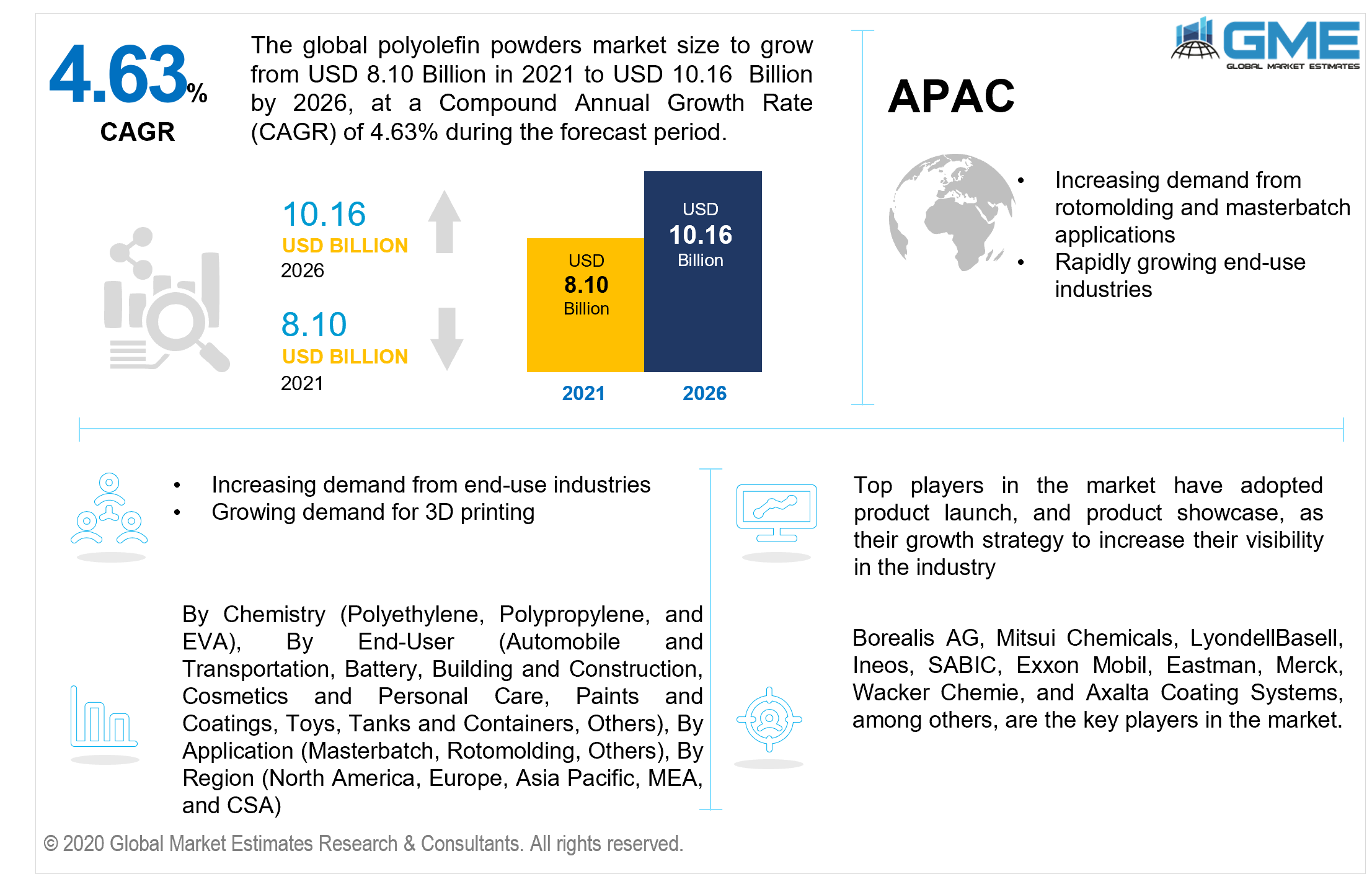

Global Polyolefin Powders Market Size, Trends & Analysis - Forecasts to 2026 By Chemistry (Polyethylene, Polypropylene, and EVA), By End-User (Automobile and Transportation, Battery, Building and Construction, Cosmetics and Personal Care, Paints and Coatings, Toys, Tanks and Containers, Others), By Application (Masterbatch, Rotomolding, Others), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

The polyolefin powders market is estimated to be valued at USD 8.10 Billion in 2021 and is projected to reach USD 10.16 Billion by 2026 at a CAGR of 4.63%. The steadily increasing use of polyolefin powders in multiple industrial sectors is driving the global market.

Swift advancements in the automotive industry, as well as the construction sector in developing economies, are presumed to drive market expansion during the forecast period.

Soaring levels of the global population, industrialization, urbanization and enhanced customer purchasing power imply that technological advancements persist to drive market expansion. One of the considerations propelling the development of the global market is the skyrocketing implementation of polyolefin powder in the container sector. The market product lines are extensively utilized in the automobile sector to strengthen the performance and weight of components. This ensures that fuel is conserved while also lowering vehicle costs.

The construction sector is acting as a prominent driver of growth and is one of the most exported product categories. Because of their elevated architectural power, these polymers are frequently used to make construction components. Increased demand for polyolefin powders in a variety of implementations notably, Bulk Molding Compounds (BMC), and Sheet Molding Compounds (SMC), among others, is driving the market growth. This powder is ubiquitously used in the production of toys, tanks, containers, automotive components, paints and coatings, batteries, cosmetic products, and so on.

Another notable aspect driving advancement in the global market is the expanding use of such powders in SLS (Selective Laser Sintering) powder beds for 3D printing implementations, as well as in commercial Li-Ion batteries as a separator, combined with the elevated demand for Li-Ion batteries in myriad end-use sectors. The increasing demand for Lithium-Ion batteries for application domains such as automobiles and IoT-powered commercial facilities is driving sales proliferation in the global market.

Concerns about the effects of such powders are gradually transitioning the emphasis away from chemicals and toward green (bio-based) chemicals that are more environmentally friendly. Bio-based chemicals are not only more environmentally friendly but also less expensive than mainstream chemicals. Producers' intensified focus on research and development of sustainable and ecological chemicals that can be used in production processes is presumed to generate revenue prospects for global market participants.

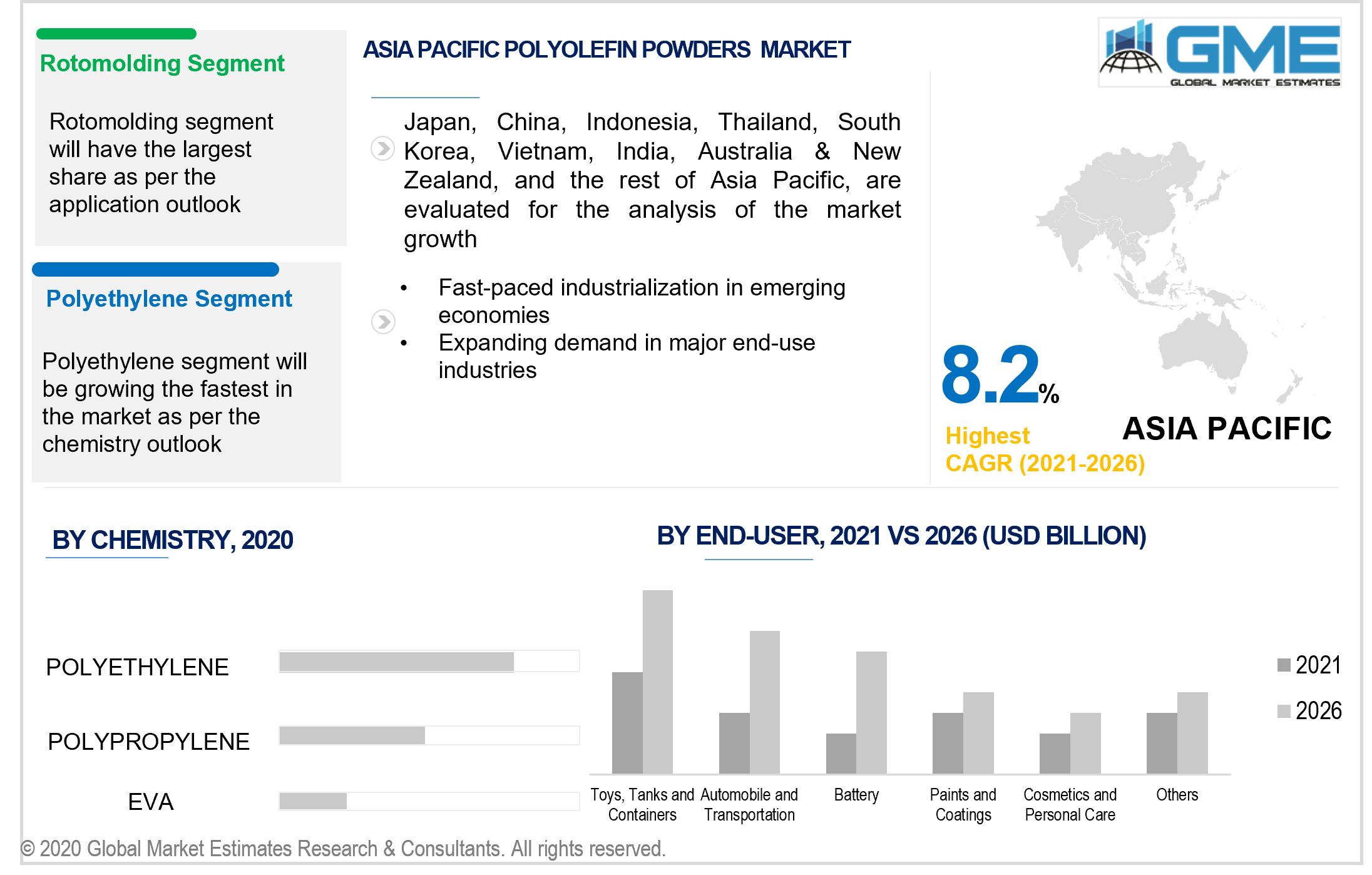

Depending on the chemistry, the market is categorized as polyethylene, polypropylene, and EVA. The polyethylene segment is expected to account for the largest market share owing to the availability of significantly greater density categories and increased demand from rotomolding applications for various finished products.

Low-density polyethylene or LDPE powder coatings are ideal for indoor wirework and are cost-effective through lower processing temperatures? (up to 100°C) and lower power consumption? (up to 30%). It has excellent fluidizing properties, unique flow-out, and excellent stress crack resistance. It is a food-grade prime polyethylene used for manufacturing purposes because it’s economical, releases no harmful fumes, and is non-hazardous.

Also, High-density polyethylene or HDPE powder coating has high durability and a longer lifespan. It is safe and field approved, has efficient material bonding, acid and alkali chemical resistance, mechanical resistance, high flexibility, is solvent-free, environmentally friendly, has no volatile organic chemicals, and is appropriate for food & potable water applications.

Depending on the end-user, the market is categorized as automobiles and transportation, battery, building and construction, cosmetics and personal care, paints and coatings, toys, tanks and containers, and others. Toys, tanks, and compartments accounted for a sizable portion of the market, owing to an increase in the use of polyolefin powder in rotomolding applications in the United States, China, India, and Brazil, which manufacture efficient end products.

Moreover, the overall demand for such products is increasing. According to the 2020 ITCO Global Tank Container Survey, the worldwide tank container fleet grew by over 5 percent in 2020 over 2019. This year’s survey estimated that on 1 January 2021, the global tank container fleet stood at 686,650 units worldwide, compared to the figure of 652,350 in 2020. This represents a year-on-year growth of 5.26%, compared to the 7.88% growth achieved in the previous year.

Depending on the application, the market is categorized as masterbatch, rotomolding, and others. Rotomolding is anticipated to account for the largest market share, as it provides high versatility, exceptional wrap susceptibility, reasonable deformation, and cost-effectiveness when manufacturing a variety of product lines. Furthermore, it does not mandate thermally sustainable active ingredients and can be molded utilizing high-temperature, high-speed rotational molding devices without inordinate oxidative stress.

Rotomolded polyolefin powder of various grades can be used to meet the needs of a myriad range of application domains and end-user sectors. Rotomolding is becoming more popular because it is a less expensive and simpler technique for producing plastic than other procedures.

The Asia Pacific is presumed to hold the largest share of the global market because of the area's excessive demand for these powders in rotomolding and masterbatch implementations. These application areas aid in the manufacture of plastic substances that are utilized in a variety of industrial applications. Furthermore, breakthroughs in a multitude of sectors in emerging economies, including China and India, are fueling the market.

China is foreseen to outperform in the market due to rising demand from the household appliances, electronics, and automobile industries. The uptick in sales of domestic appliances and electronic devices as a result of changing lifestyle dynamics and rapid urbanization has increased polyolefin usage. With rising middle-class discretionary income and a rising clamor for consumer electronics, the use of polyolefin powders for battery implementations and other electronic equipment applications is foreseen to rise further throughout the forecast period.

The North American market is expected to account for a significant market share owing to well-established end-use sectors and enhancements in high-end technology by regional players. This is due to the area's swiftly burgeoning sectors such as construction and container production.

There has been an increase in the use of environmentally friendly polyolefins, which results in lower emission levels and negligible ecological degradation. This is due to increased customer consciousness of ecosystem preservation, increased initiatives to manage plastic pollution levels, and rigorous government legislation.

Borealis AG, Mitsui Chemicals, LyondellBasell, Ineos, SABIC, Exxon Mobil, Eastman, Merck, Wacker Chemie, and Axalta Coating Systems, among others, are the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Polyolefin Powders Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Chemistry Overview

2.1.3 End-User Overview

2.1.4 Application Overview

2.1.5 Regional Overview

Chapter 3 Polyolefin Powders Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing Demand from End-Use Industries

3.3.1.2 Growing Demand For 3D Printing

3.3.2 Industry Challenges

3.3.2.1 Stringent Environmental Regulations, About the Use of Harmful Chemicals In Polyolefin Production

3.4 Prospective Growth Scenario

3.4.1 Chemistry Growth Scenario

3.4.2 End-User Growth Scenario

3.4.3 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Polyolefin Powders Market, By Chemistry

4.1 Chemistry Outlook

4.2 Polyethylene

4.2.1 Market Size, By Region, 2019-2026 (USD Billion)

4.3 Polypropylene, and EVA

4.3.1 Market Size, By Region, 2019-2026 (USD Billion)

4.4 EVA

4.4.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 5 Polyolefin Powders Market, By End-User

5.1 End-User Outlook

5.2 Automobile and Transportation

5.2.1 Market Size, By Region, 2019-2026 (USD Billion)

5.3 Battery

5.3.1 Market Size, By Region, 2019-2026 (USD Billion)

5.4 Building and Construction

5.4.1 Market Size, By Region, 2019-2026 (USD Billion)

5.5 Cosmetics and Personal Care

5.5.1 Market Size, By Region, 2019-2026 (USD Billion)

5.6 Paints and Coatings

5.6.1 Market Size, By Region, 2019-2026 (USD Billion)

5.7 Toys, Tanks and Containers

5.7.1 Market Size, By Region, 2019-2026 (USD Billion)

5.8 Others

5.8.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 6 Polyolefin Powders Market, By Application

6.1 Application Outlook

6.2 Masterbatch

6.2.1 Market Size, By Region, 2019-2026 (USD Billion)

6.3 Rotomolding

6.3.1 Market Size, By Region, 2019-2026 (USD Billion)

6.4 Others

6.4.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 7 Global Depth Filtration Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Billion)

7.2.2 Market Size, By Chemistry, 2019-2026 (USD Billion)

7.2.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.2.4 Market Size, By Application, 2019-2026 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Size, By Chemistry, 2019-2026 (USD Billion)

7.2.5.2 Market Size, By End-User, 2019-2026 (USD Billion)

7.2.5.3 Market Size, By Application, 2019-2026 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Size, By Chemistry, 2019-2026 (USD Billion)

7.2.6.2 Market Size, By End-User, 2019-2026 (USD Billion)

7.2.6.3 Market Size, By Application, 2019-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Billion)

7.3.2 Market Size, By Chemistry, 2019-2026 (USD Billion)

7.3.3 Market Size, By End-User 2019-2026 (USD Billion)

7.3.4 Market Size, By Application, 2019-2026 (USD Billion)

7.3.5 Germany

7.3.5.1 Market Size, By Chemistry, 2019-2026 (USD Billion)

7.3.5.2 Market Size, By End-User, 2019-2026 (USD Billion)

7.3.5.3 Market Size, By Application, 2019-2026 (USD Billion)

7.3.6 UK

7.3.6.1 Market Size, By Chemistry, 2019-2026 (USD Billion)

7.3.6.2 Market Size, By End-User, 2019-2026 (USD Billion)

7.3.6.3 Market Size, By Application, 2019-2026 (USD Billion)

7.3.7 France

7.3.7.1 Market Size, By Chemistry, 2019-2026 (USD Billion)

7.3.7.2 Market Size, By End-User, 2019-2026 (USD Billion)

7.3.7.3 Market Size, By Application, 2019-2026 (USD Billion)

7.3.8 Italy

7.3.8.1 Market Size, By Chemistry, 2019-2026 (USD Billion)

7.3.8.2 Market Size, By End-User, 2019-2026 (USD Billion)

7.3.8.3 Market Size, By Application, 2019-2026 (USD Billion)

7.3.9 Spain

7.3.9.1 Market Size, By Chemistry, 2019-2026 (USD Billion)

7.3.9.2 Market Size, By End-User, 2019-2026 (USD Billion)

7.3.9.3 Market Size, By Application, 2019-2026 (USD Billion)

7.3.10 Russia

7.3.10.1 Market Size, By Chemistry, 2019-2026 (USD Billion)

7.3.10.2 Market Size, By End-User, 2019-2026 (USD Billion)

7.3.10.3 Market Size, By Application, 2019-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country,2019-2026 (USD Billion)

7.4.2 Market Size, By Chemistry, 2019-2026 (USD Billion)

7.4.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.4.4 Market Size, By Application, 2019-2026 (USD Billion)

7.4.5 China

7.4.5.1 Market Size, By Chemistry, 2019-2026 (USD Billion)

7.4.5.2 Market Size, By End-User, 2019-2026 (USD Billion)

7.4.5.3 Market Size, By Application, 2019-2026 (USD Billion)

7.4.6 India

7.4.6.1 Market Size, By Chemistry, 2019-2026 (USD Billion)

7.4.6.2 Market Size, By End-User, 2019-2026 (USD Billion)

7.4.6.3 Market Size, By Application, 2019-2026 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Size, By Chemistry, 2019-2026 (USD Billion)

7.4.7.2 Market Size, By End-User, 2019-2026 (USD Billion)

7.4.7.3 Market Size, By Application, 2019-2026 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Size, By Chemistry, 2019-2026 (USD Billion)

7.4.8.2 Market size, By End-User, 2019-2026 (USD Billion)

7.4.8.3 Market Size, By Application, 2019-2026 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market Size, By Chemistry, 2019-2026 (USD Billion)

7.4.9.2 Market Size, By End-User, 2019-2026 (USD Billion)

7.4.9.3 Market Size, By Application, 2019-2026 (USD Billion)

7.6.5 Latin America

7.5.1 Market Size, By Country 2019-2026 (USD Billion)

7.5.2 Market Size, By Chemistry, 2019-2026 (USD Billion)

7.5.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.5.4 Market Size, By Application, 2019-2026 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Size, By Chemistry, 2019-2026 (USD Billion)

7.5.5.2 Market Size, By End-User, 2019-2026 (USD Billion)

7.5.5.3 Market Size, By Application, 2019-2026 (USD Billion)

7.5.6 Mexico

7.5.6.1 Market Size, By Chemistry, 2019-2026 (USD Billion)

7.5.6.2 Market Size, By End-User, 2019-2026 (USD Billion)

7.5.6.3 Market Size, By Application, 2019-2026 (USD Billion)

7.5.7 Argentina

7.5.7.1 Market Size, By Chemistry, 2019-2026 (USD Billion)

7.5.7.2 Market Size, By End-User, 2019-2026 (USD Billion)

7.5.7.3 Market Size, By Application, 2019-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2019-2026 (USD Billion)

7.6.2 Market Size, By Chemistry, 2019-2026 (USD Billion)

7.6.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.6.4 Market Size, By Application, 2019-2026 (USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Chemistry, 2019-2026 (USD Billion)

7.6.5.2 Market Size, By End-User, 2019-2026 (USD Billion)

7.6.5.3 Market Size, By Application, 2019-2026 (USD Billion)

7.6.6 UAE

7.6.6.1 Market Size, By Chemistry, 2019-2026 (USD Billion)

7.6.6.2 Market Size, By End-User, 2019-2026 (USD Billion)

7.6.6.3 Market Size, By Application, 2019-2026 (USD Billion)

7.6.7 South Africa

7.6.7.1 Market Size, By Chemistry, 2019-2026 (USD Billion)

7.6.7.2 Market Size, By End-User, 2019-2026 (USD Billion)

7.6.7.3 Market Size, By Application, 2019-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Borealis AG

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.3 Mitsui Chemicals

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 LyondellBasell

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Ineos

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 SABIC

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Exxon Mobil

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Eastman

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Merck

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Wacker Chemie

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Axalta Coating Systems

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

The Global Polyolefin Powders Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Polyolefin Powders Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS