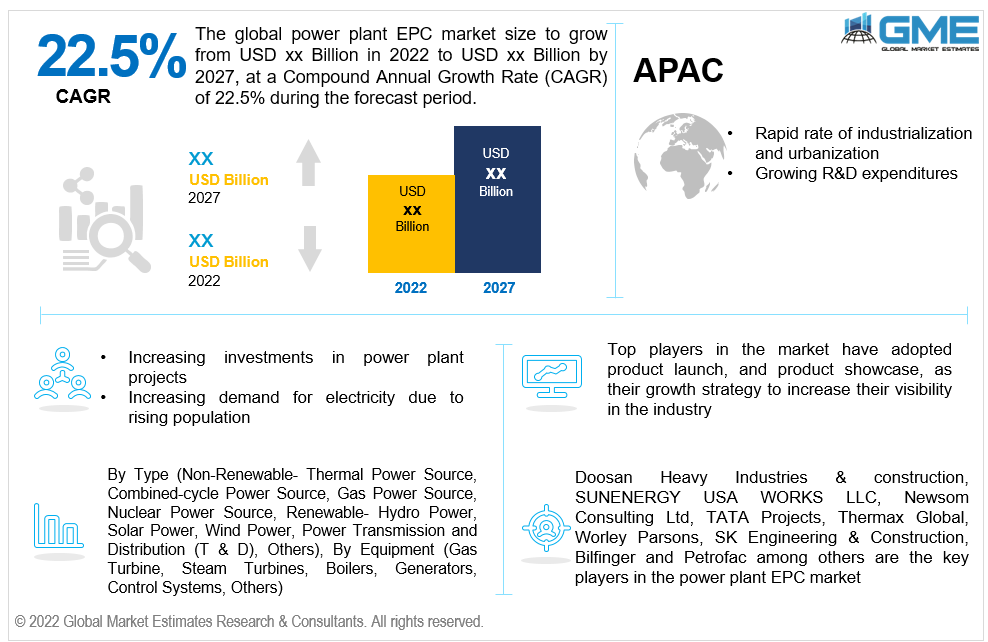

Global Power Plant EPC Market Size, Trends & Analysis - Forecasts to 2027 By Type (Non-Renewable- Thermal Power Source, Combined-cycle Power Source, Gas Power Source, Nuclear Power Source, Renewable- Hydro Power, Solar Power, Wind Power, Power Transmission and Distribution (T & D), Others), By Equipment (Gas Turbine, Steam Turbines, Boilers, Generators, Control Systems, Others), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

The Global Power Plant EPC Market is projected to grow at a CAGR value of 22.5% from 2022 to 2027.

Power plants are electricity generating industrial facilities which require constant upgradation, solutions and maintenance. Engineering, procurement, and construction (EPC) provide consulting services to these power plants and increase the efficiency of their project. EPC services for power plants entails engineering in a detailed design, procurement and construction management. Companies providing the services of EPC take charge from the inception of the power plant project to its completion and maintenance. The benefits of Power Plant EPC are that the incorporation of trained and skilled staff assures price certainty and a faster completion of the power plant project. Power Plant EPC provide solutions to any problems that arise in the power plant and are a catalyst in making a power plant an asset for the clients. The solutions include environmentally friendly options and suggestions that will increase the service years of the power generating plant.

The global power plant EPC market will be driven heavily mainly due to rising industrialization and urbanization, growing demand for electricity from the highly populated countries, increasing need for effective solutions that will help in increasing the efficiency and life service of power plants and increasing technological advancements in renewable energy and digital solutions.

Furthermore, rising number of government funding programs for power plant projects have encouraged end-users to use EPC services. Along with this increasing private-public investments and interest in the sector will support the growth of the power plant EPC market.

The COVID-19 pandemic has disrupted the supply chain system and worldwide lockdown norms have affected the electricity industry. However, due to lack of labour source, many power plant projects are facing obstacles with regards to completion of their project. Damaged supply chains have added to the woes of power plant projects that have already begun construction. However, there has been a rising demand for electricity in residential areas which due to global lockdown norms. Power plant projects are looking for resilience and effectiveness which was lacking in the pre-pandemic period. On the other hand, COVID-19 pandemic has showcased the benefit of having power plant EPC as readily available solutions to uncertain problems like the pandemic can prevent the obstruction in electricity generation.

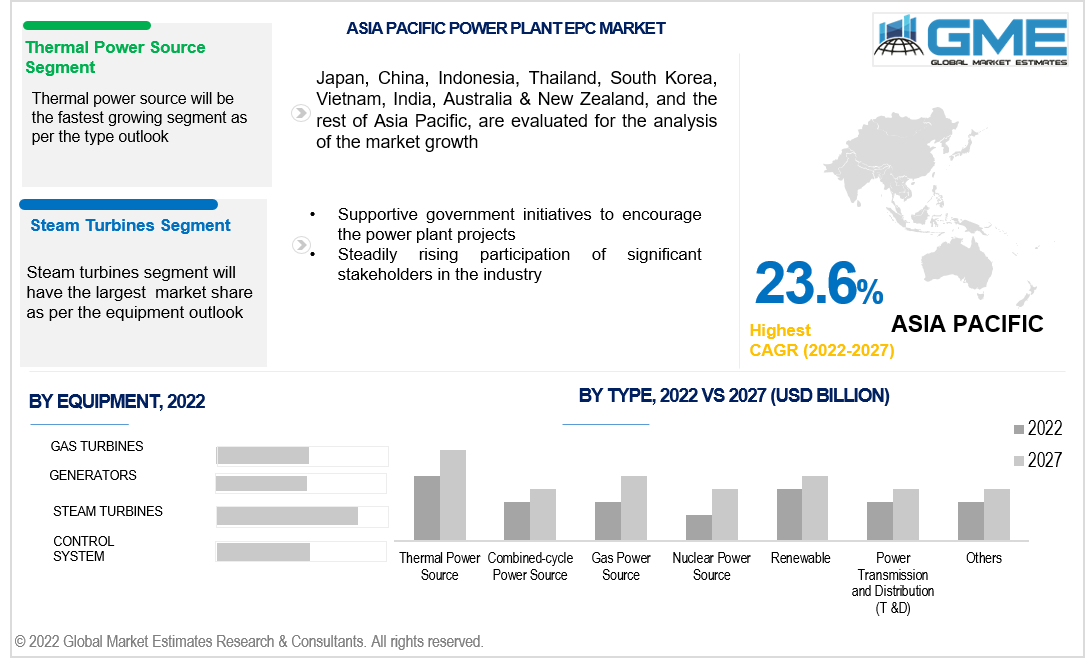

Based on the type, the power plant EPC market is divided into non-renewable- thermal power source, combined-cycle power source, gas power source, nuclear power source, renewable- hydro power, solar power, wind power, power transmission and distribution (T&D) and others. The thermal power source is expected to be the fastest-growing segment in the market from 2022 to 2027.

The thermal power source has low manufacturing costs, are a better alternative to other sources of energy because of low carbon emissions and are cost-effective. Thermal power source also takes up less space while generating huge amounts of electricity.

Based on the application, the power plant EPC market is divided into gas turbines, steam turbines, boilers, generators, control systems and others. Steam turbines are expected to have the largest segment in the market from 2022 to 2027.

Steam turbines are largely used for their reliability, less vibrations and have a high-power output ability. Steam turbines also use fewer parts, making it less dependent on other inputs for power generation. Hence, steam turbines have a high power-to-weight ratio making it an efficient equipment for energy generation.

As per the geographical analysis, the power plant EPC market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the Power Plant EPC market from 2022 to 2027. The major factor driving the growth of the market in the North American region is due to the increasing technological developments, presence of many functioning power plant projects and the need for making it more effective. The region has adopted EPC for a more cost-effective solution service and to accustom new methods of power plant generation which are environmentally sustainable and can be practiced in the long-term.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest-growing segment in the power plant EPC market during the forecast period. Rapidly rising rate of urbanization and industrialization, growing investments in the sector by both government and private entities, rising demand for electricity due to growing population and increase in the rate of new power plant projects in the region are the factors boosting the fast growth of power plant EPC in the region. The region is also experiencing active and significant investments in renewable power plant projects especially in countries such as Japan, India, China and South Korea.

Doosan Heavy Industries & construction, SUNENERGY USA WORKS LLC, Newsom Consulting Ltd, TATA Projects, Thermax Global, Worley Parsons, SK Engineering & Construction, Bilfinger and Petrofac among others are the key players in the power plant EPC market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Power Plant EPC Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Equipment Overview

2.1.4 Regional Overview

Chapter 3 Power Plant EPC Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising investments in power plant projects

3.3.2 Industry Challenges

3.3.2.1 Lack of reach of EPC services in low-income countries

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Equipment Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Equipment Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Power Plant EPC Market, By Type

4.1 Type Outlook

4.2 Non-Renewable

4.2.1 Thermal Power Source

4.2.2 Combined-cycle Power Source

4.2.3 Gas Power Source

4.2.4 Nuclear Power Source

4.2.5 Market Size, By Region, 2022-2027 (USD Million)

4.3 Renewable

4.3.1 Gas Turbines

4.3.2 Steam Turbines

4.3.3 Boilers

4.3.4 Generators

4.3.5 Control Systems

4.3.6 Others

4.4 Power Transmission and Distribution (T & D)

4.4.1 Market Size, By Region, 2022-2027 (USD Million)

4.5 Others

4.5.1 Market Size, By Region, 2022-2027 (USD Million)

Chapter 5 Power Plant EPC Market, By Equipment

5.1 Equipment Outlook

5.2 Gas Turbines

5.2.1 Market Size, By Region, 2022-2027 (USD Million)

5.3 Steam Turbines

5.3.1 Market Size, By Region, 2022-2027 (USD Million)

5.4 Boilers

5.4.1 Market Size, By Region, 2022-2027 (USD Million)

5.5 Generators

5.5.1 Market Size, By Region, 2022-2027 (USD Million)

5.6 Control Systems

5.6.1 Market Size, By Region, 2022-2027 (USD Million)

5.7 Others

5.7.1 Market Size, By Region, 2022-2027 (USD Million)

Chapter 6 Power Plant EPC Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2022-2027 (USD Million)

6.2.2 Market Size, By Type, 2022-2027 (USD Million)

6.2.3 Market Size, By Equipment, 2022-2027 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2022-2027 (USD Million)

6.2.4.2 Market Size, By Equipment, 2022-2027 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2022-2027 (USD Million)

6.2.5.2 Market Size, By Equipment, 2022-2027 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2022-2027 (USD Million)

6.3.2 Market Size, By Type, 2022-2027 (USD Million)

6.3.3 Market Size, By Equipment, 2022-2027 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Type, 2022-2027 (USD Million)

6.3.4.2 Market Size, By Equipment, 2022-2027 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2022-2027 (USD Million)

6.3.5.2 Market Size, By Equipment, 2022-2027 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Type, 2022-2027 (USD Million)

6.3.6.2 Market Size, By Equipment, 2022-2027 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2022-2027 (USD Million)

6.3.7.2 Market Size, By Equipment, 2022-2027 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2022-2027 (USD Million)

6.3.8.2 Market Size, By Equipment, 2022-2027 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2022-2027 (USD Million)

6.3.9.2 Market Size, By Equipment, 2022-2027 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2022-2027 (USD Million)

6.4.2 Market Size, By Type, 2022-2027 (USD Million)

6.4.3 Market Size, By Equipment, 2022-2027 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Type, 2022-2027 (USD Million)

6.4.4.2 Market Size, By Equipment, 2022-2027 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Type, 2022-2027 (USD Million)

6.4.5.2 Market Size, By Equipment, 2022-2027 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2022-2027 (USD Million)

6.4.6.2 Market Size, By Equipment, 2022-2027 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2022-2027 (USD Million)

6.4.7.2 Market size, By Equipment, 2022-2027 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2022-2027 (USD Million)

6.4.8.2 Market Size, By Equipment, 2022-2027 (USD Million)

6.5 Central and South America

6.5.1 Market Size, By Country 2022-2027 (USD Million)

6.5.2 Market Size, By Type, 2022-2027 (USD Million)

6.5.3 Market Size, By Equipment, 2022-2027 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2022-2027 (USD Million)

6.5.4.2 Market Size, By Equipment, 2022-2027 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2022-2027 (USD Million)

6.5.5.2 Market Size, By Equipment, 2022-2027 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2022-2027 (USD Million)

6.5.6.2 Market Size, By Equipment, 2022-2027 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2022-2027 (USD Million)

6.6.2 Market Size, By Type, 2022-2027 (USD Million)

6.6.3 Market Size, By Equipment, 2022-2027 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2022-2027 (USD Million)

6.6.4.2 Market Size, By Equipment, 2022-2027 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2022-2027 (USD Million)

6.6.5.2 Market Size, By Equipment, 2022-2027 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2022-2027 (USD Million)

6.6.6.2 Market Size, By Equipment, 2022-2027 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Doosan Heavy Industries & Construction

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 SUNENERGY USA WORKS LLC

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Newsom Consulting Ltd

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 TATA Projects

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Thermax Global

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Worley Parsons

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 SK Engineering & Construction

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Bilfinger

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Petrofac

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Others

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

The Global Power Plant EPC Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Power Plant EPC Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS