Global Molybdenum Disulfide Market Size, Trends & Analysis - Forecasts to 2026 By Product (Powder, Crystal), By Application (Coating, Semiconductor, Lubricant, Catalyst, Others), By End-User (Electronics, Construction, Chemicals, Automotive and Transportation, Aerospace, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), End-User Landscape, Company Market Share Analysis, and Competitor Analysis

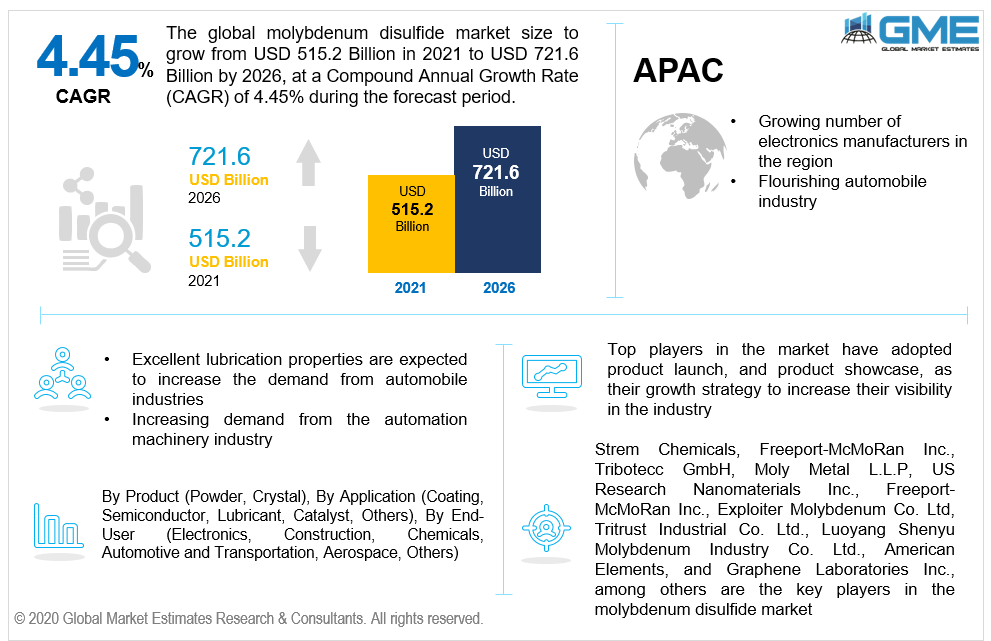

The global molybdenum disulfide market is projected to grow from USD 515.2 million in 2021 to USD 721.6 million by 2026 at a CAGR value of 4.45%. Molybdenum disulfide is commonly used as a dry lubricant in various industries. A molybdenum disulfide dry lubricant is generally found in the form of oil or grease. The excellent lubricant properties of the compound have seen them being used in critical applications like airplane engines. They are used extensively in the automotive manufacturing industry as a lubricant in engines and brake systems.

The flourishing retail & electronics industry is expected to have a positive impact on the growth of the moly disulfide market during the forecast period. The recent coronavirus pandemic has caused fluctuations in the process of raw materials and has disrupted the operations of many molybdenum disulfide manufacturers. The compound is also used as a catalyst in reactions involving desulfurization which is commonly used in the petrochemical industry, and hence the growing petrochemical industry will also support the growth of the market.

The compound has also been used as a coating agent in bullets to reduce friction when fired from a gun. The coatings are generally applied through chemical vapor deposition, this allows them to be used in applications where they are introduced to high temperatures. The compound has also been used in the production of polymer products for industrial and commercial applications. The compound when mixed with polymers result in plastics with greater tensile strength with reduced friction and has found various applications in the production of Teflon and other nylatron polymer products. The compound is also used to manufacture ball bearings, ball joints, wheel bearings, and other parts of many automation machinery. The growing automation in various industries is also expected to have a positive impact on the growth of the molybdenum disulfide market. The compound is also finding use in the semiconductor industry due to its excellent bandgap of 1.23eV. They are being used to make lasers, transistors, solar cells, LEDs, and other semiconductor devices.

The market is restrained by the introduction of substitutes like tungsten disulfide and vendors who produce low-quality cheaper products. The ineffectiveness of the compound in low temperatures is also a restraint to the growth of the market.

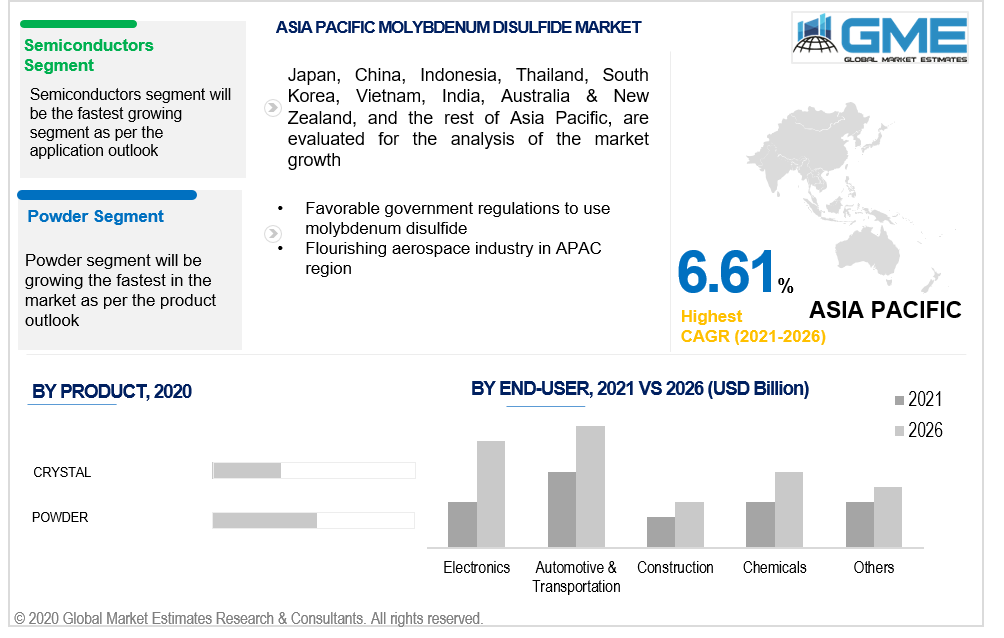

Based on the various molybdenum sulfide products available in the market, the market can be segmented as powder and crystals. The powder segment is expected to grasp a better share of the market compared to the crystal segment. Powdered molybdenum disulfide is used in the manufacturing of lubricants as the smaller size will allow for greater lubricant properties and allows the compound to be mixed with oil or grease. The growing demand for molybdenum disulfide-based dry lubricants is expected to further enhance the market for powdered molybdenum disulfide. Such high demand for molybdenum disulfide is expected to continuously grow.

Based on a large number of applications of molybdenum disulfide, the market can be segmented into coating, semiconductor, lubricant, catalyst, and others. The lubricants segment is envisaged to hold the largest share of the market. Growing application of molybdenum disulfide lubricants in the heavy vehicles industry, aerospace, and other vehicular industries are the major growth factors for this segment. Growing applications in the manufacturing of automation equipment are also expected to have a positive impact on the lubricants segment. The semiconductors segment is expected to become the fastest-growing segment. Excellent bandgap properties of the compound are expected to increase the demand for the compound from the semiconductor and electronics industry.

Based on the end-users of molybdenum disulfide, the market can be segmented into electronics, construction, chemicals, automotive and transportation, aerospace, and others. The automotive and transportation segment is expected to hold the largest share of the market. The extensive use of molybdenum disulfide lubricants in engines of automobiles has contributed heavily to the dominance of the automotive and transportation segment. The compound is also used to make ball bearings, brake systems, and other parts in the automotive and transportation industry as well. The growing use of the compound to make semiconductors as a substitute for silicon in some applications and the excellent bandgap of the compound are expected to increase the demand for the compound in the electronics industry, culminating in the electronics showing better growth rates than the other segments.

Based on region, the market can be segmented into various regions such as North America, Europe, CSA, MENA, and Asia Pacific regions. The APAC region is expected to hold the biggest percentage of the market, followed by the European region. The growing electronics industry and the presence of large automobile manufacturers in the APAC region have been the major contributors to the dominance of the APAC region. The region is also expected to register better growth rates than other regions during the forecast period owing to the increased adoption of automation and rapid industrialization. The aerospace industry in the Chinese market is growing as the country becomes one of the largest producers of commercial airplanes. The growing demand for domestic flights within the countries in the APAC region is also expected to have a positive impact on the growth of the market in the region. The growing aerospace market in the European region is a major contributor to the growth of the molybdenum disulfide market in the region.

Strem Chemicals, Freeport-McMoRan Inc., Tribotecc GmbH, Moly Metal L.L.P, US Research Nanomaterials Inc., Freeport-McMoRan Inc., Exploiter Molybdenum Co. Ltd, Tritrust Industrial Co. Ltd., Luoyang Shenyu Molybdenum Industry Co. Ltd., American Elements, and Graphene Laboratories Inc., among others are the key players in the molybdenum disulfide market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Molybdenum Disulfide Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Application Overview

2.1.4 End-User Overview

2.1.6 Regional Overview

Chapter 3 Molybdenum Disulfide Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing demand for molybdenum disulfide from the electronics and semiconductors industry

3.3.2 Industry Challenges

3.3.2.1 Growing number of substitutes such as tungsten disulfide

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Molybdenum Disulfide Market, By Product

4.1 Product Outlook

4.2 Powder

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 Crystal

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Molybdenum Disulfide Market, By Application

5.1 Application Outlook

5.2 Semiconductor

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Coating

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

5.4 Catalyst

5.4.1 Market Size, By Region, 2020-2026 (USD Million)

5.5 Others

5.5.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Molybdenum Disulfide Market, By End-User

6.1 Electronics

6.1.1 Market Size, By Region, 2020-2026 (USD Million)

6.2 Construction

6.2.1 Market Size, By Region, 2020-2026 (USD Million)

6.3 Chemicals

6.3.1 Market Size, By Region, 2020-2026 (USD Million)

6.4 Automotive and Transportation

6.4.1 Market Size, By Region, 2020-2026 (USD Million)

6.5 Aerospace

6.5.1 Market Size, By Region, 2020-2026 (USD Million)

6.6 Others

6.6.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 7 Molybdenum Disulfide Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Million)

7.2.2 Market Size, By Product, 2020-2026 (USD Million)

7.2.3 Market Size, By Application, 2020-2026 (USD Million)

7.2.4 Market Size, By End-User, 2020-2026 (USD Million)

7.2.6 U.S.

7.2.6.1 Market Size, By Product, 2020-2026 (USD Million)

7.2.4.2 Market Size, By Application, 2020-2026 (USD Million)

7.2.4.3 Market Size, By End-User, 2020-2026 (USD Million)

7.2.7 Canada

7.2.7.1 Market Size, By Product, 2020-2026 (USD Million)

7.2.7.2 Market Size, By Application, 2020-2026 (USD Million)

7.2.7.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Million)

7.3.2 Market Size, By Product, 2020-2026 (USD Million)

7.3.3 Market Size, By Application, 2020-2026 (USD Million)

7.3.4 Market Size, By End-User, 2020-2026 (USD Million)

7.3.6 Germany

7.3.6.1 Market Size, By Product, 2020-2026 (USD Million)

7.3.6.2 Market Size, By Application, 2020-2026 (USD Million)

7.3.6.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3.7 UK

7.3.7.1 Market Size, By Product, 2020-2026 (USD Million)

7.3.7.2 Market Size, By Application, 2020-2026 (USD Million)

7.3.7.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3.8 France

7.3.7.1 Market Size, By Product, 2020-2026 (USD Million)

7.3.7.2 Market Size, By Application, 2020-2026 (USD Million)

7.3.7.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3.9 Italy

7.3.9.1 Market Size, By Product, 2020-2026 (USD Million)

7.3.9.2 Market Size, By Application, 2020-2026 (USD Million)

7.3.9.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3.10 Spain

7.3.10.1 Market Size, By Product, 2020-2026 (USD Million)

7.3.10.2 Market Size, By Application, 2020-2026 (USD Million)

7.3.10.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3.11 Russia

7.3.11.1 Market Size, By Product, 2020-2026 (USD Million)

7.3.11.2 Market Size, By Application, 2020-2026 (USD Million)

7.3.11.3 Market Size, By End-User, 2020-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Million)

7.4.2 Market Size, By Product, 2020-2026 (USD Million)

7.4.3 Market Size, By Application, 2020-2026 (USD Million)

7.4.4 Market Size, By End-User, 2020-2026 (USD Million)

7.4.6 China

7.4.6.1 Market Size, By Product, 2020-2026 (USD Million)

7.4.6.2 Market Size, By Application, 2020-2026 (USD Million)

7.4.6.3 Market Size, By End-User, 2020-2026 (USD Million)

7.4.7 India

7.4.7.1 Market Size, By Product, 2020-2026 (USD Million)

7.4.7.2 Market Size, By Application, 2020-2026 (USD Million)

7.4.7.3 Market Size, By End-User, 2020-2026 (USD Million)

7.4.8 Japan

7.4.7.1 Market Size, By Product, 2020-2026 (USD Million)

7.4.7.2 Market Size, By Application, 2020-2026 (USD Million)

7.4.7.3 Market Size, By End-User, 2020-2026 (USD Million)

7.4.9 Australia

7.4.9.1 Market Size, By Product, 2020-2026 (USD Million)

7.4.9.2 Market size, By Application, 2020-2026 (USD Million)

7.4.9.3 Market Size, By End-User, 2020-2026 (USD Million)

7.4.10 South Korea

7.4.10.1 Market Size, By Product, 2020-2026 (USD Million)

7.4.10.2 Market Size, By Application, 2020-2026 (USD Million)

7.4.10.3 Market Size, By End-User, 2020-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Million)

7.5.2 Market Size, By Product, 2020-2026 (USD Million)

7.5.3 Market Size, By Application, 2020-2026 (USD Million)

7.5.4 Market Size, By End-User, 2020-2026 (USD Million)

7.5.6 Brazil

7.5.6.1 Market Size, By Product, 2020-2026 (USD Million)

7.5.6.2 Market Size, By Application, 2020-2026 (USD Million)

7.5.6.3 Market Size, By End-User, 2020-2026 (USD Million)

7.5.7 Mexico

7.5.7.1 Market Size, By Product, 2020-2026 (USD Million)

7.5.7.2 Market Size, By Application, 2020-2026 (USD Million)

7.5.7.3 Market Size, By End-User, 2020-2026 (USD Million)

7.5.8 Argentina

7.5.7.1 Market Size, By Product, 2020-2026 (USD Million)

7.5.7.2 Market Size, By Application, 2020-2026 (USD Million)

7.5.7.3 Market Size, By End-User, 2020-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Million)

7.6.2 Market Size, By Product, 2020-2026 (USD Million)

7.6.3 Market Size, By Application, 2020-2026 (USD Million)

7.6.4 Market Size, By End-User, 2020-2026 (USD Million)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Product, 2020-2026 (USD Million)

7.6.6.2 Market Size, By Application, 2020-2026 (USD Million)

7.6.6.3 Market Size, By End-User, 2020-2026 (USD Million)

7.6.7 UAE

7.6.7.1 Market Size, By Product, 2020-2026 (USD Million)

7.6.7.2 Market Size, By Application, 2020-2026 (USD Million)

7.6.7.3 Market Size, By End-User, 2020-2026 (USD Million)

7.6.8 South Africa

7.6.7.1 Market Size, By Product, 2020-2026 (USD Million)

7.6.7.2 Market Size, By Application, 2020-2026 (USD Million)

7.6.7.3 Market Size, By End-User, 2020-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Strem Chemicals

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Freeport-McMoRan Inc.

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Moly Metal L.L.P

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 US Research Nanomaterials Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Freeport-McMoRan Inc.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Exploiter Molybdenum Co. Ltd.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Tritrust Industrial Co. Ltd.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Luoyang Shenyu Molybdenum Industry Co. Ltd.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 American Elements

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Molybdenum Disulfide Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Molybdenum Disulfide Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS