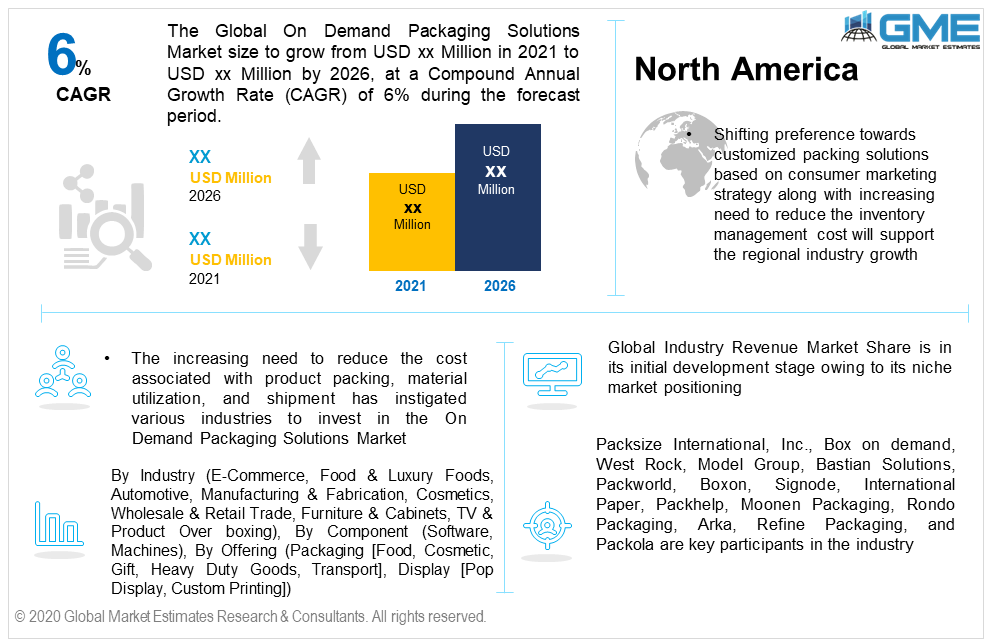

Global On Demand Packaging Solutions Market Size, Trends & Analysis - Forecasts to 2026 By Industry (E-Commerce, Food & Luxury Foods, Automotive, Manufacturing & Fabrication, Cosmetics, Wholesale & Retail Trade, Furniture & Cabinets, TV & Product Over boxing), By Component (Software, Machines), By Offering (Packaging [Food, Cosmetic, Gift, Heavy Duty Goods, Transport], Display [Pop Display, Custom Printing]), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

The increasing need to reduce the cost associated with product packing, material utilization, and shipment has instigated various industries to invest in the On Demand Packaging Solutions Market. Extended level of box customization in terms of size, shape, and thickness along with exemption from unnecessary inventory management are the prime factors to drive industry growth.

The global on demand packaging solutions market size will witness around 6% from 2021 to 2026. These packing concepts are ideal for industries facing shipping challenges especially due to the covid-19 pandemic. Various end-use industries are investing in this novel concept to safeguard themselves from unnecessary wastage and excessive costing.

E-commerce, food & luxury foods, automotive, manufacturing & fabrication, cosmetics, wholesale & retail trade, furniture & cabinets, and TV & product over boxing among others are the major industries that witnessed the largest adoption of custom size packing. The E-commerce industry dominated the overall product demand in 2019 and is intended to hold its dominance during the forecast period. E-commerce trade expansion owing to the rising preference for online sales channels has instigated consumption in this segment. Another reason to witness high demand in this segment is the impact of the covid-19 pandemic. The majority of the sale is shifted to an online platform which makes it essential for the industry to invest in upgradation and cost optimization.

Big box sizes result in unnecessary space engagement during the shipment, excessive weight, and more carbon footprints. On the contrary, the custom size boxes offer weight reduction, product space usage, and better product protection due to ideal compression which makes them ideal for e-commerce transportation.

Other key industries which are heavily investing in the industry are food & luxury foods and cosmetics. A high level of packing personalization and customization to benefit numerous branding and marketing strategies are anticipated to influence growth in these segments.

By component, the market is comprised of software and machines among others. The machine dominated the overall component segment and continue to hold its dominance during the forecast period. High level of size customization, shape convenience, design preference, and cost optimization are the main reasons to induce penetration in this segment. Other dynamics such as personalized packing, multiple printing options, and optimum resource utilization have instigated the adoption of these packing options.

Software is projected to observe the highest gains in the component segment in the coming years. Packing personalization, customization, and achieving cost efficiency are the major benefits offered by these programs.

By offering, the on demand packaging solutions market is divided into packaging and display. The packaging led the overall offering segment demand and accounted for more than 75% of the revenue share in 2019. Further, the segment is sub-divided into food, cosmetic, gift, heavy duty goods, and transport among others. Wide offering coverage accompanied by increasing product sales through e-commerce trade is among the key attributing factor to drive demand in this segment. Custom size packing in these product categories offers minimal wastage and optimal inventory management.

Another offering in the same industry which is gaining high popularity is display stands. These are board made collapsible display boards used in multiple product display, branding, and marketing strategies. These products can be fully customized and personalized as per the client requirement. Rising trend to demonstrate product samples in malls and airports have instigated the adoption of these displays.

North America On Demand Packaging Solutions is intended to dominate the global revenue share during the forecast period. The region is projected to hold more than 30% of the demand by 2026. Shifting preference towards customized packing solutions based on consumer marketing strategy along with increasing need to reduce the inventory management cost will support the regional industry growth.

The Asia Pacific Market will observe more than 6.5% CAGR from 2021 to 2026. E-commerce trade expansion accompanied by a rising need to curb unnecessary material usage by producing standard size boxes will result in high demand for custom-made boxes & cartons. Various packing companies faced severe setbacks and losses due to sudden lockdowns during the first phase of the covid-19 pandemic. This situation led to inventory wastage and unavoidable wear & tear. Thus, the introduction of the box on-demand strategy will save packing providers from excessive resource wastage.

The European packing industry is largely inclined by the optimum resource utilization agenda. The region is likely to witness significant growth during the forecast period. The presence of various large-scale and medium-scale companies capitalizing on customized packing offerings will support the overall regional growth.

Global industry revenue market share is in its initial development stage owing to its niche market positioning. Currently, only a few packing companies have invested in these packing solutions. However, with the growing advent of customized packing opportunities, other mainstream companies are expected to shift their interest towards these sustainable packing forms. Optimum resource utilization accompanied by the presence of numerous packing options based on consumer preference and business is the chief factor to invest in the market.

Packsize International, Inc., Box on demand, West Rock, Model Group, Bastian Solutions, Packworld, Boxon, Signode, International Paper, Packhelp, Moonen Packaging, Rondo Packaging, Arka, Refine Packaging, and Packola are key participants in the industry.

Please note: This is not an exhaustive list of companies profiled in the report.

As of now, a limited number of companies are in the packing category at a global level. Although, the increasing demand for box customization to reduce wastage and unnecessary inventory management is projected to boost more companies to participate in this new packing platform. The long-term sales agreement with the end-users to gain consistent profitability is among the key strategy observed in the industry.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 On demand packaging solutions industry overview, 2019-2026

2.1.1 Industry overview

2.1.2 Industry overview

2.1.3 Component overview

2.1.4 Offering overview

2.1.5 Regional overview

Chapter 3 On Demand Packaging Solutions Market Trends

3.1 Market segmentation

3.2 Industry background, 2019-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.5 COVID-19 influence over industry growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology overview

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 On Demand Packaging Solutions Market, By Industry

4.1 Industry Outlook

4.2 E-commerce

4.2.1 Market size, by region, 2019-2026 (USD Million)

4.3 Food & Luxury Foods

4.3.1 Market size, by region, 2019-2026 (USD Million)

4.4 Automotive

4.4.1 Market size, by region, 2019-2026 (USD Million)

4.5 Manufacturing & fabrication

4.5.1 Market size, by region, 2019-2026 (USD Million)

4.6 Cosmetics

4.6.1 Market size, by region, 2019-2026 (USD Million)

4.7 Wholesale & retail trade

4.7.1 Market size, by region, 2019-2026 (USD Million)

4.8 Furniture & cabinets

4.8.1 Market size, by region, 2019-2026 (USD Million)

4.9 TV & Product over boxing

4.9.1 Market size, by region, 2019-2026 (USD Million)

4.10 Others

4.10.1 Market size, by region, 2019-2026 (USD Million)

Chapter 5 On Demand Packaging Solutions Market, By Component

5.1 Component Outlook

5.2 Software

5.2.1 Market size, by region, 2019-2026 (USD Million)

5.3 Machines

5.3.1 Market size, by region, 2019-2026 (USD Million)

5.4 Others

5.4.1 Market size, by region, 2019-2026 (USD Million)

Chapter 6 On Demand Packaging Solutions Market, By Offering

6.1 Offering Outlook

6.2 Packaging

6.2.1 Market size, by region, 2019-2026 (USD Million)

6.2.2 Food

6.2.2.1 Market size, by region, 2019-2026 (USD Million)

6.2.3 Cosmetic

6.2.3.1 Market size, by region, 2019-2026 (USD Million)

6.2.4 Gift

6.2.4.1 Market size, by region, 2019-2026 (USD Million)

6.2.5 Heavy Duty Goods

6.2.5.1 Market size, by region, 2019-2026 (USD Million)

6.2.6 Transport

6.2.6.1 Market size, by region, 2019-2026 (USD Million)

6.2.7 Others

6.2.7.1 Market size, by region, 2019-2026 (USD Million)

6.3 Display

6.3.1 Market size, by region, 2019-2026 (USD Million)

6.3.2 Pop Display

6.3.2.1 Market size, by region, 2019-2026 (USD Million)

6.3.3 Custom Printing

6.3.3.1 Market size, by region, 2019-2026 (USD Million)

6.3.4 Others

6.3.4.1 Market size, by region, 2019-2026 (USD Million)

Chapter 7 On Demand Packaging Solutions Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market size, by country 2019-2026 (USD Million)

7.2.2 Market size, by industry, 2019-2026 (USD Million)

7.2.3 Market size, by component, 2019-2026 (USD Million)

7.2.4 Market size, by offering, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market size, by industry, 2019-2026 (USD Million)

7.2.5.2 Market size, by component, 2019-2026 (USD Million)

7.2.5.3 Market size, by offering, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market size, by industry, 2019-2026 (USD Million)

7.2.6.2 Market size, by component, 2019-2026 (USD Million)

7.2.6.3 Market size, by offering, 2019-2026 (USD Million)

7.2.7 Mexico

7.2.7.1 Market size, by industry, 2019-2026 (USD Million)

7.2.7.2 Market size, by component, 2019-2026 (USD Million)

7.2.7.3 Market size, by offering, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market size, by country 2019-2026 (USD Million)

7.3.2 Market size, by industry, 2019-2026 (USD Million)

7.3.3 Market size, by component, 2019-2026 (USD Million)

7.3.4 Market size, by offering, 2019-2026 (USD Million)

7.3.5 Germany

7.2.5.1 Market size, by industry, 2019-2026 (USD Million)

7.2.5.2 Market size, by component, 2019-2026 (USD Million)

7.2.5.3 Market size, by offering, 2019-2026 (USD Million)

7.3.6 Spain

7.3.6.1 Market size, by industry, 2019-2026 (USD Million)

7.3.6.2 Market size, by component, 2019-2026 (USD Million)

7.3.6.3 Market size, by offering, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market size, by industry, 2019-2026 (USD Million)

7.3.7.2 Market size, by component, 2019-2026 (USD Million)

7.3.7.3 Market size, by offering, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market size, by industry, 2019-2026 (USD Million)

7.3.8.2 Market size, by component, 2019-2026 (USD Million)

7.3.8.3 Market size, by offering, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market size, by country 2019-2026 (USD Million)

7.4.2 Market size, by industry, 2019-2026 (USD Million)

7.4.3 Market size, by component, 2019-2026 (USD Million)

7.4.4 Market size, by offering, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market size, by industry, 2019-2026 (USD Million)

7.4.5.2 Market size, by component, 2019-2026 (USD Million)

7.4.5.3 Market size, by offering, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market size, by industry, 2019-2026 (USD Million)

7.4.6.2 Market size, by component, 2019-2026 (USD Million)

7.4.6.3 Market size, by offering, 2019-2026 (USD Million)

7.4.7 Malaysia

7.4.7.1 Market size, by industry, 2019-2026 (USD Million)

7.4.7.2 Market size, by component, 2019-2026 (USD Million)

7.4.7.3 Market size, by offering, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market size, by industry, 2019-2026 (USD Million)

7.4.8.2 Market size, by component, 2019-2026 (USD Million)

7.4.8.3 Market size, by offering, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market size, by industry, 2019-2026 (USD Million)

7.4.9.2 Market size, by component, 2019-2026 (USD Million)

7.4.9.3 Market size, by offering, 2019-2026 (USD Million)

7.5 Central & South America

7.5.1 Market size, by country 2019-2026 (USD Million)

7.5.2 Market size, by industry, 2019-2026 (USD Million)

7.5.3 Market size, by component, 2019-2026 (USD Million)

7.5.4 Market size, by offering, 2019-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market size, by industry, 2019-2026 (USD Million)

7.5.5.2 Market size, by component, 2019-2026 (USD Million)

7.5.5.3 Market size, by offering, 2019-2026 (USD Million)

7.5.6 Argentina

7.5.6.1 Market size, by industry, 2019-2026 (USD Million)

7.5.6.2 Market size, by component, 2019-2026 (USD Million)

7.5.6.3 Market size, by offering, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market size, by country 2019-2026 (USD Million)

7.6.2 Market size, by industry, 2019-2026 (USD Million)

7.6.3 Market size, by component, 2019-2026 (USD Million)

7.6.4 Market size, by offering, 2019-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market size, by industry, 2019-2026 (USD Million)

7.6.5.2 Market size, by component, 2019-2026 (USD Million)

7.6.5.3 Market size, by offering, 2019-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market size, by industry, 2019-2026 (USD Million)

7.6.6.2 Market size, by component, 2019-2026 (USD Million)

7.6.6.3 Market size, by offering, 2019-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market size, by industry, 2019-2026 (USD Million)

7.6.7.2 Market size, by component, 2019-2026 (USD Million)

7.6.7.3 Market size, by offering, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive analysis, 2020

8.2 Packsize International, Inc.

8.2.1 Company overview

8.2.2 Financial analysis

8.2.3 Strategic positioning

8.2.4 Info graphic analysis

8.3 Box on demand

8.3.1 Company overview

8.3.2 Financial analysis

8.3.3 Strategic positioning

8.3.4 Info graphic analysis

8.4 West Rock

8.4.1 Company overview

8.4.2 Financial analysis

8.4.3 Strategic positioning

8.4.4 Info graphic analysis

8.5 Model Group

8.5.1 Company overview

8.5.2 Financial analysis

8.5.3 Strategic positioning

8.5.4 Info graphic analysis

8.6 Bastian Solutions

8.6.1 Company overview

8.6.2 Financial analysis

8.6.3 Strategic positioning

8.6.4 Info graphic analysis

8.7 Packworld

8.7.1 Company overview

8.7.2 Financial analysis

8.7.3 Strategic positioning

8.7.4 Info graphic analysis

8.8 Boxon

8.8.1 Company overview

8.8.2 Financial analysis

8.8.3 Strategic positioning

8.8.4 Info graphic analysis

8.9 Signode

8.9.1 Company overview

8.9.2 Financial analysis

8.9.3 Strategic positioning

8.9.4 Info graphic analysis

8.10 International Paper

8.10.1 Company overview

8.10.2 Financial analysis

8.10.3 Strategic positioning

8.10.4 Info graphic analysis

8.11 Packhelp

8.11.1 Company overview

8.11.2 Financial analysis

8.11.3 Strategic positioning

8.11.4 Info graphic analysis

8.12 Moonen Packaging

8.12.1 Company overview

8.12.2 Financial analysis

8.12.3 Strategic positioning

8.12.4 Info graphic analysis

8.13 Rondo Packaging

8.13.1 Company overview

8.13.2 Financial analysis

8.13.3 Strategic positioning

8.13.4 Info graphic analysis

8.14 Arka

8.14.1 Company overview

8.14.2 Financial analysis

8.14.3 Strategic positioning

8.14.4 Info graphic analysis

8.15 Refine Packaging

8.15.1 Company overview

8.15.2 Financial analysis

8.15.3 Strategic positioning

8.15.4 Info graphic analysis

8.16 Packola

8.16.1 Company overview

8.16.2 Financial analysis

8.16.3 Strategic positioning

8.16.4 Info graphic analysis

The Global On Demand Packaging Solutions Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the On Demand Packaging Solutions Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS