Global NGS Newborn Genetic Testing /Screening Market Size, Trends & Analysis - Forecasts to 2027 By Sample Type (Blood, Saliva, and Others), By Application (Inherited & Other Disorders Screening/ Testing and Pharmacogenomics), By End-use (Hospitals & Clinics, Diagnostic Centers, and Others), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East & Africa), End-User Landscape Analysis, Company Market Share Analysis, and Competitor Analysis

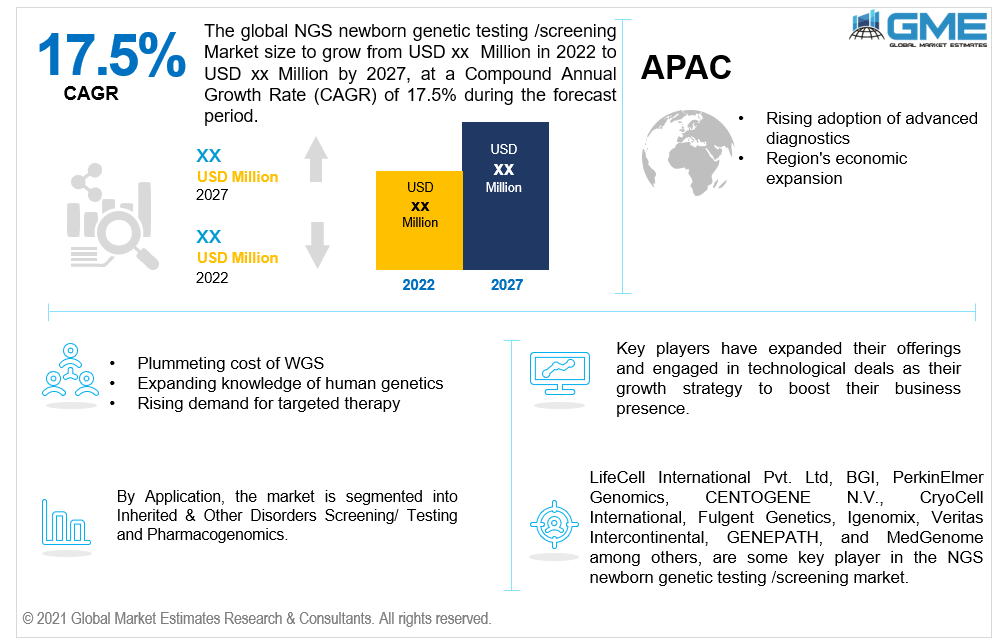

The global NGS Newborn Genetic Testing /Screening Market is projected to grow at a CAGR value of 17.5% from 2022 to 2027. Rising awareness about chromosomal abnormalities in the fetus among parents coupled with the increasing prevalence of neonatal diseases is driving the growth of the NGS newborn genetic testing /screening market.

Every year, approximately 7.9 million babies are born with birth abnormalities around the world, most of whom appear healthy at birth and have no family history of the condition. Many affected babies do not show symptoms until later in life when they are severe and often irreversible symptoms. Early detection of an illness allows proper and prompt medical action before it leads to more significant and often irreversible health problems.

Study and analysis of substantial amounts of a newborn’s DNA exhibit great potential in addressing the clinical challenges associated with conventional newborn screening programs, thereby creating opportunities for the growth of the NGS-based screening market. Whole genome sequencing for newborns helps discover the genetic abnormalities that the newborn may be at risk of developing throughout infancy, childhood, or later in life.

Integration of whole genome sequencing with conventional newborn screening blood tests further expands the application of testing, enabling the treatment of more newborns for potential health concerns. Also, some parents are getting their newborns' genomes sequenced by third-party entities viz., direct-to-consumer corporations. These factors are anticipated to spur the market revenue at a lucrative CAGR during the forecast period.

The COVID-19 pandemic had a considerable impact on the market. Lockdowns have been established and emergencies have been proclaimed in the majority of countries to contain the spread of SARS-CoV-2 infection. This also disrupts the supply chain and thus hampered the movement of raw materials, thereby limiting the market growth.

The market witnessed a decline in testing volume due to reducing in-person visits for newborn genetic testing, particularly in the early 2020s. Moreover, a large proportion of research and healthcare participants postponed the clinical studies and testing procedures. The increased risk of COVID-19 infection in neonatal would put even more restrictions on newborn genetic testing. However, several public organizations support continuing genetic testing in newborns, thereby driving the market growth during the pandemic.

The infrastructural failure of research institutes, clinics, and hospitals has adversely impacted healthcare systems and research programs, causing healthcare professionals to escape and leave research centers and hospitals. Furthermore, due to the costs of maintaining huge stockpiles and storage space constraints, these centers have limited quantities of reagents and other consumables.

This has had an impact on not only hospital-based patient care but also therapeutic development initiatives. The conflict is predicted to result in inequities in the supply of services and medicine in both countries. While healthcare facilities in Ukraine are being abandoned or even shelled, inflation and sanctions have impacted the Russian healthcare system over the border. As a result, the protracted conflict is projected to hamper the market growth for a certain period.

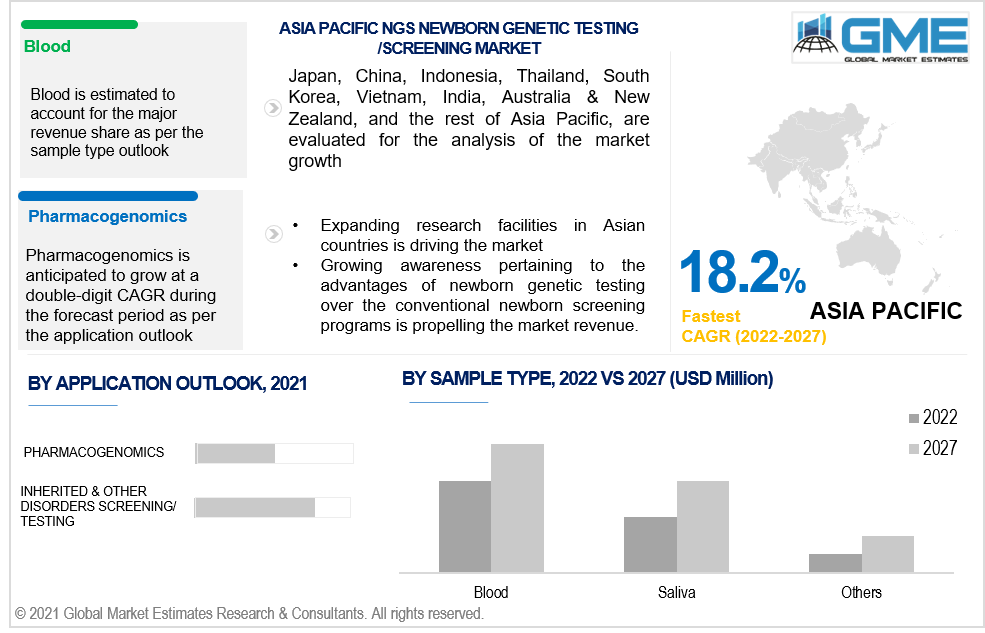

The blood segment is estimated to capture the maximum share in 2021 owing to the successful application of blood samples in investigating several serious health ailments in newborns. Blood as a sample has proven its efficiency in effectively diagnosing rare genetic diseases. Moreover, the presence of a substantial number of companies that offer blood-based genetic testing is driving the segment revenue.

On the other hand, Saliva is anticipated to register the fastest growth over the forecast period. This can be attributed to the advantages of saliva samples over blood as they are easy to collect. Saliva samples can be collected at home and sent to the lab without needing the patient to visit the lab or clinic. Considering it a lucrative source of revenue, several test manufacturers are investing in the development of saliva-based tests, resulting in the fastest growth of this segment during the forecast period.

NGS newborn genetic testing /screening for inherited & other disorders has dominated the revenue share in 2021. In recent years, the prevalence of genetic illnesses and chromosomal anomalies has risen quickly over the world. Genetic diseases and chromosomal anomalies are recorded in 2 to 5% of live births, according to the World Health Organization (WHO). In developing economies, these illnesses account for roughly 30% of pediatric hospital visits and 50% of pediatric mortality. As the prevalence of these ailments rises, so will the market's target demographic, thereby providing a healthy outlook for the segment’s growth.

Pharmacogenomics-based application is expected to register the fastest growth during the forecast period. A constant increase in genetic and clinical information as a result of technological advancements in genomic technologies is spurring the growth of this segment. The companies are using the clinical data generated through newborn testing to restructure their therapy R&D programs. Increased demand for targeted therapy is expected to further boost segment growth.

Hospitals & clinics are the key end-users of the market with maximum revenue share in 2021. High penetration of test usage in hospital and clinical settings has attributed to the dominance of this segment. Access to current technologies in newborn genetic testing, as well as favorable reimbursement rules, are also driving the segment growth.

On the other hand, diagnostic centers are witnessing a spur in demand for their services owing to the increasing number of experienced and trained professionals in this setting. Furthermore, the increasing shift of patients from hospitals to stand-alone diagnostic centers due to fewer crowds that help speed up the testing process as compared to the hospitals which are overburdened with several other testing procedures.

North America (the United States, Canada, and Mexico) is estimated to account for the major revenue share of the NGS newborn genetic testing /screening market owing to the confluence of various factors such as the presence of leading market players, Effective regulatory and reimbursement infrastructure for the safe and clinical implementation of genomic tests in the region, and presence of well-established R&D infrastructure among others.

In the United States, newborn infants are routinely tested for genetic diseases. Before the infant leaves the hospital, most states need a minimum of 32 tests. Moreover, according to the Council for Responsible Genetics, 98% of infants in the country already undergo screening programs. That's almost 4.3 million newborns. The emergence of newborn genetic sequencing would further expand the testing of various conditions. Owing to the breakthroughs in whole-genome sequencing, newborn screening is on the verge of a massive expansion in the country, thereby driving revenue flow in the U.S.

On the other hand, Asia-Pacific is projected to grow lucratively during the forecast period. Expansion of global market players in the Asian markets including China, India, and others is one of the key factors driving the market. Moreover, Asian countries are gaining significant attention among global market players as a hub for clinical studies of novel tests and therapies owing to low manufacturing and operating cost in this region. Furthermore, as WGS becomes cheaper and easier, along with constant growth in knowledge and understanding of human genetics among consumers, Asian countries are expected to grow notably in the global NGS newborn genetic testing market.

LifeCell International Pvt. Ltd, BGI, PerkinElmer Genomics, CENTOGENE N.V., CryoCell International, Fulgent Genetics, Igenomix, Veritas Intercontinental, GENEPATH, and MedGenome among others, are some key players operating the in the NGS newborn genetic testing /screening market.

Please note: This is not an exhaustive list of companies profiled in the report.

These key players are making focused attempts to enhance their market presence in the life science industry. New product development, merger, and acquisitions, and licensing deals are some of the key strategies undertaken by these companies to sustain the rising market competition.

Chapter 1 Research Methodology

1.1 Research Assumptions

1.2 Research Methodology

1.2.1 Estimates and Forecast Timeline

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GME’s Internal Database

1.3.3 Primary Research

1.3.4 Secondary Sources & Third-Party Perspectives

1.3.4.1 Company Information Sources

1.3.4.2 Secondary Data Sources

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Data Visualization

1.6 Data Validation & Publishing

1.7 Market Model

1.7.1 Model Details

1.7.1.1 Top-Down Approach

1.7.1.2 Bottom-Up Approach

1.8 Market Segmentation & Scope

1.9 Market Definition

Chapter 2 Executive Summary

2.1. Global Market Outlook

2.2 Sample Type Outlook

2.3 Application Outlook

2.4 End-use Outlook

2.5 Regional Outlook

Chapter 3 Global NGS Newborn Genetic Testing /Screening Market Trend Analysis

3.1. Market Introduction

3.2 Penetration & Growth Prospect Mapping

3.3 Impact of COVID-19 on the NGS Newborn Genetic Testing /Screening Market

3.4 Metric Data on Life Science Industry

3.5 Market Dynamic Analysis

3.5.1 Market Driver Analysis

3.5.2 Market Restraint Analysis

3.5.3 Industry Challenges

3.5.4 Industry Opportunities

3.6 Porter’s Five Analysis

3.6.1 Supplier Power

3.6.2 Buyer Power

3.6.3 Substitution Threat

3.6.4 Threat from New Entrant

3.7 Market Entry Strategies

Chapter 4 NGS Newborn Genetic Testing /Screening Market: Sample Type Trend Analysis

4.1 Sample Type: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

4.2 Blood

4.2.1 Market Estimates & Forecast Analysis of Blood Segment, By Region, 2019-2027 (USD Million)

4.3 Saliva

4.3.1 Market Estimates & Forecast Analysis of Saliva Segment, By Region, 2019-2027 (USD Million)

4.4 Other Samples

4.4.1 Market Estimates & Forecast Analysis of Other Samples Segment, By Region, 2019-2027 (USD Million)

Chapter 5 NGS Newborn Genetic Testing /Screening Market: Application Trend Analysis

5.1 Application: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

5.2 Inherited & Other Disorders Screening/ Testing

5.2.1 Market Estimates & Forecast Analysis of Inherited & Other Disorders Screening/ Testing Segment, By Region, 2019-2027 (USD Million)

5.3 Pharmacogenomics

5.3.1 Market Estimates & Forecast Analysis of Pharmacogenomics Segment, By Region, 2019-2027 (USD Million)

Chapter 6 NGS Newborn Genetic Testing /Screening Market: End-use Trend Analysis

6.1 End-use: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

6.2 Hospitals & Clinics

6.2.1 Market Estimates & Forecast Analysis of Hospitals & Clinics Segment, By Region, 2019-2027 (USD Million)

6.3 Diagnostic Centers

6.3.1 Market Estimates & Forecast Analysis of Diagnostic Centers Segment, By Region, 2019-2027 (USD Million)

6.4 Others

6.4.1 Market Estimates & Forecast Analysis of Others Segment, By Region, 2019-2027 (USD Million)

Chapter 7 NGS Newborn Genetic Testing /Screening Market, By Region

7.1 Regional Outlook

7.2 North America

7.2.1 Market Estimates & Forecast Analysis, By End-use 2019-2027 (USD Million)

7.2.2 Market Estimates & Forecast Analysis, By Sample Type, 2019-2027 (USD Million)

7.2.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Million)

7.2.4 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Estimates & Forecast Analysis, By Sample Type, 2019-2027 (USD Million)

7.2.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Million)

7.2.5.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Million)

7.2.6 Canada

7.2.6.1 Market Estimates & Forecast Analysis, By Sample Type, 2019-2027 (USD Million)

7.2.6.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Million)

7.2.6.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Million)

7.2.7 Mexico

7.2.7.1 Market Estimates & Forecast Analysis, By Sample Type, 2019-2027 (USD Million)

7.2.7.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Million)

7.2.7.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Million)

7.3 Europe

7.3.1 Market Estimates & Forecast Analysis, By End-use 2019-2027 (USD Million)

7.3.2 Market Estimates & Forecast Analysis, By Sample Type, 2019-2027 (USD Million)

7.3.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Million)

7.3.4 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Million)

7.3.5 Germany

7.3.5.1 Market Estimates & Forecast Analysis, By Sample Type, 2019-2027 (USD Million)

7.3.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Million)

7.3.5.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Million)

7.3.6 UK

7.3.6.1 Market Estimates & Forecast Analysis, By Sample Type, 2019-2027 (USD Million)

7.3.6.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Million)

7.3.6.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Million)

7.3.7 France

7.3.7.1 Market Estimates & Forecast Analysis, By Sample Type, 2019-2027 (USD Million)

7.3.7.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Million)

7.3.7.2 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Million)

7.3.8 Italy

7.3.8.1 Market Estimates & Forecast Analysis, By Sample Type, 2018-2027 (USD Million)

7.3.8.2 Market Estimates & Forecast Analysis, By Application, 2018-2027 (USD Million)

7.3.8.2 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Million)

7.3.9 Spain

7.3.9.1 Market Estimates & Forecast Analysis, By Sample Type, 2019-2027 (USD Million)

7.3.9.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Million)

7.3.8.2 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Million)

7.3.10 Rest of Europe

7.3.10.1 Market Estimates & Forecast Analysis, By Sample Type, 2019-2027 (USD Million)

7.3.10.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Million)

7.3.8.2 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Million)

7.4 Asia Pacific

7.4.1 Market Estimates & Forecast Analysis, By End-use 2019-2027 (USD Million)

7.4.2 Market Estimates & Forecast Analysis, By Sample Type, 2019-2027 (USD Million)

7.4.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Million)

7.4.4 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Million)

7.4.5 China

7.4.5.1 Market Estimates & Forecast Analysis, By Sample Type, 2019-2027 (USD Million)

7.4.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Million)

7.4.5.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Million)

7.4.6 India

7.4.6.1 Market Estimates & Forecast Analysis, By Sample Type, 2019-2025 (USD Million)

7.4.6.2 Market Estimates & Forecast Analysis, By Application, 2019-2025 (USD Million)

7.4.6.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Million)

7.4.7 Japan

7.4.7.1 Market Estimates & Forecast Analysis, By Sample Type, 2019-2027 (USD Million)

7.4.7.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Million)

7.4.7.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Million)

7.4.8 South Korea

7.4.8.1 Market Estimates & Forecast Analysis, By Sample Type, 2018-2027 (USD Million)

7.4.8.2 Market Estimates & Forecast Analysis, By Application, 2018-2027 (USD Million)

7.4.8.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Million)

7.4.9 Rest of Asia Pacific

7.4.9.1 Market Estimates & Forecast Analysis, By Sample Type, 2019-2027 (USD Million)

7.4.9.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Million)

7.4.9.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Million)

7.5 Central & South America

7.5.1 Market Estimates & Forecast Analysis, By End-use 2019-2027 (USD Million)

7.5.2 Market Estimates & Forecast Analysis, By Sample Type, 2019-2027 (USD Million)

7.5.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Million)

7.5.4 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Estimates & Forecast Analysis, By Sample Type, 2019-2027 (USD Million)

7.5.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Million)

7.5.5.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Million)

7.5.6 Rest of Central & South America

7.5.6.1 Market Estimates & Forecast Analysis, By Sample Type, 2019-2027 (USD Million)

7.5.6.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Million)

7.5.6.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Million)

7.6 Middle East & Africa

7.6.1 Market Estimates & Forecast Analysis, By End-use 2019-2027 (USD Million)

7.6.2 Market Estimates & Forecast Analysis, By Sample Type, 2019-2027 (USD Million)

7.6.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Million)

7.6.4 Market Estimates & Forecast Analysis, By Country, 2019-2027 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Estimates & Forecast Analysis, By Sample Type, 2019-2027 (USD Million)

7.6.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Million)

7.6.5.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Million)

7.6.6 South Africa

7.6.6.1 Market Estimates & Forecast Analysis, By Sample Type, 2019-2027 (USD Million)

7.6.6.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Million)

7.6.6.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Million)

7.6.7 Rest of Middle East & Africa

7.6.7.1 Market Estimates & Forecast Analysis, By Sample Type, 2019-2027 (USD Million)

7.6.7.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Million)

7.6.7.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Million)

Chapter 8 Competitive Analysis

8.1 Key Global Players, Recent Developments & their Impact on the Industry

8.2 Four Quadrant Competitor Positioning Matrix

8.2.1 Key Innovators

8.2.2 Market Leaders

8.2.3 Emerging Players

8.2.4 Market Challengers

8.3 Vendor Landscape Analysis

8.4 End-User Landscape Analysis

8.5 Company Market Share Analysis, 2021

Chapter 9 Company Profile Analysis

9.1 LifeCell International Pvt. Ltd

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Strategic Initiatives

9.1.4 Service/Software Benchmarking

9.2 BGI

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Initiatives

9.2.4 Service/Software Benchmarking

9.3 PerkinElmer Genomics

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Initiatives

9.3.4 Service/Software Benchmarking

9.4 CENTOGENE N.V.

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Initiatives

9.4.4 Service/Software Benchmarking

9.5 CryoCell International

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Initiatives

9.5.4 Service/Software Benchmarking

9.6 Fulgent Genetics

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Initiatives

9.6.4 Service/Software Benchmarking

9.7 Igenomix

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Initiatives

9.7.4 Service/Software Benchmarking

9.8 Veritas Intercontinental

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Initiatives

9.8.4 Service/Software Benchmarking

9.9 GENEPATH

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Initiatives

9.9.4 Service/Software Benchmarking

9.10 MedGenome

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Initiatives

9.10.4 Service/Software Benchmarking

List of Tables

1 Technological advancements in NGS newborn genetic testing /screening market

2 Global NGS newborn genetic testing /screening market: key market drivers

3 Global NGS newborn genetic testing /screening market: key market challenges

4 Global NGS newborn genetic testing /screening market: key market opportunities

5 Global NGS newborn genetic testing /screening market: Key market restraints

6 Global NGS newborn genetic testing /screening market estimates & forecast analysis, 2019-2027 (USD billion)

7 Global NGS newborn genetic testing /screening market, by sample type, 2019-2027 (USD billion)

8 Blood: Global NGS newborn genetic testing /screening market, by region, 2019-2027 (USD billion)

9 Saliva: Global NGS newborn genetic testing /screening market, by region, 2019-2027 (USD billion)

10 Other samples: Global NGS newborn genetic testing /screening market, by region, 2019-2027 (USD billion)

11 Global NGS newborn genetic testing /screening market, by application, 2019-2027 (USD billion)

12 Inherited & other disorders screening/ testing: Global NGS newborn genetic testing /screening market, by region, 2019-2027 (USD billion)

13 Pharmacogenomics: Global NGS newborn genetic testing /screening market, by region, 2019-2027 (USD billion)

14 Global NGS newborn genetic testing /screening market, by end-use, 2019-2027 (USD billion)

15 Hospitals & clinics: Global NGS newborn genetic testing /screening market, by region, 2019-2027 (USD billion)

16 Diagnostic centers: Global NGS newborn genetic testing /screening market, by region, 2019-2027 (USD billion)

17 Other end-users: Global NGS newborn genetic testing /screening market, by region, 2019-2027 (USD billion)

18 Regional analysis: Global NGS newborn genetic testing /screening market, by region, 2019-2027 (USD billion)

19 North America: NGS newborn genetic testing /screening market, by type, 2019-2027 (USD billion)

20 North America: NGS newborn genetic testing /screening market, by application, 2019-2027 (USD billion)

21 North America: NGS newborn genetic testing /screening market, by end-use, 2019-2027 (USD billion)

22 North America: NGS newborn genetic testing /screening market, by country, 2019-2027 (USD billion)

23 U.S.: NGS newborn genetic testing /screening market, by type, 2019-2027 (USD billion)

24 U.S.: NGS newborn genetic testing /screening market, by application, 2019-2027 (USD billion)

25 U.S.: NGS newborn genetic testing /screening market, by end-use, 2019-2027 (USD billion)

26 Canada: NGS newborn genetic testing /screening market, by type, 2019-2027 (USD billion)

27 Canada: NGS newborn genetic testing /screening market, by application, 2019-2027 (USD billion)

28 Canada: NGS newborn genetic testing /screening market, by end-use, 2019-2027 (USD billion)

29 Mexico: NGS newborn genetic testing /screening market, by type, 2019-2027 (USD billion)

30 Mexico: NGS newborn genetic testing /screening market, by application, 2019-2027 (USD billion)

31 Mexico: NGS newborn genetic testing /screening market, by end-use, 2019-2027 (USD billion)

32 Europe: NGS newborn genetic testing /screening market, by type, 2019-2027 (USD billion)

33 Europe: NGS newborn genetic testing /screening market, by application, 2019-2027 (USD billion)

34 Europe: NGS newborn genetic testing /screening market, by end-use, 2019-2027 (USD billion)

35 Europe: NGS newborn genetic testing /screening market, by country, 2019-2027 (USD billion)

36 Germany: NGS newborn genetic testing /screening market, by type, 2019-2027 (USD billion)

37 Germany: NGS newborn genetic testing /screening market, by application, 2019-2027 (USD billion)

38 Germany: NGS newborn genetic testing /screening market, by end-use, 2019-2027 (USD billion)

39 UK: NGS newborn genetic testing /screening market, by type, 2019-2027 (USD billion)

40 UK: NGS newborn genetic testing /screening market, by application, 2019-2027 (USD billion)

41 UK: NGS newborn genetic testing /screening market, by end-use, 2019-2027 (USD billion)

42 France: NGS newborn genetic testing /screening market, by type, 2019-2027 (USD billion)

43 France: NGS newborn genetic testing /screening market, by application, 2019-2027 (USD billion)

44 France: NGS newborn genetic testing /screening market, by end-use, 2019-2027 (USD billion)

45 Italy: NGS newborn genetic testing /screening market, by type, 2019-2027 (USD billion)

46 Italy: NGS newborn genetic testing /screening market, by application, 2019-2027 (USD billion)

47 Italy: NGS newborn genetic testing /screening market, by end-use, 2019-2027 (USD billion)

48 Spain: NGS newborn genetic testing /screening market, by type, 2019-2027 (USD billion)

49 Spain: NGS newborn genetic testing /screening market, by application, 2019-2027 (USD billion)

50 Spain: NGS newborn genetic testing /screening market, by end-use, 2019-2027 (USD billion)

51 Rest of Europe: NGS newborn genetic testing /screening market, by type, 2019-2027 (USD billion)

52 Rest of Europe: NGS newborn genetic testing /screening market, by application, 2019-2027 (USD billion)

53 Rest of Europe: NGS newborn genetic testing /screening market, by end-use, 2019-2027 (USD billion)

54 Asia Pacific: NGS newborn genetic testing /screening market, by type, 2019-2027 (USD billion)

55 Asia Pacific: NGS newborn genetic testing /screening market, by application, 2019-2027 (USD billion)

56 Asia Pacific: NGS newborn genetic testing /screening market, by end-use, 2019-2027 (USD billion)

57 Asia Pacific: NGS newborn genetic testing /screening market, by country, 2019-2027 (USD billion)

58 China: NGS newborn genetic testing /screening market, by type, 2019-2027 (USD billion)

59 China: NGS newborn genetic testing /screening market, by application, 2019-2027 (USD billion)

60 China: NGS newborn genetic testing /screening market, by end-use, 2019-2027 (USD billion)

61 India: NGS newborn genetic testing /screening market, by type, 2019-2027 (USD billion)

62 India: NGS newborn genetic testing /screening market, by application, 2019-2027 (USD billion)

63 India: NGS newborn genetic testing /screening market, by end-use, 2019-2027 (USD billion)

64 Japan: NGS newborn genetic testing /screening market, by type, 2019-2027 (USD billion)

65 Japan: NGS newborn genetic testing /screening market, by application, 2019-2027 (USD billion)

66 Japan: NGS newborn genetic testing /screening market, by end-use, 2019-2027 (USD billion)

67 South Korea: NGS newborn genetic testing /screening market, by type, 2019-2027 (USD billion)

68 South Korea: NGS newborn genetic testing /screening market, by application, 2019-2027 (USD billion)

69 South Korea: NGS newborn genetic testing /screening market, by end-use, 2019-2027 (USD billion)

70 Middle East & Africa: NGS newborn genetic testing /screening market, by type, 2019-2027 (USD billion)

71 Middle East & Africa: NGS newborn genetic testing /screening market, by application, 2019-2027 (USD billion)

72 Middle East & Africa: NGS newborn genetic testing /screening market, by end-use, 2019-2027 (USD billion)

73 Middle East & Africa: NGS newborn genetic testing /screening market, by country, 2019-2027 (USD billion)

74 Saudi Arabia: NGS newborn genetic testing /screening market, by type, 2019-2027 (USD billion)

75 Saudi Arabia: NGS newborn genetic testing /screening market, by application, 2019-2027 (USD billion)

76 Saudi Arabia: NGS newborn genetic testing /screening market, by end-use, 2019-2027 (USD billion)

77 South Africa: NGS newborn genetic testing /screening market, by type, 2019-2027 (USD billion)

78 South Africa: NGS newborn genetic testing /screening market, by application, 2019-2027 (USD billion)

79 South Africa: NGS newborn genetic testing /screening market, by end-use, 2019-2027 (USD billion)

80 Central & South America: NGS newborn genetic testing /screening market, by type, 2019-2027 (USD billion)

81 Central & South America: NGS newborn genetic testing /screening market, by application, 2019-2027 (USD billion)

82 Central & South America: NGS newborn genetic testing /screening market, by end-use, 2019-2027 (USD billion)

83 Central & South America: NGS newborn genetic testing /screening market, by country, 2019-2027 (USD billion)

84 Brazil: NGS newborn genetic testing /screening market, by type, 2019-2027 (USD billion)

85 Brazil: NGS newborn genetic testing /screening market, by application, 2019-2027 (USD billion)

86 Brazil: NGS newborn genetic testing /screening market, by end-use, 2019-2027 (USD billion)

87 LifeCell International Pvt. Ltd: Products offered

88 BGI: Products offered

89 PerkinElmer Genomics: Products offered

90 CENTOGENE N.V.: Products offered

91 CryoCell International: Products offered

92 Fulgent Genetics: Products offered

93 Igenomix: Products offered

94 Veritas Intercontinental: Products offered

95 GENEPATH: Products offered

96 MedGenome: Products offered

List of Figures

1. Global NGS newborn genetic testing /screening market segmentation & research scope

2. Primary research partners and local informers

3. Primary research process

4. Primary research approaches

5. Primary research responses

6. Global NGS newborn genetic testing /screening market: penetration & growth prospect mapping

7. Global NGS newborn genetic testing /screening market: value chain analysis

8. Global NGS newborn genetic testing /screening market drivers

9. Global NGS newborn genetic testing /screening market restraints

10. Global NGS newborn genetic testing /screening market opportunities

11. Global NGS newborn genetic testing /screening market challenges

12. Key NGS newborn genetic testing /screening market manufacturer analysis

13. Global NGS newborn genetic testing /screening market: porter’s five forces analysis

14. Pestle analysis & impact analysis

15. LifeCell International Pvt. Ltd: Company snapshot

16. LifeCell International Pvt. Ltd: SWOT analysis

17. BGI: Company snapshot

18. BGI: SWOT analysis

19. PerkinElmer Genomics: Company snapshot

20. PerkinElmer Genomics: SWOT analysis

21. CENTOGENE N.V.: Company snapshot

22. CENTOGENE N.V.: SWOT analysis

23. CryoCell International: Company snapshot

24. CryoCell International: SWOT analysis

25. Fulgent Genetics: Company snapshot

26. Fulgent Genetics: SWOT analysis

27. Igenomix: Company snapshot

28. Igenomix: SWOT analysis

29. Veritas Intercontinental: Company snapshot

30. Veritas Intercontinental: SWOT analysis

31. GENEPATH: Company snapshot

32. GENEPATH: SWOT analysis

33. MedGenome: Company snapshot

34. MedGenome: SWOT analysis

The Global NGS Newborn Genetic Testing /Screening Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the NGS Newborn Genetic Testing /Screening Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS