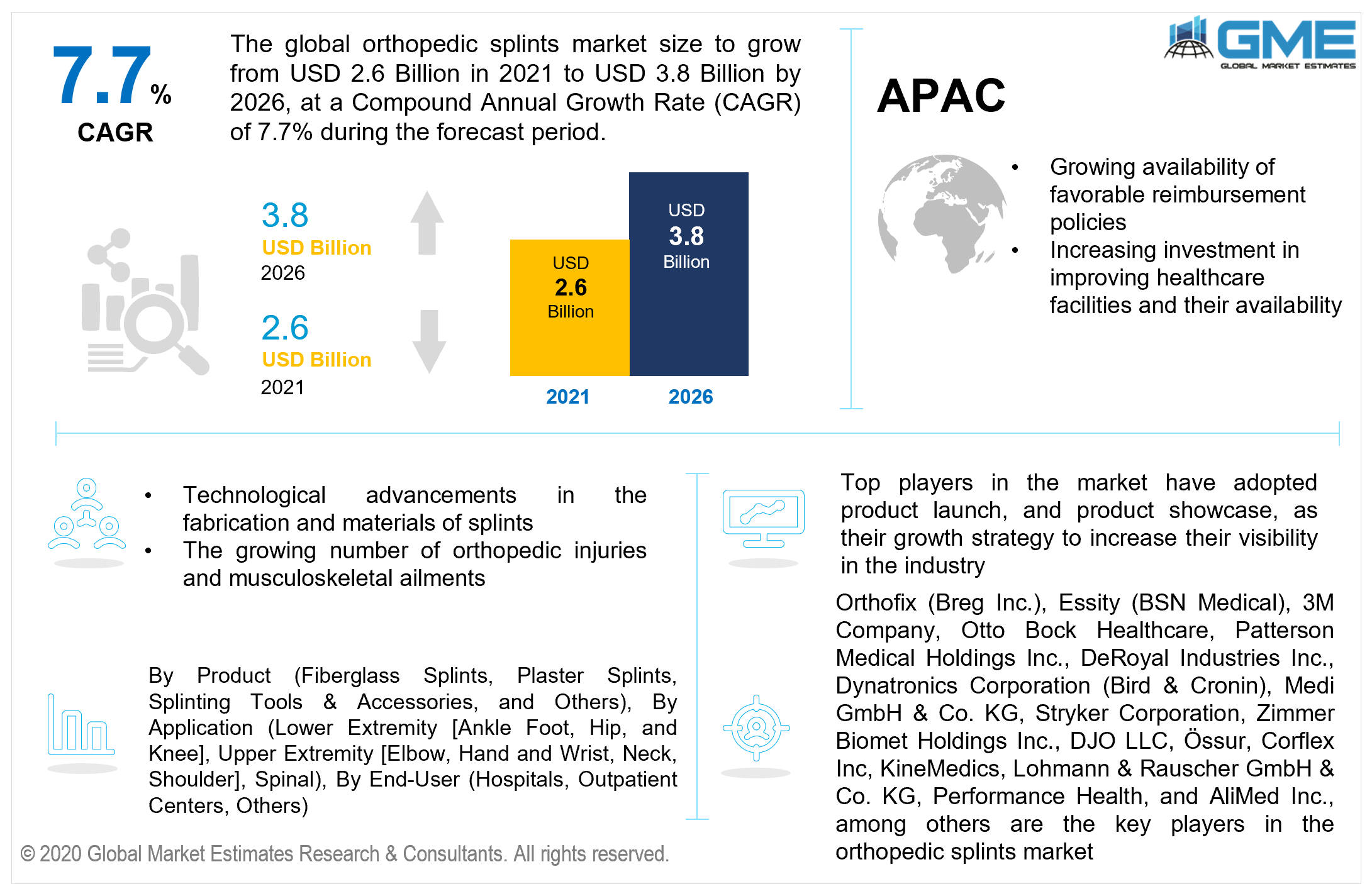

Global Orthopedic Splints Market Size, Trends & Analysis - Forecasts to 2026 By Product (Fiberglass Splints, Plaster Splints, Splinting Tools & Accessories, and Others), By Application (Lower Extremity [Ankle Foot, Hip, and Knee], Upper Extremity [Elbow, Hand and Wrist, Neck, Shoulder], Spinal), By End-User (Hospitals, Outpatient Centers, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

The global orthopedic splints market is projected to grow from USD 2.6 billion in 2021 to USD 3.8 billion by 2026 at a CAGR value of 7.7% between 2021 to 2026. The market is driven by the increasing incidence of musculoskeletal and orthopedic ailments among the geriatric population. The rising number of arthritis cases across the globe is expected to increase the demand for orthopedic splints during the forecast period.

According to the U.S. Centre for Disease Control, it was estimated that around 22% of the adult population suffered from arthritis in 2015, this number is expected to reach 26% or 78 million adults by the year 2040. Orthopedic splints are used by arthritis patients to rest and support their joints and limbs while preventing further worsening of the ailment.

According to the NHS, over 10 million people suffer from arthritis and are more common in people above the age of forty. The number of injuries related to sports and other recreational activities is also on the rise. Unnatural movement of joints and limbs and collisions during these activities often result in fractures and other conditions that require movement restriction and support. As splints are ideal for providing support and restricting movement to ensure that the body heals without any deformities, the market for such splints is expected to grow considerably during the forecast period.

The availability of reimbursement policies and the growing availability of medical services in developing nations are expected to further increase the demand for splints during the forecast period. The technology used in splint manufacturing like the advent of fiberglass splints has also contributed to the growth of the market. Till the late 1970s, the market was dominated by plaster casts. Fiberglass splints have several advantages over plaster splints such as shorter drying periods, being lightweight, and are more comfortable to wear. Increased investment in the research and development of novel splints such as open lattice plastic casts is expected to contribute to the growth of the market.

The market is restrained by the stringent government regulations that have to be met before products can be sold in markets. People tend to neglect small injuries as there is a lack of awareness among people that such injuries heal more effectively through the use of splints and medical intervention which can prevent complications later on. The market is also restrained by the cost and the lack of coverage by insurance policies in less developed nations.

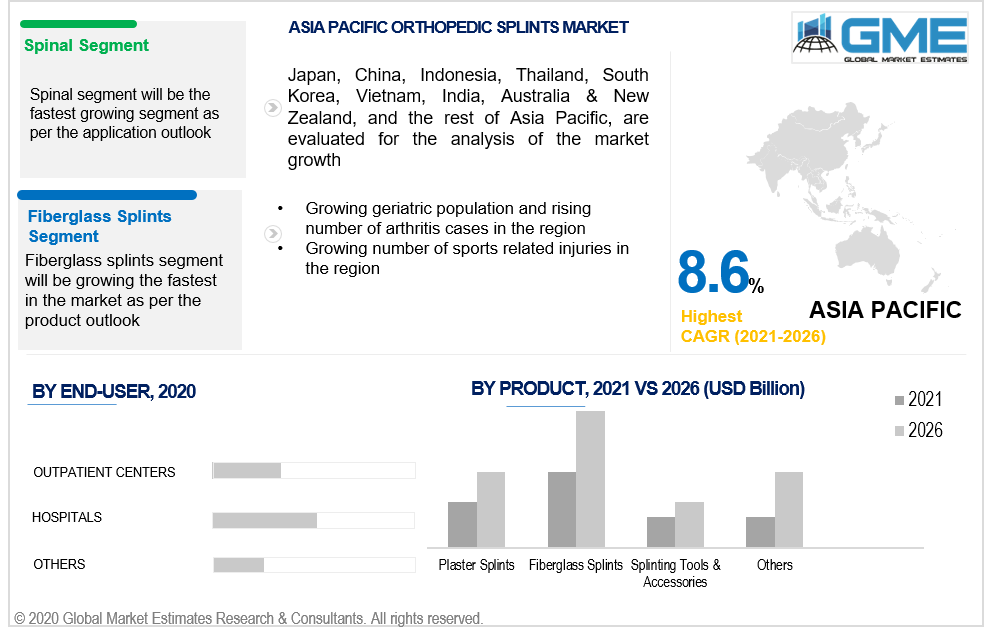

Based on the product, the market is segmented into fiberglass splints, plaster splints, splinting tools & accessories, and others. The fiberglass segment is expected to hold the lion’s share of the market during the forecast period. Fiberglass splints are lighter than other splints, have better water resistance, and can be dried in a few hours unlike splints made from plaster which can take up to days. Fiberglass splints are also more comfortable than other splints but they are also more expensive than conventional splints made from plaster. The advantages of fiberglass splints and technological advancements in material synthesis and fabrication of splints are expected to result in this segment becoming the fastest-growing segment during the forecast period.

Based on the application, the market is segmented into lower extremity, upper extremity, and spinal. The spinal segment is envisaged to hold to the dominant share of the market during the forecast period. The growing number of spinal injuries and rising number of accidents related to sports combined with the advancements in technology have contributed to the dominance of this segment. The spinal segment is also expected to grow at a faster rate than the other segments during the forecast period.

Based on the end-users of orthopedic splints, the market is segmented into hospitals, outpatient centers, and others. The hospitals segment is expected to hold the largest share of the market revenues during the forecast period. Hospitals are well equipped and have access to a greater number of procedures that make them more appealing to patients. Hospitals are also capable of catering to patients who need post-operation rehabilitation and other care required after surgeries. The growing need for splints in various post-operation procedures is expected to result in the hospitals segment registering better growth rates than the other segments during the forecast period.

Based on region, the market can be segmented into North America, Europe, Central & South America, Middle East & North Africa, and Asia Pacific. The North American region is expected to be the dominant segment in the market during the forecast period. High availability of innovative orthopedic products, the growing geriatric population, and the growing availability of various reimbursement schemes for orthopedic surgeries have contributed to the dominance of this region in the market.

The Asia Pacific region is expected to become the fastest-growing region during the forecast period followed by Europe. The growing availability of novel products, an increasing number of sports-related injuries, government investments in improving healthcare and sports facilities, are expected to be the major drivers of the orthopedic splints market in the APAC region.

Orthofix (Breg Inc.), Essity (BSN Medical), 3M Company, Otto Bock Healthcare, Patterson Medical Holdings Inc., DeRoyal Industries Inc., Dynatronics Corporation (Bird & Cronin), Medi GmbH & Co. KG, Stryker Corporation, Zimmer Biomet Holdings Inc., DJO LLC, Össur, Corflex Inc, KineMedics, Lohmann & Rauscher GmbH & Co. KG, Performance Health, and AliMed Inc., among others are the key players in the orthopedic splints market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Orthopedic Splints Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Application Overview

2.1.4 End-User Overview

2.1.6 Regional Overview

Chapter 3 Orthopedic Splints Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising prevalence of arthritis among the growing geriatric population

3.3.2 Industry Challenges

3.3.2.1 Negligence of minor musculoskeletal injuries

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Orthopedic Splints Market, By Product

4.1 Product Outlook

4.2 Fiberglass Splints

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Plaster Splints

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Splinting Tools & Accessories

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Others

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Orthopedic Splints Market, By Application

5.1 Application Outlook

5.2 Lower Extremity

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Upper Extremity

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Spinal

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Orthopedic Splints Market, By End-User

6.1 Hospitals

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Outpatient Centers

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Others

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Orthopedic Splints Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Product, 2020-2026 (USD Billion)

7.2.3 Market Size, By Application, 2020-2026 (USD Billion)

7.2.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Product, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By Application, 2020-2026 (USD Billion)

7.2.4.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.2.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.2.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Product, 2020-2026 (USD Billion)

7.3.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Product, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Product, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Product, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Product, 2020-2026 (USD Billion)

7.3.11.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.11.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Product, 2020-2026 (USD Billion)

7.4.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Product, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Product, 2020-2026 (USD Billion)

7.4.9.2 Market size, By Application, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Product, 2020-2026 (USD Billion)

7.4.10.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Product, 2020-2026 (USD Billion)

7.5.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Product, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Product, 2020-2026 (USD Billion)

7.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Product, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Orthofix

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Essity

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 3M Company

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Otto Bock Healthcare

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Patterson Medical Holdings Inc.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 DeRoyal Industries Inc.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Dynatronics Corporation

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Medi GmbH & Co. KG

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Stryker Corporation

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Orthopedic Splints Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Orthopedic Splints Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS