Global Laboratory Informatics Market Size, Trends & Analysis - Forecasts to 2028 By Product (Laboratory Information Management Systems (LIMS), Electronic Lab Notebooks (ELN), Scientific Data Management Systems (SDMS), Laboratory Execution Systems (LES), Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS), Chromatography Data Systems (CDS), and Enterprise Content Management (ECM)), By Delivery Mode (On-premise, Web-hosted, and Cloud-based), By Component (Software and Services), By End-use (Life Sciences, CROs, Chemical Industry, F&B and Agriculture, Environmental Testing Labs, Petrochemical Refineries & Oil and Gas Industry, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

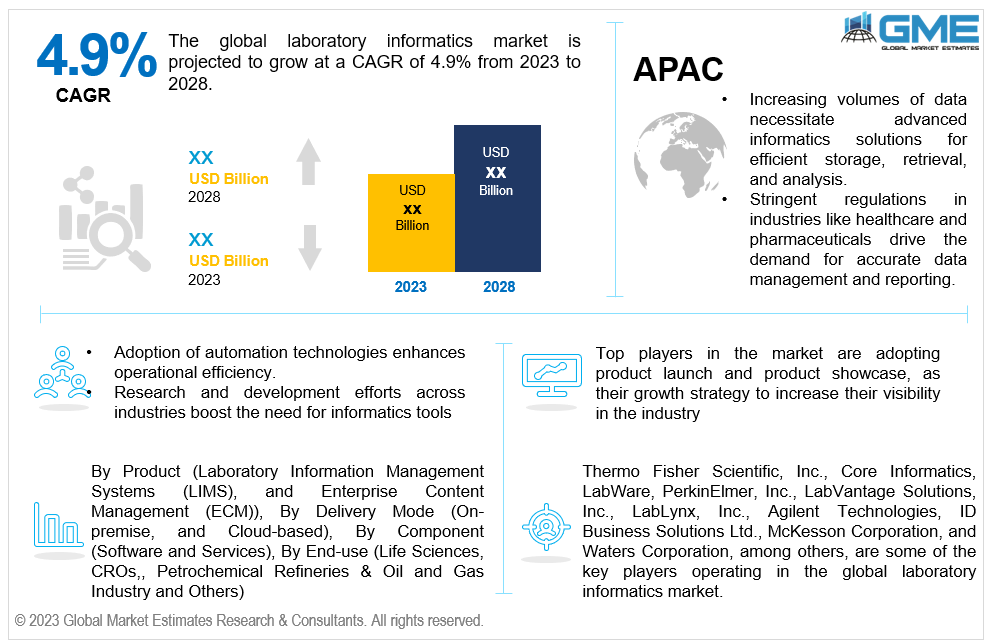

The global laboratory informatics market is projected to grow at a CAGR of 4.9% from 2023 to 2028.

The increasing demand for laboratory automation is a major factor contributing to the adoption of laboratory informatics. The need for efficient handling of the increased volume of data generated by laboratories, especially in molecular genomics and genetic testing practices, promotes the adoption of laboratory automation solutions.

The advancements in molecular genomics and genetic testing practices have led to a substantial increase in laboratory data generation. The adoption of laboratory informatics is crucial to manage this large volume of data effectively.

The rising preference towards personalized medicine, cancer genomics studies, and the increasing requirements for patient engagement are fostering a growing demand for lab automation systems and, consequently, laboratory informatics. The evolution of more user-friendly laboratory informatics software solutions in laboratory informatics is contributing to market growth. Additionally, the migration of data to the cloud and the rise of start-ups in this sector are shaping the landscape of laboratory informatics.

Challenges for the global laboratory informatics market include the high costs of implementation, data security concerns, and the complexity of integrating diverse laboratory systems. Regulatory compliance issues and resistance to adopting new technologies also pose barriers, impacting the widespread adoption of laboratory informatics solutions.

Laboratory information management system (LIMS) segment is expected to hold the largest share of the market over the forecast period. The system include managing data, system and security administration, stability studies, inventory, instruments, schedules, logistics, storage capacity, and analytical laboratory workflow solutions. The increasing need for seamlessly integrated services in life sciences and research to reduce errors in laboratory data management and enhance the quality management of research analysis is expected to drive the segment growth.

The enterprise content management (ECM) segment is expected to be the fastest-growing segment in the market from 2023-2028. ECM provides solutions to handle the increasing challenges in the healthcare industry. ECM is a centralized approach to managing an organization's media and electronic documents by capturing, creating, organizing, accessing, and analysing them. Companies that provide ECM services offer help with consulting, designing, implementing, and maintaining these software solutions.

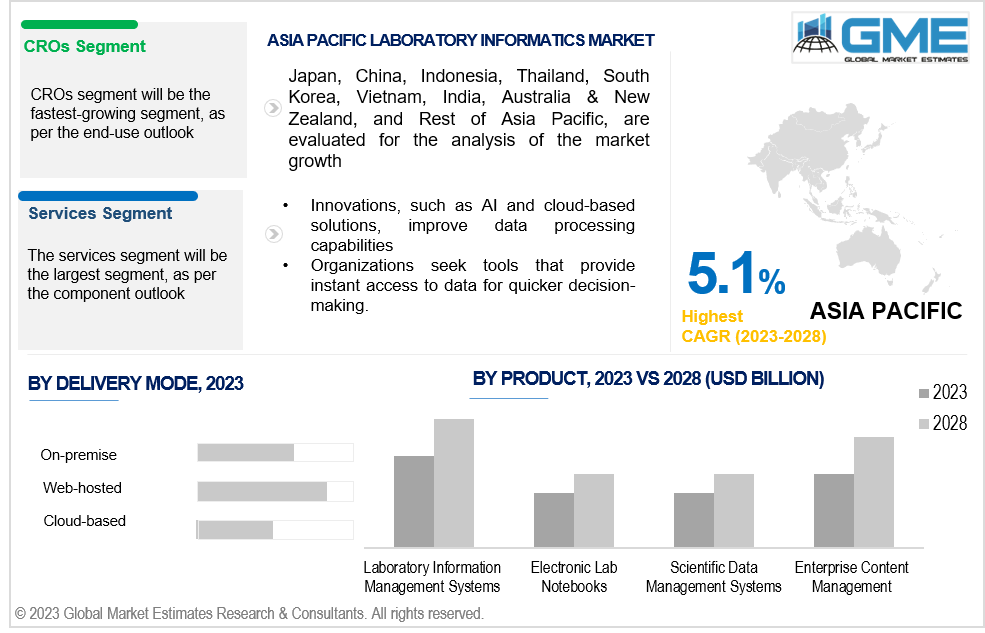

The on-premises segment is anticipated to be the fastest-growing segment in the market from 2023-2028. This delivery mode entails installing services and solutions directly on the computers within an organization. On-premises systems offer businesses greater control and customization over their software, providing a localized and dedicated infrastructure. This approach is favoured for its security features and the ability to meet specific organizational needs, contributing to segment growth.

The cloud-based segment is expected to hold the largest share of the market over the forecast period. Cloud-based laboratory informatics technology helps to store large quantities of data in a faraway place, freeing up space on the devices. This technology provides laboratory informatics services such as Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). Companies like Core Informatics and LabVantage Solutions, Inc. provide cloud-based LIMS services.

The software segment is anticipated to be the fastest-growing segment in the market from 2023-2028. The segment growth is attributed to technologically advanced software like SaaS (Software as a Service), providing efficient information management solutions for laboratories. Software designed for laboratory informatics is vital in storage, data capture, interpretation, and analysis. Regularly updating this software is essential to align it with the scientific data analytics methods, contributing to the sector's profitable expansion in the forecast period.

The services segment is anticipated to hold the largest share of the market over the forecast period. The main factor contributing to the segment's dominance is the outsourcing of LIMS systems. Large pharmaceutical research labs, lacking the necessary resources and expertise for deploying analytics, prefer outsourcing these services to meet their requirements.

The CROs (Contract Research Organizations) segment is anticipated to be the fastest-growing segment in the market from 2023-2028. The increasing adoption of outsourcing services by healthcare companies to reduce their operational costs and improve efficiency, drives growth of the CROs segment. Laboratory Information Management Systems (LIMS) have applications in forensic science, metal and mining industry, and various pharmaceutical laboratories. The growing imperative to manage operational costs, combined with the advantages linked to LIMS utilization, is a significant factor expected to fuel the expansion of this segment.

The life sciences segment is expected to hold the largest share of the market. This sector includes molecular diagnostic and clinical research labs, pharmaceutical and biotech firms, biobanks, contract service organizations, and academic research institutes. There is a growing need for laboratory informatics in the life sciences industry to enhance product innovation, quality, and operational efficiency. Laboratory informatics systems play a crucial role in efficiently managing vast amounts of data and breaking down silos in research and discovery processes.

North America is expected to be the dominant region in the market during the forecast period. The primary reasons boosting the regional market growth include the increased adoption of LIMS due to rising healthcare costs and the pressing need to control these expenses. Additionally, the region's well-established pharmaceutical companies and the growing emphasis on managing operational costs related to information management and analysis are crucial factors contributing to the regional market's expansion.

Asia Pacific is predicted to witness rapid growth during the forecast period. Countries like China and India are emerging as outsourcing hubs, with India experiencing growth in eClinical services. The increasing demand for laboratory informatics in India is driven by its capability to provide efficient and effective infrastructure for conducting clinical trials, emphasizing affordable patient care and evidence-based management.

Thermo Fisher Scientific, Inc., Core Informatics, LabWare, PerkinElmer, Inc., LabVantage Solutions, Inc., LabLynx, Inc., Agilent Technologies, ID Business Solutions Ltd., McKesson Corporation, and Waters Corporation, among others, are some of the key players operating in the global laboratory informatics market.

Please note: This is not an exhaustive list of companies profiled in the report.

In April 2023, the commencement of the second stage of the STARLIMS Quality Manufacturing Electronic Laboratory Notebook (ELN) project was initiated by Beijing Tide Pharmaceutical Co., Ltd. Building upon the success of the first phase, which integrated STARLIMS' Laboratory Information Management System (LIMS) and Scientific Data Management System (SDMS), this project aims to enhance data integrity, automate data management, and standardize processes at Tide Pharmaceutical's testing center.

In April 2022, Scitara, a pioneer in laboratory digital transformation, partnered with PerkinElmer, a company specializing in scientific-analytical technology. The partnership aims to integrate PerkinElmer's Signals Research Suite informatics platform with laboratory instruments via Scitara's iPaaS for Science, known as Scitara DLX.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL LABORATORY INFORMATICS MARKET, BY PRODUCT

4.1 Introduction

4.2 Laboratory Informatics Market: Product Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Laboratory Information Management Systems (LIMS)

4.4.1 Laboratory Information Management Systems (LIMS) Market Estimates and Forecast, 2020-2028 (USD Million)

4.5 Electronic Lab Notebooks (ELN)

4.5.1 Electronic Lab Notebooks (ELN) Market Estimates and Forecast, 2020-2028 (USD Million)

4.6 Scientific Data Management Systems (SDMS)

4.6.1 Scientific Data Management Systems (SDMS) Market Estimates and Forecast, 2020-2028 (USD Million)

4.7 Laboratory Execution Systems (LES)

4.7.1 Laboratory Execution Systems (LES) Market Estimates and Forecast, 2020-2028 (USD Million)

4.8 Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS)

4.8.1 Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS) Market Estimates and Forecast, 2020-2028 (USD Million)

4.9 Chromatography Data Systems (CDS)

4.9.1 Chromatography Data Systems (CDS) Market Estimates and Forecast, 2020-2028 (USD Million)

4.10 Enterprise Content Management (ECM)

4.10.1 Enterprise Content Management (ECM) Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL LABORATORY INFORMATICS MARKET, BY END-USE

5.1 Introduction

5.2 Laboratory Informatics Market: End-use Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Life Sciences

5.4.1 Life Sciences Market Estimates and Forecast, 2020-2028 (USD Million)

5.5 CROs

5.5.1 CROs Market Estimates and Forecast, 2020-2028 (USD Million)

5.6 Chemical Industry

5.6.1 Chemical Industry Market Estimates and Forecast, 2020-2028 (USD Million)

5.7 F&B and Agriculture

5.7.1 Market Estimates and Forecast, 2020-2028 (USD Million)

5.8 Environmental Testing Labs

5.8.1 Environmental Testing Labs Market Estimates and Forecast, 2020-2028 (USD Million)

5.9 Petrochemical Refineries & Oil and Gas Industry

5.9.1 Petrochemical Refineries & Oil and Gas Industry Market Estimates and Forecast, 2020-2028 (USD Million)

5.10 Others

5.10.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL LABORATORY INFORMATICS MARKET, BY DELIVERY MODE

6.1 Introduction

6.2 Laboratory Informatics Market: Delivery Mode Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4 On-premise

6.4.1 On-premise Market Estimates and Forecast, 2020-2028 (USD Million)

6.5 Web-hosted

6.5.1 Web-hosted Market Estimates and Forecast, 2020-2028 (USD Million)

6.6 Cloud-based

6.6.1 Cloud-based Market Estimates and Forecast, 2020-2028 (USD Million)

7 GLOBAL LABORATORY INFORMATICS MARKET, BY COMPONENT

7.1 Introduction

7.2 Laboratory Informatics Market: Component Scope Key Takeaways

7.3 Revenue Growth Analysis, 2022 & 2028

7.4 Software

7.4.1 Software Market Estimates and Forecast, 2020-2028 (USD Million)

7.5 Services

7.5.1 Services Market Estimates and Forecast, 2020-2028 (USD Million)

8 GLOBAL LABORATORY INFORMATICS MARKET, BY REGION

8.1 Introduction

8.2 North America Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.2.1 By Product

8.2.2 By End-use

8.2.3 By Delivery Mode

8.2.4 By Component

8.2.5 By Country

8.2.5.1 U.S. Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.2.5.1.1 By Product

8.2.5.1.2 By End-use

8.2.5.1.3 By Delivery Mode

8.2.5.1.4 By Component

8.2.5.2 Canada Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.2.5.2.1 By Product

8.2.5.2.2 By End-use

8.2.5.2.3 By Delivery Mode

8.2.5.2.4 By Component

8.2.5.3 Mexico Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.2.5.3.1 By Product

8.2.5.3.2 By End-use

8.2.5.3.3 By Delivery Mode

8.2.5.3.4 By Component

8.3 Europe Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.1 By Product

8.3.2 By End-use

8.3.3 By Delivery Mode

8.3.4 By Component

8.3.5 By Country

8.3.5.1 Germany Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.1.1 By Product

8.3.5.1.2 By End-use

8.3.5.1.3 By Delivery Mode

8.3.5.1.4 By Component

8.3.5.2 U.K. Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.2.1 By Product

8.3.5.2.2 By End-use

8.3.5.2.3 By Delivery Mode

8.3.5.2.4 By Component

8.3.5.3 France Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.3.1 By Product

8.3.5.3.2 By End-use

8.3.5.3.3 By Delivery Mode

8.3.5.3.4 By Component

8.3.5.4 Italy Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.4.1 By Product

8.3.5.4.2 By End-use

8.3.5.4.3 By Delivery Mode

8.3.5.4.4 By Component

8.3.5.5 Spain Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.5.1 By Product

8.3.5.5.2 By End-use

8.3.5.5.3 By Delivery Mode

8.3.5.5.4 By Component

8.3.5.6 Netherlands Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.6.1 By Product

8.3.5.6.2 By End-use

8.3.5.6.3 By Delivery Mode

8.3.5.6.4 By Component

8.3.5.7 Rest of Europe Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.7.1 By Product

8.3.5.7.2 By End-use

8.3.5.7.3 By Delivery Mode

8.3.5.7.4 By Component

8.4 Asia Pacific Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.1 By Product

8.4.2 By End-use

8.4.3 By Delivery Mode

8.4.4 By Component

8.4.5 By Country

8.4.5.1 China Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.1.1 By Product

8.4.5.1.2 By End-use

8.4.5.1.3 By Delivery Mode

8.4.5.1.4 By Component

8.4.5.2 Japan Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.2.1 By Product

8.4.5.2.2 By End-use

8.4.5.2.3 By Delivery Mode

8.4.5.2.4 By Component

8.4.5.3 India Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.3.1 By Product

8.4.5.3.2 By End-use

8.4.5.3.3 By Delivery Mode

8.4.5.3.4 By Component

8.4.5.4 South Korea Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.4.1 By Product

8.4.5.4.2 By End-use

8.4.5.4.3 By Delivery Mode

8.4.5.4.4 By Component

8.4.5.5 Singapore Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.5.1 By Product

8.4.5.5.2 By End-use

8.4.5.5.3 By Delivery Mode

8.4.5.5.4 By Component

8.4.5.6 Malaysia Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.6.1 By Product

8.4.5.6.2 By End-use

8.4.5.6.3 By Delivery Mode

8.4.5.6.4 By Component

8.4.5.7 Thailand Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.7.1 By Product

8.4.5.7.2 By End-use

8.4.5.7.3 By Delivery Mode

8.4.5.7.4 By Component

8.4.5.8 Indonesia Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.8.1 By Product

8.4.5.8.2 By End-use

8.4.5.8.3 By Delivery Mode

8.4.5.8.4 By Component

8.4.5.9 Vietnam Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.9.1 By Product

8.4.5.9.2 By End-use

8.4.5.9.3 By Delivery Mode

8.4.5.9.4 By Component

8.4.5.10 Taiwan Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.10.1 By Product

8.4.5.10.2 By End-use

8.4.5.10.3 By Delivery Mode

8.4.5.10.4 By Component

8.4.5.11 Rest of Asia Pacific Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.11.1 By Product

8.4.5.11.2 By End-use

8.4.5.11.3 By Delivery Mode

8.4.5.11.4 By Component

8.5 Middle East and Africa Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.1 By Product

8.5.2 By End-use

8.5.3 By Delivery Mode

8.5.4 By Component

8.5.5 By Country

8.5.5.1 Saudi Arabia Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.5.1.1 By Product

8.5.5.1.2 By End-use

8.5.5.1.3 By Delivery Mode

8.5.5.1.4 By Component

8.5.5.2 U.A.E. Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.5.2.1 By Product

8.5.5.2.2 By End-use

8.5.5.2.3 By Delivery Mode

8.5.5.2.4 By Component

8.5.5.3 Israel Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.4.3.1 By Product

8.5.4.3.2 By End-use

8.5.4.3.3 By Delivery Mode

8.5.5.3.4 By Component

8.5.5.4 South Africa Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.5.4.1 By Product

8.5.5.4.2 By End-use

8.5.5.4.3 By Delivery Mode

8.5.5.4.4 By Component

8.5.5.5 Rest of Middle East and Africa Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.5.5.1 By Product

8.5.5.5.2 By End-use

8.5.5.5.2 By Delivery Mode

8.5.5.5.4 By Component

8.6 Central and South America Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.1 By Product

8.6.2 By End-use

8.6.3 By Delivery Mode

8.6.4 By Component

8.6.5 By Country

8.6.5.1 Brazil Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.5.1.1 By Product

8.6.5.1.2 By End-use

8.6.5.1.3 By Delivery Mode

8.6.5.1.4 By Component

8.6.5.2 Argentina Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.5.2.1 By Product

8.6.5.2.2 By End-use

8.6.5.2.3 By Delivery Mode

8.6.5.2.4 By Component

8.6.5.3 Chile Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.5.3.1 By Product

8.6.5.3.2 By End-use

8.6.5.3.3 By Delivery Mode

8.6.5.5.4 By Component

8.6.5.4 Rest of Central and South America Laboratory Informatics Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.5.4.1 By Product

8.6.5.4.2 By End-use

8.6.5.4.3 By Delivery Mode

8.6.5.4.4 By Component

9 COMPETITIVE LANDCAPE

9.1 Company Market Share Analysis

9.2 Four Quadrant Positioning Matrix

9.2.1 Market Leaders

9.2.2 Market Visionaries

9.2.3 Market Challengers

9.2.4 Niche Market Players

9.3 Vendor Landscape

9.3.1 North America

9.3.2 Europe

9.3.3 Asia Pacific

9.3.4 Rest of the World

9.4 Company Profiles

9.4.1 Thermo Fisher Scientific, Inc.

9.4.1.1 Business Description & Financial Analysis

9.4.1.2 SWOT Analysis

9.4.1.3 Products & Services Offered

9.4.1.4 Strategic Alliances between Business Partners

9.4.2 Core Informatics

9.4.2.1 Business Description & Financial Analysis

9.4.2.2 SWOT Analysis

9.4.2.3 Products & Services Offered

9.4.2.4 Strategic Alliances between Business Partners

9.4.3 LabWare

9.4.3.1 Business Description & Financial Analysis

9.4.3.2 SWOT Analysis

9.4.3.3 Products & Services Offered

9.4.3.4 Strategic Alliances between Business Partners

9.4.4 PerkinElmer, Inc.

9.4.4.1 Business Description & Financial Analysis

9.4.4.2 SWOT Analysis

9.4.4.3 Products & Services Offered

9.4.4.4 Strategic Alliances between Business Partners

9.4.5 LabVantage Solutions, Inc.

9.4.5.1 Business Description & Financial Analysis

9.4.5.2 SWOT Analysis

9.4.5.3 Products & Services Offered

9.4.5.4 Strategic Alliances between Business Partners

9.4.6 LabLynx, Inc.

9.4.6.1 Business Description & Financial Analysis

9.4.6.2 SWOT Analysis

9.4.6.3 Products & Services Offered

9.4.6.4 Strategic Alliances between Business Partners

9.4.7 Agilent Technologies

9.4.7.1 Business Description & Financial Analysis

9.4.7.2 SWOT Analysis

9.4.7.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.8 ID Business Solutions Ltd.

9.4.8.1 Business Description & Financial Analysis

9.4.8.2 SWOT Analysis

9.4.8.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.9 McKesson Corporation

9.4.9.1 Business Description & Financial Analysis

9.4.9.2 SWOT Analysis

9.4.9.3 Products & Services Offered

9.4.9.4 Strategic Alliances between Business Partners

9.4.10 Waters Corporation

9.4.10.1 Business Description & Financial Analysis

9.4.10.2 SWOT Analysis

9.4.10.3 Products & Services Offered

9.4.10.4 Strategic Alliances between Business Partners

9.4.11 Other Companies

9.4.11.1 Business Description & Financial Analysis

9.4.11.2 SWOT Analysis

9.4.11.3 Products & Services Offered

9.4.11.4 Strategic Alliances between Business Partners

10 RESEARCH METHODOLOGY

10.1 Market Introduction

10.1.1 Market Definition

10.1.2 Market Scope & Segmentation

10.2 Information Procurement

10.2.1 Secondary Research

10.2.1.1 Purchased Databases

10.2.1.2 GMEs Internal Data Repository

10.2.1.3 Secondary Resources & Third Party Perspectives

10.2.1.4 Company Information Sources

10.2.2 Primary Research

10.2.2.1 Various Types of Respondents for Primary Interviews

10.2.2.2 Number of Interviews Conducted throughout the Research Process

10.2.2.3 Primary Stakeholders

10.2.2.4 Discussion Guide for Primary Participants

10.2.3 Expert Panels

10.2.3.1 Expert Panels Across 30+ Industry

10.2.4 Paid Local Experts

10.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

10.3 Market Estimation

10.3.1 Top-Down Approach

10.3.1.1 Macro-Economic Indicators Considered

10.3.1.2 Micro-Economic Indicators Considered

10.3.2 Bottom Up Approach

10.3.2.1 Company Share Analysis Approach

10.3.2.2 Estimation of Potential Product Sales

10.4 Data Triangulation

10.4.1 Data Collection

10.4.2 Time Series, Cross Sectional & Panel Data Analysis

10.4.3 Cluster Analysis

10.5 Analysis and Output

10.5.1 Inhouse AI Based Real Time Analytics Tool

10.5.2 Output From Desk & Primary Research

10.6 Research Assumptions & Limitations

10.7.1 Research Assumptions

10.7.2 Research Limitations

LIST OF TABLES

1 Global Laboratory Informatics Market, By Product, 2020-2028 (USD Mllion)

2 Laboratory Information Management Systems (LIMS) Market, By Region, 2020-2028 (USD Mllion)

3 Electronic Lab Notebooks (ELN) Market, By Region, 2020-2028 (USD Mllion)

4 Scientific Data Management Systems (SDMS) Market, By Region, 2020-2028 (USD Mllion)

5 Laboratory Execution Systems (LES)Market, By Region, 2020-2028 (USD Mllion)

6 Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS) Market, By Region, 2020-2028 (USD Mllion)

7 Chromatography Data Systems (CDS) Market, By Region, 2020-2028 (USD Mllion)

8 Enterprise Content Management (ECM) Market, By Region, 2020-2028 (USD Mllion)

9 Global Laboratory Informatics Market, By End-use, 2020-2028 (USD Mllion)

10 Life Sciences Market, By Region, 2020-2028 (USD Mllion)

11 CROs Market, By Region, 2020-2028 (USD Mllion)

12 Chemical Industry Market, By Region, 2020-2028 (USD Mllion)

13 F&B and Agriculture Market, By Region, 2020-2028 (USD Mllion)

14 Environmental Testing Labs Market, By Region, 2020-2028 (USD Mllion)

15 Petrochemical Refineries & Oil and Gas Industry Market, By Region, 2020-2028 (USD Mllion)

16 other Market, By Region, 2020-2028 (USD Mllion)

17 Global Laboratory Informatics Market, By Delivery Mode, 2020-2028 (USD Mllion)

18 On-premise Market, By Region, 2020-2028 (USD Mllion)

19 Web-hosted Market, By Region, 2020-2028 (USD Mllion)

20 Cloud-based Market, By Region, 2020-2028 (USD Mllion)

21 Global Laboratory Informatics Market, By Component, 2020-2028 (USD Mllion)

22 Software Market, By Region, 2020-2028 (USD Mllion)

23 Services Market, By Region, 2020-2028 (USD Mllion)

24 Regional Analysis, 2020-2028 (USD Mllion)

25 North America Laboratory Informatics Market, By Product, 2020-2028 (USD Million)

26 North America Laboratory Informatics Market, By End-use, 2020-2028 (USD Million)

27 North America Laboratory Informatics Market, By Delivery Mode, 2020-2028 (USD Million)

28 North America Laboratory Informatics Market, By Component, 2020-2028 (USD Million)

29 North America Laboratory Informatics Market, By Country, 2020-2028 (USD Million)

30 U.S Laboratory Informatics Market, By Product, 2020-2028 (USD Million)

31 U.S Laboratory Informatics Market, By End-use, 2020-2028 (USD Million)

32 U.S Laboratory Informatics Market, By Delivery Mode, 2020-2028 (USD Million)

33 U.S Laboratory Informatics Market, By Component, 2020-2028 (USD Million)

34 Canada Laboratory Informatics Market, By Product, 2020-2028 (USD Million)

35 Canada Laboratory Informatics Market, By End-use, 2020-2028 (USD Million)

36 Canada Laboratory Informatics Market, By Delivery Mode, 2020-2028 (USD Million)

37 CANADA Laboratory Informatics Market, By Component, 2020-2028 (USD Million)

38 Mexico Laboratory Informatics Market, By Product, 2020-2028 (USD Million)

39 Mexico Laboratory Informatics Market, By End-use, 2020-2028 (USD Million)

40 Mexico Laboratory Informatics Market, By Delivery Mode, 2020-2028 (USD Million)

41 mexico Laboratory Informatics Market, By Component, 2020-2028 (USD Million)

42 Europe Laboratory Informatics Market, By Product, 2020-2028 (USD Million)

43 Europe Laboratory Informatics Market, By End-use, 2020-2028 (USD Million)

44 Europe Laboratory Informatics Market, By Delivery Mode, 2020-2028 (USD Million)

45 europe Laboratory Informatics Market, By Component, 2020-2028 (USD Million)

46 Germany Laboratory Informatics Market, By Product, 2020-2028 (USD Million)

47 Germany Laboratory Informatics Market, By End-use, 2020-2028 (USD Million)

48 Germany Laboratory Informatics Market, By Delivery Mode, 2020-2028 (USD Million)

49 germany Laboratory Informatics Market, By Component, 2020-2028 (USD Million)

50 U.K Laboratory Informatics Market, By Product, 2020-2028 (USD Million)

51 U.K Laboratory Informatics Market, By End-use, 2020-2028 (USD Million)

52 U.K Laboratory Informatics Market, By Delivery Mode, 2020-2028 (USD Million)

53 U.k Laboratory Informatics Market, By Component, 2020-2028 (USD Million)

54 France Laboratory Informatics Market, By Product, 2020-2028 (USD Million)

55 France Laboratory Informatics Market, By End-use, 2020-2028 (USD Million)

56 France Laboratory Informatics Market, By Delivery Mode, 2020-2028 (USD Million)

57 france Laboratory Informatics Market, By Component, 2020-2028 (USD Million)

58 Italy Laboratory Informatics Market, By Product, 2020-2028 (USD Million)

59 Italy Laboratory Informatics Market, By END-USE, 2020-2028 (USD Million)

60 Italy Laboratory Informatics Market, By Delivery Mode, 2020-2028 (USD Million)

61 italy Laboratory Informatics Market, By Component, 2020-2028 (USD Million)

62 Spain Laboratory Informatics Market, By Product, 2020-2028 (USD Million)

63 Spain Laboratory Informatics Market, By End-use, 2020-2028 (USD Million)

64 Spain Laboratory Informatics Market, By Delivery Mode, 2020-2028 (USD Million)

65 spain Laboratory Informatics Market, By Component, 2020-2028 (USD Million)

66 Rest Of Europe Laboratory Informatics Market, By Product, 2020-2028 (USD Million)

67 Rest Of Europe Laboratory Informatics Market, By End-use, 2020-2028 (USD Million)

68 Rest of Europe Laboratory Informatics Market, By Delivery Mode, 2020-2028 (USD Million)

69 REST OF EUROPE Laboratory Informatics Market, By Component, 2020-2028 (USD Million)

70 Asia Pacific Laboratory Informatics Market, By Product, 2020-2028 (USD Million)

71 Asia Pacific Laboratory Informatics Market, By End-use, 2020-2028 (USD Million)

72 Asia Pacific Laboratory Informatics Market, By Delivery Mode, 2020-2028 (USD Million)

73 asia Laboratory Informatics Market, By Component, 2020-2028 (USD Million)

74 Asia Pacific Laboratory Informatics Market, By Country, 2020-2028 (USD Million)

75 China Laboratory Informatics Market, By Product, 2020-2028 (USD Million)

76 China Laboratory Informatics Market, By End-use, 2020-2028 (USD Million)

77 China Laboratory Informatics Market, By Delivery Mode, 2020-2028 (USD Million)

78 china Laboratory Informatics Market, By Component, 2020-2028 (USD Million)

79 India Laboratory Informatics Market, By Product, 2020-2028 (USD Million)

80 India Laboratory Informatics Market, By End-use, 2020-2028 (USD Million)

81 India Laboratory Informatics Market, By Delivery Mode, 2020-2028 (USD Million)

82 india Laboratory Informatics Market, By Component, 2020-2028 (USD Million)

83 Japan Laboratory Informatics Market, By Product, 2020-2028 (USD Million)

84 Japan Laboratory Informatics Market, By End-use, 2020-2028 (USD Million)

85 Japan Laboratory Informatics Market, By Delivery Mode, 2020-2028 (USD Million)

86 japan Laboratory Informatics Market, By Component, 2020-2028 (USD Million)

87 South Korea Laboratory Informatics Market, By Product, 2020-2028 (USD Million)

88 South Korea Laboratory Informatics Market, By End-use, 2020-2028 (USD Million)

89 South Korea Laboratory Informatics Market, By Delivery Mode, 2020-2028 (USD Million)

90 south korea Laboratory Informatics Market, By Component, 2020-2028 (USD Million)

91 Middle East and Africa Laboratory Informatics Market, By Product, 2020-2028 (USD Million)

92 Middle East and Africa Laboratory Informatics Market, By End-use, 2020-2028 (USD Million)

93 Middle East and Africa Laboratory Informatics Market, By Delivery Mode, 2020-2028 (USD Million)

94 MIDDLE EAST and AFRICA Laboratory Informatics Market, By Component, 2020-2028 (USD Million)

95 Middle East and Africa Laboratory Informatics Market, By Country, 2020-2028 (USD Million)

96 Saudi Arabia Laboratory Informatics Market, By Product, 2020-2028 (USD Million)

97 Saudi Arabia Laboratory Informatics Market, By End-use, 2020-2028 (USD Million)

98 Saudi Arabia Laboratory Informatics Market, By Delivery Mode, 2020-2028 (USD Million)

99 saudi arabia Laboratory Informatics Market, By Component, 2020-2028 (USD Million)

100 UAE Laboratory Informatics Market, By Product, 2020-2028 (USD Million)

101 UAE Laboratory Informatics Market, By End-use, 2020-2028 (USD Million)

102 UAE Laboratory Informatics Market, By Delivery Mode, 2020-2028 (USD Million)

103 uae Laboratory Informatics Market, By Component, 2020-2028 (USD Million)

104 Central and South America Laboratory Informatics Market, By Product, 2020-2028 (USD Million)

105 Central and South America Laboratory Informatics Market, By End-use, 2020-2028 (USD Million)

106 Central and South America Laboratory Informatics Market, By Delivery Mode, 2020-2028 (USD Million)

107 CENTRAL and SOUTH AMERICA Laboratory Informatics Market, By Component, 2020-2028 (USD Million)

108 Central and South America Laboratory Informatics Market, By Country, 2020-2028 (USD Million)

109 Brazil Laboratory Informatics Market, By Product, 2020-2028 (USD Million)

110 Brazil Laboratory Informatics Market, By End-use, 2020-2028 (USD Million)

111 Brazil Laboratory Informatics Market, By Delivery Mode, 2020-2028 (USD Million)

112 brazil Laboratory Informatics Market, By Component, 2020-2028 (USD Million)

113 THERMO FISHER SCIENTIFIC, INC.: Products & Services Offering

114 Core Informatics: Products & Services Offering

115 LabWare: Products & Services Offering

116 PerkinElmer, Inc.: Products & Services Offering

117 LabVantage Solutions, Inc.: Products & Services Offering

118 LABLYNX, INC.: Products & Services Offering

119 Agilent Technologies : Products & Services Offering

120 ID Business Solutions Ltd.: Products & Services Offering

121 McKesson Corporation, Inc: Products & Services Offering

122 WATERS CORPORATION: Products & Services Offering

123 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Laboratory Informatics Market Overview

2 Global Laboratory Informatics Market Value From 2020-2028 (USD Mllion)

3 Global Laboratory Informatics Market Share, By Product (2022)

4 Global Laboratory Informatics Market Share, By End-use (2022)

5 Global Laboratory Informatics Market Share, By Delivery Mode (2022)

6 Global Laboratory Informatics Market Share, By Component (2022)

7 Global Laboratory Informatics Market, By Region (Asia Pacific Market)

8 Technological Trends In Global Laboratory Informatics Market

9 Four Quadrant Competitor Positioning Matrix

10 Impact Of Macro & Micro Indicators On The Market

11 Impact Of Key Drivers On The Global Laboratory Informatics Market

12 Impact Of Challenges On The Global Laboratory Informatics Market

13 Porter’s Five Forces Analysis

14 Global Laboratory Informatics Market: By Product Scope Key Takeaways

15 Global Laboratory Informatics Market, By Product Segment: Revenue Growth Analysis

16 Laboratory Information Management Systems (LIMS) Market, By Region, 2020-2028 (USD Mllion)

17 Electronic Lab Notebooks (ELN) Market, By Region, 2020-2028 (USD Mllion)

18 Scientific Data Management Systems (SDMS) Market, By Region, 2020-2028 (USD Mllion)

19 Laboratory Execution Systems (LES) Market, By Region, 2020-2028 (USD Mllion)

20 Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS) Market, By Region, 2020-2028 (USD Mllion)

21 Chromatography Data Systems (CDS) Market, By Region, 2020-2028 (USD Mllion)

22 Enterprise Content Management (ECM) Market, By Region, 2020-2028 (USD Mllion)

23 Global Laboratory Informatics Market: By End-use Scope Key Takeaways

24 Global Laboratory Informatics Market, By End-use Segment: Revenue Growth Analysis

25 Life Sciences Market, By Region, 2020-2028 (USD Mllion)

26 CROs Market, By Region, 2020-2028 (USD Mllion)

27 Chemical Industry Market, By Region, 2020-2028 (USD Mllion)

28 F&B and Agriculture Market, By Region, 2020-2028 (USD Mllion)

29 Environmental Testing Labs Market, By Region, 2020-2028 (USD Mllion)

30 Petrochemical Refineries & Oil and Gas Industry Market, By Region, 2020-2028 (USD Mllion)

31 Others Market, By Region, 2020-2028 (USD Mllion)

32 Global Laboratory Informatics Market: By Delivery Mode Scope Key Takeaways

33 Global Laboratory Informatics Market, By Delivery Mode Segment: Revenue Growth Analysis

34 On-premise Market, By Region, 2020-2028 (USD Mllion)

35 Web-hosted Market, By Region, 2020-2028 (USD Mllion)

36 Cloud-based Market, By Region, 2020-2028 (USD Mllion)

37 Global Laboratory Informatics Market: By Component Scope Key Takeaways

38 Global Laboratory Informatics Market, By Component Segment: Revenue Growth Analysis

39 Software Market, By Region, 2020-2028 (USD Mllion)

40 Services Market, By Region, 2020-2028 (USD Mllion)

41 Regional Segment: Revenue Growth Analysis

42 Global Laboratory Informatics Market: Regional Analysis

43 North America Laboratory Informatics Market Overview

44 North America Laboratory Informatics Market, By Product

45 North America Laboratory Informatics Market, By End-use

46 North America Laboratory Informatics Market, By Delivery Mode

47 North America Laboratory Informatics Market, By Component

48 North America Laboratory Informatics Market, By Country

49 U.S. Laboratory Informatics Market, By Product

50 U.S. Laboratory Informatics Market, By End-use

51 U.S. Laboratory Informatics Market, By Delivery Mode

52 U.S. Laboratory Informatics Market, By Component

53 Canada Laboratory Informatics Market, By Product

54 Canada Laboratory Informatics Market, By End-use

55 Canada Laboratory Informatics Market, By Delivery Mode

56 Canada Laboratory Informatics Market, By Component

57 Mexico Laboratory Informatics Market, By Product

58 Mexico Laboratory Informatics Market, By End-use

59 Mexico Laboratory Informatics Market, By Delivery Mode

60 Mexico Laboratory Informatics Market, By Component

61 Four Quadrant Positioning Matrix

62 Company Market Share Analysis

63 Thermo Fisher Scientific, Inc.: Company Snapshot

64 Thermo Fisher Scientific, Inc.: SWOT Analysis

65 Thermo Fisher Scientific, Inc.: Geographic Presence

66 Core Informatics: Company Snapshot

67 Core Informatics: SWOT Analysis

68 Core Informatics: Geographic Presence

69 LabWare: Company Snapshot

70 LabWare: SWOT Analysis

71 LabWare: Geographic Presence

72 PerkinElmer, Inc.: Company Snapshot

73 PerkinElmer, Inc.: Swot Analysis

74 PerkinElmer, Inc.: Geographic Presence

75 LabVantage Solutions, Inc.: Company Snapshot

76 LabVantage Solutions, Inc.: SWOT Analysis

77 LabVantage Solutions, Inc.: Geographic Presence

78 LabLynx, Inc.: Company Snapshot

79 LabLynx, Inc.: SWOT Analysis

80 LabLynx, Inc.: Geographic Presence

81 Agilent Technologies : Company Snapshot

82 Agilent Technologies : SWOT Analysis

83 Agilent Technologies : Geographic Presence

84 ID Business Solutions Ltd.: Company Snapshot

85 ID Business Solutions Ltd.: SWOT Analysis

86 ID Business Solutions Ltd.: Geographic Presence

87 McKesson Corporation, Inc.: Company Snapshot

88 McKesson Corporation, Inc.: SWOT Analysis

89 McKesson Corporation, Inc.: Geographic Presence

90 Waters Corporation: Company Snapshot

91 Waters Corporation: SWOT Analysis

92 Waters Corporation: Geographic Presence

93 Other Companies: Company Snapshot

94 Other Companies: SWOT Analysis

95 Other Companies: Geographic Presence

The Global Laboratory Informatics Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Laboratory Informatics Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS