Global Land Survey Equipment Market Size, Trends & Analysis - Forecasts to 2027 By Application (Inspection, Monitoring, Volumetric Calculations, Layouts Points), By Industry (Transportation, Energy & Power, Mining & Construction, Forestry, Scientific & Geological Research, Precision Agriculture, Disaster Management), By Solution (Hardware, Software, Services), By End-User (Commercial, Defense, Service Providers), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

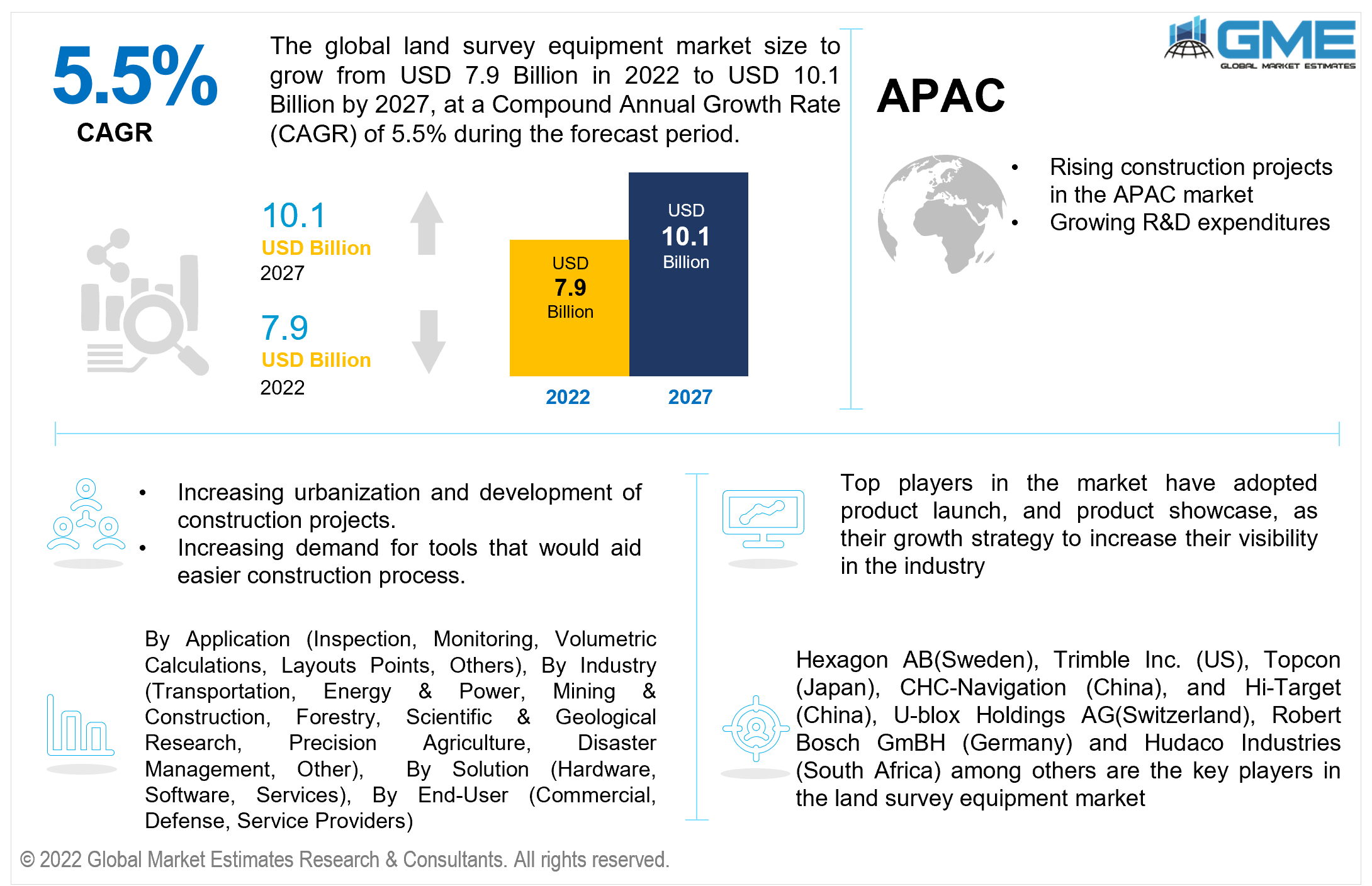

The Global Land Survey Equipment Market is projected to grow from USD 7.9 Billion in 2022 to USD 10.1 Billion by 2027 at a CAGR value of 5.5% from 2022 to 2027.

Urbanization and industrialization have led to the onset of increasing infrastructural projects worldwide. Infrastructure also plays a crucial role in determining the growth of the tourism sector in a region. As per the World Economic Forum, the current developing infrastructure would find it impossible to handle the additional 400 million tourists expected by 2030. This means that an increasing number of infrastructure projects are expected to be undertaken which would require land survey equipment that would enable sustainable and appropriate infrastructure projects for the society. Surveying plays an important role in communications, setting up legal boundaries, and execution of construction projects and indirectly aid in the positive growth of urbanization and tourism.

The market will be driven during the forecast period by the growing number of construction projects due to urbanization, the rising need for advanced equipment that leads to efficient infrastructural project execution, and increasing investments by governments in the infrastructure sector and related equipment.

Furthermore, the rising integration of electronic devices as land survey equipment and the emergence of smart cities which require good survey equipment are other factors that will boost the land survey equipment market.

COVID-19 has tremendously affected the growing construction projects and upcoming infrastructural initiatives. The reverse migration of laborers from cities to rural areas has also caused many developing countries to halt their infrastructural projects. However, the construction industry has resorted to looking for innovative solutions which require less to no manpower and would lead to cost-effective and efficient construction of projects. The use of electronic-based land survey equipment has increased during the pandemic period owing to its precision in surveying the construction area along with less dependence on human capital. The post-pandemic situation is expected to boost the land survey market owing to recommencing of several construction projects.

The construction industry has been disrupted by the war activity, projects have had to be suspended and funds kept for construction projects have had to be rerouted to support the ongoing conflict and mitigate damage. The predicted fall in demand for new construction is expected to reduce the demand for land surveys, hampering the growth of the market.

The inspection segment is expected to be the largest segment in the market from 2022 to 2027.

Land survey equipment used for inspection help construction companies and builders understands the boundaries, elevation, and angles of an area. Equipment is used for a number of tasks such as measuring boundary lines and corners of the property. Governments also use topographic land surveys for the inspection of natural and man-made constructions for site improvement.

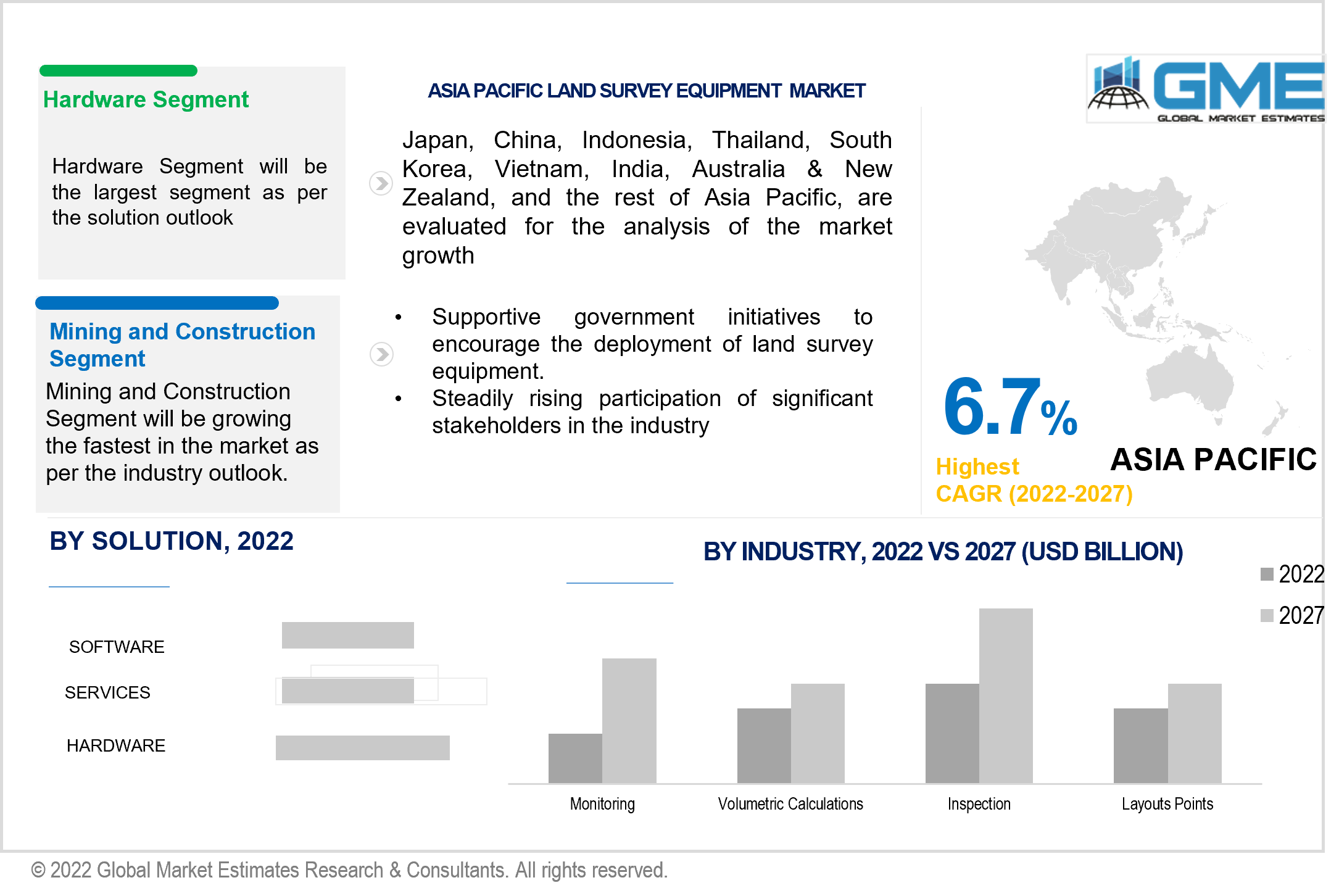

The mining and construction segment is expected to be the fastest-growing segment in the market from 2022 to 2027.

The mining and construction segment use land survey equipment for monitoring, inspection, measuring, and mapping. Mining activities use land survey equipment for several purposes such as plant establishments, mineral exploration, and planning. GNSS receivers and UAVs provide extensive maps and help in the exploration of sites.

The hardware segment is expected to be the largest segment in the market from 2022 to 2027.

Hardware land survey equipment entails 3D laser scanners, Unmanned Aerial Vehicles, levels, and GNSS systems. These are beneficial in inspecting, monitoring, and measuring construction properties without much human interference. For instance, Unmanned Aerial Vehicles (UAVs) are equipped with features such as sensors that help in monitoring and creation of 3D maps. GNSS systems are used for the precision they provide with respect to measuring land. Research and development over the years have reduced the size of the GNSS systems surveying equipment making it convenient for the user.

The commercial segment is expected to be the fastest-growing segment from 2022 to 2027.

The commercial segment includes a variety of industries that require land surveying for building infrastructure. The commercial sector uses GNSS systems and UAVs in order to measure and monitor land for approval of adding a new plant to a particular site. Several companies are also investing in land survey equipment-based innovation such as mobile data collector which gives the user real-time positioning.

North America (the United States, Canada, and Mexico) will have a dominant share in the Land Survey Equipment market from 2022 to 2027. The major factor driving the growth of the market in the North American region is the increasing adoption of technology in land surveying techniques, the rising onset of infrastructural projects, and the emergence of smart cities which require intelligent land survey equipment.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest-growing segment in the land survey equipment market during the forecast period. The rapid rate of urbanization and industrialization, growing investments by the government in the region, and the need for equipment that provide better accuracy are the factors that will boost the land survey equipment market.

Hexagon AB (Sweden), Trimble Inc. (US), Topcon (Japan), CHC-Navigation (China), Hi-Target (China), U-blox Holdings AG(Switzerland), Robert Bosch GmBH (Germany), and Hudaco Industries (South Africa) among others are the key players in the land survey equipment market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Land Survey Equipment Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Application Overview

2.1.3 Industry Overview

2.1.4 Solution Overview

2.1.5 End-User Overview

2.1.6 Regional Overview

Chapter 3 Land Survey Equipment Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Advancements in land survey equipment

3.3.1.2 Growing construction projects in APAC region

3.3.2 Industry Challenges

3.3.2.1 Lack of skilled manpower and technological progress.

3.4 Prospective Growth Scenario

3.4.1 Application Growth Scenario

3.4.2 Industry Growth Scenario

3.4.3 Solution Growth Scenario

3.4.4 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2022

3.11.1 Company Positioning Overview, 2022

Chapter 4 Land Survey Equipment Market, By Application

4.1 Application Outlook

4.2 Inspection

4.2.1 Market Size, By Region, 2022-2027 (USD Million)

4.3 Monitoring

4.3.1 Market Size, By Region, 2022-2027 (USD Million)

4.4 Volumetric Calculations

4.4.1 Market Size, By Region, 2022-2027 (USD Million)

4.5 Layout Points

4.5.1 Market Size, By Region, 2022-2027 (USD Million)

4.6 Others

4.6.1 Market Size, By Region, 2022-2027 (USD Million)

Chapter 5 Land Survey Equipment Market, By Solution

5.1 Solution Outlook

5.2 Hardware

5.2.1 Market Size, By Region, 2022-2027 (USD Million)

5.3 Software

5.3.1 Market Size, By Region, 2022-2027 (USD Million)

5.4 Services

5.4.1 Market Size, By Region, 2022-2027 (USD Million)

Chapter 6 Land Survey Equipment Market, By Industry

6.1 Transportation

6.1.1 Market Size, By Region, 2022-2027 (USD Million)

6.2 Energy & Power

6.2.1 Market Size, By Region, 2022-2027 (USD Million)

6.3 Mining & Construction

6.3.1 Market Size, By Region, 2022-2027 (USD Million)

6.4 Forestry

6.4.1 Market Size, By Region, 2022-2027 (USD Million)

6.5 Scientific & Geological Research

6.5.1 Market Size, By Region, 2022-2027 (USD Million)

6.6 Precision Agriculture

6.6.1 Market Size, By Region, 2022-2027 (USD Million)

6.7 Disaster Management

6.7.1 Market Size, By Region, 2022-2027 (USD Million)

6.8 Others

6.8.1 Market Size, By Region, 2022-2027 (USD Million)

Chapter 7 Land Survey Equipment Market, By End-User

7.1 Commercial

7.1.1 Market Size, By Region, 2022-2027 (USD Million)

7.2.1 Market Size, By Region, 2022-2027 (USD Million)

7.3 Service Providers

7.3.1 Market Size, By Region, 2022-2027 (USD Million)

Chapter 8 Land Survey Equipment Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2022-2027 (USD Million)

8.2.2 Market Size, By Application, 2022-2027 (USD Million)

8.2.3 Market Size, By Industry, 2022-2027 (USD Million)

8.2.4 Market Size, By Solution, 2022-2027 (USD Million)

8.2.5 Market Size, By End-User, 2022-2027 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Application, 2022-2027 (USD Million)

8.2.4.2 Market Size, By Industry, 2022-2027 (USD Million)

8.2.4.3 Market Size, By Solution, 2022-2027 (USD Million)

Market Size, By End-User, 2022-2027 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Application, 2022-2027 (USD Million)

8.2.7.2 Market Size, By Industry, 2022-2027 (USD Million)

8.2.7.3 Market Size, By Solution, 2022-2027 (USD Million)

8.2.7.4 Market Size, By End-User, 2022-2027 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2022-2027 (USD Million)

8.3.2 Market Size, By Application, 2022-2027 (USD Million)

8.3.3 Market Size, By Industry, 2022-2027 (USD Million)

8.3.4 Market Size, By Solution, 2022-2027 (USD Million)

8.3.5 Market Size, By End-User, 2022-2027 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Application, 2022-2027 (USD Million)

8.3.6.2 Market Size, By Industry, 2022-2027 (USD Million)

8.3.6.3 Market Size, By Solution, 2022-2027 (USD Million)

8.3.6.4 Market Size, By End-User, 2022-2027 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Application, 2022-2027 (USD Million)

8.3.7.2 Market Size, By Industry, 2022-2027 (USD Million)

8.3.7.3 Market Size, By Solution, 2022-2027 (USD Million)

8.3.7.4 Market Size, By End-User, 2022-2027 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Application, 2022-2027 (USD Million)

8.3.8.2 Market Size, By Industry, 2022-2027 (USD Million)

8.3.8.3 Market Size, By Solution, 2022-2027 (USD Million)

8.3.8.4 Market Size, By End-User, 2022-2027 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Application, 2022-2027 (USD Million)

8.3.9.2 Market Size, By Industry, 2022-2027 (USD Million)

8.3.9.3 Market Size, By Solution, 2022-2027 (USD Million)

8.3.9.4 Market Size, By End-User, 2022-2027 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Application, 2022-2027 (USD Million)

8.3.10.2 Market Size, By Industry, 2022-2027 (USD Million)

8.3.10.3 Market Size, By Solution, 2022-2027 (USD Million)

8.3.10.4 Market Size, By End-User, 2022-2027 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Application, 2022-2027 (USD Million)

8.3.11.2 Market Size, By Industry, 2022-2027 (USD Million)

8.3.11.3 Market Size, By Solution, 2022-2027 (USD Million)

8.3.11.4 Market Size, By End-User, 2022-2027 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2022-2027 (USD Million)

8.4.2 Market Size, By Application, 2022-2027 (USD Million)

8.4.3 Market Size, By Industry, 2022-2027 (USD Million)

8.4.4 Market Size, By Solution, 2022-2027 (USD Million)

8.4.5 Market Size, By End-User, 2022-2027 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Application, 2022-2027 (USD Million)

8.4.6.2 Market Size, By Industry, 2022-2027 (USD Million)

8.4.6.3 Market Size, By Solution, 2022-2027 (USD Million)

8.4.6.4 Market Size, By End-User, 2022-2027 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Application, 2022-2027 (USD Million)

8.4.7.2 Market Size, By Industry, 2022-2027 (USD Million)

8.4.7.3 Market Size, By Solution, 2022-2027 (USD Million)

8.4.7.4 Market Size, By End-User, 2022-2027 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Application, 2022-2027 (USD Million)

8.4.8.2 Market Size, By Industry, 2022-2027 (USD Million)

8.4.8.3 Market Size, By Solution, 2022-2027 (USD Million)

8.4.8.4 Market Size, By End-User, 2022-2027 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Application, 2022-2027 (USD Million)

8.4.9.2 Market size, By Industry, 2022-2027 (USD Million)

8.4.9.3 Market Size, By Solution, 2022-2027 (USD Million)

8.4.9.4 Market Size, By End-User, 2022-2027 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Application, 2022-2027 (USD Million)

8.4.10.2 Market Size, By Industry, 2022-2027 (USD Million)

8.4.10.3 Market Size, By Solution, 2022-2027 (USD Million)

8.4.10.4 Market Size, By End-User, 2022-2027 (USD Million)

8.5 Central and South America

8.5.1 Market Size, By Country 2022-2027 (USD Million)

8.5.2 Market Size, By Application, 2022-2027 (USD Million)

8.5.3 Market Size, By Industry, 2022-2027 (USD Million)

8.5.4 Market Size, By Solution, 2022-2027 (USD Million)

8.5.5 Market Size, By End-User, 2022-2027 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Application, 2022-2027 (USD Million)

8.5.6.2 Market Size, By Industry, 2022-2027 (USD Million)

8.5.6.3 Market Size, By Solution, 2022-2027 (USD Million)

8.5.6.4 Market Size, By End-User, 2022-2027 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Application, 2022-2027 (USD Million)

8.5.7.2 Market Size, By Industry, 2022-2027 (USD Million)

8.5.7.3 Market Size, By Solution, 2022-2027 (USD Million)

8.5.7.4 Market Size, By End-User, 2022-2027 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Application, 2022-2027 (USD Million)

8.5.8.2 Market Size, By Industry, 2022-2027 (USD Million)

8.5.8.3 Market Size, By Solution, 2022-2027 (USD Million)

8.5.8.4 Market Size, By End-User, 2022-2027 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2022-2027 (USD Million)

8.6.2 Market Size, By Application, 2022-2027 (USD Million)

8.6.3 Market Size, By Industry, 2022-2027 (USD Million)

8.6.4 Market Size, By Solution, 2022-2027 (USD Million)

8.6.5 Market Size, By End-User, 2022-2027 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Application, 2022-2027 (USD Million)

8.6.6.2 Market Size, By Industry, 2022-2027 (USD Million)

8.6.6.3 Market Size, By Solution, 2022-2027 (USD Million)

8.6.6.4 Market Size, By End-User, 2022-2027 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Application, 2022-2027 (USD Million)

8.6.7.2 Market Size, By Industry, 2022-2027 (USD Million)

8.6.7.3 Market Size, By Solution, 2022-2027 (USD Million)

8.6.7.4 Market Size, By End-User, 2022-2027 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Application, 2022-2027 (USD Million)

8.6.8.2 Market Size, By Industry, 2022-2027 (USD Million)

8.6.8.3 Market Size, By Solution, 2022-2027 (USD Million)

8.6.8.4 Market Size, By End-User, 2022-2027 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2022

9.2 Hexagon AB (Sweden)

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Trimbel Inc. (US)

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Topcon (Japan)

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 CHC-Navigation (China)

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Hi-Target (China)

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 U-blox Holdings AG(Switzerland)

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Robert Bosch GmBH (Germany)

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Hudaco Industries (South Africa)

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

The Global Land Survey Equipment Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Land Survey Equipment Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS