Global Precision Farming Market Size, Trends & Analysis - Forecasts to 2026 By Technology (Guidance, VRT, Remote Sensing); By Application (Crop Scouting, Field Mapping, Yield Monitoring, Weather Tracking, Variable Rate Application, Inventory Management, Farm Labor Management, Financial Management, Others); By Offering (Hardware, Software, and Services); By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Vendor Landscape, and Company Market Share Analysis and Competitor Analysis

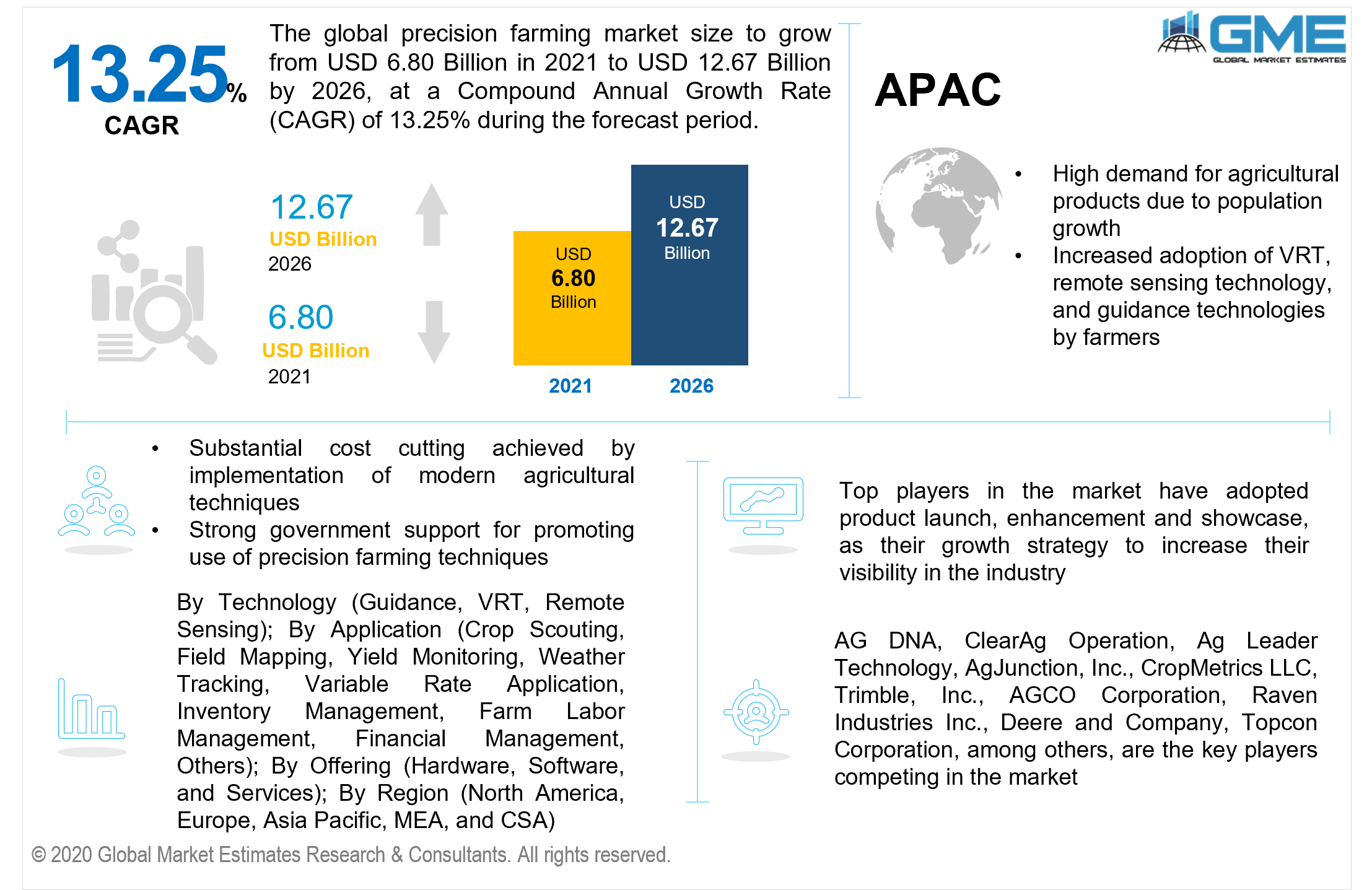

The global precision farming market is estimated to be valued at USD 6.80 billion in 2021 and is projected to reach USD 12.67 billion by 2026 at a CAGR of 13.25%. The trajectory growth of the market is associated with the increased R&D by key players and advanced analytical tools for farming practices. The rising investments and acceptance for technology-backed agricultural practices. The crucial factors influencing the advancement of the market to entail increased farm mechanization in emerging regions, surging labor costs due to a scarcity of competent labor, an increased burden on the global food supply due to the growing population, significant cost savings synonymous with intelligent farming methods, and government policies to implement sophisticated agricultural methodologies.

Precision farming is acquiring prominence among farmers as a result of the growing need for optimized agricultural production with a confined resource base. Furthermore, evolving climate patterns caused by rising global temperatures have prompted the incorporation of innovative farming technologies to boost agricultural productivity and crop production. Such farming can revolutionize the agricultural sector by increasing the efficiency and predictability of conventional farming activities. The main aspects driving the advancement of the market are rising global food demand, increased financial performance and crop yield, and agricultural monitoring systems for elevated yield output.

The adoption of technologies including GPS, IoT, and remote sensing implementations in farming is propelling the market forward. IoT assists farmers in addressing a wide range of difficulties associated with effective farming, including crop monitoring, weather forecasting, and sustainable agriculture, which offers real-time information about the ecosystem's temperature and climate conditions. Furthermore, government programs in many countries are assisting farmers in using optimized agricultural and operational tools to increase production capacity.

Furthermore, such farming offers data about the water content of the soil, which allows farmers to make better cultivation choices. It also offers cop market rates and soil management details. As a result of all of these aspects, the market is expanding. Besides that, technological advancements and increased capital expenditure in emerging technologies including driverless tractors, GPS sensing, and guidance systems are resulting in the expanding market. Such farming also assists in achieving an elevated yield with less waste by utilizing sensors.

Conversely, an inadequacy of understanding about smart agriculture among farmers, as well as the increased cost of installing modern technologies, are expected to limit the advancement of the market. In addition, the shortage of technology-based devices and competent labor in emerging regions is impeding the development of the market. Nonetheless, increased deployment of technology, VRT (Variable Rate Technology) for crop production, and an expanding necessity for weather prediction as a result of climatological modification are foreseen to produce enormous prospects for the market throughout the forecasted period.

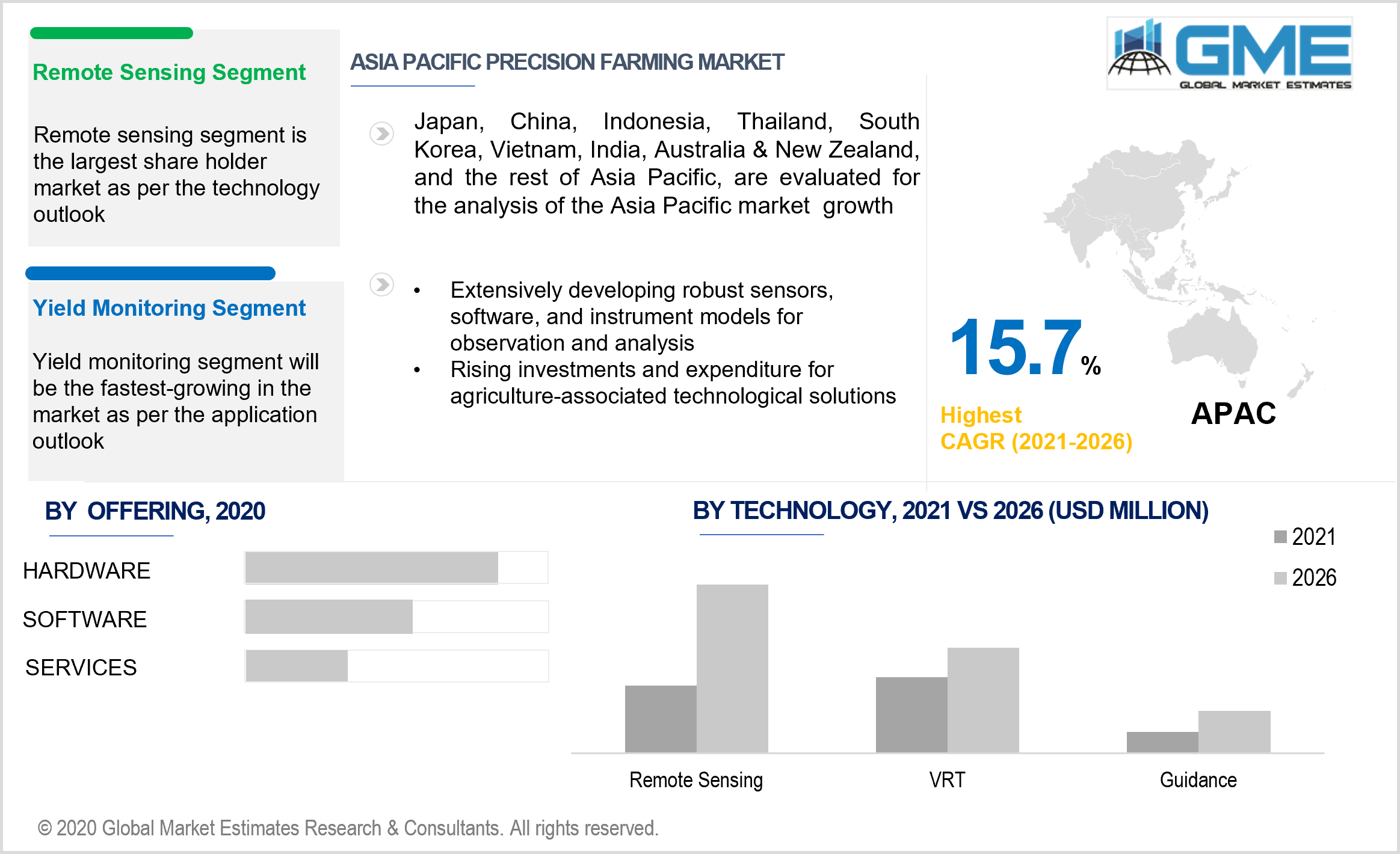

Based on technology type, the market is segmented into guidance, VRT, and remote sensing. Remote sensing as per the technology type segment is expected to hold the largest market share for growth in the coming years, owing to growing technological benefits for the agricultural sector. The unique features and services offered by the market segment make appropriate efforts in guiding farmers. These IT solutions help to guide farmers about crop rotations, soil management, optimal harvesting, and planting times. Various key players in the market are making innovations and employment of these solutions to strengthen the market position.

Based on the offering type, the market is segmented into hardware, software, and services. The hardware segment is expected to predominate. Hardware plays a vital role in smart farming by helping farmers to make efficient and precise decisions. The task is to visualize agricultural workflows and the agricultural environment. The market tools help to provide accuracy and boost convenience with workflow optimization. Further attributes to deploying efficiency and boosting agricultural productivity. The software segment is also rising in popularity with web-based cloud precision farming tools. This helps to eliminate the high costs of maintaining hardware.

The market based on its application is segmented into crop scouting, field mapping, yield monitoring, weather tracking, variable rate application, inventory management, farm labor management, financial management, and others. The yield monitoring segment is the largest shareholder of the market, as this helps the farmers to make precise decisions. The increasing applications of on-farm monitoring tools help farmers to obtain real-time monitoring for their harvest season and for making spatial databases.

This helps with making environmental compliance and tracking the food safety standards. The employment of smart devices helps in involving various technologies in the form of rain sensors, weather controllers, and water meters, helping in providing the estimate for providing the right amount of water for irrigation.

Based on the region, the market is segmented into North America, Asia-Pacific, Europe, Middle East, and Africa, and Central & South America. The North American region held the dominating position in the market globally, due to the government’s support for boosting investments in making innovations related to developing sustainable means of farming. New research and development activities to increase technological breakthroughs are being carried out for a surge in the deployment of innovative solutions in farming. The extensive employment of these IT solutions and early adoption of advanced technological means lead to this region’s supremacy.

The region is also taking numerous initiatives to set up special markets, reduce the cost of production, and enhance efficiency. The majority of the market players in this domain work exclusively to increase the production capacity with the help of novel innovative technology for growing commercialization. The requirement of smart technological IT solutions helps to manage the funds with proper allocation, offering huge opportunities for key market players.

The APAC region is expected to grow significantly owing to the rising investments and expenditure for agriculture-associated technological solutions, accompanied by the massive adoption of professional expertise. With growing government initiatives to increase opportunities related to research & development and to promote the employment of new precision farming technologies in order to increase yield.

Extensively developing robust sensors, software, and instrument models for observation and analysis are the major growth catalysts. The main reason for market growth in recent years has been the increasing growth of these solutions for boosting agricultural production, helping to reduce the scope of errors and excessive fertilizers and pesticides.

AG DNA, ClearAg Operation, Ag Leader Technology, AgJunction, Inc., CropMetrics LLC, Trimble, Inc., AGCO Corporation, Raven Industries Inc., Deere and Company, Topcon Corporation, among others, are the major players competing in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

In March 2020, AgJunction Inc. announced a collaboration with GeoSurf Corporation and Anhui Zhongke Intelligent Sense and Big Data Industrial Technology Research Institute Co. Ltd to provide enhanced precise agricultural solutions in the Asian regional market. These technology solutions for rice and onion transplanters for developing whirl technology.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Precision Farming Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Technology Overview

2.1.3 Offering Overview

2.1.4 Application Overview

2.1.5 Regional Overview

Chapter 3 Global Precision Farming Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising Investments And Acceptance For Technology-Backed Agricultural Practices

3.3.1.2 Growing Need For Optimized Agricultural Production With A Confined Resource Base

3.3.2 Industry Challenges

3.3.2.1 Inadequacy Of Understanding About Smart Agriculture Among Farmers

3.4 Prospective Growth Scenario

3.4.1 Technology Growth Scenario

3.4.2 Offering Growth Scenario

3.4.3 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Precision Farming Market, By Technology

4.1 Technology Outlook

4.2 Guidance

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 VRT

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Remote Sensing

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Global Precision Farming Market, By Offering

5.1 Offering Outlook

5.2 Hardware

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Software

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Services

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Global Precision Farming Market, by Application

6.1 Application Outlook

6.2 Crop Scouting

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Field Mapping

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

6.4 Yield Monitoring

6.4.1 Market Size, By Region, 2019-2026 (USD Million)

6.5 Weather Tracking

6.5.1 Market Size, By Region, 2019-2026 (USD Million)

6.6 Variable Rate Application

6.6.1 Market Size, By Region, 2019-2026 (USD Million)

6.7 Farm Labor Management

6.7.1 Market Size, By Region, 2019-2026 (USD Million)

6.8 Financial Management,

6.8.1 Market Size, By Region, 2019-2026 (USD Million)

6.9 Inventory Management

6.9.1 Market Size, By Region, 2019-2026 (USD Million)

6.10 Others

6.10.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Global Precision Farming Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Million)

7.2.2 Market Size, By Technology, 2019-2026 (USD Million)

7.2.3 Market Size, By Offering, 2019-2026 (USD Million)

7.2.4 Market Size, By Application, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Technology, 2019-2026 (USD Million)

7.2.5.2 Market Size, By Offering, 2019-2026 (USD Million)

7.2.5.3 Market Size, By Application, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Technology, 2019-2026 (USD Million)

7.2.6.2 Market Size, By Offering, 2019-2026 (USD Million)

7.2.6.3 Market Size, By Application, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Million)

7.3.2 Market Size, By Technology, 2019-2026 (USD Million)

7.3.3 Market Size, By Offering 2019-2026 (USD Million)

7.3.4 Market Size, By Application, 2019-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Technology, 2019-2026 (USD Million)

7.3.5.2 Market Size, By Offering, 2019-2026 (USD Million)

7.3.5.3 Market Size, By Application, 2019-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Technology, 2019-2026 (USD Million)

7.3.6.2 Market Size, By Offering, 2019-2026 (USD Million)

7.3.6.3 Market Size, By Application, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Technology, 2019-2026 (USD Million)

7.3.7.2 Market Size, By Offering, 2019-2026 (USD Million)

7.3.7.3 Market Size, By Application, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Technology, 2019-2026 (USD Million)

7.3.8.2 Market Size, By Offering, 2019-2026 (USD Million)

7.3.8.3 Market Size, By Application, 2019-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Technology, 2019-2026 (USD Million)

7.3.9.2 Market Size, By Offering, 2019-2026 (USD Million)

7.3.9.3 Market Size, By Application, 2019-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Technology, 2019-2026 (USD Million)

7.3.10.2 Market Size, By Offering, 2019-2026 (USD Million)

7.3.10.3 Market Size, By Application, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country,2019-2026 (USD Million)

7.4.2 Market Size, By Technology, 2019-2026 (USD Million)

7.4.3 Market Size, By Offering, 2019-2026 (USD Million)

7.4.4 Market Size, By Application, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Technology, 2019-2026 (USD Million)

7.4.5.2 Market Size, By Offering, 2019-2026 (USD Million)

7.4.5.3 Market Size, By Application, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Technology, 2019-2026 (USD Million)

7.4.6.2 Market Size, By Offering, 2019-2026 (USD Million)

7.4.6.3 Market Size, By Application, 2019-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Technology, 2019-2026 (USD Million)

7.4.7.2 Market Size, By Offering, 2019-2026 (USD Million)

7.4.7.3 Market Size, By Application, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Technology, 2019-2026 (USD Million)

7.4.8.2 Market size, By Offering, 2019-2026 (USD Million)

7.4.8.3 Market Size, By Application, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Technology, 2019-2026 (USD Million)

7.4.9.2 Market Size, By Offering, 2019-2026 (USD Million)

7.4.9.3 Market Size, By Application, 2019-2026 (USD Million)

7.6.5 Latin America

7.5.1 Market Size, By Country 2019-2026 (USD Million)

7.5.2 Market Size, By Technology, 2019-2026 (USD Million)

7.5.3 Market Size, By Offering, 2019-2026 (USD Million)

7.5.4 Market Size, By Application, 2019-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Technology, 2019-2026 (USD Million)

7.5.5.2 Market Size, By Offering, 2019-2026 (USD Million)

7.5.5.3 Market Size, By Application, 2019-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Technology, 2019-2026 (USD Million)

7.5.6.2 Market Size, By Offering, 2019-2026 (USD Million)

7.5.6.3 Market Size, By Application, 2019-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Technology, 2019-2026 (USD Million)

7.5.7.2 Market Size, By Offering, 2019-2026 (USD Million)

7.5.7.3 Market Size, By Application, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2019-2026 (USD Million)

7.6.2 Market Size, By Technology, 2019-2026 (USD Million)

7.6.3 Market Size, By Offering, 2019-2026 (USD Million)

7.6.4 Market Size, By Application, 2019-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Technology, 2019-2026 (USD Million)

7.6.5.2 Market Size, By Offering, 2019-2026 (USD Million)

7.6.5.3 Market Size, By Application, 2019-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Technology, 2019-2026 (USD Million)

7.6.6.2 Market Size, By Offering, 2019-2026 (USD Million)

7.6.6.3 Market Size, By Application, 2019-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Technology, 2019-2026 (USD Million)

7.6.7.2 Market Size, By Offering, 2019-2026 (USD Million)

7.6.7.3 Market Size, By Application, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 AG DNA

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.3 ClearAg Operation

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Ag Leader Technology

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 AgJunction, Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 CropMetrics LLC

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Trimble, Inc.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 AGCO Corporation

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Raven Industries Inc.

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Deere and Company

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Topcon Corporation

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

The Global Precision Farming Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Precision Farming Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS