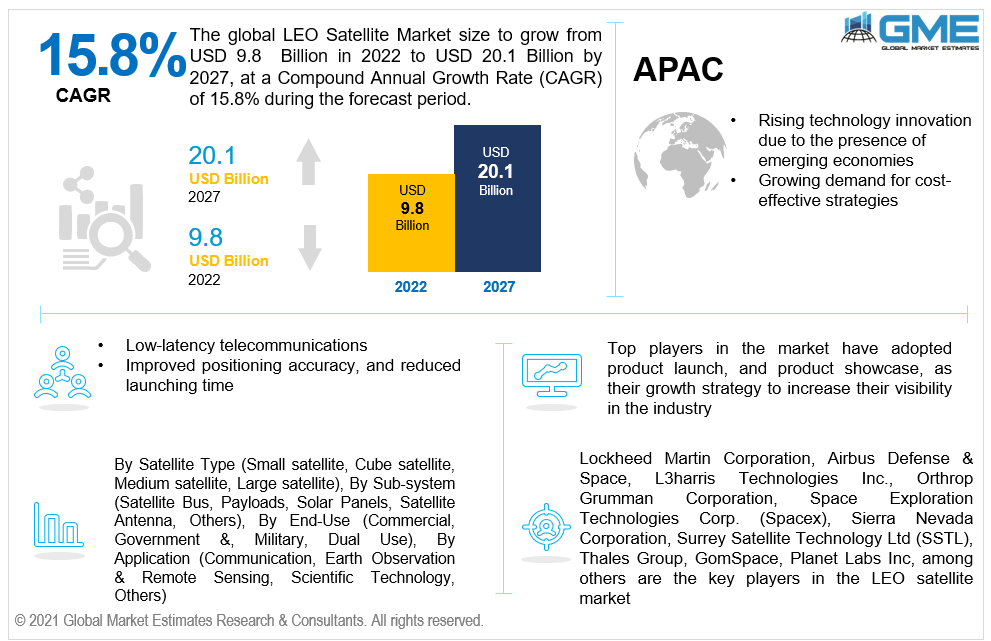

Global LEO Satellite Market Size, Trends & Analysis - Forecasts to 2027 By Satellite Type (Small satellite, Cube satellite, Medium satellite, Large satellite), By Sub-system (Satellite Bus, Payloads, Solar Panels, Satellite Antenna, Others), By End-Use (Commercial, Government &, Military, Dual Use), By Application (Communication, Earth Observation & Remote Sensing, Scientific Technology, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

The Global LEO Satellite Market is projected to grow from USD 9.8 Billion in 2022 to USD 20.1 billion in 2027 at a CAGR value of 15.8% from 2022 to 2027. According to a recent study, a Low Earth Orbit (LEO) satellite constellation outperforms a geostationary (GEO) satellite constellation in terms of reduced communication, quicker position time, better positioning accuracy, and lower deployment, construction, and maintenance expenses. As a result, using the Low Earth Orbit (LEO) constellation for navigation augmentation can lower mission costs, decrease position time, and improve localization accuracy. As a result, LEO navigation augmentation has received a lot of research attention and market growth throughout the forecast period.

Low-latency telecommunications, quicker orientation time, improved positioning accuracy, and reduced launching time, reduced construction and maintenance costs are among the benefits offered by low earth orbit (LEO) satellites, driving market expansion over the forecast period. Moreover, ease of adaptability, low price, sophisticated biomechanics, ease of construction and launching, mass production, and short lifecycles have fuelled LEO satellite market investment.

An LEO satellite deployed 600 kilometers above the Earth's surface with an average inclination angle of 30 covers about 0.45 percent of the Earth's surface. As a result of their low deployment altitude, LEO satellites can connect with a wide range of ground terminals, including specialized ground stations (GSs), 5G gNBs, ships, and other vehicles, and the Internet of Things (IoT) devices, supporting market growth. In addition, a rise in popularity for low-cost broadband among individual users in less developed countries and remote communities, where internet connectivity may be limited, is pushing investments in LEO constellations.

These constellations are driving market growth due to the advantage of LEO systems satellites' accessibility to the ground, allowing them to connect with minimum delay time for latency-sensitive operations, such as vocal communication. Furthermore, the lower distance between the Earth and the satellite provides less route distortion in satellite-to-earth communication systems, allowing for a more dependable link with less strength and antenna size. As a result, LEO satellites are often smaller and lighter than their GEO counterparts, making them less costly and driving market expansion.

The COVID-19 pandemic has wreaked havoc on countries' economies worldwide. The production of LEO communications satellites, subsystems, and elements has been hampered. Satellite systems are crucial, but supply chain issues have stopped their production for the time being.

The major drawbacks of being deployed in LEO include encountering some air drag, which can result in orbit loss and shortened satellite life expectancies. Furthermore, the high expense of installing such an LEO-based system will limit market growth during the forecast period.

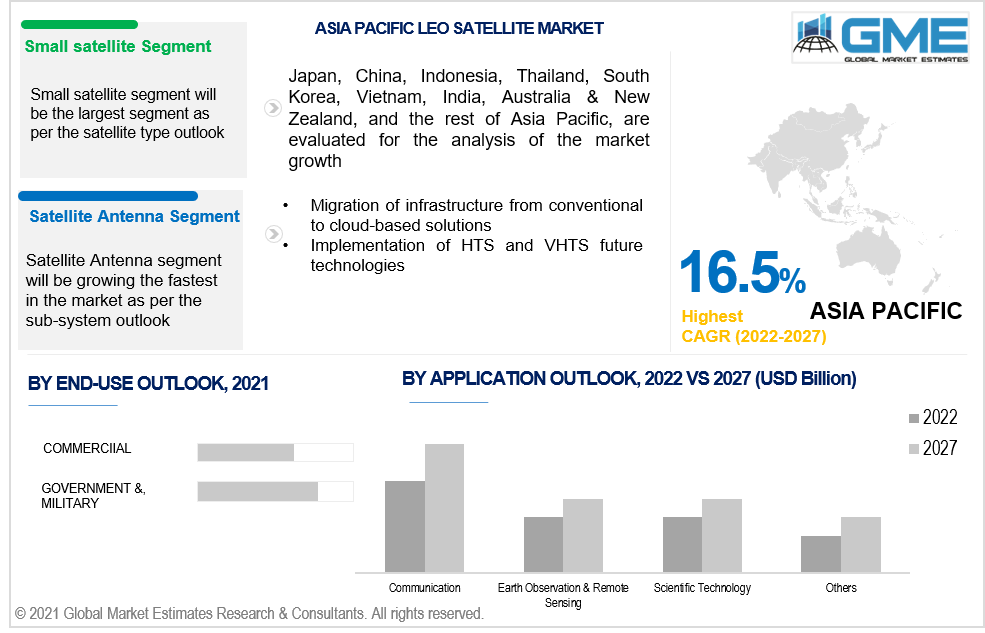

Based on the satellite type, the LEO satellite market is divided into small satellite, cube satellite, medium satellite, and large satellite. The small satellite segment is expected to be the largest segment in the market from 2022 to 2027. When compared with the huge conventional satellites at Medium Earth Orbit (MEO) and GEO, LEO deployments often include small or even nanosatellites with low production cost, dimensions, and weight (i.e., < 500 kg). As a result of these features, the launch expenses are reduced. On the other hand, small satellites must adhere to strict networking, processor, and power limits.

Based on the sub-systems, the LEO satellite market is divided into satellite buses, payloads, solar panels, satellite antennas, and others. The satellite antenna segment is expected to be the fastest-growing segment in the forecast period of 2022-2027. LEO satellite antennas are intended for maximum performance across long distances and at incredible velocities. Their broadcast precision and dependability are essential to the growth of satellite communication and the expansion of space-based communications infrastructure.

Based on the application segmentation, the LEO Satellite market is divided into communication, earth observation & remote sensing, scientific technology, and others. The communication segment is expected to be the fastest-growing segment in the forecast period of 2022-2027. The growth can be attributed to increased R&D activities for information exchange operations. Extremely sophisticated miniaturized onboard nano, micro, and compact subsystems, combined with innovative mission-compatible ground-station technology, are expected to provide improved quality communications networks.

As per the geographical analysis, the LEO satellite market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the LEO satellite market from 2022 to 2027. Increased investment in satellite equipment to improve the armed services' defense and monitoring capabilities and modification of existing interaction in military platforms, critical infrastructure, and enforcement agencies using satellite systems are expected to propel the LEO satellite market in North America.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest-growing segment in the LEO satellite market during the forecast period. Growing demand for cost-effective strategies, migration of infrastructure from conventional to cloud-based solutions, increased demand for satellite broadband networks, and implementation of HTS and VHTS future technologies are driving market growth in this region.

Lockheed Martin Corporation, Airbus Defense & Space, L3harris Technologies Inc., Orthrop Grumman Corporation, Space Exploration Technologies Corp. (Spacex), Sierra Nevada Corporation, Surrey Satellite Technology Ltd (SSTL), Thales Group, GomSpace, Planet Labs Inc, among others are the key players in the LEO satellite market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 LEO Satellite Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Satellite Type Overview

2.1.3 Sub-System Overview

2.1.4 End-Use Overview

2.1.5 Application Overview

2.1.6 Regional Overview

Chapter 3 LEO Satellite Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Improved positioning accuracy, and reduced launching time

3.3.2 End-User Challenges

3.3.2.1 High expense of installing such an LEO-based system

3.4 Prospective Growth Scenario

3.4.1 Satellite Type Growth Scenario

3.4.2 Sub-System Growth Scenario

3.4.3 End-Use Growth Scenario

3.4.4 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 LEO Satellite Market, By Satellite Type

4.1 Satellite Type Outlook

4.2 Small satellite

4.2.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 Cube satellite

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

4.4 Medium satellite

4.4.1 Market Size, By Region, 2022-2027 (USD Billion)

4.5 Large satellite

4.5.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 5 LEO Satellite Market, By End-Use

5.1 Industry Outlook

5.2 Commercial

5.2.1 Market Size, By Region, 2022-2027 (USD Billion)

5.3 Government &, Military

5.3.1 Market Size, By Region, 2022-2027 (USD Billion)

5.4 Dual Use

5.4.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 6 LEO Satellite Market, By Sub-System

6.1 Satellite Bus

6.1.1 Market Size, By Region, 2022-2027 (USD Billion)

6.2 Payloads

6.2.1 Market Size, By Region, 2022-2027 (USD Billion)

6.3 Solar Panels

6.3.1 Market Size, By Region, 2022-2027 (USD Billion)

6.4 Satellite Antenna

6.4.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 7 LEO Satellite Market, By Application

7.1 Communication

7.1.1 Market Size, By Region, 2022-2027 (USD Billion)

7.2 Earth Observation & Remote Sensing

7.2.1 Market Size, By Region, 2022-2027 (USD Billion)

7.3 Scientific Technology

7.3.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 8 LEO Satellite Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2022-2027 (USD Billion)

8.2.2 Market Size, By Satellite Type, 2022-2027 (USD Billion)

8.2.3 Market Size, By Sub-System, 2022-2027 (USD Billion)

8.2.4 Market Size, By End-Use, 2022-2027 (USD Billion)

8.2.5 Market Size, By Application, 2022-2027 (USD Billion)

8.2.6 U.S.

8.2.6.1 Market Size, By Satellite Type, 2022-2027 (USD Billion)

8.2.4.2 Market Size, By Sub-System, 2022-2027 (USD Billion)

8.2.4.3 Market Size, By End-Use, 2022-2027 (USD Billion)

Market Size, By Application, 2022-2027 (USD Billion)

8.2.7 Canada

8.2.7.1 Market Size, By Satellite Type, 2022-2027 (USD Billion)

8.2.7.2 Market Size, By Sub-System, 2022-2027 (USD Billion)

8.2.7.3 Market Size, By End-Use, 2022-2027 (USD Billion)

8.2.7.4 Market Size, By Application, 2022-2027 (USD Billion)

8.3 Europe

8.3.1 Market Size, By Country 2022-2027 (USD Billion)

8.3.2 Market Size, By Satellite Type, 2022-2027 (USD Billion)

8.3.3 Market Size, By Sub-System, 2022-2027 (USD Billion)

8.3.4 Market Size, By End-Use, 2022-2027 (USD Billion)

8.3.5 Market Size, By Application, 2022-2027 (USD Billion)

8.3.6 Germany

8.3.6.1 Market Size, By Satellite Type, 2022-2027 (USD Billion)

8.3.6.2 Market Size, By Sub-System, 2022-2027 (USD Billion)

8.3.6.3 Market Size, By End-Use, 2022-2027 (USD Billion)

8.3.6.4 Market Size, By Application, 2022-2027 (USD Billion)

8.3.7 UK

8.3.7.1 Market Size, By Satellite Type, 2022-2027 (USD Billion)

8.3.7.2 Market Size, By Sub-System, 2022-2027 (USD Billion)

8.3.7.3 Market Size, By End-Use, 2022-2027 (USD Billion)

8.3.7.4 Market Size, By Application, 2022-2027 (USD Billion)

8.3.8 France

8.3.8.1 Market Size, By Satellite Type, 2022-2027 (USD Billion)

8.3.8.2 Market Size, By Sub-System, 2022-2027 (USD Billion)

8.3.8.3 Market Size, By End-Use, 2022-2027 (USD Billion)

8.3.8.4 Market Size, By Application, 2022-2027 (USD Billion)

8.3.9 Italy

8.3.9.1 Market Size, By Satellite Type, 2022-2027 (USD Billion)

8.3.9.2 Market Size, By Sub-System, 2022-2027 (USD Billion)

8.3.9.3 Market Size, By End-Use, 2022-2027 (USD Billion)

8.3.9.4 Market Size, By Application, 2022-2027 (USD Billion)

8.3.10 Spain

8.3.10.1 Market Size, By Satellite Type, 2022-2027 (USD Billion)

8.3.10.2 Market Size, By Sub-System, 2022-2027 (USD Billion)

8.3.10.3 Market Size, By End-Use, 2022-2027 (USD Billion)

8.3.10.4 Market Size, By Application, 2022-2027 (USD Billion)

8.3.11 Russia

8.3.11.1 Market Size, By Satellite Type, 2022-2027 (USD Billion)

8.3.11.2 Market Size, By Sub-System, 2022-2027 (USD Billion)

8.3.11.3 Market Size, By End-Use, 2022-2027 (USD Billion)

8.3.11.4 Market Size, By Application, 2022-2027 (USD Billion)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2022-2027 (USD Billion)

8.4.2 Market Size, By Satellite Type, 2022-2027 (USD Billion)

8.4.3 Market Size, By Sub-System, 2022-2027 (USD Billion)

8.4.4 Market Size, By End-Use, 2022-2027 (USD Billion)

8.4.5 Market Size, By Application, 2022-2027 (USD Billion)

8.4.6 China

8.4.6.1 Market Size, By Satellite Type, 2022-2027 (USD Billion)

8.4.6.2 Market Size, By Sub-System, 2022-2027 (USD Billion)

8.4.6.3 Market Size, By End-Use, 2022-2027 (USD Billion)

8.4.6.4 Market Size, By Application, 2022-2027 (USD Billion)

8.4.7 India

8.4.7.1 Market Size, By Satellite Type, 2022-2027 (USD Billion)

8.4.7.2 Market Size, By Sub-System, 2022-2027 (USD Billion)

8.4.7.3 Market Size, By End-Use, 2022-2027 (USD Billion)

8.4.7.4 Market Size, By Application, 2022-2027 (USD Billion)

8.4.8 Japan

8.4.8.1 Market Size, By Satellite Type, 2022-2027 (USD Billion)

8.4.8.2 Market Size, By Sub-System, 2022-2027 (USD Billion)

8.4.8.3 Market Size, By End-Use, 2022-2027 (USD Billion)

8.4.8.4 Market Size, By Application, 2022-2027 (USD Billion)

8.4.9 Australia

8.4.9.1 Market Size, By Satellite Type, 2022-2027 (USD Billion)

8.4.9.2 Market size, By Sub-System, 2022-2027 (USD Billion)

8.4.9.3 Market Size, By End-Use, 2022-2027 (USD Billion)

8.4.9.4 Market Size, By Application, 2022-2027 (USD Billion)

8.4.10 South Korea

8.4.10.1 Market Size, By Satellite Type, 2022-2027 (USD Billion)

8.4.10.2 Market Size, By Sub-System, 2022-2027 (USD Billion)

8.4.10.3 Market Size, By End-Use, 2022-2027 (USD Billion)

8.4.10.4 Market Size, By Application, 2022-2027 (USD Billion)

8.5 Latin America

8.5.1 Market Size, By Country 2022-2027 (USD Billion)

8.5.2 Market Size, By Satellite Type, 2022-2027 (USD Billion)

8.5.3 Market Size, By Sub-System, 2022-2027 (USD Billion)

8.5.4 Market Size, By End-Use, 2022-2027 (USD Billion)

8.5.5 Market Size, By Application, 2022-2027 (USD Billion)

8.5.6 Brazil

8.5.6.1 Market Size, By Satellite Type, 2022-2027 (USD Billion)

8.5.6.2 Market Size, By Sub-System, 2022-2027 (USD Billion)

8.5.6.3 Market Size, By End-Use, 2022-2027 (USD Billion)

8.5.6.4 Market Size, By Application, 2022-2027 (USD Billion)

8.5.7 Mexico

8.5.7.1 Market Size, By Satellite Type, 2022-2027 (USD Billion)

8.5.7.2 Market Size, By Sub-System, 2022-2027 (USD Billion)

8.5.7.3 Market Size, By End-Use, 2022-2027 (USD Billion)

8.5.7.4 Market Size, By Application, 2022-2027 (USD Billion)

8.5.8 Argentina

8.5.8.1 Market Size, By Satellite Type, 2022-2027 (USD Billion)

8.5.8.2 Market Size, By Sub-System, 2022-2027 (USD Billion)

8.5.8.3 Market Size, By End-Use, 2022-2027 (USD Billion)

8.5.8.4 Market Size, By Application, 2022-2027 (USD Billion)

8.6 MEA

8.6.1 Market Size, By Country 2022-2027 (USD Billion)

8.6.2 Market Size, By Satellite Type, 2022-2027 (USD Billion)

8.6.3 Market Size, By Sub-System, 2022-2027 (USD Billion)

8.6.4 Market Size, By End-Use, 2022-2027 (USD Billion)

8.6.5 Market Size, By Application, 2022-2027 (USD Billion)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Satellite Type, 2022-2027 (USD Billion)

8.6.6.2 Market Size, By Sub-System, 2022-2027 (USD Billion)

8.6.6.3 Market Size, By End-Use, 2022-2027 (USD Billion)

8.6.6.4 Market Size, By Application, 2022-2027 (USD Billion)

8.6.7 UAE

8.6.7.1 Market Size, By Satellite Type, 2022-2027 (USD Billion)

8.6.7.2 Market Size, By Sub-System, 2022-2027 (USD Billion)

8.6.7.3 Market Size, By End-Use, 2022-2027 (USD Billion)

8.6.7.4 Market Size, By Application, 2022-2027 (USD Billion)

8.6.8 South Africa

8.6.8.1 Market Size, By Satellite Type, 2022-2027 (USD Billion)

8.6.8.2 Market Size, By Sub-System, 2022-2027 (USD Billion)

8.6.8.3 Market Size, By End-Use, 2022-2027 (USD Billion)

8.6.8.4 Market Size, By Application, 2022-2027 (USD Billion)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Lockheed Martin Corporation

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Airbus Defense & Space

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 L3harris Technologies Inc

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Orthrop Grumman Corporation

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Space Exploration Technologies Corp

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Sierra Nevada Corporation

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Surrey Satellite Technology Ltd (SSTL)

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9. Thales Group

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 GomSpace

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Other Companies

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

The Global LEO Satellite Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the LEO Satellite Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS