Global Neurovascular Devices Market Size, Trends & Analysis - Forecasts to 2026 By Product (Aneurysm Coiling & Embolization Devices [Embolic Coils, Flow Diversion Devices, Liquid Embolic Agents], Cerebral Balloon Angioplasty & Stenting Systems [Carotid Artery Stents, Embolic Protection Devices, Balloon Catheters], Support Devices [Microcatheters, Guidewires], Neurothrombectomy Devices [Clot Retrieval Devices, Suction & Aspiration Devices, Snares]), By Therapeutic Application (Cerebral Aneurysms, Ischemic Strokes, Carotid Artery Stenosis, Arteriovenous Malformation & Fistulas), By End-User (Hospitals & Surgical Centers, Ambulatory Care Centers, Research Laboratories & Academic Institutes); Competitive Landscape, Company Market Share Analysis, and Competitor Analysis; By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

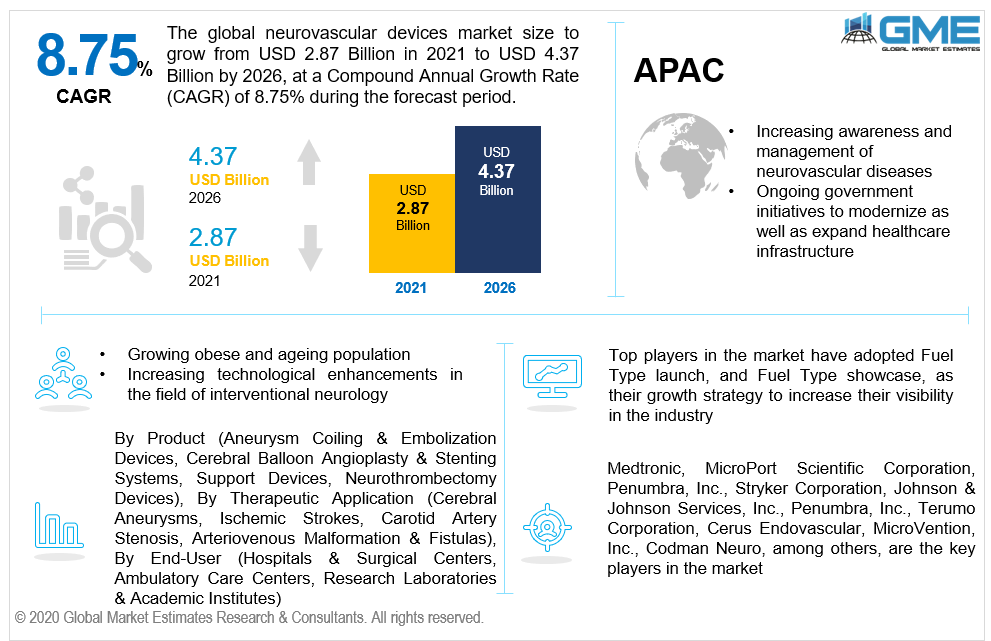

The neurovascular devices market is estimated to be valued at USD 2.87 billion in 2021 and is projected to reach USD 4.37 billion by 2026 at a CAGR of 8.75%. Throughout the forecast period, the neurovascular devices/interventional neurology market has significant development prospects due to an increase in knowledge amongst neurosurgeons regarding minimally invasive surgical methods, the expanding target patient demographic, continuing product advancement and commodification of favorable medical reimbursement rates, the enlargement of the healthcare architecture along with all developing markets, the spike in market demand for efficacious neurointerventional devices, increased research in the domain of neurovascular therapeutics, and the upsurge in demand for minimally invasive neurosurgical methodologies.

Furthermore, several government endeavors to update and develop healthcare systems around the world will have a favorable impact on the market's growth. In recent times, the frequency of governmental initiatives in the domain of interventional neurology has expanded due to growing awareness programs, publications, and mounting concerns about neurological illnesses. For example, China's central government launched a succession of healthcare changes in order to develop a basic comprehensive healthcare infrastructure that would give individuals in China functional, convenient, low-cost, and secure healthcare services. Throughout the forecast period, similar measures will boost market potential even more. Nevertheless, the global market is being held back by the substantial cost of neurovascular procedures & devices, scarcity of competent neurologists, and restrictive administrative regulations in major economies.

Strokes are the second major reason for mortality worldwide and the fifth pioneering factor of mortality in the United States. Neurointerventional devices are widely employed in endovascular stroke management. Globally, a variety of variables, particularly growing urbanization, inactive lifestyles, and stress, have contributed to an increase in the proportion of strokes. An estimated 6 million Americans suffer from brain aneurysms each year, as per the Brain Aneurysm Foundation. Every year, a half-million people die from the disease around the world. As a result of these tendencies, there is a big patient group that needs to be treated.

Stroke diagnosis is quite expensive for individuals. The average annual expenditure per capita for the management of ischemic stroke in industrialized nations including the United States is anticipated to be around USD 73,000 to USD 77.300. As a result, remuneration via public and commercial health insurance has been crucial in the acceptance of neurointerventional devices in the United States. Government and non-government groups in the Asia Pacific developing economies including Japan and China have taken steps to improve and enforce reimbursement schemes for the management of neurovascular illnesses. The proportion of patients having therapy is expected to rise as a result of this circumstance.

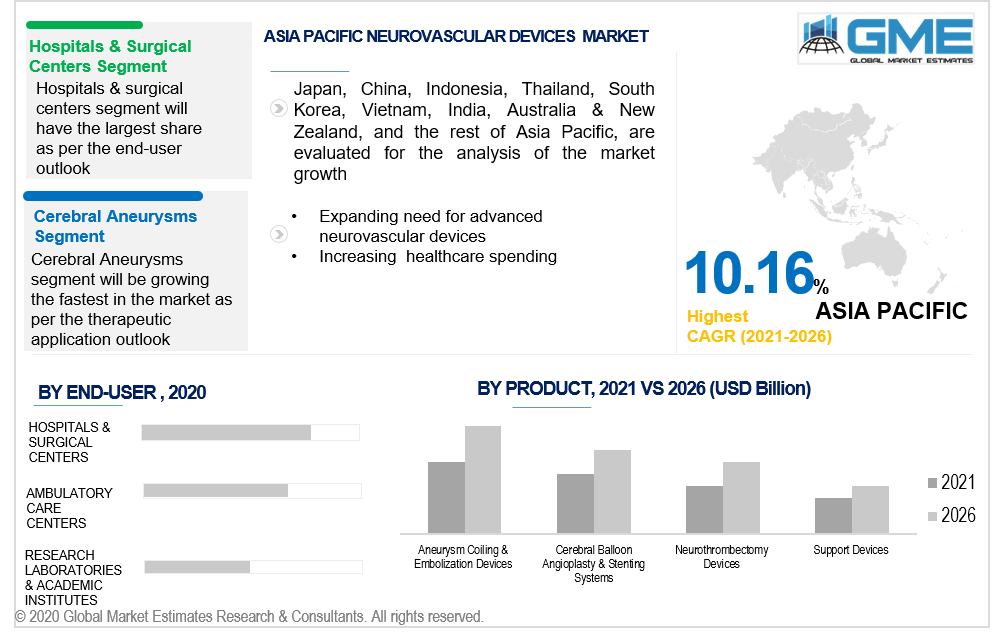

Attributable to the proliferating market supply of embolic coils for neurovascular management and escalating end-user interest for minimally intrusive neurosurgical operations, the aneurysm coiling & embolization devices segment is expected to contribute to the highest proportion of the market. The escalating occurrence of neurological diseases including brain aneurysms, strokes, and arteriovenous malformations (AVMs), as well as expanding healthcare spending and R&D funding are all leading to the advancement of the neurovascular device market.

The cerebral aneurysm segment is expected to constitute the largest proportion of the global market, driven by neurosurgeons' increased acceptance of minimally invasive neurosurgical operations, rising spending on healthcare in developing economies, and rising susceptibility elements including high blood pressure, nicotine consumption, excessive cholesterol diabetes, and overweight.

Hospitals & surgical centers are foreseen to account for the largest share of the global market. The simplicity of planning, the oriented healthcare professionals, the optimized performance, soaring inclusion of technologically advanced treatment solutions, and the elevated wellbeing and effectiveness of these establishments, are the prominent factors leading to the overall market growth.

Throughout the forecast period, North America is likely to be the major market. Aspects, including the elevated demand for minimally intrusive surgical procedures, the burgeoning target patient demographic for neurovascular disorders, skyrocketing knowledge among neurosurgeons about the rewards of interventional neurology equipment, and persistent government programs to modernize and broaden medical tourism, are driving the market. Furthermore, declining product prices have improved the use of these devices, thus aiding market expansion in this area.

Europe contributed to the market's second-largest share. According to the Stroke Alliance for Europe (SAFE), the proportion of persons suffering from a stroke in the European Union is expected to rise by 27% between 2017 and 2047, and the associated medical costs connected with stroke management will rise as a consequence. Mostly as a result of demographic aging and higher overall survival. As a result, the rising frequency of neurovascular disorders amongst Europe's adult and elderly populations is expected to fuel market expansion in the area. Furthermore, rising healthcare costs and widespread implementation of technically sophisticated solutions in countries such as Germany, France, and the United Kingdom are projected to accelerate the implementation of neurointerventional devices in the coming years.

Owing to the constantly growing senior demographic with neurovascular diseases, Asia Pacific is expected to have a higher CAGR throughout the forecast period. According to the United Nations Population Fund, Asia Pacific's elderly demographic is growing at an unparalleled level, with one in every four individuals in the area expected to be over 60 years old by 2050. In addition, growing markets in nations including Japan, China, and India are likely to boost the Asia Pacific market's development.

Medtronic, MicroPort Scientific Corporation, Penumbra, Inc., Stryker Corporation, Johnson & Johnson Services, Inc., Terumo Corporation, Cerus Endovascular, MicroVention, Inc., Codman Neuro, among others, are the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Neurovascular Devices Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Therapeutic Application Overview

2.1.4 End-User Overview

2.1.5 Regional Overview

Chapter 3 Neurovascular Devices Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising Healthcare Spending

3.3.1.2 Expanding Technological Enhancements In The Field Of Interventional Neurology

3.3.2 Industry Challenges

3.3.2.1 Scarcity Of Qualified Neurologists

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Therapeutic Application Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Neurovascular Devices Market, By Product

4.1 Product Outlook

4.2 Aneurysm Coiling & Embolization Devices

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.2.2 Market Size, By Embolic Coils, 2019-2026 (USD Million)

4.2.3 Market Size, By Flow Diversion Devices, 2019-2026 (USD Million)

4.2.4 Market Size, By Liquid Embolic Agents, 2019-2026 (USD Million)

4.3 Cerebral Balloon Angioplasty & Stenting Systems

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.3.2 Market Size, By Carotid Artery Stents, 2019-2026 (USD Million)

4.3.3 Market Size, By Embolic Protection Devices, 2019-2026 (USD Million)

4.3.4 Market Size, By Balloon Catheters, 2019-2026 (USD Million)

4.4 Support Devices

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.4.2 Market Size, By Microcatheters, 2019-2026 (USD Million)

4.4.3 Market Size, By Guidewires, 2019-2026 (USD Million)

4.5 Neurothrombectomy Devices

4.5.1 Market Size, By Region, 2019-2026 (USD Million)

4.5.2 Market Size, By Clot Retrieval Devices, 2019-2026 (USD Million)

4.5.3 Market Size, By Suction & Aspiration Devices, 2019-2026 (USD Million)

4.5.4 Market Size, By Snares, 2019-2026 (USD Million)

Chapter 5 Neurovascular Devices Market, By Therapeutic Application

5.1 Therapeutic Application Outlook

5.2 Cerebral Aneurysms

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Ischemic Strokes

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Carotid Artery Stenosis

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

5.5 Arteriovenous Malformation & Fistulas

5.5.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Neurovascular Devices Market, by End-User

6.1 End-User Outlook

6.2 Hospitals & Surgical Centers

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Ambulatory Care Centers

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

6.4 Research Laboratories & Academic Institutes

6.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Neurovascular Devices Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Million)

7.2.2 Market Size, By Product, 2019-2026 (USD Million)

7.2.3 Market Size, By Therapeutic Application, 2019-2026 (USD Million)

7.2.4 Market Size, By End-User, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Product, 2019-2026 (USD Million)

7.2.5.2 Market Size, By Therapeutic Application, 2019-2026 (USD Million)

7.2.5.3 Market Size, By End-User, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Product, 2019-2026 (USD Million)

7.2.6.2 Market Size, By Therapeutic Application, 2019-2026 (USD Million)

7.2.6.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Million)

7.3.2 Market Size, By Product, 2019-2026 (USD Million)

7.3.3 Market Size, By Therapeutic Application 2019-2026 (USD Million)

7.3.4 Market Size, By End-User, 2019-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.5.2 Market Size, By Therapeutic Application, 2019-2026 (USD Million)

7.3.5.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.6.2 Market Size, By Therapeutic Application, 2019-2026 (USD Million)

7.3.6.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.7.2 Market Size, By Therapeutic Application, 2019-2026 (USD Million)

7.3.7.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.8.2 Market Size, By Therapeutic Application, 2019-2026 (USD Million)

7.3.8.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.9.2 Market Size, By Therapeutic Application, 2019-2026 (USD Million)

7.3.9.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.10.2 Market Size, By Therapeutic Application, 2019-2026 (USD Million)

7.3.10.3 Market Size, By End-User, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country,2019-2026 (USD Million)

7.4.2 Market Size, By Product, 2019-2026 (USD Million)

7.4.3 Market Size, By Therapeutic Application, 2019-2026 (USD Million)

7.4.4 Market Size, By End-User, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Product, 2019-2026 (USD Million)

7.4.5.2 Market Size, By Therapeutic Application, 2019-2026 (USD Million)

7.4.5.3 Market Size, By End-User, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Product, 2019-2026 (USD Million)

7.4.6.2 Market Size, By Therapeutic Application, 2019-2026 (USD Million)

7.4.6.3 Market Size, By End-User, 2019-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Product, 2019-2026 (USD Million)

7.4.7.2 Market Size, By Therapeutic Application, 2019-2026 (USD Million)

7.4.7.3 Market Size, By End-User, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Product, 2019-2026 (USD Million)

7.4.8.2 Market size, By Therapeutic Application, 2019-2026 (USD Million)

7.4.8.3 Market Size, By End-User, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Product, 2019-2026 (USD Million)

7.4.9.2 Market Size, By Therapeutic Application, 2019-2026 (USD Million)

7.4.9.3 Market Size, By End-User, 2019-2026 (USD Million)

7.6.5 Latin America

7.5.1 Market Size, By Country 2019-2026 (USD Million)

7.5.2 Market Size, By Product, 2019-2026 (USD Million)

7.5.3 Market Size, By Therapeutic Application, 2019-2026 (USD Million)

7.5.4 Market Size, By End-User, 2019-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Product, 2019-2026 (USD Million)

7.5.5.2 Market Size, By Therapeutic Application, 2019-2026 (USD Million)

7.5.5.3 Market Size, By End-User, 2019-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Product, 2019-2026 (USD Million)

7.5.6.2 Market Size, By Therapeutic Application, 2019-2026 (USD Million)

7.5.6.3 Market Size, By End-User, 2019-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Product, 2019-2026 (USD Million)

7.5.7.2 Market Size, By Therapeutic Application, 2019-2026 (USD Million)

7.5.7.3 Market Size, By End-User, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2019-2026 (USD Million)

7.6.2 Market Size, By Product, 2019-2026 (USD Million)

7.6.3 Market Size, By Therapeutic Application, 2019-2026 (USD Million)

7.6.4 Market Size, By End-User, 2019-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Product, 2019-2026 (USD Million)

7.6.5.2 Market Size, By Therapeutic Application, 2019-2026 (USD Million)

7.6.5.3 Market Size, By End-User, 2019-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Product, 2019-2026 (USD Million)

7.6.6.2 Market Size, By Therapeutic Application, 2019-2026 (USD Million)

7.6.6.3 Market Size, By End-User, 2019-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Product, 2019-2026 (USD Million)

7.6.7.2 Market Size, By Therapeutic Application, 2019-2026 (USD Million)

7.6.7.3 Market Size, By End-User, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Medtronic

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 MicroPort Scientific Corporation

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Penumbra, Inc.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Stryker Corporation

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Johnson & Johnson Services, Inc.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Penumbra, Inc.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Terumo Corporation

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Cerus Endovascular

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 MicroVention, Inc.

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Codman Neuro

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

The Global Neurovascular Devices Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Neurovascular Devices Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS