Global Oncology Antibody Drug Conjugates Market Size, Trends & Analysis - Forecasts to 2027 By Indication (Breast Cancer, Ovarian Cancer, Cervical Cancer, NSCLC, Colorectal Cancer, Pancreatic Cancer, Hodgkin Lymphoma, Leukemia, Gastric Cancer), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East & Africa), End-User Landscape Analysis, Company Market Share Analysis, and Competitor Analysis

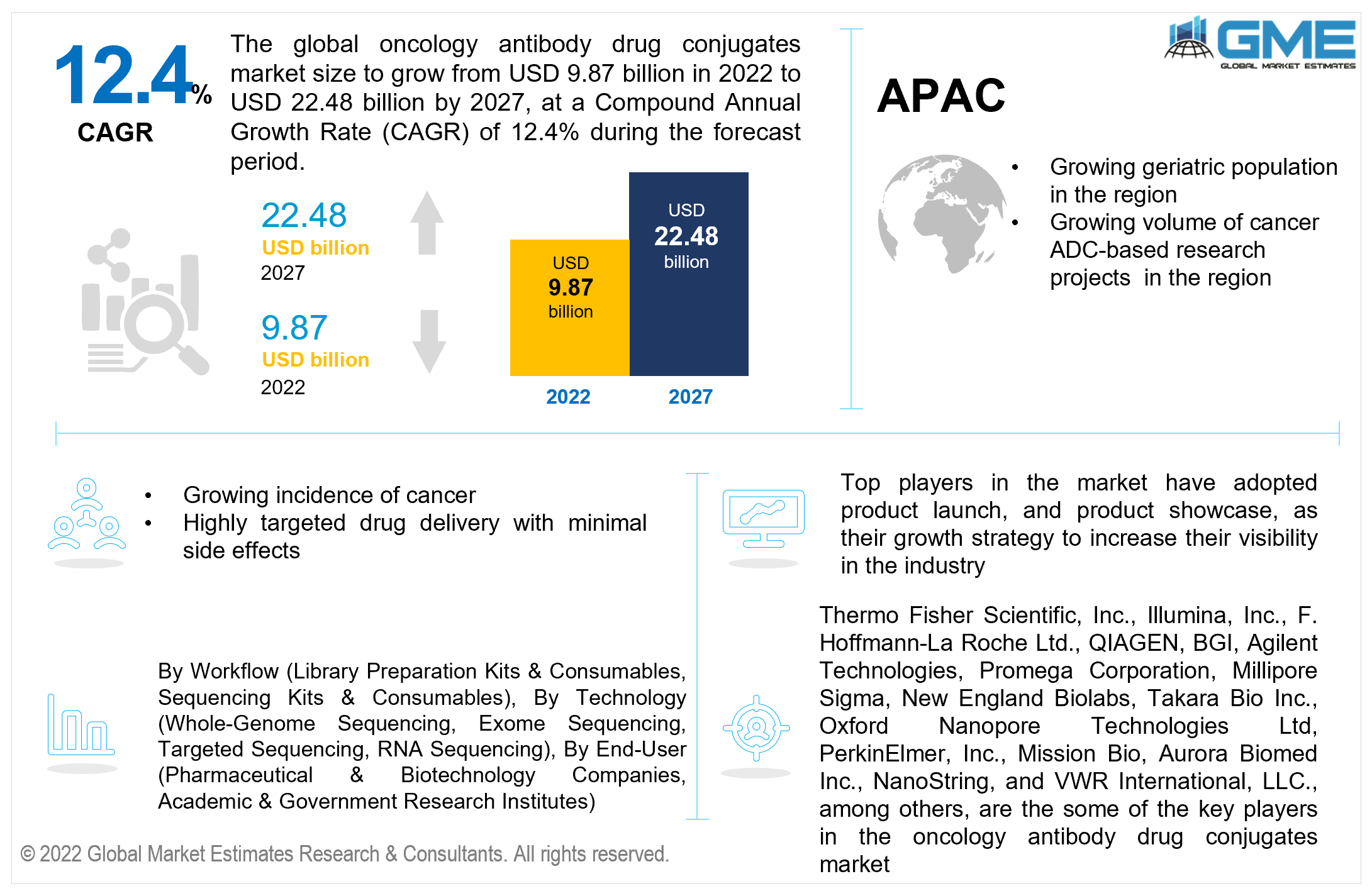

The Global Oncology Antibody Drug Conjugates Market is projected to grow from USD 9.87 billion in 2022 to USD 22.48 billion at a CAGR value of 12.4% from 2022 to 2027.

The increased prevalence of cancer in the population, favorable outcomes from the use of targeted biosimilars in cancer treatment, and the expiration of cancer drug patents are driving the market for oncology antibody drug conjugates.

People are becoming more aware of cancer and the available treatments as it has become one of the main causes of death around the world. As per the data made available by the American Cancer Society, 1.9 million new cases of cancer are expected in the United States alone. The mortality numbers for 2022 are expected to reach 609,360 deaths in the United States.

Globally, cancer has been responsible for over 10 million deaths in 2020 as per the WHO’s data. The most common forms of cancer plaguing the population are lung, breast, colon, and prostate cancers.

Some of the major causes of cancer include exposure to hazardous substances that can accumulate in the body over time, as well as lifestyle factors such as the use of alcohol, tobacco, and narcotics. The demand for targeted cancer treatment and preventive vaccines is likely to drive the growth of the oncology antibody drug conjugates market. Targeted treatment of cancer growths and tumors is becoming increasingly popular owing to the lower risk of adverse effects and greater quality of life among patients during the treatment. The cancer antibody drug conjugates make use of the body's immune system to either directly or indirectly combat cancer. The oncology antibody drug conjugates are specially designed drugs that have been produced to release toxic drugs into carcinogenic cells in the body.

Pharmaceutical and biotechnology companies have been heavily investing in the development of novel oncology antibody drug conjugates. Pfizer's Mylotarg and Bespona are examples of currently available oncology antibody drug conjugates available in the market. These two drugs are largely used for treating different types of leukemia. Gentech’s Kadcyla is utilized in treating breast cancer while Seattle Genetics’ Adectris and Genentech’s Polivy are used in the lymphoma treatments.

Governments across developing regions are increasing their investment in cancer research instituted and cancer treatment centers. The rate of new cancer cases has been estimated to reach 444 people per 100,000 people based on the cancer statistics from 2013 to 2017. This growing prevalence of cancer has been instrumental in the growing government investment in cancer research and treatment.

The oncology antibody drug conjugates market is hampered by the risk of antibody drug conjugates attacking healthy cells, the cytotoxic drugs utilized to create oncology antibody drug conjugates are generally considered to be poisonous by themselves. These compounds can reduce the red and white blood cell counts and platelet counts, cause nerve pain, and damage the liver. The high costs involved in drug development have led to high prices for these drugs in the market, poor insurance coverages, and lack of proper accessibility in developing countries are restricting the growth of the oncology antibody drug conjugates market.

The COVID-19 pandemic has seen profits soar for many pharmaceutical and biotechnology companies. The pandemic has led to rapid growth in the healthcare sector as a whole but many sectors within the industry such as oncology had to take a backseat as the world focused on dampening the impact of the pandemic.

As the world returns to normalcy, pharmaceutical companies and biotechnology companies are expected to increase investment in the development of novel oncology antibody drug conjugates owing to the greater availability of funds. Patient treatments that had been delayed are slowly being completed and restarted.

The growing prevalence of cancer among the geriatric population combined with the impact of COVID is expected to further increase the demand for oncology antibody drug conjugates.

The conflict between Ukraine and Russia has had a substantial influence on global trade. The oncology antibody drug conjugates market has surely been affected by disruption in operations in these two countries bolstered by numerous businesses' voluntary boycotting of conducting business in Russia.

Due to the disruption of clinical trials and treatment procedures in Ukraine, demand for oncology antibody drug conjugates and other consumables used for pharmaceutical research and treatment has decreased. Because of the trade restrictions imposed on Russia, a substantial number of research and treatment institutes would witness a shortage of oncology antibody drug conjugates.

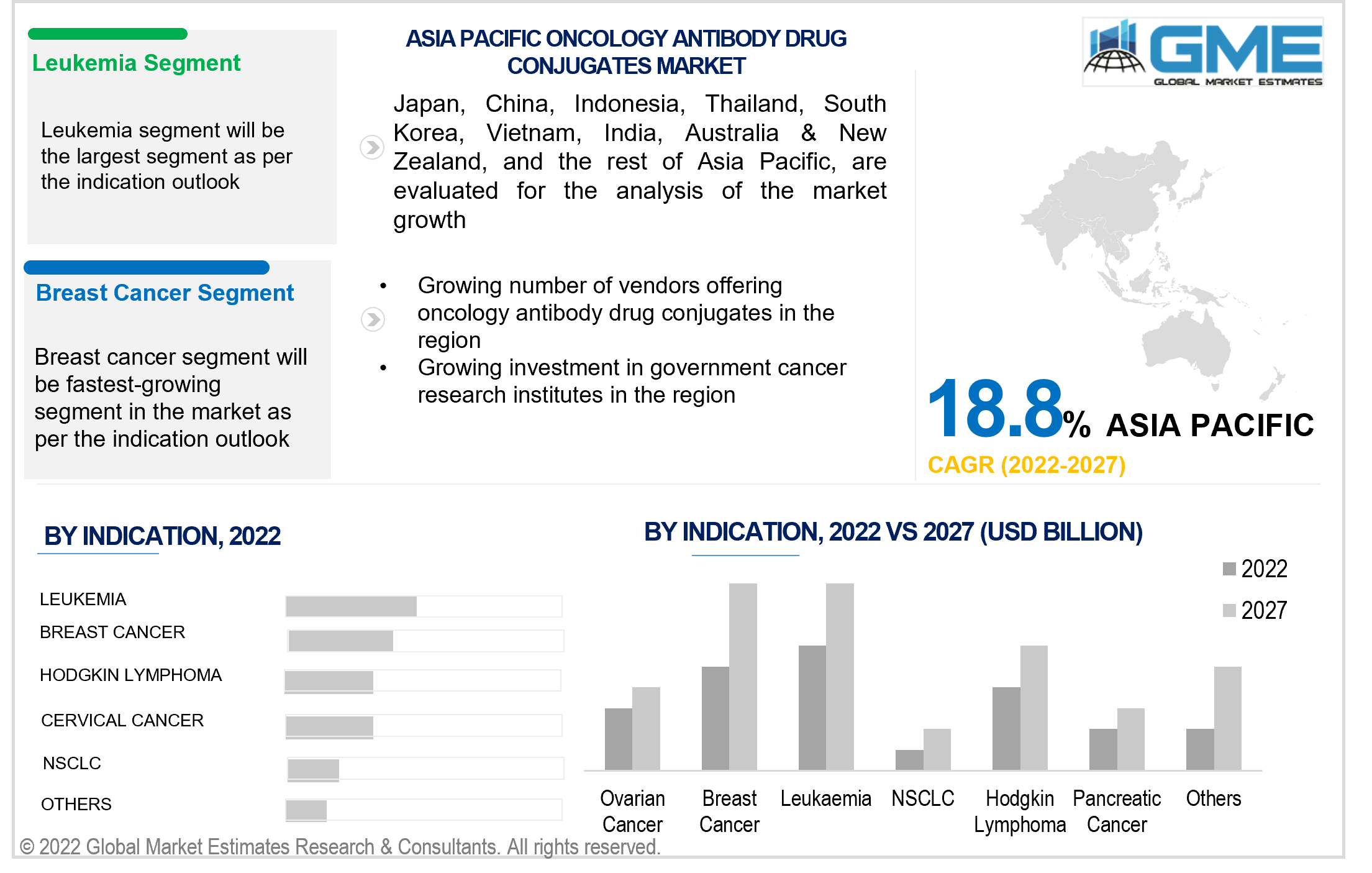

The leukemia segment is expected to be the largest oncology antibody drug conjugates market segment based on the indication. The large number of FDA-approved treatment options that are available for treating various types of leukemia has led to the dominance of the leukemia segment. The heavy investment in the development of novel targeted treatments for blood cancer has also played a crucial role in the development of this segment.

The breast cancer segment is expected to be the fastest-growing segment in the market. The breast cancer segment already has seen an increase in the availability of oncology antibody drug conjugates for treating breast cancer and the expected increase in FDA approvals for new products is expected to further expand the market segment.

North America (the United States, Canada, and Mexico) will dominate the oncology antibody drug conjugates market from 2022 to 2027. The presence of major pharmaceutical players in the region, greater investment by governments into the cancer treatment and healthcare sector as a whole, and the strong insurance market in the region have contributed to the dominance of the region.

The United States is expected to have the lion's share in the North American oncology antibody drug conjugates market. This is attributed to the large number of world-class cancer research and treatment institutions present in the United States, strong government support, good insurance coverage, and heavy investment in oncology pharmaceuticals development by pharmaceutical companies in the country.

However, the Asia-Pacific region is expected to be the fastest-growing region in the oncology antibody drug conjugates market during the forecast period. The growing prevalence of cancer among the region’s population, increasing investment in cancer treatment research, a growing number of pharmaceutical companies, and the growing government investment in cancer research institutes in the region.

China is expected to hold the largest share in the Asia Pacific oncology antibody drug conjugates market. The growing number of cancer research institutions in the country combined with the growing prevalence of cancer among the population and growing geriatric populations are expected to enhance the growth of the Chinese oncology antibody drug conjugates market.

Pfizer Inc., Astellas Pharma Inc., Gilead Sciences, Inc., GlaxoSmithKline, F. Hoffmann-La Roche AG, Daiichi Sankyo, AstraZeneca, Sanofi, AbbVie, Merck & Co., Byondis, RemeGen, ImmunoGen, Seagen, Rakuten Medical, BioAtla, Bicycle Therapeutics, ADC Therapeutics, Genmab, Helix BioPharma, CytomX, and Innate Pharma, among others, are some of the key players in the oncology antibody drug conjugates market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Research Methodology

1.1 Research Assumptions

1.2 Research Methodology

1.2.1 Estimates and Forecast Timeline

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GME’s Internal Database

1.3.3 Primary Research

1.3.4 Secondary Sources & Third-Party Perspectives

1.3.4.1 Company Information Sources: Annual Reports, Investor Presentation, Press Release, SEC Filling, Company Blogs & Website

1.3.4.2 Secondary Data Sources: World Health Organization, USFDA, National Cancer Institute, American Cancer Society, CDC, WCRF, and the Global Cancer Observatory, among others

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Data Visualization

1.6 Data Validation & Publishing

1.7 Market Model

1.7.1 Model Details

1.7.1.1 Top-Down Approach

1.7.1.2 Bottom-Up Approach

1.8 Market Segmentation & Scope

1.9 Market Definition

Chapter 2 Executive Summary

2.1. Global Market Outlook

2.2 Indication Outlook

2.3 Regional Outlook

Chapter 3 Global Oncology Antibody Drug Conjugates Market Trend Analysis

3.1. Market Introduction

3.2 Penetration & Growth Prospect Mapping

3.3 Impact of COVID-19 on the Oncology Antibody Drug Conjugates Market

3.4 Metric Data on Cash Transactions

3.5 Market Driver Analysis

3.5.1 Market Driver Analysis

3.5.2 Market Restraint Analysis

3.5.3 Industry Challenges

3.5.4 Industry Opportunities

3.6 Porter’s Five Analysis

3.6.1 Supplier Power

3.6.2 Buyer Power

3.6.3 Substitution Threat

3.6.4 Threat from New Entrant

3.7 Market Entry Strategies

Chapter 4 Oncology Antibody Drug Conjugates Market: Indication Trend Analysis

4.1 Indication: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

4.2 Breast Cancer

4.2.1 Market Estimates & Forecast Analysis of Breast Cancer Segment, By Region, 2019-2027 (USD Billion)

4.3 Ovarian Cancer

4.3.1 Market Estimates & Forecast Analysis of Ovarian Cancer Segment, By Region, 2019-2027 (USD Billion)

4.4 Cervical Cancer

4.4.1 Market Estimates & Forecast Analysis of Cervical Cancer Segment, By Region, 2019-2027 (USD Billion)

4.5 NSCLC

4.5.1 Market Estimates & Forecast Analysis of NSCLC Segment, By Region, 2019-2027 (USD Billion)

4.6 Colorectal Cancer

4.6.1 Market Estimates & Forecast Analysis of Colorectal Cancer Segment, By Region, 2019-2027 (USD Billion)

4.7 Pancreatic Cancer

4.7.1 Market Estimates & Forecast Analysis of Colorectal Cancer Segment, By Region, 2019-2027 (USD Billion)

4.8 Hodgkin Lymphoma

4.8.1 Market Estimates & Forecast Analysis of Hodgkin Lymphoma End-User Segment, By Region, 2019-2027 (USD Billion)

4.9 Leukaemia

4.9.1 Market Estimates & Forecast Analysis of Leukaemia Segment, By Region, 2019-2027 (USD Billion)

4.10 Gastric Cancer

4.10.1 Market Estimates & Forecast Analysis of Gastric Cancer Segment, By Region, 2019-2027 (USD Billion)

4.11 Others

4.11.1 Market Estimates & Forecast Analysis of Others Segment, By Region, 2019-2027 (USD Billion)

Chapter 5 Oncology Antibody Drug Conjugates Market, By Region

5.1 Regional Outlook

5.2 North America

5.2.1 Market Estimates & Forecast Analysis, By Country 2019-2025 (USD Billion)

5.2.2 Market Estimates & Forecast Analysis, By Indication, 2019-2025 (USD Billion)

5.2.3 U.S.

5.2.3.1 Market Estimates & Forecast Analysis, By Indication, 2019-2025 (USD Billion)

5.2.4 Canada

5.2.4.1 Market Estimates & Forecast Analysis, By Indication, 2019-2025 (USD Billion)

5.2.5 Mexico

5.2.5.1 Market Estimates & Forecast Analysis, By Indication, 2019-2027 (USD Billion)

5.3 Europe

5.3.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

5.3.2 Market Estimates & Forecast Analysis, By Indication, 2019-2027 (USD Billion)

5.3.3 Germany

5.3.3.1 Market Estimates & Forecast Analysis, By Indication, 2019-2027 (USD Billion)

5.3.4 UK

5.3.4.1 Market Estimates & Forecast Analysis, By Indication, 2019-2027 (USD Billion)

5.3.5 France

5.3.5.1 Market Estimates & Forecast Analysis, By Indication, 2019-2027 (USD Billion)

5.3.6 Russia

5.3.6.1 Market Estimates & Forecast Analysis, By Indication, 2019-2027 (USD Billion)

5.3.7 Italy

5.3.7.1 Market Estimates & Forecast Analysis, By Indication, 2019-2027 (USD Billion)

5.3.8 Spain

5.3.8.1 Market Estimates & Forecast Analysis, By Indication, 2019-2027 (USD Billion)

5.3.9 Rest of Europe

5.3.9.1 Market Estimates & Forecast Analysis, By Indication, 2019-2027 (USD Billion)

5.4 Asia Pacific

5.4.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

5.4.2 Market Estimates & Forecast Analysis, By Indication, 2019-2027 (USD Billion)

5.4.3 China

5.4.3.1 Market Estimates & Forecast Analysis, By Indication, 2019-2027 (USD Billion)

5.4.4 India

5.4.4.1 Market Estimates & Forecast Analysis, By Indication, 2019-2027 (USD Billion)

5.4.5 Japan

5.4.5.1 Market Estimates & Forecast Analysis, By Indication, 2019-2027 (USD Billion)

5.4.6 Australia

5.4.6.1 Market Estimates & Forecast Analysis, By Indication, 2019-2027 (USD Billion)

5.4.7 South Korea

5.4.7.1 Market Estimates & Forecast Analysis, By Indication, 2019-2027 (USD Billion)

5.4.8 Rest of Asia Pacific

7.3.8.1 Market Estimates & Forecast Analysis, By Indication, 2019-2027 (USD Billion)

5.5 Central & South America

5.5.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

5.5.2 Market Estimates & Forecast Analysis, By Indication, 2019-2027 (USD Billion)

5.5.3 Brazil

5.5.3.1 Market Estimates & Forecast Analysis, By Indication, 2019-2027 (USD Billion)

5.5.4 Rest of Central & South America

5.5.4.1 Market Estimates & Forecast Analysis, By Indication, 2019-2027 (USD Billion)

5.6 Middle East & Africa

5.6.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

5.6.2 Market Estimates & Forecast Analysis, By Indication, 2019-2027 (USD Billion)

5.6.3 Saudi Arabia

5.6.3.1 Market Estimates & Forecast Analysis, By Indication, 2019-2027 (USD Billion)

5.6.4 United Arab Emirates

5.6.4.1 Market Estimates & Forecast Analysis, By Indication, 2019-2027 (USD Billion)

5.6.5 South Africa

5.6.5.1 Market Estimates & Forecast Analysis, By Indication, 2019-2027 (USD Billion)

5.6.6 Rest of Middle East & Africa

5.6.6.1 Market Estimates & Forecast Analysis, By Indication, 2019-2027 (USD Billion)

Chapter 8 Competitive Analysis

8.1 Key Global Players, Recent Developments & their Impact on the Industry

8.2 Four Quadrant Competitor Positioning Matrix

8.2.1 Key Innovators

8.2.2 Market Leaders

8.2.3 Emerging Players

8.2.4 Market Challengers

8.3 Vendor Landscape Analysis

8.4 End-User Landscape Analysis

8.5 Company Market Share Analysis, 2021

Chapter 9 Company Profile Analysis

9.1 Pfizer Inc.

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Strategic Initiatives

9.1.4 Product Benchmarking

9.2 Astellas Pharma Inc.

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Initiatives

9.2.4 Product Benchmarking

9.3 Gilead Sciences, Inc.

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Initiatives

9.3.4 Product Benchmarking

9.4 GlaxoSmithKline

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Initiatives

9.4.4 Product Benchmarking

9.5 F. Hoffmann-La Roche AG

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Initiatives

9.5.4 Product Benchmarking

9.6 Daiichi Sankyo

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Initiatives

9.6.4 Product Benchmarking

9.7 AstraZeneca

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Initiatives

9.7.4 Product Benchmarking

9.8 Sanofi

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Initiatives

9.8.4 Product Benchmarking

9.9 AbbVie

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Initiatives

9.9.4 Product Benchmarking

9.10 Merck & Co.

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Initiatives

9.10.4 Product Benchmarking

9.11 Other Companies

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Initiatives

9.11.4 Product Benchmarking

List of Tables

1 Technological Advancements In Oncology Antibody Drug Conjugates Market

2 Global Oncology Antibody Drug Conjugates Market: Key Market Drivers

3 Global Oncology Antibody Drug Conjugates Market: Key Market Challenges

4 Global Oncology Antibody Drug Conjugates Market: Key Market Opportunities

5 Global Oncology Antibody Drug Conjugates Market: Key Market Restraints

6 Global Oncology Antibody Drug Conjugates Market Estimates & Forecast Analysis, 2019-2027 (USD Billion)

7 Global Oncology Antibody Drug Conjugates Market, By Indication, 2019-2027 (USD Billion)

8 Breast Cancer: Global Oncology Antibody Drug Conjugates Market, By Region, 2019-2027 (USD Billion)

9 Ovarian Cancer: Global Oncology Antibody Drug Conjugates Market, By Region, 2019-2027 (USD Billion)

10 Cervical Cancer: Global Oncology Antibody Drug Conjugates Market, By Region, 2019-2027 (USD Billion)

11 NSCLC: Global Oncology Antibody Drug Conjugates Market, By Region, 2019-2027 (USD Billion)

12 Colorectal Cancer: Global Oncology Antibody Drug Conjugates Market, By Region, 2019-2027 (USD Billion)

13 Pancreatic Cancer: Global Oncology Antibody Drug Conjugates Market, By Region, 2019-2027 (USD Billion)

14 Hodgkin Lymphoma: Global Oncology Antibody Drug Conjugates Market, By Region, 2019-2027 (USD Billion)

15 Leukaemia: Global Oncology Antibody Drug Conjugates Market, By Region, 2019-2027 (USD Billion)

16 Gastric Cancer: Global Oncology Antibody Drug Conjugates Market, By Region, 2019-2027 (USD Billion)

17 Others: Global Oncology Antibody Drug Conjugates Market, By Region, 2019-2027 (USD Billion)

18 Regional Analysis: Global Oncology Antibody Drug Conjugates Market, By Region, 2019-2027 (USD Billion)

19 North America: Oncology Antibody Drug Conjugates Market, By Indication, 2019-2027 (USD Billion)

20 North America: Oncology Antibody Drug Conjugates Market, By Country, 2019-2027 (USD Billion)

21 U.S: Oncology Antibody Drug Conjugates Market, By Indication, 2019-2027 (USD Billion)

22 Canada: Oncology Antibody Drug Conjugates Market, By Indication, 2019-2027 (USD Billion)

23 Mexico: Oncology Antibody Drug Conjugates Market, By Indication, 2019-2027 (USD Billion)

24 Europe: Oncology Antibody Drug Conjugates Market, By Indication, 2019-2027 (USD Billion)

25 Europe: Oncology Antibody Drug Conjugates Market, By Country, 2019-2027 (USD Billion)

26 Germany: Oncology Antibody Drug Conjugates Market, By Indication, 2019-2027 (USD Billion)

27 UK: Oncology Antibody Drug Conjugates Market, By Indication, 2019-2027 (USD Billion)

28 France: Oncology Antibody Drug Conjugates Market, By Indication, 2019-2027 (USD Billion)

29 Italy: Oncology Antibody Drug Conjugates Market, By Indication, 2019-2027 (USD Billion)

30 Spain: Oncology Antibody Drug Conjugates Market, By Indication, 2019-2027 (USD Billion)

31 Rest Of Europe: Oncology Antibody Drug Conjugates Market, By Indication, 2019-2027 (USD Billion)

32 Asia Pacific: Oncology Antibody Drug Conjugates Market, By Indication, 2019-2027 (USD Billion)

33 Asia Pacific: Oncology Antibody Drug Conjugates Market, By Country, 2019-2027 (USD Billion)

34 China: Oncology Antibody Drug Conjugates Market, By Indication, 2019-2027 (USD Billion)

35 India: Oncology Antibody Drug Conjugates Market, By Indication, 2019-2027 (USD Billion)

36 Japan: Oncology Antibody Drug Conjugates Market, By Indication, 2019-2027 (USD Billion)

37 South Korea: Oncology Antibody Drug Conjugates Market, By Indication, 2019-2027 (USD Billion)

38 Middle East & Africa: Oncology Antibody Drug Conjugates Market, By Indication, 2019-2027 (USD Billion)

39 Middle East & Africa: Oncology Antibody Drug Conjugates Market, By Country, 2019-2027 (USD Billion)

40 Saudi Arabia: Oncology Antibody Drug Conjugates Market, By Indication, 2019-2027 (USD Billion)

41 UAE: Oncology Antibody Drug Conjugates Market, By Indication, 2019-2027 (USD Billion)

42 Central & South America: Oncology Antibody Drug Conjugates Market, By Indication, 2019-2027 (USD Billion)

43 Central & South America: Oncology Antibody Drug Conjugates Market, By Country, 2019-2027 (USD Billion)

44 Brazil: Oncology Antibody Drug Conjugates Market, By Indication, 2019-2027 (USD Billion)

45 Pfizer Inc.: Products Offered

46 Astellas Pharma Inc.: Products Offered

47 Gilead Sciences, Inc.: Products Offered

48 GlaxoSmithKline: Products Offered

49 F. Hoffmann-La Roche AG: Products Offered

50 Daiichi Sankyo: Products Offered

51 AstraZeneca: Products Offered

52 Sanofi: Products Offered

53 AbbVie: Products Offered

54 Merck & Co.: Products Offered

55 Other Companies: Products Offered

List of Figures

1. Global Oncology Antibody Drug Conjugates Market Segmentation & Research Scope

2. Primary Research Partners and Local Informers

3. Primary Research Process

4. Primary Research Approaches

5. Primary Research Responses

6. Global Oncology Antibody Drug Conjugates Market: Penetration & Growth Prospect Mapping

7. Global Oncology Antibody Drug Conjugates Market: Value Chain Analysis

8. Global Oncology Antibody Drug Conjugates Market Drivers

9. Global Oncology Antibody Drug Conjugates Market Restraints

10. Global Oncology Antibody Drug Conjugates Market Opportunities

11. Global Oncology Antibody Drug Conjugates Market Challenges

12. Key Oncology Antibody Drug Conjugates Market Manufacturer Analysis

13. Global Oncology Antibody Drug Conjugates Market: Porter’s Five Forces Analysis

14. PESTLE Analysis & Impact Analysis

15. Pfizer Inc.: Company Snapshot

16. Pfizer Inc.: Swot Analysis

17. Astellas Pharma Inc.: Company Snapshot

18. Astellas Pharma Inc.: Swot Analysis

19. Gilead Sciences, Inc.: Company Snapshot

20. Gilead Sciences, Inc.: Swot Analysis

21. GlaxoSmithKline: Company Snapshot

22. GlaxoSmithKline: Swot Analysis

23. F. Hoffmann-La Roche AG: Company Snapshot

24. F. Hoffmann-La Roche AG: Swot Analysis

25. Daiichi Sankyo: Company Snapshot

26. Daiichi Sankyo: Swot Analysis

27. AstraZeneca: Company Snapshot

28. AstraZeneca: Swot Analysis

29. Sanofi: Company Snapshot

30. Sanofi: Swot Analysis

31. AbbVie: Company Snapshot

32. AbbVie: Swot Analysis

33. Merck & Co.: Company Snapshot

34. Merck & Co.: Swot Analysis

35. Other Companies: Company Snapshot

36. Other Companies: Swot Analysis

The Global Oncology Antibody Drug Conjugates Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Oncology Antibody Drug Conjugates Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS