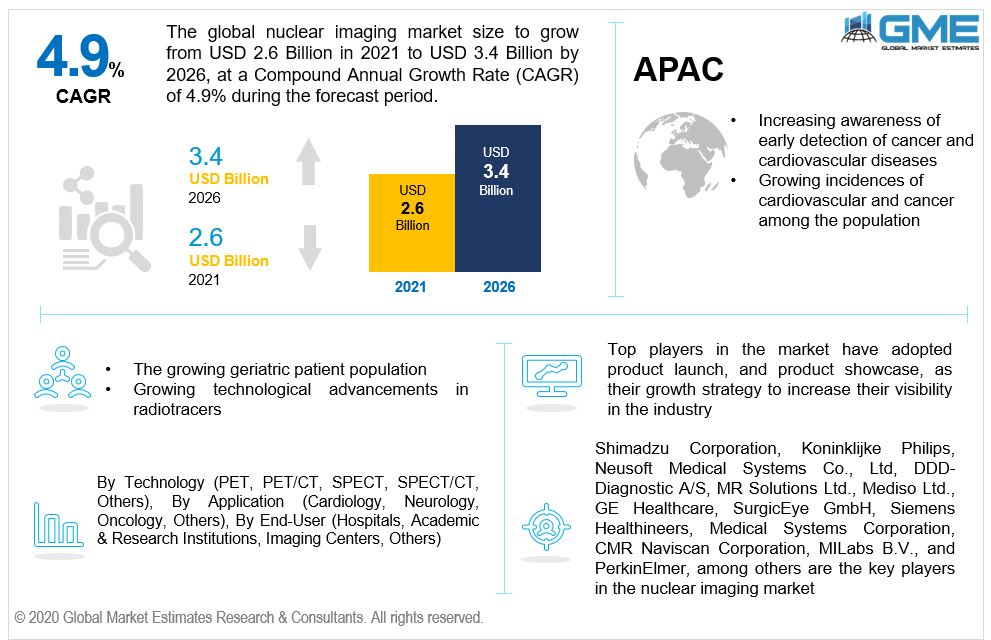

Global Nuclear Imaging Market Size, Trends & Analysis - Forecasts to 2026 By Technology (PET, PET/CT, SPECT, SPECT/CT, Others), By Application (Cardiology, Neurology, Oncology, Others), By End-User (Hospitals, Academic & Research Institutions, Imaging Centers, Others), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

The global nuclear imaging market is projected to grow from USD 2.6 billion in 2021 to USD 3.4 billion by 2026 at a CAGR value 4.9% during the forecast period. Technological development and advancement in the nuclear imaging field have been a major growth factor for the nuclear imaging systems market. Technological changes have changed the focus from standalone imaging systems to hybrid systems in recent years. The development of novel radiotracers and improvements in existing radiotracers have also contributed to the growth of the nuclear imaging market.

Nuclear imaging is carried out through small quantities of radioactive materials that are tied up with another compound used by the cells or compounds that get attached to the cancerous cells in the body. Nuclear imaging equipment allows the user to image the path of the radioactive material and the area where they concentrate to study for abnormalities. Along with applications in oncology, nuclear imaging is being widely used in cardiology and neurology. The growing number of applications of nuclear imaging has made a significant impact on the growth of the nuclear imaging market.

The growing prevalence of cardiovascular diseases and cancer in the population along with the growing geriatric population has increased the demand for better prevention and detection of such diseases. Nuclear imaging equipment is vital to early disease detection and management of diseases leading to a growing nuclear imaging market. The high cost of such equipment has been a major restraint on the growth of the market, but with the increased prevalence of cancer, governments are beginning to invest heavily in improving access to such facilities. Nuclear imaging is a largely painless experience for patients except in the cases where an intravenous injection is required which have increased the demand for nuclear imaging. Data integration into nuclear imaging equipment represents a lucrative opportunity for nuclear imaging vendors as the advantages of comprehensive patient history along with reconstruction of images, generation of 3D images, and artificial intelligence-assisted medical diagnosis are becoming popular among physicians. Due to the high costs of such imaging equipment, there is a growing number of partnerships between public and private entities to increase the accessibility to such imaging services. The nuclear imaging market is restrained by the high price of equipment and the growing shortage of technetium 99 which is commonly used as the imaging material for nuclear imaging.

Nuclear imaging technology has grown considerably in recent years and has resulted in various new techniques and equipment for nuclear imaging. Based on the technology employed, the nuclear imaging market can be fragmented into SPECT, SPECT/CT, PET, PET/CT, and others segments.

The PET segment clutched the lion’s share of the nuclear imaging market, PET nuclear imaging is capable of producing high-resolution images that can provide comprehensive information to the physician. Technological advancements have increased the applicability of PET scans in the field of oncology as are used to detect various types of cancer like colorectal cancer, lung cancer, breast cancer, and esophageal cancer, among others.

The SPECT/CT segment is envisaged to grow quicker than the other segments during the forecast period. The growing applicability of hybrid systems such as SPECT/CT systems which can provide highly accurate location information as well as highly specific details of the growth is becoming increasingly popular. Hospitals are increasingly replacing standalone imaging systems with hybrid systems. The low cost of SPECT systems compared to PET imaging systems is also expected to result in the growth of the SPECT/CT segment during the forecast period.

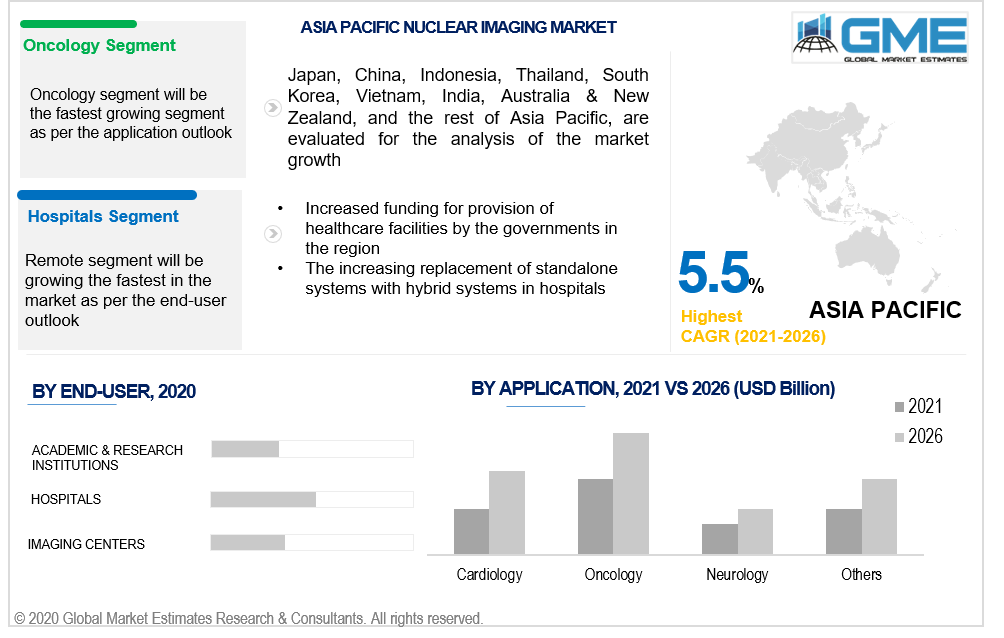

Based on the various applications of nuclear imaging, the market can be divided into cardiology, neurology, oncology, and others. The oncology segment is envisaged to hold the most considerable share of the nuclear imaging market while also logging the fastest growth rate. The growing prevalence of cancer among the population especially among the growing geriatric population has been one of the major drivers of this segment.

Technological advancements in radiotracers used in the detection of cancerous growths through nuclear imaging have also contributed to the dominance of the oncology segment. Cancer has become one of the leading causes of death which has prompted an increase in public and private funding for oncology research and nuclear imaging.

Based on the end-users of nuclear imaging, the market can be fragmented into hospitals, academic & research institutions, diagnostic centers, and others. The hospital segment held the dominant share of the nuclear imaging market owing to the wide range of services that have to be offered by hospitals. As cancer and cardiovascular disorders have become a common occurrence, hospitals have to be well equipped to deal with patients suffering from these disorders which have prompted the growth of the hospitals segment in the nuclear imaging market.

The nuclear imaging market can be categorized geographically as North America, Central & South America, Middle East & Africa, and Asia Pacific regions. The North American region held the dominant share of the nuclear imaging market owing to the large geriatric population in the region and the growing incidence of cancer and cardiovascular disorders. The region has witnessed heavy spending on healthcare infrastructure by the governments in the past few decades which has contributed to the dominance of this region over the nuclear imaging market.

The APAC region is envisaged to grow significantly quicker than the other regions. The growing awareness of early detection of terminal illnesses like cancer and cardiovascular disorders combined with the growing incidence of such diseases among the population is expected to be the major drivers of the nuclear imaging market in the APAC region. The increasing government funding in improving the healthcare facilities and oncology research is expected to contribute positively to the growth of the nuclear imaging market in the APAC region during the forecast period.

Shimadzu Corporation, Koninklijke Philips, Neusoft Medical Systems Co., Ltd, DDD-Diagnostic A/S, MR Solutions Ltd., Mediso Ltd., GE Healthcare, SurgicEye GmbH, Siemens Healthineers, Medical Systems Corporation, CMR Naviscan Corporation, MILabs B.V., and PerkinElmer, among others are the key players in the nuclear imaging market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Nuclear Imaging Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Technology Overview

2.1.3 Application Overview

2.1.4 End-User Overview

2.1.6 Regional Overview

Chapter 3 Nuclear Imaging Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising prevalence of cancer and cardiovascular diseases

3.3.2 Industry Challenges

3.3.2.1 High cost of nuclear imaging equipment

3.4 Prospective Growth Scenario

3.4.1 Technology Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Nuclear Imaging Market, By Technology

4.1 Technology Outlook

4.2 PET

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 PET/CT

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 SPECT

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 SPECT/CT

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Nuclear Imaging Market, By Application

5.1 Application Outlook

5.2 Cardiology

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Neurology

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Oncology

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Others

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Nuclear Imaging Market, By End-User

6.1 Hospitals

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Imaging Centers

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Academic & Research Institutions

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Others

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Nuclear Imaging Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.2.3 Market Size, By Application, 2020-2026 (USD Billion)

7.2.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By Application, 2020-2026 (USD Billion)

7.2.4.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.2.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.2.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.11.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.11.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.9.2 Market size, By Application, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.10.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.5.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Technology, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Shimadzu Corporation

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Koninklijke Philips

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Neusoft Medical Systems Co., Ltd

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 DDD-Diagnostic A/S

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 MR Solutions Ltd.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Mediso Ltd.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 GE Healthcare

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 SurgicEye GmbH

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Siemens Healthineers

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Nuclear Imaging Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Nuclear Imaging Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS