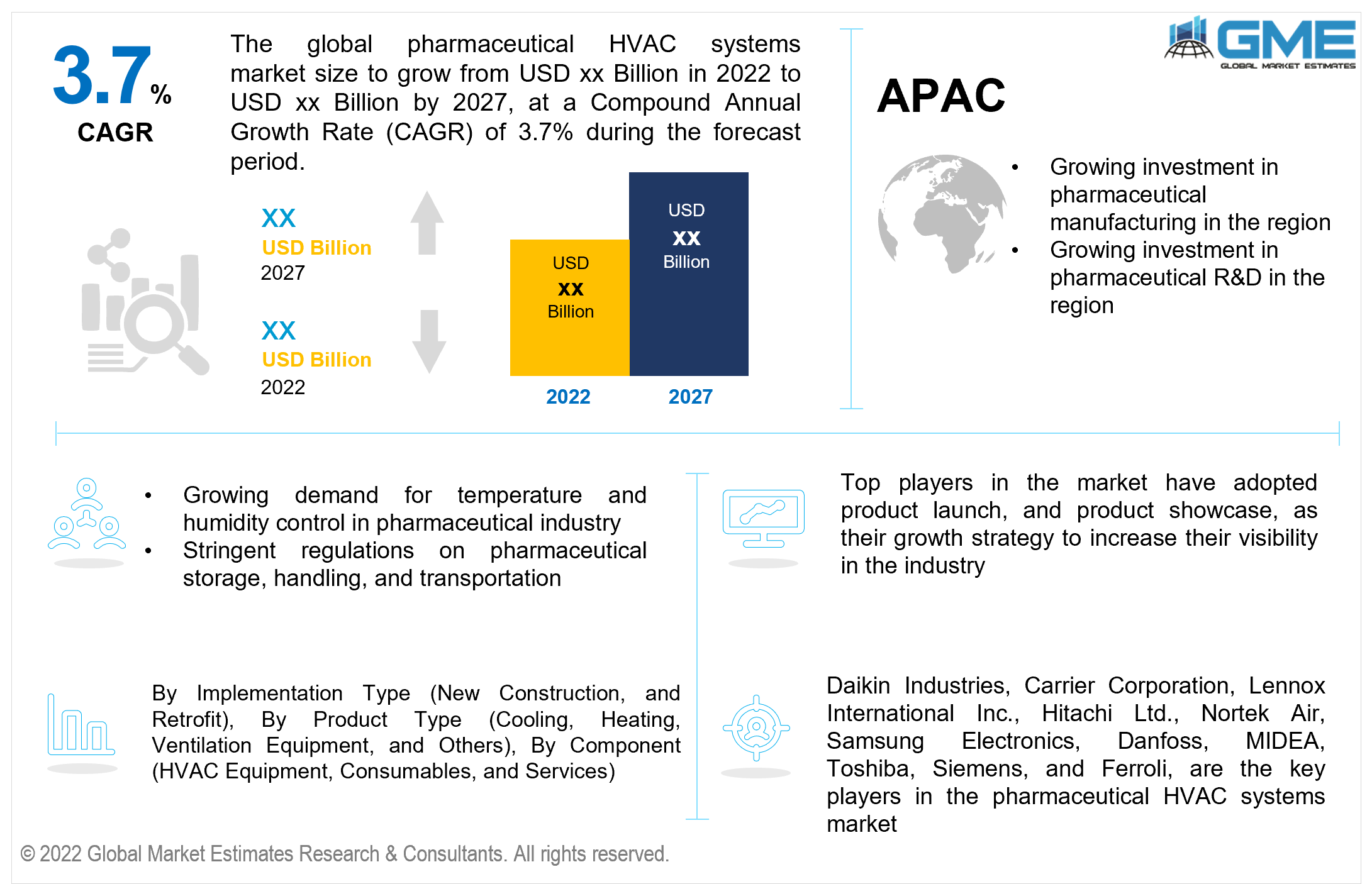

Global Pharmaceutical HVAC Systems Market Size, Trends & Analysis - Forecasts to 2027 By Implementation Type (New Construction, and Retrofit), By Product Type (Cooling, Heating, Ventilation Equipment, and Others), By Component (HVAC Equipment, Consumables, and Services), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

The global pharmaceutical hvac systems market is projected to grow at a CAGR value of 3.7% from 2022 to 2027. The pharmaceutical HVAC systems market is largely driven by the growing demand for the high degree of control over pressure, temperature, humidity, and other factors in the pharmaceutical industry. Stringent regulations on pharmaceutical storage and the growing storage and manufacturing conditions necessary for quality control in the industry have also contributed to the growth of the pharmaceutical HVAC systems market.

The pharmaceutical industry’s products are often restrained by stringent storage conditions. Stringent control over temperature, humidity, and pressure requires large-scale equipment to maintain the necessary levels. These equipment are expensive to maintain owing to the large energy demand and cost of maintenance and compensating for the maintenance downtime. Technological advancements are making HVAC systems becoming increasingly energy-efficient which is expected to increase the demand for pharmaceutical HVAC systems. Government regulations necessitate the need to reduce energy consumption and reduce the carbon footprints of companies. IoT and cloud technology are also being exploited by HVAC manufacturers to create new systems that help pharmaceutical companies reduce maintenance costs.

The growing demand for quality assurance, testing, and other manufacturing processes in the pharmaceutical industry is expected to increase the demand for pharmaceutical HVAC systems. Diagnostic equipment needs to operate within very strict environmental conditions to ensure the equipment works as needed. Failure of equipment, false outputs, and an increased margin of error from lack of proper humidity and temperature maintenance can cost the company significant losses. The presence of excess moisture and temperature can adversely affect pharmaceutical products and ingredients. The development of specialized HVAC systems for the control of moisture content in rooms is another factor of growth in the pharmaceutical HVAC system market.

The growing investment in research and development in the pharmaceutical industry has also had a positive influence on the growth of the market. The growing demand for cleanrooms in the research and development of pharmaceutical products has also been instrumental in the development of the pharmaceutical HVAC system market. HVAC systems play a crucial role in clean rooms and HVAC manufacturers are increasingly developing specialized HVAC systems for clean room applications.

The COVID-19 pandemic has resulted in an increase in the adoption of such pharmaceutical HVAC systems. Manufacturing and delivery of HVAC systems took a hit owing to mandatory lockdowns, supply chain constraints, and fluctuations in raw material prices. The increased investment in research and development of vaccines, medicines, and other pharmaceutical products has increased the demand for pharmaceutical HVAC systems.

The market is restrained by the lack of adequate funding and budgetary retrains on research and development departments, growing demand for skilled professionals capable of utilizing pharmaceutical HVAC systems, high cost of adoption and maintenance of HVAC systems.

The pharmaceutical HVAC system market is largely driven by the growing investment in pharmaceutical research, growing technological advancements in HVAC systems, increased adoption of cleanrooms, and the growing need for energy-efficient environment regulators for storage and manufacturing purposes in the pharmaceutical industry.

Based on the implementation type, the pharmaceutical HVAC systems market is segmented into new construction, and retrofit. The new construction segment is expected to hold the largest piece of the market during the forecast period. The growing investment in the development of new pharmaceutical infrastructure, the rapid growth of the pharmaceutical industry and increasing demand for manufacturing plants have been instrumental in the domination of the new construction segment.

The retrofit segment is expected to showcase a greater growth rate owing to increasing investment in the development of older facilities and the growing demand for cleanrooms in the pharmaceutical industry.

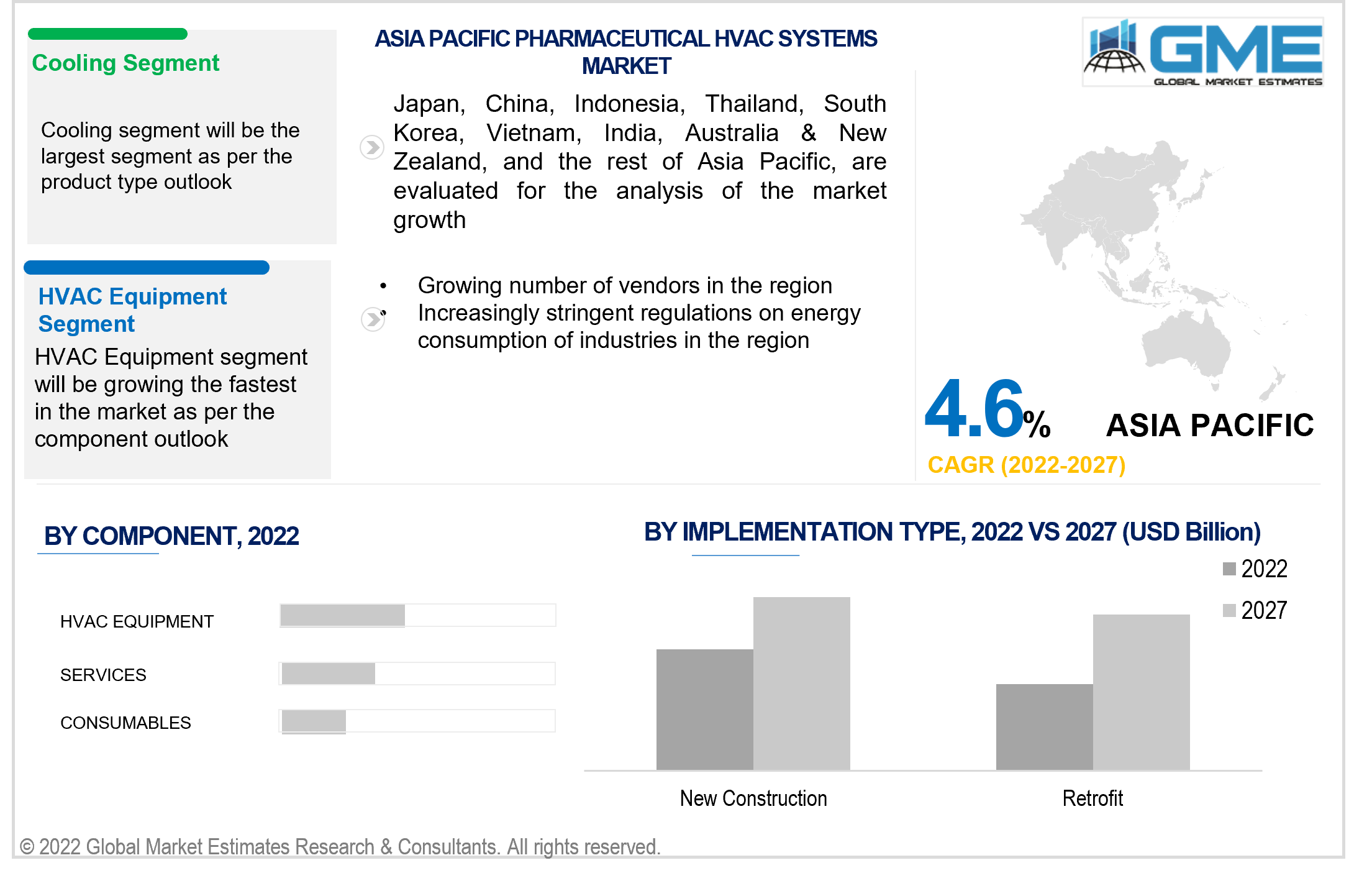

Based on the product type, the pharmaceutical HVAC systems market is segmented into cooling, heating, ventilation equipment, and others. The cooling segment is expected to hold the largest piece of the market during the forecast period. Many pharmaceutical products and ingredients are highly reactive to temperatures. They require to be stored in specific temperature ranges to prevent deterioration of quality and prevent contamination. The growing investment in the development of vaccines has also contributed to the increased market share for the cooling segment.

Based on the component, the pharmaceutical HVAC systems market is segmented into HVAC equipment, consumables, and services. The HVAC equipment segment is expected to hold the largest piece of the market during the forecast period. The growing demand for cleanrooms and increasing adoption of energy-efficient environment control equipment have resulted in the HVAC equipment growing at the fastest rate during the forecast period.

Based on region, the market can be segmented into various regions such as North America, Europe, Central and South America, Middle East and North Africa, and Asia Pacific regions. The North American region is expected to be the dominant force in the market during the forecast period. The region’s increased investment in R&D processes, presence of major industry players in the market, stringent regulations on pharmaceutical product storage, transportation, and handling, and increasingly stringent regulations on energy consumption of industries are the major drivers of the market in the region.

The APAC region is expected to become the fastest-growing region in the market during the forecast period. The growing pharmaceutical manufacturing industry in the region increased outsourcing of pharmaceutical manufacturing in the region, and increasing investment in pharmaceutical research in the region is expected to enhance the market in the region during the forecast period.

Daikin Industries, Carrier Corporation, Lennox International Inc., Hitachi Ltd., Nortek Air, Samsung Electronics, Danfoss, MIDEA, Toshiba, Siemens, and Ferroli, among others, are the key players in the pharmaceutical HVAC systems market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Pharmaceutical HVAC Systems Industry Overview, 2020-2027

2.1.1 Industry Overview

2.1.2 Implementation Type Overview

2.1.3 Component Overview

2.1.4 Product Type Overview

2.1.6 Regional Overview

Chapter 3 Pharmaceutical HVAC Systems Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising demand for cleanrooms in the pharmaceutical industry

3.3.2 Industry Challenges

3.3.2.1 Lack of adequate infrastructure and high cost of adoption

3.4 Prospective Growth Scenario

3.4.1 Implementation Type Growth Scenario

3.4.2 Component Growth Scenario

3.4.3 Product Type Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Pharmaceutical HVAC Systems Market, By Implementation Type

4.1 Implementation Type Outlook

4.2 New Construction

4.2.1 Market Size, By Region, 2020-2027 (USD Billion)

4.3 Retrofit

4.3.1 Market Size, By Region, 2020-2027 (USD Billion)

Chapter 5 Pharmaceutical HVAC Systems Market, By Component

5.1 Component Outlook

5.2 HVAC Equipment

5.2.1 Market Size, By Region, 2020-2027 (USD Billion)

5.3 Consumables

5.3.1 Market Size, By Region, 2020-2027 (USD Billion)

5.4 Services

5.4.1 Market Size, By Region, 2020-2027 (USD Billion)

Chapter 6 Pharmaceutical HVAC Systems Market, By Product Type

6.1 Cooling

6.1.1 Market Size, By Region, 2020-2027 (USD Billion)

6.2 Heating

6.2.1 Market Size, By Region, 2020-2027 (USD Billion)

6.3 Ventilation Equipment

6.3.1 Market Size, By Region, 2020-2027 (USD Billion)

6.4 Others

6.4.1 Market Size, By Region, 2020-2027 (USD Billion)

Chapter 7 Pharmaceutical HVAC Systems Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2027 (USD Billion)

7.2.2 Market Size, By Implementation Type, 2020-2027 (USD Billion)

7.2.3 Market Size, By Component, 2020-2027 (USD Billion)

7.2.4 Market Size, By Product Type, 2020-2027 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Implementation Type, 2020-2027 (USD Billion)

7.2.4.2 Market Size, By Component, 2020-2027 (USD Billion)

7.2.4.3 Market Size, By Product Type, 2020-2027 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Implementation Type, 2020-2027 (USD Billion)

7.2.7.2 Market Size, By Component, 2020-2027 (USD Billion)

7.2.7.3 Market Size, By Product Type, 2020-2027 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2027 (USD Billion)

7.3.2 Market Size, By Implementation Type, 2020-2027 (USD Billion)

7.3.3 Market Size, By Component, 2020-2027 (USD Billion)

7.3.4 Market Size, By Product Type, 2020-2027 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Implementation Type, 2020-2027 (USD Billion)

7.3.6.2 Market Size, By Component, 2020-2027 (USD Billion)

7.3.6.3 Market Size, By Product Type, 2020-2027 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Implementation Type, 2020-2027 (USD Billion)

7.3.7.2 Market Size, By Component, 2020-2027 (USD Billion)

7.3.7.3 Market Size, By Product Type, 2020-2027 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Implementation Type, 2020-2027 (USD Billion)

7.3.7.2 Market Size, By Component, 2020-2027 (USD Billion)

7.3.7.3 Market Size, By Product Type, 2020-2027 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Implementation Type, 2020-2027 (USD Billion)

7.3.9.2 Market Size, By Component, 2020-2027 (USD Billion)

7.3.9.3 Market Size, By Product Type, 2020-2027 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Implementation Type, 2020-2027 (USD Billion)

7.3.10.2 Market Size, By Component, 2020-2027 (USD Billion)

7.3.10.3 Market Size, By Product Type, 2020-2027 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Implementation Type, 2020-2027 (USD Billion)

7.3.11.2 Market Size, By Component, 2020-2027 (USD Billion)

7.3.11.3 Market Size, By Product Type, 2020-2027 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2027 (USD Billion)

7.4.2 Market Size, By Implementation Type, 2020-2027 (USD Billion)

7.4.3 Market Size, By Component, 2020-2027 (USD Billion)

7.4.4 Market Size, By Product Type, 2020-2027 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Implementation Type, 2020-2027 (USD Billion)

7.4.6.2 Market Size, By Component, 2020-2027 (USD Billion)

7.4.6.3 Market Size, By Product Type, 2020-2027 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Implementation Type, 2020-2027 (USD Billion)

7.4.7.2 Market Size, By Component, 2020-2027 (USD Billion)

7.4.7.3 Market Size, By Product Type, 2020-2027 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Implementation Type, 2020-2027 (USD Billion)

7.4.7.2 Market Size, By Component, 2020-2027 (USD Billion)

7.4.7.3 Market Size, By Product Type, 2020-2027 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Implementation Type, 2020-2027 (USD Billion)

7.4.9.2 Market size, By Component, 2020-2027 (USD Billion)

7.4.9.3 Market Size, By Product Type, 2020-2027 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Implementation Type, 2020-2027 (USD Billion)

7.4.10.2 Market Size, By Component, 2020-2027 (USD Billion)

7.4.10.3 Market Size, By Product Type, 2020-2027 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2027 (USD Billion)

7.5.2 Market Size, By Implementation Type, 2020-2027 (USD Billion)

7.5.3 Market Size, By Component, 2020-2027 (USD Billion)

7.5.4 Market Size, By Product Type, 2020-2027 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Implementation Type, 2020-2027 (USD Billion)

7.5.6.2 Market Size, By Component, 2020-2027 (USD Billion)

7.5.6.3 Market Size, By Product Type, 2020-2027 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Implementation Type, 2020-2027 (USD Billion)

7.5.7.2 Market Size, By Component, 2020-2027 (USD Billion)

7.5.7.3 Market Size, By Product Type, 2020-2027 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Implementation Type, 2020-2027 (USD Billion)

7.5.7.2 Market Size, By Component, 2020-2027 (USD Billion)

7.5.7.3 Market Size, By Product Type, 2020-2027 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2027 (USD Billion)

7.6.2 Market Size, By Implementation Type, 2020-2027 (USD Billion)

7.6.3 Market Size, By Component, 2020-2027 (USD Billion)

7.6.4 Market Size, By Product Type, 2020-2027 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Implementation Type, 2020-2027 (USD Billion)

7.6.6.2 Market Size, By Component, 2020-2027 (USD Billion)

7.6.6.3 Market Size, By Product Type, 2020-2027 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Implementation Type, 2020-2027 (USD Billion)

7.6.7.2 Market Size, By Component, 2020-2027 (USD Billion)

7.6.7.3 Market Size, By Product Type, 2020-2027 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Implementation Type, 2020-2027 (USD Billion)

7.6.7.2 Market Size, By Component, 2020-2027 (USD Billion)

7.6.7.3 Market Size, By Product Type, 2020-2027 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2021

8.2 Daikin Industries

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Carrier Corporation

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Lennox International Inc.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Hitachi Ltd.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Hitachi Ltd

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Samsung Electronics

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Danfoss

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 MIDEA

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Toshiba

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Pharmaceutical HVAC Systems Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Pharmaceutical HVAC Systems Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS