Global Plasma Derived Therapies Market Size, Trends & Analysis - Forecasts to 2028 By Product (Coagulation Factors, Immunoglobulins, Albumin, and Others), By Application (Primary Immunodeficiency Diseases, Hemophilia, Idiopathic Thrombocytopenic Purpura (ITP), and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

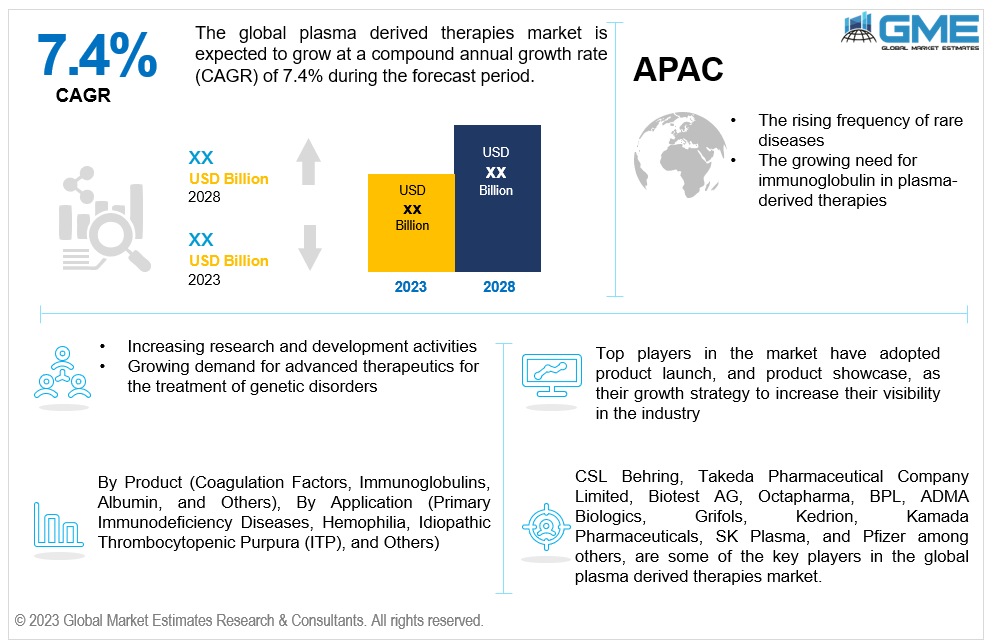

The global plasma derived therapies market is estimated to exhibit a CAGR of 7.4% from 2023 to 2028.

The market is growing primarily due to the rising frequency of rare diseases such as von Willebrand disease, idiopathic thrombocytopenic purpura (ITP), primary immunodeficiency diseases, and the growing need for immunoglobulin in plasma-derived therapies. There is a greater need for rare disease plasma treatments due to the rising incidence of rare diseases, which has raised awareness and enhanced diagnostic capacity. Technological developments in plasma fractionation have improved the effectiveness of separating and removing particular constituents from blood plasma, which has aided in creating focused treatments for rare diseases. Furthermore, albumin therapy has become necessary in managing specific rare diseases, demonstrating the adaptability of plasma-derived medicines in treating various illnesses. For instance, according to a 2021 research published by the Centres for Disease Control and Prevention, 3.2 million people in the United States are thought to have von Willebrand disease.

Increasing research and development activities and growing demand for advanced therapeutics for the treatment of genetic disorders are expected to support the market growth during the forecast period. Increasing efforts in research and development have resulted in a wide range of medications made from plasma. The objective is to create novel and cutting-edge therapies, such as coagulation factor concentrates and intravenous immunoglobulins (IVIG), to treat various diseases. Additionally, ongoing research into improving and refining manufacturing technology has facilitated increased productivity, scalability, and cost-effectiveness in the manufacturing of plasma-derived medicinal products (PDMPs). For instance, Takeda declared in 2023 that it would invest around USD 0.664 billion (100 billion yen) to construct a new plasma-derived therapy (PDT) manufacturing plant in Osaka, Japan. This is Takeda's biggest-ever investment in increasing its production capacity in Japan.

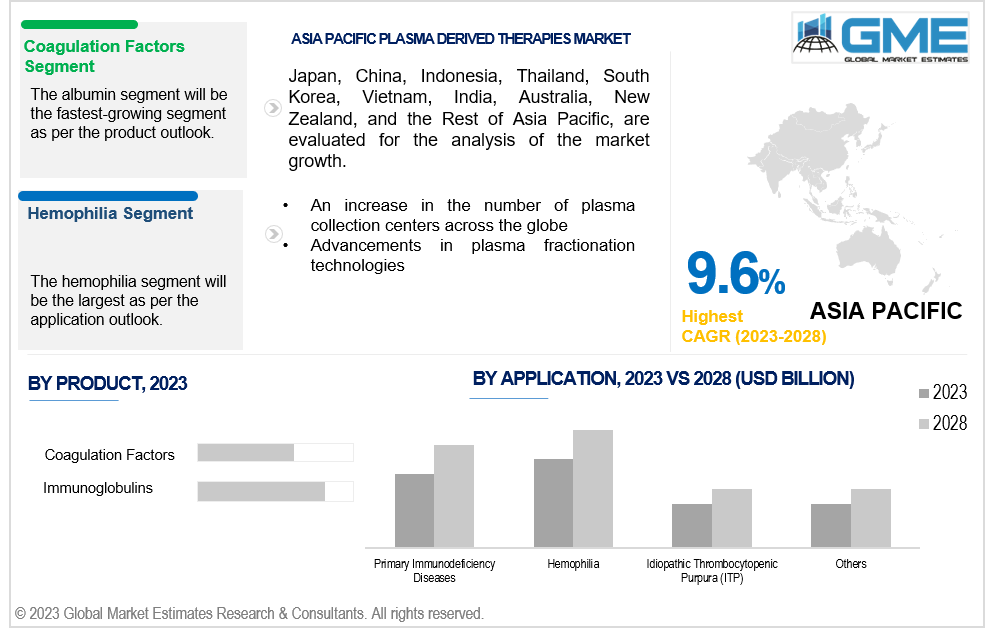

An increase in the number of plasma collection centers globally and advancements in plasma fractionation technologies are propelling the market's growth. The development of plasma-derived therapies, such as hyperimmune globulins and cryoprecipitate therapy, depends on the accurate extraction of proteins, including immunoglobulins and clotting factors, which are made possible by modern plasma fractionation techniques. Moreover, technological developments in plasma fractionation have increased the accuracy of separating particular components from the plasma, facilitating the development of tailored therapeutics such as clotting factor treatments and plasma protein therapies.

Novel and enhanced products in the field of plasma-derived therapeutics are being introduced as a result of ongoing research and development. Plasma-derived products are becoming safer and more effective because of advanced production procedures and purification techniques, providing opportunities for market growth. Moreover, companies that emphasize patient-centric strategies, such as enhanced convenience, customized treatment programs, and home-based therapies, can find opportunities to differentiate themselves in the market. However, the high cost of plasma therapy and stringent regulatory requirements hinder market growth.

The immunoglobulins segment is expected to hold the largest share of the market over the forecast period. Blood plasma collection is fundamental in producing plasma-derived therapies, including immunoglobulins. A steady and plentiful supply of blood plasma is required to meet the growing need for these therapies. An effective infrastructure for collecting blood plasma is one factor contributing to the immunoglobulins segment's dominance. Moreover, the inclusion of Alpha-1 proteinase inhibitor therapy under the category of immunoglobulins advances the significance of this segment. A genetic condition known as alpha-1 antitrypsin deficiency can harm the liver and lungs. Alpha-1 proteinase inhibitor medicine is used to treat it.

The albumin segment is expected to be the fastest-growing segment in the market from 2023-2028. The plasma protein albumin is used in numerous distinct medical applications. Many medical disorders, including burns, trauma, liver illnesses, surgery, and hypoalbuminemia, are treated with it. The versatility of albumin contributes to its increased demand across multiple therapeutic areas. Additionally, in surgical settings, albumin is frequently utilized, particularly in crucial procedures, including organ transplants, heart surgeries, and trauma surgeries. The demand for albumin is rising due to the increasing number of surgical procedures performed worldwide since albumin is essential for preserving tissue integrity and blood volume.

The hemophilia segment is expected to hold the largest share of the market during the forecast period. Hemophilia is a genetic disorder characterized by deficient or dysfunctional blood clotting factors. The demand for products generated from plasma is consistently high due to the global prevalence of hemophilia, making it a substantial segment within the plasma-derived therapies market. For instance, based on data released by the World Federation of Haemophilia in 2020, around 209,614 individuals worldwide had hemophilia across 120 countries.

The primary immunodeficiency diseases (PID) segment is anticipated to be the fastest-growing segment in the market from 2023-2028. The identification and diagnosis of primary immunodeficiency diseases have improved due to advancements in genetic testing and diagnostic procedures. It is anticipated that if more instances are identified, there will be a greater need for specific treatments, such as immunoglobulins made from plasma. Moreover, patient advocacy groups and support organizations are crucial in raising awareness about primary immunodeficiency diseases. These organizations frequently work with industry stakeholders and healthcare professionals to enhance treatment alternatives, increasing the use of plasma-derived therapies.

North America is expected to be the largest region in the global market. Advances in communication and healthcare education have led to a greater awareness of rare diseases among the general public and healthcare professionals. The need for therapeutic options, including plasma-derived medicines, is driven in North America by the possibility of early diagnosis and treatment resulting from this increased awareness. For instance, the National Institute of Allergy and Infectious Disorders estimates that in 2020, over 500,000 Americans were afflicted with one of the more than 200 primary immunodeficiency disorders.

Asia Pacific is anticipated to witness rapid growth during the forecast period. The growth is attributed to increasing joint research and development projects resulting from collaborations between universities, research centers, and pharmaceutical companies. These collaborations support the development of more effective production techniques, innovative treatment discoveries, and product enhancements throughout Asia Pacific. For instance, to accelerate the development of meaningful hyperimmune treatment against COVID-19, major companies like Bio Products Laboratory (BPL), Takeda Pharmaceutical Company Limited, Biotest AG, Octapharma, and CSL Behring collaborated in April 2020.

CSL Behring,Takeda Pharmaceutical Company Limited, Biotest AG, Octapharma, BPL, ADMA Biologics, Grifols, Kedrion, Kamada Pharmaceuticals, SK Plasma, and Pfizer among others, are some of the key players in the global plasma derived therapies market.

Please note: This is not an exhaustive list of companies profiled in the report.

Grifols, one of the top producers of plasma-derived medications, and GC Pharma signed a deal in July 2020 to buy a plasma fractionation plant in Montreal, 11 additional plasma collection centers in the United States, and two purifying facilities.

The development process of anti-SARS-CoV-2 polyclonal hyperimmune globulin (H-IG)-TAK-888 for the treatment of coronavirus (COVID-19) was started by Takeda Pharmaceutical Company Limited in March 2020.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL PLASMA DERIVED THERAPIES MARKET, BY PRODUCT

4.1 Introduction

4.2 Plasma Derived Therapies Market: Product Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Coagulation Factors

4.4.1 Coagulation Factors Market Estimates and Forecast, 2020-2028 (USD Million)

4.5 Immunoglobulins

4.5.1 Immunoglobulins Market Estimates and Forecast, 2020-2028 (USD Million)

4.6 Albumin

4.6.1 Albumin Market Estimates and Forecast, 2020-2028 (USD Million)

4.7 Others

4.7.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL PLASMA DERIVED THERAPIES MARKET, BY APPLICATION

5.1 Introduction

5.2 Plasma Derived Therapies Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Primary Immunodeficiency Diseases

5.4.1 Primary Immunodeficiency Diseases Market Estimates and Forecast, 2020-2028 (USD Million)

5.5 Hemophilia

5.5.1 Hemophilia Market Estimates and Forecast, 2020-2028 (USD Million)

5.6 Idiopathic Thrombocytopenic Purpura (ITP)

5.6.1 Idiopathic Thrombocytopenic Purpura (ITP) Market Estimates and Forecast, 2020-2028 (USD Million)

5.7 Others

5.7.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL PLASMA DERIVED THERAPIES MARKET, BY REGION

6.1 Introduction

6.2 North America Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.1 By Product

6.2.2 By Application

6.2.3 By Country

6.2.3.1 U.S. Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.1.1 By Product

6.2.3.1.2 By Application

6.2.3.2 Canada Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.2.1 By Product

6.2.3.2.2 By Application

6.2.3.3 Mexico Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.3.1 By Product

6.2.3.3.2 By Application

6.3 Europe Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.1 By Product

6.3.2 By Application

6.3.3 By Country

6.3.3.1 Germany Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.1.1 By Product

6.3.3.1.2 By Application

6.3.3.2 U.K. Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.2.1 By Product

6.3.3.2.2 By Application

6.3.3.3 France Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.3.1 By Product

6.3.3.3.2 By Application

6.3.3.4 Italy Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.4.1 By Product

6.3.3.4.2 By Application

6.3.3.5 Spain Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.5.1 By Product

6.3.3.5.2 By Application

6.3.3.6 Netherlands Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.6.1 By Product

6.3.3.6.2 By Application

6.3.3.7 Rest of Europe Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.6.1 By Product

6.3.3.6.2 By Application

6.4 Asia Pacific Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.1 By Product

6.4.2 By Application

6.4.3 By Country

6.4.3.1 China Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.1.1 By Product

6.4.3.1.2 By Application

6.4.3.2 Japan Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.2.1 By Product

6.4.3.2.2 By Application

6.4.3.3 India Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.3.1 By Product

6.4.3.3.2 By Application

6.4.3.4 South Korea Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.4.1 By Product

6.4.3.4.2 By Application

6.4.3.5 Singapore Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.5.1 By Product

6.4.3.5.2 By Application

6.4.3.6 Malaysia Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.6.1 By Product

6.4.3.6.2 By Application

6.4.3.7 Thailand Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.6.1 By Product

6.4.3.6.2 By Application

6.4.3.8 Indonesia Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.7.1 By Product

6.4.3.7.2 By Application

6.4.3.9 Vietnam Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.8.1 By Product

6.4.3.8.2 By Application

6.4.3.10 Taiwan Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.10.1 By Product

6.4.3.10.2 By Application

6.4.3.11 Rest of Asia Pacific Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.11.1 By Product

6.4.3.11.2 By Application

6.5 Middle East and Africa Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.1 By Product

6.5.2 By Application

6.5.3 By Country

6.5.3.1 Saudi Arabia Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.1.1 By Product

6.5.3.1.2 By Application

6.5.3.2 U.A.E. Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.2.1 By Product

6.5.3.2.2 By Application

6.5.3.3 Israel Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.3.1 By Product

6.5.3.3.2 By Application

6.5.3.4 South Africa Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.4.1 By Product

6.5.3.4.2 By Application

6.5.3.5 Rest of Middle East and Africa Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.5.1 By Product

6.5.3.5.2 By Application

6.6 Central and South America Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.1 By Product

6.6.2 By Application

6.6.3 By Country

6.6.3.1 Brazil Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.1.1 By Product

6.6.3.1.2 By Application

6.6.3.2 Argentina Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.2.1 By Product

6.6.3.2.2 By Application

6.6.3.3 Chile Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.3.1 By Product

6.6.3.3.2 By Application

6.6.3.3 Rest of Central and South America Plasma Derived Therapies Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.3.1 By Product

6.6.3.3.2 By Application

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 CSL Behring

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Takeda Pharmaceutical Company Limited

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Biotest AG

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Octapharma

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 BPL

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 ADMA BIOLOGICS

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Grifols

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Kedrion

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Kamada Pharmaceuticals

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 SK Plasma

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

2 Coagulation Factors Market, By Region, 2020-2028 (USD Mllion)

3 Immunoglobulins Market, By Region, 2020-2028 (USD Mllion)

4 Albumin Market, By Region, 2020-2028 (USD Mllion)

5 OTHERS Market, By Region, 2020-2028 (USD Mllion)

6 Global Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

7 Primary Immunodeficiency Diseases Market, By Region, 2020-2028 (USD Mllion)

8 Hemophilia Market, By Region, 2020-2028 (USD Mllion)

9 Idiopathic Thrombocytopenic Purpura (ITP) Market, By Region, 2020-2028 (USD Mllion)

10 OTHERS Market, By Region, 2020-2028 (USD Mllion)

11 Regional Analysis, 2020-2028 (USD Mllion)

12 North America Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

13 North America Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

14 North America Plasma Derived Therapies Market, By COUNTRY, 2020-2028 (USD Mllion)

15 U.S. Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

16 U.S. Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

17 Canada Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

18 Canada Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

19 Mexico Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

20 Mexico Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

21 Europe Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

22 Europe Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

23 EUROPE Plasma Derived Therapies Market, By COUNTRY, 2020-2028 (USD Mllion)

24 Germany Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

25 Germany Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

26 U.K. Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

27 U.K. Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

28 France Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

29 France Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

30 Italy Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

31 Italy Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

32 Spain Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

33 Spain Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

34 Netherlands Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

35 Netherlands Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

36 Rest Of Europe Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

37 Rest Of Europe Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

38 Asia Pacific Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

39 Asia Pacific Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

40 ASIA PACIFIC Plasma Derived Therapies Market, By COUNTRY, 2020-2028 (USD Mllion)

41 China Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

42 China Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

43 Japan Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

44 Japan Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

45 India Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

46 India Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

47 South Korea Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

48 South Korea Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

49 Singapore Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

50 Singapore Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

51 Thailand Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

52 Thailand Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

53 Malaysia Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

54 Malaysia Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

55 Indonesia Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

56 Indonesia Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

57 Vietnam Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

58 Vietnam Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

59 Taiwan Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

60 Taiwan Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

61 Rest of APAC Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

62 Rest of APAC Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

63 Middle East and Africa Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

64 Middle East and Africa Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

65 MIDDLE EAST & ADRICA Plasma Derived Therapies Market, By COUNTRY, 2020-2028 (USD Mllion)

66 Saudi Arabia Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

67 Saudi Arabia Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

68 UAE Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

69 UAE Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

70 Israel Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

71 Israel Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

72 South Africa Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

73 South Africa Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

74 Rest Of Middle East and Africa Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

75 Rest Of Middle East and Africa Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

76 Central and South America Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

77 Central and South America Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

78 CENTRAL AND SOUTH AMERICA Plasma Derived Therapies Market, By COUNTRY, 2020-2028 (USD Mllion)

79 Brazil Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

80 Brazil Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

81 Chile Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

82 Chile Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

83 Argentina Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

84 Argentina Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

85 Rest Of Central and South America Plasma Derived Therapies Market, By Product, 2020-2028 (USD Mllion)

86 Rest Of Central and South America Plasma Derived Therapies Market, By Application, 2020-2028 (USD Mllion)

87 CSL Behring: Products & Services Offering

88 Takeda Pharmaceutical Company Limited: Products & Services Offering

89 Biotest AG: Products & Services Offering

90 Octapharma: Products & Services Offering

91 BPL: Products & Services Offering

92 ADMA BIOLOGICS: Products & Services Offering

93 Grifols : Products & Services Offering

94 Kedrion: Products & Services Offering

95 Kamada Pharmaceuticals, Inc: Products & Services Offering

96 SK Plasma: Products & Services Offering

97 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Plasma Derived Therapies Market Overview

2 Global Plasma Derived Therapies Market Value From 2020-2028 (USD Mllion)

3 Global Plasma Derived Therapies Market Share, By Product (2022)

4 Global Plasma Derived Therapies Market Share, By Application (2022)

5 Global Plasma Derived Therapies Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Plasma Derived Therapies Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Plasma Derived Therapies Market

10 Impact Of Challenges On The Global Plasma Derived Therapies Market

11 Porter’s Five Forces Analysis

12 Global Plasma Derived Therapies Market: By Product Scope Key Takeaways

13 Global Plasma Derived Therapies Market, By Product Segment: Revenue Growth Analysis

14 Coagulation Factors Market, By Region, 2020-2028 (USD Mllion)

15 Immunoglobulins Market, By Region, 2020-2028 (USD Mllion)

16 Albumin Market, By Region, 2020-2028 (USD Mllion)

17 Others Market, By Region, 2020-2028 (USD Mllion)

18 Global Plasma Derived Therapies Market: By Application Scope Key Takeaways

19 Global Plasma Derived Therapies Market, By Application Segment: Revenue Growth Analysis

20 Primary Immunodeficiency Diseases Market, By Region, 2020-2028 (USD Mllion)

21 Hemophilia Market, By Region, 2020-2028 (USD Mllion)

22 Idiopathic Thrombocytopenic Purpura (ITP) Market, By Region, 2020-2028 (USD Mllion)

23 Others Market, By Region, 2020-2028 (USD Mllion)

24 Regional Segment: Revenue Growth Analysis

25 Global Plasma Derived Therapies Market: Regional Analysis

26 North America Plasma Derived Therapies Market Overview

27 North America Plasma Derived Therapies Market, By Product

28 North America Plasma Derived Therapies Market, By Application

29 North America Plasma Derived Therapies Market, By Country

30 U.S. Plasma Derived Therapies Market, By Product

31 U.S. Plasma Derived Therapies Market, By Application

32 Canada Plasma Derived Therapies Market, By Product

33 Canada Plasma Derived Therapies Market, By Application

34 Mexico Plasma Derived Therapies Market, By Product

35 Mexico Plasma Derived Therapies Market, By Application

36 Four Quadrant Positioning Matrix

37 Company Market Share Analysis

38 CSL Behring: Company Snapshot

39 CSL Behring: SWOT Analysis

40 CSL Behring: Geographic Presence

41 Takeda Pharmaceutical Company Limited: Company Snapshot

42 Takeda Pharmaceutical Company Limited: SWOT Analysis

43 Takeda Pharmaceutical Company Limited: Geographic Presence

44 Biotest AG: Company Snapshot

45 Biotest AG: SWOT Analysis

46 Biotest AG: Geographic Presence

47 Octapharma: Company Snapshot

48 Octapharma: Swot Analysis

49 Octapharma: Geographic Presence

50 BPL: Company Snapshot

51 BPL: SWOT Analysis

52 BPL: Geographic Presence

53 ADMA BIOLOGICS: Company Snapshot

54 ADMA BIOLOGICS: SWOT Analysis

55 ADMA BIOLOGICS: Geographic Presence

56 Grifols : Company Snapshot

57 Grifols : SWOT Analysis

58 Grifols : Geographic Presence

59 Kedrion: Company Snapshot

60 Kedrion: SWOT Analysis

61 Kedrion: Geographic Presence

62 Kamada Pharmaceuticals, Inc.: Company Snapshot

63 Kamada Pharmaceuticals, Inc.: SWOT Analysis

64 Kamada Pharmaceuticals, Inc.: Geographic Presence

65 SK Plasma: Company Snapshot

66 SK Plasma: SWOT Analysis

67 SK Plasma: Geographic Presence

68 Other Companies: Company Snapshot

69 Other Companies: SWOT Analysis

70 Other Companies: Geographic Presence

The Global Plasma Derived Therapies Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Plasma Derived Therapies Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS