Global Life Science Instrumentation Market Size, Trends & Analysis - Forecasts to 2028 By Technology Type (PCR Technology, Spectroscopy, Microscopy, Chromatography, Electrophoresis, Next-generation Sequencing, Flow Cytometry, Centrifuges, and Others), By Application Type (Clinical & Diagnostic, Research, and Others), By Distribution Channel (Hospitals, Pharmaceutical Companies, Academic Institutions, and Others), and By Region (North America, Asia Pacific, Central & South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

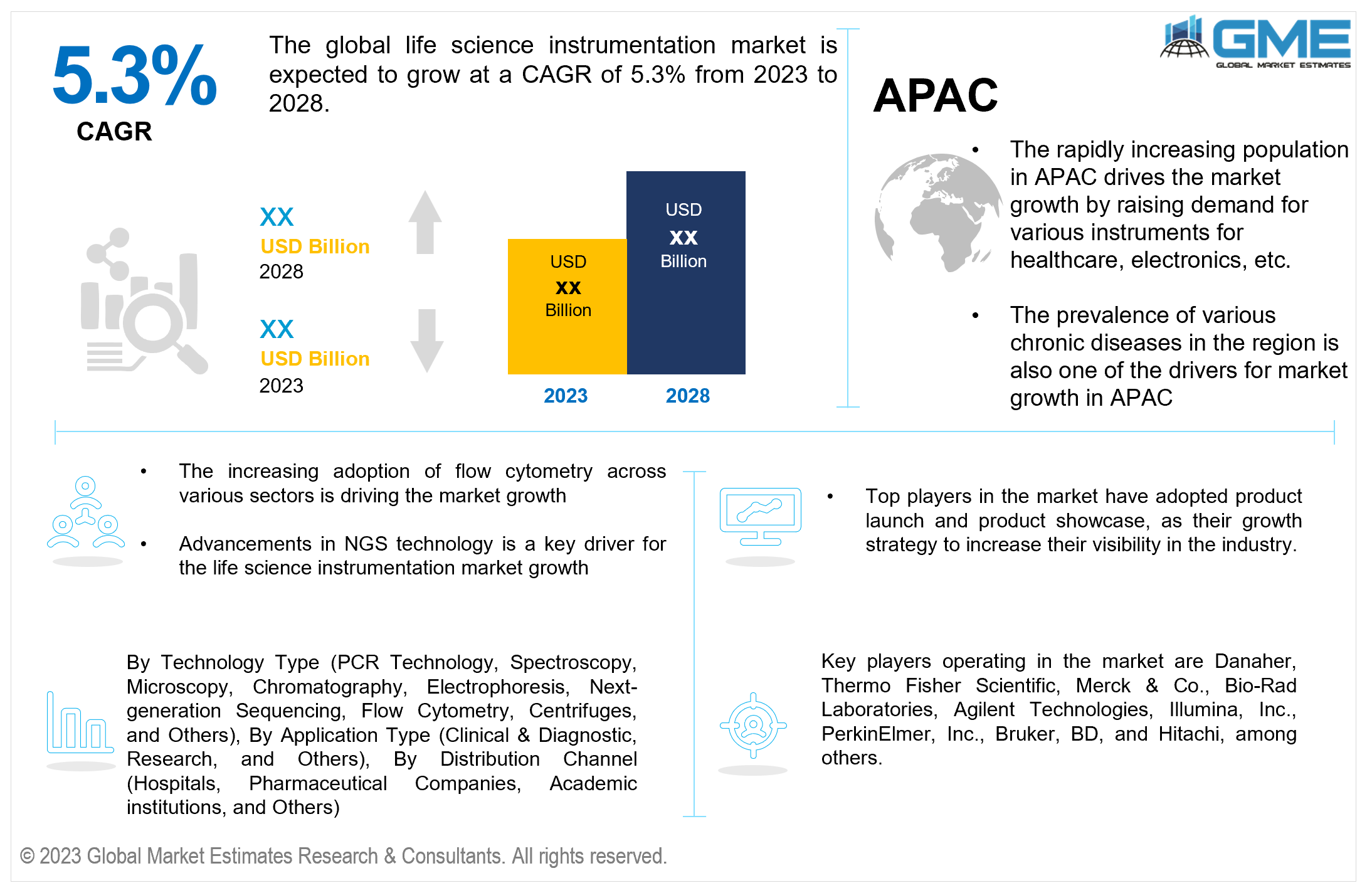

The global life science instrumentation market is expected to exhibit a CAGR of 5.3% from 2023 to 2028. Life science instrumentation encompasses various instruments, components (hardware, services), and apparatus used in the life sciences field for study, analysis, and experimentation. Life science instrumentation allows scientists, researchers, and professionals to study various biological processes, structures, and interactions at different levels of biological complexity, from molecular and cellular to organismal and ecological levels.

There are many factors that drives the global life instrumentation market growth. One of the primary factors is the growing global burden of chronic illnesses. As the prevalence of conditions such as cancer, cardiovascular disorders, and neurological ailments continues to rise, the demand for sophisticated instrumentation also increases to understand disease mechanisms, develop targeted therapies, and monitor treatment outcomes. Simultaneously, the rise in research and development (R&D) activities across diverse sectors drives robust demand for cutting-edge instrumentation. Industries ranging from pharmaceuticals to biotechnology and environmental sciences increasingly rely on these tools to fuel innovation, accelerate product development, and enhance product efficacy.

The global life science instrumentation market growth is further propelled by the substantial influx of public and private investments in the healthcare sector. Among the driving forces, the increasing adoption of flow cytometry techniques is a significant contributor. This method allows simultaneous analysis of multiple cellular parameters, for which it has numerous applications in immunology, cancer research, and drug development. Its versatility and ability to provide insights into complex biological processes is fuelling strong demand for flow cytometry instruments, contributing significantly to the market growth. BD, a major player in the life science instrument production, gained CE-IVD certification for the BD FACSDuet automated flow cytometry system in March 2019, which helped clinical laboratories enhance their productivity by reducing mistakes and eliminating manual user interactions during assay procedures. Furthermore, constant evolution of next-generation sequencing (NGS) technology is aiding in driving market growth. NGS has transformed genomics research by allowing quick and cost-effective study of whole genomes and transcriptomes. As researchers uncover the genetic underpinnings of diseases and gain insights into personalized medicine, the demand for advanced NGS platforms and associated instrumentation is rising.

Despite the promising growth prospects, global life science instrumentation market faces certain restraints that hinders its growth. One key barrier is high expense of procurement and maintaining modern instrumentation. The intricate technologies and precision engineering involved contribute to elevated price points, limiting accessibility particularly for smaller research institutions or resource-constrained regions. Additionally, a shortage of skilled human resources capable of effectively operating and interpreting complex instrumentation poses another challenge. Specialized training to utilize the full potential of these instruments can hinder their widespread utilization, potentially stifling research progress and innovation.

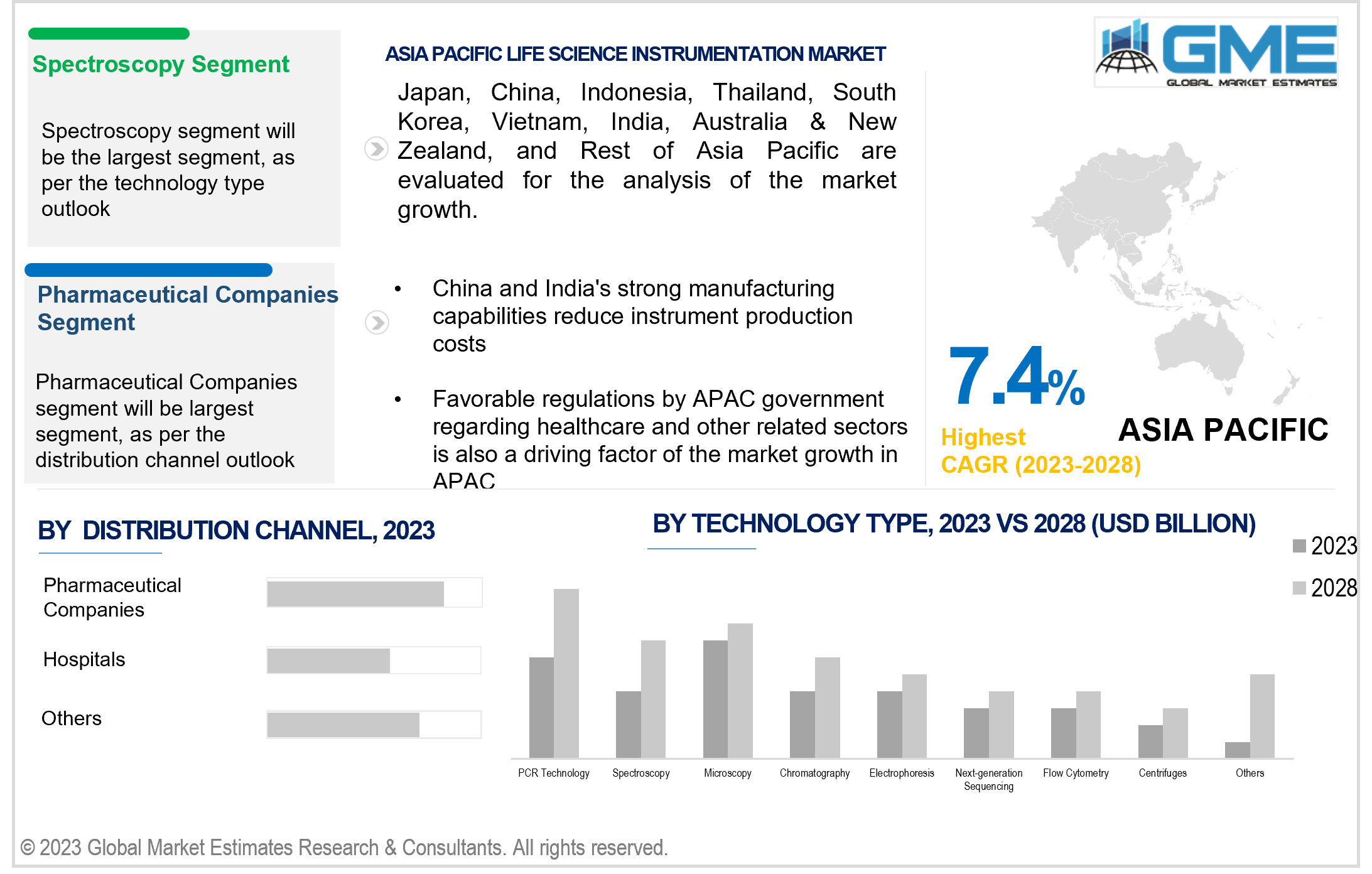

On the basis of technology type, the market is segmented into PCR technology, spectroscopy, microscopy, chromatography, electrophoresis, next-generation sequencing, flow cytometry, centrifuges, and others. The spectroscopy segment is expected to be the largest segment during the forecast period. It allows the analysis of molecular composition, structure, and interactions, aiding research in fields such as chemistry, biology, and materials science. With techniques such as mass spectrometry and nuclear magnetic resonance (NMR) spectroscopy playing pivotal roles in drug discovery, disease diagnosis, and material characterization, spectroscopy's broad utility solidifies its prominence in the market.

Next-generation sequencing (NGS) is expected to be the fastest-growing segment in the global life science instrumentation market due to its revolutionary approach to DNA analysis. NGS enables rapid, high-throughput sequencing of entire genomes and transcriptomes, and provides insights into genetics, diseases, and personalized medicine. Its speed, cost-effectiveness, and wide-ranging applications have fuelled its adoption across research, diagnostics, and pharmaceutical development is propelling NGS segment growth.

On the basis of application type, the market is segmented into clinical & diagnostic, research, and others. The clinical & diagnostic segment is expected to be the largest segment during the forecast period. These instruments allow accurate disease diagnosis, prognosis, and treatment monitoring, driving their essentiality in medical settings. The demand for these instruments arises from the growing need for precise diagnostics, personalized medicine, and disease management, making this segment a cornerstone for advancing patient care and improving health outcomes.

The research applications segment is expected to be the fastest-growing segment in the global life science instrumentation market due to increasing R&D activities across sectors such as consumer electronics and healthcare, rising demand for advanced tools for innovation, and increasing exploration of complex biological processes. Researchers' pursuit of deeper insights into diseases, genetics, and cellular mechanisms fuels demand for cutting-edge instruments, propelling the segment growth.

On the basis of distribution channel, the market is segmented into hospitals, pharmaceutical companies, academic institutions, and others. The pharmaceutical companies segment is expected to be the largest segment during the forecast period. This is due to their extensive reliance on advanced tools for drug discovery, development, and quality control. These companies heavily invest in cutting-edge instrumentation to innovate, validate, and produce pharmaceuticals effectively, making them the largest segment in the market.

Hospitals segment is expected to be the fastest-growing segment in the global life science instrumentation market due to escalating demand for advanced diagnostic tools and treatment monitoring. With the rise of personalized medicine, hospitals increasingly rely on instruments such as imaging systems, PCR machines, and diagnostic analysers to enhance patient care.

North America is analysed to account for the largest share in the global life science instrumentation market during the forecast period. The regional growth is attributed to the presence of major key players such as Cambridge-Boston BioTech and Sygnature Discovery, fostering innovation and competition. The continuous invention of cutting-edge technologies further demonstrates North America as the majority share-holder in the global life science instrumentation market. Moreover, the rising toll of terminal diseases is further driving demand for advanced instrumentation in research, diagnostics, and treatment, propelling North America to claim the largest share in the market.

Asia Pacific is expected to be the fastest growing region across the global life science instrumentation market. The region's growing population fuels healthcare demands, while established factories and industries bolster instrument production. Countries such as China, Japan, India, and South Korea are known to have cheaper capital and labor costs. This facilitates them to be key region for instrument production. Moreover, the presence of a significant population affected by chronic diseases amplifies the need for advanced tools for research, diagnostics, and treatment, driving the rapid expansion of the life science instrumentation market in the region.

Key players operating in the global life science instrumentation market include Danaher, Thermo Fisher Scientific, Merck & Co., Bio-Rad Laboratories, Agilent Technologies, Illumina, Inc., PerkinElmer, Inc., Bruker, BD, and Hitachi, among others.

Please note: This is not an exhaustive list of companies profiled in the report.

In January 2023, Thermo Fisher Scientific entered into a collaboration with AstraZeneca to develop Companion Diagnostic (CDx) test for Tagrisso, as part of a global, multiyear partnership.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics on Feed Stocks

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL LIFE SCIENCE INSTRUMENTATION MARKET, BY APPLICATION TYPE

4.2 Life Science Instrumentation Market: Application Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 Clinical & Diagnostic Market Estimates and Forecast, 2020-2028 (USD Billion)

4.5.1 Research Market Estimates and Forecast, 2020-2028 (USD Billion)

4.6.1 Other Applications Market Estimates and Forecast, 2020-2028 (USD Billion)

5 GLOBAL LIFE SCIENCE INSTRUMENTATION MARKET, BY TECHNOLOGY TYPE

5.2 Life Science Instrumentation Market: Technology Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 PCR Technology Market Estimates and Forecast, 2020-2028 (USD Billion)

5.5 Next Generation Sequencing

5.5.1 Next Generation Sequencing Market Estimates and Forecast, 2020-2028 (USD Billion)

5.6.1 Flow Cytometry Market Estimates and Forecast, 2020-2028 (USD Billion)

5.7.1 Spectrometry Market Estimates and Forecast, 2020-2028 (USD Billion)

5.8.1 Microscopy Market Estimates and Forecast, 2020-2028 (USD Billion)

5.9.1 Chromatography Market Estimates and Forecast, 2020-2028 (USD Billion)

5.10.1 Electrophoresis Market Estimates and Forecast, 2020-2028 (USD Billion)

5.11.1 Centrifuges Market Estimates and Forecast, 2020-2028 (USD Billion)

5.12.1 Other Technologies Market Estimates and Forecast, 2020-2028 (USD Billion)

6 GLOBAL LIFE SCIENCE INSTRUMENTATION MARKET, BY DISTRIBUTION CHANNEL

6.2 Life Science Instrumentation Market: Distribution Channel Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4.1 Hospitals Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.1 Pharmaceutical Companies Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6.1 Academic Institutions Market Estimates and Forecast, 2020-2028 (USD Billion)

6.7.1 Other Channels Market Estimates and Forecast, 2020-2028 (USD Billion)

6.8.1 Other Users Market Estimates and Forecast, 2020-2028 (USD Billion)

7 GLOBAL LIFE SCIENCE INSTRUMENTATION MARKET, BY REGION

7.2.4.1 U.S. Life Science Instrumentation Market Estimates and Forecast, 2020-2028 (USD Billion)

7.2.4.1.3 By Distribution Channel

7.2.4.2 Canada Life Science Instrumentation Market Estimates and Forecast, 2020-2028 (USD Billion)

7.2.4.2.3 By Distribution Channel

7.2.4.3 Mexico Life Science Instrumentation Market Estimates and Forecast, 2020-2028 (USD Billion)

7.2.4.3.3 By Distribution Channel

7.3 Europe Life Science Instrumentation Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.1 Germany Life Science Instrumentation Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.1.3 By Distribution Channel

7.3.4.2 U.K. Life Science Instrumentation Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.2.3 By Distribution Channel

7.3.4.3 France Life Science Instrumentation Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.3.3 By Distribution Channel

7.3.4.4 Italy Life Science Instrumentation Market Estimates and Forecast, 2020-2028 (USD Billion)

7.2.4.4.3 By Distribution Channel

7.3.4.5 Spain Life Science Instrumentation Market Estimates and Forecast, 2020-2028 (USD Billion)

7.2.4.5.3 By Distribution Channel

7.2.4.7.3 By Distribution Channel

7.2.4.7.3 By Distribution Channel

7.4 Asia Pacific Life Science Instrumentation Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.1 China Life Science Instrumentation Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.1.3 By Distribution Channel

7.4.4.2 Japan Life Science Instrumentation Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.2.3 By Distribution Channel

7.4.4.3 India Life Science Instrumentation Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.3.3 By Distribution Channel

7.4.4.4.3 By Distribution Channel

7.4.4.5.3 By Distribution Channel

7.4.4.6 Malaysia Life Science Instrumentation Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.7.3 By Distribution Channel

7.4.4.7 Thailand Life Science Instrumentation Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.7.3 By Distribution Channel

7.4.4.8.3 By Distribution Channel

7.4.4.9 Vietnam Life Science Instrumentation Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.9.3 By Distribution Channel

7.4.4.10 Taiwan Life Science Instrumentation Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.10.1 By Application Type

7.4.4.10.3 By Distribution Channel

7.4.4.11.1 By Application Type

7.4.4.11.3 By Distribution Channel

7.5.4.1.3 By Distribution Channel

7.5.4.2 U.A.E. Life Science Instrumentation Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.4.2.3 By Distribution Channel

7.5.4.3 Israel Life Science Instrumentation Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.4.3.3 By Distribution Channel

7.5.4.4.3 By Distribution Channel

7.5.4.5.2 By Distribution Channel

7.7.4.1 Brazil Life Science Instrumentation Market Estimates and Forecast, 2020-2028 (USD Billion)

7.7.4.1.3 By Distribution Channel

7.7.4.2.3 By Distribution Channel

7.7.4.3 Chile Life Science Instrumentation Market Estimates and Forecast, 2020-2028 (USD Billion)

7.7.4.3.3 By Distribution Channel

7.7.4.4.3 By Distribution Channel

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.4.1.1 Business Description & Financial Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Thermo Fisher Scientific, Inc.

8.4.2.1 Business Description & Financial Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3.1 Business Description & Financial Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4.1 Business Description & Financial Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Agilent Technologies, Inc.

8.4.5.1 Business Description & Financial Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.7.1 Business Description & Financial Analysis

8.4.7.3 Products & Services Offered

8.4.7.4 Strategic Alliances between Business Partners

8.4.7.1 Business Description & Financial Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8.1 Business Description & Financial Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9.1 Business Description & Financial Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10.1 Business Description & Financial Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

9.1.2 Market Scope & Segmentation

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.4 Discussion Guide for Primary Participants

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global Life Science Instrumentation Market, By Application Type, 2020-2028 (USD Billion)

2 Clinical & Diagnostic Market, By Region, 2020-2028 (USD Billion)

3 Research Market, By Region, 2020-2028 (USD Billion)

4 Other Applications Market, By Region, 2020-2028 (USD Billion)

5 Global Life Science Instrumentation Market, By Technology Type, 2020-2028 (USD Billion)

6 PCR Technology Market, By Region, 2020-2028 (USD Billion)

7 Next Generation Sequencing Market, By Region, 2020-2028 (USD Billion)

8 Flow Cytometry Market, By Region, 2020-2028 (USD Billion)

9 Spectrometry Market, By Region, 2020-2028 (USD Billion)

10 Microscopy Market, By Region, 2020-2028 (USD Billion)

11 Chromatography Market, By Region, 2020-2028 (USD Billion)

12 Electrophoresis Market, By Region, 2020-2028 (USD Billion)

13 Centrifuges Market, By Region, 2020-2028 (USD Billion)

14 Other technologies Market, By Region, 2020-2028 (USD Billion)

15 Global Life Science Instrumentation Market, By Distribution Channel, 2020-2028 (USD Billion)

16 Hospitals Market, By Region, 2020-2028 (USD Billion)

17 Pharmaceutical Companies Market, By Region, 2020-2028 (USD Billion)

18 Academic Institutions Market, By Region, 2020-2028 (USD Billion)

19 Other Channels Market, By Region, 2020-2028 (USD Billion)

20 Regional Analysis, 2020-2028 (USD Billion)

21 North America Life Science Instrumentation Market, By Application Type, 2020-2028 (USD Billion)

22 North America Life Science Instrumentation Market, By Technology Type, 2020-2028 (USD Billion)

23 North America Life Science Instrumentation Market, By Distribution Channel, 2020-2028 (USD Billion)

24 North America Life Science Instrumentation Market, By Country, 2020-2028 (USD Billion)

25 U.S Life Science Instrumentation Market, By Application Type, 2020-2028 (USD Billion)

26 U.S Life Science Instrumentation Market, By Technology Type, 2020-2028 (USD Billion)

27 U.S Life Science Instrumentation Market, By Distribution Channel, 2020-2028 (USD Billion)

28 Canada Life Science Instrumentation Market, By Application Type, 2020-2028 (USD Billion)

29 Canada Life Science Instrumentation Market, By Technology Type, 2020-2028 (USD Billion)

30 Canada Life Science Instrumentation Market, By Distribution Channel, 2020-2028 (USD Billion)

31 Mexico Life Science Instrumentation Market, By Application Type, 2020-2028 (USD Billion)

32 Mexico Life Science Instrumentation Market, By Technology Type, 2020-2028 (USD Billion)

33 Mexico Life Science Instrumentation Market, By Distribution Channel, 2020-2028 (USD Billion)

34 Europe Life Science Instrumentation Market, By Application Type, 2020-2028 (USD Billion)

35 Europe Life Science Instrumentation Market, By Technology Type, 2020-2028 (USD Billion)

36 Europe Life Science Instrumentation Market, By Distribution Channel, 2020-2028 (USD Billion)

37 Germany Life Science Instrumentation Market, By Application Type, 2020-2028 (USD Billion)

38 Germany Life Science Instrumentation Market, By Technology Type, 2020-2028 (USD Billion)

39 Germany Life Science Instrumentation Market, By Distribution Channel, 2020-2028 (USD Billion)

40 UK Life Science Instrumentation Market, By Application Type, 2020-2028 (USD Billion)

41 UK Life Science Instrumentation Market, By Technology Type, 2020-2028 (USD Billion)

42 UK Life Science Instrumentation Market, By Distribution Channel, 2020-2028 (USD Billion)

43 France Life Science Instrumentation Market, By Application Type, 2020-2028 (USD Billion)

44 France Life Science Instrumentation Market, By Technology Type, 2020-2028 (USD Billion)

45 France Life Science Instrumentation Market, By Distribution Channel, 2020-2028 (USD Billion)

46 Italy Life Science Instrumentation Market, By Application Type, 2020-2028 (USD Billion)

47 Italy Life Science Instrumentation Market, By T Technology Type Type, 2020-2028 (USD Billion)

48 Italy Life Science Instrumentation Market, By Distribution Channel, 2020-2028 (USD Billion)

49 Spain Life Science Instrumentation Market, By Application Type, 2020-2028 (USD Billion)

50 Spain Life Science Instrumentation Market, By Technology Type, 2020-2028 (USD Billion)

51 Spain Life Science Instrumentation Market, By Distribution Channel, 2020-2028 (USD Billion)

52 Rest Of Europe Life Science Instrumentation Market, By Application Type, 2020-2028 (USD Billion)

53 Rest Of Europe Life Science Instrumentation Market, By Technology Type, 2020-2028 (USD Billion)

54 Rest of Europe Life Science Instrumentation Market, By Distribution Channel, 2020-2028 (USD Billion)

55 Asia Pacific Life Science Instrumentation Market, By Application Type, 2020-2028 (USD Billion)

56 Asia Pacific Life Science Instrumentation Market, By Technology Type, 2020-2028 (USD Billion)

57 Asia Pacific Life Science Instrumentation Market, By Distribution Channel, 2020-2028 (USD Billion)

58 Asia Pacific Life Science Instrumentation Market, By Country, 2020-2028 (USD Billion)

59 China Life Science Instrumentation Market, By Application Type, 2020-2028 (USD Billion)

60 China Life Science Instrumentation Market, By Technology Type, 2020-2028 (USD Billion)

61 China Life Science Instrumentation Market, By Distribution Channel, 2020-2028 (USD Billion)

62 India Life Science Instrumentation Market, By Application Type, 2020-2028 (USD Billion)

63 India Life Science Instrumentation Market, By Technology Type, 2020-2028 (USD Billion)

64 India Life Science Instrumentation Market, By Distribution Channel, 2020-2028 (USD Billion)

65 Japan Life Science Instrumentation Market, By Application Type, 2020-2028 (USD Billion)

66 Japan Life Science Instrumentation Market, By Technology Type, 2020-2028 (USD Billion)

67 Japan Life Science Instrumentation Market, By Distribution Channel, 2020-2028 (USD Billion)

68 South Korea Life Science Instrumentation Market, By Application Type, 2020-2028 (USD Billion)

69 South Korea Life Science Instrumentation Market, By Technology Type, 2020-2028 (USD Billion)

70 South Korea Life Science Instrumentation Market, By Distribution Channel, 2020-2028 (USD Billion)

71 Middle East and Africa Life Science Instrumentation Market, By Application Type, 2020-2028 (USD Billion)

72 Middle East and Africa Life Science Instrumentation Market, By Technology Type, 2020-2028 (USD Billion)

73 Middle East and Africa Life Science Instrumentation Market, By Distribution Channel, 2020-2028 (USD Billion)

74 Middle East and Africa Life Science Instrumentation Market, By Country, 2020-2028 (USD Billion)

75 Saudi Arabia Life Science Instrumentation Market, By Application Type, 2020-2028 (USD Billion)

76 Saudi Arabia Life Science Instrumentation Market, By Technology Type, 2020-2028 (USD Billion)

77 Saudi Arabia Life Science Instrumentation Market, By Distribution Channel, 2020-2028 (USD Billion)

78 UAE Life Science Instrumentation Market, By Application Type, 2020-2028 (USD Billion)

79 UAE Life Science Instrumentation Market, By Technology Type, 2020-2028 (USD Billion)

80 UAE Life Science Instrumentation Market, By Distribution Channel, 2020-2028 (USD Billion)

81 Central & South America Life Science Instrumentation Market, By Application Type, 2020-2028 (USD Billion)

82 Central & South America Life Science Instrumentation Market, By Technology Type, 2020-2028 (USD Billion)

83 Central & South America Life Science Instrumentation Market, By Distribution Channel, 2020-2028 (USD Billion)

84 Central & South America Life Science Instrumentation Market, By Country, 2020-2028 (USD Billion)

85 Brazil Life Science Instrumentation Market, By Application Type, 2020-2028 (USD Billion)

86 Brazil Life Science Instrumentation Market, By Technology Type, 2020-2028 (USD Billion)

87 Brazil Life Science Instrumentation Market, By Distribution Channel, 2020-2028 (USD Billion)

88 Danaher: Products & Services Offering

89 Thermo Fisher Scientific, Inc.: Products & Services Offering

90 Merck & Co.: Products & Services Offering

91 Bio-Rad Laboratories: Products & Services Offering

92 Agilent Technologies, Inc.: Products & Services Offering

93 ILLUMINA, INC.: Products & Services Offering

94 PerkinElmer, Inc. : Products & Services Offering

95 Bruker: Products & Services Offering

96 Hitachi, Inc: Products & Services Offering

97 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Life Science Instrumentation Market Overview

2 Global Life Science Instrumentation Market Value From 2020-2028 (USD Billion)

3 Global Life Science Instrumentation Market Share, By Application Type (2022)

4 Global Life Science Instrumentation Market Share, By Technology Type (2022)

5 Global Life Science Instrumentation Market Share, By Distribution Channel (2022)

6 Global Life Science Instrumentation Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Life Science Instrumentation Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Life Science Instrumentation Market

11 Impact Of Challenges On The Global Life Science Instrumentation Market

12 Porter’s Five Forces Analysis

13 Global Life Science Instrumentation Market: By Application Type Scope Key Takeaways

14 Global Life Science Instrumentation Market, By Application Type Segment: Revenue Growth Analysis

15 Clinical & Diagnostic Market, By Region, 2020-2028 (USD Billion)

16 Research Market, By Region, 2020-2028 (USD Billion)

17 Other Applications Market, By Region, 2020-2028 (USD Billion)

18 Global Life Science Instrumentation Market: By Technology Type Scope Key Takeaways

19 Global Life Science Instrumentation Market, By Technology Type Segment: Revenue Growth Analysis

20 PCR Technology Market, By Region, 2020-2028 (USD Billion)

21 Next Generation Sequencing Market, By Region, 2020-2028 (USD Billion)

22 Flow Cytometry Market, By Region, 2020-2028 (USD Billion)

23 Spectrometry Market, By Region, 2020-2028 (USD Billion)

24 Microscopy Market, By Region, 2020-2028 (USD Billion)

25 Chromatography Market, By Region, 2020-2028 (USD Billion)

26 Electrophoresis Market, By Region, 2020-2028 (USD Billion)

27 Centrifuges Market, By Region, 2020-2028 (USD Billion)

28 Other technologies Market, By Region, 2020-2028 (USD Billion)

29 Global Life Science Instrumentation Market: By Distribution Channel Scope Key Takeaways

30 Global Life Science Instrumentation Market, By Distribution Channel Segment: Revenue Growth Analysis

31 Hospitals Market, By Region, 2020-2028 (USD Billion)

32 Pharmaceutical Companies Market, By Region, 2020-2028 (USD Billion)

33 Academic Institutions Market, By Region, 2020-2028 (USD Billion)

34 Other Channels Market, By Region, 2020-2028 (USD Billion)

35 Regional Segment: Revenue Growth Analysis

36 Global Life Science Instrumentation Market: Regional Analysis

37 North America Life Science Instrumentation Market Overview

38 North America Life Science Instrumentation Market, By Application Type

39 North America Life Science Instrumentation Market, By Technology Type

40 North America Life Science Instrumentation Market, By Distribution Channel

41 North America Life Science Instrumentation Market, By Country

42 U.S. Life Science Instrumentation Market, By Application Type

43 U.S. Life Science Instrumentation Market, By Technology Type

44 U.S. Life Science Instrumentation Market, By Distribution Channel

45 Canada Life Science Instrumentation Market, By Application Type

46 Canada Life Science Instrumentation Market, By Technology Type

47 Canada Life Science Instrumentation Market, By Distribution Channel

48 Mexico Life Science Instrumentation Market, By Application Type

49 Mexico Life Science Instrumentation Market, By Technology Type

50 Mexico Life Science Instrumentation Market, By Distribution Channel

51 Four Quadrant Positioning Matrix

52 Company Market Share Analysis

53 Danaher: Company Snapshot

54 Danaher: SWOT Analysis

55 Danaher: Geographic Presence

56 Thermo Fisher Scientific, Inc.: Company Snapshot

57 Thermo Fisher Scientific, Inc.: SWOT Analysis

58 Thermo Fisher Scientific, Inc.: Geographic Presence

59 Merck & Co.: Company Snapshot

60 Merck & Co.: SWOT Analysis

61 Merck & Co.: Geographic Presence

62 Bio-Rad Laboratories: Company Snapshot

63 Bio-Rad Laboratories: Swot Analysis

64 Bio-Rad Laboratories: Geographic Presence

65 Agilent Technologies, Inc.: Company Snapshot

66 Agilent Technologies, Inc.: SWOT Analysis

67 Agilent Technologies, Inc.: Geographic Presence

68 Illumina, Inc.: Company Snapshot

69 Illumina, Inc.: SWOT Analysis

70 Illumina, Inc.: Geographic Presence

71 PerkinElmer, Inc. : Company Snapshot

72 PerkinElmer, Inc. : SWOT Analysis

73 PerkinElmer, Inc. : Geographic Presence

74 Bruker: Company Snapshot

75 Bruker: SWOT Analysis

76 Bruker: Geographic Presence

77 Hitachi, Inc.: Company Snapshot

78 Hitachi, Inc.: SWOT Analysis

79 Hitachi, Inc.: Geographic Presence

80 Other Companies: Company Snapshot

81 Other Companies: SWOT Analysis

82 Other Companies: Geographic Presence

The Global Life Science Instrumentation Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Life Science Instrumentation Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS