Global Livestock Feeding Robots Market Size, Trends & Analysis - Forecasts to 2026 By Livestock (Ruminants, Horses, Swine, Poultry, and Others), By Farm Size (Small and Medium-Sized Farms, and Large Sized Farms), By Mechanism (Track-Guided Robot, and Self-Propelled Robot), By Type (Feed Pusher, Feeding Robots and Robotic Feed Kitchen/ Storage) Competitive Landscape Company Market Share Analysis, and Competitor Analysis

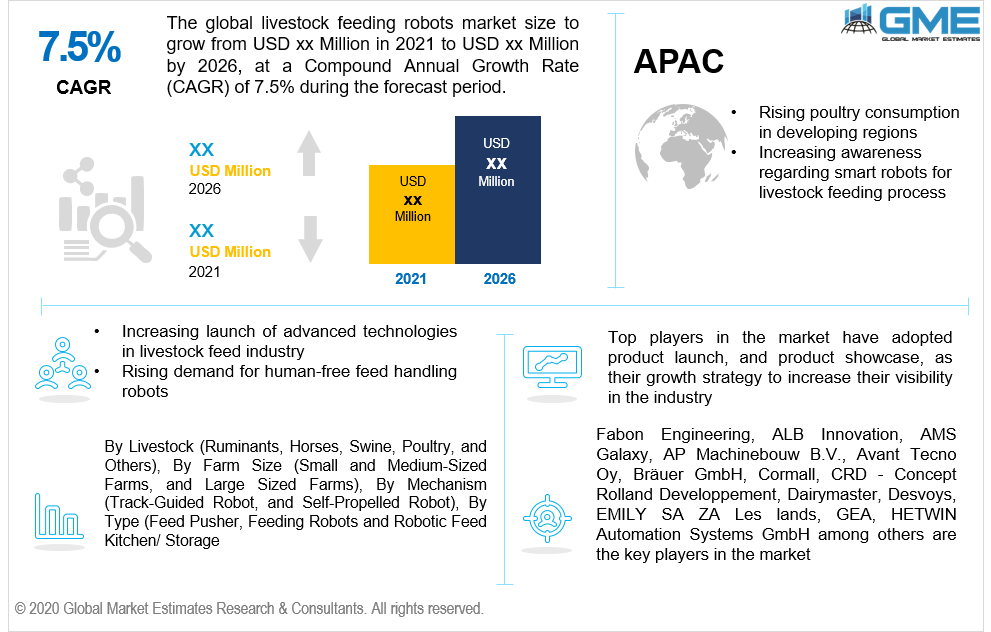

The global livestock feeding robots market is projected to grow at a CAGR value of around 7.5% during the forecast period [2021 to 2026].

The feeding robot travels on a rail across the farm to feed additives to cattle, swine, horses, poultry animals. The feeding robot docks onto a power rail in order to charge the batteries and to be able to drive into the feed kitchen and carry out mixing on mains voltage. This gives the robot extra capacity and prolongs the lifespan of the batteries. To navigate, the robot uses an antenna that follows an induction wire or transponders in the floor. This makes it possible to operate without any need for a rail, even between different buildings and across farmyards.

The feeding robot follows the programmed route by means of small reference magnets placed just under the floor surface. This saves costs and makes feeding robot installation much easier, especially on large farms.

The market for livestock feeding robots will flourish and grow rapidly owing to factors such as growing demand for livestock products such as meat and dairy products, clubbed with rapidly rising population, increasing demand for poultry products, increasing demand for human-free feed handling robots, integration of artificial intelligence and livestock feeding system, and increasing demand for robots to manage huge farms for cattle feeding process. Also, the rising demand for feed to add nutritive value and increase the cattle’s efficiency is estimated to fuel the market growth.

Furthermore, the growing number of large sized dairy farms, rising focus of top players on technological advancements related to feeding robots, feeding pushers and robotic kitchen storage machines, and cost effectiveness associated with using automatic and battery operated feeding robots are some of the other driving factors for the market.

The augment of Covid-19 across the globe took a toll on the supply chain of feed additives and robots for livestock management. In addition, transport restrictions to and fro from the provider country prevented vital ingredients, such as soybean meal, from being delivered to the cattle farms and ultimately this also hampered the use and new purchase of feeding robots. However, considering the ease in lockdown norms and rising demand for meat and poultry products, the market for livestock feeding robots will pick up the pace and grow exponentially.

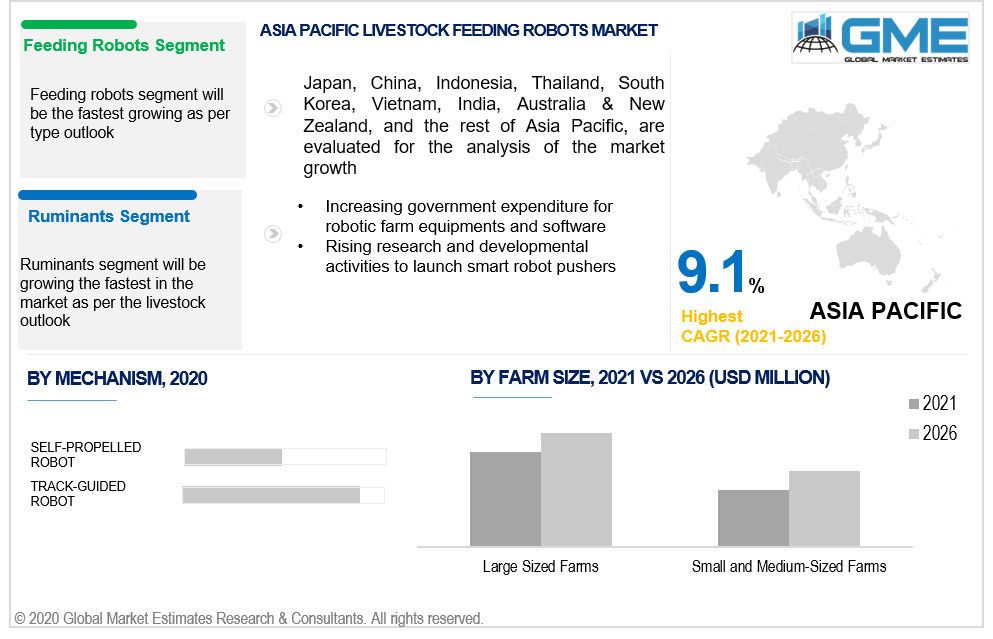

Based on the livestock type, the livestock feeding robots market is segmented into Ruminants, Horses, Swine, Poultry, and other livestock animals. The ruminant segment is estimated to dominate the global market from 2021 to 2026. Increasing demand for dairy food products and rising population across the globe, along with reduced labor costs associated with feeding management are some of the reasons for the segment to be the largest in the market.

Track-guided robots and self-propelled robots are the two segments as per the mechanism outlook of the livestock feeding robots market. The track-guided robot segment will be the fastest growing segment in the livestock feeding robots market from 2021 to 2026. Increasing availability and product launch strategies for track-guided robots and the rising number of large sized farms that require automatic feeding systems are some of the factors supporting the growth of this segment.

Based on the type of products available, the market is segmented into feed pusher, feeding robots and robotic feed kitchen/ storage. The feed pusher robot segment is analyzed to be the fastest growing segment in the livestock feeding robots market. The pusher pushes the feed towards the livestock animals and helps initiate and stimulate the feeding process. With a constant availability of feed, the intake of dry matter can increase as much as 3.5%.

Based on the farm size, the market can be segmented into small and medium-sized farms and large sized farms. Large sized farms will be the largest shareholder of the market. This is mainly because of the benefits of trail-based feeding robots offering efficient feed management to large sized livestock farms. Management of large herd size and high quantity feed monitoring requirements are some of the factors supporting the growth of the large sized farms segment.

As per the geographical analysis, the livestock feeding robots market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the market from 2021 to 2026. The dominant share of North America is mainly attributed to the rising awareness regarding the latest technology to manage the feeding procedure of farm animals, increasing demand for dairy products, and rising demand for hands-free cattle handling systems.

The Asia Pacific segment will be growing the fastest due to the increasing awareness among consumers regarding the importance of automated feeding systems, rapid economic growth of the region, and the increasing demand for meat from China, India, Japan, and Australia.

Fabon Engineering, ALB Innovation, AMS Galaxy, AP Machinebouw B.V., Avant Tecno Oy, Bräuer GmbH, Cormall, CRD - Concept Rolland Developpement, Dairymaster, Desvoys, EMILY SA ZA Les lands, GEA, HETWIN Automation Systems GmbH, HOLARAS Hoopman Machines, JOZ b.v., Jydeland Maskinfabrik A/S, Lely, MULTIONE s.r.l., PEECON, Pellon Group Oy, RABAUD, Rovibec Agrisolusions, Sacema, Schauer Agrotronic GmbH, Sieplo BV, STORTI, Trioliet B.V., Tuchel Maschinenbau, Valmetal, WASSERBAUER GmbH Fütter, Westermann GmbH & Co. KG, and Zonderland Constructie B.V. among others are the key players in the livestock feeding robots market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Livestock Feeding Robots Industry Overview, 2021-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Livestock Overview

2.1.4 Farm Size Overview

2.1.5 Mechanism Overview

2.1.6 Regional Overview

Chapter 3 Livestock Feeding Robots Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2021-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Advancements in the automated feeding systems

3.3.2 Industry Challenges

3.3.2.1 Lack of adequate infrastructure and automated systems in third world countries

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Livestock Growth Scenario

3.4.3 Farm Size Growth Scenario

3.4.4 Mechanism Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Mechanism Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Livestock Feeding Robots Market, By Type

4.1 Type Outlook

4.2 Feed Pusher

4.2.1 Market Size, By Region, 2021-2026 (USD Million)

4.3 Feeding Robots

4.3.1 Market Size, By Region, 2021-2026 (USD Million)

4.4 Robotic Feed Kitchen/ Storage

4.4.1 Market Size, By Region, 2021-2026 (USD Million)

Chapter 5 Livestock Feeding Robots Market, By Farm Size

5.1 Farm Size Outlook

5.2 Small and Medium-Sized Farms

5.2.1 Market Size, By Region, 2021-2026 (USD Million)

5.3 Large Sized Farms

5.3.1 Market Size, By Region, 2021-2026 (USD Million)

Chapter 6 Livestock Feeding Robots Market, By Livestock

6.1 Ruminants

6.1.1 Market Size, By Region, 2021-2026 (USD Million)

6.2 Horses

6.2.1 Market Size, By Region, 2021-2026 (USD Million)

6.3 Swine

6.3.1 Market Size, By Region, 2021-2026 (USD Million)

6.4 Poultry

6.4.1 Market Size, By Region, 2021-2026 (USD Million)

6.5 Others

6.5.1 Market Size, By Region, 2021-2026 (USD Million)

Chapter 7 Livestock Feeding Robots Market, By Mechanism

7.1 Track-Guided Robot

7.1.1 Market Size, By Region, 2021-2026 (USD Million)

7.2 Self-Propelled Robot

7.2.1 Market Size, By Region, 2021-2026 (USD Million)

Chapter 8 Livestock Feeding Robots Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2021-2026 (USD Million)

8.2.2 Market Size, By Type, 2021-2026 (USD Million)

8.2.3 Market Size, By Livestock, 2021-2026 (USD Million)

8.2.4 Market Size, By Farm Size, 2021-2026 (USD Million)

8.2.5 Market Size, By Mechanism, 2021-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Type, 2021-2026 (USD Million)

8.2.4.2 Market Size, By Livestock, 2021-2026 (USD Million)

8.2.4.3 Market Size, By Farm Size, 2021-2026 (USD Million)

Market Size, By Mechanism, 2021-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Type, 2021-2026 (USD Million)

8.2.7.2 Market Size, By Livestock, 2021-2026 (USD Million)

8.2.7.3 Market Size, By Farm Size, 2021-2026 (USD Million)

8.2.7.4 Market Size, By Mechanism, 2021-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2021-2026 (USD Million)

8.3.2 Market Size, By Type, 2021-2026 (USD Million)

8.3.3 Market Size, By Livestock, 2021-2026 (USD Million)

8.3.4 Market Size, By Farm Size, 2021-2026 (USD Million)

8.3.5 Market Size, By Mechanism, 2021-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Type, 2021-2026 (USD Million)

8.3.6.2 Market Size, By Livestock, 2021-2026 (USD Million)

8.3.6.3 Market Size, By Farm Size, 2021-2026 (USD Million)

8.3.6.4 Market Size, By Mechanism, 2021-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Type, 2021-2026 (USD Million)

8.3.7.2 Market Size, By Livestock, 2021-2026 (USD Million)

8.3.7.3 Market Size, By Farm Size, 2021-2026 (USD Million)

8.3.7.4 Market Size, By Mechanism, 2021-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Type, 2021-2026 (USD Million)

8.3.8.2 Market Size, By Livestock, 2021-2026 (USD Million)

8.3.8.3 Market Size, By Farm Size, 2021-2026 (USD Million)

8.3.8.4 Market Size, By Mechanism, 2021-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Type, 2021-2026 (USD Million)

8.3.9.2 Market Size, By Livestock, 2021-2026 (USD Million)

8.3.9.3 Market Size, By Farm Size, 2021-2026 (USD Million)

8.3.9.4 Market Size, By Mechanism, 2021-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Type, 2021-2026 (USD Million)

8.3.10.2 Market Size, By Livestock, 2021-2026 (USD Million)

8.3.10.3 Market Size, By Farm Size, 2021-2026 (USD Million)

8.3.10.4 Market Size, By Mechanism, 2021-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Type, 2021-2026 (USD Million)

8.3.11.2 Market Size, By Livestock, 2021-2026 (USD Million)

8.3.11.3 Market Size, By Farm Size, 2021-2026 (USD Million)

8.3.11.4 Market Size, By Mechanism, 2021-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2021-2026 (USD Million)

8.4.2 Market Size, By Type, 2021-2026 (USD Million)

8.4.3 Market Size, By Livestock, 2021-2026 (USD Million)

8.4.4 Market Size, By Farm Size, 2021-2026 (USD Million)

8.4.5 Market Size, By Mechanism, 2021-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Type, 2021-2026 (USD Million)

8.4.6.2 Market Size, By Livestock, 2021-2026 (USD Million)

8.4.6.3 Market Size, By Farm Size, 2021-2026 (USD Million)

8.4.6.4 Market Size, By Mechanism, 2021-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Type, 2021-2026 (USD Million)

8.4.7.2 Market Size, By Livestock, 2021-2026 (USD Million)

8.4.7.3 Market Size, By Farm Size, 2021-2026 (USD Million)

8.4.7.4 Market Size, By Mechanism, 2021-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Type, 2021-2026 (USD Million)

8.4.8.2 Market Size, By Livestock, 2021-2026 (USD Million)

8.4.8.3 Market Size, By Farm Size, 2021-2026 (USD Million)

8.4.8.4 Market Size, By Mechanism, 2021-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Type, 2021-2026 (USD Million)

8.4.9.2 Market size, By Livestock, 2021-2026 (USD Million)

8.4.9.3 Market Size, By Farm Size, 2021-2026 (USD Million)

8.4.9.4 Market Size, By Mechanism, 2021-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Type, 2021-2026 (USD Million)

8.4.10.2 Market Size, By Livestock, 2021-2026 (USD Million)

8.4.10.3 Market Size, By Farm Size, 2021-2026 (USD Million)

8.4.10.4 Market Size, By Mechanism, 2021-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country 2021-2026 (USD Million)

8.5.2 Market Size, By Type, 2021-2026 (USD Million)

8.5.3 Market Size, By Livestock, 2021-2026 (USD Million)

8.5.4 Market Size, By Farm Size, 2021-2026 (USD Million)

8.5.5 Market Size, By Mechanism, 2021-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Type, 2021-2026 (USD Million)

8.5.6.2 Market Size, By Livestock, 2021-2026 (USD Million)

8.5.6.3 Market Size, By Farm Size, 2021-2026 (USD Million)

8.5.6.4 Market Size, By Mechanism, 2021-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Type, 2021-2026 (USD Million)

8.5.7.2 Market Size, By Livestock, 2021-2026 (USD Million)

8.5.7.3 Market Size, By Farm Size, 2021-2026 (USD Million)

8.5.7.4 Market Size, By Mechanism, 2021-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Type, 2021-2026 (USD Million)

8.5.8.2 Market Size, By Livestock, 2021-2026 (USD Million)

8.5.8.3 Market Size, By Farm Size, 2021-2026 (USD Million)

8.5.8.4 Market Size, By Mechanism, 2021-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2021-2026 (USD Million)

8.6.2 Market Size, By Type, 2021-2026 (USD Million)

8.6.3 Market Size, By Livestock, 2021-2026 (USD Million)

8.6.4 Market Size, By Farm Size, 2021-2026 (USD Million)

8.6.5 Market Size, By Mechanism, 2021-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Type, 2021-2026 (USD Million)

8.6.6.2 Market Size, By Livestock, 2021-2026 (USD Million)

8.6.6.3 Market Size, By Farm Size, 2021-2026 (USD Million)

8.6.6.4 Market Size, By Mechanism, 2021-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Type, 2021-2026 (USD Million)

8.6.7.2 Market Size, By Livestock, 2021-2026 (USD Million)

8.6.7.3 Market Size, By Farm Size, 2021-2026 (USD Million)

8.6.7.4 Market Size, By Mechanism, 2021-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Type, 2021-2026 (USD Million)

8.6.8.2 Market Size, By Livestock, 2021-2026 (USD Million)

8.6.8.3 Market Size, By Farm Size, 2021-2026 (USD Million)

8.6.8.4 Market Size, By Mechanism, 2021-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Lely

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 AMS Galaxy

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 AP Machinebouw B.V.

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Avant Tecno Oy

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Bräuer GmbH

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Cormall

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 CRD - Concept Rolland Developpement

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Dairymaster

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Fabon Engineering

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Other Companies

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

The Global Livestock Feeding Robots Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Livestock Feeding Robots Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS