Global Life Science Consumables Market Size, Trends & Analysis - Forecasts to 2027 By Technology (PCR & qPCR, Sequencing Technology, Flow Cytometry, Microarray, Mass Spectrometry, Chromatography, and Others), By Application (Proteomics, Genomics, Cell Biology, Others), By End-use (Pharmaceutical & Biotechnology Company, Academic & Government Research Institutes, and Others), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East & Africa), End-User Landscape Analysis, Company Market Share Analysis, and Competitor Analysis

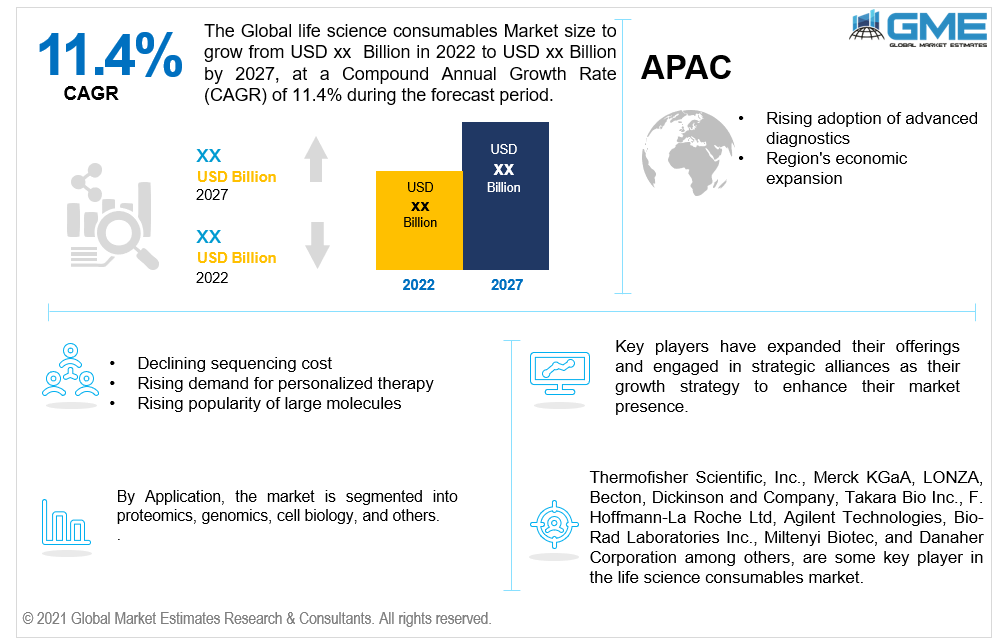

The global life science consumables market is projected to grow at a CAGR value of 11.4% from 2022 to 2027. Wide acceptance and usage of sequencing technologies, chromatography procedures, mass spectrometry, and other technologies by research and healthcare settings as a result of technical developments are anticipated to drive the growth of the life science consumables market.

Life science companies are striving for consistent and relevant clinical trial data to establish the efficacy of novel therapies. The emergence of remote monitoring and decentralized trials has accelerated the amount of data generated by digital health technologies such as mobile devices, telemedicine, and wearables, thus providing reliable clinical data to analyze and establish therapies’ effectiveness.

Apart from clinical data, artificial intelligence and quantum computing-based technological advancements in genomic information curation have transformed the medication development approach by life science companies. Current real-world data and real-world evidence exhibit the potential to advance clinical trial design/execution and yield better insights. Thus, the growth of the life science industry is anticipated to significantly influence the life science consumables market in terms of adoption rate and revenue growth.

The COVID-19 pandemic had a favorable impact on market growth globally, with the rapid development of diagnostics, expedited regulatory clearances, and increased distribution of consumables across the globe to contain the spread of the virus. To detect infectious infections, many diagnostic procedures have always been necessary. COVID-19 is currently detected using a variety of molecular and immunoassays.

The use of genomic technologies to better understand the mechanism of the COVID-19 virus and the contribution to the development of new tests for the management of COVID-19 patients has boosted the market revenue. In November 2020, Tata Medical and Diagnostics launched new COVID-19 diagnostic testing in India in partnership with the Council of Scientific and Industrial Research Institute of Genomics and Integrative Biology.

The infrastructural failure of research institutes, clinics, and hospitals has adversely impacted healthcare systems and research programs, causing healthcare professionals to escape and leave research centers and hospitals. Furthermore, due to the costs of maintaining huge stockpiles and storage space constraints, these centers have limited quantities of reagents and other consumables.

This has had an impact on not only hospital-based patient care but also therapeutic development initiatives. The conflict is predicted to result in inequities in the supply of medicine in both countries. While therapeutic manufacturing facilities in Ukraine are being abandoned or even shelled, inflation and sanctions have impacted the Russian healthcare system over the border. As a result, the protracted conflict is projected to hamper the market growth for a certain period.

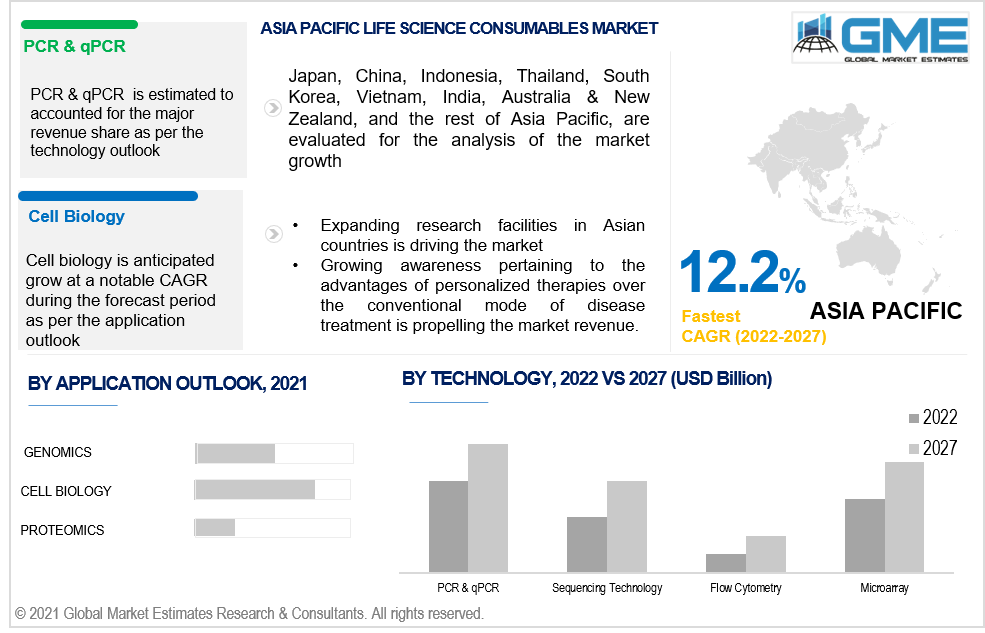

The PCR & qPCR are estimated to capture the maximum share in 2021 owing to the successful application of PCR & qPCR in COVID-19 testing. COVID-19 detection assays use RT-PCR technology to determine the amount of RNA in coronavirus-infected patients' samples. The widespread use of PCR by global healthcare organizations as well as hospitals, laboratories, and public health laboratories has contributed significantly to the revenue generated through this technology segment.

On the other hand, sequencing technology is anticipated to register the fastest growth over the forecast period. The plummeting cost of sequencing coupled with new product launches to streamline next-generation sequencing (NGS) workflow is bolstering segment growth. For instance, in December 2021, Twist Bioscience launched a 96-Plex library prep kit as a cost-effective preparation kit for NGS. The launch of this product further enables the end-users to shift from SNP microarray to an NGS-based approach.

The cell biology segment is estimated to account for the major share in 2021. This can be attributed to the expanding use of robust instruments by researchers in the life science space. As a result, the operating market players continue to expand their cell biology offerings. Cytiva, Merck KGaA, Horizon Discovery, and Takara Bio, to name a few, are some key companies focussing on offering products in this segment.

Genomics-based application is expected to emerge as a lucrative source of revenue growth during the forecast period. A constant increase in genetic information as a result of technological advancements in genomic technologies such as array and sequencing technology is spurring the growth of this segment. Moreover, genomic technology companies continue to upgrade or launch new products to keep pace with changing market demand, thereby supporting the growth of this segment.

Government and academic research institutes are the key end-users of the market with maximum revenue share in 2021. High penetration of life science tools in the research settings has attributed to the dominance of this segment. In addition, rising government funds to accelerate genomic R&D programs further boost segment growth.

On the other hand, pharmaceutical & biotechnology companies are expected to grow lucratively during the forecast period. Increased clinical and genetic data to support novel therapy development is expected to provide a healthy growth outlook for this segment. Expanding therapeutic pipeline, rising investment flow for new therapy/ tests development, and success of advanced diagnostics are some other key factors that are positively impacting the growth of the pharmaceutical & biotechnology company-based life science consumables market.

North America (the United States, Canada, and Mexico) is estimated to account for the major revenue share of the life science consumables market owing to the confluence of multiple factors such as the domestic presence of leading market players such as Thermo Fisher Scientific, Illumina, and others, well-established healthcare infrastructure, and a well-regulated framework for the approval and clinical practice of genomic tests in the region.

An increase in the number of genomic operations for academic and clinical applications in the United States has bolstered the adoption rate of life science consumables in the country. Moreover, the country’s biopharma industry has witnessed tremendous growth over the past years with increased development and approval of nanobodies, synthetic vaccines, fusion proteins, immunotherapeutics, immunoconjugates, and others in the country. This has driven the investment flow in R&D related to life sciences research by the pharmaceutical and biopharmaceutical companies, resulting in the healthy growth of the U.S. market

On the other hand, Asia-Pacific is anticipated to register the fastest growth during the forecast period. Expansion of global market players in the Asian markets including China, India, and others is one of the key factors driving the market. Moreover, Asian countries are gaining significant attention among global market players as a hub for clinical studies of novel tests and therapies owing to low manufacturing and operating cost in this region.

China is estimated to account for the maximum revenue share in the Asia Pacific market. The number of clinical trials for CAR-T cell therapies in China has surpassed the number of clinical trials carried out in the U.S. over the past few years, thereby positively impacting the growth of this market.

Thermofisher Scientific, Inc., Merck KGaA, LONZA, Becton, Dickinson and Company, Takara Bio Inc., F. Hoffmann-La Roche Ltd, Agilent Technologies, Bio-Rad Laboratories Inc., Miltenyi Biotec, and Danaher Corporation among others, are some of the key players operating in the life science consumables market.

Please note: This is not an exhaustive list of companies profiled in the report.

These key players are making focused attempts to enhance their market presence in the life science industry. New product development, merger, and acquisitions, and licensing deals are some of the key strategies undertaken by these companies to sustain the rising market competition.

Chapter 1 Research Methodology

1.1 Research Assumptions

1.2 Research Methodology

1.2.1 Estimates and Forecast Timeline

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GME’s Internal Database

1.3.3 Primary Research

1.3.4 Secondary Sources & Third-Party Perspectives

1.3.4.1 Company Information Sources

1.3.4.2 Secondary Data Sources

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Data Visualization

1.6 Data Validation & Publishing

1.7 Market Model

1.7.1 Model Details

1.7.1.1 Top-Down Approach

1.7.1.2 Bottom-Up Approach

1.8 Market Segmentation & Scope

1.9 Market Definition

Chapter 2 Executive Summary

2.1. Global Market Outlook

2.2 Technology Outlook

2.3 Application Outlook

2.4 End-use Outlook

2.5 Regional Outlook

Chapter 3 Global Life Science Consumables Market Trend Analysis

3.1. Market Introduction

3.2 Penetration & Growth Prospect Mapping

3.3 Impact of COVID-19 on the Life Science Consumables Market

3.4 Metric Data on Life Science Industry

3.5 Market Dynamic Analysis

3.5.1 Market Driver Analysis

3.5.2 Market Restraint Analysis

3.5.3 Industry Challenges

3.5.4 Industry Opportunities

3.6 Porter’s Five Analysis

3.6.1 Supplier Power

3.6.2 Buyer Power

3.6.3 Substitution Threat

3.6.4 Threat from New Entrant

3.7 Market Entry Strategies

Chapter 4 Life Science Consumables Market: Technology Trend Analysis

4.1 Technology: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

4.2 PCR & qPCR

4.2.1 Market Estimates & Forecast Analysis of PCR & qPCR Segment, By Region, 2019-2027 (USD Billion)

4.3 Sequencing Technology

4.3.1 Market Estimates & Forecast Analysis of Sequencing Technology Segment, By Region, 2019-2027 (USD Billion)

4.4 Flow Cytometry

4.4.1 Market Estimates & Forecast Analysis of Flow Cytometry Segment, By Region, 2019-2027 (USD Billion)

4.5 Microarray

4.5.1 Market Estimates & Forecast Analysis of Microarray Segment, By Region, 2019-2027 (USD Billion)

4.6 Microarray

4.6.1 Market Estimates & Forecast Analysis of Microarray Segment, By Region, 2019-2027 (USD Billion)

4.7 Chromatography

4.7.1 Market Estimates & Forecast Analysis of Chromatography Segment, By Region, 2019-2027 (USD Billion)

4.8 Others

4.8.1 Market Estimates & Forecast Analysis of Others Segment, By Region, 2019-2027 (USD Billion)

Chapter 5 Life Science Consumables Market: Application Trend Analysis

5.1 Application: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

5.2 Proteomics

5.2.1 Market Estimates & Forecast Analysis of Proteomics Segment, By Region, 2019-2027 (USD Billion)

5.3 Genomics

5.3.1 Market Estimates & Forecast Analysis of Genomics Segment, By Region, 2019-2027 (USD Billion)

5.4 Cell Biology

5.4.1 Market Estimates & Forecast Analysis of Cell Biology Segment, By Region, 2019-2027 (USD Billion)

5.5 Others

5.5.1 Market Estimates & Forecast Analysis of Others Segment, By Region, 2019-2027 (USD Billion)

Chapter 6 Life Science Consumables Market: End-use Trend Analysis

6.1 End-use: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

6.2 Pharmaceutical & Biotechnology Company

6.2.1 Market Estimates & Forecast Analysis of Pharmaceutical & Biotechnology Company Segment, By Region, 2019-2027 (USD Billion)

6.3 Government and Academic Research Institutes

6.3.1 Market Estimates & Forecast Analysis of Government and Academic Research Institutes Segment, By Region, 2019-2027 (USD Billion)

6.4 Others

6.4.1 Market Estimates & Forecast Analysis of Others Segment, By Region, 2019-2027 (USD Billion)

Chapter 7 Life Science Consumables Market, By Region

7.1 Regional Outlook

7.2 North America

7.2.1 Market Estimates & Forecast Analysis, By End-use 2019-2027 (USD Billion)

7.2.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.2.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.2.4 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.2.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.2.5.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.2.6.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.2.6.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Billion)

7.2.7 Mexico

7.2.7.1 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.2.7.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.2.7.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Billion)

7.3 Europe

7.3.1 Market Estimates & Forecast Analysis, By End-use 2019-2027 (USD Billion)

7.3.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.3.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.3.4 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

7.3.5 Germany

7.3.5.1 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.3.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.3.5.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Billion)

7.3.6 UK

7.3.6.1 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.3.6.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.3.6.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Billion)

7.3.7 France

7.3.7.1 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.3.7.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.3.7.2 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Billion)

7.3.8 Italy

7.3.8.1 Market Estimates & Forecast Analysis, By Technology, 2018-2027 (USD Billion)

7.3.8.2 Market Estimates & Forecast Analysis, By Application, 2018-2027 (USD Billion)

7.3.8.2 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Billion)

7.3.9 Spain

7.3.9.1 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.3.9.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.3.8.2 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Billion)

7.3.10 Rest of Europe

7.3.10.1 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.3.10.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.3.8.2 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Estimates & Forecast Analysis, By End-use 2019-2027 (USD Billion)

7.4.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.4.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.4.4 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

7.4.5 China

7.4.5.1 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.4.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.4.5.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Billion)

7.4.6 India

7.4.6.1 Market Estimates & Forecast Analysis, By Technology, 2019-2025 (USD Billion)

7.4.6.2 Market Estimates & Forecast Analysis, By Application, 2019-2025 (USD Billion)

7.4.6.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.4.7.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.4.7.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Billion)

7.4.8 South Korea

7.4.8.1 Market Estimates & Forecast Analysis, By Technology, 2018-2027 (USD Billion)

7.4.8.2 Market Estimates & Forecast Analysis, By Application, 2018-2027 (USD Billion)

7.4.8.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Billion)

7.4.9 Rest of Asia Pacific

7.4.9.1 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.4.9.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.4.9.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Billion)

7.5 Central & South America

7.5.1 Market Estimates & Forecast Analysis, By End-use 2019-2027 (USD Billion)

7.5.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.5.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.5.4 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.5.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.5.5.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Billion)

7.5.6 Rest of Central & South America

7.5.6.1 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.5.6.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.5.6.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Billion)

7.6 Middle East & Africa

7.6.1 Market Estimates & Forecast Analysis, By End-use 2019-2027 (USD Billion)

7.6.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.6.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.6.4 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.6.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.6.5.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Billion)

7.6.6 South Africa

7.6.6.1 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.6.6.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.6.6.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Billion)

7.6.7 Rest of Middle East & Africa

7.6.7.1 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.6.7.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.6.7.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Billion)

Chapter 8 Competitive Analysis

8.1 Key Global Players, Recent Developments & their Impact on the Industry

8.2 Four Quadrant Competitor Positioning Matrix

8.2.1 Key Innovators

8.2.2 Market Leaders

8.2.3 Emerging Players

8.2.4 Market Challengers

8.3 Vendor Landscape Analysis

8.4 End-User Landscape Analysis

8.5 Company Market Share Analysis, 2021

Chapter 9 Company Profile Analysis

9.1 Thermofisher Scientific, Inc.

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Strategic Initiatives

9.1.4 Service/Software Benchmarking

9.2 Merck KGaA

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Initiatives

9.2.4 Service/Software Benchmarking

9.3 LONZA

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Initiatives

9.3.4 Service/Software Benchmarking

9.4 Becton, Dickinson and Company

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Initiatives

9.4.4 Service/Software Benchmarking

9.5 Takara Bio Inc.

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Initiatives

9.5.4 Service/Software Benchmarking

9.6 F. Hoffmann-La Roche Ltd

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Initiatives

9.6.4 Service/Software Benchmarking

9.7 Agilent Technologies

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Initiatives

9.7.4 Service/Software Benchmarking

9.8 Bio-Rad Laboratories Inc.

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Initiatives

9.8.4 Service/Software Benchmarking

9.9 Miltenyi Biotec

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Initiatives

9.9.4 Service/Software Benchmarking

9.10 Danaher Corporation

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Initiatives

9.10.4 Service/Software Benchmarking

List of Tables

1 Technological advancements in life science consumables market

2 Global life science consumables market: key market drivers

3 Global life science consumables market: key market challenges

4 Global life science consumables market: key market opportunities

5 Global life science consumables market: Key market restraints

6 Global life science consumables market estimates & forecast analysis, 2019-2027 (USD billion)

7 Global life science consumables market, by type, 2019-2027 (USD billion)

8 PCR & qPCR: Global life science consumables market, by region, 2019-2027 (USD billion)

9 Sequencing technology: Global life science consumables market, by region, 2019-2027 (USD billion)

10 Flow cytometry: Global life science consumables market, by region, 2019-2027 (USD billion)

11 Microarray: Global life science consumables market, by region, 2019-2027 (USD billion)

12 Mass spectrometry: Global life science consumables market, by region, 2019-2027 (USD billion)

13 Chromatography: Global life science consumables market, by region, 2019-2027 (USD billion)

14 Others: Global life science consumables market, by region, 2019-2027 (USD billion)

15 Global life science consumables market, by application, 2019-2027 (USD billion)

16 Proteomics: Global life science consumables market, by region, 2019-2027 (USD billion)

17 Genomics: Global life science consumables market, by region, 2019-2027 (USD billion)

18 Cell Biology: Global life science consumables market, by region, 2019-2027 (USD billion)

19 Others: Global life science consumables market, by region, 2019-2027 (USD billion)

20 Global life science consumables market, by end-use, 2019-2027 (USD billion)

21 Pharmaceutical & biotechnology company: Global life science consumables market, by region, 2019-2027 (USD billion)

22 Academic & government research institutes: Global life science consumables market, by region, 2019-2027 (USD billion)

23 Other end-users: Global life science consumables market, by region, 2019-2027 (USD billion)

24 Regional analysis: Global life science consumables market, by region, 2019-2027 (USD billion)

25 North America: life science consumables market, by type, 2019-2027 (USD billion)

26 North America: life science consumables market, by application, 2019-2027 (USD billion)

27 North America: life science consumables market, by end-use, 2019-2027 (USD billion)

28 North America: life science consumables market, by country, 2019-2027 (USD billion)

29 U.S.: life science consumables market, by type, 2019-2027 (USD billion)

30 U.S.: life science consumables market, by application, 2019-2027 (USD billion)

31 U.S.: life science consumables market, by end-use, 2019-2027 (USD billion)

32 Canada: life science consumables market, by type, 2019-2027 (USD billion)

33 Canada: life science consumables market, by application, 2019-2027 (USD billion)

34 Canada: life science consumables market, by end-use, 2019-2027 (USD billion)

35 Mexico: life science consumables market, by type, 2019-2027 (USD billion)

36 Mexico: life science consumables market, by application, 2019-2027 (USD billion)

37 Mexico: life science consumables market, by end-use, 2019-2027 (USD billion)

38 Europe: life science consumables market, by type, 2019-2027 (USD billion)

39 Europe: life science consumables market, by application, 2019-2027 (USD billion)

40 Europe: life science consumables market, by end-use, 2019-2027 (USD billion)

41 Europe: life science consumables market, by country, 2019-2027 (USD billion)

42 Germany: life science consumables market, by type, 2019-2027 (USD billion)

43 Germany: life science consumables market, by application, 2019-2027 (USD billion)

44 Germany: life science consumables market, by end-use, 2019-2027 (USD billion)

45 UK: life science consumables market, by type, 2019-2027 (USD billion)

46 UK: life science consumables market, by application, 2019-2027 (USD billion)

47 UK: life science consumables market, by end-use, 2019-2027 (USD billion)

48 France: life science consumables market, by type, 2019-2027 (USD billion)

49 France: life science consumables market, by application, 2019-2027 (USD billion)

50 France: life science consumables market, by end-use, 2019-2027 (USD billion)

51 Italy: life science consumables market, by type, 2019-2027 (USD billion)

52 Italy: life science consumables market, by application, 2019-2027 (USD billion)

53 Italy: life science consumables market, by end-use, 2019-2027 (USD billion)

54 Spain: life science consumables market, by type, 2019-2027 (USD billion)

55 Spain: life science consumables market, by application, 2019-2027 (USD billion)

56 Spain: life science consumables market, by end-use, 2019-2027 (USD billion)

57 Rest of Europe: life science consumables market, by type, 2019-2027 (USD billion)

58 Rest of Europe: life science consumables market, by application, 2019-2027 (USD billion)

59 Rest of Europe: life science consumables market, by end-use, 2019-2027 (USD billion)

60 Asia Pacific: life science consumables market, by type, 2019-2027 (USD billion)

61 Asia Pacific: life science consumables market, by application, 2019-2027 (USD billion)

62 Asia Pacific: life science consumables market, by end-use, 2019-2027 (USD billion)

63 Asia Pacific: life science consumables market, by country, 2019-2027 (USD billion)

64 China: life science consumables market, by type, 2019-2027 (USD billion)

65 China: life science consumables market, by application, 2019-2027 (USD billion)

66 China: life science consumables market, by end-use, 2019-2027 (USD billion)

67 India: life science consumables market, by type, 2019-2027 (USD billion)

68 India: life science consumables market, by application, 2019-2027 (USD billion)

69 India: life science consumables market, by end-use, 2019-2027 (USD billion)

70 Japan: life science consumables market, by type, 2019-2027 (USD billion)

71 Japan: life science consumables market, by application, 2019-2027 (USD billion)

72 Japan: life science consumables market, by end-use, 2019-2027 (USD billion)

73 South Korea: life science consumables market, by type, 2019-2027 (USD billion)

74 South Korea: life science consumables market, by application, 2019-2027 (USD billion)

75 South Korea: life science consumables market, by end-use, 2019-2027 (USD billion)

76 Middle East & Africa: life science consumables market, by type, 2019-2027 (USD billion)

77 Middle East & Africa: life science consumables market, by application, 2019-2027 (USD billion)

78 Middle East & Africa: life science consumables market, by end-use, 2019-2027 (USD billion)

79 Middle East & Africa: life science consumables market, by country, 2019-2027 (USD billion)

80 Saudi Arabia: life science consumables market, by type, 2019-2027 (USD billion)

81 Saudi Arabia: life science consumables market, by application, 2019-2027 (USD billion)

82 Saudi Arabia: life science consumables market, by end-use, 2019-2027 (USD billion)

83 South Africa: life science consumables market, by type, 2019-2027 (USD billion)

84 South Africa: life science consumables market, by application, 2019-2027 (USD billion)

85 South Africa: life science consumables market, by end-use, 2019-2027 (USD billion)

86 Central & South America: life science consumables market, by type, 2019-2027 (USD billion)

87 Central & South America: life science consumables market, by application, 2019-2027 (USD billion)

88 Central & South America: life science consumables market, by end-use, 2019-2027 (USD billion)

89 Central & South America: life science consumables market, by country, 2019-2027 (USD billion)

90 Brazil: life science consumables market, by type, 2019-2027 (USD billion)

91 Brazil: life science consumables market, by application, 2019-2027 (USD billion)

92 Brazil: life science consumables market, by end-use, 2019-2027 (USD billion)

93 Thermofisher Scientific, Inc.: Products offered

94 Merck KGaA: Products offered

95 LONZA: Products offered

96 Becton, Dickinson and Company: Products offered

97 Takara Bio Inc.: Products offered

98 F. Hoffmann-La Roche Ltd: Products offered

99 Agilent Technologies: Products offered

100 Bio-Rad Laboratories Inc.: Products offered

101 Miltenyi Biotec: Products offered

102 Danaher Corporation: Products offered

List of Figures

1. Global life science consumables market segmentation & research scope

2. Primary research partners and local informers

3. Primary research process

4. Primary research approaches

5. Primary research responses

6. Global life science consumables market: penetration & growth prospect mapping

7. Global life science consumables market: value chain analysis

8. Global life science consumables market drivers

9. Global life science consumables market restraints

10. Global life science consumables market opportunities

11. Global life science consumables market challenges

12. Key life science consumables market manufacturer analysis

13. Global life science consumables market: porter’s five forces analysis

14. Pestle analysis & impact analysis

15. Thermofisher Scientific, Inc.: Company snapshot

16. Thermofisher Scientific, Inc.: SWOT analysis

17. Merck KGaA: Company snapshot

18. Merck KGaA: SWOT analysis

19. LONZA: Company snapshot

20. LONZA: SWOT analysis

21. Becton, Dickinson and Company: Company snapshot

22. Becton, Dickinson and Company: SWOT analysis

23. Takara Bio Inc.: Company snapshot

24. Takara Bio Inc.: SWOT analysis

25. F. Hoffmann-La Roche Ltd: Company snapshot

26. F. Hoffmann-La Roche Ltd: SWOT analysis

27. Agilent Technologies: Company snapshot

28. Agilent Technologies: SWOT analysis

29. Bio-Rad Laboratories Inc.: Company snapshot

30. Bio-Rad Laboratories Inc.: SWOT analysis

31. Miltenyi Biotec: Company snapshot

32. Miltenyi Biotec: SWOT analysis

33. Danaher Corporation: Company snapshot

34. Danaher Corporation: SWOT analysis

The Global Life Science Consumables Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Life Science Consumables Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS