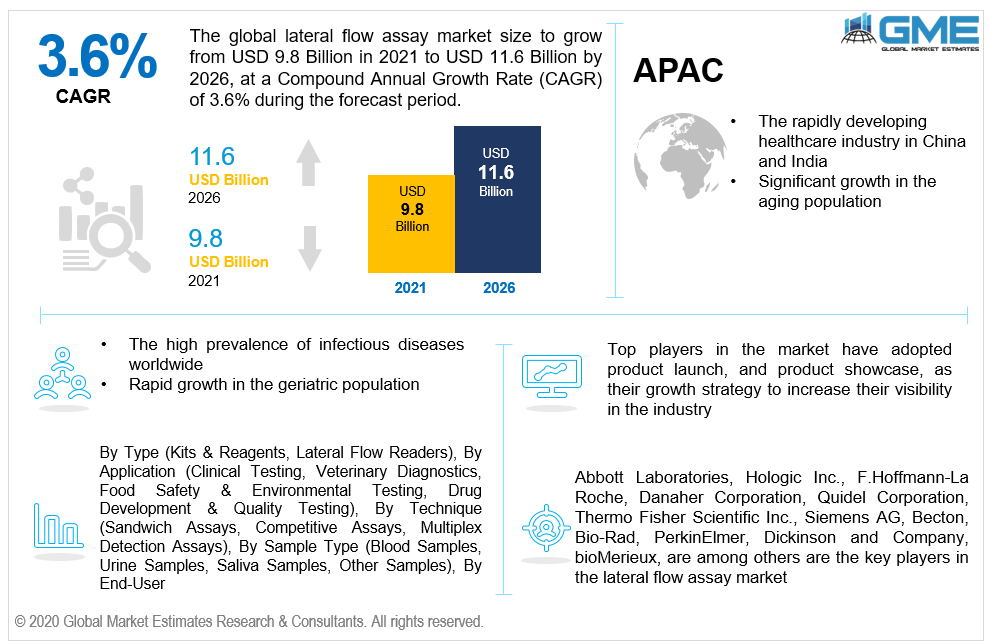

Global Lateral Flow Assay Market Size, Trends, and Analysis - Forecasts To 2026 By Product Type (Kits & Reagents, Lateral Flow Readers), By Application (Clinical Testing, Veterinary Diagnostics, Food Safety & Environmental Testing, Drug Development & Quality Testing), By Technique (Sandwich Assays, Competitive Assays, Multiplex Detection Assays), By Sample Type (Blood Samples, Urine Samples, Saliva Samples, Other Samples), By End-User (Hospitals & Clinics, Diagnostics Laboratories, Home Care Settings, Pharmaceuticals & Biotechnology Companies, Other End Users), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

The global lateral flow assay market is projected to grow from USD 0.20 billion in 2021 to USD 0.24 billion by 2026 at a CAGR value of 8.0% from 2021 to 2026.

Lateral flow assays, also known as lateral flow immunochromatographic assays, are ligno gadgets that are used to indicate the existence of a target biomolecule in a specimen without using specialized and expensive hardware, as well as highly qualified healthcare professionals. This market has acquired considerable momentum in homecare settings.

The use of lateral flow assays in the point-of-care medical field has gained a lot of momentum in the scientific community, which is driving the market for lateral flow assays. Furthermore, the high frequency of contagious illnesses, rapid expansion of the geriatric population, rising need for point-of-care diagnostic techniques, and increased use of home-based lateral flow assay instruments are all driving the market’s growth.

One of the primary factors driving the growth of the market for lateral flow assays is the rising use of lateral flow devices in residential care facilities. Aspects like accessibility, portability, and rapid interpretation of the data without the need for additional instrumentation or medical intervention, has boosted the usage of this device rapidly since their inception. As a result, the fact that diagnostic tests are available without a prescription is enhancing their use and hence is also boosting the market expansion.

There has been a rise in the priority for diagnostics solutions, particularly lateral flow assays, since the advent of the coronavirus (COVID-19), as it is a pillar for the management of the pandemic. During the initial phase of 2020, the prevalence of COVID-19 surged significantly in different nations, prompting key operational firms to spend in R&D for rapid diagnostic tests. As a consequence, various antibody/antigen assays have been developed thereby boosting demand for lateral flow assays during the forecast period.

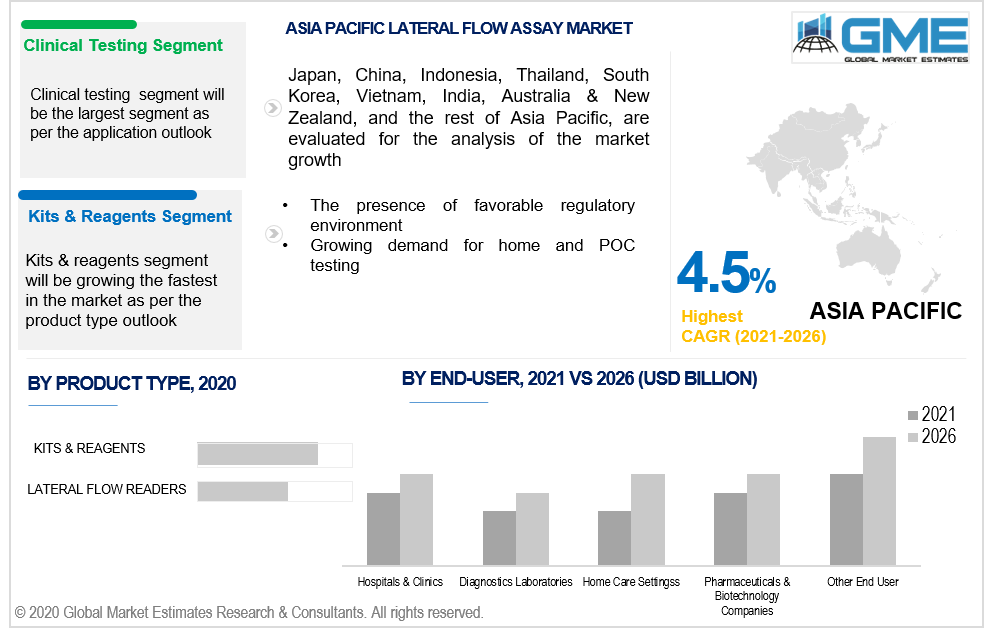

Based on the product, the market is segmented into kits and reagents, and lateral flow readers. The kits and reagents segment is analyzed to be the fastest-growing segment in the market from 2021 to 2026. The growing usage of lateral flow kits and reagents for POC testing, the rising prevalence of chronic diseases, the increasing use of lateral flow kits in residential care, and their comfort and convenience of use are all factors contributing to this segment's growth.

Based on the sample type, the market is segmented into blood samples, urine samples, saliva samples, and other samples. The market for clinical testing is expected to be the largest shareholder of the market from 2021 to 2026. The utilization of blood samples in lateral flow tests for bacterial infections including malaria, HIV, and syphilis, as well as increased knowledge of rapid solution providers and the simplicity of detecting illness antigens from blood samples, are all driving this segment's growth.

Based on the application, the market is segmented into, clinical testing, veterinary diagnostics, food safety & environmental testing, drug development & quality testing. The market for clinical testing is expected to be the largest shareholder of the market from 2021 to 2026. The rising burden of diabetes, mounting need to cut costs of healthcare, and expanding desire for patient-centric care are all factors contributing to this segment's growth.

Based on the technique, the market is segmented into the sandwich assay, multiplex detection assay, and competitive assay. The market for the sandwich assay is expected to be the largest shareholder of the market from 2021 to 2026.

Based on the end-users, the market is segmented into hospitals and clinics, home care, diagnostic laboratories, biotechnology and pharmaceutical companies, and others. The market for hospitals and clinics is expected to be the largest shareholder of the market from 2021 to 2026. The hospitals and clinics market is growing caused by technological developments, increased acceptance of point-of-care testing, and an increasing patient preference for quick and early evaluation.

As per the geographical analysis, the lateral flow assay market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the lateral flow assay market from 2021 to 2026. The growth is attributed to the increase in the prevalence of several contagious diseases in this region, such as Lyme disease and pneumonia, as well as an elevated death rate connected with HIV/AIDS. The United States has the highest market share in North America, owing to a huge patient pool and higher accessibility as disposable income grows.

Moreover, the Asia-Pacific region is expected to be the fastest-growing segment in the lateral flow assay market during the forecast period. With the rising incidence of chronic disorders such as tuberculosis, hepatitis, cardiac ailments, and cholesterol problems, as well as a growing population, the Asia Pacific region is likely to see increased demand in the future. Furthermore, the aging demography, soaring life expectancy, ascending per capita income, vastly increased investments in the region by key market players, the advancement of private-sector hospitals and clinics to rural areas, the availability of cheap manufacturing labor, the occurrence of a favorable regulatory regime, and continued growth for household and point-of-care diagnostics are all supporting the market growth in the APAC region.

Abbott Laboratories, Hologic Inc., F.Hoffmann-La Roche, Danaher Corporation, Quidel Corporation, Thermo Fisher Scientific Inc., Siemens AG, Becton, Bio-Rad, PerkinElmer, Dickinson and Company, bioMerieux, among others are the key players in the lateral flow assay market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Lateral Flow Assay Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Product Type Overview

2.1.3 Sample Type Overview

2.1.4 End-User Overview

2.1.5 Application Overview

2.1.6 Technique Overview

2.1.7 Regional Overview

Chapter 3 Lateral Flow Assay Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 High prevalence of infectious diseases worldwide

3.3.1.2 Rapid growth in the geriatric population

3.3.2 Industry Challenges

3.3.2.1 Reluctance among doctors and patients to change existing diagnostic procedures

3.4 Prospective Growth Scenario

3.4.1 Product Type Growth Scenario

3.4.2 Sample Type Growth Scenario

3.4.3 End-User Growth Scenario

3.4.4 Application Growth Scenario

3.4.5 Technique Scenario

3.4.6 Clinical Trial Phase Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Lateral Flow Assay Market, By Product Type

4.1 Product Type Outlook

4.2 Kits & Reagents

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Lateral Flow Readers

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Lateral Flow Assay Market, By Sample Type

5.1 Sample Type Outlook

5.2 Blood Samples

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Urine Samples

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Saliva Samples

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Other Samples

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Lateral Flow Assay Market, By End-User

6.1 Diagnostics Laboratories

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Hospitals & Clinics

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Home Care Settings

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Pharmaceuticals & Biotechnology Companies

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Lateral Flow Assay Market, By Application

7.1 Clinical Testing

7.1.1 Market Size, By Region, 2020-2026 (USD Billion)

7.2 Veterinary Diagnostics

7.2.1 Market Size, By Region, 2020-2026 (USD Billion)

7.3 Food Safety & Environmental Testing

7.3.1 Market Size, By Region, 2020-2026 (USD Billion)

7.4 Drug Development & Quality Testing

7.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 8 Lateral Flow Assay Market, By Technique

8.1 Sandwich Assays

8.1.1 Market Size, By Region, 2020-2026 (USD Billion)

8.2 Competitive Assays

8.2.1 Market Size, By Region, 2020-2026 (USD Billion)

8.3 Multiplex Detection Assays

8.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 9 Lateral Flow Assay Market, By Region

9.1 Regional outlook

9.2 North America

9.2.1 Market Size, By Country 2020-2026 (USD Billion)

9.2.2 Market Size, By Product Type, 2020-2026 (USD Billion)

9.2.3 Market Size, By Sample Type, 2020-2026 (USD Billion)

9.2.4 Market Size, By End-User, 2020-2026 (USD Billion)

9.2.5 Market Size, By Application, 2020-2026 (USD Billion)

9.2.6 Market Size, By Technique, 2020-2026 (USD Billion)

9.2.7 U.S.

9.2.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

9.2.7.2 Market Size, By Sample Type, 2020-2026 (USD Billion)

9.2.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

9.2.7.4 Market Size, By Application, 2020-2026 (USD Billion)

9.2.7.5 Market Size, By Technique, 2020-2026 (USD Billion)

9.2.8 Canada

9.2.8.1 Market Size, By Product Type, 2020-2026 (USD Billion)

9.2.8.2 Market Size, By Sample Type, 2020-2026 (USD Billion)

9.2.8.3 Market Size, By End-User, 2020-2026 (USD Billion)

9.2.8.4 Market Size, By Application, 2020-2026 (USD Billion)

9.2.8.5 Market Size, By Technique, 2020-2026 (USD Billion)

9.2.9 Mexico

9.2.9.1 Market Size, By Product Type, 2020-2026 (USD Billion)

9.2.9.2 Market Size, By Sample Type, 2020-2026 (USD Billion)

9.2.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

9.2.9.4 Market Size, By Application, 2020-2026 (USD Billion)

9.2.9.5 Market Size, By Technique, 2020-2026 (USD Billion)

9.3 Europe

9.3.1 Market Size, By Country 2020-2026 (USD Billion)

9.3.2 Market Size, By Product Type, 2020-2026 (USD Billion)

9.3.3 Market Size, By Sample Type, 2020-2026 (USD Billion)

9.3.4 Market Size, By End-User, 2020-2026 (USD Billion)

9.3.5 Market Size, By Application, 2020-2026 (USD Billion)

9.3.6 Market Size, By Technique, 2020-2026 (USD Billion)

9.3.7 Germany

9.3.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

9.3.7.2 Market Size, By Sample Type, 2020-2026 (USD Billion)

9.3.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

9.3.7.4 Market Size, By Application, 2020-2026 (USD Billion)

9.3.7.5 Market Size, By Technique, 2020-2026 (USD Billion)

9.3.8 UK

9.3.8.1 Market Size, By Product Type, 2020-2026 (USD Billion)

9.3.8.2 Market Size, By Sample Type, 2020-2026 (USD Billion)

9.3.8.3 Market Size, By End-User, 2020-2026 (USD Billion)

9.3.8.4 Market Size, By Application, 2020-2026 (USD Billion)

9.3.8.5 Market Size, By Technique, 2020-2026 (USD Billion)

9.3.9 France

9.3.9.1 Market Size, By Product Type, 2020-2026 (USD Billion)

9.3.9.2 Market Size, By Sample Type, 2020-2026 (USD Billion)

9.3.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

9.3.9.4 Market Size, By Application, 2020-2026 (USD Billion)

9.3.9.5 Market Size, By Technique, 2020-2026 (USD Billion)

9.3.10 Italy

9.3.10.1 Market Size, By Product Type, 2020-2026 (USD Billion)

9.3.10.2 Market Size, By Sample Type, 2020-2026 (USD Billion)

9.3.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

9.3.10.4 Market Size, By Application, 2020-2026 (USD Billion)

9.3.10.5 Market Size, By Technique, 2020-2026 (USD Billion)

9.4 Asia Pacific

9.4.1 Market Size, By Country 2020-2026 (USD Billion)

9.4.2 Market Size, By Product Type, 2020-2026 (USD Billion)

9.4.3 Market Size, By Sample Type, 2020-2026 (USD Billion)

9.4.4 Market Size, By End-User, 2020-2026 (USD Billion)

9.4.5 Market Size, By Application, 2020-2026 (USD Billion)

9.4.6 Market Size, By Technique, 2020-2026 (USD Billion)

9.4.7 China

9.4.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

9.4.7.2 Market Size, By Sample Type, 2020-2026 (USD Billion)

9.4.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

9.4.7.4 Market Size, By Application, 2020-2026 (USD Billion)

9.4.7.5 Market Size, By Technique, 2020-2026 (USD Billion)

9.4.8 India

9.4.8.1 Market Size, By Product Type, 2020-2026 (USD Billion)

9.4.8.2 Market Size, By Sample Type, 2020-2026 (USD Billion)

9.4.8.3 Market Size, By End-User, 2020-2026 (USD Billion)

9.4.8.4 Market Size, By Application, 2020-2026 (USD Billion)

9.4.8.5 Market Size, By Technique, 2020-2026 (USD Billion)

9.4.9 Japan

9.4.9.1 Market Size, By Product Type, 2020-2026 (USD Billion)

9.4.9.2 Market Size, By Sample Type, 2020-2026 (USD Billion)

9.4.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

9.4.9.4 Market Size, By Application, 2020-2026 (USD Billion)

9.4.9.5 Market Size, By Technique, 2020-2026 (USD Billion)

9.5 MEA

9.5.1 Market Size, By Country 2020-2026 (USD Billion)

9.5.2 Market Size, By Product Type, 2020-2026 (USD Billion)

9.5.3 Market Size, By Sample Type, 2020-2026 (USD Billion)

9.5.4 Market Size, By End-User, 2020-2026 (USD Billion)

9.5.5 Market Size, By Application, 2020-2026 (USD Billion)

9.5.6 Market Size, By Technique, 2020-2026 (USD Billion)

9.5.7 Saudi Arabia

9.5.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

9.5.7.2 Market Size, By Sample Type, 2020-2026 (USD Billion)

9.5.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

9.5.7.4 Market Size, By Application, 2020-2026 (USD Billion)

9.5.7.5 Market Size, By Technique, 2020-2026 (USD Billion)

9.5.8 UAE

9.5.8.1 Market Size, By Product Type, 2020-2026 (USD Billion)

9.5.8.2 Market Size, By Sample Type, 2020-2026 (USD Billion)

9.5.8.3 Market Size, By End-User, 2020-2026 (USD Billion)

9.5.8.4 Market Size, By Application, 2020-2026 (USD Billion)

9.5.8.5 Market Size, By Technique, 2020-2026 (USD Billion)

9.5.9 South Africa

9.5.9.1 Market Size, By Product Type, 2020-2026 (USD Billion)

9.5.9.2 Market Size, By Sample Type, 2020-2026 (USD Billion)

9.5.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

9.5.9.4 Market Size, By Application, 2020-2026 (USD Billion)

9.5.9.5 Market Size, By Technique, 2020-2026 (USD Billion)

Chapter 10 Company Landscape

10.1 Competitive Analysis, 2020

10.2 Abbott Laboratories

10.2.1 Company Overview

10.2.2 Financial Analysis

10.2.3 Strategic Positioning

10.2.4 Info Graphic Analysis

10.3 Hologic Inc

10.3.1 Company Overview

10.3.2 Financial Analysis

10.3.3 Strategic Positioning

10.3.4 Info Graphic Analysis

10.4 F.Hoffmann-La Roche

10.4.1 Company Overview

10.4.2 Financial Analysis

10.4.3 Strategic Positioning

10.4.4 Info Graphic Analysis

10.5 Danaher Corporation

10.5.1 Company Overview

10.5.2 Financial Analysis

10.5.3 Strategic Positioning

10.5.4 Info Graphic Analysis

10.6 Quidel Corporation

10.6.1 Company Overview

10.6.2 Financial Analysis

10.6.3 Strategic Positioning

10.6.4 Info Graphic Analysis

10.7 Thermo Fisher Scientific Inc

10.7.1 Company Overview

10.7.2 Financial Analysis

10.7.3 Strategic Positioning

10.7.4 Info Graphic Analysis

10.8 Siemens AG

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Strategic Positioning

10.10.4 Info Graphic Analysis

10.9 Bio-Rad

10.9.1 Company Overview

10.9.2 Financial Analysis

10.9.3 Strategic Positioning

10.9.4 Info Graphic Analysis

10.10 Other Companies

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Strategic Positioning

10.10.4 Info Graphic Analysis

The Global Lateral Flow Assay Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Lateral Flow Assay Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS