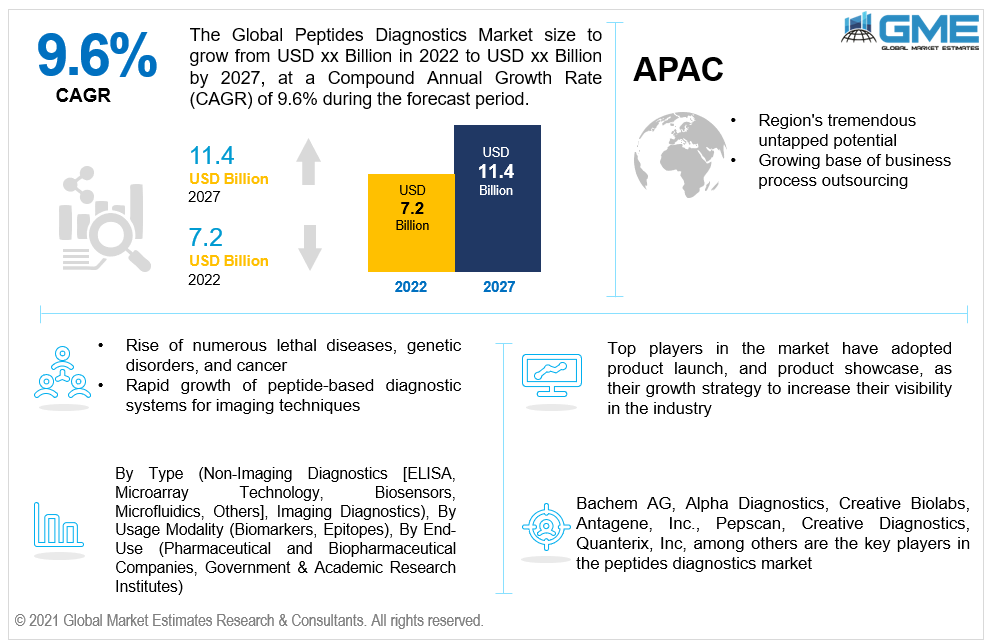

Global Peptides Diagnostics Market Size, Trends & Analysis - Forecasts to 2027 By Type (Non-Imaging Diagnostics [ELISA, Microarray Technology, Biosensors, Microfluidics, Others], Imaging Diagnostics), By Usage Modality (Biomarkers, Epitopes), By End-Use (Pharmaceutical and Biopharmaceutical Companies, Government & Academic Research Institutes), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

The Global Peptides Diagnostics Market is projected to grow at a CAGR value of 9.6% from 2022 to 2027. In the recent few decades, the use of synthetic peptides in diagnostics has increased to obtain specific and accurate information about a disease, a high purity profile, and the potential to be chemically changed. The peptide probes that have been discovered are employed in both imaging and non-imaging diagnostics. The rise of numerous lethal diseases, genetic disorders, and cancer will drive market expansion during the forecast period, by allowing clinicians to predict and assess therapy effects across a broad range of disorders.

According to the published literature on PUBMED, peptides are always 2.5 times less used than proteins. It also is worth noting that the usage of peptides in diagnostics has been consistent and has shown linear development over time. The ability of peptide diagnostics to recognize microbial pathogens by using antigenic synthetic peptides in molecular and genomic assays, as well as the rapid growth of peptide-based diagnostic systems for imaging techniques, such as single-photon emission computed tomography (SPECT) and positron emission tomography (PET) are significantly adding to market growth.

Rising malignancy and metabolic disturbances such as osteoarthritis, overweight, and hypertension, as well as increased research expenditures and investment for R&D and the development of advanced mechanized peptide synthesizers, will all contribute to the use of peptide diagnostics over the forecast period.

Furthermore, peptide diagnostics make it easier to quantify antibodies directed against autoantigens, potentially leading to more precise assays. Moreover, the accessibility of statistical models to efficiently define the amino acid composition of the immunogenic site of the protein recognized by the target antibody is propelling the market growth. However, decreased metabolic consistency and expensive instrument costs are limiting market growth during the foreseeable period, limiting their potential.

Following the pandemic, the need for peptide diagnostics increased as thousands of scientists began to tackle this new problem utilizing a range of peptide-based methodological techniques. Peptides were used to analyze viral epitopes recognized by VirScan-based serological stereotyping, to distinguish SARS-CoV-2 antibody diagnostic assays, and SARS-CoV-2 peptide pools encompassing viral proteins were used to identify immune biomarkers of SARS-CoV-2 illness.

Reduced danger of trial-and-error therapy and over-prescription, as well as a higher probability of combating the disease at an early stage and minimizing its length, are all factors that support market expansion.

Additionally, the potential for more personalized treatment by avoiding broad-spectrum medications, as well as speedier quarantining of infected patients and reduced risk of nosocomial pathogens through earlier detection, are driving market expansion. According to estimates, peptide diagnostic approaches could have reduced the scope of the 2014 Ebola epidemic in Sierra Leone by much to 30%.

Based on the type, the peptides diagnostics market is segmented into non-imaging diagnostics and imaging diagnostics. The non-imaging diagnostics segment which is further fragmented into ELISA, microarray technology, biosensors, microfluidics, and others is expected to hold the largest piece of the market during the forecast period. Diagnostic and epidemiological research has long struggled to diagnose diseases efficiently and consistently in humans. Non-imaging diagnostics are driving segment expansion by assisting in the development of an appropriate disease effective management and identifying harmful viruses and bacteria utilizing antigenic synthetic peptides in molecular and genomic assays.

Under non-imaging diagnostics, ELISA is considered to be the most preferred technology platform. The Swiss scientists Engvall and Perlman modified the RIA method to create the ELISA technology in 1971. It is a quantitative analytical approach for detecting the existence of a target chemical at a precise concentration in biological fluids. ELISA assays are a type of quantitative assay in which target antibodies and allergens can be evaluated at very small concentrations with little chance of contamination.

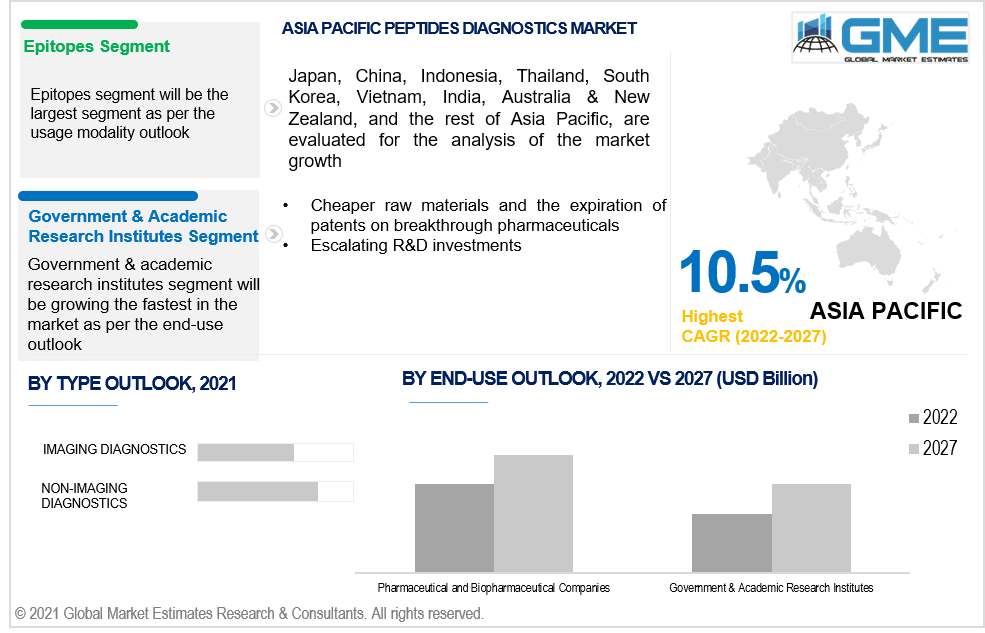

Based on the usage modality in peptides diagnostics, the market is segmented into biomarkers and epitopes. The epitopes segment is expected to grow the fastest in the peptides diagnostics market from 2022 to 2027. Peptide scanning is a frequently utilized approach for mapping protein antigens and selecting linear epitopes. Epitope mapping with peptides is a well-established and widely used method for developing vaccines against fatal viral infections and generating value from the limitless perspectives of multiple peptide synthesis. The majority of today's protein epitopes are only characterized by cross-reacting peptides, and the peptide approach is the principal source of epitope identification.

Based on the end-use in peptides diagnostics, the market is segmented into pharmaceutical and biopharmaceutical companies, and government & academic research institutes. The government & academic research institutes segment is expected to hold a larger share as compared to other segments. Peptides are used to make epitope-specific antibodies, map antibody epitopes and enzyme binding ability, and create new enzymes, medicines, and vaccinations, among other things. Antimicrobial peptides are now being studied to see if they can help with wound healing. Skin problems such as psoriasis, rosacea, and eczema may be exacerbated by having extremely high or extremely low amounts of bioactive peptides.

As per the geographical analysis, the peptides diagnostics market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico), will have a dominant share in the peptides diagnostics market from 2022 to 2027. The rising need for diagnostics in cancer and other disorders, as well as a developing biotechnology industry. The government's increased R&D spending is expected to aid peptide diagnostics in maintaining their supremacy in the next years, and the region's well-established biotech and pharmaceutical industry factors contribute to the market domination.

The APAC region is expected to showcase the fastest growth rate among all regions. The region's tremendous untapped potential, low raw material costs, growing base of business process outsourcing, thriving biotech industry, and increasing R&D investments are all factors. Cheaper raw materials and the expiration of patents on breakthrough pharmaceuticals are projected to bolster the generic industry soon, providing major growth potential.

Bachem AG, Alpha Diagnostics, Creative Biolabs, Antagene, Inc., Pepscan, Creative Diagnostics, Quanterix, Inc, among others are the key players in the global peptides diagnostics market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Peptides Diagnostics Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Usage Modality Overview

2.1.4 End-Use Overview

2.1.6 Regional Overview

Chapter 3 Peptides Diagnostics Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 The rise of numerous lethal diseases, genetic disorders, and cancer

3.3.2 Industry Challenges

3.3.2.1 Decreased metabolic consistency and expensive instrument costs

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Usage Modality Growth Scenario

3.4.3 End-Use Growth Scenario

3.5 COVID-19 Influence over Usage Modality Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 Peptides Diagnostics Market, By Usage Modality

4.1 Usage Modality Outlook

4.2 Biomarkers

4.2.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 Epitopes

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 5 Peptides Diagnostics Market, By Type

5.1 Type Outlook

5.2 Non-Imaging Diagnostics

5.2.1 Market Size, By Region, 2022-2027 (USD Billion)

5.3 Imaging Diagnostics

5.3.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 6 Peptides Diagnostics Market, By End-Use

6.1 Pharmaceutical and Biopharmaceutical Companies

6.1.1 Market Size, By Region, 2022-2027 (USD Billion)

6.2 Government & Academic Research Institutes

6.2.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 7 Nuclear Imaging Equipment Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2022-2027 (USD Billion)

7.2.2 Market Size, By Type, 2022-2027 (USD Billion)

7.2.3 Market Size, By End-Use, 2022-2027 (USD Billion)

7.2.4 Market Size, By Usage Modality, 2022-2027 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Type, 2022-2027 (USD Billion)

7.2.4.2 Market Size, By End-Use, 2022-2027 (USD Billion)

7.2.4.3 Market Size, By Usage Modality, 2022-2027 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Type, 2022-2027 (USD Billion)

7.2.7.2 Market Size, By End-Use, 2022-2027 (USD Billion)

7.2.7.3 Market Size, By Usage Modality, 2022-2027 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2022-2027 (USD Billion)

7.3.2 Market Size, By Type, 2022-2027 (USD Billion)

7.3.3 Market Size, By End-Use, 2022-2027 (USD Billion)

7.3.4 Market Size, By Usage Modality, 2022-2027 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Type, 2022-2027 (USD Billion)

7.3.6.2 Market Size, By End-Use, 2022-2027 (USD Billion)

7.3.6.3 Market Size, By Usage Modality, 2022-2027 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Type, 2022-2027 (USD Billion)

7.3.7.2 Market Size, By End-Use, 2022-2027 (USD Billion)

7.3.7.3 Market Size, By Usage Modality, 2022-2027 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Type, 2022-2027 (USD Billion)

7.3.7.2 Market Size, By End-Use, 2022-2027 (USD Billion)

7.3.7.3 Market Size, By Usage Modality, 2022-2027 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Type, 2022-2027 (USD Billion)

7.3.9.2 Market Size, By End-Use, 2022-2027 (USD Billion)

7.3.9.3 Market Size, By Usage Modality, 2022-2027 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Type, 2022-2027 (USD Billion)

7.3.10.2 Market Size, By End-Use, 2022-2027 (USD Billion)

7.3.10.3 Market Size, By Usage Modality, 2022-2027 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Type, 2022-2027 (USD Billion)

7.3.11.2 Market Size, By End-Use, 2022-2027 (USD Billion)

7.3.11.3 Market Size, By Usage Modality, 2022-2027 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2022-2027 (USD Billion)

7.4.2 Market Size, By Type, 2022-2027 (USD Billion)

7.4.3 Market Size, By End-Use, 2022-2027 (USD Billion)

7.4.4 Market Size, By Usage Modality, 2022-2027 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Type, 2022-2027 (USD Billion)

7.4.6.2 Market Size, By End-Use, 2022-2027 (USD Billion)

7.4.6.3 Market Size, By Usage Modality, 2022-2027 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Type, 2022-2027 (USD Billion)

7.4.7.2 Market Size, By End-Use, 2022-2027 (USD Billion)

7.4.7.3 Market Size, By Usage Modality, 2022-2027 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Type, 2022-2027 (USD Billion)

7.4.7.2 Market Size, By End-Use, 2022-2027 (USD Billion)

7.4.7.3 Market Size, By Usage Modality, 2022-2027 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Type, 2022-2027 (USD Billion)

7.4.9.2 Market size, By End-Use, 2022-2027 (USD Billion)

7.4.9.3 Market Size, By Usage Modality, 2022-2027 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Type, 2022-2027 (USD Billion)

7.4.10.2 Market Size, By End-Use, 2022-2027 (USD Billion)

7.4.10.3 Market Size, By Usage Modality, 2022-2027 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2022-2027 (USD Billion)

7.5.2 Market Size, By Type, 2022-2027 (USD Billion)

7.5.3 Market Size, By End-Use, 2022-2027 (USD Billion)

7.5.4 Market Size, By Usage Modality, 2022-2027 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Type, 2022-2027 (USD Billion)

7.5.6.2 Market Size, By End-Use, 2022-2027 (USD Billion)

7.5.6.3 Market Size, By Usage Modality, 2022-2027 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Type, 2022-2027 (USD Billion)

7.5.7.2 Market Size, By End-Use, 2022-2027 (USD Billion)

7.5.7.3 Market Size, By Usage Modality, 2022-2027 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Type, 2022-2027 (USD Billion)

7.5.7.2 Market Size, By End-Use, 2022-2027 (USD Billion)

7.5.7.3 Market Size, By Usage Modality, 2022-2027 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2022-2027 (USD Billion)

7.6.2 Market Size, By Type, 2022-2027 (USD Billion)

7.6.3 Market Size, By End-Use, 2022-2027 (USD Billion)

7.6.4 Market Size, By Usage Modality, 2022-2027 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Type, 2022-2027 (USD Billion)

7.6.6.2 Market Size, By End-Use, 2022-2027 (USD Billion)

7.6.6.3 Market Size, By Usage Modality, 2022-2027 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Type, 2022-2027 (USD Billion)

7.6.7.2 Market Size, By End-Use, 2022-2027 (USD Billion)

7.6.7.3 Market Size, By Usage Modality, 2022-2027 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Type, 2022-2027 (USD Billion)

7.6.7.2 Market Size, By End-Use, 2022-2027 (USD Billion)

7.6.7.3 Market Size, By Usage Modality, 2022-2027 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2022

8.2 Bachem AG

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Infographic Analysis

8.3 Alpha Diagnostics

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Infographic Analysis

8.4 Creative Biolabs

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Infographic Analysis

8.5 Antagene, Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Infographic Analysis

8.6 Pepscan

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Infographic Analysis

8.7 Creative Diagnostics

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Infographic Analysis

8.8 Quanterix, Inc

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.9 Other Companies

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

The Global Peptides Diagnostics Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Peptides Diagnostics Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS