Global Polybutadiene Market Size, Trends & Analysis - Forecasts to 2026 By Type (Solid Polybutadiene [High Cis, Low Cis, High Trans, High Vinyl], Liquid Polybutadiene), By Application (Tires, Polymer Modification, Industrial Rubber, Chemical), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

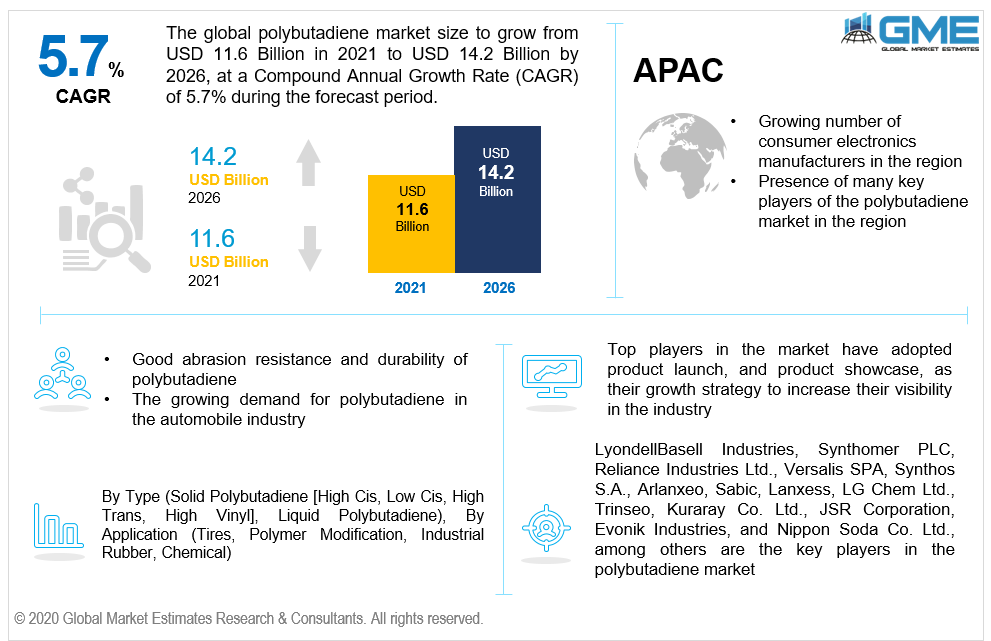

The global polybutadiene market is projected to grow from USD 11.6 billion in 2021 to USD 14.2 billion by 2026 at a CAGR value of 5.7% from 2021 and 2026. Polybutadiene or butadiene rubber [BR] is a type of man-made rubber that is used extensively in the rubber tire manufacturing industry. Polybutadiene has excellent wear and tear resistance which has led to its heavy usage for manufacturing tires.

Polybutadiene is the second most-produced synthetic rubber by volume after styrene-butadiene rubber. Synthetic rubber has high abrasion resistance, good elasticity, chemical resistance, and is cheaper than natural rubber making them ideal for various industrial applications. Almost 70% of the total volume of polybutadiene produced in the world is used in the automobile industry to manufacture tires. It is also used to strengthen or modify plastics, used in making golf balls, and encapsulation of electrical components because of their good electrical resistance. Polybutadiene is made through the polymerization of 1,3-butadiene.

In 2020, over 78 million automobiles were manufactured across the world. With such large automobile production, the tire industry has also thrived with the automobile manufacturing industry. Synthetic rubber is also significantly cheaper than natural rubber, which has also contributed to the growth of the polybutadiene market. The polybutadiene market is restrained by the fluctuating prices of crude oil in the international market.

The COVID-19 pandemic has had a significant impact on the market. With automobile manufacturing and sales numbers falling to some of the lowest numbers since 2017, the polybutadiene market was also impacted as production slowed down due to lockdowns and supply chain restrictions. The key players in the polybutadiene industry are focusing their production on developing nations as there is a growing demand for automobiles and automobile parts in such nations as the per capita income rises. The growing demand for polybutadiene from the electronic components market for encapsulation of electric components is also expected to rise as the demand for consumer electronics increases.

Synthetic tires disintegrate into tiny particles during normal wear and tear which ends up in oceans and water bodies. The growing concerns of pollution stemming from tires have resulted in synthetic rubber alternatives and increased recycling of old tires which will act as a restraint to the growth of the market.

Research and development investment focused on improving the properties of polymers through using polybutadiene as additives are expected to offer lucrative opportunities for vendors during the forecast period.

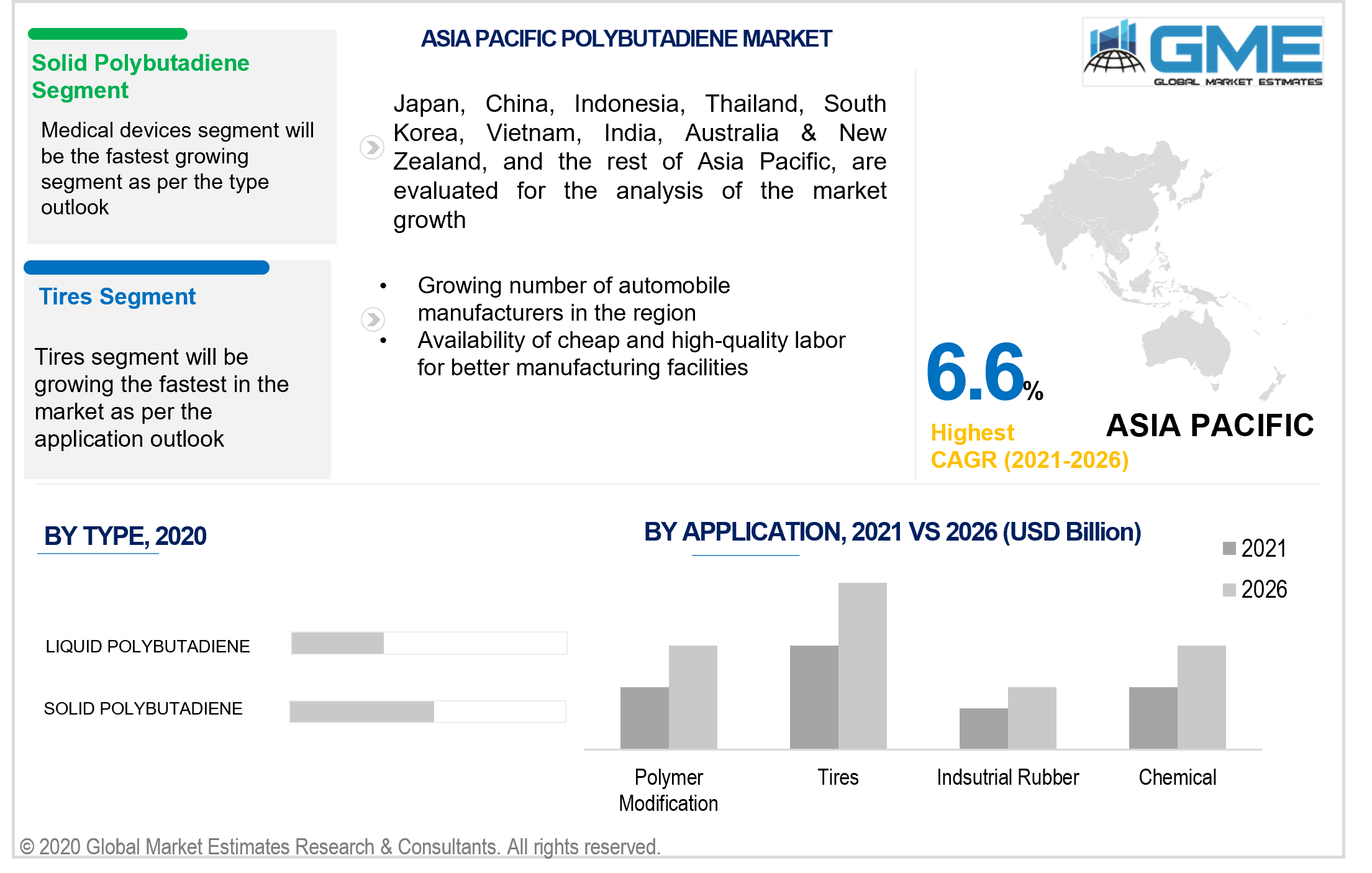

Based on the type of polybutadiene used, the market can be fragmented as solid polybutadiene and liquid polybutadiene. The solid polybutadiene segment is envisaged to procure the biggest chunk of the polybutadiene market. Among this segment, the high cis subsegment is expected to grow comparatively faster than the other subsegments. Solid polybutadiene is used in the manufacturing of tires which has been the major element for the prolonged dominance of the solid polybutadiene segment over the other segments. The growing use of solid polybutadiene for other purposes such as modifying rubber, manufacture of sporting goods, encapsulation of electrical components, and other applications are envisaged to lead this segment into showcasing a significantly greater growth rate than the liquid polybutadiene segment.

Based on the various applications of polybutadiene, the market can be classified into chemical, industrial rubber, tires, and polymer modification segments. Among these segments, the tires segment has clutched the lion’s share of the polybutadiene market. A large number of the automobile being manufactured annually and the large demand for tires from this industry has been the biggest cause for the continued dominance of the tires segment over the polybutadiene market.

Polybutadiene offers excellent abrasion resistance, wear and tear resistance, and is tough and durable. These properties make them ideal for the tire industry. They are often added as an additive to improve the properties of polymers both natural and manmade. As tires are a crucial part of the automobile industry, and as automobiles will always be in need of more tires, the tires segment is envisaged to continue its dominance and showcase the fastest growth rate among all segments during the forecast period.

Based on region, the market can be segmented into various regions such as North America, Europe, Central & South America, Middle East & North Africa, and Asia Pacific regions. The Asia Pacific region is envisaged to grasp the largest piece of the polybutadiene market during the forecast period. The growing number of automobile manufacturing plants in the region as major automobile manufacturers turn to counties like China and India for setting up new manufacturing plants owing to the availability of cheap and high-quality labor in the region. The growing per capita income in this region and large demand for mass-produced cheaper light automobiles in the region has been advantageous for the automobile industry in the Asia Pacific region. The growing urbanization rate as cities thrive in the region has also contributed to the growth of the automobile sector in the region which has in turn translated to an increase in the demand for polybutadiene. The region has also seen an increase in the number of polybutadiene vendors in the region to serve the growing number of automobile manufacturers. The growing number of electronics manufacturers in the region is also expected to have a positive impact on the polybutadiene market in the Asia Pacific region.

LyondellBasell Industries, Synthomer PLC, Reliance Industries Ltd., Versalis SPA, Synthos S.A., Arlanxeo, Sabic, Lanxess, LG Chem Ltd., Trinseo, Kuraray Co. Ltd., JSR Corporation, Evonik Industries, and Nippon Soda Co. Ltd., among others are the key players in the polybutadiene market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Polybutadiene Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Polybutadiene Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Large application in the manufacturing of tires for automobiles

3.3.2 Industry Challenges

3.3.2.1 Growing concerns of pollution from the use of polybutadiene tires

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Technology Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Polybutadiene Market, By Type

4.1 Type Outlook

4.2 Solid Polybutadiene

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Liquid Polybutadiene

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Polybutadiene Market, By Application

5.1 Application Outlook

5.2 Tire Manufacturing

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Polymer Modification

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Chemical

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Industrial Rubber Manufacturing

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Polybutadiene Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Billion)

6.2.2 Market Size, By Type, 2020-2026 (USD Billion)

6.2.3 Market Size, By Application, 2020-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.2.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.2.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Billion)

6.3.2 Market Size, By Type, 2020-2026 (USD Billion)

6.3.3 Market Size, By Application, 2020-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.8.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Billion)

6.4.2 Market Size, By Type, 2020-2026 (USD Billion)

6.4.3 Market Size, By Application, 2020-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.7.2 Market size, By Application, 2020-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.8.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Billion)

6.5.2 Market Size, By Type, 2020-2026 (USD Billion)

6.5.3 Market Size, By Application, 2020-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.5.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.5.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Billion)

6.6.2 Market Size, By Type, 2020-2026 (USD Billion)

6.6.3 Market Size, By Application, 2020-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.6.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.6.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 LyondellBasell Industries

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Synthomer PLC

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Reliance Industries Ltd.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Versalis SPA

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Synthos S.A.

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Arlanxeo

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Sabic

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 LG Chem Ltd.

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Other Companies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Polybutadiene Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Polybutadiene Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS