Global Pharmaceutical Analytical Testing Outsourcing Market Size, Trends & Analysis - Forecasts to 2029 By Service (Bioanalytical Testing, Method Development & Validation, Stability Testing, and Others), By End-use (Pharmaceutical Companies, Biopharmaceutical Companies, and Contract Research Organizations), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

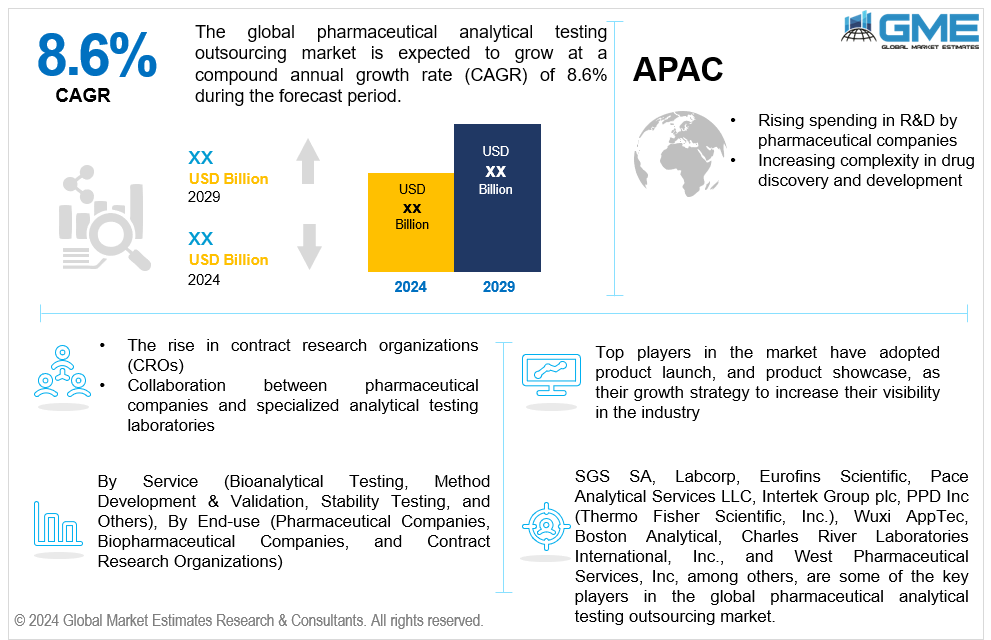

The global pharmaceutical analytical testing outsourcing market is estimated to exhibit a CAGR of 8.6% from 2024 to 2029.

The primary factors propelling the market growth are the rising spending in R&D by pharmaceutical companies and the increasing complexity in drug discovery and development. The rising investment in R&D by pharmaceutical companies fuels the demand for analytical testing outsourcing services, driven by factors such as the increasing number of clinical trial registrations, the need for comprehensive pharmaceutical testing solutions, and the imperative for regulatory compliance testing. Furthermore, with the advent of biologics, biosimilars, and customized medicine, pharmaceutical R&D is becoming more complex. Throughout the drug development process, analytical testing is essential to guarantee efficacy, safety, and regulatory compliance. The pharmaceutical industry can obtain specialized expertise and cutting-edge technologies by outsourcing analytical testing without making significant infrastructure investments. For instance, the top 15 global pharmaceutical companies including Pfizer, Novartis, and Eli Lilly spent a record USD 133 billion on research and development in 2021, according to IQVIA.

The rise in contract research organizations (CROs) and the collaboration between pharmaceutical companies and specialized analytical testing laboratories are expected to support the market growth. Pharmaceutical firms can outsource analytical testing services at a reasonable cost by working with specialized analytical testing laboratories. Companies can maximize resource usage, lower capital costs, and achieve cost reductions when utilizing contract analytical services instead of maintaining internal testing facilities. Additionally, these collaborations enable access to state-of-the-art instrumentation and methodologies for complex analytical challenges, driving growth rates in adopting advanced analytical techniques. For instance, a strategic partnership was formed in February 2022 between The Center for Breakthrough Medicines (CBM) and BioAnalysis LLC (BIA), providing CBM's clients with direct access to BIA's state-of-the-art testing capabilities. These capabilities include the ability to characterize viral vectors using BIA's unique sedimentation velocity approach to analytical ultracentrifugation.

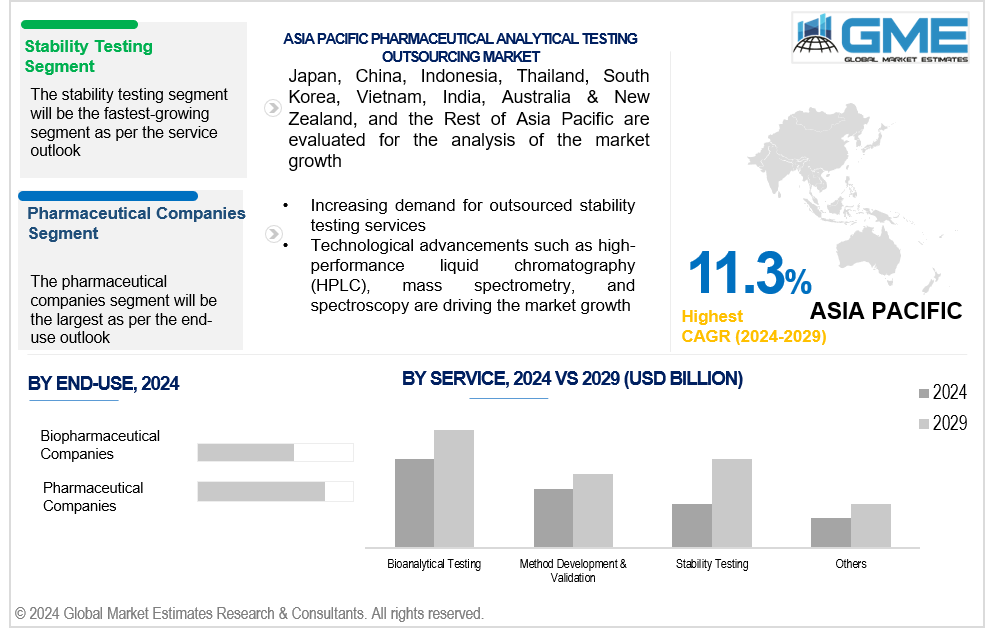

The increasing demand for outsourced stability testing services coupled with technological advancements such as high-performance liquid chromatography (HPLC), mass spectrometry, and spectroscopy propel market growth. Stability testing equipment and cutting-edge technologies are available at specialized analytical testing labs. These labs continually invest in the newest tools and techniques available, which allows them to provide precise and trustworthy stability evaluations for pharmaceuticals and fuels the expansion of quality control outsourcing. Moreover, companies can conduct stability testing for products destined for international markets due to specialized laboratories with expertise in global regulatory requirements, which boosts the demand for analytical method development services.

Outsourcing analytical research to labs with expertise in global regulatory requirements offers opportunities for pharmaceutical companies to ensure compliance with diverse regulatory standards. GMP (Good Manufacturing Practice) testing partners can assist in meeting stringent regulatory guidelines and facilitating product registration and market access in different regions. Additionally, there are opportunities to improve the efficacy and efficiency of analytical testing procedures through the integration of data analytics and artificial intelligence (AI) technologies.

However, data security and confidentiality concerns and regulatory compliance challenges may hinder market growth during the forecast period.

The bioanalytical testing segment is expected to hold the largest share of the market over the forecast period. In bioanalytical testing, biological samples are analyzed to determine the presence and concentration of pharmaceuticals and their metabolites. This is integral to pharmaceutical testing since it frequently calls for specialist expertise and complex equipment.

The stability testing segment is expected to be the fastest-growing segment in the market from 2024 to 2029. Stability testing is required by regulatory bodies as an essential part of pharmaceutical development to assess the stability and shelf-life of pharmaceutical products. Pharmaceutical companies increasingly depend on outsourcing partners with stability testing expertise to ensure compliance as worldwide regulatory standards get more demanding.

The pharmaceutical companies segment is expected to witness the largest share of the market over the forecast period. Pharmaceutical companies spend the majority of their money and efforts on the creation, identification, and marketing of novel medications. By outsourcing this type of testing, they can concentrate on their core skills by using the knowledge of specialized contract research organizations (CROs) to provide analytical testing services.

The biopharmaceutical companies segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. The discovery of biologics, biosimilars, gene therapies, and cell-based therapies, among other scientific innovations, has propelled the biopharmaceutical industry's growth. The need for sophisticated analytical testing techniques for these complex biopharmaceuticals fuels the need for outsourcing services.

North America is expected to be the largest region in the global market. The growth of the North American region is driven by the stringent regulatory requirements set by organizations such as the U.S. Food and Drug Administration (FDA) and Health Canada, which mandate rigorous analytical testing throughout the drug development lifecycle. Pharmaceutical companies can effectively ensure regulatory compliance by outsourcing analytical testing.

Asia Pacific is anticipated to witness rapid growth during the forecast period. The pharmaceutical sector is growing significantly in the Asia Pacific region due to increased healthcare costs, a rise in the prevalence of chronic diseases, and easier access to healthcare services. The need for analytical testing services to guarantee the efficacy, safety, and quality of pharmaceutical products is being fueled by this growth.

SGS SA, Labcorp, Eurofins Scientific, Pace Analytical Services LLC, Intertek Group plc, PPD Inc (Thermo Fisher Scientific, Inc.), Wuxi AppTec, Boston Analytical, Charles River Laboratories International, Inc., and West Pharmaceutical Services, Inc, among others, are some of the key players in the global pharmaceutical analytical testing outsourcing market.

Please note: This is not an exhaustive list of companies profiled in the report.

In March 2024, LGM Pharma announced significant developments, such as a USD 2 million investment in its Analytical Testing Services (ATS) and a 50% capacity boost. In addition to improving internal resources for growth and providing clients with a simplified and effective production solution, this growth supports introducing new manufacturing capabilities.

In August 2023, Astellas Analytical Science Laboratories, Inc., one of Eurofins Scientific's testing facilities, was transferred to Astellas as part of an outsourcing agreement. By utilizing Astella's experience, the partnership sought to expand Eurofin's biopharmaceutical testing services in Japan and bolster its market position.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET, BY Service

4.1 Introduction

4.2 Pharmaceutical Analytical Testing Outsourcing Market: Service Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Bioanalytical Testing

4.4.1 Bioanalytical Testing Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Method Development & Validation

4.5.1 Method Development & Validation Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Stability Testing

4.6.1 Stability Testing Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Others

4.7.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET, BY END-USE

5.1 Introduction

5.2 Pharmaceutical Analytical Testing Outsourcing Market: End-use Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Pharmaceutical Companies

5.4.1 Pharmaceutical Companies Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Biopharmaceutical Companies

5.5.1 Biopharmaceutical Companies Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Contract Research Organizations

5.6.1 Contract Research Organizations Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET, BY REGION

6.1 Introduction

6.2 North America Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Service

6.2.2 By End-use

6.2.3 By Country

6.2.3.1 U.S. Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Service

6.2.3.1.2 By End-use

6.2.3.2 Canada Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Service

6.2.3.2.2 By End-use

6.2.3.3 Mexico Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Service

6.2.3.3.2 By End-use

6.3 Europe Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Service

6.3.2 By End-use

6.3.3 By Country

6.3.3.1 Germany Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Service

6.3.3.1.2 By End-use

6.3.3.2 U.K. Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Service

6.3.3.2.2 By End-use

6.3.3.3 France Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Service

6.3.3.3.2 By End-use

6.3.3.4 Italy Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Service

6.3.3.4.2 By End-use

6.3.3.5 Spain Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Service

6.3.3.5.2 By End-use

6.3.3.6 Netherlands Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Service

6.3.3.6.2 By End-use

6.3.3.7 Rest of Europe Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Service

6.3.3.6.2 By End-use

6.4 Asia Pacific Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Service

6.4.2 By End-use

6.4.3 By Country

6.4.3.1 China Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Service

6.4.3.1.2 By End-use

6.4.3.2 Japan Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Service

6.4.3.2.2 By End-use

6.4.3.3 India Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Service

6.4.3.3.2 By End-use

6.4.3.4 South Korea Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Service

6.4.3.4.2 By End-use

6.4.3.5 Singapore Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Service

6.4.3.5.2 By End-use

6.4.3.6 Malaysia Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Service

6.4.3.6.2 By End-use

6.4.3.7 Thailand Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Service

6.4.3.6.2 By End-use

6.4.3.8 Indonesia Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Service

6.4.3.7.2 By End-use

6.4.3.9 Vietnam Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Service

6.4.3.8.2 By End-use

6.4.3.10 Taiwan Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Service

6.4.3.10.2 By End-use

6.4.3.11 Rest of Asia Pacific Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Service

6.4.3.11.2 By End-use

6.5 Middle East and Africa Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Service

6.5.2 By End-use

6.5.3 By Country

6.5.3.1 Saudi Arabia Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Service

6.5.3.1.2 By End-use

6.5.3.2 U.A.E. Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Service

6.5.3.2.2 By End-use

6.5.3.3 Israel Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Service

6.5.3.3.2 By End-use

6.5.3.4 South Africa Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Service

6.5.3.4.2 By End-use

6.5.3.5 Rest of Middle East and Africa Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Service

6.5.3.5.2 By End-use

6.6 Central and South America Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Service

6.6.2 By End-use

6.6.3 By Country

6.6.3.1 Brazil Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Service

6.6.3.1.2 By End-use

6.6.3.2 Argentina Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Service

6.6.3.2.2 By End-use

6.6.3.3 Chile Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Service

6.6.3.3.2 By End-use

6.6.3.3 Rest of Central and South America Pharmaceutical Analytical Testing Outsourcing Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Service

6.6.3.3.2 By End-use

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 SGS SA

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Labcorp

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Eurofins Scientific

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Pace Analytical Services LLC

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Intertek Group plc

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 PPD INC (THERMO FISHER SCIENTIFIC INC. )

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Wuxi AppTec

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Boston Analytical

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Charles River Laboratories International, Inc.

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 West Pharmaceutical Services

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Type of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

2 Bioanalytical Testing Market, By Region, 2021-2029 (USD Mllion)

3 Method Development & Validation Market, By Region, 2021-2029 (USD Mllion)

4 Stability Testing Market, By Region, 2021-2029 (USD Mllion)

5 Others Market, By Region, 2021-2029 (USD Mllion)

6 Global Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

7 Pharmaceutical Companies Market, By Region, 2021-2029 (USD Mllion)

8 Biopharmaceutical Companies Market, By Region, 2021-2029 (USD Mllion)

9 Contract Research Organizations Market, By Region, 2021-2029 (USD Mllion)

10 Regional Analysis, 2021-2029 (USD Mllion)

11 North America Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

12 North America Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

13 North America Pharmaceutical Analytical Testing Outsourcing Market, By COUNTRY, 2021-2029 (USD Mllion)

14 U.S. Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

15 U.S. Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

16 Canada Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

17 Canada Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

18 Mexico Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

19 Mexico Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

20 Europe Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

21 Europe Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

22 EUROPE Pharmaceutical Analytical Testing Outsourcing Market, By COUNTRY, 2021-2029 (USD Mllion)

23 Germany Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

24 Germany Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

25 U.K. Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

26 U.K. Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

27 France Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

28 France Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

29 Italy Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

30 Italy Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

31 Spain Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

32 Spain Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

33 Netherlands Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

34 Netherlands Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

35 Rest Of Europe Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

36 Rest Of Europe Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

37 Asia Pacific Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

38 Asia Pacific Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

39 ASIA PACIFIC Pharmaceutical Analytical Testing Outsourcing Market, By COUNTRY, 2021-2029 (USD Mllion)

40 China Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

41 China Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

42 Japan Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

43 Japan Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

44 India Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

45 India Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

46 South Korea Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

47 South Korea Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

48 Singapore Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

49 Singapore Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

50 Thailand Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

51 Thailand Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

52 Malaysia Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

53 Malaysia Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

54 Indonesia Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

55 Indonesia Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

56 Vietnam Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

57 Vietnam Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

58 Taiwan Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

59 Taiwan Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

60 Rest of APAC Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

61 Rest of APAC Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

62 Middle East and Africa Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

63 Middle East and Africa Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

64 MIDDLE EAST & ADRICA Pharmaceutical Analytical Testing Outsourcing Market, By COUNTRY, 2021-2029 (USD Mllion)

65 Saudi Arabia Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

66 Saudi Arabia Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

67 UAE Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

68 UAE Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

69 Israel Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

70 Israel Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

71 South Africa Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

72 South Africa Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

73 Rest Of Middle East and Africa Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

74 Rest Of Middle East and Africa Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

75 Central and South America Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

76 Central and South America Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

77 CENTRAL AND SOUTH AMERICA Pharmaceutical Analytical Testing Outsourcing Market, By COUNTRY, 2021-2029 (USD Mllion)

78 Brazil Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

79 Brazil Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

80 Chile Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

81 Chile Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

82 Argentina Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

83 Argentina Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

84 Rest Of Central and South America Pharmaceutical Analytical Testing Outsourcing Market, By Service, 2021-2029 (USD Mllion)

85 Rest Of Central and South America Pharmaceutical Analytical Testing Outsourcing Market, By End-use, 2021-2029 (USD Mllion)

86 SGS SA: Products & Services Offering

87 Labcorp: Products & Services Offering

88 Eurofins Scientific: Products & Services Offering

89 Pace Analytical Services LLC: Products & Services Offering

90 Intertek Group plc: Products & Services Offering

91 PPD INC (Thermo Fisher Scientific Inc.): Products & Services Offering

92 Wuxi AppTec: Products & Services Offering

93 Boston Analytical: Products & Services Offering

94 Charles River Laboratories International, Inc., Inc: Products & Services Offering

95 West Pharmaceutical Services: Products & Services Offering

96 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Pharmaceutical Analytical Testing Outsourcing Market Overview

2 Global Pharmaceutical Analytical Testing Outsourcing Market Value From 2021-2029 (USD Mllion)

3 Global Pharmaceutical Analytical Testing Outsourcing Market Share, By Service (2023)

4 Global Pharmaceutical Analytical Testing Outsourcing Market Share, By End-use (2023)

5 Global Pharmaceutical Analytical Testing Outsourcing Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Pharmaceutical Analytical Testing Outsourcing Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Pharmaceutical Analytical Testing Outsourcing Market

10 Impact Of Challenges On The Global Pharmaceutical Analytical Testing Outsourcing Market

11 Porter’s Five Forces Analysis

12 Global Pharmaceutical Analytical Testing Outsourcing Market: By Service Scope Key Takeaways

13 Global Pharmaceutical Analytical Testing Outsourcing Market, By Service Segment: Revenue Growth Analysis

14 Bioanalytical Testing Market, By Region, 2021-2029 (USD Mllion)

15 Method Development & Validation Market, By Region, 2021-2029 (USD Mllion)

16 Stability Testing Market, By Region, 2021-2029 (USD Mllion)

17 Others Market, By Region, 2021-2029 (USD Mllion)

18 Global Pharmaceutical Analytical Testing Outsourcing Market: By End-use Scope Key Takeaways

19 Global Pharmaceutical Analytical Testing Outsourcing Market, By End-use Segment: Revenue Growth Analysis

20 Pharmaceutical Companies Market, By Region, 2021-2029 (USD Mllion)

21 Biopharmaceutical Companies Market, By Region, 2021-2029 (USD Mllion)

22 Contract Research Organizations Market, By Region, 2021-2029 (USD Mllion)

23 Global Pharmaceutical Analytical Testing Outsourcing Market: Regional Analysis

24 North America Pharmaceutical Analytical Testing Outsourcing Market Overview

25 North America Pharmaceutical Analytical Testing Outsourcing Market, By Service

26 North America Pharmaceutical Analytical Testing Outsourcing Market, By End-use

27 North America Pharmaceutical Analytical Testing Outsourcing Market, By Country

28 U.S. Pharmaceutical Analytical Testing Outsourcing Market, By Service

29 U.S. Pharmaceutical Analytical Testing Outsourcing Market, By End-use

30 Canada Pharmaceutical Analytical Testing Outsourcing Market, By Service

31 Canada Pharmaceutical Analytical Testing Outsourcing Market, By End-use

32 Mexico Pharmaceutical Analytical Testing Outsourcing Market, By Service

33 Mexico Pharmaceutical Analytical Testing Outsourcing Market, By End-use

34 Four Quadrant Positioning Matrix

35 Company Market Share Analysis

36 SGS SA: Company Snapshot

37 SGS SA: SWOT Analysis

38 SGS SA: Geographic Presence

39 Labcorp: Company Snapshot

40 Labcorp: SWOT Analysis

41 Labcorp: Geographic Presence

42 Eurofins Scientific: Company Snapshot

43 Eurofins Scientific: SWOT Analysis

44 Eurofins Scientific: Geographic Presence

45 Pace Analytical Services LLC: Company Snapshot

46 Pace Analytical Services LLC: Swot Analysis

47 Pace Analytical Services LLC: Geographic Presence

48 Intertek Group plc: Company Snapshot

49 Intertek Group plc: SWOT Analysis

50 Intertek Group plc: Geographic Presence

51 PPD INC (THERMO FISHER SCIENTIFIC INC.): Company Snapshot

52 PPD INC (THERMO FISHER SCIENTIFIC INC.): SWOT Analysis

53 PPD INC (THERMO FISHER SCIENTIFIC INC.): Geographic Presence

54 Wuxi AppTec : Company Snapshot

55 Wuxi AppTec : SWOT Analysis

56 Wuxi AppTec : Geographic Presence

57 Boston Analytical: Company Snapshot

58 Boston Analytical: SWOT Analysis

59 Boston Analytical: Geographic Presence

60 Charles River Laboratories International, Inc., Inc.: Company Snapshot

61 Charles River Laboratories International, Inc., Inc.: SWOT Analysis

62 Charles River Laboratories International, Inc., Inc.: Geographic Presence

63 West Pharmaceutical Services: Company Snapshot

64 West Pharmaceutical Services: SWOT Analysis

65 West Pharmaceutical Services: Geographic Presence

66 Other Companies: Company Snapshot

67 Other Companies: SWOT Analysis

68 Other Companies: Geographic Presence

The Global Pharmaceutical Analytical Testing Outsourcing Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Pharmaceutical Analytical Testing Outsourcing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS