Global Lyocell Fiber Market Size, Trends & Analysis - Forecasts to 2026 By Product (Staple Fiber, Cross-Linked Fiber), By Application (Apparel, Medical and Hygiene, Automotive Filters, Home Textiles, Others), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Vendor Landscape, and Company Market Share Analysis and Competitor Analysis

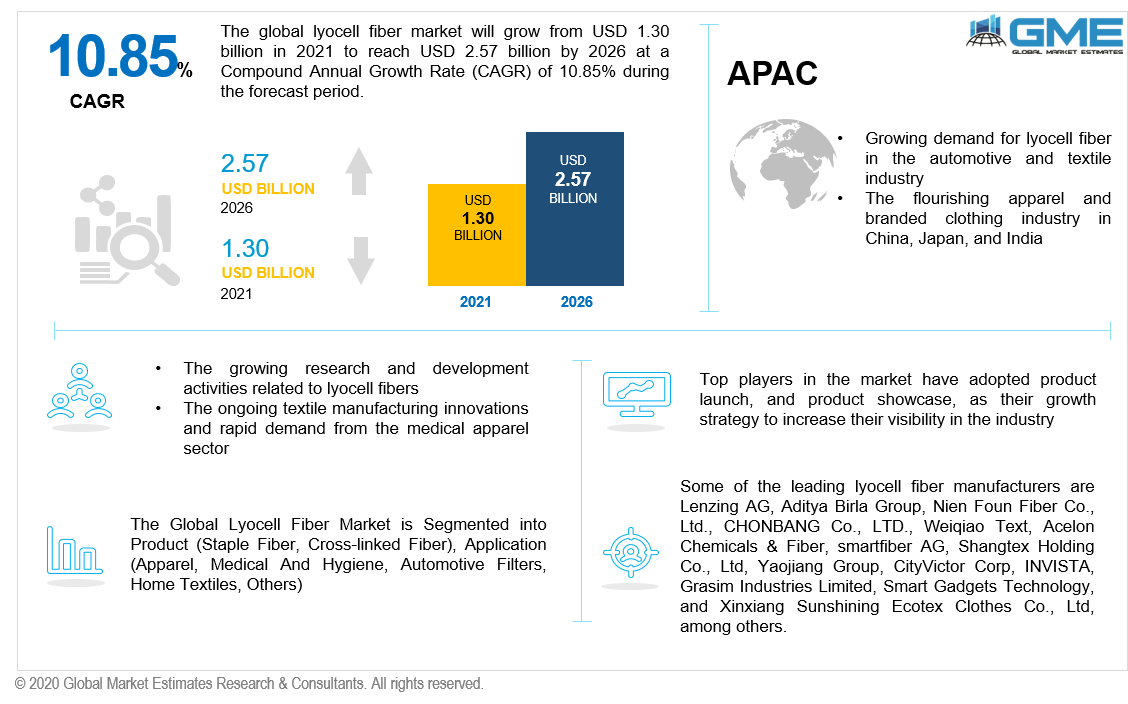

The global lyocell fiber market will grow from USD 1.30 billion in 2021 to reach USD 2.57 billion in 2026, with a CAGR of 10.85% during the forecast period. The rising demand for lyocell fibers, and increasing product launch strategies in the developed markets are a few of the key factors expected to drive market growth during the forecast period. The ongoing textile manufacturing innovations and rapid development in the healthcare sector is a major contributor to the global lyocell fiber market growth.

Also, tencel fabric or lyocell fabric is widely used in numerous industries, including pulp, fashion, medical, paper, and textile. Due to its high adaptability, lyocell fiber is used as an alternative for cotton and silk in the production of bed linens, sportswear, jeans, shirts, denim, t-shirts, and towels, and hence with the flourishing fabric industry, the market for lyocell fiber will be growing the fastest.

Furthermore, increasing production of lyocell fiber with advanced N-methyl morpholine-N-oxide (NMMO) technology (which is a simple, resource-saving, and environmentally beneficial method of regeneration), and increasing awareness of utilizing sterilized products, as well as the rising influence of biodegradable fibers are some of the other factors supporting the growth of the market.

Wood is the primary raw material utilized in the production of fiber lyocell products. The increased emphasis on sustainable wood cultivation is projected to boost the market growth. Growing demand for lyocell cellulose-based products as a result of the rejection of petroleum-based products is likely to help the market grow. As a result, the increasing demand for lyocell fiber from the footwear industry will support the growth of the lyocell fiber market.

The shrink resistance of lyocell fibers has emerged as the main factor encouraging its adoption in textile applications and therefore supporting the growth of the market. Furthermore, rising initiatives by national governments around the world to eliminate or reduce the number of plastic products in the environment are likely to assist industry growth throughout the forecast period.

COVID-19, has a positive impact on the market. COVID-19 has also influenced the demand for fiber lyocell, which has been exacerbated by the application of lockdown and a halt in fiber lyocell manufacturing. However, with the ease of lockdown restrictions and reopening of production of apparel, footwear, and other products which require lyocell fiber, the market will see growth during the forecast period.

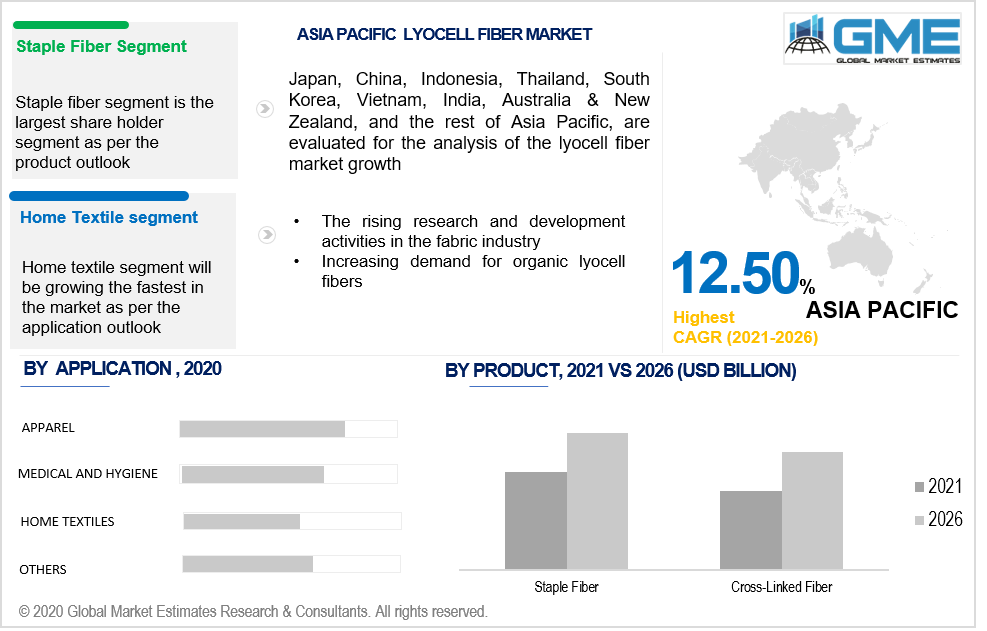

The product segment is categorized into staple fiber and cross-linked fiber. The staple fiber segment is expected to hold the largest market share in terms of revenue and volume from 2021 to 2026 due to the increasing usage of staple fabric in the textile industry. The increasing demand for staple fiber for the production of towels, denim, and other apparel is expected to boost the global lyocell fiber market.

The usage of cross-linked fiber in jersey fabrics, non-woven fabrics, and knitwear are expected to drive significant growth in demand for the product. During the forecast period of 2021 to 2026, the staple fiber’s increasing use in the production of home textiles such as drapes, bed sheets, and curtains is expected to fuel market expansion. The staple fiber’s demand is also projected to increase significantly as a result of its use in the automobile industry.

Apparel, medical and hygiene, automotive filters, home textiles, and other applications are the major segments of the lyocell fiber market. The apparel application is expected to hold the largest share of the market in terms of revenue from 2021 to 2026 due to its absorbency and softness properties.

The apparel segment is followed by home textiles, which comprise bed sheets, draperies, curtains, and carpets. The product is utilized as medical accessories, elastic and non-elastic bandages, absorbent pads, compression bandages, wound-contact layers, gauze dressings, and as wipes in operating theatres.

As per the geographical analysis, the lyocell fiber market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the market from 2021 to 2026. The high largest share of the North American region is mainly due to the presence of key competitors in the US market, flourishing apparel manufacturing sector, and increasing technological advancements. Furthermore, growth in aerospace and automobile production, along with rising use of lyocell fibers in the aforementioned industries' interior applications, are likely to be the primary factors driving industry growth throughout the forecast period.

Furthermore, the Asia Pacific region will grow with the highest CAGR rate in the market. The presence of a substantial textile manufacturing business in China and India, as well as growing government attempts to boost textile production, is likely to fuel market expansion throughout the forecast period.

Some of the leading lyocell manufacturers are Lenzing AG, Aditya Birla Group, Nien Foun Fiber Co., Ltd., CHONBANG Co., LTD., Weiqiao Text, Acelon Chemicals & Fiber, smartfiber AG, Shangtex Holding Co., Ltd, Yaojiang Group, CityVictor Corp, INVISTA, Grasim Industries Limited, Smart Gadgets Technology, and Xinxiang Sunshining Ecotex Clothes Co., Ltd, among others.

Please note: This is not an exhaustive list of companies profiled in the report.

In June 2019, Lenzing AG established the world’s largest lyocell fiber manufacturing facility in Thailand and invested around USD 1.11 billion in the new facility for the bulk production of lyocell fibers.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Lyocell Fiber Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.1 Product Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Global Lyocell Fiber Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing demand for lyocell fibers from the textile industry

3.3.2 Industry Challenges

3.3.2.1 Lack of resources and distribution channels in small and medium-sized enterprises

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Lyocell Fiber Market, By Product

4.1 Product Outlook

4.2 Staple Fiber

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Cross Linked Fiber

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Global Lyocell Fiber Market, By Application

5.1 Application Outlook

5.2 Apparel

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Home Textiles

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Medical and Hygiene

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Automotive Filters

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Others

5.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Global Lyocell Fiber Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Billion)

6.2.2 Market Size, By Product, 2020-2026 (USD Billion)

6.2.3 Market Size, By Application, 2020-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.2.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.2.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Billion)

6.3.2 Market Size, By Product, 2020-2026 (USD Billion)

6.3.3 Market Size, By Application, 2020-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.8.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Billion)

6.4.2 Market Size, By Product, 2020-2026 (USD Billion)

6.4.3 Market Size, By Application, 2020-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.7.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.8.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Billion)

6.5.2 Market Size, By Product, 2020-2026 (USD Billion)

6.5.3 Market Size, By Application, 2020-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.5.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.5.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Product, 2020-2026 (USD Billion)

6.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Billion)

6.6.2 Market Size, By Product, 2020-2026 (USD Billion)

6.6.3 Market Size, By Application, 2020-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.6.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.6.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Product, 2020-2026 (USD Billion)

6.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Lenzing AG

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info-Graphic Analysis

7.3 Acegreen Eco-Material Technology Co., Ltd.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info-Graphic Analysis

7.4 Aditya Birla Group

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info-Graphic Analysis

7.5 Baoding Swan Fiber Co. Ltd.

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info-Graphic Analysis

7.6 Chonbang Co., Ltd.

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info-Graphic Analysis

7.7 Weiqiao Textile Company Limited

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info-Graphic Analysis

7.8 Zhejiang Yaojiang Industrial Group Limited

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info-Graphic Analysis

7.9 China Populus Textile Ltd.

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info-Graphic Analysis

7.10 SK Global Chemical Co., Ltd.

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info-Graphic Analysis

7.11 Great Duksan Corp.

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info-Graphic Analysis

7.12 Other Companies

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info-Graphic Analysis

The Global Lyocell Fiber Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Lyocell Fiber Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS