2022-2030 (USD Million)

207 Google: PRODUCTS & SERVICES OFFERING

208 IBM: PRODUCTS & SERVICES OFFERING

209 Adobe: PRODUCTS & SERVICES OFFERING

210 Salesforce: PRODUCTS & SERVICES OFFERING

211 Microsoft: PRODUCTS & SERVICES OFFERING

212 ORACLE: PRODUCTS & SERVICES OFFERING

213 SAP: PRODUCTS & SERVICES OFFERING

214 Accenture: PRODUCTS & SERVICES OFFERING

215 DXC Technology, Inc: PRODUCTS & SERVICES OFFERING

216 Guidewire Software: PRODUCTS & SERVICES OFFERING

217 Other Companies: PRODUCTS & SERVICES OFFERING

LIST OF FIGURES

1 Global Insurance Platform Market Overview

2 Global Insurance Platform Market Value From 2022-2030 (USD Mllion)

3 Global Insurance Platform Market Share, By User Type (2024)

4 Global Insurance Platform Market Share, By Insurance Type (2024)

5 Global Insurance Platform Market Share, By Deployment Model (2024)

6 Global Insurance Platform Market Share, By Functionality (2024)

7 Global Insurance Platform Market Share, By Technology Adoption (2024)

8 Global Insurance Platform Market, By Region (Asia Pacific Market)

9 Technological Trends In Global Insurance Platform Market

10 Four Quadrant Competitor Positioning Matrix

11 Impact Of Macro & Micro Indicators On The Market

12 Impact Of Key Drivers On The Global Insurance Platform Market

13 Impact Of Challenges On The Global Insurance Platform Market

14 Porter’s Five Forces Analysis

15 Global Insurance Platform Market: By User Type Scope Key Takeaways

16 Global Insurance Platform Market, By User Type Segment: Revenue Growth Analysis

17 Individual Users Market, By Region, 2022-2030 (USD Mllion)

18 Small and Medium Enterprises (SMEs) Market, By Region, 2022-2030 (USD Mllion)

19 Large Enterprises Market, By Region, 2022-2030 (USD Mllion)

20 Global Insurance Platform Market: By Insurance Type Scope Key Takeaways

21 Global Insurance Platform Market, By Insurance Type Segment: Revenue Growth Analysis

22 Life Insurance Market, By Region, 2022-2030 (USD Mllion)

23 Health Insurance Market, By Region, 2022-2030 (USD Mllion)

24 Property Insurance Market, By Region, 2022-2030 (USD Mllion)

25 Automobile Insurance Market, By Region, 2022-2030 (USD Mllion)

26 Travel Insurance Market, By Region, 2022-2030 (USD Mllion)

27 Blockchain Market, By Region, 2022-2030 (USD Mllion)

28 Global Insurance Platform Market: By Deployment Model Scope Key Takeaways

29 Global Insurance Platform Market, By Deployment Model Segment: Revenue Growth Analysis

30 Cloud-based Market, By Region, 2022-2030 (USD Mllion)

31 On-premise Market, By Region, 2022-2030 (USD Mllion)

32 Hybrid Market, By Region, 2022-2030 (USD Mllion)

33 Global Insurance Platform Market: By Functionality Scope Key Takeaways

34 Global Insurance Platform Market, By Functionality Segment: Revenue Growth Analysis

35 Claims Management Market, By Region, 2022-2030 (USD Mllion)

36 Policy Management Market, By Region, 2022-2030 (USD Mllion)

37 Billing Management Market, By Region, 2022-2030 (USD Mllion)

38 Customer Management Market, By Region, 2022-2030 (USD Mllion)

39 Risk Management Market, By Region, 2022-2030 (USD Mllion)

40 Global Insurance Platform Market: By Technology Adoption Scope Key Takeaways

41 Global Insurance Platform Market, By Technology Adoption Segment: Revenue Growth Analysis

42 Traditional Platforms Market, By Region, 2022-2030 (USD Mllion)

43 Digital Platforms Market, By Region, 2022-2030 (USD Mllion)

44 AI-Driven Platforms Market, By Region, 2022-2030 (USD Mllion)

45 Blockchain-Based Platforms Market, By Region, 2022-2030 (USD Mllion)

46 Regional Analysis, 2022-2030 (USD Mllion)

47 Regional Segment: Revenue Growth Analysis

48 Global Insurance Platform Market: Regional Analysis

49 North America Insurance Platform Market Overview

50 North America Insurance Platform Market, By User Type

51 North America Insurance Platform Market, By Insurance Type

52 North America Insurance Platform Market, By Deployment Model

53 North America Insurance Platform Market, By Functionality

54 North America Insurance Platform Market, By Technology Adoption

55 North America Insurance Platform Market, By Country

56 U.S. Insurance Platform Market, By User Type

57 U.S. Insurance Platform Market, By Insurance Type

58 U.S. Insurance Platform Market, By Deployment Model

59 U.S. Insurance Platform Market, By Functionality

60 U.S. Insurance Platform Market, By Technology Adoption

61 Canada Insurance Platform Market, By User Type

62 Canada Insurance Platform Market, By Insurance Type

63 Canada Insurance Platform Market, By Deployment Model

64 Canada Insurance Platform Market, By Functionality

65 Canada Insurance Platform Market, By Technology Adoption

66 Mexico Insurance Platform Market, By User Type

67 Mexico Insurance Platform Market, By Insurance Type

68 Mexico Insurance Platform Market, By Deployment Model

69 Mexico Insurance Platform Market, By Functionality

70 Mexico Insurance Platform Market, By Technology Adoption

71 Four Quadrant Positioning Matrix

72 Company Market Share Analysis

73 Google: Company Snapshot

74 Google: SWOT Analysis

75 Google: Geographic Presence

76 IBM: Company Snapshot

77 IBM: SWOT Analysis

78 IBM: Geographic Presence

79 Adobe: Company Snapshot

80 Adobe: SWOT Analysis

81 Adobe: Geographic Presence

82 Salesforce: Company Snapshot

83 Salesforce: Swot Analysis

84 Salesforce: Geographic Presence

85 Microsoft: Company Snapshot

86 Microsoft: SWOT Analysis

87 Microsoft: Geographic Presence

88 ORACLE: Company Snapshot

89 ORACLE: SWOT Analysis

90 ORACLE: Geographic Presence

91 SAP : Company Snapshot

92 SAP : SWOT Analysis

93 SAP : Geographic Presence

94 Accenture: Company Snapshot

95 Accenture: SWOT Analysis

96 Accenture: Geographic Presence

97 DXC Technology, Inc.: Company Snapshot

98 DXC Technology, Inc.: SWOT Analysis

99 DXC Technology, Inc.: Geographic Presence

100 Guidewire Software: Company Snapshot

101 Guidewire Software: SWOT Analysis

102 Guidewire Software: Geographic Presence

103 Other Companies: Company Snapshot

104 Other Companies: SWOT Analysis

105 Other Companies: Geographic Presence

The Global Insurance Platform Market has been studied from the year 2019 till 2030. However, the CAGR provided in the report is from the year 2025 to 2030. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Insurance Platform Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS