Global Predictive Genetic Testing and Consumer Genomics Market Size, Trends & Analysis - Forecasts to 2026 By Type (Predictive Testing [Genetic Susceptibility Test, Predictive Diagnostics, Population Screening Programs], Consumer Genomics, Wellness Genetics [Nutria Genetics, Skin & Metabolism Genetics, Others]), By Application (Cancer Screening, Cardiovascular Screening, Musculoskeletal Screening, Diabetic Screening, Parkinsons / Alzheimer Disease Screening, Others), By Setting Type (DTC, Professional), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

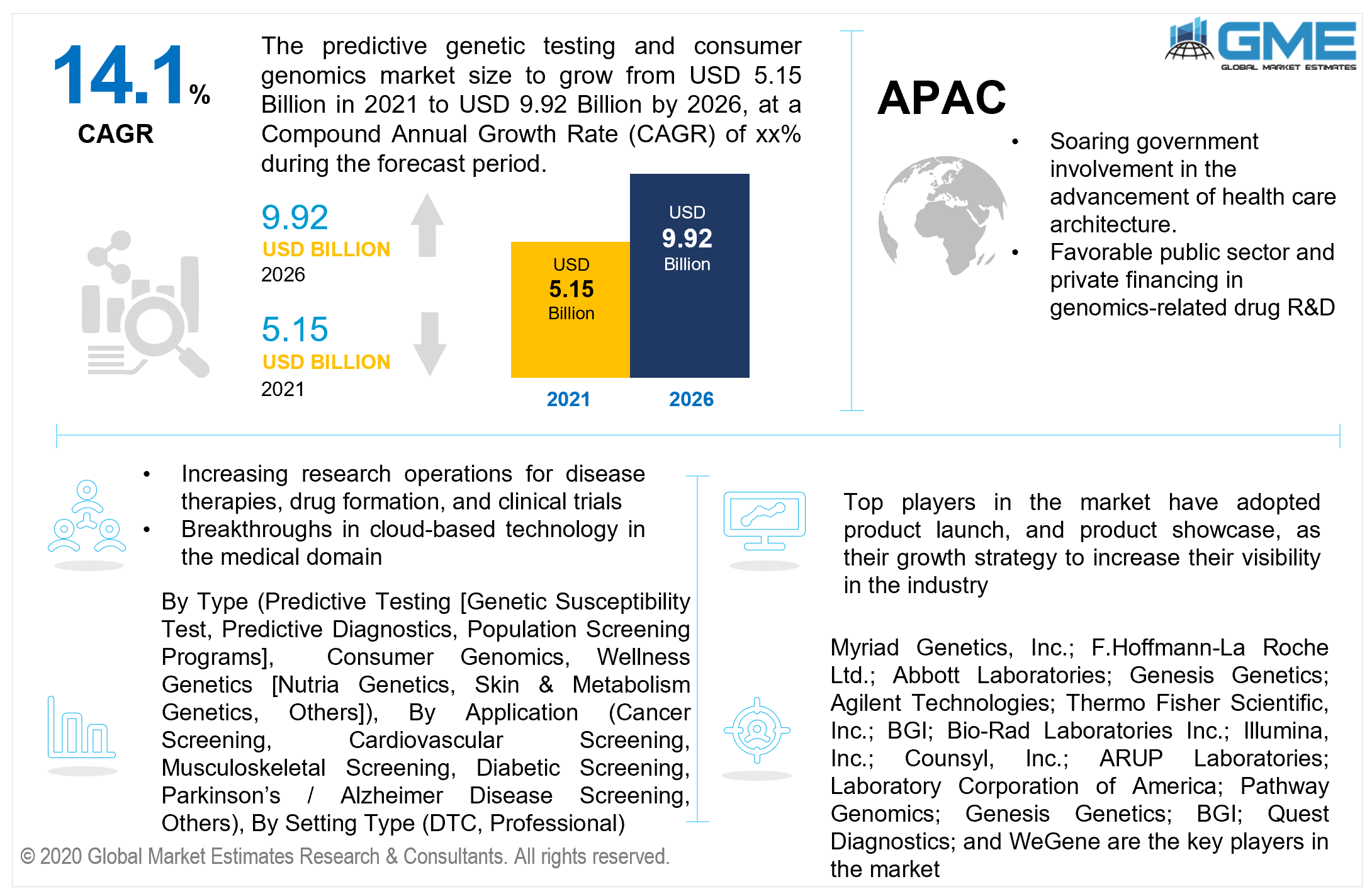

The global predictive genetic testing and consumer genomics market is estimated to be valued at USD 5.15 billion in 2021 and is projected to reach USD 9.92 billion by 2026 at a CAGR of 14.1%. Growing consciousness of the rewards of predictive genetic testing, as well as the emergence of Next-generation Platform Sequencing (NGS), are anticipated to push the predictive genetic testing & consumer genomics market growth over the forecast period.

Predictive genetic testing aids in the analysis of a genetic status in order to provide improved medication and assistance. Furthermore, government financial support for R&D projects to ramp up genomics accessibility via technological enhancements will propel market expansion. Demand in this market has been generated by healthier life and soaring healthcare awareness programmes.

Furthermore, continual research projects on the essence of particular diseases and comprehending the lineage of a particular gene are assumed to open up new market prospects. Market advancement is presumed to accelerate as the necessity for vaccine development expands, particularly during the Covid-19 epidemic. Since genetic testing aids in the comprehension of genes and the detection of alterations in chromosomes or proteins in living organisms.

Rising healthcare awareness and a shift in public preference toward a healthy lifestyle have resulted in the growth of the market. Factors such as the government's and other private regulatory bodies' increased attention to public health care, increased effectiveness & quality of genetic testing, and the prevalence of chronic diseases and genetic diseases such as Parkinson's and cystic fibrosis is expected to drive the global market during the forecast period.

Furthermore, the growing desire to comprehend one's family history is boosting the overall market share. One of the principal growth drivers is the excessive frequency of collaboration concepts among services companies in the genomics sector, which has resulted in a broader frontier of predictive genetic testing. Novel collaborations enable businesses to give plausible end-to-end solutions to customers, increasing client acceptance.

Predictive genetic testing is a new but quickly expanding sector in public health practises, particularly in economically stable countries. It's being utilised more and more to drive dietary choices and training outcomes for a variety of diseases. It is usually done in healthy people and includes detecting specific genetic features that may cause disease later in life. Genetic susceptibility testing, predictive diagnostic testing, and population screening are some of the most popular forms of predictive genetic testing. They may be beneficial in those who have a family history of some curable genetic illnesses. The worldwide genetic testing market is predicted to develop significantly in the future, owing to an increase in the occurrences of genetic diseases and cancer, as well as an increase in knowledge and adoption of tailored medications. For example, genetic testing is commonly utilised in pharmacogenomics, often known as drug-gene testing. Furthermore, developments in genetic testing methodologies are likely to drive the growth of the genetic testing market over the forecast period.

Based on the type in the market is divided into predictive testing, consumer genomics, and wellness genetics. In clinical practice and translational research, predictive testing is widely favoured for forecasting the risk of illnesses such as neurodegenerative disorders and cancer. This allowed it to contribute to a substantial market share. The ‘predict and prevent' concept is expected to enhance public awareness of early screening initiatives.

Ongoing research and development activities in genetic susceptibility testing have increased the acceptance of tests for cancer susceptibility screening and suitable prognosis by identifying an effective treatment regimen. The availability of multigene panels for the identification of various gene mutations has hastened the use of susceptibility testing, resulting in increased revenue generation.

Based on the application, the market is categorized as cancer screening, cardiovascular screening, musculoskeletal screening, diabetic screening, Parkinson's / Alzheimer disease screening, others. The biggest revenue flow was recorded from prediction tests for diagnosing cancer. Factors propelling this market entails an elevated occurrence rate of breast and ovarian cancer worldwide, as well as the widespread use of gene susceptibility testing.

The cancer indication is expected to exhibit analogous market growth trends due to the provision of products that encompass tests for multiple cancer types. Predictive and pre-dispositional genetic testing assists orthopaedic physicians and healthcare professionals in understanding the risk of disease progression prior to the initiation of symptoms.

Based on the type of setting the market is categorized as DTC and professional. DTC (direct to consumer) settings is presumed to hold the largest market share, because of the increased adequacy of direct-to-consumer tests at reasonable price levels and expanding patient understanding of DTC test methods This previously suggested notion has culminated in a boost in DTC test kit total revenue. As new companies implement tactics including the introduction of gene-based services and also post-genetic DTC counselling as an add-on service, the market's key corporations face a significant competitive advantage.

North America dominated the market, trailed by Europe. North America's prominence can be attributed to aspects including its well-established healthcare system, elevated understanding, the preponderance of chronic diseases, and rapid enactment of innovative technologies. North America decimated the market in terms of revenue due to the involvement of multiple players centred in the United States. These companies hold numerous patents linked to predictive testing and wellness genomics.

Growing awareness of genetic functions in the recognition of these rare disorders, as well as breakthroughs in cloud-based technology in the medical domain, are vital considerations foreseen to propel the area's market growth. Increased research operations for disease therapies, drug formation, and clinical trials are also helping to drive up demand in the area. The inclusion of major market players will also help to boost market expansion in the area.

Moreover, Asia Pacific is expected to grow at a substantial rate due to rising discretionary income, increased demand for genetic analysis, the preponderance of unhealthy lifestyle choices, favourable public sector and private financing in genomics-related drug R&D and soaring government involvement in the advancement of health care architecture.

Furthermore, the market in this area has been ascertained to be aimed by a number of established players, as countries such as China and India are assumed to be attractive markets for new companies in the wellness genomics field. Aside from increased demand, this area's manufacturer capability is foreseen to expand significantly in the coming years. Leading players are expanding into emerging economies by offering services via robust distribution channels.

Myriad Genetics, Inc.; F.Hoffmann-La Roche Ltd.; Abbott Laboratories; Genesis Genetics; Agilent Technologies; Thermo Fisher Scientific, Inc.; BGI; Bio-Rad Laboratories Inc.; Illumina, Inc.; Counsyl, Inc.; ARUP Laboratories; Laboratory Corporation of America; Pathway Genomics; Genesis Genetics; Quest Diagnostics; and WeGene are the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Predictive Genetic Testing And Consumer Genomics Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Setting Type Overview

2.1.4 Application Overview

2.1.5 Regional Overview

Chapter 3 Predictive Genetic Testing And Consumer Genomics Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing Global Awareness About Utilization Of Genetic Tests

3.3.1.2 Rising Growth Of Pharmaceutical Companies Involved In Research Of Genomics

3.3.2 Industry Challenges

3.3.2.1 High Cost On Genomic Research Equipment And Complexity In Predictive Genetic Testing & Consumer Genomics

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Setting Type Growth Scenario

3.4.3 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Predictive Genetic Testing And Consumer Genomics Market, By Type

4.1 Type Outlook

4.2 Predictive Testing

4.2.1 Market Size, By Region, 2019-2026 (USD Billion)

4.2.2 Market Size, By Genetic Susceptibility Test, 2019-2026 (USD Billion)

4.2.3 Market Size, By Predictive Diagnostics, 2019-2026 (USD Billion)

4.2.4 Market Size, By Population Screening Programs, 2019-2026 (USD Billion)

4.3 Wellness Genetics

4.3.1 Market Size, By Region, 2019-2026 (USD Billion)

4.3.2 Market Size, By Nutria Genetics, 2019-2026 (USD Billion)

4.3.3 Market Size, By Skin & Metabolism Genetics, 2019-2026 (USD Billion)

4.3.4 Market Size, By Others, 2019-2026 (USD Billion)

4.4 Consumer Genomics

4.4.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 5 Predictive Genetic Testing And Consumer Genomics Market, By Setting Type

5.1 Setting Type Outlook

5.2 DTC

5.2.1 Market Size, By Region, 2019-2026 (USD Billion)

5.3 Professional

5.3.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 6 Predictive Genetic Testing And Consumer Genomics Market, By Application

6.1 Application Outlook

6.2 Cancer Screening

6.2.1 Market Size, By Region, 2019-2026 (USD Billion)

6.3 Cardiovascular Screening

6.3.1 Market Size, By Region, 2019-2026 (USD Billion)

6.4 Musculoskeletal Screening

6.4.1 Market Size, By Region, 2019-2026 (USD Billion)

6.5 Diabetic Screening

6.5.1 Market Size, By Region, 2019-2026 (USD Billion),

6.6 Parkinson’s / Alzheimer Disease Screening

6.6.1 Market Size, By Region, 2019-2026 (USD Billion)

6.7 Others

6.7.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 7 Global Depth Filtration Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Billion)

7.2.2 Market Size, By Type, 2019-2026 (USD Billion)

7.2.3 Market Size, By Setting Type, 2019-2026 (USD Billion)

7.2.4 Market Size, By Application, 2019-2026 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Size, By Type, 2019-2026 (USD Billion)

7.2.5.2 Market Size, By Setting Type, 2019-2026 (USD Billion)

7.2.5.3 Market Size, By Application, 2019-2026 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Size, By Type, 2019-2026 (USD Billion)

7.2.6.2 Market Size, By Setting Type, 2019-2026 (USD Billion)

7.2.6.3 Market Size, By Application, 2019-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Billion)

7.3.2 Market Size, By Type, 2019-2026 (USD Billion)

7.3.3 Market Size, By Setting Type 2019-2026 (USD Billion)

7.3.4 Market Size, By Application, 2019-2026 (USD Billion)

7.3.5 Germany

7.3.5.1 Market Size, By Type, 2019-2026 (USD Billion)

7.3.5.2 Market Size, By Setting Type, 2019-2026 (USD Billion)

7.3.5.3 Market Size, By Application, 2019-2026 (USD Billion)

7.3.6 UK

7.3.6.1 Market Size, By Type, 2019-2026 (USD Billion)

7.3.6.2 Market Size, By Setting Type, 2019-2026 (USD Billion)

7.3.6.3 Market Size, By Application, 2019-2026 (USD Billion)

7.3.7 France

7.3.7.1 Market Size, By Type, 2019-2026 (USD Billion)

7.3.7.2 Market Size, By Setting Type, 2019-2026 (USD Billion)

7.3.7.3 Market Size, By Application, 2019-2026 (USD Billion)

7.3.8 Italy

7.3.8.1 Market Size, By Type, 2019-2026 (USD Billion)

7.3.8.2 Market Size, By Setting Type, 2019-2026 (USD Billion)

7.3.8.3 Market Size, By Application, 2019-2026 (USD Billion)

7.3.9 Spain

7.3.9.1 Market Size, By Type, 2019-2026 (USD Billion)

7.3.9.2 Market Size, By Setting Type, 2019-2026 (USD Billion)

7.3.9.3 Market Size, By Application, 2019-2026 (USD Billion)

7.3.10 Russia

7.3.10.1 Market Size, By Type, 2019-2026 (USD Billion)

7.3.10.2 Market Size, By Setting Type, 2019-2026 (USD Billion)

7.3.10.3 Market Size, By Application, 2019-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country,2019-2026 (USD Billion)

7.4.2 Market Size, By Type, 2019-2026 (USD Billion)

7.4.3 Market Size, By Setting Type, 2019-2026 (USD Billion)

7.4.4 Market Size, By Application, 2019-2026 (USD Billion)

7.4.5 China

7.4.5.1 Market Size, By Type, 2019-2026 (USD Billion)

7.4.5.2 Market Size, By Setting Type, 2019-2026 (USD Billion)

7.4.5.3 Market Size, By Application, 2019-2026 (USD Billion)

7.4.6 India

7.4.6.1 Market Size, By Type, 2019-2026 (USD Billion)

7.4.6.2 Market Size, By Setting Type, 2019-2026 (USD Billion)

7.4.6.3 Market Size, By Application, 2019-2026 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Size, By Type, 2019-2026 (USD Billion)

7.4.7.2 Market Size, By Setting Type, 2019-2026 (USD Billion)

7.4.7.3 Market Size, By Application, 2019-2026 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Size, By Type, 2019-2026 (USD Billion)

7.4.8.2 Market size, By Setting Type, 2019-2026 (USD Billion)

7.4.8.3 Market Size, By Application, 2019-2026 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market Size, By Type, 2019-2026 (USD Billion)

7.4.9.2 Market Size, By Setting Type, 2019-2026 (USD Billion)

7.4.9.3 Market Size, By Application, 2019-2026 (USD Billion)

7.6.5 Latin America

7.5.1 Market Size, By Country 2019-2026 (USD Billion)

7.5.2 Market Size, By Type, 2019-2026 (USD Billion)

7.5.3 Market Size, By Setting Type, 2019-2026 (USD Billion)

7.5.4 Market Size, By Application, 2019-2026 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Size, By Type, 2019-2026 (USD Billion)

7.5.5.2 Market Size, By Setting Type, 2019-2026 (USD Billion)

7.5.5.3 Market Size, By Application, 2019-2026 (USD Billion)

7.5.6 Mexico

7.5.6.1 Market Size, By Type, 2019-2026 (USD Billion)

7.5.6.2 Market Size, By Setting Type, 2019-2026 (USD Billion)

7.5.6.3 Market Size, By Application, 2019-2026 (USD Billion)

7.5.7 Argentina

7.5.7.1 Market Size, By Type, 2019-2026 (USD Billion)

7.5.7.2 Market Size, By Setting Type, 2019-2026 (USD Billion)

7.5.7.3 Market Size, By Application, 2019-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2019-2026 (USD Billion)

7.6.2 Market Size, By Type, 2019-2026 (USD Billion)

7.6.3 Market Size, By Setting Type, 2019-2026 (USD Billion)

7.6.4 Market Size, By Application, 2019-2026 (USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Type, 2019-2026 (USD Billion)

7.6.5.2 Market Size, By Setting Type, 2019-2026 (USD Billion)

7.6.5.3 Market Size, By Application, 2019-2026 (USD Billion)

7.6.6 UAE

7.6.6.1 Market Size, By Type, 2019-2026 (USD Billion)

7.6.6.2 Market Size, By Setting Type, 2019-2026 (USD Billion)

7.6.6.3 Market Size, By Application, 2019-2026 (USD Billion)

7.6.7 South Africa

7.6.7.1 Market Size, By Type, 2019-2026 (USD Billion)

7.6.7.2 Market Size, By Setting Type, 2019-2026 (USD Billion)

7.6.7.3 Market Size, By Application, 2019-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Myriad Genetics, Inc.

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.3 F.Hoffmann-La Roche Ltd.

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Abbott Laboratories

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Genesis Genetics

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Agilent Technologies

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Thermo Fisher Scientific, Inc.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 BGI

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Bio-Rad Laboratories Inc.

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Pathway Genomics

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Genesis Genetics

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Quest Diagnostics

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

8.13 WeGene

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Info Graphic Analysis

8.14 Other Companies

8.14.1 Company Overview

8.14.2 Financial Analysis

8.14.3 Strategic Positioning

8.14.4 Info Graphic Analysis

The Global Predictive Genetic Testing and Consumer Genomics Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Predictive Genetic Testing and Consumer Genomics Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS