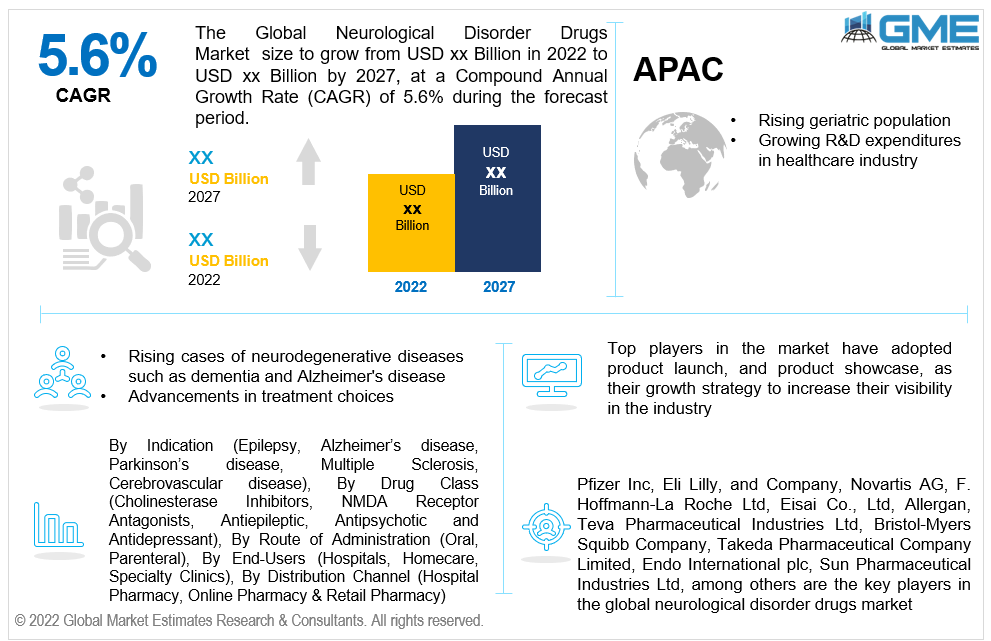

Global Neurological Disorder Drugs Market Size, Trends & Analysis - Forecasts to 2027 By Indication (Epilepsy, Alzheimers disease, Parkinsons disease, Multiple Sclerosis, Cerebrovascular disease, and others), By Drug Class (Cholinesterase Inhibitors, NMDA Receptor Antagonists, Antiepileptic, Antipsychotic and Antidepressant and others), By Route of Administration (Oral, Parenteral, Others), By End-Users (Hospitals, Homecare, Specialty Clinics, Others), By Distribution Channel (Hospital Pharmacy, Online Pharmacy, and Retail Pharmacy), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

The Global Neurological Disorder Drugs Market is projected to grow at a CAGR value of 5.6% from 2022 to 2027.

Increased patient knowledge, advancements in treatment choices, and the adoption of a sedentary lifestyle are all factors that influence the need for neurological condition medications. Furthermore, the neurological disorder drugs market is expected to grow due to rising consciousness related to early diagnosis of diseases via outreach programs by government agencies and private entities, as well as market access to effective prescription medications soon, attributed to the existence of a powerful drug pipeline.

According to the Global Burden of Disease Report, neurological and mental illnesses account for 33% of years lived with disability and 13% of disability-adjusted life years (DALYs). An increase in the prevalence of such diseases leads to sedentary lifestyle habits among the general public, as well as the augmentation of telemedicine services, advancements in diagnostic technology solutions, extensive research activities in the field, and the growing popularity of online pharmacies, are all driving market growth.

The worldwide pharmaceutical supply chains have been impacted by COVID-19's lockdowns and other restrictions, particularly those relying on India and China, both of which are major suppliers of active pharmaceutical ingredients (APIs) and generics. As a result of the pandemic, some governments have tightened trade restrictions as resources and attention have shifted to treating virus-affected patients and researching the virus.

Nonetheless, product recalls, high treatment costs and significant failure rates of clinical studies linked to diagnosis and therapy, including difficulties in early detection of neurological diseases are anticipated to stymie market expansion over the forecast period.

Based on the indication, the neurological disorder drugs market is divided into epilepsy, Alzheimer's disease, Parkinson's disease, multiple sclerosis, cerebrovascular disease, and others.

The Parkinson's disease segment is expected to be the fastest-growing segment in the market from 2022 to 2027. Parkinson’s Disease (PD) is one of the leading neurological disorders growing worldwide that is a chronic neurodegenerative disorder showing loss of muscular control that results in tremor, rigidity, and postural reflex impairment among other things. According to research, it is growing at an increasing rate of over 2% of individuals globally that are aged over 65.

Based on the drug class, the neurological disorder drugs market is divided into cholinesterase inhibitors, NMDA receptor antagonists, antiepileptics, antipsychotics, antidepressants, and others.

The cholinesterase inhibitors segment is expected to be the fastest-growing segment in the market from 2022 to 2027. Cholinesterase Inhibitors are approved drugs used to temporarily treat symptoms of Alzheimer’s disease. By preventing the breakdown of acetylcholine and facilitating nerve cell communication, these drugs mitigate symptoms associated with major thought processes like judgment, memory, language, and many others.

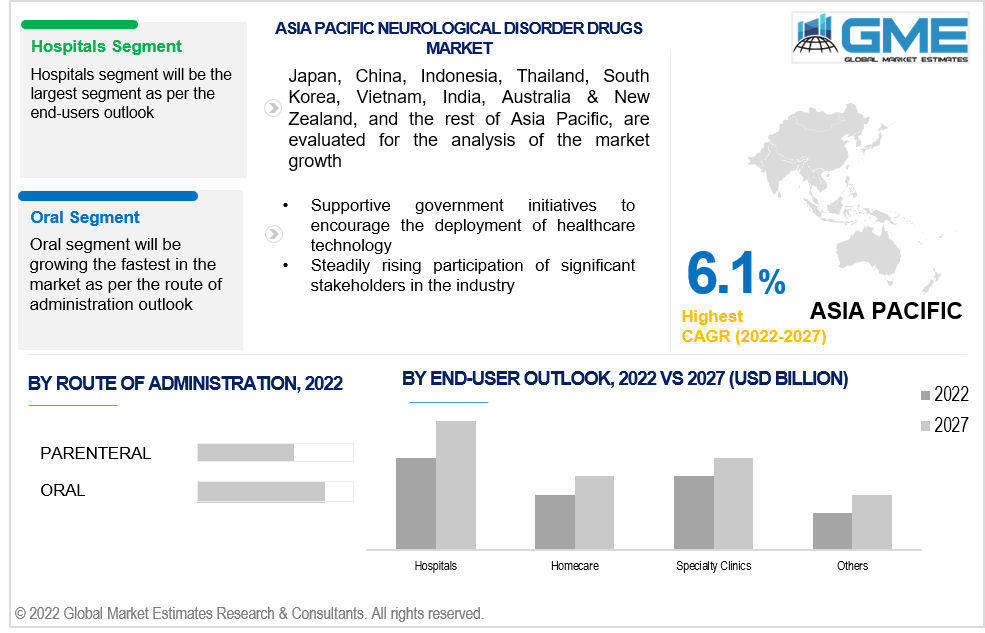

Based on the route of administration, the neurological disorder drugs market is divided into oral, parenteral, and others. The oral segment is expected to be the fastest-growing segment in the market from 2022 to 2027. The growth could be attributed to the ease of use, convenience, and safety of drug administration. It is also comfortable for repeated and prolonged usage, cost-effective because the patient incurs no additional costs, as well as can be self-administered pain-free, all of which are factors driving the segment growth.

Based on the end-user’s segmentation, the neurological disorder drugs market is divided into hospitals, home care, specialty clinics, and others. The hospital's segment is expected to be the largest segment in the market from 2022 to 2027. The rising number of diagnostic imaging operations conducted in hospitals, and the growing desire to improve patient care quality are driving the segment growth. Furthermore, the increasing usage of advanced and innovative technologies in hospitals to improve operational efficiencies is likely to promote the growth of this end-user segment.

Based on the distribution channel, the neurological disorder drugs market is divided into hospital pharmacies, online pharmacies, and retail pharmacies. The retail pharmacy segment is expected to be the fastest-growing segment in the market from 2022 to 2027.

Effective therapeutic management for chronic conditions such as diabetes, asthma, and hypertension is provided by retail pharmacists. Communication between healthcare experts, such as physicians and pharmacists, can help ensure that patients take their prescriptions exactly as recommended and avoid any negative side effects, thereby driving the segment growth.

As per the geographical analysis, the neurological disorder drugs market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the neurological disorder drugs market from 2022 to 2027. The major factors driving the growth of the market in the North American region are the rising prevalence of patients suffering from neurological disorders, and increasing healthcare expenditure in the U.S. and Canada.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest-growing segment in the neurological disorder drugs market during the forecast period. The rapidly rising geriatric population, increasing demand for better healthcare infrastructure, a significant investment in R&D, a large number of generic manufacturers, and an increase in government programs and specialized organizations are some of the factors driving the regional market growth.

Pfizer Inc, Eli Lilly, and Company, Novartis AG, F. Hoffmann-La Roche Ltd, Eisai Co., Ltd, Allergan, Teva Pharmaceutical Industries Ltd, Bristol-Myers Squibb Company, Takeda Pharmaceutical Company Limited, Endo International plc, Sun Pharmaceutical Industries Ltd, among others are the key players in the global neurological disorder drugs market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Neurological Disorder Drugs Market Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Indication Overview

2.1.3 Drug Class Overview

2.1.4 Route of Administration Overview

2.1.5 End-Users Overview

2.1.6 Distribution Channel Overview

2.1.7 Regional Overview

Chapter 3 Global Neurological Disorder Drugs Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising cases of neurological disorders

3.3.2 Industry Challenges

3.3.2.1 High treatment costs

3.4 Prospective Growth Scenario

3.4.1 Indication Growth Scenario

3.4.2 Drug Class Growth Scenario

3.4.3 Route of Administration Growth Scenario

3.4.4 End-Users Growth Scenario

3.4.5 Distribution Channel Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 Central & South America

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 Global Neurological Disorder Drugs Market, By Indication

4.1 Indication Outlook

4.2 Epilepsy

4.2.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 Alzheimer’s Disease

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

4.4 Parkinson’s Disease

4.4.1 Market Size, By Region, 2022-2027 (USD Billion)

4.5 Multiple Sclerosis

4.5.1 Market Size, By Region, 2022-2027 (USD Billion)

4.6 Cerebrovascular Disease

4.6.1 Market Size, By Region, 2022-2027 (USD Billion)

4.7 Others

4.7.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 5 Global Neurological Disorder Drugs Market, By Drug Class

5.1 Drug Class Outlook

5.2 Cholinesterase Inhibitors

5.2.1 Market Size, By Region, 2022-2027 (USD Billion)

5.3 NMDA Receptor Antagonists

5.3.1 Market Size, By Region, 2022-2027 (USD Billion)

5.4 Antipsychotic and Antidepressant

5.4.1 Market Size, By Region, 2022-2027 (USD Billion)

5.5 Others

5.5.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 6 Global Neurological Disorder Drugs Market, By Route of Administration

6.1 Oral

6.1.1 Market Size, By Region, 2022-2027 (USD Billion)

6.2 Parenteral

6.2.1 Market Size, By Region, 2022-2027 (USD Billion)

6.3 Others

6.3.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 7 Global Neurological Disorder Drugs Market, By End-Users

7.1 Hospitals

7.1.1 Market Size, By Region, 2022-2027 (USD Billion)

7.2 Homecare

7.2.1 Market Size, By Region, 2022-2027 (USD Billion)

7.2 Specialty Clinics

7.2.1 Market Size, By Region, 2022-2027 (USD Billion)

7.2 Others

7.2.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 8 Global Neurological Disorder Drugs Market, By Distribution Channel

8.1 Hospital Pharmacy

8.1.1 Market Size, By Region, 2022-2027 (USD Billion)

8.2 Online Pharmacy

8.2.1 Market Size, By Region, 2022-2027 (USD Billion)

8.2 Retail Pharmacy

8.2.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 9 Global Neurological Disorder Drugs Market, By Region

9.1 Regional outlook

9.2 North America

9.2.1 Market Size, By Country 2022-2027 (USD Billion)

9.2.2 Market Size, By Indication, 2022-2027 (USD Billion)

9.2.3 Market Size, By Drug Class, 2022-2027 (USD Billion)

9.2.4 Market Size, By Route of Administration, 2022-2027 (USD Billion)

9.2.5 Market Size, By End-Users, 2022-2027 (USD Billion)

9.2.6 Market Size, By Distribution Channel, 2022-2027 (USD Billion)

9.2.7 U.S.

9.2.7.1 Market Size, By Indication, 2022-2027 (USD Billion)

9.2.7.2 Market Size, By Drug Class, 2022-2027 (USD Billion)

9.2.7.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

9.2.7.4 Market Size, By End-Users, 2022-2027 (USD Billion)

9.2.7.5 Market Size, By Distribution Channel, 2022-2027 (USD Billion)

9.2.8 Canada

9.2.8.1 Market Size, By Indication, 2022-2027 (USD Billion)

9.2.8.2 Market Size, By Drug Class, 2022-2027 (USD Billion)

9.2.8.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

9.2.8.4 Market Size, By End-Users, 2022-2027 (USD Billion)

9.2.8.5 Market Size, By Distribution Channel, 2022-2027 (USD Billion)

9.2.9 Mexico

9.2.9.1 Market Size, By Indication, 2022-2027 (USD Billion)

9.2.9.2 Market Size, By Drug Class, 2022-2027 (USD Billion)

9.2.9.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

9.2.9.4 Market Size, By End-Users, 2022-2027 (USD Billion)

9.2.9.5 Market Size, By Distribution Channel, 2022-2027 (USD Billion)

9.3 Europe

9.3.1 Market Size, By Country 2022-2027 (USD Billion)

9.3.2 Market Size, By Indication, 2022-2027 (USD Billion)

9.3.3 Market Size, By Drug Class, 2022-2027 (USD Billion)

9.3.4 Market Size, By Route of Administration, 2022-2027 (USD Billion)

9.3.5 Market Size, By End-Users, 2022-2027 (USD Billion)

9.3.6 Market Size, By Distribution Channel, 2022-2027 (USD Billion)

9.3.7 Germany

9.3.7.1 Market Size, By Indication, 2022-2027 (USD Billion)

9.3.7.2 Market Size, By Drug Class, 2022-2027 (USD Billion)

9.3.7.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

9.3.7.4 Market Size, By End-Users, 2022-2027 (USD Billion)

9.3.7.5 Market Size, By Distribution Channel, 2022-2027 (USD Billion)

9.3.8 UK

9.3.8.1 Market Size, By Indication, 2022-2027 (USD Billion)

9.3.8.2 Market Size, By Drug Class, 2022-2027 (USD Billion)

9.3.8.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

9.3.8.4 Market Size, By End-Users, 2022-2027 (USD Billion)

9.3.8.5 Market Size, By Distribution Channel, 2022-2027 (USD Billion)

9.3.9 France

9.3.9.1 Market Size, By Indication, 2022-2027 (USD Billion)

9.3.9.2 Market Size, By Drug Class, 2022-2027 (USD Billion)

9.3.9.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

9.3.9.4 Market Size, By End-Users, 2022-2027 (USD Billion)

9.3.9.5 Market Size, By Distribution Channel, 2022-2027 (USD Billion)

9.3.10 Italy

9.3.10.1 Market Size, By Indication, 2022-2027 (USD Billion)

9.3.10.2 Market Size, By Drug Class, 2022-2027 (USD Billion)

9.3.10.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

9.3.10.4 Market Size, By End-Users, 2022-2027 (USD Billion)

9.3.10.5 Market Size, By Distribution Channel, 2022-2027 (USD Billion)

9.4 Asia Pacific

9.4.1 Market Size, By Country 2022-2027 (USD Billion)

9.4.2 Market Size, By Indication, 2022-2027 (USD Billion)

9.4.3 Market Size, By Drug Class, 2022-2027 (USD Billion)

9.4.4 Market Size, By Route of Administration, 2022-2027 (USD Billion)

9.4.5 Market Size, By End-Users, 2022-2027 (USD Billion)

9.4.6 Market Size, By Distribution Channel, 2022-2027 (USD Billion)

9.4.7 China

9.4.7.1 Market Size, By Indication, 2022-2027 (USD Billion)

9.4.7.2 Market Size, By Drug Class, 2022-2027 (USD Billion)

9.4.7.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

9.4.7.4 Market Size, By End-Users, 2022-2027 (USD Billion)

9.4.7.5 Market Size, By Distribution Channel, 2022-2027 (USD Billion)

9.4.8 India

9.4.8.1 Market Size, By Indication, 2022-2027 (USD Billion)

9.4.8.2 Market Size, By Drug Class, 2022-2027 (USD Billion)

9.4.8.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

9.4.8.4 Market Size, By End-Users, 2022-2027 (USD Billion)

9.4.8.5 Market Size, By Distribution Channel, 2022-2027 (USD Billion)

9.4.9 Japan

9.4.9.1 Market Size, By Indication, 2022-2027 (USD Billion)

9.4.9.2 Market Size, By Drug Class, 2022-2027 (USD Billion)

9.4.9.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

9.4.9.4 Market Size, By End-Users, 2022-2027 (USD Billion)

9.4.9.5 Market Size, By Distribution Channel, 2022-2027 (USD Billion)

9.5 MEA

9.5.1 Market Size, By Country 2022-2027 (USD Billion)

9.5.2 Market Size, By Indication, 2022-2027 (USD Billion)

9.5.3 Market Size, By Drug Class, 2022-2027 (USD Billion)

9.5.4 Market Size, By Route of Administration, 2022-2027 (USD Billion)

9.5.5 Market Size, By End-Users, 2022-2027 (USD Billion)

9.5.6 Market Size, By Distribution Channel, 2022-2027 (USD Billion)

9.5.7 Saudi Arabia

9.5.7.1 Market Size, By Indication, 2022-2027 (USD Billion)

9.5.7.2 Market Size, By Drug Class, 2022-2027 (USD Billion)

9.5.7.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

9.5.7.4 Market Size, By End-Users, 2022-2027 (USD Billion)

9.5.7.5 Market Size, By Distribution Channel, 2022-2027 (USD Billion)

9.5.8 UAE

9.5.8.1 Market Size, By Indication, 2022-2027 (USD Billion)

9.5.8.2 Market Size, By Drug Class, 2022-2027 (USD Billion)

9.5.8.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

9.5.8.4 Market Size, By End-Users, 2022-2027 (USD Billion)

9.5.8.5 Market Size, By Distribution Channel, 2022-2027 (USD Billion)

9.5.9 South Africa

9.5.9.1 Market Size, By Indication, 2022-2027 (USD Billion)

9.5.9.2 Market Size, By Drug Class, 2022-2027 (USD Billion)

9.5.9.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

9.5.9.4 Market Size, By End-Users, 2022-2027 (USD Billion)

9.5.9.5 Market Size, By Distribution Channel, 2022-2027 (USD Billion)

Chapter 10 Company Landscape

10.1 Competitive Analysis, 2022

10.2 Pfizer Inc

10.2.1 Company Overview

10.2.2 Financial Analysis

10.2.3 Strategic Positioning

10.2.4 Info Graphic Analysis

10.3 Eli Lilly and Company

10.3.1 Company Overview

10.3.2 Financial Analysis

10.3.3 Strategic Positioning

10.3.4 Info Graphic Analysis

10.4 Novartis AG

10.4.1 Company Overview

10.4.2 Financial Analysis

10.4.3 Strategic Positioning

10.4.4 Info Graphic Analysis

10.5 F. Hoffmann-La Roche Ltd

10.5.1 Company Overview

10.5.2 Financial Analysis

10.5.3 Strategic Positioning

10.5.4 Info Graphic Analysis

10.6 Eisai Co. Ltd.

10.6.1 Company Overview

10.6.2 Financial Analysis

10.6.3 Strategic Positioning

10.6.4 Info Graphic Analysis

10.7 Allergan

10.7.1 Company Overview

10.7.2 Financial Analysis

10.7.3 Strategic Positioning

10.7.4 Info Graphic Analysis

10.8 Teva Pharmaceutical Industries Ltd

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Strategic Positioning

10.10.4 Info Graphic Analysis

10.9 Bristol-Myers Squibb Company

10.9.1 Company Overview

10.9.2 Financial Analysis

10.9.3 Strategic Positioning

10.9.4 Info Graphic Analysis

10.10 Takeda Pharmaceutical Company Limited

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Strategic Positioning

10.10.4 Info Graphic Analysis

10.11 Endo International plc

10.11.1 Company Overview

10.11.2 Financial Analysis

10.11.3 Strategic Positioning

10.11.4 Info Graphic Analysis

10.12 Sun Pharmaceutical Industries Ltd

10.12.1 Company Overview

10.12.2 Financial Analysis

10.12.3 Strategic Positioning

10.12.4 Info Graphic Analysis

10.13 Other Companies

10.13.1 Company Overview

10.13.2 Financial Analysis

10.13.3 Strategic Positioning

10.13.4 Info Graphic Analysis

The Global Neurological Disorder Drugs Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Neurological Disorder Drugs Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS