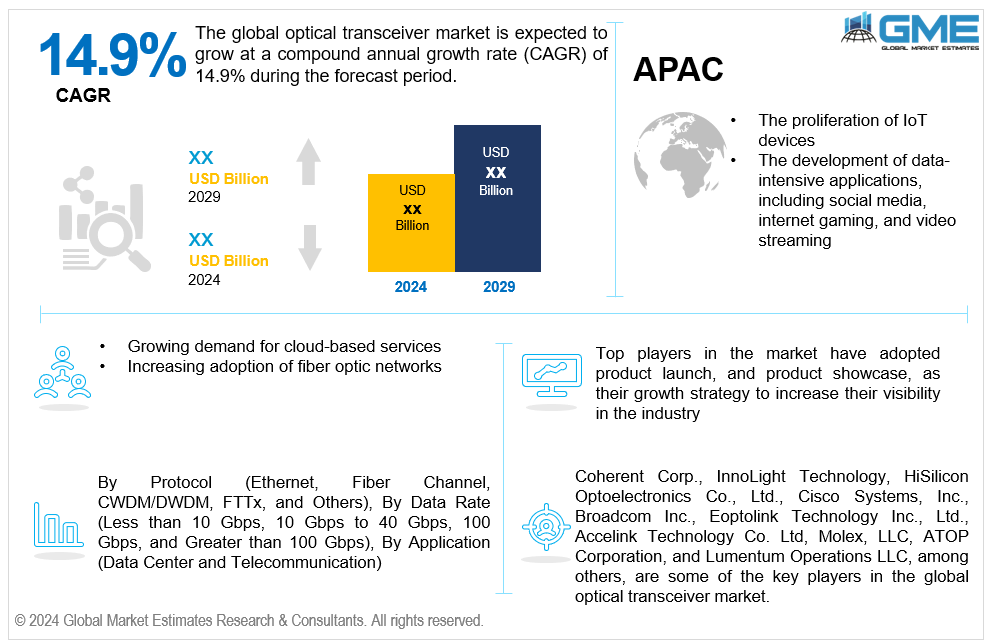

Global Optical Transceiver Market Size, Trends & Analysis - Forecasts to 2029 By Protocol (Ethernet, Fiber Channel, CWDM/DWDM, FTTx, and Others), By Data Rate (Less than 10 Gbps, 10 Gbps to 40 Gbps, 100 Gbps, and Greater than 100 Gbps), By Application (Data Center and Telecommunication), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global optical transceiver market is estimated to exhibit a CAGR of 14.9% from 2024 to 2029.

The primary factors propelling the market growth are the proliferation of IoT devices and the development of data-intensive applications, including social media, internet gaming, and video streaming. Reliable and fast communication networks are in greater demand as the number of IoT devices in numerous industries, including healthcare, manufacturing, transportation, and smart cities, keeps rising. Due to its reputation for delivering data over great distances with little signal loss, fiber optic transceivers are becoming increasingly important in Internet of Things deployments where capacity and dependability are critical. Furthermore, the rising necessity for faster data transmission rates to accommodate the large influx of data created by IoT devices is driving the demand for high-speed optical transceivers. For instance, the number of worldwide IoT connections increased by 18% in 2022 to reach 14.3 billion active IoT endpoints, according to the State of IoT—Spring 2023 report.

Growing demand for cloud-based services and the increasing adoption of fiber optic networks are expected to support the market growth. The growing dependence of enterprises and consumers on cloud computing for software services, computing power, and storage has increased the demand for scalable, dependable, and fast communication infrastructure. Transceivers and other optical communication modules are essential for facilitating quick and effective data transfer between end-user devices, data centers, and cloud servers. Additionally, wireless optical transceivers are becoming increasingly prevalent in cloud environments since they eliminate the need for physical cables and enable flexibility and convenience of installation. For instance, HashiCorp (2023) reports that 90% of large enterprises have implemented multi-cloud infrastructure.

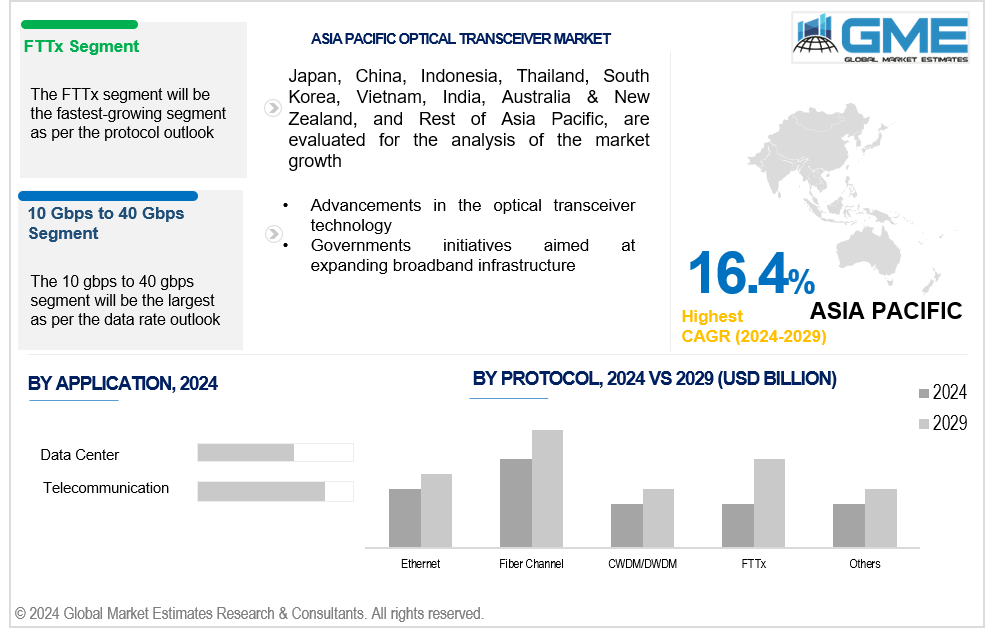

Advancements in the optical transceiver technology in optical interconnect solutions and coherent optical transceivers and government initiatives aimed at expanding broadband infrastructure propel market growth. With continuous advancements in optical transceiver technology, various industries and applications have fulfilled their changing needs through performance, efficiency, and scalability improvements. For instance, coherent optical transceivers use sophisticated signal processing methods and modulation techniques to offer longer reach, greater data transfer rates, and better spectral efficiency. Additionally, by providing more affordable and energy-efficient options to conventional copper-based interconnects, the development of optical interconnect solutions, such as silicon photonics and integrated photonics, has completely changed data center and telecommunications networks.

Consistent demand for more bandwidth and the expansion of 5G networks present significant opportunities for coherent optical transceivers. These transceivers are crucial for expanding the telecommunications infrastructure, allowing for effective transmission over great distances with little signal loss. Furthermore, upgrading existing networks is necessary for increasing data rates and developing technology, especially in data centers and telephony. This allows manufacturers of optical transceiver modules to offer cutting-edge solutions that satisfy expanding bandwidth requirements while maintaining backward compatibility.

However, complexity in the installation and maintenance and significant upfront investment hinder market growth.

The fiber channel segment is expected to hold the largest share of the market over the forecast period. High-performance computer settings frequently use fiber channel protocols, where quick data transmission and minimal latency are essential. These protocols are commonly used for server and storage communication in data centers and storage area networks (SANs), where quick data transfer is necessary for smooth operations.

The Fiber to the x (FTTx) segment is expected to be the fastest-growing segment in the market from 2024-2029. Fiber optic cables are installed as part of FTTx technology to provide voice, video, and high-speed internet to residential, business, and industrial locations. The need to convert current copper-based networks to fiber optics is expanding due to the increased demand for high-bandwidth applications like streaming video, online gaming, and cloud services.

The 10 Gbps to 40 Gbps segment is expected to hold the largest share of the market over the forecast period. Optical transceivers operating in the 10 Gbps to 40 Gbps range often offer a good balance between cost-effectiveness and performance. They are more reasonably priced and energy-efficient than alternatives with slower speeds, but they also offer higher data rates.

The greater than 100 Gbps segment is anticipated to be the fastest-growing segment in the market from 2024-2029. Next-generation optical transceivers, such as 400G Ethernet and beyond, are being deployed to meet the requirements of ultra-fast and low-latency connectivity. Optical transceivers operating at data rates greater than 100 Gbps are essential components of these advanced network infrastructures.

The telecommunication segment is expected to hold the largest share of the market over the forecast period. In the telecommunication industry, the launch of 5G networks is significantly increasing demand for optical transceivers. In order to facilitate bandwidth-intensive applications like augmented reality, Internet of Things (IoT) devices, and high-definition video streaming, 5G networks need to have dependable and fast connectivity. Optical transceivers play a crucial role in providing the necessary backbone infrastructure for 5G networks.

The data center segment is anticipated to be the fastest-growing segment in the market from 2024-2029. Due to the widespread use of cloud computing, big data analytics, streaming services, and other data-intensive applications, data centers are witnessing an unparalleled surge in data traffic. High-speed optical transceivers are therefore becoming increasingly necessary to enable the transmission of massive amounts of data inside data centers.

North America is expected to be the largest region in the global market. The growing number of data centers in the North American region is expected to support the market growth. Optical transceivers capable of supporting data rates such as 100 Gbps, 400 Gbps, and beyond are in high demand to enable faster data transmission and reduce latency within data centers. For instance, as per Cloudscene, the United States had the highest number of data centers globally as of September 2023, with 5,375.

Asia Pacific is anticipated to witness rapid growth during the forecast period. Asia Pacific countries such as China, India, Japan, and South Korea are making substantial investments in telecom infrastructure to satisfy the growing demand for mobile connectivity and high-speed internet. This increases the need for optical transceivers in fiber optic networks, which are essential for rapid data transmission and long-distance communication. For instance, China has invested a total of USD 101.4 billion (CNY 730 billion) in 5G base stations in the year 2023, according to RCR Wireless News.

Coherent Corp., InnoLight Technology, HiSilicon Optoelectronics Co., Ltd., Cisco Systems, Inc., Broadcom Inc., Eoptolink Technology Inc., Ltd., Accelink Technology Co. Ltd, Molex, LLC, ATOP Corporation, and Lumentum Operations LLC, among others, are some of the key players in the global optical transceiver market.

Please note: This is not an exhaustive list of companies profiled in the report.

In November 2023, at a price of around USD 750 million, Lumentum Operations LLC acquired Cloud Light Technology Limited, a provider of optical fiber transceivers, optical sensors, and optical solutions.

In February 2023, using opto-semiconductor manufacturing technology, Hamamatsu Photonics K.K. developed the optical transceiver P16671-01AS, which transfers data at a rate of 1.25 Gbps. This transceiver was created for application in medical, scientific, and semiconductor manufacturing apparatus.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL OPTICAL TRANSCEIVER MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL OPTICAL TRANSCEIVER MARKET, BY PROTOCOL

4.1 Introduction

4.2 Optical Transceiver Market: Protocol Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Ethernet

4.4.1 Ethernet Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Fiber Channel

4.5.1 Fiber Channel Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 CWDM/DWDM

4.6.1 CWDM/DWDM Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 FTTx

4.7.1 FTTx Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Others

4.8.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL OPTICAL TRANSCEIVER MARKET, BY DATA RATE

5.1 Introduction

5.2 Optical Transceiver Market: Data Rate Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Less than 10 Gbps

5.4.1 Less than 10 Gbps Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 10 Gbps to 40 Gbps

5.5.1 10 Gbps to 40 Gbps Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 100 Gbps

5.6.1 100 Gbps Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Greater than 100 Gbps

5.7.1 Greater than 100 Gbps Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL OPTICAL TRANSCEIVER MARKET, BY APPLICATION

6.1 Introduction

6.2 Optical Transceiver Market: Application Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Data Center

6.4.1 Data Center Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Telecommunication

6.5.1 Telecommunication Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL OPTICAL TRANSCEIVER MARKET, BY REGION

7.1 Introduction

7.2 North America Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Protocol

7.2.2 By Data Rate

7.2.3 By Application

7.2.4 By Country

7.2.4.1 U.S. Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Protocol

7.2.4.1.2 By Data Rate

7.2.4.1.3 By Application

7.2.4.2 Canada Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Protocol

7.2.4.2.2 By Data Rate

7.2.4.2.3 By Application

7.2.4.3 Mexico Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Protocol

7.2.4.3.2 By Data Rate

7.2.4.3.3 By Application

7.3 Europe Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Protocol

7.3.2 By Data Rate

7.3.3 By Application

7.3.4 By Country

7.3.4.1 Germany Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Protocol

7.3.4.1.2 By Data Rate

7.3.4.1.3 By Application

7.3.4.2 U.K. Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Protocol

7.3.4.2.2 By Data Rate

7.3.4.2.3 By Application

7.3.4.3 France Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Protocol

7.3.4.3.2 By Data Rate

7.3.4.3.3 By Application

7.3.4.4 Italy Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Protocol

7.3.4.4.2 By Data Rate

7.2.4.4.3 By Application

7.3.4.5 Spain Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Protocol

7.3.4.5.2 By Data Rate

7.2.4.5.3 By Application

7.3.4.6 Netherlands Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Protocol

7.3.4.6.2 By Data Rate

7.2.4.6.3 By Application

7.3.4.7 Rest of Europe Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Protocol

7.3.4.7.2 By Data Rate

7.2.4.7.3 By Application

7.4 Asia Pacific Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Protocol

7.4.2 By Data Rate

7.4.3 By Application

7.4.4 By Country

7.4.4.1 China Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Protocol

7.4.4.1.2 By Data Rate

7.4.4.1.3 By Application

7.4.4.2 Japan Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Protocol

7.4.4.2.2 By Data Rate

7.4.4.2.3 By Application

7.4.4.3 India Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Protocol

7.4.4.3.2 By Data Rate

7.4.4.3.3 By Application

7.4.4.4 South Korea Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Protocol

7.4.4.4.2 By Data Rate

7.4.4.4.3 By Application

7.4.4.5 Singapore Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Protocol

7.4.4.5.2 By Data Rate

7.4.4.5.3 By Application

7.4.4.6 Malaysia Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Protocol

7.4.4.6.2 By Data Rate

7.4.4.6.3 By Application

7.4.4.7 Thailand Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Protocol

7.4.4.7.2 By Data Rate

7.4.4.7.3 By Application

7.4.4.8 Indonesia Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Protocol

7.4.4.8.2 By Data Rate

7.4.4.8.3 By Application

7.4.4.9 Vietnam Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Protocol

7.4.4.9.2 By Data Rate

7.4.4.9.3 By Application

7.4.4.10 Taiwan Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Protocol

7.4.4.10.2 By Data Rate

7.4.4.10.3 By Application

7.4.4.11 Rest of Asia Pacific Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Protocol

7.4.4.11.2 By Data Rate

7.4.4.11.3 By Application

7.5 Middle East and Africa Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Protocol

7.5.2 By Data Rate

7.5.3 By Application

7.5.4 By Country

7.5.4.1 Saudi Arabia Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Protocol

7.5.4.1.2 By Data Rate

7.5.4.1.3 By Application

7.5.4.2 U.A.E. Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Protocol

7.5.4.2.2 By Data Rate

7.5.4.2.3 By Application

7.5.4.3 Israel Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Protocol

7.5.4.3.2 By Data Rate

7.5.4.3.3 By Application

7.5.4.4 South Africa Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Protocol

7.5.4.4.2 By Data Rate

7.5.4.4.3 By Application

7.5.4.5 Rest of Middle East and Africa Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Protocol

7.5.4.5.2 By Data Rate

7.5.4.5.2 By Application

7.6 Central and South America Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Protocol

7.6.2 By Data Rate

7.6.3 By Application

7.6.4 By Country

7.6.4.1 Brazil Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Protocol

7.6.4.1.2 By Data Rate

7.6.4.1.3 By Application

7.6.4.2 Argentina Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Protocol

7.6.4.2.2 By Data Rate

7.6.4.2.3 By Application

7.6.4.3 Chile Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Protocol

7.6.4.3.2 By Data Rate

7.6.4.3.3 By Application

7.6.4.4 Rest of Central and South America Optical Transceiver Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Protocol

7.6.4.4.2 By Data Rate

7.6.4.4.3 By Application

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 Coherent Corp.

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 InnoLight Technology

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 HiSilicon Optoelectronics Co., Ltd.

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Cisco Systems, Inc.

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Broadcom Inc.

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 EOPTOLINK TECHNOLOGY INC., LTD.

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Accelink Technology Co. Ltd

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Molex, LLC

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 ATOP Corporation

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Lumentum Operations LLC

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Type Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Optical Transceiver Market, By Protocol, 2021-2029 (USD Mllion)

2 Ethernet Market, By Region, 2021-2029 (USD Mllion)

3 Fiber Channel Market, By Region, 2021-2029 (USD Mllion)

4 CWDM/DWDM Market, By Region, 2021-2029 (USD Mllion)

5 FTTx Market, By Region, 2021-2029 (USD Mllion)

6 Others Market, By Region, 2021-2029 (USD Mllion)

7 Global Optical Transceiver Market, By Data Rate, 2021-2029 (USD Mllion)

8 Less than 10 Gbps Market, By Region, 2021-2029 (USD Mllion)

9 10 Gbps to 40 Gbps Market, By Region, 2021-2029 (USD Mllion)

10 100 Gbps Market, By Region, 2021-2029 (USD Mllion)

11 Greater than 100 Gbps Market, By Region, 2021-2029 (USD Mllion)

12 Global Optical Transceiver Market, By Application, 2021-2029 (USD Mllion)

13 Data Center Market, By Region, 2021-2029 (USD Mllion)

14 Telecommunication Market, By Region, 2021-2029 (USD Mllion)

15 Regional Analysis, 2021-2029 (USD Mllion)

16 North America Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

17 North America Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

18 North America Optical Transceiver Market, By Application, 2021-2029 (USD Million)

19 North America Optical Transceiver Market, By Country, 2021-2029 (USD Million)

20 U.S Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

21 U.S Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

22 U.S Optical Transceiver Market, By Application, 2021-2029 (USD Million)

23 Canada Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

24 Canada Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

25 Canada Optical Transceiver Market, By Application, 2021-2029 (USD Million)

26 Mexico Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

27 Mexico Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

28 Mexico Optical Transceiver Market, By Application, 2021-2029 (USD Million)

29 Europe Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

30 Europe Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

31 Europe Optical Transceiver Market, By Application, 2021-2029 (USD Million)

32 Europe Optical Transceiver Market, By Country 2021-2029 (USD Million)

33 Germany Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

34 Germany Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

35 Germany Optical Transceiver Market, By Application, 2021-2029 (USD Million)

36 U.K Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

37 U.K Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

38 U.K Optical Transceiver Market, By Application, 2021-2029 (USD Million)

39 France Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

40 France Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

41 France Optical Transceiver Market, By Application, 2021-2029 (USD Million)

42 Italy Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

43 Italy Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

44 Italy Optical Transceiver Market, By Application, 2021-2029 (USD Million)

45 Spain Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

46 Spain Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

47 Spain Optical Transceiver Market, By Application, 2021-2029 (USD Million)

48 Netherlands Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

49 Netherlands Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

50 Netherlands Optical Transceiver Market, By Application, 2021-2029 (USD Million)

51 Rest Of Europe Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

52 Rest Of Europe Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

53 Rest of Europe Optical Transceiver Market, By Application, 2021-2029 (USD Million)

54 Asia Pacific Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

55 Asia Pacific Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

56 Asia Pacific Optical Transceiver Market, By Application, 2021-2029 (USD Million)

57 Asia Pacific Optical Transceiver Market, By Country, 2021-2029 (USD Million)

58 China Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

59 China Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

60 China Optical Transceiver Market, By Application, 2021-2029 (USD Million)

61 India Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

62 India Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

63 India Optical Transceiver Market, By Application, 2021-2029 (USD Million)

64 Japan Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

65 Japan Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

66 Japan Optical Transceiver Market, By Application, 2021-2029 (USD Million)

67 South Korea Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

68 South Korea Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

69 South Korea Optical Transceiver Market, By Application, 2021-2029 (USD Million)

70 malaysia Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

71 malaysia Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

72 malaysia Optical Transceiver Market, By Application, 2021-2029 (USD Million)

73 Thailand Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

74 Thailand Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

75 Thailand Optical Transceiver Market, By Application, 2021-2029 (USD Million)

76 Indonesia Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

77 Indonesia Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

78 Indonesia Optical Transceiver Market, By Application, 2021-2029 (USD Million)

79 Vietnam Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

80 Vietnam Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

81 Vietnam Optical Transceiver Market, By Application, 2021-2029 (USD Million)

82 Taiwan Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

83 Taiwan Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

84 Taiwan Optical Transceiver Market, By Application, 2021-2029 (USD Million)

85 Rest of Asia Pacific Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

86 Rest of Asia Pacific Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

87 Rest of Asia Pacific Optical Transceiver Market, By Application, 2021-2029 (USD Million)

88 Middle East and Africa Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

89 Middle East and Africa Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

90 Middle East and Africa Optical Transceiver Market, By Application, 2021-2029 (USD Million)

91 Middle East and Africa Optical Transceiver Market, By Country, 2021-2029 (USD Million)

92 Saudi Arabia Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

93 Saudi Arabia Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

94 Saudi Arabia Optical Transceiver Market, By Application, 2021-2029 (USD Million)

95 UAE Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

96 UAE Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

97 UAE Optical Transceiver Market, By Application, 2021-2029 (USD Million)

98 Israel Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

99 Israel Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

100 Israel Optical Transceiver Market, By Application, 2021-2029 (USD Million)

101 South Africa Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

102 South Africa Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

103 South Africa Optical Transceiver Market, By Application, 2021-2029 (USD Million)

104 Rest of Middle East and Africa Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

105 Rest of Middle East and Africa Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

106 Rest of Middle East and Africa Optical Transceiver Market, By Application, 2021-2029 (USD Million)

107 Central and South America Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

108 Central and South America Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

109 Central and South America Optical Transceiver Market, By Application, 2021-2029 (USD Million)

110 Central and South America Optical Transceiver Market, By Country, 2021-2029 (USD Million)

111 Brazil Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

112 Brazil Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

113 Brazil Optical Transceiver Market, By Application, 2021-2029 (USD Million)

114 Argentina Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

115 Argentina Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

116 Argentina Optical Transceiver Market, By Application, 2021-2029 (USD Million)

117 Chile Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

118 Chile Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

119 Chile Optical Transceiver Market, By Application, 2021-2029 (USD Million)

120 Rest of Central and South America Optical Transceiver Market, By Protocol, 2021-2029 (USD Million)

121 Rest of Central and South America Optical Transceiver Market, By Data Rate, 2021-2029 (USD Million)

122 Rest of Central and South America Optical Transceiver Market, By Application, 2021-2029 (USD Million)

123 Coherent Corp.: Products & Services Offering

124 InnoLight Technology: Products & Services Offering

125 HiSilicon Optoelectronics Co., Ltd.: Products & Services Offering

126 Cisco Systems, Inc.: Products & Services Offering

127 Broadcom Inc.: Products & Services Offering

128 EOPTOLINK TECHNOLOGY INC., LTD.: Products & Services Offering

129 Accelink Technology Co. Ltd : Products & Services Offering

130 Molex, LLC: Products & Services Offering

131 ATOP Corporation, Inc: Products & Services Offering

132 Lumentum Operations LLC: Products & Services Offering

133 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Optical Transceiver Market Overview

2 Global Optical Transceiver Market Value From 2021-2029 (USD Mllion)

3 Global Optical Transceiver Market Share, By Protocol (2023)

4 Global Optical Transceiver Market Share, By Data Rate (2023)

5 Global Optical Transceiver Market Share, By Application (2023)

6 Global Optical Transceiver Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Optical Transceiver Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Optical Transceiver Market

11 Impact Of Challenges On The Global Optical Transceiver Market

12 Porter’s Five Forces Analysis

13 Global Optical Transceiver Market: By Protocol Scope Key Takeaways

14 Global Optical Transceiver Market, By Protocol Segment: Revenue Growth Analysis

15 Ethernet Market, By Region, 2021-2029 (USD Mllion)

16 Fiber Channel Market, By Region, 2021-2029 (USD Mllion)

17 CWDM/DWDM Market, By Region, 2021-2029 (USD Mllion)

18 FTTx Market, By Region, 2021-2029 (USD Mllion)

19 Others Market, By Region, 2021-2029 (USD Mllion)

20 Global Optical Transceiver Market: By Data Rate Scope Key Takeaways

21 Global Optical Transceiver Market, By Data Rate Segment: Revenue Growth Analysis

22 Less than 10 Gbps Market, By Region, 2021-2029 (USD Mllion)

23 10 Gbps to 40 Gbps Market, By Region, 2021-2029 (USD Mllion)

24 100 Gbps Market, By Region, 2021-2029 (USD Mllion)

25 Greater than 100 Gbps Market, By Region, 2021-2029 (USD Mllion)

26 Global Optical Transceiver Market: By Application Scope Key Takeaways

27 Global Optical Transceiver Market, By Application Segment: Revenue Growth Analysis

28 Data Center Market, By Region, 2021-2029 (USD Mllion)

29 Telecommunication Market, By Region, 2021-2029 (USD Mllion)

30 Regional Segment: Revenue Growth Analysis

31 Global Optical Transceiver Market: Regional Analysis

32 North America Optical Transceiver Market Overview

33 North America Optical Transceiver Market, By Protocol

34 North America Optical Transceiver Market, By Data Rate

35 North America Optical Transceiver Market, By Application

36 North America Optical Transceiver Market, By Country

37 U.S. Optical Transceiver Market, By Protocol

38 U.S. Optical Transceiver Market, By Data Rate

39 U.S. Optical Transceiver Market, By Application

40 Canada Optical Transceiver Market, By Protocol

41 Canada Optical Transceiver Market, By Data Rate

42 Canada Optical Transceiver Market, By Application

43 Mexico Optical Transceiver Market, By Protocol

44 Mexico Optical Transceiver Market, By Data Rate

45 Mexico Optical Transceiver Market, By Application

46 Four Quadrant Positioning Matrix

47 Company Market Share Analysis

48 Coherent Corp.: Company Snapshot

49 Coherent Corp.: SWOT Analysis

50 Coherent Corp.: Geographic Presence

51 InnoLight Technology: Company Snapshot

52 InnoLight Technology: SWOT Analysis

53 InnoLight Technology: Geographic Presence

54 HiSilicon Optoelectronics Co., Ltd.: Company Snapshot

55 HiSilicon Optoelectronics Co., Ltd.: SWOT Analysis

56 HiSilicon Optoelectronics Co., Ltd.: Geographic Presence

57 Cisco Systems, Inc.: Company Snapshot

58 Cisco Systems, Inc.: Swot Analysis

59 Cisco Systems, Inc.: Geographic Presence

60 Broadcom Inc.: Company Snapshot

61 Broadcom Inc.: SWOT Analysis

62 Broadcom Inc.: Geographic Presence

63 EOPTOLINK TECHNOLOGY INC., LTD.: Company Snapshot

64 EOPTOLINK TECHNOLOGY INC., LTD.: SWOT Analysis

65 EOPTOLINK TECHNOLOGY INC., LTD.: Geographic Presence

66 Accelink Technology Co. Ltd : Company Snapshot

67 Accelink Technology Co. Ltd : SWOT Analysis

68 Accelink Technology Co. Ltd : Geographic Presence

69 Molex, LLC: Company Snapshot

70 Molex, LLC: SWOT Analysis

71 Molex, LLC: Geographic Presence

72 ATOP Corporation, Inc.: Company Snapshot

73 ATOP Corporation, Inc.: SWOT Analysis

74 ATOP Corporation, Inc.: Geographic Presence

75 Lumentum Operations LLC: Company Snapshot

76 Lumentum Operations LLC: SWOT Analysis

77 Lumentum Operations LLC: Geographic Presence

78 Other Companies: Company Snapshot

79 Other Companies: SWOT Analysis

80 Other Companies: Geographic Presence

The Global Optical Transceiver Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Optical Transceiver Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS