Global Monopolar Electrosurgery Market Size, Trends & Analysis - Forecasts to 2026 By Type (Hand Instrument [Electrosurgical Pencils, Monopolar Forceps, Monopolar Electrodes], Electrosurgical Generator, Return Electrode [Single Use, Re-usable], Accessories [Footswitches, Connectors], Others), By Application (General Surgery, Gynecology Surgery, Cardiovascular Surgery, Cosmetic Surgery, Orthopedic Surgery, Urology Surgery), By End-User (Hospitals, Ambulatory Surgery Centers, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

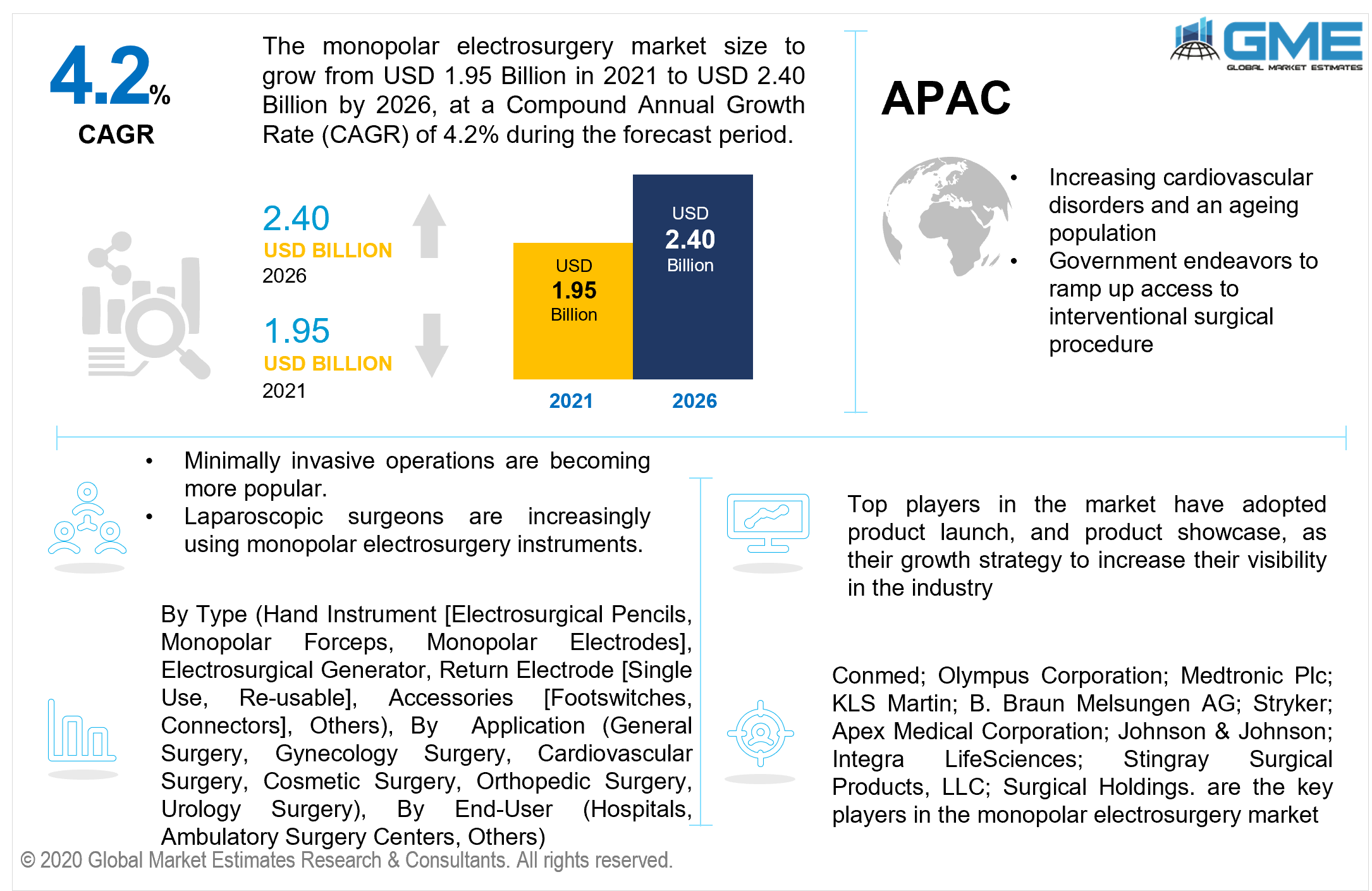

The global monopolar electrosurgery market is projected to grow from USD 1.95 billion in 2021 to USD 2.40 billion by 2026 at a CAGR value of 4.2% between 2021 to 2026. Some of the key reasons boosting the market include an increasing desire for less intrusive operations, a development in the use of monopolar electrosurgery instruments by laparoscopy practitioners, and an increase in the incidence of chronic diseases.

Furthermore, rising demand for minimally invasive operations due to faster recovery, shorter hospital stays, and lower costs, an expanding geriatric population, and increased preferences for electrosurgery over traditional surgical procedures are all contributing to market expansion.

Factors such as rising technical advancement in electrosurgical devices, soaring demand for less invasive surgical procedures, an increase in the number of cosmetic surgical operations, and a surge in the pediatric population are expected to drive the market over the forecast period. Obesity, which is boosting demand for electrosurgical goods, might be a growth factor in the coming years. In contrast, reimbursement challenges, as well as the hazards associated with employing these devices, are some of the factors that may impede the worldwide monopolar electrosurgery market growth.

Some of the primary drivers driving the market include an increasing inclination for less invasive procedures, an increase in the use of monopolar electrosurgery instruments by laparoscopic surgeons, and an increase in the frequency of chronic illnesses. Minimally invasive operations assist to reduce post-surgical problems, provide speedier recovery, and have reduced readmission rates, all of which contribute to reduced total treatment costs.

According to research published in The Journal of the American Medical Association, open surgery necessitates an average hospital stay of 7.4 days, whereas laparoscopic and thoracoscopic operations necessitate hospital stays of 4.5 days. According to the study, the overall cost of treatment for minimally invasive operations was 23.0 percent lower than open surgery. According to Johns Hopkins researchers, choosing for less invasive procedures saved around USD 300 million per year in post-surgical problems.

Different governments across the world are actively embracing optional operations and financing numerous efforts to make monopolar electrosurgery more accessible to patients. There is a massive spike in chronic illness cases, as well as an upsurge in individuals who opt to undergo monopolar electrosurgery. They are putting technical and monetary strain on healthcare systems around the world, resulting in a shortage of hospital beds. As a result, these are the primary drivers driving the growth of the monopolar electrosurgery market.

Furthermore, many other governments are proposing new programs, including subsidies and funding, for multiple organizations and hospitals to improve elective procedures in order to minimize waiting periods and rake in other costs for the healthcare industry. Additionally, the use of ultrasonic instruments in laparoscopic operations has increased significantly. This is the most significant problem confronting the monopolar electrosurgery market.

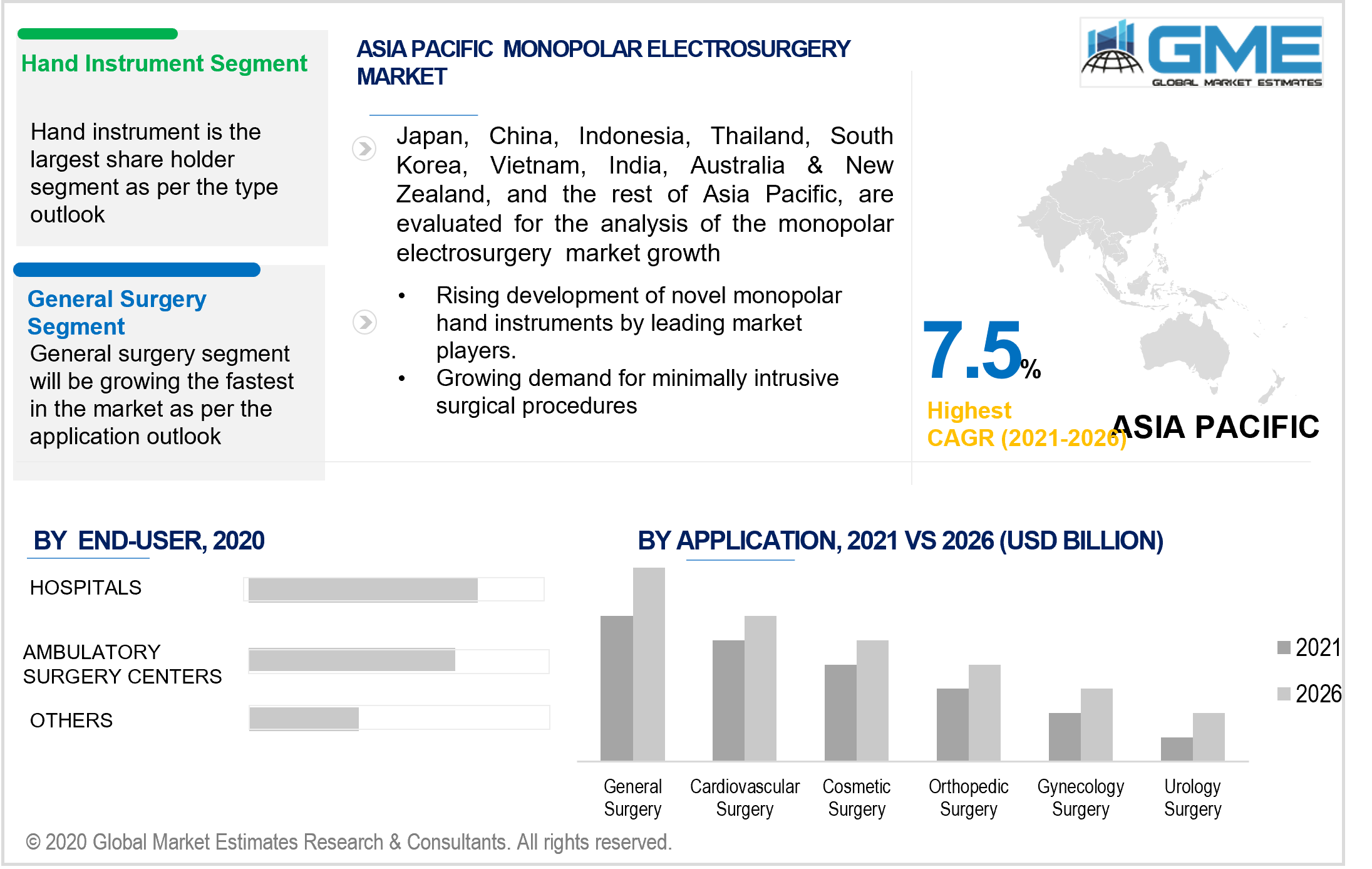

Based on the type, the market is divided into hand instruments, generators, accessories, and others. The hand instrument segment is presumed to predominate in the market. The regular development of novel monopolar hand instruments by leading market players has aided the expansion of the monopolar electrosurgery tool market. The gadget is a new addition to Renuvion's product line. The high application ratio of disposable and reusable electrosurgical instruments accounts for a substantial proportion of this category. Furthermore, technical improvements in electrosurgical equipment, as well as an increase in the number of aesthetic and plastic operations, are fueling the expansion of this category.

Based on the type of application, the market is divided into general surgery, gynecology surgery, cardiovascular surgery, cosmetic surgery, orthopedic surgery, and urology surgery. The general surgery category is foreseen to lead in the market. The growing elderly population has resulted in a significant increase in surgical treatments. According to the World Health Organization, an estimated 900.0 million persons aged 60 and over were registered globally in 2019. This segment's high proportion can be ascribed to the following rise in the incidence of numerous diseases/conditions, the increasing proportion of surgical operations done, and the expanding incidence of overweight.

Based on the end-user, the market is divided into hospitals, ambulatory surgery centers, and others. Hospitals are the market's largest end consumers, owing to growth in hospital infrastructure enhancements in both established and emerging nations. Furthermore, this can be due to the growing use of technologically improved goods, enhanced patient knowledge, and a greater emphasis on favorable medical results. In addition, hospital medical environments are implementing minimally invasive techniques to decrease postoperative problems and speed recuperation.

North America is foreseen to dominate the market and account for the largest revenue share. This supremacy can be due to a sophisticated healthcare system, and increased per capita spending. The growing prevalence of chronic illnesses, as well as increased knowledge of the benefits of electrosurgery, are projected to drive market expansion in the area. Additionally, a rise in the volume of innovative equipment approvals from the US FDA is expected to drive the development potential of the monopolar electrosurgery market.

Considerable annual sales volumes of monopolar electrosurgery instruments increased physician demand for sophisticated minimally intrusive surgical equipment, and attractive insurance coverage for medical procedures are all positioned to assist North America to maintain its global market leadership.

The Asia Pacific region is the market's most lucrative income generator. This market is assumed to evolve rapidly in the future, ascribed primarily to an expanding patient demographic, increased demand for minimally intrusive surgical procedures, advancements in medical systems, increased research projects, increased relevancy of cosmetic surgeries, government endeavors to ramp up access to interventional surgical procedure, an elevated physician populace, and strengthened healthcare system in the area.

Conmed; Olympus Corporation; Medtronic Plc; KLS Martin; B. Braun Melsungen AG; Stryker; Apex Medical Corporation; Johnson & Johnson; Integra LifeSciences; Stingray Surgical Products, LLC; and Surgical Holdings are the key players in the monopolar electrosurgery market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Monopolar Electrosurgery Market Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 End-User Overview

2.1.5 Regional Overview

Chapter 3 Monopolar Electrosurgery Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rise in government initiatives to increase access to elective surgery

3.3.1.2 Increase in number of minimally invasive surgical procedures performed

3.3.2 Industry Challenges

3.3.2.1 Rise in preference for advanced ultrasonic devices for minimally invasive surgical procedures

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.7 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Monopolar Electrosurgery Market, By Type

4.1 Type Outlook

4.2 Hand Instrument

4.2.1 Market Size, By Region, 2019-2026 (USD Billion)

4.3 Electrosurgical Generator

4.3.1 Market Size, By Region, 2019-2026 (USD Billion)

4.4 Return Electrode

4.4.1 Market Size, By Region, 2019-2026 (USD Billion)

4.5 Accessories

4.5.1 Market Size, By Region, 2019-2026 (USD Billion)

4.6 Others

4.6.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 5 Monopolar Electrosurgery Market, By Application

5.1 Application Outlook

5.2 General Surgery

5.2.1 Market Size, By Region, 2019-2026 (USD Billion)

5.3 Gynecology Surgery

5.3.1 Market Size, By Region, 2019-2026 (USD Billion)

5.4 Cardiovascular Surgery

5.3.1 Market Size, By Region, 2019-2026 (USD Billion)

5.4 Cosmetic Surgery

5.4.1 Market Size, By Region, 2019-2026 (USD Billion)

5.5 Orthopedic Surgery

5.5.1 Market Size, By Region, 2019-2026 (USD Billion)

5.6 Urology Surgery

5.6.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 6 Monopolar Electrosurgery Market, By End-User

6.1 End-User Outlook

6.2 Hospitals

6.2.1 Market Size, By Region, 2019-2026 (USD Billion)

6.3 Ambulatory Surgery Centers

6.3.1 Market Size, By Region, 2019-2026 (USD Billion)

6.4 Others

6.4.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 7 Monopolar Electrosurgery Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Billion)

7.2.2 Market Size, By Type, 2019-2026 (USD Billion)

7.2.3 Market Size, By Application, 2019-2026 (USD Billion)

7.2.4 Market Size, By End-User, 2019-2026 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Size, By Type, 2019-2026 (USD Billion)

7.2.5.2 Market Size, By Application, 2019-2026 (USD Billion)

7.2.5.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Size, By Type, 2019-2026 (USD Billion)

7.2.6.2 Market Size, By Application, 2019-2026 (USD Billion)

7.2.6.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Billion)

7.3.2 Market Size, By Type, 2019-2026 (USD Billion)

7.3.3 Market Size, By Application, 2019-2026 (USD Billion)

7.3.4 Market Size, By End-User, 2019-2026 (USD Billion)

7.3.5 Germany

7.3.5.1 Market Size, By Type, 2019-2026 (USD Billion)

7.3.5.2 Market Size, By Application, 2019-2026 (USD Billion)

7.3.5.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.3.6 UK

7.3.6.1 Market Size, By Type, 2019-2026 (USD Billion)

7.3.6.2 Market Size, By Application, 2019-2026 (USD Billion)

7.3.6.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.3.7 France

7.3.7.1 Market Size, By Type, 2019-2026 (USD Billion)

7.3.7.2 Market Size, By Application, 2019-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.3.8 Italy

7.3.8.1 Market Size, By Type, 2019-2026 (USD Billion)

7.3.8.2 Market Size, By Application, 2019-2026 (USD Billion)

7.3.8.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.3.9 Spain

7.3.9.1 Market Size, By Type, 2019-2026 (USD Billion)

7.3.9.2 Market Size, By Application, 2019-2026 (USD Billion)

7.3.9.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.3.10 Russia

7.3.10.1 Market Size, By Type, 2019-2026 (USD Billion)

7.3.10.2 Market Size, By Application, 2019-2026(USD Billion)

7.3.10.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2019-2026 (USD Billion)

7.4.2 Market Size, By Type, 2019-2026 (USD Billion)

7.4.3 Market Size, By Application, 2019-2026 (USD Billion)

7.4.4 Market Size, By End-User, 2019-2026 (USD Billion)

7.4.5 China

7.4.5.1 Market Size, By Type, 2019-2026 (USD Billion)

7.4.5.2 Market Size, By Application, 2019-2026 (USD Billion)

7.4.5.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.4.6 India

7.4.6.1 Market Size, By Type, 2019-2026 (USD Billion)

7.4.6.2 Market Size, By Application, 2019-2026 (USD Billion)

7.4.6.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Size, By Type, 2019-2026 (USD Billion)

7.4.7.2 Market Size, By Application, 2019-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Size, By Type, 2019-2026 (USD Billion)

7.4.8.2 Market size, By Application, 2019-2026 (USD Billion)

7.4.8.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market Size, By Type, 2019-2026 (USD Billion)

7.4.9.2 Market Size, By Application, 2019-2026 (USD Billion)

7.4.9.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2019-2026 (USD Billion)

7.5.2 Market Size, By Type, 2019-2026 (USD Billion)

7.5.3 Market Size, By Application, 2019-2026 (USD Billion)

7.5.4 Market Size, By End-User, 2019-2026 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Size, By Type, 2019-2026 (USD Billion)

7.5.5.2 Market Size, By Application, 2019-2026 (USD Billion)

7.5.5.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.5.6 Mexico

7.5.6.1 Market Size, By Type, 2019-2026 (USD Billion)

7.5.6.2 Market Size, By Application, 2019-2026 (USD Billion)

7.5.6.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.5.7 Argentina

7.5.7.1 Market Size, By Type, 2019-2026 (USD Billion)

7.5.7.2 Market Size, By Application, 2019-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.7 MEA

7.7.1 Market Size, By Country 2019-2026 (USD Billion)

7.7.2 Market Size, By Type, 2019-2026 (USD Billion)

7.7.3 Market Size, By Application, 2019-2026 (USD Billion)

7.7.4 Market Size, By End-User, 2019-2026 (USD Billion)

7.7.5 Saudi Arabia

7.7.5.1 Market Size, By Type, 2019-2026 (USD Billion)

7.7.5.2 Market Size, By Application, 2019-2026 (USD Billion)

7.7.5.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.7.6 UAE

7.7.6.1 Market Size, By Type, 2019-2026 (USD Billion)

7.7.6.2 Market Size, By Application, 2019-2026 (USD Billion)

7.7.6.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.7.7 South Africa

7.7.7.1 Market Size, By Type, 2019-2026 (USD Billion)

7.7.7.2 Market Size, By Application, 2019-2026 (USD Billion)

7.7.7.3 Market Size, By End-User, 2019-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Conmed

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Olympus Corporation

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Medtronic Plc

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 KLS Martin

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 B. Braun Melsungen AG

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Stryker

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Apex Medical Corporation

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Johnson & Johnson

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Integra LifeSciences

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Stingray Surgical Products, LLC

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Surgical Holdings

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

8.13 Other Companies

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Info Graphic Analysis

The Global Monopolar Electrosurgery Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Monopolar Electrosurgery Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS