Global Methacrylic Acid Market Size, Trends & Analysis – Forecasts to 2026 By Type (Paint, Adhesive, Fibre Processing Agent, Rubber Modifier, Leather Treatment, Paper Processing Agent, Lubricant Additive, Cement Mixing Agent, Others), By End Use (Construction, Automobiles, Electronics, Textile, Pharmaceutical), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User landscape, Company Market Share Analysis, and Competitor Analysis

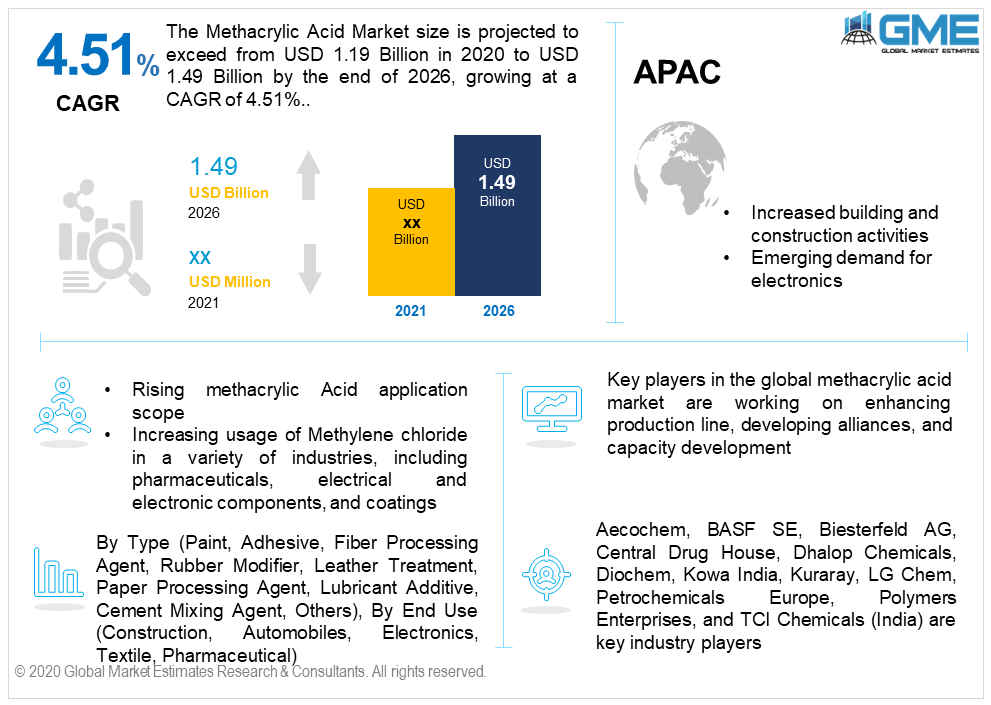

The global methacrylic acid market size is projected to exceed from USD 1.19 Billion in 2020 to USD 1.49 Billion by the end of 2026, growing at a CAGR of 4.51%. Rapidly developing product demand due to increased urbanization and growth in diversified sectors such as construction, automobiles, electronics, textiles, pharmaceuticals will induce industry growth.

Methacrylic acid (MAA) is a transparent and organic compound that possesses an irksome smell. It is a carboxylic corrosive which is water emulsifiable and mixable with organic catalysts. Methacrylic acid blends favorably with most of the organic dissolvents and quickly diffuses in warm water. Extensively utilized for the production of artificial resins, these organic composites are ordinarily generated by the decarboxylation of Citra conic acid, mesa conic acid, so on and so forth. It can likewise be developed employing acetone cyanohydrin coupled with the application of methacrylamide sulphate and sulphuric acid. Methacrylic acid represents a forerunner to a comprehensive array of industrial chemicals.

In the emerging nations, rapid infrastructural expansion and extension of construction ventures primarily will conceive profitable growth possibilities. Further, the prime market stimulators for the expansion of the product are the automotive and electronics businesses. Moreover, booming industrialisation plus enhanced financing for exploration and expansion of glacial product type will convince the progression of the overall market. In the subsequent years, the augmented market for bio-based alternatives because of their environment-friendly nature will also reinforce the global market growth rate.

Although, a limited storage extent coupled with rising pricing will hinder the market growth. Additionally, the extremely eroding and volatile character of the product may constraint the penetration in some industries.

The widespread COVID-19 pandemic has significantly transformed the situation of the global acrylic acid market and has negatively affected its extension. The pandemic has impacted diverse ventures ranging across various end-users like the building, construction and automobile sectors due to the disruptions of supply chains and raw material delivery systems. Further, social distancing has reduced the demand for public mobility systems contracting the demand for automobile production and thereby reducing the MAA demand.

Before the COVID-19 era, the emerging nations experiencing rapid infrastructural expansion and extension of construction ventures primarily conceived remunerative growth prospects. But, the pandemic led to the major market stimulators of electronic and automobile businesses to shut down temporarily. The outbreak has contracted operational activity, productivity and limited the utility chains, due to the sudden impositions of national and international boundaries. Also, the interruptions in the value chain have limited the stock of inventories. Consequently, this impediment has hampered the growth of the market and disturbed the advancement of end-use ventures.

Nevertheless, as the markets are preparing to restore their services, the demand for MAA is expected to expand globally in the forthcoming period. With the emerging awareness around sustainability and diversification in the post-pandemic era, the market for global acrylic acid is expected to stimulate by leaps and bounds.

The global market is segmented into various dimensions based on the application ranging from lubricant additive, leather treatment, fibre processing agent, paper processing agent, cement mixing agent, rubber modifier, paint, and adhesives.

The material is utilised across multiple applications ranging from light boards, facades, windowpanes, Television layout boards, coatings, and emulsions. Furthermore, the market is foreseen to progress owing to technological advancement in the production process.

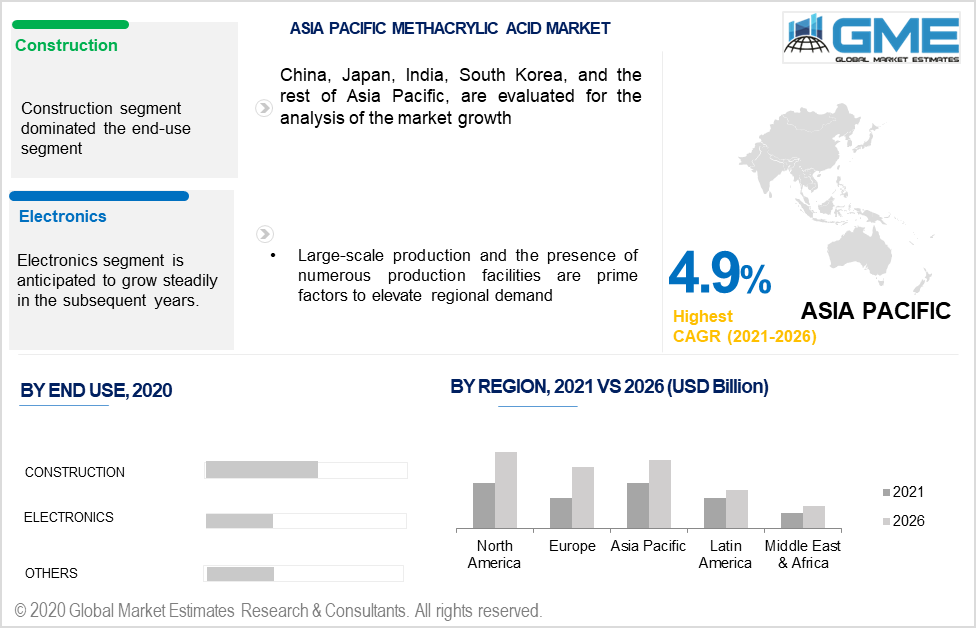

The methacrylic acid market is segmented into various dimensions based on end-use, extending over the industries of textile, paper manufacture, leather, construction, electronics, automobiles, paints, and coatings. The demand is anticipated to be propelled mainly by the increasing end-user businesses, varying across automobiles, construction and electronics. Producers are devising bio-based panaceas, consequently magnifying the market development. The growing preference for bio-based product type is expected to sustain due to its eco-friendly qualities.

On account of surging disposable incomes, improving sustenance standards, and advancing urbanization, there is a stimulated demand from development activities. Hence, the product will be highly utilized for building and construction activities. Moreover, the rising requirement for electronics in emerging economies is one of the prime determinants affecting the overall market growth.

During the projection period, the Asia Pacific region would account for the highest revenue share and witness the highest CAGR of 4.9% from 2021 to 2026. Large-scale production and the presence of numerous production facilities are prime factors to elevate regional demand.

Europe is projected to observe a booming trend owing to increased demand from lightweight locomotive components manufacturers. Germany, UK, Italy, France, and Russia will be the major countries to gain maximum revenue share in the region.

North America is anticipated to show promising trends ascribing to the stringent guidelines laid down by the Environment Protection Agency to deter automobile emissions. Nonetheless, MAA portrays fuel-efficient features which assist to comply with the regulations concerning carbon effusions.

The report renders a comprehensive exposition of the subsequent key players in the global methacrylic acid market, incorporating their contentious panorama, capability, and latest advancements like alliances, assets, and finances, capacity development, and market turnarounds.

The influential market players included in the industry are Aecochem, BASF SE, Biesterfeld AG, Central Drug House, Dhalop Chemicals, Diochem, Dow, Evonik Industries AG, Formosa M Co., KH Chemicals, Kowa India, Kuraray, LG Chem, Mitsubishi Gas Chemical Company, Parchem fine & speciality chemicals, Petrochemicals Europe, Polymers Enterprises, Shree Chemicals, and TCI Chemicals (India) among others.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Methacrylic Acid (Maa) Market Industry overview, 2019-2026

2.1.1 Industry overview

2.1.2 End Use overview

2.1.3 Application overview

2.1.4 Regional overview

Chapter 3 Global Methacrylic Acid (Maa) Market Trends

3.1 Market segmentation

3.2 Industry background, 2019-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.4.1 Product growth scenario

3.5 Industry influence over product growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology overview

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 Global Methacrylic Acid (Maa) Market, By Application

4.1 Application Outlook

4.2 Lubricant Additive

4.2.1 Market size, by region, 2019-2026 (USD Million)

4.3 Leather Treatment

4.3.1 Market size, by region, 2019-2026 (USD Million)

4.4 Fibre Processing Agent

4.4.1 Market size, by region, 2019-2026 (USD Million)

4.5 Paper Processing Agent

4.5.1 Market size, by region, 2019-2026 (USD Million)

4.6 Cement Mixing Agent

4.6.1 Market size, by region, 2019-2026 (USD Million)

4.7 Rubber Modifier

4.7.1 Market size, by region, 2019-2026 (USD Million)

4.8 Paints and Adhesives

4.8.1 Market size, by region, 2019-2026 (USD Million)

Chapter 5 Natural Cosmetic Ingredient Market, By End Use

5.1 End Use Outlook

5.2 Construction

5.2.1 Market size, by region, 2019-2026 (USD Million)

5.3 Automobiles

5.3.1 Market size, by region, 2019-2026 (USD Million)

5.4 Electronics

5.4.1 Market size, by region, 2019-2026 (USD Million)

5.5 Textiles

5.5.1 Market size, by region, 2019-2026 (USD Million)

5.6 Pharmaceuticals

5.5.1 Market size, by region, 2019-2026 (USD Million)

Chapter 6 Natural Cosmetic Ingredient Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market size, by country 2019-2026 (USD Million)

6.2.2 Market size, by product, 2019-2026 (USD Million)

6.2.3 Market size, by application, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market size, by product, 2019-2026 (USD Million)

6.2.4.2 Market size, by application, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market size, by product, 2019-2026 (USD Million)

6.2.5.2 Market size, by application, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market size, by country 2019-2026 (USD Million)

6.3.2 Market size, by product, 2019-2026 (USD Million)

6.3.3 Market size, by application, 2019-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market size, by product, 2019-2026 (USD Million)

6.2.4.2 Market size, by application, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market size, by product, 2019-2026 (USD Million)

6.3.5.2 Market size, by application, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market size, by product, 2019-2026 (USD Million)

6.3.6.2 Market size, by application, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market size, by product, 2019-2026 (USD Million)

6.3.7.2 Market size, by application, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market size, by product, 2019-2026 (USD Million)

6.3.8.2 Market size, by application, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market size, by product, 2019-2026 (USD Million)

6.3.9.2 Market size, by application, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market size, by country 2019-2026 (USD Million)

6.4.2 Market size, by product, 2019-2026 (USD Million)

6.4.3 Market size, by application, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market size, by product, 2019-2026 (USD Million)

6.4.4.2 Market size, by application, 2019-2026 (USD Million)

6.4.5 Japan

6.4.5.1 Market size, by product, 2019-2026 (USD Million)

6.4.5.2 Market size, by application, 2019-2026 (USD Million)

6.4.6 Australia

6.4.6.1 Market size, by product, 2019-2026 (USD Million)

6.4.6.2 Market size, by application, 2019-2026 (USD Million)

6.4.7 Singapore

6.4.7.1 Market size, by product, 2019-2026 (USD Million)

6.4.7.2 Market size, by application, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market size, by product, 2019-2026 (USD Million)

6.4.8.2 Market size, by application, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market size, by country 2019-2026 (USD Million)

6.5.2 Market size, by product, 2019-2026 (USD Million)

6.5.3 Market size, by application, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market size, by product, 2019-2026 (USD Million)

6.5.4.2 Market size, by application, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market size, by product, 2019-2026 (USD Million)

6.5.5.2 Market size, by application, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market size, by country 2019-2026 (USD Million)

6.6.2 Market size, by product, 2019-2026 (USD Million)

6.6.3 Market size, by application, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market size, by product, 2019-2026 (USD Million)

6.6.4.2 Market size, by application, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market size, by product, 2019-2026 (USD Million)

6.6.5.2 Market size, by application, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive analysis, 2020

7.2 Aecochem

7.2.1 Company overview

7.2.2 Financial analysis

7.2.3 Strategic positioning

7.2.4 Info graphic analysis

7.3 BASF SE

7.3.1 Company overview

7.3.2 Financial analysis

7.3.3 Strategic positioning

7.3.4 Info graphic analysis

7.4 Biesterfeld AG

7.4.1 Company overview

7.4.2 Financial analysis

7.4.3 Strategic positioning

7.4.4 Info graphic analysis

7.5 Central Drug House

7.5.1 Company overview

7.5.2 Financial analysis

7.5.3 Strategic positioning

7.5.4 Info graphic analysis

7.6 Dhalop Chemicals

7.6.1 Company overview

7.6.2 Financial analysis

7.6.3 Strategic positioning

7.6.4 Info graphic analysis

7.7 Diochem

7.7.1 Company overview

7.7.2 Financial analysis

7.7.3 Strategic positioning

7.7.4 Info graphic analysis

7.8 Dow

7.8.1 Company overview

7.8.2 Financial analysis

7.8.3 Strategic positioning

7.8.4 Info graphic analysis

7.9 Evonik Industries AG

7.9.1 Company overview

7.9.2 Financial analysis

7.9.3 Strategic positioning

7.9.4 Info graphic analysis

7.10 Formosa M Co.

7.10.1 Company overview

7.10.2 Financial analysis

7.10.3 Strategic positioning

7.10.4 Info graphic analysis

7.11 KH Chemicals

7.11.1 Company overview

7.11.2 Financial analysis

7.11.3 Strategic positioning

7.11.4 Info graphic analysis

7.12 Kowa India

7.12.1 Company overview

7.12.2 Financial analysis

7.12.3 Strategic positioning

7.12.4 Info graphic analysis

7.13 Kuraray

7.13.1 Company overview

7.13.2 Financial analysis

7.13.3 Strategic positioning

7.13.4 Info graphic analysis

7.14 LG Chem

7.14.1 Company overview

7.14.2 Financial analysis

7.14.3 Strategic positioning

7.14.4 Info graphic analysis

7.15 Mitsubishi Gas Chemical Company

7.15.1 Company overview

7.15.2 Financial analysis

7.15.3 Strategic positioning

7.15.4 Info graphic analysis

7.16 Parchem fine & speciality chemicals

7.16.1 Company overview

7.16.2 Financial analysis

7.16.3 Strategic positioning

7.16.4 Info graphic analysis

7.17 Petrochemicals Europe

7.17.1 Company overview

7.17.2 Financial analysis

7.17.3 Strategic positioning

7.17.4 Info graphic analysis

7.18 Polymers Enterprises

7.18.1 Company overview

7.18.2 Financial analysis

7.18.3 Strategic positioning

7.18.4 Info graphic analysis

7.19 Shree Chemicals

7.19.1 Company overview

7.19.2 Financial analysis

7.19.3 Strategic positioning

7.19.4 Info graphic analysis

7.20 TCI Chemicals (India)

7.20.1 Company overview

7.20.2 Financial analysis

7.20.3 Strategic positioning

7.20.4 Info graphic analysis

The Global Methacrylic Acid Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Methacrylic Acid Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS