Global Pharmaceutical Isolator Market Size, Trends & Analysis - Forecasts to 2026 By Type (Open Isolator, Closed Isolator), By Pressure (Negative Pressure, Positive Pressure), By Application (Aseptic Isolator, Containment Isolator, Sampling Isolator, Fluid Dispensing Isolator, Others), By End-User (Hospitals, Pharmaceutical & Biotechnology Companies, Research & Academic Laboratories), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

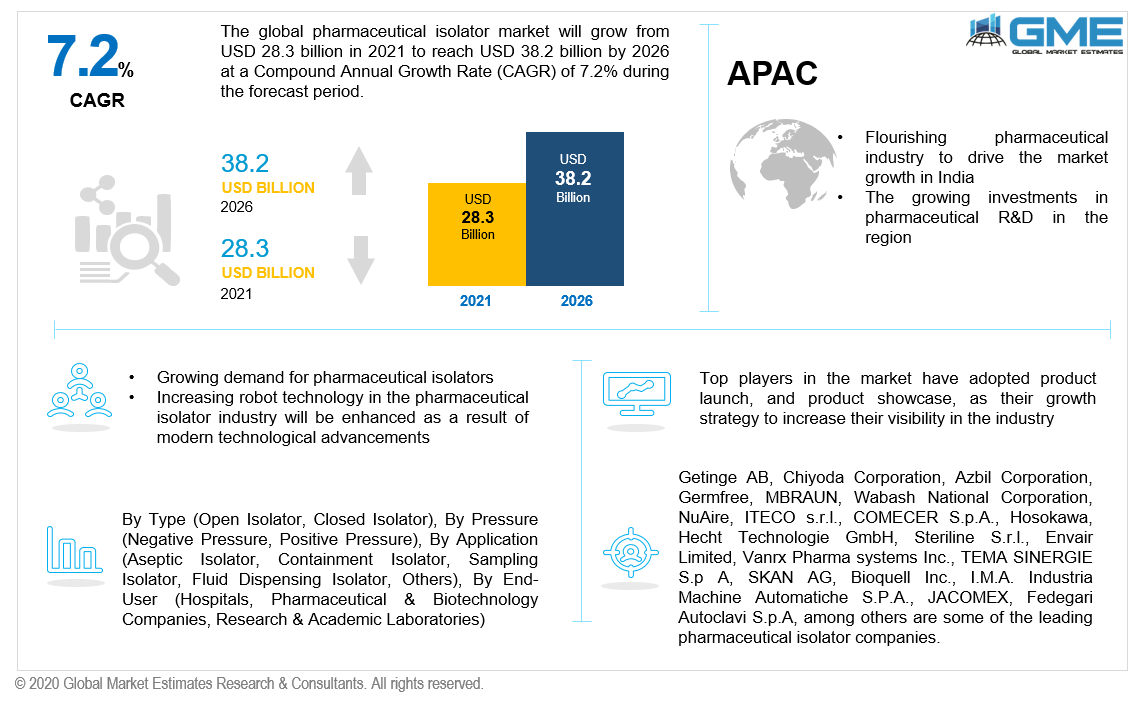

The global pharmaceutical isolator market will grow from USD 28.3 billion in 2021 to reach USD 38.2 billion by 2026 at a CAGR of 7.2%.

The global pharmaceutical isolator market is likely to be driven by the increasing demand for isolators in the pharmaceutical industry to provide a bio-decontaminated environment and rising investments in biotechnological & pharmaceutical R&D activities. There have been major advancements in increasing the isolator efficiency and in the launch of new products using pharmaceutical isolators. These are some of the factors thriving the market growth during the forecast period.

The increasing use of sterilized procedures, the cost of non-compliance, increased research laboratories, and soaring use of hazardous substances are some of the leading key factors driving the pharmaceutical isolators market during the forecast period. A pharmaceutical isolator isolates the interior from the outside environment indefinitely. Pharmaceutical isolators are generally used for handling medications, quality control operations, and items that must be entirely isolated from the environment. They are also available in a variety of shapes and sizes, which increases their applicability in a broad range of sectors. As per the isolator size, the pharmaceutical isolator is light in weight and easy to move from one place to another place. These aforementioned aspects aid in boosting the overall market share.

The majority of pharmaceutical isolators are designed and launched to meet the needs of manufacturing or research facilities. Closed pharmaceutical isolators are expected to lead the global market during the forecast period. Increased strategic collaboration and stringent product approval process are two factors boosting the market growth. The low operational expenses of pharmaceutical isolators are another prominent driver for market expansion. Renowned manufacturers provide isolators to pharmaceutical enterprises at a considerably lower cost than traditional clean-rooms. Operator involvement has the potential to contaminate the cleaned and disinfected clean rooms. The pharmaceutical isolator sector, on the other hand, minimizes contamination and offers a bio-decontaminated environment in which only the medication and production materials come into touch with the whole management system.

The automatic bio-decontamination method allows for repeated high levels of disinfectant in the pharmaceutical isolator's interior. The sterility assurance level (SAL) is significantly greater than that of sanitized clean rooms, effectively propelling the pharmaceutical isolator market expansion. Moreover, the future of robot technology in the pharmaceutical isolator industry will be enhanced as a result of modern technological advancements. Sequential pharmaceutical isolator-based manufacturing procedure in pharma firms is required since it improves the quality of reproducibility. Moreover, the desired results are seamlessly attained with the advent of robotics technology.

Furthermore, some of the crucial developments, such as advanced mobility, enhanced coherence with active pharmaceutical ingredients or APIs, and the enormous sterility guarantee, allow isolators for pharmaceutical applications. These factors have culminated in a positive impact on the pharmaceutical isolators market's growth.

The coronavirus outbreak caused a major catastrophe in both the health and economic sectors. Global economic growth has slowed to near-zero levels. Many manufacturing industrial operations were halted as a result of the strict lockdown measures. However, the healthcare industry remained in high demand as the coronavirus caused a global health disaster. Thus, the overall market is foreseen to witness robust growth throughout the forecast period.

Depending on the type, the market is segmented into closed isolator and open isolator. The open system isolator segment is expected to hold the lion’s share during the forecast period of 2021-2026. These isolators are easy to use, validate, and are very inexpensive. Moreover, the expansion of product manufacturing and contract manufacturing services in the pharmaceutical is expected to drive the growth of the open system isolator market.

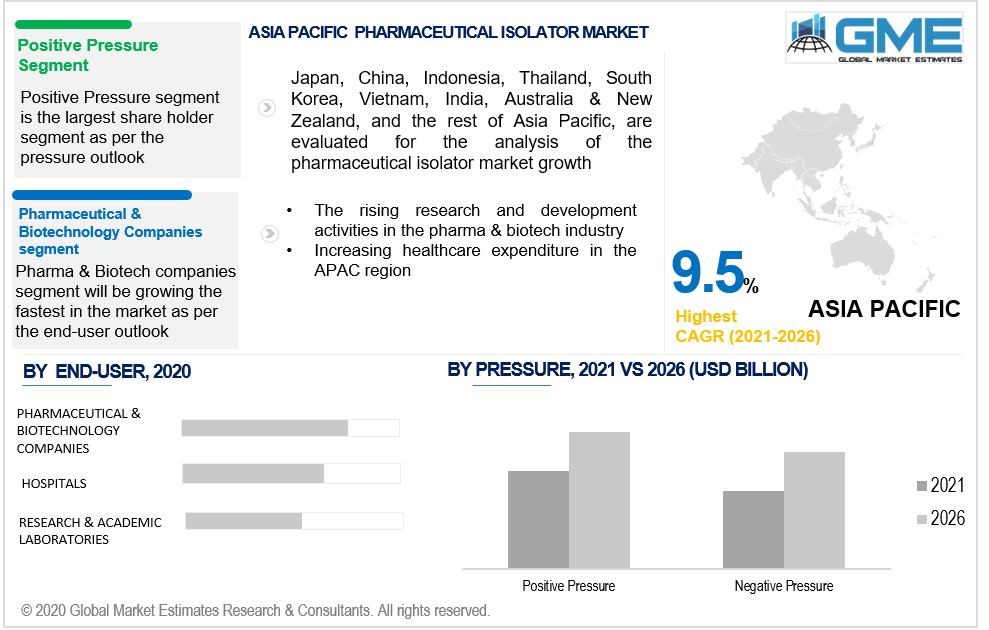

Based on the pressure segment, the market is segmented into negative pressure and positive pressure. The positive pressure segment is expected to hold the largest share of the market during the forecast period. Positive pressure isolators are designed to improve product security. Positive and negative air will pass through the HEPA filters as it enters and exits the isolator. A positive pressure system will enable cytotoxic drug-contaminated air into the workplace. These aforementioned factors aids in the supremacy of this segment.

Depending on the end-user, the market is segmented into hospitals, pharmaceutical & biotechnology companies, and research & academic laboratories. The pharmaceutical and biotechnological segment is expected to grow at the highest CAGR rate during the forecast period. It is ascribed to the pharmaceutical companies' increasing level of outsourcing for early stages of drug development activities, along with clinical and laboratory testing services.

Moreover, with rising government assistance, pharmaceutical and biotechnology companies are outsourcing medical research to develop novel vaccines and pharmaceuticals over the forecast period. As a result, rising demand for pharmaceutical isolators will augment market growth during the forecast period.

Based on the application segment, the market is segmented into aseptic isolator, containment isolator, sampling isolator, fluid dispensing isolator, others. The aseptic isolator will be the largest shareholder in the market owing to the rising need for sterilized environmental conditions for downstream processing of drug-making procedures, and increasing usage of aseptic isolators in small and mid-sized pharmaceutical companies.

As per the geographical analysis, the global market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America is expected to hold the largest share of the market during the forecast period. This supremacy is ascribed to the increasing investments in research & development activities to produce innovative drugs in the region. Furthermore, the rising adoption of ingenious healthcare products, soaring demand for pharmaceutical isolators throughout the pharmaceutical industry, and expanding level of spending on healthcare services are flourishing the pharmaceutical isolator market.

Due to the increasing proportion of pharmaceutical firms, and expanding level of investments in pharmaceutical isolators, Asia Pacific is expected to grow at the highest CAGR rate during the forecast period. It is due to the use of cutting-edge technologies and systems, as well as a significant increase in the number of biotechnology laboratories, this region is presumed to witness robust growth. The increasing patient population, rising research activities, favorable government policies, and soaring healthcare expenses are flourishing the regional market growth.

Getinge AB, Chiyoda Corporation, Azbil Corporation, Germfree, MBRAUN, Wabash National Corporation, NuAire, ITECO s.r.l., COMECER S.p.A., Hosokawa, Hecht Technologie GmbH, Steriline S.r.l., Envair Limited, Vanrx Pharma systems Inc., TEMA SINERGIE S.p A, SKAN AG, Bioquell Inc., I.M.A. Industria Machine Automatiche S.P.A., JACOMEX, Fedegari Autoclavi S.p.A, among others are some of the leading pharmaceutical isolator companies.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Pharmaceutical Isolator Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Pressure Overview

2.1.3 Application Overview

2.1.4 Type Overview

2.1.5 End-User Overview

2.1.6 Regional Overview

Chapter 3 Pharmaceutical Isolator Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing investment in the pharmaceutical R&D

3.3.2 Industry Challenges

3.3.2.1 High maintenance cost of pharmaceutical infrastructure

3.4 Prospective Growth Scenario

3.4.1 Pressure Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 Type Growth Scenario

3.4.4 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Pharmaceutical Isolator Market, By Pressure

4.1 Pressure Outlook

4.2 Negative Pressure

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Positive Pressure

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Pharmaceutical Isolator Market, By Application

5.1 Application Outlook

5.2 Aseptic Isolator

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Containment Isolator

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Sampling Isolator

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Fluid Dispensing Isolator

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Others

5.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Pharmaceutical Isolator Market, By Type

6.1 Type Outlook

6.2 Open Isolator

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Closed Isolator

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Pharmaceutical Isolator Market, By End-User

7.1 End-User Outlook

7.2 Pharmaceutical and Biotechnological Companies

7.2.1 Market Size, By Region, 2020-2026 (USD Billion)

7.3 Hospitals

7.3.1 Market Size, By Region, 2020-2026 (USD Billion)

7.4 Research & Academic Laboratories

7.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 8 Pharmaceutical Isolator Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2020-2026 (USD Billion)

8.2.2 Market Size, By Pressure, 2020-2026 (USD Billion)

8.2.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.2.4 Market Size, By Type, 2020-2026 (USD Billion)

8.2.5 Market Size, By Application, 2020-2026 (USD Billion)

8.2.6 U.S.

8.2.6.1 Market Size, By Pressure, 2020-2026 (USD Billion)

8.2.6.2 Market Size, By End-User, 2020-2026 (USD Billion)

8.2.6.3 Market Size, By Type, 2020-2026 (USD Billion)

8.2.6.4 Market Size, By Application, 2020-2026 (USD Billion)

8.2.7 Canada

8.2.7.1 Market Size, By Pressure, 2020-2026 (USD Billion)

8.2.7.2 Market Size, By End-User, 2020-2026 (USD Billion)

8.2.7.3 Market Size, By Type, 2020-2026 (USD Billion)

8.2.7.4 Market Size, By Application, 2020-2026 (USD Billion)

8.3 Europe

8.3.1 Market Size, By Country 2020-2026 (USD Billion)

8.3.2 Market Size, By Pressure, 2020-2026 (USD Billion)

8.3.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.4 Market Size, By Type, 2020-2026 (USD Billion)

8.3.5 Market Size, By Application, 2020-2026 (USD Billion)

8.3.6 Germany

8.3.6.1 Market Size, By Pressure, 2020-2026 (USD Billion)

8.3.6.2 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.6.3 Market Size, By Type, 2020-2026 (USD Billion)

8.3.6.4 Market Size, By Application, 2020-2026 (USD Billion)

8.3.7 UK

8.3.7.1 Market Size, By Pressure, 2020-2026 (USD Billion)

8.3.7.2 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.7.3 Market Size, By Type, 2020-2026 (USD Billion)

8.3.7.4 Market Size, By Application, 2020-2026 (USD Billion)

8.3.8 France

8.3.8.1 Market Size, By Pressure, 2020-2026 (USD Billion)

8.3.8.2 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.8.3 Market Size, By Type, 2020-2026 (USD Billion)

8.3.8.4 Market Size, By Application, 2020-2026 (USD Billion)

8.3.9 Italy

8.3.9.1 Market Size, By Pressure, 2020-2026 (USD Billion)

8.3.9.2 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.9.3 Market Size, By Type, 2020-2026 (USD Billion)

8.3.9.4 Market Size, By Application, 2020-2026 (USD Billion)

8.3.10 Spain

8.3.10.1 Market Size, By Pressure, 2020-2026 (USD Billion)

8.3.10.2 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.10.3 Market Size, By Type, 2020-2026 (USD Billion)

8.3.10.4 Market Size, By Application, 2020-2026 (USD Billion)

8.3.11 Russia

8.3.11.1 Market Size, By Pressure, 2020-2026 (USD Billion)

8.3.11.2 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.11.3 Market Size, By Type, 2020-2026 (USD Billion)

8.3.11.4 Market Size, By Application, 2020-2026 (USD Billion)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2020-2026 (USD Billion)

8.4.2 Market Size, By Pressure, 2020-2026 (USD Billion)

8.4.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.4 Market Size, By Type, 2020-2026 (USD Billion)

8.4.5 Market Size, By Application, 2020-2026 (USD Billion)

8.4.6 China

8.4.6.1 Market Size, By Pressure, 2020-2026 (USD Billion)

8.4.6.2 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.6.3 Market Size, By Type, 2020-2026 (USD Billion)

8.4.6.4 Market Size, By Application, 2020-2026 (USD Billion)

8.4.7 India

8.4.7.1 Market Size, By Pressure, 2020-2026 (USD Billion)

8.4.7.2 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.7.3 Market Size, By Type, 2020-2026 (USD Billion)

8.4.7.4 Market Size, By Application, 2020-2026 (USD Billion)

8.4.8 Japan

8.4.8.1 Market Size, By Pressure, 2020-2026 (USD Billion)

8.4.8.2 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.8.3 Market Size, By Type, 2020-2026 (USD Billion)

8.4.8.4 Market Size, By Application, 2020-2026 (USD Billion)

8.4.9 Australia

8.4.9.1 Market Size, By Pressure, 2020-2026 (USD Billion)

8.4.9.2 Market size, By End-User, 2020-2026 (USD Billion)

8.4.9.3 Market Size, By Type, 2020-2026 (USD Billion)

8.4.9.4 Market Size, By Application, 2020-2026 (USD Billion)

8.4.10 South Korea

8.4.10.1 Market Size, By Pressure, 2020-2026 (USD Billion)

8.4.10.2 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.10.3 Market Size, By Type, 2020-2026 (USD Billion)

8.4.10.4 Market Size, By Application, 2020-2026 (USD Billion)

8.5 Latin America

8.5.1 Market Size, By Country 2020-2026 (USD Billion)

8.5.2 Market Size, By Pressure, 2020-2026 (USD Billion)

8.5.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.4 Market Size, By Type, 2020-2026 (USD Billion)

8.5.5 Market Size, By Application, 2020-2026 (USD Billion)

8.5.6 Brazil

8.5.6.1 Market Size, By Pressure, 2020-2026 (USD Billion)

8.5.6.2 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.6.3 Market Size, By Type, 2020-2026 (USD Billion)

8.5.6.4 Market Size, By Application, 2020-2026 (USD Billion)

8.5.7 Mexico

8.5.7.1 Market Size, By Pressure, 2020-2026 (USD Billion)

8.5.7.2 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.7.3 Market Size, By Type, 2020-2026 (USD Billion)

8.5.7.4 Market Size, By Application, 2020-2026 (USD Billion)

8.5.8 Argentina

8.5.8.1 Market Size, By Pressure, 2020-2026 (USD Billion)

8.5.8.2 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.8.3 Market Size, By Type, 2020-2026 (USD Billion)

8.5.8.4 Market Size, By Application, 2020-2026 (USD Billion)

8.6 MEA

8.6.1 Market Size, By Country 2020-2026 (USD Billion)

8.6.2 Market Size, By Pressure, 2020-2026 (USD Billion)

8.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.4 Market Size, By Type, 2020-2026 (USD Billion)

8.6.5 Market Size, By Application, 2020-2026 (USD Billion)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Pressure, 2020-2026 (USD Billion)

8.6.6.2 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.6.3 Market Size, By Type, 2020-2026 (USD Billion)

8.6.6.4 Market Size, By Application, 2020-2026 (USD Billion)

8.6.7 UAE

8.6.7.1 Market Size, By Pressure, 2020-2026 (USD Billion)

8.6.7.2 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.7.3 Market Size, By Type, 2020-2026 (USD Billion)

8.6.7.4 Market Size, By Application, 2020-2026 (USD Billion)

8.6.8 South Africa

8.6.8.1 Market Size, By Pressure, 2020-2026 (USD Billion)

8.6.8.2 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.8.3 Market Size, By Type, 2020-2026 (USD Billion)

8.6.8.4 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Getinge AB

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info-Graphic Analysis

9.3 Chiyoda Corporation

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info-Graphic Analysis

9.4 Azbil Corporation

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info-Graphic Analysis

9.5 Germfree

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info-Graphic Analysis

9.6 MBRAUN

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info-Graphic Analysis

9.7 Wabash National Corporation

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info-Graphic Analysis

9.8 NuAire

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info-Graphic Analysis

9.9 COMECER S.p.A

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info-Graphic Analysis

9.10 Hosokawa

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info-Graphic Analysis

9.11 SKAN AG

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info-Graphic Analysis

9.12 Other Companies

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info-Graphic Analysis

The Global Pharmaceutical Isolator Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Pharmaceutical Isolator Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS