Global Psoriasis Drugs Market Size, Trends & Analysis - Forecasts to 2026 By Treatment Type (Topicals, Systemic, Biologics), By Therapeutic Class (Tumor Necrosis Factor Inhibitor, Interleukin Inhibitors, Anti-Inflammatory, Corticosteroids, Vitamin D Analogues), By Application (Plaque Psoriasis, Guttate Psoriasis, Nail Psoriasis, Erythrodermic Psoriasis, Pustular Psoriasis, Intertriginous Psoriasis, Others), By Distribution Channel (Hospitals & Clinics, E-commerce, Retail Pharmacies), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Psoriasis Drugs Market Size

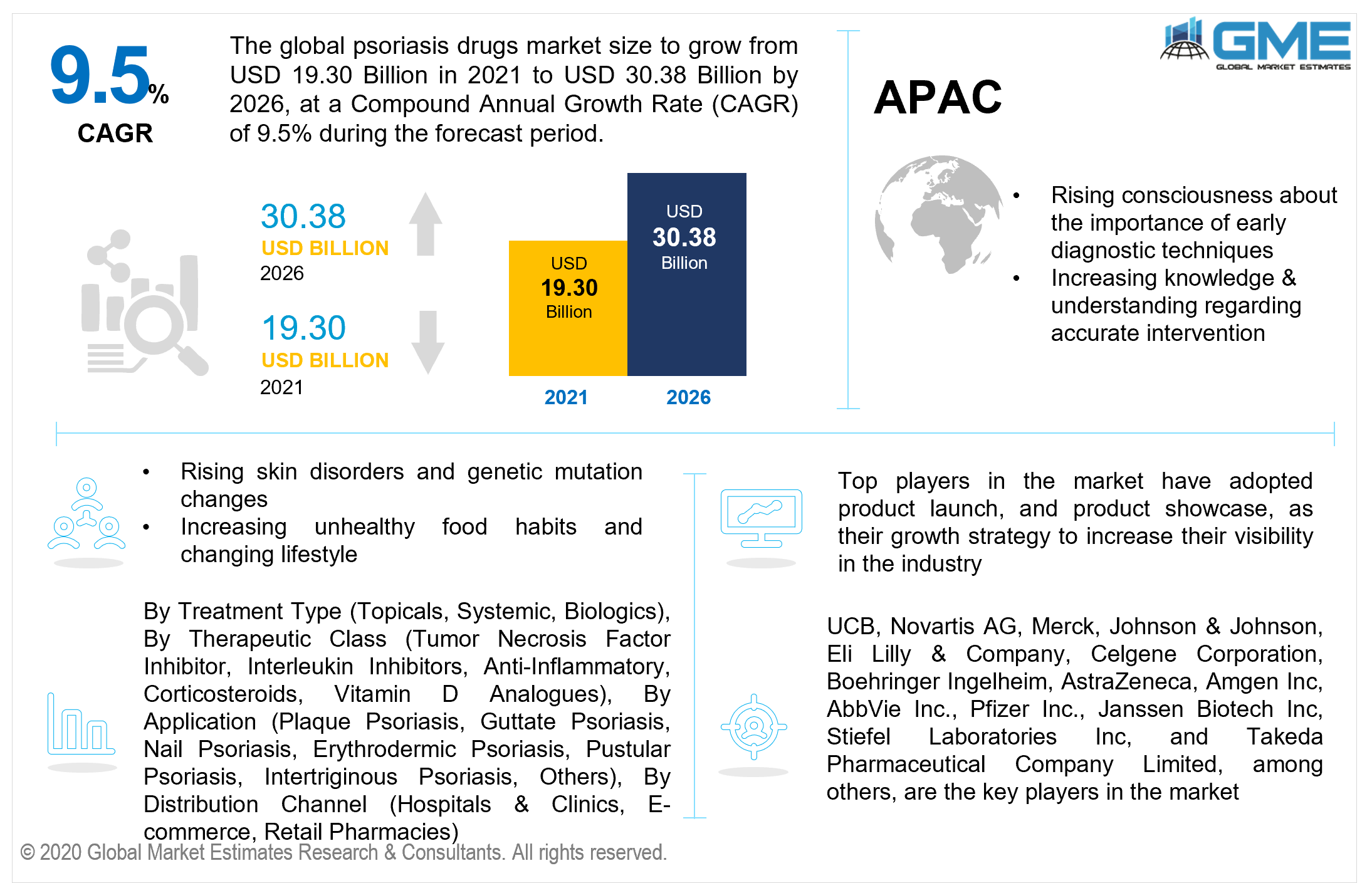

The global psoriasis drugs market is estimated to be valued at USD 19.30 billion in 2021 and is projected to reach USD 30.38 billion by 2026 at a CAGR of 9.5%. Rising disease consciousness, a boost in biologic reimbursement schemes, and sophisticated diagnostic and technological techniques are all plausible to drive up the use of psoriasis therapeutics.

Furthermore, the growing number of psoriasis patients is expected to accelerate growth opportunities. The key drivers which contribute to the psoriasis drug market include increasing skin disorders, unhealthy diets, rising genetic disorders, growing viral & bacterial infections, the rising prevalence of chronic diseases, and the mounting requirement & inclination for innovative drugs.

The swiftly rising geriatric population, the expanding preponderance of plaque psoriasis and psoriatic arthritis, a large pipeline of biologics and biosimilar products, favorable government initiatives, and the burgeoning prescription quantity of biologic products are among the significant aspects driving the development of the market.

According to the World Health Organization (WHO), the preponderance of psoriasis ranges from 0.09 percent to 11.0 percent across all countries, rendering psoriasis a major global concern. The pervasiveness of psoriasis ranges from 15 to 5.0 percent in most developed economies, with an ascending pattern in disease preponderance witnessed in recent times.

The notable aspects driving market advancement are an escalating disease burden and demand for psoriasis medications in developing economies, as well as an upsurge in psoriasis research and pipeline drugs. Novel drugs with oral administration provide options for patients who are afraid of needles. The prevalence of psoriasis has gradually increased over time in various geographical areas. This rise can be ascribed to biological and economic factors, as well as urbanization. The surge in incidence rates could also be linked to a decline in reactions or the development of resistance to disease-controlling treatments.

The exact cause of psoriasis is unknown; notwithstanding, specific genetic and environmental considerations may contribute to the disease's initiation. The majority of accessible therapies target slow disease progression by preventing keratinocyte hyperproliferation. Many groundbreaking psoriasis medications and advanced techniques have been introduced in the psoriasis medicine market, impacting the expansion of combination therapies and, as a consequence, anticipated to boost the market growth.

The COVID-19 epidemic subsequently had an adverse expansion effect on the psoriasis market, owing to regulations published by various regulatory authorities indicating that patients undergoing psoriasis medication are more likely to become infected with COVID-19. In March 2020, the International Psoriasis Council (IPC) advised physicians to withdraw or delay the use of immunosuppressive medications.

Nevertheless, in September 2020, researchers from the University of Pennsylvania's Perelman School of Medicine and 16 other research institutions from the United States and Canada, in collaboration with the National Psoriasis Foundation, developed guidelines to care for psoriasis patients during the coronavirus epidemic. The researchers discovered no substantiation that medical treatments for psoriasis and psoriatic arthritis must be discontinued or modified in order to reduce COVID-19 risks. This policy is anticipated to re-ignite market growth.

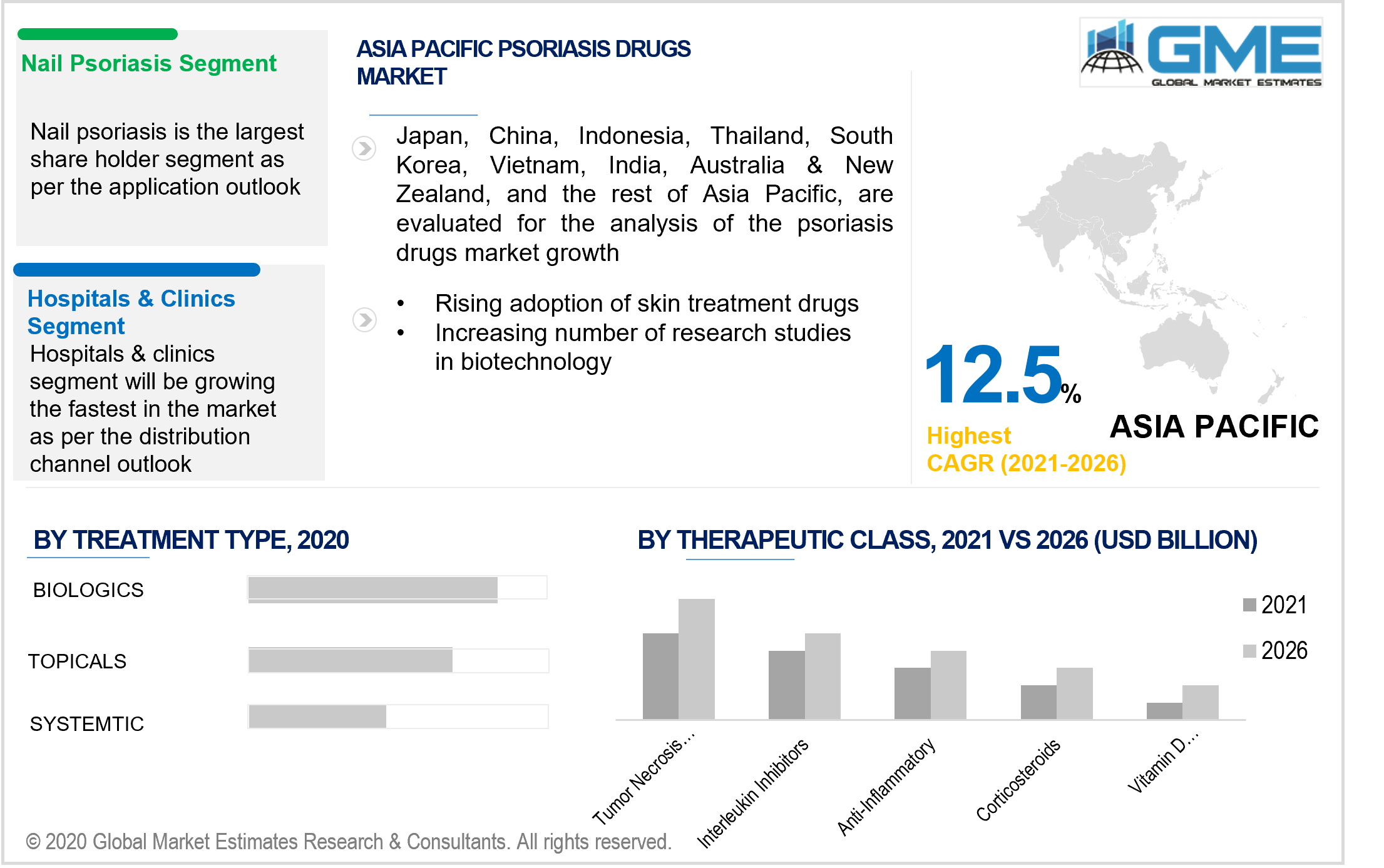

Based on treatment type, the market is segmented into topicals, systemic, and biologics. During the forecast period, the market for biologics is estimated to predominate. Biologics are typically administered via injection and are typically suggested for potential customers who do not adapt to conventional medicine or have correlated psoriatic arthritis. The segment's market share is ascribed to its capacity to cure the ailment by targeting specific areas of the immune system, consequently treating the disorder from the ground up, resulting in elevated affirmation among healthcare professionals.

Growing biologics studies, increasing technological breakthroughs, soaring levels of FDA approvals, growing research and development, the launch of new products, growing awareness about biologics, and increasing adoption of these products are the major drivers which contribute to this market.

During the forecast period, the topicals segment is expected to grow at the fastest rate. The Topicals segment's expansion can be ascribed to increased knowledge of the ailment, and topicals, as the first line of diagnosis for the disorder, are in high demand among medical professionals.

Based on therapeutic class, the market is segmented into tumor necrosis factor inhibitors, interleukin inhibitors, anti-inflammatory, corticosteroids, and vitamin D analogues. During the forecast period, the market for tumor necrosis factor inhibitors is estimated to predominate. The potential of this therapeutic class to mitigate inflammation, which is a widespread consequence affiliated with the condition and one of the principal objectives of the healthcare system, corresponds to the market share held by this segment.

During the forecast period, the market for interleukin inhibitors is estimated to grow at the fastest rate. The attributes assisting in this expansion include their enhanced safety and effectiveness when contrasted to many other classes of psoriasis medications, which steadily leads to elevated patient implementation.

Based on application, the market is segmented into plaque psoriasis, guttate psoriasis, nail psoriasis, erythrodermic psoriasis, pustular psoriasis, intertriginous psoriasis, and others. During the forecast period, the market for nail psoriasis is estimated to predominate. The dominance of this segment is due to the condition's elevated incidence rate, which raises consciousness about it and drives demand for these medications to cure nail psoriasis. The fact that nearly half of psoriasis patients have nail modifications demonstrates the disease's high prevalence.

Based on distribution channels, the market is segmented into hospitals and clinics, e-commerce, and retail pharmacies. During the forecast period, the market for hospitals & clinics segment is estimated to predominate. The rising reliance on this distribution channel for obtaining drugs affiliated with the ailment, such as systemic medications and phototherapy, corresponds to this segment's market share.

The e-commerce segment is presumed to grow at a faster pace. The perpetual growth of online medication stores, as well as the synonymous increase in online medication retailing culture, pertains to the e-commerce segment's pace of growth.

During the forecast period, North America is presumed to hold the largest market share. The area's market dominance is due to elevated therapeutic implementation, sophisticated healthcare facilities, and increased understanding of the condition. All through the forecast period, the United States is foreseen to outperform the market. Amongst some of the principal reasons for its supremacy are the region's established healthcare architecture, high therapeutic enactment, and the involvement of key manufacturing companies. Furthermore, the rising pervasiveness of psoriasis and favorable government reforms are boosting market development.

During the forecast period, the Asia Pacific region is presumed to grow at the fastest rate. The area's robust expansion can be ascribed to a surge in consciousness about the importance of early diagnostic techniques and unaddressed healthcare needs of medical care user groups, which are creating unique possibilities for the market in this region. Japan is presumed to predominate during the forecast period owing to elevated unrealized medical requirements of patients, soaring discretionary money, increasing knowledge & understanding regarding accurate intervention, and convenient access to top-notch medication.

UCB, Novartis AG, Merck, Johnson & Johnson, Eli Lilly & Company, Celgene Corporation, Boehringer Ingelheim, AstraZeneca, Amgen Inc, AbbVie Inc., Pfizer Inc., Janssen Biotech Inc, Stiefel Laboratories Inc, and Takeda Pharmaceutical Company Limited, among others, are the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Treatment Types

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Psoriasis Drugs Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Treatment Type Overview

2.1.3 Therapeutic Class Overview

2.1.4 Application Overview

2.1.5 Distribution Channel Overview

2.1.6 Regional Overview

Chapter 3 Psoriasis Drugs Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing prevalence of skin diseases

3.3.1.2 Growing demand for skin care and skin drugs

3.3.2 Industry Challenges

3.3.2.1 Adverse side effects of most of the existing medication and the high cost of the treatment

3.4 Prospective Growth Scenario

3.4.1 Treatment Type Growth Scenario

3.4.2 Therapeutic Class Growth Scenario

3.4.3 Application Growth Scenario

3.4.4 Distribution Channel Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.7 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Psoriasis Drugs Market, By Treatment Type

4.1 Treatment Type Outlook

4.2 Topicals

4.2.1 Market Size, By Region, 2019-2026 (USD Billion)

4.3 Systemic

4.3.1 Market Size, By Region, 2019-2026 (USD Billion)

4.4 Biologics

4.4.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 5 Psoriasis Drugs Market, By Therapeutic Class

5.1 Therapeutic Class Outlook

5.2 Tumor Necrosis Factor Inhibitor

5.2.1 Market Size, By Region, 2019-2026 (USD Billion)

5.3 Interleukin Inhibitors

5.3.1 Market Size, By Region, 2019-2026 (USD Billion)

5.4 Anti-Inflammatory

5.4.1 Market Size, By Region, 2019-2026 (USD Billion)

5.5 Corticosteroids

5.5.1 Market Size, By Region, 2019-2026 (USD Billion)

5.6 Vitamin D Analogues

5.6.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 6 Psoriasis Drugs Market, By Application

6.1 Application Outlook

6.2 Plaque Psoriasis

6.2.1 Market Size, By Region, 2019-2026 (USD Billion)

6.3 Guttate Psoriasis

6.3.1 Market Size, By Region, 2019-2026 (USD Billion)

6.4 Nail Psoriasis

6.4.1 Market Size, By Region, 2019-2026 (USD Billion)

6.5 Erythrodermic Psoriasis

6.5.1 Market Size, By Region, 2019-2026 (USD Billion)

6.6 Pustular Psoriasis

6.6.1 Market Size, By Region, 2019-2026 (USD Billion)

6.7 Intertriginous psoriasis

6.7.1 Market Size, By Region, 2019-2026 (USD Billion)

6.8 Others

6.8.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 7 Psoriasis Drugs Market, By Distribution Channel

7.1 Distribution Channel Outlook

7.2 Hospitals and Clinics

7.2.1 Market Size, By Region, 2019-2026 (USD Billion)

7.3 E-commerce

7.3.1 Market Size, By Region, 2019-2026 (USD Billion)

7.4 Retail Pharmacies

7.4.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 8 Psoriasis Drugs Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2019-2026 (USD Billion)

8.2.2 Market Size, By Treatment Type, 2019-2026 (USD Billion)

8.2.3 Market Size, By Therapeutic Class, 2019-2026 (USD Billion)

8.2.4 Market Size, By Application, 2019-2026 (USD Billion)

8.2.5 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

8.2.6 U.S.

8.2.6.1 Market Size, By Treatment Type, 2019-2026 (USD Billion)

8.2.6.2 Market Size, By Therapeutic Class, 2019-2026 (USD Billion)

8.2.6.3 Market Size, By Application, 2019-2026 (USD Billion)

8.2.6.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

8.2.7 Canada

8.2.7.1 Market Size, By Treatment Type, 2019-2026 (USD Billion)

8.2.7.2 Market Size, By Therapeutic Class, 2019-2026 (USD Billion)

8.2.7.3 Market Size, By Application, 2019-2026 (USD Billion)

8.2.7.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

8.3 Europe

8.3.1 Market Size, By Country 2019-2026 (USD Billion)

8.3.2 Market Size, By Treatment Type, 2019-2026 (USD Billion)

8.3.3 Market Size, By Therapeutic Class, 2019-2026 (USD Billion)

8.3.4 Market Size, By Application, 2019-2026 (USD Billion)

8.3.5 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

8.3.6 Germany

8.3.6.1 Market Size, By Treatment Type, 2019-2026 (USD Billion)

8.3.6.2 Market Size, By Therapeutic Class, 2019-2026 (USD Billion)

8.3.6.3 Market Size, By Application, 2019-2026 (USD Billion)

8.3.6.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

8.3.7 UK

8.3.7.1 Market Size, By Treatment Type, 2019-2026 (USD Billion)

8.3.7.2 Market Size, By Therapeutic Class, 2019-2026 (USD Billion)

8.3.7.3 Market Size, By Application, 2019-2026 (USD Billion)

8.3.7.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

8.3.8 France

8.3.8.1 Market Size, By Treatment Type, 2019-2026 (USD Billion)

8.3.8.2 Market Size, By Therapeutic Class, 2019-2026 (USD Billion)

8.3.8.3 Market Size, By Application, 2019-2026 (USD Billion)

8.3.8.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

8.3.9 Italy

8.3.9.1 Market Size, By Treatment Type, 2019-2026 (USD Billion)

8.3.9.2 Market Size, By Therapeutic Class, 2019-2026 (USD Billion)

8.3.9.3 Market Size, By Application, 2019-2026 (USD Billion)

8.3.9.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

8.3.10 Spain

8.3.10.1 Market Size, By Treatment Type, 2019-2026 (USD Billion)

8.3.10.2 Market Size, By Therapeutic Class, 2019-2026 (USD Billion)

8.3.10.3 Market Size, By Application, 2019-2026 (USD Billion)

8.3.10.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

8.3.11 Russia

8.3.11.1 Market Size, By Treatment Type, 2019-2026 (USD Billion)

8.3.11.2 Market Size, By Therapeutic Class, 2019-2026 (USD Billion)

8.3.11.3 Market Size, By Application, 2019-2026 (USD Billion)

8.3.11.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2019-2026 (USD Billion)

8.4.2 Market Size, By Treatment Type, 2019-2026 (USD Billion)

8.4.3 Market Size, By Therapeutic Class, 2019-2026 (USD Billion)

8.4.4 Market Size, By Application, 2019-2026 (USD Billion)

8.4.5 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

8.4.6 China

8.4.6.1 Market Size, By Treatment Type, 2019-2026 (USD Billion)

8.4.6.2 Market Size, By Therapeutic Class, 2019-2026 (USD Billion)

8.4.6.3 Market Size, By Application, 2019-2026 (USD Billion)

8.4.6.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

8.4.7 India

8.4.7.1 Market Size, By Treatment Type, 2019-2026 (USD Billion)

8.4.7.2 Market Size, By Therapeutic Class, 2019-2026 (USD Billion)

8.4.7.3 Market Size, By Application, 2019-2026 (USD Billion)

8.4.7.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

8.4.8 Japan

8.4.8.1 Market Size, By Treatment Type, 2019-2026 (USD Billion)

8.4.8.2 Market Size, By Therapeutic Class, 2019-2026 (USD Billion)

8.4.8.3 Market Size, By Application, 2019-2026 (USD Billion)

8.4.8.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

8.4.9 Australia

8.4.9.1 Market Size, By Treatment Type, 2019-2026 (USD Billion)

8.4.9.2 Market size, By Therapeutic Class, 2019-2026 (USD Billion)

8.4.9.3 Market Size, By Application, 2019-2026 (USD Billion)

8.4.9.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

8.4.10 South Korea

8.4.10.1 Market Size, By Treatment Type, 2019-2026 (USD Billion)

8.4.10.2 Market Size, By Therapeutic Class, 2019-2026 (USD Billion)

8.4.10.3 Market Size, By Application, 2019-2026 (USD Billion)

8.4.10.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

8.5 Latin America

8.5.1 Market Size, By Country 2019-2026 (USD Billion)

8.5.2 Market Size, By Treatment Type, 2019-2026 (USD Billion)

8.5.3 Market Size, By Therapeutic Class, 2019-2026 (USD Billion)

8.5.4 Market Size, By Application, 2019-2026 (USD Billion)

8.5.5 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

8.5.6 Brazil

8.5.6.1 Market Size, By Treatment Type, 2019-2026 (USD Billion)

8.5.6.2 Market Size, By Therapeutic Class, 2019-2026 (USD Billion)

8.5.6.3 Market Size, By Application, 2019-2026 (USD Billion)

8.5.6.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

8.5.7 Mexico

8.5.7.1 Market Size, By Treatment Type, 2019-2026 (USD Billion)

8.5.7.2 Market Size, By Therapeutic Class, 2019-2026 (USD Billion)

8.5.7.3 Market Size, By Application, 2019-2026 (USD Billion)

8.5.7.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

8.5.8 Argentina

8.5.8.1 Market Size, By Treatment Type, 2019-2026 (USD Billion)

8.5.8.2 Market Size, By Therapeutic Class, 2019-2026 (USD Billion)

8.5.8.3 Market Size, By Application, 2019-2026 (USD Billion)

8.5.8.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

8.6 MEA

8.6.1 Market Size, By Country 2019-2026 (USD Billion)

8.6.2 Market Size, By Treatment Type, 2019-2026 (USD Billion)

8.6.3 Market Size, By Therapeutic Class, 2019-2026 (USD Billion)

8.6.4 Market Size, By Application, 2019-2026 (USD Billion)

8.6.5 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Treatment Type, 2019-2026 (USD Billion)

8.6.6.2 Market Size, By Therapeutic Class, 2019-2026 (USD Billion)

8.6.6.3 Market Size, By Application, 2019-2026 (USD Billion)

8.6.6.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

8.6.7 UAE

8.6.7.1 Market Size, By Treatment Type, 2019-2026 (USD Billion)

8.6.7.2 Market Size, By Therapeutic Class, 2019-2026 (USD Billion)

8.6.7.3 Market Size, By Application, 2019-2026 (USD Billion)

8.6.7.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

8.6.8 South Africa

8.6.8.1 Market Size, By Treatment Type, 2019-2026 (USD Billion)

8.6.8.2 Market Size, By Therapeutic Class, 2019-2026 (USD Billion)

8.6.8.3 Market Size, By Application, 2019-2026 (USD Billion)

8.6.8.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 . UCB

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Novartis AG

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Merck

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Johnson & Johnson

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Eli Lilly & Company

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Celgene Corporation

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Boehringer Ingelheim

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 AstraZeneca

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Amgen Inc

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 AbbVie Inc

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

9.12 Pfizer Inc

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info Graphic Analysis

9.13 Janssen Biotech Inc

9.13.1 Company Overview

9.13.2 Financial Analysis

9.13.3 Strategic Positioning

9.13.4 Info Graphic Analysis

9.14 Stiefel Laboratories Inc

9.14.1 Company Overview

9.14.2 Financial Analysis

9.14.3 Strategic Positioning

9.14.4 Info Graphic Analysis

9.15 Takeda Pharmaceutical Company Limited

9.15.1 Company Overview

9.15.2 Financial Analysis

9.15.3 Strategic Positioning

9.15.4 Info Graphic Analysis

9.16 Other Companies

9.16.1 Company Overview

9.16.2 Financial Analysis

9.16.3 Strategic Positioning

9.16.4 Info Graphic Analysis

The Global Psoriasis Drugs Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Psoriasis Drugs Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS