Global Protein Chip Market, Trends & Analysis - Forecasts to 2026 By Application (Diagnostics, Proteomics, Antibody Characterization), By Technology (Analytical Microarrays, Functional Protein Microarrays, and Reverse Protein Microarray), By End-User (Hospitals & Clinics, Diagnostic Labs, Academic & Research Institutes, Pharma and Biotech Companies), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East & Africa), Company Market Share Analysis, and Competitor Analysis

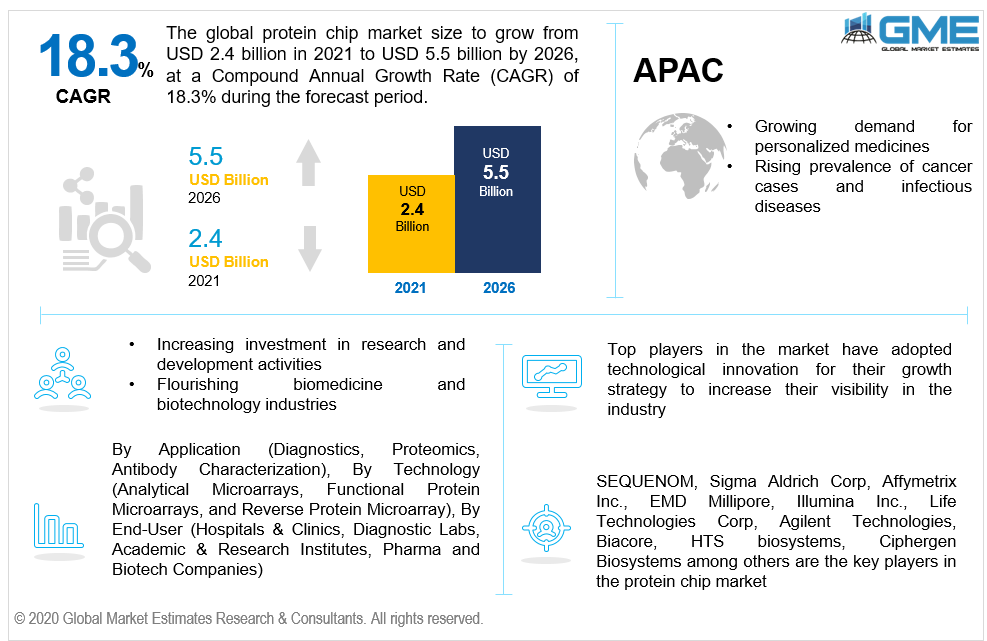

The global protein chip market is projected to grow from USD 2.4 billion in 2020 to USD 5.5 billion by 2026, at a CAGR of 18.3% between 2021 and 2026. Protein microarrays, also known as protein chips, are parallel assay systems that contain small amounts of proteins in a high-density format. Protein chips have a major role in diagnostic domain. With the help of these chips, healthcare providers can check the level of infection for a particular disease or disorder.

Protein chips have been widely used to perform basic research in healthcare and bio medical firms. Furthermore, these chips have also been implemented in the drug discovery research projects pertaining to infectious and deadly diseases. Protein chips consist of a support surface such as a glass slide or micro titre plate which helps to capture protein in use, and these molecules are further labelled and assembled in a dye with a specific colour and added to the array. Any reaction between them is then signalled and notified for further experiment.

Major drivers for protein chip market is the rising need for personalized medicines, and increasing demand for target specific drugs especially for the cancer diseases. Most of the large pharmaceutical companies have been investing heavily in the research and development domain and adopted the use of latest microarray technology. This is analyzed to support the market growth further.

Furthermore, the flourishing biomedicine and biotechnology industries will further help in increasing the demand for protein chips in the market. Hence, this trend is estimated to help the global protein chips market grow the fastest especially in the APAC region majorly due to the increasing population clubbed with rising number of infectious diseases, and increasing technological advancements and rising awareness regarding target oriented drug delivery therapies for cancer treatment.

Automated screening of targets using protein chips is one of the major restraints of the protein chip market as these are system-based and the output would completely depend on the input provided. Another restraint for this market would be the scarcity or availability of protein in the market place despite heavy investments.

The COVID-19 pandemic has negatively impacted the entire economy across the globe but it has been a boon for the protein chip market. These chips have helped healthcare providers fasten the process of drug discovery and has been one of the prime tool to eliminate the risk of disease spread. However, with the revival of the economy and the increased need for technological advancement in the medical and healthcare industry, the protein chip market is estimated to perform exceptionally well during the forecast period.

Based on the application of the product, the market can be segmented into diagnostics, proteomics and antibody characterization. As of 2020, proteomics holds the largest share of the market and is expected to grow at a steady pace from 2021 to 2026. It is used to investigate and understand the activity, position and reaction process of proteins with the drugs or target tissue.

Based on technology, the protein chip market is segmented into analytical microarrays, functional protein microarrays, and reverse protein microarray. The functional protein microarray segment is expected to hold a major share in the market during the forecast period majorly due to its application in advanced diagnostics. Furthermore, the 2nd largest share holder in the market is the analytical microarray segment. Heavy investments in research and developmental projects related to the use of microarrays would be an added advantage for the functional protein microarray segment to dominate the market during the forecast period.

Based on end-user, the protein chip market is can be segmented into hospitals & clinics, diagnostic labs, academic & research institutes, pharma and biotech companies. Hospitals and clinics segment will hold the largest share of the market during the forecast period. This is mainly due to the increasing number of infectious diseases, cancer cases, post surgical complications, and rising COVID-19 cases; followed by an increasing number of tests required at hospital on daily basis. Research institutes is the 2nd largest share holder of the market.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (UAE, Saudi Arabia, Rest of MEA) and Central & South America (Brazil, and Rest of CSA).

Based on the geographical studies, the North American region holds the largest share in the protein chip market which is then followed by European region. Rising technical advancements in the health care industry across the northern region and increasing number of investment programs to sponsor the use of latest microarray technology in drug discovery research has helped the North American market grow considerably. The European region holds the second largest market and shares mainly due to the presence of major players and the rising number of cancer patients in the region.

Asia Pacific region is expected to be the fastest-growing among all other regions, mainly due to the increasing population clubbed with rising prevalence of infection, diseases and cancer cases and the growing need for technological advancement in the region.

SEQUENOM, Sigma Aldrich Corp, Affymetrix Inc., EMD Millipore, Illumina Inc., Life Technologies Corp, Agilent Technologies, Biacore, HTS biosystems, Ciphergen Biosystems among others are the key players in the protein chip market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Protein Chip Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Application Overview

2.1.3 Technology Overview

2.1.4 End-User Overview

2.1.6 Regional Overview

Chapter 3 Protein Chip Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising prevalence of infectious diseases

3.3.2 Industry Challenges

3.3.2.1 Lack of adequate infrastructure and automated laboratory systems in developing nations

3.4 Prospective Growth Scenario

3.4.1 Application Growth Scenario

3.4.2 Technology Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Protein Chip Market, By Application

4.1 Application Outlook

4.2 Diagnostics

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Proteomics

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Antibody Characterization

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Protein Chip Market, By Technology

5.1 Technology Outlook

5.2 Analytical Microarrays

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Functional Protein Microarrays

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Reverse Protein Microarray

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Protein Chip Market, By End-User

6.1 Hospitals & Clinics

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Diagnostic Labs

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Academic & Research Institutes

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Pharma and Biotech Companies

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Protein Chip Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Application, 2020-2026 (USD Billion)

7.2.3 Market Size, By Technology, 2020-2026 (USD Billion)

7.2.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Application, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.2.4.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Application, 2020-2026 (USD Billion)

7.2.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.2.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.3 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Application, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Application, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Application, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Application, 2020-2026 (USD Billion)

7.3.11.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.11.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.3 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Application, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Application, 2020-2026 (USD Billion)

7.4.9.2 Market size, By Technology, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Application, 2020-2026 (USD Billion)

7.4.10.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.3 Market Size, By Technology, 2020-2026 (USD Billion)

7.5.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Application, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Application, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Application, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6.3 Market Size, By Technology, 2020-2026 (USD Billion)

7.6.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Application, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Application, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Application, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 SEQUENOM

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Sigma Aldrich Corp

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Affymetrix Inc.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 EMD Millipore

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Illumina Inc

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Life Technologies Corp

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Agilent Technologies

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Other Companies

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

The Global Protein Chip Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Protein Chip Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS