Global NGS-based Food Safety Screening & Testing Market Size, Trends & Analysis - Forecasts to 2027 By Product (Instruments and Consumables & Accessories), By Application (Meat, Poultry, and Seafood, Dairy Products, Processed Food, and Other Foods), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East & Africa), End-User Landscape Analysis,

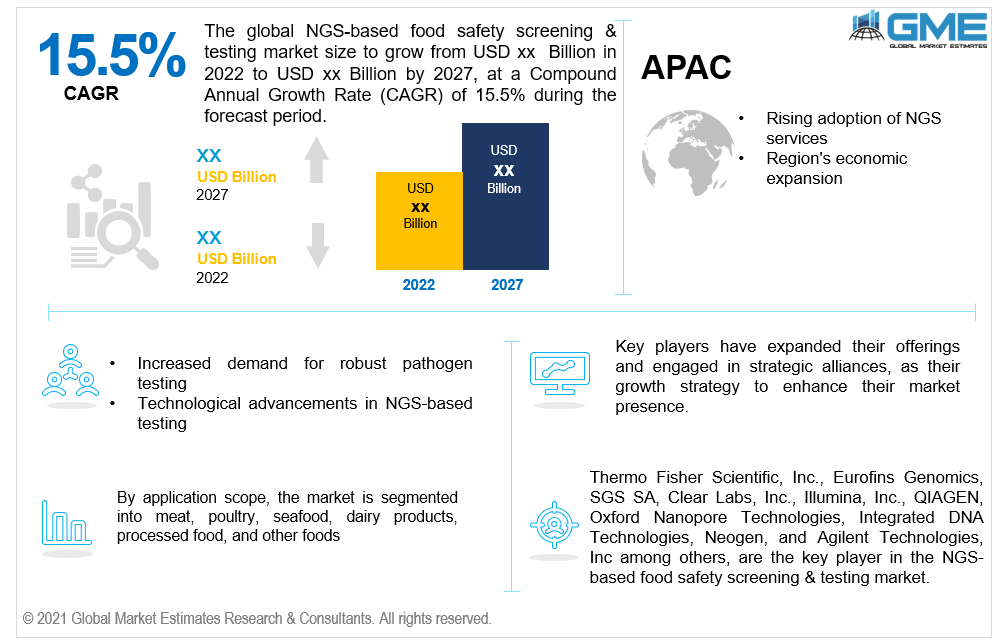

The Global NGS-based Food Safety Screening & Testing Market is projected to grow at a CAGR value of 15.5% from 2022 to 2027. Food authenticity testing has been revolutionized by the advent of Next Generation Sequencing (NGS) in the food and beverage industry. NGS untargeted approach facilitates accurate screening and separation of several different species in a given sample.

Approximately, USD 15 billion costs to the food industry due to food fraud. The complexity of the food supply chain poses challenges to the capabilities of the analytical instruments used for ingredient traceability. The species included in food and feed samples must be identified as part of the confirmation of authenticity, raw material traceability, and quality control of handling and cleaning operations in food manufacturing lines. Implementation of streamlined NGS workflow with ready-to-use kits for DNA extraction and library preparation exhibits great potential to effectively address the food testing-related challenges with the conventional mode of testing.

NGS-based methodologies and sample characterization workflows, such as taxonomic profiling of bacterial populations and WGS of isolates, are gaining momentum along with culturing and PCR-based identification methods. Food quality testing labs are now well equipped with portable devices from Oxford Nanopore as well as desktop sequencing platforms from Ion Torrent or Illumina, for advanced food screening workflows.

In addition, research communities at global dairy companies are using the QIAGEN CLC Genomics Workbench integrated with Oxford Nanopore sequencing technology to carry out whole metagenome shotgun analysis on dairy products to establish a "normal" microbiome community baseline and track the deviations that are linked to food spoilage. Technical and commercial advantages associated with the application of NGS in food testing labs over the conventional method of testing is driving the market growth.

The positive impact of COVID-19 on the food safety testing business is being driven by rising consumer awareness of safe food items and the spread of foodborne diseases. Food security requirements are getting stricter to secure a safer supply of food to people in both domestic and international countries. Consumers, manufacturers, and regulators are all subject to numerous restrictions enacted by governments.

However, the introduction of lockdown and other pandemic mandates has resulted in the partial or complete shutdown of several laboratories. This has resulted in a decline in the overall testing volume across the globe. Moreover, restricted movement of raw materials due to the hindered supply chain has posed a threat to market growth during a pandemic.

The Russian invasion of Ukraine has had a significant influence on food supplies and costs, particularly for wheat, corn, and grain. Both countries supply roughly a third of the world's wheat, accounting for nearly a quarter of global production. Grain and wheat production isn't the only industry in jeopardy.

The major suppliers of sunflower oil — the third most traded vegetable oil – are Russia and Ukraine. Fertilizers have become a rare commodity as a result of natural gas supply problems, placing the agriculture sector on the verge of collapse. Moreover, the food industry is expected to witness more frequent shortages and unmanageable price increases due to the possibility of more sanctions against Russia.

The food business in the United States and around the world continues to suffer due to Russia's invasion of Ukraine. Brazil's fertilizer supply is in jeopardy, with Russia accounting for nearly a fifth of all imports. Brazil is a major exporter of meat, corn, coffee, sugar, soybeans, and other agricultural products, therefore the scenario has the potential to raise commodity prices.

China is facing significant challenges to circumvent this situation. China, as one of Russia's few remaining partners, is under pressure to preserve and expand trade to assist Russia's economic and financial systems to survive. Although China has attempted to boost its food self-sufficiency, it still imports up to 10% of its wheat and corn. These factors are expected to have a negative impact on the growth of this market.

NGS consumables segment captured maximum revenue share in the 2021 market and is expected to continue this trend throughout the forecast period. This can be attributed to the technological advancements in the NGS workflows coupled with the increased demand for advanced pre-sequencing products and kits to perform target enrichment, DNA fragmentation, size selection, and others.

Moreover, frequent usage and purchase rate of consumables to carry the sequencing process of a given sample are anticipated to drive the segment revenue. On the other hand, instruments are anticipated to register significant growth during the forecast period owing to the continuous launch of new platforms to streamline the sequencing process.

Changing lifestyles and an expanding population is driving up the demand for processed foods. The rising income of the population, especially in emerging countries, results in increased spending on processed meals. Rapid urbanization is resulting in the expansion of modern store formats that promote processed foods. These factors are driving the usage of NGS-based food screening for processed food, resulting in the major share of this segment.

Furthermore, dairy products are expected to find substantial revenue share in the future market. An increase in consumption of dairy product and changing consumer preference from meat to dairy products for protein enrichment have spurred the testing of these products. Moreover, the cold chain logistics and modern retail facilities have facilitated easy availability of dairy goods which further propel the segment growth.

North America (the United States, Canada, and Mexico) is estimated to account for the major revenue share in the market. The regional market is driven by the presence of multiple clinical laboratories that employ NGS to provide testing services. In addition, the major players in North America are engaged in the development and commercialization of new products, which is boosting the market growth.

Increased production in the food industry in North America is also driving the market. Foodborne disease outbreaks are also related to the vast market in North America. Food safety testing protocol is mandatory at each step of production and processing to safeguard the safety of food for human consumptions while also fueling the market. GMO testing and microbial testing are the most common forms of testing in this region. The introduction and enforcement of rigorous food safety rules, such as a zero-tolerance policy for Listeria contamination, has fueled the expansion of food safety testing. Microbial testing is common in the United States, followed by GMO testing.

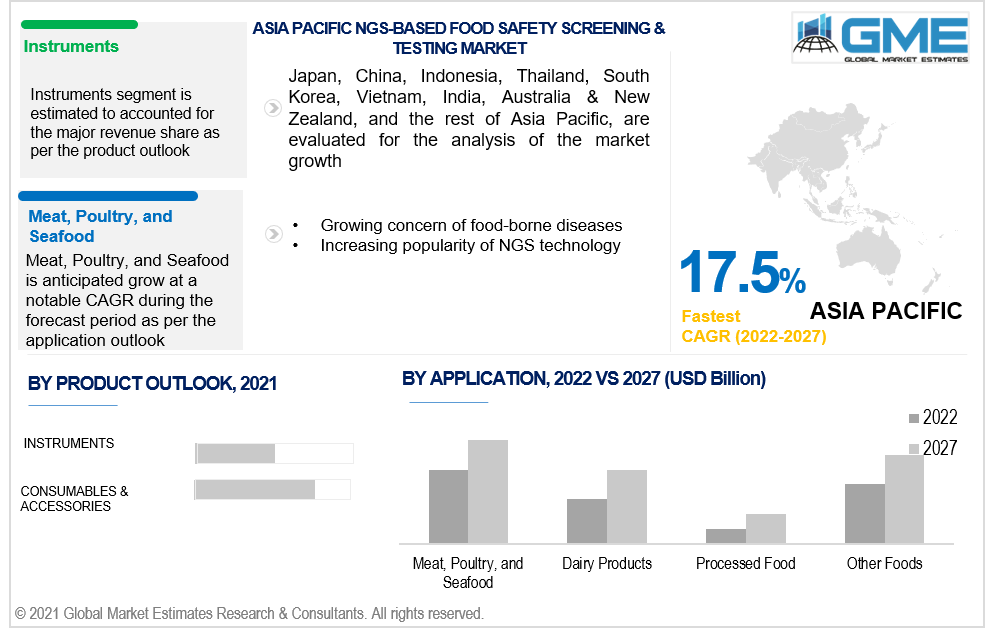

On the other hand, Asia-Pacific is expected to emerge as a lucrative source of revenue during the forecast period because of the growing demand for NGS, as well as an increase in public knowledge of NGS. Moreover, the market is also driven by the high demand for pathogen testing is in high demand, especially in the meat and poultry industries. Furthermore, recent advances in information and communication technology have aided in the strengthening of the food safety regulatory framework, giving the food safety testing business a boost.

China is expected to account for a significant share in the Asia Pacific NGS-based Food Safety Screening & Testing Market. With growing awareness and understanding of NGS technology among the China research community, the China market is expected to propel revenue flow in this region.

Thermo Fisher Scientific, Inc., Eurofins Genomics, SGS SA, Clear Labs, Inc., Illumina, Inc., QIAGEN, Oxford Nanopore Technologies, Integrated DNA Technologies, Neogen, and Agilent Technologies, Inc among others, are some of the key players operating in the NGS-based food safety screening & testing market.

Please note: This is not an exhaustive list of companies profiled in the report.

These participants continue to undertake various organic and inorganic growth strategies to enhance their market presence and gain a competitive advantage in the market. For instance, in March 2019, Clear Labs integration of its ‘Clear Safety’ food safety solution with nanopore sequencing by using the GridION X5 for rapid pathogen testing.

Chapter 1 Research Methodology

1.1 Research Assumptions

1.2 Research Methodology

1.2.1 Estimates and Forecast Timeline

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GME’s Internal Database

1.3.3 Primary Research

1.3.4 Secondary Sources & Third-Party Perspectives

1.3.4.1 Company Information Sources

1.3.4.2 Secondary Data Sources

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Data Visualization

1.6 Data Validation & Publishing

1.7 Market Model

1.7.1 Model Details

1.7.1.1 Top-Down Approach

1.7.1.2 Bottom-Up Approach

1.8 Market Segmentation & Scope

1.9 Market Definition

Chapter 2 Executive Summary

2.1. Global Market Outlook

2.2 Product Outlook

2.3 Application Outlook

2.4 Regional Outlook

Chapter 3 Global NGS-based Food Safety Screening & Testing Market Trend Analysis

3.1. Market Introduction

3.2 Penetration & Growth Prospect Mapping

3.3 Impact of COVID-19 on the NGS-based Food Safety Screening & Testing Market

3.4 Metric Data on Food Safety Screening & Testing Industry

3.5 Market Dynamic Analysis

3.5.1 Market Driver Analysis

3.5.2 Market Restraint Analysis

3.5.3 Industry Challenges

3.5.4 Industry Opportunities

3.6 Porter’s Five Analysis

3.6.1 Supplier Power

3.6.2 Buyer Power

3.6.3 Substitution Threat

3.6.4 Threat from New Entrant

3.6.5 Intensity of Competitive Rivalry

3.7 Market Entry Strategies

Chapter 4 NGS-based Food Safety Screening & Testing Market: Product Trend Analysis

4.1 Product: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

4.2 Instruments

4.2.1 Market Estimates & Forecast Analysis of Instruments Segment, By Region, 2019-2027 (USD Billion)

4.3 Consumables & Accessories

4.3.1 Market Estimates & Forecast Analysis of Consumables & Accessories Segment, By Region, 2019-2027 (USD Billion)

Chapter 5 NGS-based Food Safety Screening & Testing Market: Application Trend Analysis

5.1 Application: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

5.2 Meat, Poultry, and Seafood

5.2.1 Market Estimates & Forecast Analysis of Meat, Poultry, and Seafood Segment, By Region, 2019-2027 (USD Billion)

5.3 Dairy Products

5.3.1 Market Estimates & Forecast Analysis of Dairy Products Segment, By Region, 2019-2027 (USD Billion)

5.4 Processed Food

5.4.1 Market Estimates & Forecast Analysis of Processed Food Segment, By Region, 2019-2027 (USD Billion)

5.5 Other Foods

5.5.1 Market Estimates & Forecast Analysis of Other Foods Segment, By Region, 2019-2027 (USD Billion)

Chapter 6 NGS-based Food Safety Screening & Testing Market, By Region

6.1 Regional Outlook

6.2 North America

6.2.1 Market Estimates & Forecast Analysis, By Application 2019-2027 (USD Billion)

6.2.2 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

6.2.3 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

6.2.4.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

6.2.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.2.6 Mexico

6.2.6.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

6.2.6.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.3 Europe

6.3.1 Market Estimates & Forecast Analysis, By Application 2019-2026 (USD Billion)

6.3.2 Market Estimates & Forecast Analysis, By Product, 2019-2026 (USD Billion)

6.3.3 Market Estimates & Forecast Analysis, By Country, 2019-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Estimates & Forecast Analysis, By Product, 2019-2026 (USD Billion)

6.3.4.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Estimates & Forecast Analysis, By Product, 2019-2026 (USD Billion)

6.3.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Estimates & Forecast Analysis, By Product, 2019-2026 (USD Billion)

6.3.6.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.3.7 Russia

6.3.7.1 Market Estimates & Forecast Analysis, By Product, 2019-2026 (USD Billion)

6.3.7.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.3.8 Italy

6.3.8.1 Market Estimates & Forecast Analysis, By Product, 2018-2026 (USD Billion)

6.3.8.2 Market Estimates & Forecast Analysis, By Application, 2018-2026 (USD Billion)

6.3.9 Spain

6.3.9.1 Market Estimates & Forecast Analysis, By Product, 2019-2026 (USD Billion)

6.3.9.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.3.10 Rest of Europe

6.3.10.1 Market Estimates & Forecast Analysis, By Product, 2019-2026 (USD Billion)

6.3.10.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Estimates & Forecast Analysis, By Application 2019-2026 (USD Billion)

6.4.2 Market Estimates & Forecast Analysis, By Product, 2019-2026 (USD Billion)

6.4.3 Market Estimates & Forecast Analysis, By Country, 2019-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Estimates & Forecast Analysis, By Product, 2019-2026 (USD Billion)

6.4.4.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Estimates & Forecast Analysis, By Product, 2019-2025 (USD Billion)

6.4.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2025 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Estimates & Forecast Analysis, By Product, 2019-2026 (USD Billion)

6.4.6.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Estimates & Forecast Analysis, By Product, 2019-2026 (USD Billion)

6.4.7.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Estimates & Forecast Analysis, By Product, 2018-2026 (USD Billion)

6.4.8.2 Market Estimates & Forecast Analysis, By Application, 2018-2026 (USD Billion)

6.3.9 Rest of Asia Pacific

6.3.9.1 Market Estimates & Forecast Analysis, By Product, 2019-2026 (USD Billion)

6.3.9.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.5 Central & South America

6.5.1 Market Estimates & Forecast Analysis, By Application 2019-2026 (USD Billion)

6.5.2 Market Estimates & Forecast Analysis, By Product, 2019-2026 (USD Billion)

6.5.3 Market Estimates & Forecast Analysis, By Country, 2019-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Estimates & Forecast Analysis, By Product, 2019-2026 (USD Billion)

6.5.4.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.5.5 Rest of Central & South America

6.5.5.1 Market Estimates & Forecast Analysis, By Product, 2019-2026 (USD Billion)

6.5.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.6 Middle East & Africa

6.6.1 Market Estimates & Forecast Analysis, By Application 2019-2026 (USD Billion)

6.6.2 Market Estimates & Forecast Analysis, By Product, 2019-2026 (USD Billion)

6.6.3 Market Estimates & Forecast Analysis, By Country, 2019-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Estimates & Forecast Analysis, By Product, 2019-2026 (USD Billion)

6.6.4.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.6.4.3 Market Estimates & Forecast Analysis, By Platform, 2019-2026 (USD Billion)

6.6.5 United Arab Emirates

6.6.5.1 Market Estimates & Forecast Analysis, By Product, 2019-2026 (USD Billion)

6.6.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Estimates & Forecast Analysis, By Product, 2019-2026 (USD Billion)

6.6.6.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

6.6.7 Rest of Middle East & Africa

6.6.7.1 Market Estimates & Forecast Analysis, By Product, 2019-2026 (USD Billion)

6.6.7.2 Market Estimates & Forecast Analysis, By Application, 2019-2026 (USD Billion)

Chapter 7 Competitive Analysis

7.1 Key Global Players, Recent Developments & their Impact on the Industry

7.2 Four Quadrant Competitor Positioning Matrix

7.2.1 Key Innovators

7.2.2 Market Leaders

7.2.3 Emerging Players

7.2.4 Market Challengers

7.3 Vendor Landscape Analysis

7.4 End-User Landscape Analysis

7.5 Company Market Share Analysis, 2021

Chapter 8 Company Profile Analysis

8.1 Thermo Fisher Scientific, Inc.

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Strategic Initiatives

8.1.4 Product Benchmarking

8.2 Eurofins Genomics

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Initiatives

8.2.4 Product Benchmarking

8.3 SGS SA

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Initiatives

8.3.4 Product Benchmarking

8.4 Clear Labs, Inc.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Initiatives

8.4.4 Product Benchmarking

8.5 Illumina, Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Initiatives

8.5.4 Product Benchmarking

8.6 QIAGEN

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Initiatives

8.6.4 Product Benchmarking

8.7 Oxford Nanopore Technologies

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Initiatives

8.7.4 Product Benchmarking

8.8 Integrated DNA Technologies

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Initiatives

8.8.4 Product Benchmarking

8.9 Neogen

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Initiatives

8.9.4 Product Benchmarking

8.10 Agilent Technologies, Inc

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Initiatives

8.10.4 Product Benchmarking

List of Tables

1 Technological Advancements In NGS-based Food Safety Screening & Testing Market

2 Global NGS-based Food Safety Screening & Testing Market: Key Market Drivers

3 Global NGS-based Food Safety Screening & Testing Market: Key Market Challenges

4 Global NGS-based Food Safety Screening & Testing Market: Key Market Opportunities

5 Global NGS-based Food Safety Screening & Testing Market: Key Market Restraints

6 Global NGS-based Food Safety Screening & Testing Market Estimates & Forecast Analysis, 2019-2027 (USD Billion)

7 Global NGS-based Food Safety Screening & Testing Market, By Product, 2019-2027 (USD Billion)

8 Instruments: Global NGS-based Food Safety Screening & Testing Market, By Region, 2019-2027 (USD Billion)

9 Consumables & Accessories: Global NGS-based Food Safety Screening & Testing Market, By Region, 2019-2027 (USD Billion)

10 Global NGS-based Food Safety Screening & Testing Market, By Application, 2019-2027 (USD Billion)

11 Meat, Poultry, and Seafood: Global NGS-based Food Safety Screening & Testing Market, By Region, 2019-2027 (USD Billion)

12 Dairy Products: Global NGS-based Food Safety Screening & Testing Market, By Region, 2019-2027 (USD Billion)

13 Processed Food: Global NGS-based Food Safety Screening & Testing Market, By Region, 2019-2027 (USD Billion)

14 Other Foods: Global NGS-based Food Safety Screening & Testing Market, By Region, 2019-2027 (USD Billion)

15 Regional Analysis: Global NGS-based Food Safety Screening & Testing Market, By Region, 2019-2027 (USD Billion)

16 North America: NGS-based Food Safety Screening & Testing Market, By Product, 2019-2027 (USD Billion)

17 North America: NGS-based Food Safety Screening & Testing Market, By Application, 2019-2027 (USD Billion)

18 North America: NGS-based Food Safety Screening & Testing Market, By Country, 2019-2027 (USD Billion)

19 U.S: NGS-based Food Safety Screening & Testing Market, By Product, 2019-2027 (USD Billion)

20 U.S: NGS-based Food Safety Screening & Testing Market, By Application, 2019-2027 (USD Billion)

21 Canada: NGS-based Food Safety Screening & Testing Market, By Product, 2019-2027 (USD Billion)

22 Canada: NGS-based Food Safety Screening & Testing Market, By Application, 2019-2027 (USD Billion)

23 Mexico: NGS-based Food Safety Screening & Testing Market, By Product, 2019-2027 (USD Billion)

24 Mexico: NGS-based Food Safety Screening & Testing Market, By Application, 2019-2027 (USD Billion)

25 Europe: NGS-based Food Safety Screening & Testing Market, By Product, 2019-2027 (USD Billion)

26 Europe: NGS-based Food Safety Screening & Testing Market, By Application, 2019-2027 (USD Billion)

27 Europe: NGS-based Food Safety Screening & Testing Market, By Country, 2019-2027 (USD Billion)

28 Germany: NGS-based Food Safety Screening & Testing Market, By Product, 2019-2027 (USD Billion)

29 Germany: NGS-based Food Safety Screening & Testing Market, By Application, 2019-2027 (USD Billion)

30 UK: NGS-based Food Safety Screening & Testing Market, By Product, 2019-2027 (USD Billion)

31 UK: NGS-based Food Safety Screening & Testing Market, By Application, 2019-2027 (USD Billion)

32 France: NGS-based Food Safety Screening & Testing Market, By Product, 2019-2027 (USD Billion)

33 France: NGS-based Food Safety Screening & Testing Market, By Application, 2019-2027 (USD Billion)

34 Italy: NGS-based Food Safety Screening & Testing Market, By Product, 2019-2027 (USD Billion)

35 Italy: NGS-based Food Safety Screening & Testing Market, By Application, 2019-2027 (USD Billion)

36 Spain: NGS-based Food Safety Screening & Testing Market, By Product, 2019-2027 (USD Billion)

37 Spain: NGS-based Food Safety Screening & Testing Market, By Application, 2019-2027 (USD Billion)

38 Russia: NGS-based Food Safety Screening & Testing Market, By Product, 2019-2027 (USD Billion)

39 Russia: NGS-based Food Safety Screening & Testing Market, By Application, 2019-2027 (USD Billion)

40 Rest Of Europe: NGS-based Food Safety Screening & Testing Market, By Product, 2019-2027 (USD Billion)

41 Rest Of Europe: NGS-based Food Safety Screening & Testing Market, By Application, 2019-2027 (USD Billion)

42 Asia Pacific: NGS-based Food Safety Screening & Testing Market, By Product, 2019-2027 (USD Billion)

43 Asia Pacific: NGS-based Food Safety Screening & Testing Market, By Application, 2019-2027 (USD Billion)

44 Asia Pacific: NGS-based Food Safety Screening & Testing Market, By Country, 2019-2027 (USD Billion)

45 China: NGS-based Food Safety Screening & Testing Market, By Product, 2019-2027 (USD Billion)

46 China: NGS-based Food Safety Screening & Testing Market, By Application, 2019-2027 (USD Billion)

47 India: NGS-based Food Safety Screening & Testing Market, By Product, 2019-2027 (USD Billion)

48 India: NGS-based Food Safety Screening & Testing Market, By Application, 2019-2027 (USD Billion)

49 Japan: NGS-based Food Safety Screening & Testing Market, By Product, 2019-2027 (USD Billion)

50 Japan: NGS-based Food Safety Screening & Testing Market, By Application, 2019-2027 (USD Billion)

51 Australia: NGS-based Food Safety Screening & Testing Market, By Product, 2019-2027 (USD Billion)

52 Australia: NGS-based Food Safety Screening & Testing Market, By Application, 2019-2027 (USD Billion)

53 South Korea: NGS-based Food Safety Screening & Testing Market, By Product, 2019-2027 (USD Billion)

54 South Korea: NGS-based Food Safety Screening & Testing Market, By Application, 2019-2027 (USD Billion)

55 Middle East & Africa: NGS-based Food Safety Screening & Testing Market, By Product, 2019-2027 (USD Billion)

56 Middle East & Africa: NGS-based Food Safety Screening & Testing Market, By Application, 2019-2027 (USD Billion)

57 Middle East & Africa: NGS-based Food Safety Screening & Testing Market, By Country, 2019-2027 (USD Billion)

58 Saudi Arabia: NGS-based Food Safety Screening & Testing Market, By Product, 2019-2027 (USD Billion)

59 Saudi Arabia: NGS-based Food Safety Screening & Testing Market, By Application, 2019-2027 (USD Billion)

60 UAE: NGS-based Food Safety Screening & Testing Market, By Product, 2019-2027 (USD Billion)

61 UAE: NGS-based Food Safety Screening & Testing Market, By Application, 2019-2027 (USD Billion)

62 South Africa: NGS-based Food Safety Screening & Testing Market, By Product, 2019-2027 (USD Billion)

63 South Africa: NGS-based Food Safety Screening & Testing Market, By Application, 2019-2027 (USD Billion)

64 Central & South America: NGS-based Food Safety Screening & Testing Market, By Product, 2019-2027 (USD Billion)

65 Central & South America: NGS-based Food Safety Screening & Testing Market, By Application, 2019-2027 (USD Billion)

66 Central & South America: NGS-based Food Safety Screening & Testing Market, By Country, 2019-2027 (USD Billion)

67 Brazil: NGS-based Food Safety Screening & Testing Market, By Product, 2019-2027 (USD Billion)

68 Brazil: NGS-based Food Safety Screening & Testing Market, By Application, 2019-2027 (USD Billion)

69 Thermo Fisher Scientific, Inc.: Products Offered

70 Eurofins Genomics: Products Offered

71 SGS SA: Products Offered

72 Clear Labs, Inc.: Products Offered

73 Illumina, Inc.: Products Offered

74 QIAGEN: Products Offered

75 Oxford Nanopore Technologies: Products Offered

76 Integrated DNA Technologies: Products Offered

77 Neogen: Products Offered

78 Agilent Technologies, Inc: Products Offered

List of Figures

1. Global NGS-based Food Safety Screening & Testing Market Segmentation & Research Scope

2. Primary Research Partners and Local Informers

3. Primary Research Process

4. Primary Research Approaches

5. Primary Research Responses

6. Global NGS-based Food Safety Screening & Testing Market: Penetration & Growth Prospect Mapping

7. Global NGS-based Food Safety Screening & Testing Market: Value Chain Analysis

8. Global NGS-based Food Safety Screening & Testing Market Drivers

9. Global NGS-based Food Safety Screening & Testing Market Restraints

10. Global NGS-based Food Safety Screening & Testing Market Opportunities

11. Global NGS-based Food Safety Screening & Testing Market Challenges

12. Key NGS-based Food Safety Screening & Testing Market Manufacturer Analysis

13. Global NGS-based Food Safety Screening & Testing Market: Porter’s Five Forces Analysis

14. PESTLE Analysis & Impact Analysis

15. Thermo Fisher Scientific, Inc.: Company Snapshot

16. Thermo Fisher Scientific, Inc.: Swot Analysis

17. Eurofins Genomics: Company Snapshot

18. Eurofins Genomics: Swot Analysis

19. SGS SA: Company Snapshot

20. SGS SA: Swot Analysis

21. Clear Labs, Inc.: Company Snapshot

22. Clear Labs, Inc.: Swot Analysis

23. Illumina, Inc.: Company Snapshot

24. Illumina, Inc.: Swot Analysis

25. QIAGEN: Company Snapshot

26. QIAGEN: Swot Analysis

27. Oxford Nanopore Technologies: Company Snapshot

28. Oxford Nanopore Technologies: Swot Analysis

29. Integrated DNA Technologies: Company Snapshot

30. Integrated DNA Technologies: Swot Analysis

31. Neogen: Company Snapshot

32. Neogen: Swot Analysis

33. Agilent Technologies, Inc: Company Snapshot

34. Agilent Technologies, Inc: Swot Analysis

The Global NGS-based Food Safety Screening & Testing Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the NGS-based Food Safety Screening & Testing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS