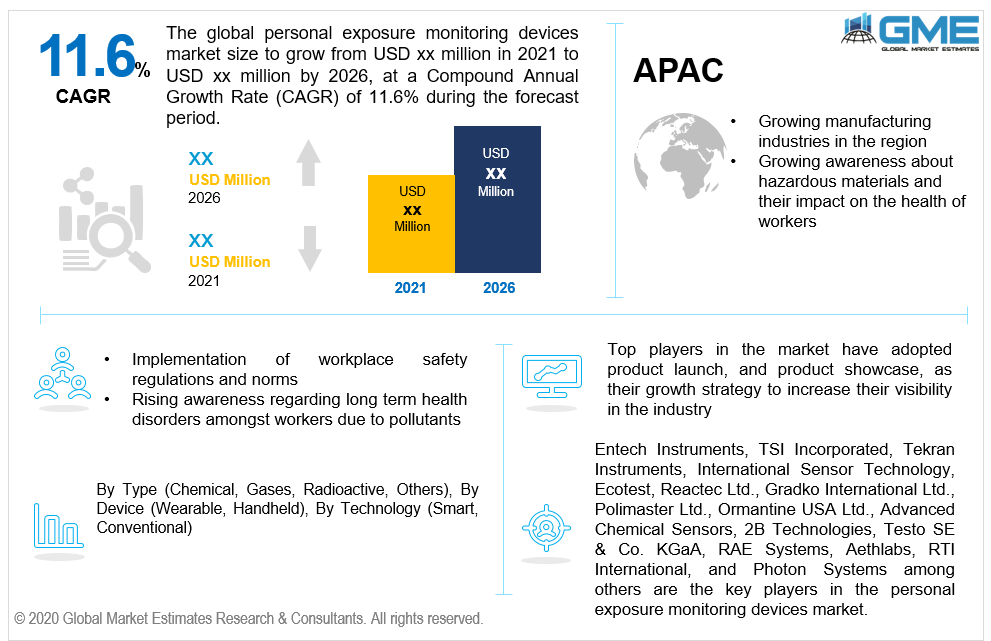

Global Personal Exposure Monitoring Devices Market Size, Trends & Analysis - Forecasts to 2026 By Type (Chemical, Gases, Radioactive, Others), By Device (Wearable, Handheld), By Technology (Smart, Conventional), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

The global personal exposure monitoring devices market is projected to grow at a CAGR value of 11.6% during the forecast period [2021 to 2026]. With the advent of the industrial revolution age, various new chemicals and materials have been developed to meet the demands of the modern consumer. In the current day and age, many occupations involve the use of various hazardous substances which can be inhaled, ingested, or absorbed through the skin. Prolonged exposure to such toxic elements can result in long-term health problems among the workers.

Respiratory hazards are some of the commonly measured hazards, gases, particular matter, biological organisms, and low concentration of oxygen are the commonly measured respiratory hazards. Other hazards like exposure to chemicals, physical hazards like vibration, noise, and radiation, are some of the other types of hazards that a worker can be exposed to in a high-risk work environment. In developing and developed nations, exposure monitoring is a mandatory requirement in many workplaces to ensure the safety of its workers. Companies are given the option of carrying out the tests themselves or they can outsource it to experts who will carry out the monitoring of exposure levels at regular intervals. These devices allow for continuous monitoring of the worker’s health over a prolonged period of time to create an exposure record for each employee.

Technological advancements have made such devices smaller and more efficient which has allowed them to be made into handheld and wearable devices. The personal exposure monitoring devices market is driven by the growing number of hazardous materials being used in industries and the stringent safety regulations.

In a study conducted by the EDF an NGO in the United States, they found that consumers were willing to pay between 100 USD and 300 USD, and as much as 500 USD for premium personal exposure monitoring devices. Among the respondents, most of them were interested in attaining data on the chemicals the body has been exposed to. The growing popularity of products such as 23andMe, and other genealogy services shows that there is a market for personal exposure monitoring devices in the retail market. This offers a lucrative opportunity for personal exposure monitoring device manufacturers who have been building their devices for industrial applications.

The personal exposure monitoring devices market is restrained by the high cost of such monitoring devices and lack of awareness regarding employee safety in third world countries.

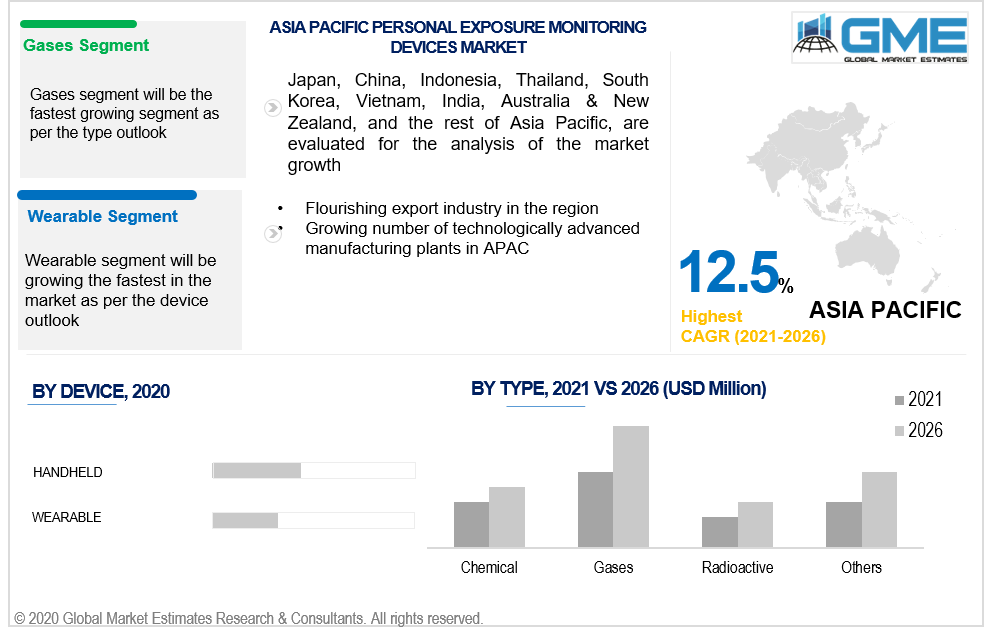

Based on the type of personal exposure monitoring device used, the market can be segmented into chemical gases, radioactive, and others. The gases segment is envisaged to clutch the lion’s share of the market over the other segments. Gases and the various particulate matter that are suspended in the air in workplaces during the manufacturing processes are the most common form of hazard. Workers in various industries are often exposed to particulate matter that can become fatal if allowed to accumulate within the human body. This has necessitated the need for such exposure monitoring devices to ensure the safety of the workers. The gases segment is also expected to grow at a much greater growth rate than other segments. The increased use of nanoparticles in industrial applications and the growing air pollution rates are expected to contribute to the growth of the market.

Based on the device type, the personal exposure monitoring device market can be segmented into wearable and handheld segments. The handheld segment is expected to hold the dominant share of the market as most monitoring devices are not light enough to be worn on the body without discomfort. Technological advancements have made it possible for new wearable monitoring devices but they are largely limited to monitoring air quality and gaseous pollutants. Technological advancements are envisaged to cause the wearable devices segment to grow much faster than the other segments during the forecast period.

Based on the technology employed in these monitoring devices, the market can be segmented into smart and conventional segments. Conventional segments allow for reading current values through a monitor or show the presence of a pollutant through a color change in the case of badges. Conventional personal exposure devices are readily available and more cost-effective than smart devices. These devices are great in applications where the quantity of the hazardous substance need not be measured and just their presence has to be measured. Smart devices allow for continuous monitoring of the exposure numbers and allow for the transmission of data to a central command center. The conventional segment held the largest piece of the personal exposure monitoring devices market during the forecast period. The smart segment is expected to register a significantly greater growth rate than the conventional segment.

Based on region, the market can be broken into various regions such as North America, Europe, Central & South America, Middle East & Africa, and Asia Pacific regions. The North American region is expected to be the dominant force in the market during the forecast period. The presence of stringent regulatory bodies like OSHA to ensure the safety of workers has necessitated the need for personal exposure monitoring devices in the region.

Technological advancements and the growing usage of advanced materials for manufacturing have been the major contributors to the growth of the personal exposure monitoring devices market in the North American region.

The Asia Pacific region is expected to grow at greater growth rates than the other regions during the forecast period. The groin manufacturing industry in the region, increasing awareness of the dangers of prolonged exposure to hazardous materials in industries is expected to be the major backers of the personal exposure monitoring devices market in the Asia Pacific region.

Entech Instruments, TSI Incorporated, Tekran Instruments, International Sensor Technology, Ecotest, Reactec Ltd., Gradko International Ltd., Polimaster Ltd., Ormantine USA Ltd., Advanced Chemical Sensors, 2B Technologies, Testo SE & Co. KGaA, RAE Systems, Aethlabs, RTI International, and Photon Systems among others are the key players in the personal exposure monitoring devices market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Personal Exposure Monitoring Devices Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Device Overview

2.1.4 Technology Overview

2.1.6 Regional Overview

Chapter 3 Personal Exposure Monitoring Devices Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing stringent regulatory norms related to workplace safety

3.3.2 Industry Challenges

3.3.2.1 High cost associated with personal exposure monitoring devices in developing counties

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Device Growth Scenario

3.4.3 Technology Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Personal Exposure Monitoring Devices Market, By Type

4.1 Type Outlook

4.2 Gases

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 Radioactive

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

4.4 Chemicals

4.4.1 Market Size, By Region, 2020-2026 (USD Million)

4.5 Others

4.5.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Personal Exposure Monitoring Devices Market, By Device

5.1 Device Outlook

5.2 Handheld

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Wearable

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Personal Exposure Monitoring Devices Market, By Technology

6.1 Smart

6.1.1 Market Size, By Region, 2020-2026 (USD Million)

6.2 Conventional

6.2.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 7 Personal Exposure Monitoring Devices Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Million)

7.2.2 Market Size, By Type, 2020-2026 (USD Million)

7.2.3 Market Size, By Device, 2020-2026 (USD Million)

7.2.4 Market Size, By Technology, 2020-2026 (USD Million)

7.2.6 U.S.

7.2.6.1 Market Size, By Type, 2020-2026 (USD Million)

7.2.4.2 Market Size, By Device, 2020-2026 (USD Million)

7.2.4.3 Market Size, By Technology, 2020-2026 (USD Million)

7.2.7 Canada

7.2.7.1 Market Size, By Type, 2020-2026 (USD Million)

7.2.7.2 Market Size, By Device, 2020-2026 (USD Million)

7.2.7.3 Market Size, By Technology, 2020-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Million)

7.3.2 Market Size, By Type, 2020-2026 (USD Million)

7.3.3 Market Size, By Device, 2020-2026 (USD Million)

7.3.4 Market Size, By Technology, 2020-2026 (USD Million)

7.3.6 Germany

7.3.6.1 Market Size, By Type, 2020-2026 (USD Million)

7.3.6.2 Market Size, By Device, 2020-2026 (USD Million)

7.3.6.3 Market Size, By Technology, 2020-2026 (USD Million)

7.3.7 UK

7.3.7.1 Market Size, By Type, 2020-2026 (USD Million)

7.3.7.2 Market Size, By Device, 2020-2026 (USD Million)

7.3.7.3 Market Size, By Technology, 2020-2026 (USD Million)

7.3.8 France

7.3.7.1 Market Size, By Type, 2020-2026 (USD Million)

7.3.7.2 Market Size, By Device, 2020-2026 (USD Million)

7.3.7.3 Market Size, By Technology, 2020-2026 (USD Million)

7.3.9 Italy

7.3.9.1 Market Size, By Type, 2020-2026 (USD Million)

7.3.9.2 Market Size, By Device, 2020-2026 (USD Million)

7.3.9.3 Market Size, By Technology, 2020-2026 (USD Million)

7.3.10 Spain

7.3.10.1 Market Size, By Type, 2020-2026 (USD Million)

7.3.10.2 Market Size, By Device, 2020-2026 (USD Million)

7.3.10.3 Market Size, By Technology, 2020-2026 (USD Million)

7.3.11 Russia

7.3.11.1 Market Size, By Type, 2020-2026 (USD Million)

7.3.11.2 Market Size, By Device, 2020-2026 (USD Million)

7.3.11.3 Market Size, By Technology, 2020-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Million)

7.4.2 Market Size, By Type, 2020-2026 (USD Million)

7.4.3 Market Size, By Device, 2020-2026 (USD Million)

7.4.4 Market Size, By Technology, 2020-2026 (USD Million)

7.4.6 China

7.4.6.1 Market Size, By Type, 2020-2026 (USD Million)

7.4.6.2 Market Size, By Device, 2020-2026 (USD Million)

7.4.6.3 Market Size, By Technology, 2020-2026 (USD Million)

7.4.7 India

7.4.7.1 Market Size, By Type, 2020-2026 (USD Million)

7.4.7.2 Market Size, By Device, 2020-2026 (USD Million)

7.4.7.3 Market Size, By Technology, 2020-2026 (USD Million)

7.4.8 Japan

7.4.7.1 Market Size, By Type, 2020-2026 (USD Million)

7.4.7.2 Market Size, By Device, 2020-2026 (USD Million)

7.4.7.3 Market Size, By Technology, 2020-2026 (USD Million)

7.4.9 Australia

7.4.9.1 Market Size, By Type, 2020-2026 (USD Million)

7.4.9.2 Market size, By Device, 2020-2026 (USD Million)

7.4.9.3 Market Size, By Technology, 2020-2026 (USD Million)

7.4.10 South Korea

7.4.10.1 Market Size, By Type, 2020-2026 (USD Million)

7.4.10.2 Market Size, By Device, 2020-2026 (USD Million)

7.4.10.3 Market Size, By Technology, 2020-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Million)

7.5.2 Market Size, By Type, 2020-2026 (USD Million)

7.5.3 Market Size, By Device, 2020-2026 (USD Million)

7.5.4 Market Size, By Technology, 2020-2026 (USD Million)

7.5.6 Brazil

7.5.6.1 Market Size, By Type, 2020-2026 (USD Million)

7.5.6.2 Market Size, By Device, 2020-2026 (USD Million)

7.5.6.3 Market Size, By Technology, 2020-2026 (USD Million)

7.5.7 Mexico

7.5.7.1 Market Size, By Type, 2020-2026 (USD Million)

7.5.7.2 Market Size, By Device, 2020-2026 (USD Million)

7.5.7.3 Market Size, By Technology, 2020-2026 (USD Million)

7.5.8 Argentina

7.5.7.1 Market Size, By Type, 2020-2026 (USD Million)

7.5.7.2 Market Size, By Device, 2020-2026 (USD Million)

7.5.7.3 Market Size, By Technology, 2020-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Million)

7.6.2 Market Size, By Type, 2020-2026 (USD Million)

7.6.3 Market Size, By Device, 2020-2026 (USD Million)

7.6.4 Market Size, By Technology, 2020-2026 (USD Million)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Type, 2020-2026 (USD Million)

7.6.6.2 Market Size, By Device, 2020-2026 (USD Million)

7.6.6.3 Market Size, By Technology, 2020-2026 (USD Million)

7.6.7 UAE

7.6.7.1 Market Size, By Type, 2020-2026 (USD Million)

7.6.7.2 Market Size, By Device, 2020-2026 (USD Million)

7.6.7.3 Market Size, By Technology, 2020-2026 (USD Million)

7.6.8 South Africa

7.6.7.1 Market Size, By Type, 2020-2026 (USD Million)

7.6.7.2 Market Size, By Device, 2020-2026 (USD Million)

7.6.7.3 Market Size, By Technology, 2020-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Entech Instruments

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 TSI Inc.

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Cook Medical Inc.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Tekran Instruments

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Photon Systems

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 RTI International

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Gradko International Ltd.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Polimaster Ltd.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Ormantine USA Ltd.

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Personal Exposure Monitoring Devices Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Personal Exposure Monitoring Devices Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS