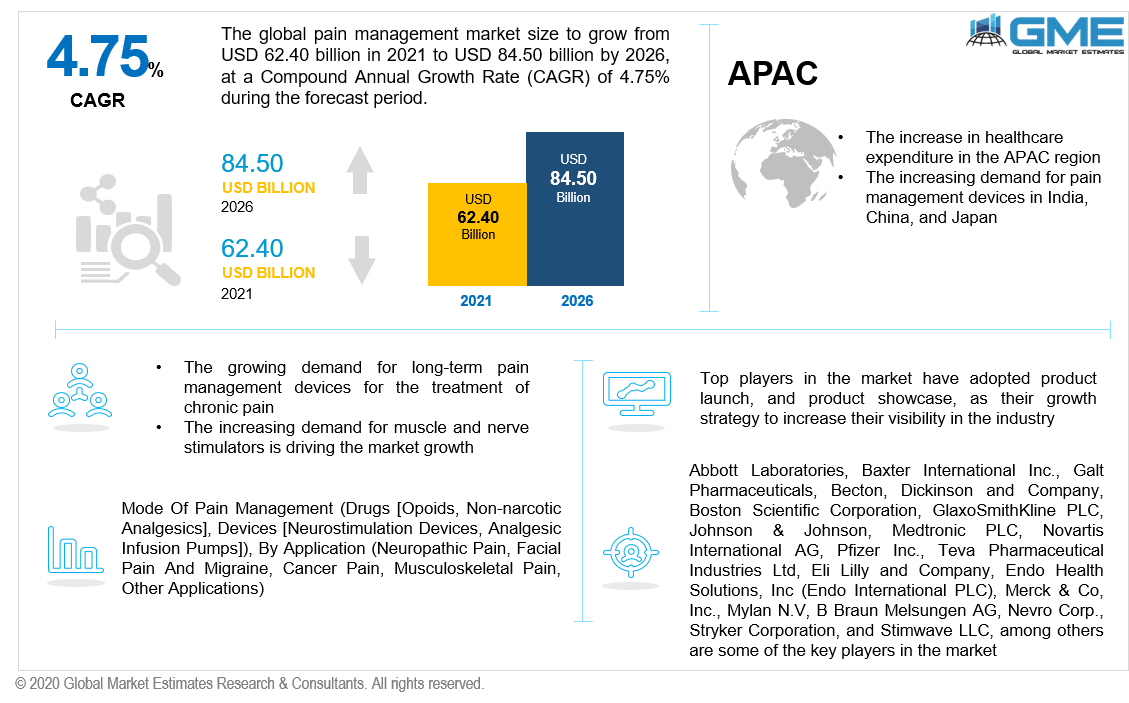

Global Pain Management Market Size, Trends & Analysis - Forecasts to 2026 By Mode of Pain Management (Drugs [Opioids, Non-Narcotic Analgesics], Devices [Neurostimulation Devices, Analgesic Infusion Pumps]), By Application (Neuropathic Pain, Facial Pain and Migraine, Cancer Pain, Musculoskeletal Pain, Other Applications), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Vendor Landscape, and Company Market Share Analysis and Competitor Analysis

The global pain management market will grow from USD 62.40 billion in 2021 to reach USD 84.50 billion in 2026, with a CAGR of 4.75% over the forecast period.

The rising cases of chronic diseases, cancer and infectious disorders are some of the key factors expected to drive market growth over the forecast period. The well-established market of painkiller drugs as the first line of treatment is a major contributor to the global pain management market's growth. As of 2020 analysis, device-based pain management therapies have been more popular, as people have become more reliant on them for longer period and have gained a better understanding of their negative effects.

Moreover, the increasing global burden of the elderly population is anticipated to fuel market expansion, since the occurrence of chronic pain is very high among the geriatric population and is regarded as an independent risk factor for mortality. Increased product launches are also likely to drive the market. The other factors supporting the growth of the pain management trends in 2020 are the introduction of technologically advanced products, growing cases of cancer, and the high prevalence of diabetes.

Post-surgical pain is a major focus of hospitals, where the cost of monitoring and treating side effects creates a significant demand for pain management medications and devices. According to the CDC, approximately 54 million cases of arthritis were registered in the United States in 2019, making it the leading cause of post-surgical disability. As a result, the demand for pain management stimulators to treat chronic pain increased. Patients are increasingly looking for alternate treatment choices, such as pain management devices, due to the ineffectiveness of oral medications.

The market for pain management will be growing rapidly owing to factors such as the increasing number of cases associated with COVID-19, cancer, etc., and the rising geriatric patient pool especially in developing regions. Moreover, the rising support from government organizations in the form of research funds to launch pain management devices and the lack of invasive surgeries is also helping the market attain rapid growth. Some of the most significant competitors, such as Galt Pharmaceuticals, Baudax Bio, and Athena Bioscience, are leading the market after successfully launching FDA-approved products in the developed and developing regions.

The COVID-19 pandemic has an influence on healthcare systems all across the globe. Globally, health organizations are working to prevent the spread of coronavirus using lockdown protocols and have postponed the majority of elective and non-urgent surgeries. Furthermore, numerous elective surgeries and in-person patient visits have been canceled or postponed, which is projected to increase demand for at-home pain treatment.

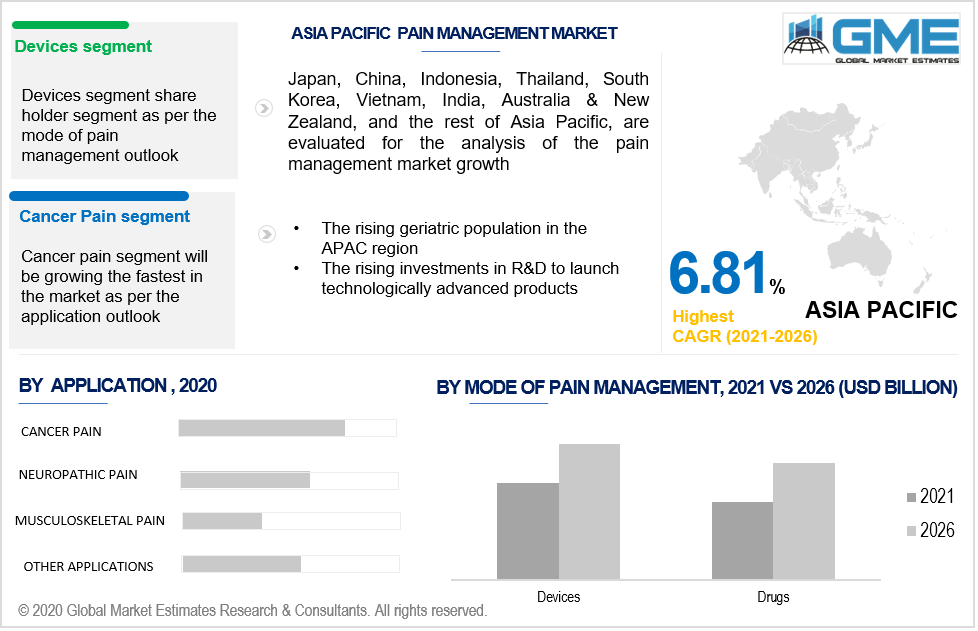

The mode of pain management segment is categorized into devices and drugs. The devices segment is expected to hold the largest market share in terms of revenue from 2021 to 2026. The segment is further classified as neurostimulation devices and analgesic infusion pumps. The neurostimulation devices are analyzed to hold the biggest revenue share during the forecast period. These neurostimulators are extremely important in the treatment of chronic pain, depression, epilepsy, Parkinson's disease, and movement disorders. The growing geriatric population, and the increasing incidence of neurological disorders are expected to boost the pain management market.

Neuropathic pain, facial pain and migraine, cancer pain, musculoskeletal pain, and other applications are the major segments of the pain management market. The cancer pain application will be the fastest-growing segment with the highest CAGR value from 2021 to 2026. The rising number of cancer cases has increased the demand for pain management devices to alleviate the pain caused by nerve compression, mostly due to tumor compression and other variables dependent on cancer progression.

According to National Cancer Institute data, around 5930 new cases of Acute Lymphoblastic Leukemia (ALL) were detected in 2019 with an anticipated 1500 deaths.

As per the geographical analysis, the global pain management market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the market from 2021 to 2026. The largest share of the pain management market size in the US is mainly due to the presence of key competitors in the country, rising healthcare expenses, and the presence of pain specialist physicians. Moreover, the growing government frameworks along with the rising healthcare infrastructure are some of the factors increasing the pain management market size in the US over the forecast period.

Furthermore, the Asia Pacific region will grow with the highest CAGR rate in the market. Rising chronic infections, rare and genetic cancer diseases, rising expenses in healthcare, and increasing R&D investments in manufacturing of advanced healthcare treatment options will impact the pain management market size in India positively, along with other countries like China, Japan, South Korea, Australia and Malaysia.

Abbott Laboratories, Baxter International Inc., Galt Pharmaceuticals, Becton, Dickinson and Company, Boston Scientific Corporation, Fresenius SE & Co. KGaA, GlaxoSmithKline PLC, Johnson & Johnson, Medtronic PLC, Novartis International AG, Pfizer Inc., Teva Pharmaceutical Industries Ltd, Eli Lilly and Company, Endo Health Solutions, Inc (Endo International PLC), Merck & Co, Inc., Mylan N.V, Purdue Pharma LP, B Braun Melsungen AG, Nevro Corp., Colfax Corporation, Omron Healthcare Inc., Smiths Medical, Stryker Corporation, and Stimwave LLC, among others are some of the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

In September 2020, Galt Pharmaceuticals' Orphangesic Forte, bagged the FDA approval for its non-opioid pain medicine for patients suffering from mild to moderate pain.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Pain Management Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.1 Mode of Pain Management Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Global Pain Management Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing cases of chronic diseases are driving the market growth

3.3.1.2 Increasing demand for long-term pain management from the geriatric population

3.3.2 Industry Challenges

3.3.2.1 High procedural and purchase cost of pain management devices

3.4 Prospective Growth Scenario

3.4.1 Mode of Pain Management Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Pain Management Market, By Mode of Pain Management

4.1 Mode of Pain Management Outlook

4.2 Devices

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.2.1.1 Neurostimulation Devices Market Size, By Region, 2020-2026 (USD Billion)

4.2.1.2 Analgesic Infusion Pumps Market Size, By Region, 2020-2026 (USD Billion)

4.3 Drugs

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3.1.1 Opioids Market Size, By Region, 2020-2026 (USD Billion)

4.3.1.2 Non-Narcotic Analgesics Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Global Pain Management Market, By Application

5.1 Application Outlook

5.2 Neuropathic Pain

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Facial Pain and Migraine

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Cancer Pain

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Musculoskeletal Pain

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Other Applications

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Global Pain Management Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Billion)

6.2.2 Market Size, By Mode of Pain Management, 2020-2026 (USD Billion)

6.2.3 Market Size, By Application, 2020-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Mode of Pain Management, 2020-2026 (USD Billion)

6.2.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Mode of Pain Management, 2020-2026 (USD Billion)

6.2.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Billion)

6.3.2 Market Size, By Mode of Pain Management, 2020-2026 (USD Billion)

6.3.3 Market Size, By Application, 2020-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Mode of Pain Management, 2020-2026 (USD Billion)

6.3.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Mode of Pain Management, 2020-2026 (USD Billion)

6.3.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Mode of Pain Management, 2020-2026 (USD Billion)

6.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Mode of Pain Management, 2020-2026 (USD Billion)

6.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Mode of Pain Management, 2020-2026 (USD Billion)

6.3.8.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Mode of Pain Management, 2020-2026 (USD Billion)

6.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Billion)

6.4.2 Market Size, By Mode of Pain Management, 2020-2026 (USD Billion)

6.4.3 Market Size, By Application, 2020-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Mode of Pain Management, 2020-2026 (USD Billion)

6.4.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Mode of Pain Management, 2020-2026 (USD Billion)

6.4.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Mode of Pain Management, 2020-2026 (USD Billion)

6.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Mode of Pain Management, 2020-2026 (USD Billion)

6.4.7.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Mode of Pain Management, 2020-2026 (USD Billion)

6.4.8.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Billion)

6.5.2 Market Size, By Mode of Pain Management, 2020-2026 (USD Billion)

6.5.3 Market Size, By Application, 2020-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Mode of Pain Management, 2020-2026 (USD Billion)

6.5.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Mode of Pain Management, 2020-2026 (USD Billion)

6.5.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Mode of Pain Management, 2020-2026 (USD Billion)

6.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Billion)

6.6.2 Market Size, By Mode of Pain Management, 2020-2026 (USD Billion)

6.6.3 Market Size, By Application, 2020-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Mode of Pain Management, 2020-2026 (USD Billion)

6.6.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Mode of Pain Management, 2020-2026 (USD Billion)

6.6.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Mode of Pain Management, 2020-2026 (USD Billion)

6.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Abbott Laboratories

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 InfoGraphic Analysis

7.3 Baxter International Inc.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 InfoGraphic Analysis

7.4 Medtronic PLC

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 InfoGraphic Analysis

7.5 Galt Pharmaceuticals

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 InfoGraphic Analysis

7.6 Becton, Dickinson and Company

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 InfoGraphic Analysis

7.7 Boston Scientific Corporation

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 InfoGraphic Analysis

7.8 Novartis International AG

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 InfoGraphic Analysis

7.9 GlaxoSmithKline PLC

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 InfoGraphic Analysis

7.10 Pfizer Inc.

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 InfoGraphic Analysis

7.11 Teva Pharmaceutical Industries Ltd.

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 InfoGraphic Analysis

7.12 Other Companies

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 InfoGraphic Analysis

The Global Pain Management Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Pain Management Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS