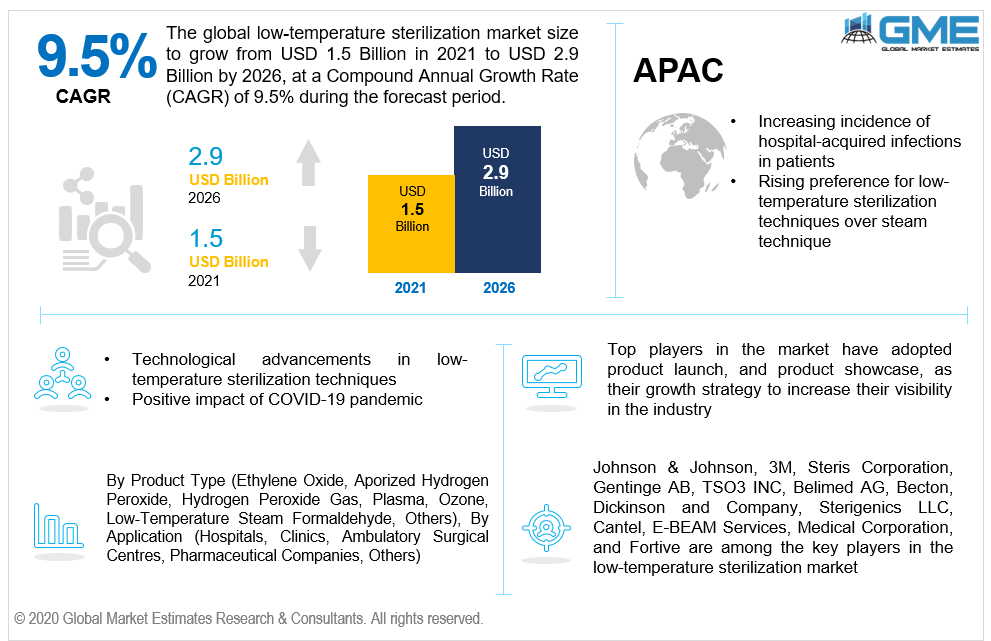

Global Low-Temperature Sterilization Market Size, Trends & Analysis - Forecasts to 2026 By Product Type (Ethylene Oxide, Aporized Hydrogen Peroxide, Hydrogen Peroxide Gas, Plasma, Ozone, Low-Temperature Steam Formaldehyde, Others), By Application (Hospitals, Clinics, Ambulatory Surgical Centres, Pharmaceutical Companies, Others), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

The global low-temperature sterilization market is projected to grow from USD 1.5 billion in 2021 to USD 2.9 billion by 2026 at a CAGR value of 9.5% from 2021 to 2026.

The growth of the global low-temperature sterilization market is primarily driven by the increasing incidence of hospital-acquired infections in patients specifically the ones that are receiving long-term treatment, rising preference for low-temperature sterilization techniques over steam technique in order to sterilize heat-sensitive surgical equipment and supplies.

Furthermore, the increasing prevalence of chronic diseases such as cancer and diabetes and rising safety & hygiene consciousness among consumers is likely to fuel the market growth.

Moreover, the emerging economies such as India, Japan and China are expected to provide a wide range of growth opportunities for low-temperature sterilization players in the low-temperature sterilization market. This is driven by their large and growing populations as well as the increasing number of hospitals and clinics.

Sterilization is the practice of eradicating microorganisms as well as other infections from an object or surface utilizing pharmacological or radiation treatments, or by exposing the material to extreme heat. Low-temperature sterilization is one of the most normally employed treatments for various thermal and humidity-sensitive implantable implants and equipment. It is an excellent choice for sterilizing products that have been harmed by dry heat or steam sterilization. Low-temperature sterilization, unlike heat sterilization, can be used to sterilize heat-sensitive goods.

The usage of low-temperature sterilization is being pushed by an increase in hospital-associated illnesses, increased global awareness about cleaning and sterilization, and an increase in the number of procedures. Furthermore, an increase in the frequency of diseases such as cancer and tuberculosis are expected to increase the use of medical tools, boosting the low-temperature sterilization market. However, as the number of disposable devices grows, the necessity for device sterilization decreases, posing a challenge for the market in the coming years. Non-sterile implements or devices result in higher infection rates, a longer patient stays higher expenses, and possibly higher fatality rates. The hospital's sterile processing section is in charge of reprocessing used or contaminated medical devices. Reprocessing is the process of cleaning medical devices with a sterilizer or disinfectant to remove soil and other impurities.

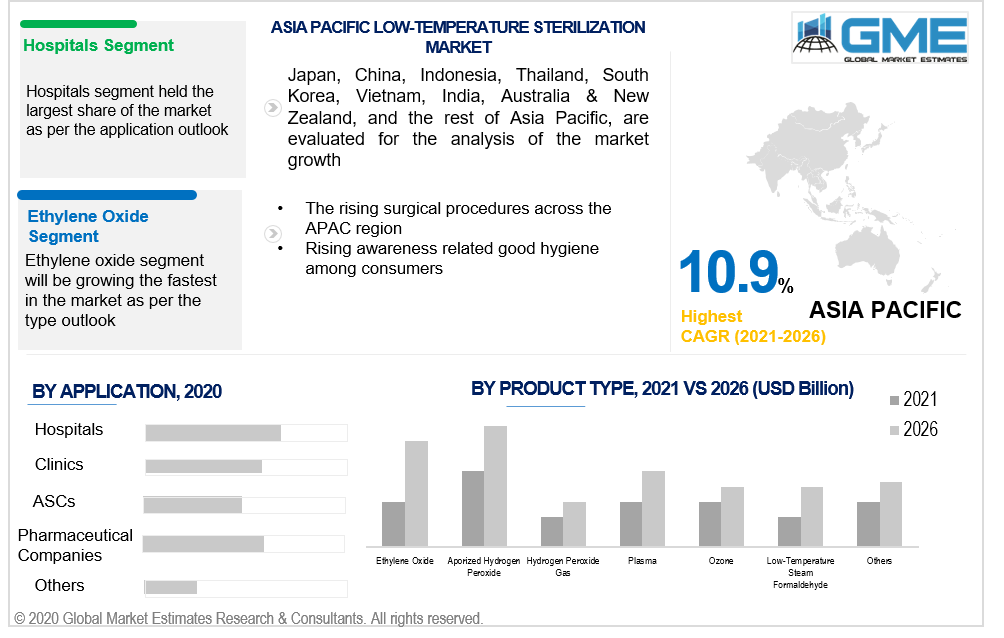

Based on the type of product, the low-temperature sterilization market is segmented into ethylene oxide, hydrogen peroxide gas plasma, ozone and others. Ethylene oxide is expected to be the fastest growing segment in the low-temperature sterilization market from 2021 to 2026.

Ethylene oxide is a colorless, flammable vapor with a pleasant odor that can be ignited at ambient temperature. In modest doses, it is employed as a pesticide and a disinfecting agent. It is mostly used to make other compounds, such as antifreeze. Ethylene oxide's propensity to destroy DNA makes it an excellent sterilizer and hence is the fastest growing segment in the market. During the forecast period of 2021 to 2026, the ethylene oxide category is expected to be the largest segment too owing to its widespread use in sterilizing both moisture-sensitive devices and heat-sensitive devices across developed and developing countries.

Hospitals, clinics, ambulatory surgical centres, pharmaceutical companies, others are the application segments of the low-temperature sterilization market.

The hospitals segment is expected to have a major share of the market during the forecast period. This is mainly attributed to the high recurrence of hospital-associated infections and the increases in the number of operations and examinations. Also rising number of geriatric patient who need medical care, and rising cases of chronic diseases will boost the growth of this segment in the market.

Based on region, the low-temperature sterilization market is segmented into various regions such as North America, Europe, Central and South America, Middle East and Africa, and the Asia Pacific.

The North American region dominated and accounted for the majority of the market share in 2020. The expansion of this regional market can be associated with the rising rates of hospital-acquired infections and the high prevalence of chronic diseases. Increasing regulatory norms aimed at providing patient safety and adoption of enhanced healthcare services are also expected to drive the growth of this market.

The low-temperature sterilization market for Asia Pacific region is predicted to expand at the fastest rate owing to rising aging population, increasing healthcare expenditure, rising number of hospital admissions and outpatient visits and prevalence of chronic and infectious diseases. The rising surgical procedures across the APAC region is also contributing to the growth of the market. Other factors supporting the growth of this regions is the rising awareness related good hygiene among consumers, as well as increasing knowledge of infectious diseases and their preventive measures. Moreover, the COVID-19 pandemic has played a major role in uplifting the low-temperature sterilization market’s revenue and the CAGR is expected to grow rapidly during the forecast period.

The major low-temperature sterilization providers have a distinct outsourcing strategy than their smaller competitors. Johnson & Johnson, 3M, Steris Corporation, Gentinge AB, TSO3 INC, Belimed AG, Becton, Dickinson and Company, Sterigenics LLC, Cantel, E-BEAM Services, Medical Corporation, and Fortive are among the key players in the low temperature sterilization market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Low-Temperature Sterilization Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Low-Temperature Sterilization Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing incidence of hospital-acquired infections in patients

3.3.2 Industry Challenges

3.3.2.1 Lack of awareness regarding latest regulatory norms on low-temperature sterilization

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2019

3.11.1 Company Positioning Overview, 2019

Chapter 4 Low-Temperature Sterilization Market, By Type

4.1 Type Outlook

4.2 Ethylene Oxide

4.2.1 Market size, by region, 2019-2026 (USD Billion)

4.3 Aporized Hydrogen Peroxide

4.3.1 Market size, by region, 2019-2026 (USD Billion)

4.4 Hydrogen Peroxide Gas

4.4.1 Market size, by region, 2019-2026 (USD Billion)

4.5 Plasma

4.5.1 Market size, by region, 2019-2026 (USD Billion)

4.6 Ozone

4.6.1 Market size, by region, 2019-2026 (USD Billion)

4.7 Low-Temperature Steam Formaldehyde

4.7.1 Market size, by region, 2019-2026 (USD Billion)

4.8 Others

4.8.1 Market size, by region, 2019-2026 (USD Billion)

Chapter 5 Low-Temperature Sterilization Market, By Application

5.1 Application Outlook

5.2 Hospitals

5.2.1 Market Size, By Region, 2019-2026 (USD Billion)

5.3 Clinics

5.3.1 Market Size, By Region, 2019-2026 (USD Billion)

5.4 Ambulatory Surgical Centres

5.4.1 Market Size, By Region, 2019-2026 (USD Billion)

5.5 Pharmaceutical Companies

5.5.1 Market Size, By Region, 2019-2026 (USD Billion)

5.6 Others

5.6.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 6 Low-Temperature Sterilization Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country, 2019-2026 (USD Billion)

6.2.2 Market Size, By Type, 2019-2026 (USD Billion)

6.2.3 Market Size, By Application, 2019-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2019-2026 (USD Billion)

6.2.4.2 Market Size, By Application, 2019-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2019-2026 (USD Billion)

6.2.5.2 Market Size, By Application, 2019-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country, 2019-2026 (USD Billion)

6.3.2 Market Size, By Type, 2019-2026 (USD Billion)

6.3.3 Market Size, By Application, 2019-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Type, 2019-2026 (USD Billion)

6.3.4.2 Market Size, By Application, 2019-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2019-2026 (USD Billion)

6.3.5.2 Market Size, By Application, 2019-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Type, 2019-2026 (USD Billion)

6.3.6.2 Market Size, By Application, 2019-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2019-2026 (USD Billion)

6.3.7.2 Market Size, By Application, 2019-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2019-2026 (USD Billion)

6.3.8.2 Market Size, By Application, 2019-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2019-2026 (USD Billion)

6.3.9.2 Market Size, By Application, 2019-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country, 2019-2026 (USD Billion)

6.4.2 Market Size, By Type, 2019-2026 (USD Billion)

6.4.3 Market Size, By Application, 2019-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Type, 2019-2026 (USD Billion)

6.4.4.2 Market Size, By Application, 2019-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Type, 2019-2026 (USD Billion)

6.4.5.2 Market Size, By Application, 2019-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2019-2026 (USD Billion)

6.4.6.2 Market Size, By Application, 2019-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2019-2026 (USD Billion)

6.4.7.2 Market size, By Application, 2019-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2019-2026 (USD Billion)

6.4.8.2 Market Size, By Application, 2019-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country, 2019-2026 (USD Billion)

6.5.2 Market Size, By Type, 2019-2026 (USD Billion)

6.5.3 Market Size, By Application, 2019-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2019-2026 (USD Billion)

6.5.4.2 Market Size, By Application, 2019-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2019-2026 (USD Billion)

6.5.5.2 Market Size, By Application, 2019-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2019-2026 (USD Billion)

6.5.6.2 Market Size, By Application, 2019-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country, 2019-2026 (USD Billion)

6.6.2 Market Size, By Type, 2019-2026 (USD Billion)

6.6.3 Market Size, By Application, 2019-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2019-2026 (USD Billion)

6.6.4.2 Market Size, By Application, 2019-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2019-2026 (USD Billion)

6.6.5.2 Market Size, By Application, 2019-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2019-2026 (USD Billion)

6.6.6.2 Market Size, By Application, 2019-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2019

7.2 3M

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Infographic Analysis

7.3 Steris

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Infographic Analysis

7.4 Belimed

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Infographic Analysis

7.5 Cantel Medical

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Infographic Analysis

7.6 TSO3

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Infographic Analysis

7.7 Johnson & Johnson

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Infographic Analysis

7.8 Getinge

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Infographic Analysis

7.9 Advanced Sterilization Products (ASP)

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Infographic Analysis

7.10 Matachana

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Infographic Analysis

7.11 Sterigenics International

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Infographic Analysis

7.12 Other Companies

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Infographic Analysis

The Global Low-Temperature Sterilization Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Low-Temperature Sterilization Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS