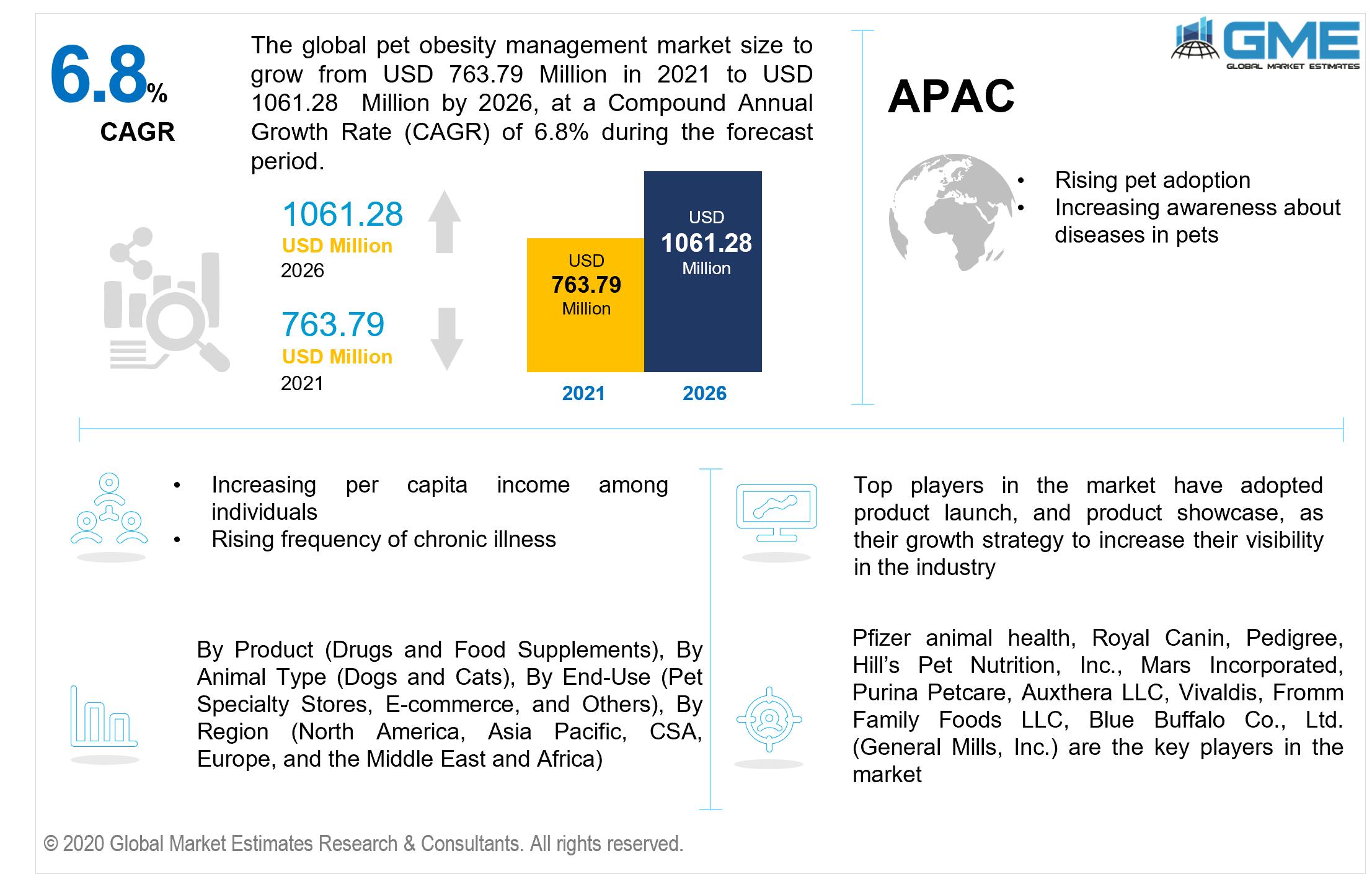

Global Pet Obesity Management Market Size, Trends & Analysis - Forecasts to 2026 By Product (Drugs and Food Supplements), By Animal Type (Dogs and Cats), By End-Use (Pet Specialty Stores, E-commerce, and Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

The global pet obesity management market is projected to grow from USD 763.79 million in 2021 to USD 1061.28 million by 2026 at a CAGR value of 6.8% between 2021 to 2026. The overall market is foreseen to expand due to increased overweight consciousness and need, as well as expanding pet adoption rates. Furthermore, the rising prevalence of illnesses associated with pet obesity and osteoarthritis is likely to provide substantial potential possibilities in the market throughout the forecast period.

As the frequency of pet obesity rises, so does the acceptance of pet obesity management strategies. Obesity raises the risk of chronic illnesses (osteoarthritis, diabetes, and many more), hence pet management regimens have been more popular in recent years. The increased ownership of pets and per capita earnings among individuals, particularly in emerging nations, are likely to fuel this market's expansion. Increased occurrences of obesity-related disorders in pets are predicted to increase demand for pet obesity management, boosting the market growth.

Weight loss in dogs is achieved by a designed diet, medicines, or a combination of the two. Being overweight in dogs raises the risk of developing various chronic diseases, as well as consequences such as osteoarthritis and diabetes. Obesity in pets like dogs, cats, and other animals that are in high demand is treated with pet weight management. Weight-loss medications for pets are only accessible through veterinarians or with a veterinary prescription.

Obesity is nowadays acknowledged as the most common medical issue in pets all over the world. Obesity in dogs is seen as a severe welfare concern since it can result in pain and disability. It is also likely to have an impact on pets' capacity to conduct natural activities (e.g. exercise as usual). Obesity in pets can induce serious health complications and worsen preexisting ailments, shortening and lowering the quality of a pet's lifespan. Weight control strategies for pets, including weight maintenance courses and weight loss, are included in pet obesity management. The energy intake from meals by the dogs must be less than what the energy consumed each day throughout the weight reduction phase. Weight loss in dogs is achieved by a designed diet, medicines, or a combination of the two.

Being overweight has been linked to a variety of clinical and subclinical disorders that might jeopardize a pet's health. Successful weight-loss regimens entail an awareness of human-animal interactions in addition to traditional dietary control. Practitioners can use the processes and dynamics of human-animal interaction to design effective treatment strategies for their clients.

The coronavirus outbreak has had a substantial detrimental influence on pet healthcare. The COVID-19 pandemic cases are the result of explicit or oblique human interaction. There is a misconception that animals would spread diseases, leading to people abandoning their pets. Furthermore, COVID-19 has disrupted the supply chain, resulting in a global scarcity of animal health items such as nutritious feed and vaccinations.

Furthermore, a growing number of pet owners are aware of and worried about maintaining their dogs' weight, particularly in the early stages, as excess weight can lead to a variety of health problems. In addition, if left unchecked, it can lead to astronomically high medical expenditures. Owners are adopting efficient weight control regimens for their dogs because of these worries.

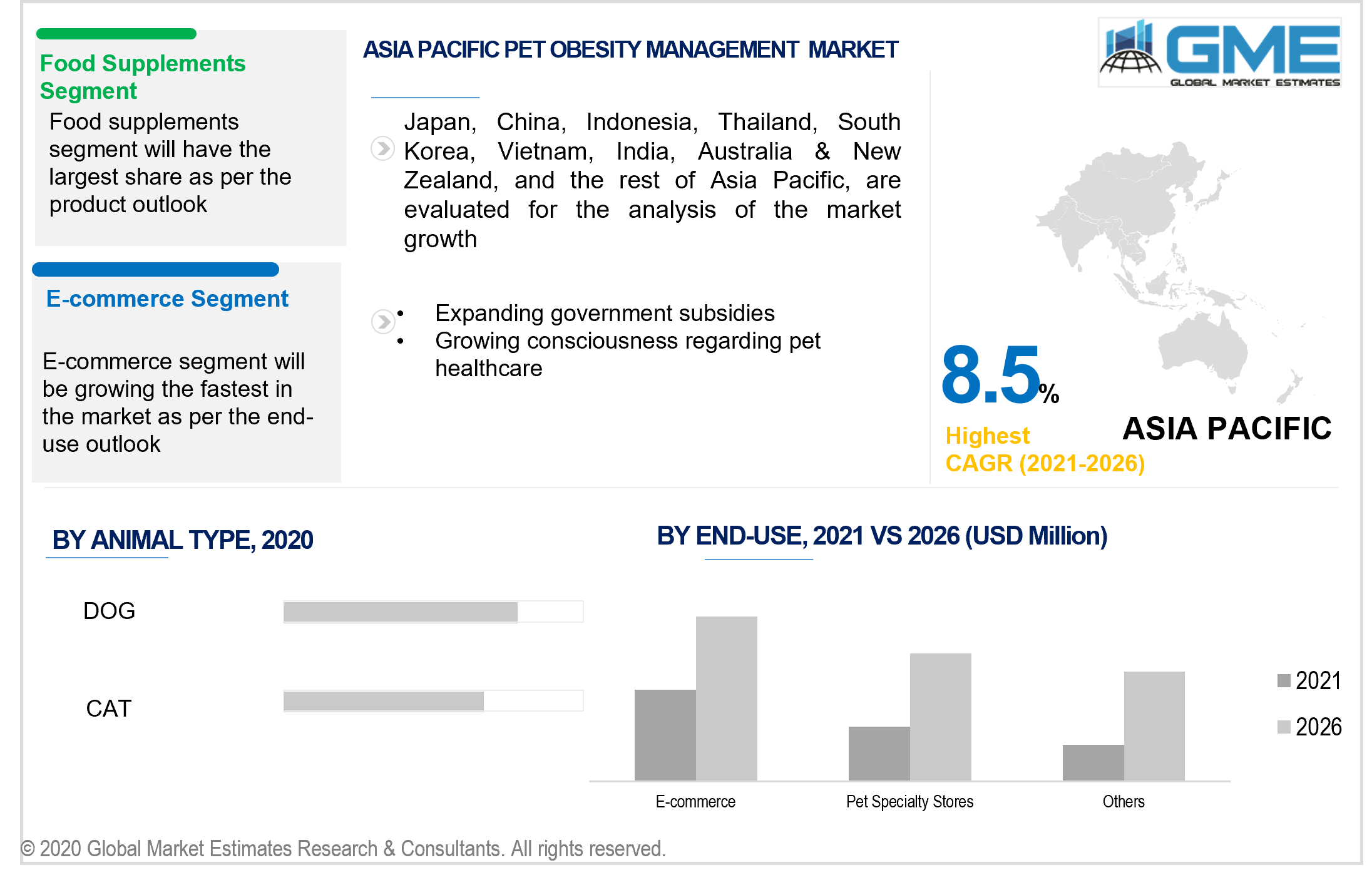

Based on the product, the market can be segmented as drugs and food supplements. Due to the shortage of branded pet medications on the market, the food supplements category will account for the largest market share soon. As pet owners prefer dietary supplements and exercise over medications for obesity control, the industry will grow even more. The growing demand for wholesome, clean, and nutritional food products is expected to propel the market. Consumers are paying more for high-quality pet meals as their lives change. The rising frequency of pet obesity, as well as the resulting increase in the number of instances of osteoarthritis, is driving up demand for weight-loss supplements.

Based on animal type, the market is divided into dogs and cats. Due to rising animal healthcare expenditures, particularly in developed areas, the dog-animal type segment will lead the market in the forecast period. Companion animal expenditures have been steadily increasing, according to animal healthcare organizations. Moreover, according to the APPA Pet Owners Survey on pet health spending the average number of visits to the vet per year is 2.7 for dogs and 21% of dog owners now use calming products. The most popular services received at the vet’s office include routine physicals and vaccines– performed on 48% of dogs.

Based on end-use, the market is classified as pet specialty stores, e-commerce, and others. Due to the easy availability of pet food supplements on online portals, the e-commerce segment is projected to lead the market in the coming years. Furthermore, many sites provide pet products at a discount. Furthermore, increased smartphone and internet penetration in developing economies such as India and China, which provide access to remote regions, is expected to boost the use of eCommerce websites.

Over the forecast period, North America is predicted to account for the largest market share. Obesity has impacted one-fourth of the region's canine population, prompting an increase in the adoption of pet obesity control strategies and product offerings. Insurance firms are developing policies to meet the growing need for pet owners to control their pets' weight properly.

The pet spending sector in the United States is predicted to grow the fastest. Advantageous insurance policies are also expected to broaden the market's potential. Furthermore, escalating worries amongst pet owners about the dangers inherent with obesity are increasing demand for effective weight control programs, which is expected to drive market growth.

Europe is anticipated to be the market's second-largest region. Obesity is becoming more frequent in late adulthood in this region as a result of a dearth of fitness, which is a significant factor driving market expansion. Additionally, increasing consciousness of the significance of healthcare of household pets is a key driver driving market evolution.

Furthermore, several committee initiatives for animal welfare are a key driver in market expansion. For example, the World Small Animal Veterinary Association (WSAVA) formed a One Health committee to address the transmission of zoonotic illnesses from dogs, cats, and other companion animals to people.

Over the forecast period, the APAC region market is expected to grow at a fast rate. Because of the growing adoption of pets in India, the country's market is a big revenue provider to the regional industry. Regionally, numerous governments are investing to build veterinary healthcare infrastructure. The developing countries’ national and state governments have given directives to expand the number of veterinary hospitals and clinics.

Pfizer animal health, Royal Canin, Pedigree, Hill’s Pet Nutrition, Inc., Mars Incorporated, Purina Petcare, Auxthera LLC, Vivaldis, Fromm Family Foods LLC, Blue Buffalo Co., Ltd. (General Mills, Inc.) are the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Pet Obesity Management Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Animal Type Overview

2.1.4 End-Use Overview

2.1.5 Regional Overview

Chapter 3 Pet Obesity Management Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising frequency of pet obesity

3.3.1.2 Increased ownership of pets

3.3.2 Industry Challenges

3.3.2.1 Limited Study and Industry Participants

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Animal Type Growth Scenario

3.4.3 End-Use Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Pet Obesity Management Market, By Product

4.1 Product Outlook

4.2 Drugs

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Food Supplements

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Pet Obesity Management Market, By Animal Type

5.1 Animal Type Outlook

5.2 Dogs

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Cats

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Pet Obesity Management Market, By End-Use

6.1 End-Use Outlook

6.2 Pet Specialty Stores

6.2.1 Market size, By Region, 2019-2026 (USD Million)

6.3 E-commerce

6.3.1 Market size, By Region, 2019-2026 (USD Million)

Chapter 7 Pet Obesity Management Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Million)

7.2.2 Market Size, By Product, 2019-2026 (USD Million)

7.2.3 Market Size, By Animal Type, 2019-2026 (USD Million)

7.2.4 Market Size, By End-Use, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Product, 2019-2026 (USD Million)

7.2.5.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.2.5.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Product, 2019-2026 (USD Million)

7.2.6.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.2.6.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Million)

7.3.2 Market Size, By Product, 2019-2026 (USD Million)

7.3.3 Market Size, By Animal Type, 2019-2026 (USD Million)

7.3.4 Market Size, By End-Use, 2019-2026 (USD Million)

7.3.5 Germany

7.2.5.1 Market Size, By Product, 2019-2026 (USD Million)

7.2.5.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.2.5.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.6.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.3.6.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.7.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.3.7.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.8.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.3.8.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.9.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.3.9.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.10.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.3.10.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2019-2026 (USD Million)

7.4.2 Market Size, By Product, 2019-2026 (USD Million)

7.4.3 Market Size, By Animal Type, 2019-2026 (USD Million)

7.4.4 Market Size, By End-Use, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Product, 2019-2026 (USD Million)

7.4.5.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.4.5.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Product, 2019-2026 (USD Million)

7.4.6.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.4.6.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Product, 2019-2026 (USD Million)

7.4.7.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.4.7.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Product, 2019-2026 (USD Million)

7.4.8.2 Market size, By Animal Type, 2019-2026 (USD Million)

7.4.8.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Product, 2019-2026 (USD Million)

7.4.9.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.4.9.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2019-2026 (USD Million)

7.5.2 Market Size, By Product, 2019-2026 (USD Million)

7.5.3 Market Size, By Animal Type, 2019-2026 (USD Million)

7.5.4 Market Size, By End-Use, 2019-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Product, 2019-2026 (USD Million)

7.5.5.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.5.5.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Product, 2019-2026 (USD Million)

7.5.6.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.5.6.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Product, 2019-2026 (USD Million)

7.5.7.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.5.7.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2019-2026 (USD Million)

7.6.2 Market Size, By Product, 2019-2026 (USD Million)

7.6.3 Market Size, By Animal Type, 2019-2026 (USD Million)

7.6.4 Market Size, By End-Use, 2019-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Product, 2019-2026 (USD Million)

7.6.5.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.6.5.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Product, 2019-2026 (USD Million)

7.6.6.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.6.6.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Product, 2019-2026 (USD Million)

7.6.7.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.6.7.3 Market Size, By End-Use, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Pfizer animal health

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Royal Canin

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Pedigree

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Hill’s Pet Nutrition, Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Mars Incorporated

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Purina Petcare

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Auxthera LLC

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Vivaldis

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Fromm Family Foods LLC

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Blue Buffalo Co., Ltd. (General Mills, Inc.)

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

The Global Pet Obesity Management Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Pet Obesity Management Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS