Global Pharmaceutical Excipient Market Size, Trends & Analysis - Forecasts to 2027 By Product (Organic, Inorganic), By Functionality (Fillers and Diluents, Binders, Coatings, Flavoring agents, Disintegrants, Colorants, Others), By Dosage Form (Oral Formulations, Tablets, Capsules, Liquid Formulation, Parenteral Formulation), By Region (Europe, North America, Asia Pacific Central & South America, and the Middle East & Africa), End-User Landscape Analysis, Company Market Share Analysis, and Competitor Analysis

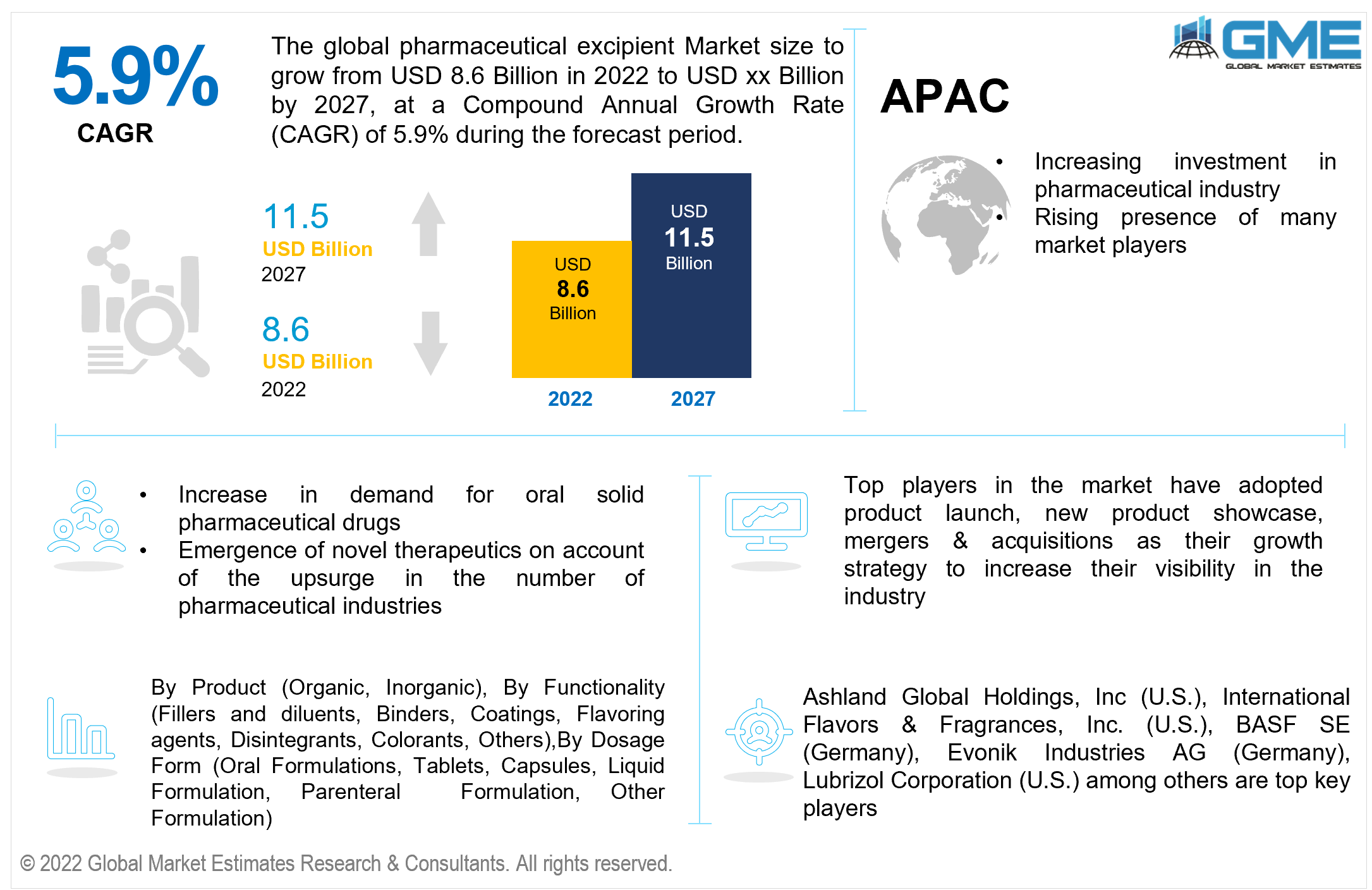

The global pharmaceutical excipient market is expected to grow from USD 8.6 Billion in 2022 to USD 11.5 billion in 2027 at a CAGR of 5.9% from 2022 to 2027.

The global pharmaceutical excipients market is driven by the increase popular of strong oral pharmaceutical drugs and the development of novel therapeutics by the upsurge in the number of pharmaceutical companies. The use of nanotechnology in improving drug formulation and excipients has led to the development of tablets with nanotechnology-based coatings, nano-determined liposomes, and vaccines.

Moreover, major drug manufacturers have advocated moving their manufacturing plants for pharmaceutical excipients, additives, glycerin, and fatty acids to emerging economies. This move was prompted by the higher production costs and stringent unofficial laws in North America and Europe.

Applications of excipients in oral formulations are driving tremendous investments in the pharmaceutical excipients market.

COVID-19 spread rapidly, and public health authorities across forced a lockdown to diminish the spread. The covid-19 pandemic exceptionally impacted the global economy as many industries suffered from lockdowns and a lack of availability of manpower. Like many different industries, the covid-19 pandemic massively affected the pharmaceutical excipients market. The abrupt burden of lockdown and social distancing guidelines upset the appropriation channel and store network of unrefined components for the top pharmaceutical companies. The absence of supply also influenced nations like China and India, and it decreased the manufacturing of drugs worldwide. The covid-19 decidedly affected the pharmaceutical excipients market also. Pharmaceutical excipients were utilized in R&D exercises to distinguish the vaccine combination for the infection, which seriously affected numerous medical care areas. It adversely affected the pharmaceutical excipients, particularly the companies who are profoundly reliant upon outsourcing. The removal of restrictions has helped in numerous nations, many companies have begun their production work, and the demand for pharmaceutical excipients has increased. The pharmaceutical excipients market will show tremendous growth after the post-covid circumstance.

The Ukraine-Russia war impacted the market growth rate adversely. Due to supply chain breakage, the transportation of raw materials is difficult. This has caused difficulties in the production process for drug manufacturers. The key market will witness a rise in price in overall pharmaceutical excipient products. Due to problems in the manufacturing process, the pharmaceutical sector will see a slowdown.

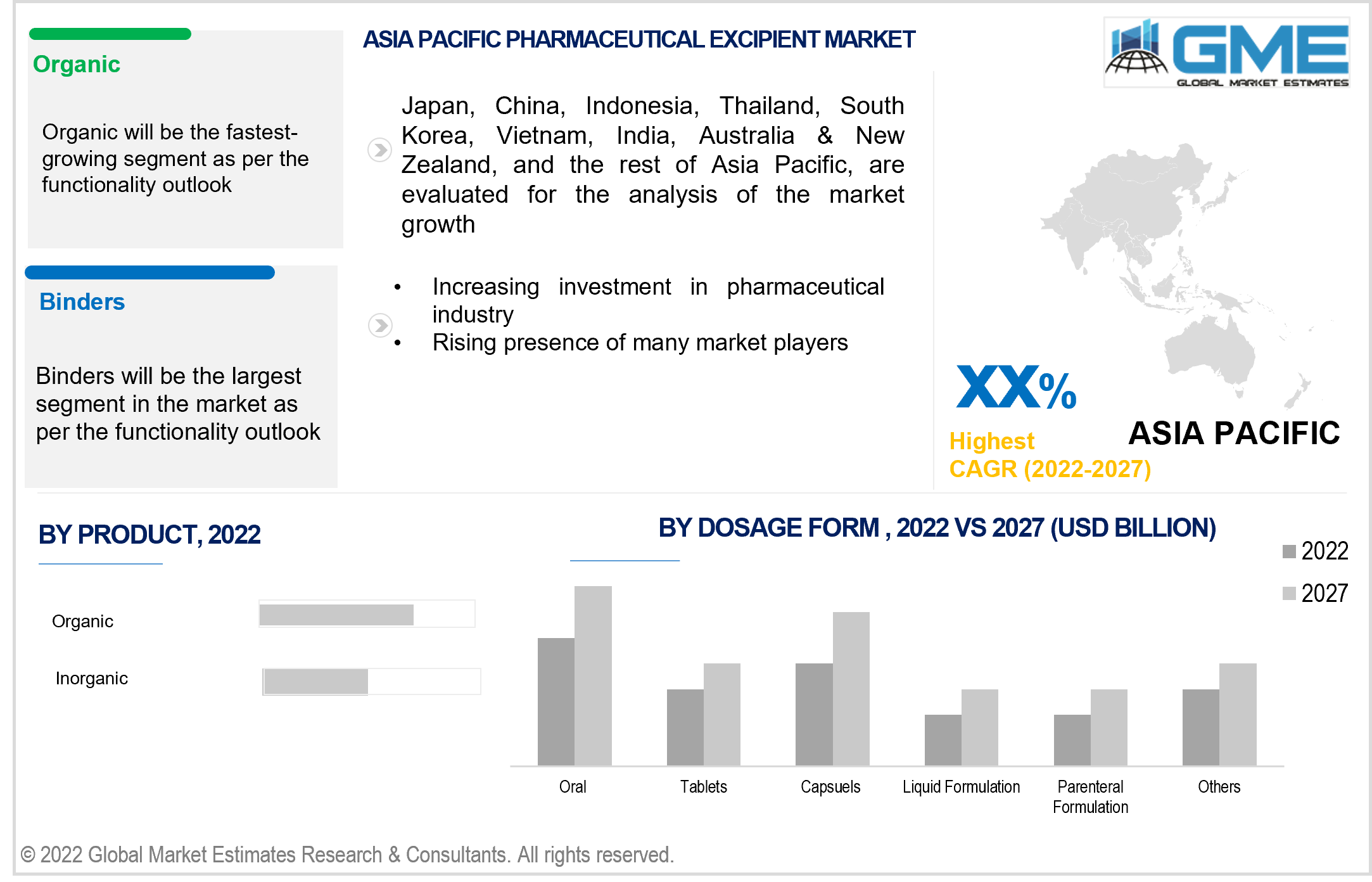

The market is expected to be dominated by the organic segment, based on product. Increasing demand for synthetic substances include polymers, petrochemicals, oleochemicals, and proteins. These ingredients are a significant part of any drug and assume an important role in fulfilling the motivation behind the medicine. According to a report by IMS Institute for Healthcare Informatics, the general volume of medicines utilized across the globe stretched around 4.5 trillion by 2020. As the interest for clinical drug production in the pharmaceutical areas in nations across the globe increases, the claim for the utilization of pharmaceutical excipients is likewise expected to rise fundamentally, which can assist with boosting the market growth.

The organic segment is expected to become the fastest-growing market. Growing demand for natural polymers and sugars in the pharmaceutical excipient market is expected to contribute to the rapid growth of the organic segment.

The binders section held the largest segment of the pharmaceutical excipients market, based on functionality. Powders, granules, and other dry substances that are utilized as strengthening agents in pharmaceutical formulations are held together by binder excipients, which act as glue. Binder excipients play a crucial role in the formulation of medications and treatments because they affect the density, disintegration, and rate of dissolution of the drug in the body. As a result, there is an increasing demand for using these excipients to make pharmaceuticals.

The oral formulations section held the lion’s share of the pharmaceutical excipients market, based on the dosage forms. The significant purpose is their wide use and viability against numerous sicknesses. Initially, medical services experts had suggested antiviral drugs as the effective means of security against COVID-19, particularly due to their viability in resolving pneumonia and other respiratory diseases brought about by the infection. For instance, Pfizer made a declaration in March 2021, which expressed that it had initiated the stage 1 investigation of novel oral antiviral restorative specialists to battle against SARS-COV-2. These drugs, alongside numerous clinical other orally administered medicines, are normally endorsed in huge numbers and are expected to contribute to the rapid growth of the oral formulations market.

Europe is expected to hold a dominant share of the pharmaceutical excipients industry because of the increased excipient use caused by the existence of several multinational pharmaceutical companies.

North America holds the second-most elevated pharmaceutical excipients market share. The increasing demand for innovative excipients has also been a result of the increased focus on improved pharmaceutical goods, generic drugs, and biosimilars, all of which are projected to contribute to market growth in the region. This district will see fast growth in the forecast period because of the expansive research on drug-excipient interactions to further develop drug productivity.

The Asia Pacific will see the fastest growth rate during the forecast period. The increasing investment in the pharmaceutical industry by governments and private players will increase market interest. The Asia Pacific will also witness the rise of many new market players in the region.

Eastman Chemical Corporation, Huntsman Corporation, Roquette, JRS Pharma, Ashland Global Holdings, Inc., International Flavors & Fragrances, Inc., BASF SE, Evonik Industries AG, Roquette Frères, Associated British Foods plc, Archer Daniels Midland Company, and Lubrizol Corporation among others are top key players in the pharmaceutical excipient market.

Please note: This is not an exhaustive list of companies profiled in the report.

Business extensions, new product dispatches, consolidations and acquisitions, and joint efforts with instructive colleges are the methodologies key players adjust to take special care of the growing interest for pharmaceutical excipients.

In March 2022, Evonik sent off the EUDRATEC SoluFlow, a new microparticle innovation to improve the dissolvability of active pharmaceutical ingredients in oral drug products. As more than 70% of new little particles are insoluble, EUDRATEC SoluFlow, in this way, empowers the advancement of new oral therapeutics in different regions like malignant growth, cardiovascular illnesses, infectious illnesses, and diabetes.

Chapter 1 Research Functionality ology

1.1 Research Assumptions

1.2 Research Functionality ology

1.2.1 Estimates and Forecast Timeline

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GME’s Internal Database

1.3.3 Primary Research

1.3.4 Secondary Sources & Third-Party Perspectives

1.3.4.1 Company Information Sources: Annual Reports, Investor Presentation, Press Release, SEC Filling, Company Blogs & Website

1.3.4.2 Secondary Data Sources: World Health Organization, USFDA, IFPMA, American Association of Pharmaceutical Scientists, American Society of Health Systems, and FAPA.

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Data Visualization

1.6 Data Validation & Publishing

1.7 Market Model

1.7.1 Model Details

1.7.1.1 Top-Down Approach

1.7.1.2 Bottom-Up Approach

1.8 Market Segmentation & Scope

1.9 Market Definition

Chapter 2 Executive Summary

2.1. Global Market Outlook

2.2 Product Outlook

2.3 Functionality Outlook

2.4 Dosage Form Outlook

2.5 Regional Outlook

Chapter 3 Global Pharmaceutical Excipient Market Trend Analysis

3.1. Market Introduction

3.2 Penetration & Growth Prospect Mapping

3.3 Impact of COVID-19 on the Pharmaceutical Excipient Market

3.4 Metric Data on Pharmaceutical Industry

3.5 Market Driver Analysis

3.5.1 Market Driver Analysis

3.5.2 Market Restraint Analysis

3.5.3 Industry Challenges

3.5.4 Industry Opportunities

3.6 Porter’s Five Analysis

3.6.1 Supplier Power

3.6.2 Buyer Power

3.6.3 Substitution Threat

3.6.4 Threat from New Entrant

3.7 Market Entry Strategies

Chapter 4 Pharmaceutical Excipient Market: Product Trend Analysis

4.1 Product: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

4.2 Organic

4.2.1 Market Estimates & Forecast Analysis of Organic Segment, By Region, 2019-2027 (USD Billion)

4.3 Inorganic

4.3.1 Market Estimates & Forecast Analysis of Inorganic Segment, By Region, 2019-2027 (USD Billion)

Chapter 5 Pharmaceutical Excipient Market: Functionality Trend Analysis

5.1 Functionality: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

5.2 Fillers and Diluents

5.2.1 Market Estimates & Forecast Analysis of Fillers and Diluents Segment, By Region, 2019-2027 (USD Billion)

5.3 Binders

5.3.1 Market Estimates & Forecast Analysis of Binders Segment, By Region, 2019-2027 (USD Billion)

5.4 Coatings

5.4.1 Market Estimates & Forecast Analysis of Coatings Segment, By Region, 2019-2027 (USD Billion)

5.5 Flavoring Agents

5.5.1 Market Estimates & Forecast Analysis of Flavoring Agents Segment, By Region, 2019-2027 (USD Billion)

5.6 Disintegrants

5.6.1 Market Estimates & Forecast Analysis of Disintegrants Segment, By Region, 2019-2027 (USD Billion)

5.7 Colorants

5.7.1 Market Estimates & Forecast Analysis of Colorants Segment, By Region, 2019-2027 (USD Billion)

5.8 Others

5.8.1 Market Estimates & Forecast Analysis of Others Segment, By Region, 2019-2027 (USD Billion)

Chapter 6 Pharmaceutical Excipient Market: Dosage Form Trend Analysis

6.1 Dosage Form: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

6.2 Oral Formulations

6.2.1 Market Estimates & Forecast Analysis of Oral Formulations Segment, By Region, 2019-2027 (USD Billion)

6.3 Tablets

6.3.1 Market Estimates & Forecast Analysis of Tablets Segment, By Region, 2019-2027 (USD Billion)

6.4 Capsules

6.4.1 Market Estimates & Forecast Analysis of Capsules Segment, By Region, 2019-2027 (USD Billion)

6.5 Liquid Formulation

6.5.1 Market Estimates & Forecast Analysis of Liquid Formulation Segment, By Region, 2019-2027 (USD Billion)

6.6 Parenteral Formulation

6.5.1 Market Estimates & Forecast Analysis of Parenteral Formulation Segment, By Region, 2019-2027 (USD Billion)

Chapter 7 Pharmaceutical Excipient Market, By Region

7.1 Regional Outlook

7.2 North America

7.2.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.2.2 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.2.3 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.2.4 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.2.5.2 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.2.5.3 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.2.6.2 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.2.6.3 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

7.5.7 Mexico

7.5.5.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.5.5.2 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.5.5.3 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

7.3 Europe

7.3.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.3.2 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.3.3 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.3.4 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

7.3.5 Germany

7.3.5.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.3.5.2 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.3.5.3 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

7.3.6 UK

7.3.6.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.3.6.2 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.3.6.3 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

7.3.7 France

7.3.7.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.3.7.2 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.3.7.3 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

7.3.8 Russia

7.3.8.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.3.8.2 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.3.8.3 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.3.9.2 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.3.9.3 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.3.10.2 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.3.10.3 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

7.3.11 Rest of Europe

7.3.11.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.3.11.2 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.3.11.3 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.4.2 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.4.3 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.4.4 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

7.4.5 China

7.4.5.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.4.5.2 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.4.5.3 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

7.4.6 India

7.4.6.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.4.6.2 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.4.6.3 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.4.7.2 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.4.7.3 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.4.8.2 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.4.8.3 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.4.9.2 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.4.9.3 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

7.3.10 Rest of Asia Pacific

7.3.10.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.3.10.2 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.3.10.3 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

7.5 Central & South America

7.5.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.5.2 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.5.3 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.5.4 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.5.5.2 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.5.5.3 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

7.5.6 Rest of Central & South America

7.5.6.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.5.6.2 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.5.6.3 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

7.6 Middle East & Africa

7.6.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.6.2 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.6.3 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.6.4 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.6.5.2 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.6.5.3 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

7.6.6 United Arab Emirates

7.6.6.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.6.6.2 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.6.6.3 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

7.6.7 South Africa

7.6.7.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.6.7.2 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.6.7.3 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

7.5.8 Rest of Middle East & Africa

7.5.8.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.5.8.2 Market Estimates & Forecast Analysis, By Functionality, 2019-2027 (USD Billion)

7.5.8.3 Market Estimates & Forecast Analysis, By Dosage Form, 2019-2027 (USD Billion)

Chapter 8 Competitive Analysis

8.1 Key Global Players, Recent Developments & their Impact on the Industry

8.2 Four Quadrant Competitor Positioning Matrix

8.2.1 Key Innovators

8.2.2 Market Leaders

8.2.3 Emerging Players

8.2.4 Market Challengers

8.3 Vendor Landscape Analysis

8.4 Dosage Form Landscape Analysis

8.5 Company Market Share Analysis, 2021

Chapter 9 Company Profile Analysis

9.1 Ashland Global Holdings, Inc

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Strategic Initiatives

9.1.4 Product Benchmarking

9.2 International Flavors & Fragrances, Inc .

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Initiatives

9.2.4 Product Benchmarking

9.3 BASF SE

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Initiatives

9.3.4 Product Benchmarking

9.4 Evonik Industries AG

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Initiatives

9.4.4 Product Benchmarking

9.5 Roquette Frères

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Initiatives

9.5.4 Product Benchmarking

9.6 Associated British Foods plc.

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Initiatives

9.6.4 Product Benchmarking

9.7 Archer Daniels Midland Company

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Initiatives

9.7.4 Product Benchmarking

9.8 Lubrizol Corporation

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Initiatives

9.8.4 Product Benchmarking

9.9 Innophos Holdings

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Initiatives

9.9.4 Product Benchmarking

9.10 Kerry Group plc .

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Initiatives

9.10.4 Product Benchmarking

9.11 Other Companies

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Initiatives

9.11.4 Product Benchmarking

List of Tables

1 Technological Advancements In Pharmaceutical Excipient Market

2 Global Pharmaceutical Excipient Market: Key Market Drivers

3 Global Pharmaceutical Excipient Market: Key Market Challenges

4 Global Pharmaceutical Excipient Market: Key Market Opportunities

5 Global Pharmaceutical Excipient Market: Key Market Restraints

6 Global Pharmaceutical Excipient Market Estimates & Forecast Analysis, 2019-2027 (USD Billion)

7 Global Pharmaceutical Excipient Market, By Product, 2019-2027 (USD Billion)

8 Organic: Global Pharmaceutical Excipient Market, By Region, 2019-2027 (USD Billion)

9 Inorganic: Global Pharmaceutical Excipient Market, By Region, 2019-2027 (USD Billion)

10 Global Pharmaceutical Excipient Market, By Functionality, 2019-2027 (USD Billion)

11 Fillers and diluents: Global Pharmaceutical Excipient Market, By Region, 2019-2027 (USD Billion)

12 Binders: Global Pharmaceutical Excipient Market, By Region, 2019-2027 (USD Billion)

13 Coatings: Global Pharmaceutical Excipient Market, By Region, 2019-2027 (USD Billion)

14 Flavoring agents: Global Pharmaceutical Excipient Market, By Region, 2019-2027 (USD Billion)

15 Disintegrants: Global Pharmaceutical Excipient Market, By Region, 2019-2027 (USD Billion)

16 Colorants: Global Pharmaceutical Excipient Market, By Region, 2019-2027 (USD Billion)

17 Others: Global Pharmaceutical Excipient Market, By Region, 2019-2027 (USD Billion)

18 Global Pharmaceutical Excipient Market, By Dosage Form, 2019-2027 (USD Billion)

19 Oral Formulations: Global Pharmaceutical Excipient Market, By Region, 2019-2027 (USD Billion)

20 Tablets: Global Pharmaceutical Excipient Market, By Region, 2019-2027 (USD Billion)

21 Capsules: Global Pharmaceutical Excipient Market, By Region, 2019-2027 (USD Billion)

22 Liquid Formulation: Global Pharmaceutical Excipient Market, By Region, 2019-2027 (USD Billion)

23 Parenteral Formulation: Global Pharmaceutical Excipient Market, By Region, 2019-2027 (USD Billion)

24 Regional Analysis: Global Pharmaceutical Excipient Market, By Region, 2019-2027 (USD Billion)

25 North America: Pharmaceutical Excipient Market, By Product, 2019-2027 (USD Billion)

26 North America: Pharmaceutical Excipient Market, By Functionality, 2019-2027 (USD Billion)

27 North America: Pharmaceutical Excipient Market, By Dosage Form, 2019-2027 (USD Billion)

28 North America: Pharmaceutical Excipient Market, By Country, 2019-2027 (USD Billion)

29 U.S: Pharmaceutical Excipient Market, By Product, 2019-2027 (USD Billion)

30 U.S: Pharmaceutical Excipient Market, By Functionality, 2019-2027 (USD Billion)

31 U.S: Pharmaceutical Excipient Market, By Dosage Form, 2019-2027 (USD Billion)

32 Canada: Pharmaceutical Excipient Market, By Product, 2019-2027 (USD Billion)

33 Canada: Pharmaceutical Excipient Market, By Functionality, 2019-2027 (USD Billion)

34 Canada: Pharmaceutical Excipient Market, By Dosage Form, 2019-2027 (USD Billion)

35 Mexico: Pharmaceutical Excipient Market, By Product, 2019-2027 (USD Billion)

36 Mexico: Pharmaceutical Excipient Market, By Functionality, 2019-2027 (USD Billion)

37 Mexico: Pharmaceutical Excipient Market, By Dosage Form, 2019-2027 (USD Billion)

38 Europe: Pharmaceutical Excipient Market, By Product, 2019-2027 (USD Billion)

39 Europe: Pharmaceutical Excipient Market, By Functionality, 2019-2027 (USD Billion)

40 Europe: Pharmaceutical Excipient Market, By Dosage Form, 2019-2027 (USD Billion)

41 Europe: Pharmaceutical Excipient Market, By Country, 2019-2027 (USD Billion)

42 Germany: Pharmaceutical Excipient Market, By Product, 2019-2027 (USD Billion)

43 Germany: Pharmaceutical Excipient Market, By Functionality, 2019-2027 (USD Billion)

44 Germany: Pharmaceutical Excipient Market, By Dosage Form, 2019-2027 (USD Billion)

45 UK: Pharmaceutical Excipient Market, By Product, 2019-2027 (USD Billion)

46 UK: Pharmaceutical Excipient Market, By Functionality, 2019-2027 (USD Billion)

47 UK: Pharmaceutical Excipient Market, By Dosage Form, 2019-2027 (USD Billion)

48 France: Pharmaceutical Excipient Market, By Product, 2019-2027 (USD Billion)

49 France: Pharmaceutical Excipient Market, By Functionality, 2019-2027 (USD Billion)

50 France: Pharmaceutical Excipient Market, By Dosage Form, 2019-2027 (USD Billion)

51 Italy: Pharmaceutical Excipient Market, By Product, 2019-2027 (USD Billion)

52 Italy: Pharmaceutical Excipient Market, By T Functionality Ipe, 2019-2027 (USD Billion)

53 Italy: Pharmaceutical Excipient Market, By Dosage Form, 2019-2027 (USD Billion)

54 Spain: Pharmaceutical Excipient Market, By Product, 2019-2027 (USD Billion)

55 Spain: Pharmaceutical Excipient Market, By Functionality, 2019-2027 (USD Billion)

56 Spain: Pharmaceutical Excipient Market, By Dosage Form, 2019-2027 (USD Billion)

57 Rest Of Europe: Pharmaceutical Excipient Market, By Product, 2019-2027 (USD Billion)

58 Rest Of Europe: Pharmaceutical Excipient Market, By Functionality, 2019-2027 (USD Billion)

59 Rest Of Europe: Pharmaceutical Excipient Market, By Dosage Form, 2019-2027 (USD Billion)

60 Asia Pacific: Pharmaceutical Excipient Market, By Product, 2019-2027 (USD Billion)

61 Asia Pacific: Pharmaceutical Excipient Market, By Functionality, 2019-2027 (USD Billion)

62 Asia Pacific: Pharmaceutical Excipient Market, By Dosage Form, 2019-2027 (USD Billion)

63 Asia Pacific: Pharmaceutical Excipient Market, By Country, 2019-2027 (USD Billion)

64 China: Pharmaceutical Excipient Market, By Product, 2019-2027 (USD Billion)

65 China: Pharmaceutical Excipient Market, By Functionality, 2019-2027 (USD Billion)

66 China: Pharmaceutical Excipient Market, By Dosage Form, 2019-2027 (USD Billion)

67 India: Pharmaceutical Excipient Market, By Product, 2019-2027 (USD Billion)

68 India: Pharmaceutical Excipient Market, By Functionality, 2019-2027 (USD Billion)

69 India: Pharmaceutical Excipient Market, By Dosage Form, 2019-2027 (USD Billion)

70 Japan: Pharmaceutical Excipient Market, By Product, 2019-2027 (USD Billion)

71 Japan: Pharmaceutical Excipient Market, By Functionality, 2019-2027 (USD Billion)

72 Japan: Pharmaceutical Excipient Market, By Dosage Form, 2019-2027 (USD Billion)

73 South Korea: Pharmaceutical Excipient Market, By Product, 2019-2027 (USD Billion)

74 South Korea: Pharmaceutical Excipient Market, By Functionality, 2019-2027 (USD Billion)

75 South Korea: Pharmaceutical Excipient Market, By Dosage Form, 2019-2027 (USD Billion)

76 Middle East & Africa: Pharmaceutical Excipient Market, By Product, 2019-2027 (USD Billion)

77 Middle East & Africa: Pharmaceutical Excipient Market, By Functionality, 2019-2027 (USD Billion)

78 Middle East & Africa: Pharmaceutical Excipient Market, By Dosage Form, 2019-2027 (USD Billion)

79 Middle East & Africa: Pharmaceutical Excipient Market, By Country, 2019-2027 (USD Billion)

80 Saudi Arabia: Pharmaceutical Excipient Market, By Product, 2019-2027 (USD Billion)

81 Saudi Arabia: Pharmaceutical Excipient Market, By Functionality, 2019-2027 (USD Billion)

82 Saudi Arabia: Pharmaceutical Excipient Market, By Dosage Form, 2019-2027 (USD Billion)

83 UAE: Pharmaceutical Excipient Market, By Product, 2019-2027 (USD Billion)

84 UAE: Pharmaceutical Excipient Market, By Functionality, 2019-2027 (USD Billion)

85 UAE: Pharmaceutical Excipient Market, By Dosage Form, 2019-2027 (USD Billion)

86 Central & South America: Pharmaceutical Excipient Market, By Product, 2019-2027 (USD Billion)

87 Central & South America: Pharmaceutical Excipient Market, By Functionality, 2019-2027 (USD Billion)

88 Central & South America: Pharmaceutical Excipient Market, By Dosage Form, 2019-2027 (USD Billion)

89 Central & South America: Pharmaceutical Excipient Market, By Country, 2019-2027 (USD Billion)

90 Brazil: Pharmaceutical Excipient Market, By Product, 2019-2027 (USD Billion)

91 Brazil: Pharmaceutical Excipient Market, By Functionality, 2019-2027 (USD Billion)

92 Brazil: Pharmaceutical Excipient Market, By Dosage Form, 2019-2027 (USD Billion)

93 Ashland Global Holdings, Inc.: Products Offered

94 International Flavours & Fragrances, Inc.: Products Offered

95 BASF SE: Products Offered

96 Evonik Industries AG: Products Offered

97 Roquette Frères: Products infered

98 Associated British Foods plc.: Products Offered

99 Archer Daniels Midland Company: Products Offered

100 Lubrizol Corporation: Products Offered

101 Innophos Holdings: Products Offered

102 Kerry Group plc .: Products Offered

103 Other Companies: Products Offered

List of Figures

1. Global Pharmaceutical Excipient Market Segmentation & Research Scope

2. Primary Research Partners and Local Informers

3. Primary Research Process

4. Primary Research Approaches

5. Primary Research Responses

6. Global Pharmaceutical Excipient Market: Penetration & Growth Prospect Mapping

7. Global Pharmaceutical Excipient Market: Value Chain Analysis

8. Global Pharmaceutical Excipient Market Drivers

9. Global Pharmaceutical Excipient Market Restraints

10. Global Pharmaceutical Excipient Market Opportunities

11. Global Pharmaceutical Excipient Market Challenges

12. Key Pharmaceutical Excipient Market Manufacturer Analysis

13. Global Pharmaceutical Excipient Market: Porter’s Five Forces Analysis

14. PESTLE Analysis & Impact Analysis

15. Ashland Global Holdings, Inc .: Company Snapshot

16. Ashland Global Holdings, Inc .: Swot Analysis

17. International Flavors & Fragrances, Inc .: Company Snapshot

18. International Flavors & Fragrances, Inc .: Swot Analysis

19. BASF SE: Company Snapshot

20. BASF SE: Swot Analysis

21. Evonik Industries AG: Company Snapshot

22. Evonik Industries AG: Swot Analysis

23. Roquette Frères: Company Snapshot

24. Roquette Frères: Swot Analysis

25. Associated British Foods plc.: Company Snapshot

26. Associated British Foods plc.: Swot Analysis

27. Archer Daniels Midland Company: Company Snapshot

28. Archer Daniels Midland Company: Swot Analysis

29. Lubrizol Corporation: Company Snapshot

30. Lubrizol Corporation: Swot Analysis

31. Innophos Holdings: Company Snapshot

32. Innophos Holdings: Swot Analysis

33. Kerry Group plc .: Company Snapshot

34. Kerry Group plc .: Swot Analysis

35. Other Companies: Company Snapshot

36. Other Companies: Swot Analysis

The Global Pharmaceutical Excipient Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Pharmaceutical Excipient Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS