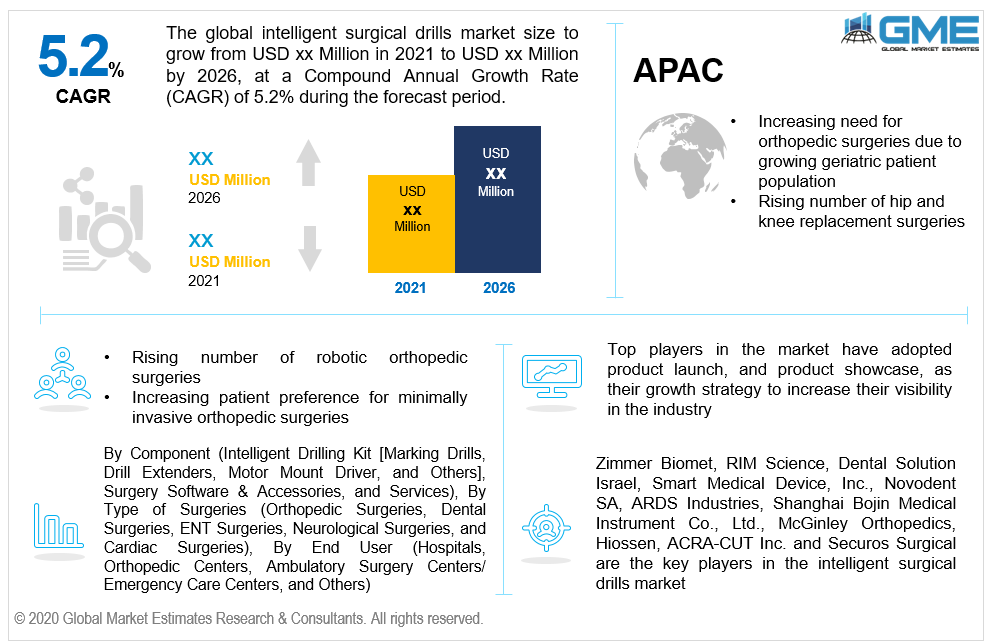

Global Intelligent Surgical Drills Market Size, Trends & Analysis - Forecasts to 2026 By Component (Intelligent Drilling Kit [Marking Drills, Drill Extenders, Motor Mount Driver, and Others], Surgery Software & Accessories, and Services), By Type of Surgeries (Orthopedic Surgeries, Dental Surgeries, ENT Surgeries, Neurological Surgeries, and Cardiac Surgeries), By End User (Hospitals, Orthopedic Centers, Ambulatory Surgery Centers/ Emergency Care Centers, and Others), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

The global intelligent surgical drills market is projected to grow at a CAGR value of 5.2% during the forecast period [2021 to 2026]. The orthopedic surgical instrument industry has recently witnessed a breakthrough in its surgical/ pneumatic drills segment by launching an orthopedic power drill. The industry has welcomed intelligent or smart surgical drills along with navigation systems that will help surgeons perform accurate and minimally invasive bone surgeries and offer a significantly improved implant position and treatment outcome.

The market for intelligent surgical drill systems will be increasing drastically owing to an increasing need for orthopedic surgeries due to the growing geriatric patient population. As per the recent data by WHO, 1 in 40 patients would need to undergo some or the other form of orthopedic surgery majorly due to the increasing prevalence of osteoporosis.

Moreover, with the increasing number of hip and knee replacement surgeries, healthcare providers across the globe are taking a keen interest in using intelligent drills. Researchers across the globe have predicted that the total yearly counts of hip arthroplasty will increase from 498,000 replacements in 2020 to 652,000 replacements in 2025, followed by 850,000 replacements in 2030, and around 1,429,000 replacements in 2040.

Intelligent drills offer real-time physiological and drilling data and reduce the number of procedural steps that are high in a traditional surgery set up. Such advantageous features will help the doctors make appropriate decisions and park an implant more easily. Moreover, these drilling systems are radiation-free in nature which helps to cut down on the use of x-ray systems. These advantages and features of the intelligent orthopedic surgical drill will support the market growth from 2021 to 2026.

Furthermore, these drills have an exclusive feature to automatically stop at the distal bone based on the results of an analysis of the difference in the rotational speed of the drill bit according to the difference in strength and the density of the bone tissue. This will help the surgeons identify the bone depth and avoid causing parallel damage to the patient. Another associated system with the intelligent drilling kit is Computer-Aided Orthopaedic Surgery (CAOS). CAOS plays a vital role in the industry as it has been developed and launched for the purpose of robotic surgical procedures. Robotic surgical systems and CAOS are together used to conduct minimally invasive surgeries.

As per iData's robotic surgery statistics report, as of 2018, 86% of total robotic surgeries performed were minimally invasive surgeries in the United States. Hence, increasing patient preference for minimally invasive orthopedic surgeries, rising awareness regarding smart surgical tools and increasing research and developmental activities to launch navigating and drilling systems (for example: intelligent Otologic drill) will boost the market growth from 2021 to 2026. However, high cost associated with robotic surgeries and smart drilling systems will hamper the growth of the market in the developing regions.

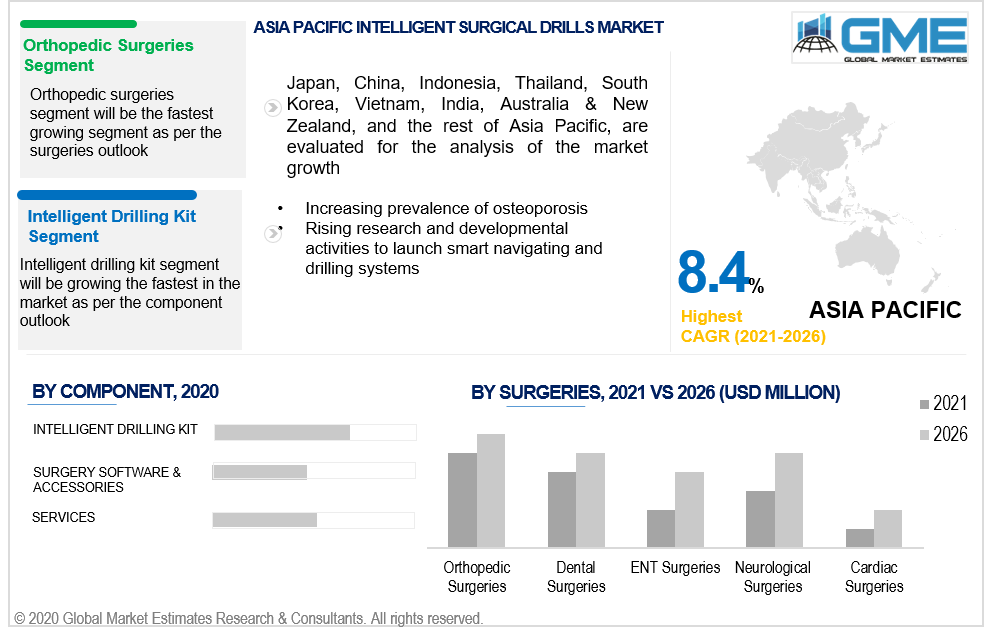

Based on the component outlook, the market is segmented into intelligent drilling kit [marking drills/detecting drill, drill extenders, motor mount driver, and others], surgery software & accessories, and services. The surgery software and accessories segment will be the largest segment in terms of revenue and market size. This is mainly attributed to the rising preference for minimally and robotic surgeries across developed countries and increasing demand for navigating software systems to conduct real-time monitoring surgeries.

As per the type of surgery outlook, the market can be segmented into orthopedic surgeries, dental surgeries, ENT surgeries, neurological surgeries, and cardiac surgeries. The orthopedic surgeries segment will be the fastest growing segment owing to increasing product launch strategies and rising manufacturer penetration in the bone drilling industry with smart and advanced navigating technologies.

The market based on end-user outlook is segregated into hospitals, orthopedic centers, ambulatory surgery centers/ emergency care centers, and others. The hospitals segment will be the largest one owing to rising awareness of smart and intelligent drills, high spending power for robotic surgical equipment, and an increasing number of skilled professionals catering to hospitals across the developed regions.

As per the geographical analysis, the intelligent surgical drills market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the market from 2021 to 2026. The dominant share of North America is mainly attributed to increasing research and development activities revolving around painless orthopedic surgeries, increasing prevalence of obesity that is giving rise to increasing need for hip and knee surgeries, high spending power of both healthcare providers and healthcare consumers for advanced surgeries, and presence of key players in the North American region.

However, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) segment will be the fastest growing regional segment in the intelligent surgical drills market from 2021 to 2026. Countries like China and India have high growth opportunities as these countries are at the forefront in terms of skilled professionals, increasing prevalence of osteoporosis, and rising preference for minimally invasive surgeries.

Zimmer Biomet, RIM Science, Dental Solution Israel, Smart Medical Device, Inc., Novodent SA, ARDS Industries, Shanghai Bojin Medical Instrument Co., Ltd., McGinley Orthopedics, Hiossen, ACRA-CUT Inc. and Securos Surgical are the key players in the intelligent surgical drills market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Intelligent Surgical Drills Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Component Overview

2.1.3 Surgery Type Overview

2.1.4 End-User Overview

2.1.6 Regional Overview

Chapter 3 Intelligent Surgical Drills Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising prevalence of osteoporosis and orthopedic surgeries

3.3.2 Industry Challenges

3.3.2.1 Lack of adequate infrastructure and automated surgical systems in developing nations

3.4 Prospective Growth Scenario

3.4.1 Component Growth Scenario

3.4.2 Surgery Type Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Intelligent Surgical Drills Market, By Component

4.1 Component Outlook

4.2 Intelligent Drilling Kit

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.2.2 Marking Drills

4.2.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.2.3 Drill Extenders

4.2.3.1 Market Size, By Region, 2020-2026 (USD Million)

4.2.4 Motor Mount Driver

4.2.4.1 Market Size, By Region, 2020-2026 (USD Million)

4.2.5 Others

4.2.5.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 Surgery Software & Accessories

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

4.4 Service

4.4.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Intelligent Surgical Drills Market, By Surgery Type

5.1 Surgery Type Outlook

5.2 Orthopedic Surgeries

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Dental Surgeries

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

5.4 ENT Surgeries

5.4.1 Market Size, By Region, 2020-2026 (USD Million)

5.5 Neurological Surgeries

5.5.1 Market Size, By Region, 2020-2026 (USD Million)

5.6 Cardiac Surgeries

5.6.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Intelligent Surgical Drills Market, By End-User

6.1 Hospitals

6.1.1 Market Size, By Region, 2020-2026 (USD Million)

6.2 Orthopedic Centers

6.2.1 Market Size, By Region, 2020-2026 (USD Million)

6.3 Ambulatory Surgery Centers/ Emergency Care Centers

6.3.1 Market Size, By Region, 2020-2026 (USD Million)

6.3 Others

6.3.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 7 Intelligent Surgical Drills Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Million)

7.2.2 Market Size, By Surgery Type, 2020-2026 (USD Million)

7.2.3 Market Size, By Component, 2020-2026 (USD Million)

7.2.4 Market Size, By End-User, 2020-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Surgery Type, 2020-2026 (USD Million)

7.2.5.2 Market Size, By Component, 2020-2026 (USD Million)

7.2.5.3 Market Size, By End-User, 2020-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Surgery Type, 2020-2026 (USD Million)

7.2.6.2 Market Size, By Component, 2020-2026 (USD Million)

7.2.6.3 Market Size, By End-User, 2020-2026 (USD Million)

7.2.7 Mexico

7.2.7.1 Market Size, By Surgery Type, 2020-2026 (USD Million)

7.2.7.2 Market Size, By Component, 2020-2026 (USD Million)

7.2.7.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Million)

7.3.2 Market Size, By Surgery Type, 2020-2026 (USD Million)

7.3.3 Market Size, By Component, 2020-2026 (USD Million)

7.3.4 Market Size, By End-User, 2020-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Surgery Type, 2020-2026 (USD Million)

7.3.5.2 Market Size, By Component, 2020-2026 (USD Million)

7.3.5.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Surgery Type, 2020-2026 (USD Million)

7.3.6.2 Market Size, By Component, 2020-2026 (USD Million)

7.3.6.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Surgery Type, 2020-2026 (USD Million)

7.3.7.2 Market Size, By Component, 2020-2026 (USD Million)

7.3.7.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Surgery Type, 2020-2026 (USD Million)

7.3.8.2 Market Size, By Component, 2020-2026 (USD Million)

7.3.8.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Surgery Type, 2020-2026 (USD Million)

7.3.9.2 Market Size, By Component, 2020-2026 (USD Million)

7.3.9.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Surgery Type, 2020-2026 (USD Million)

7.3.10.2 Market Size, By Component, 2020-2026 (USD Million)

7.3.10.3 Market Size, By End-User, 2020-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Million)

7.4.2 Market Size, By Surgery Type, 2020-2026 (USD Million)

7.4.3 Market Size, By Component, 2020-2026 (USD Million)

7.4.4 Market Size, By End-User, 2020-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Surgery Type, 2020-2026 (USD Million)

7.4.5.2 Market Size, By Component, 2020-2026 (USD Million)

7.4.5.3 Market Size, By End-User, 2020-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Surgery Type, 2020-2026 (USD Million)

7.4.6.2 Market Size, By Component, 2020-2026 (USD Million)

7.4.6.3 Market Size, By End-User, 2020-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Surgery Type, 2020-2026 (USD Million)

7.4.7.2 Market Size, By Component, 2020-2026 (USD Million)

7.4.7.3 Market Size, By End-User, 2020-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Million)

7.5.2 Market Size, By Surgery Type, 2020-2026 (USD Million)

7.5.3 Market Size, By Component, 2020-2026 (USD Million)

7.5.4 Market Size, By End-User, 2020-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Surgery Type, 2020-2026 (USD Million)

7.5.5.2 Market Size, By Component, 2020-2026 (USD Million)

7.5.5.3 Market Size, By End-User, 2020-2026 (USD Million)

7.5.6 Argentina

7.5.6.1 Market Size, By Surgery Type, 2020-2026 (USD Million)

7.5.6.2 Market Size, By Component, 2020-2026 (USD Million)

7.5.6.3 Market Size, By End-User, 2020-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Million)

7.6.2 Market Size, By Surgery Type, 2020-2026 (USD Million)

7.6.3 Market Size, By Component, 2020-2026 (USD Million)

7.6.4 Market Size, By End-User, 2020-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Surgery Type, 2020-2026 (USD Million)

7.6.5.2 Market Size, By Component, 2020-2026 (USD Million)

7.6.5.3 Market Size, By End-User, 2020-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Surgery Type, 2020-2026 (USD Million)

7.6.6.2 Market Size, By Component, 2020-2026 (USD Million)

7.6.6.3 Market Size, By End-User, 2020-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Surgery Type, 2020-2026 (USD Million)

7.6.7.2 Market Size, By Component, 2020-2026 (USD Million)

7.6.7.3 Market Size, By End-User, 2020-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Zimmer Biomet

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 RIM Science

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Dental Solution Israel

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Smart Medical Device, Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Novodent SA

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 ARDS Industries

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Shanghai Bojin Medical Instrument Co., Ltd.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 McGinley Orthopedics

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 ACRA-CUT Inc.

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Intelligent Surgical Drills Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Intelligent Surgical Drills Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS