Global Rapid Medical Diagnostic Kits Market Size, Trends & Analysis - Forecasts to 2026 By Product (Over the Counter (OTC) Kits, Prescribed Kits), By Technology (Lateral Flow, Solid Phase, Agglutination, Other Technologies), By Application (Blood Glucose Testing, Cardiometabolic Testing, Infectious Disease Testing, Fecal Occult Blood Testing, Pregnancy and Fertility Testing, Coagulation Testing, Lipid Profile Testing, Toxicology Testing, Other Applications), By End-use (Home Care, Hospitals & Clinics, Diagnostic Laboratories), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

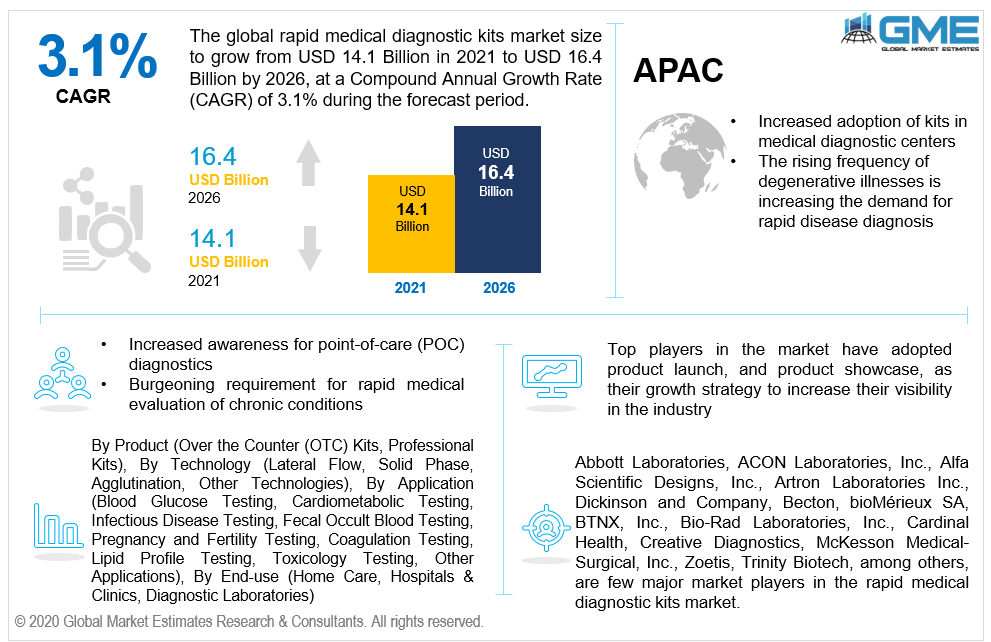

The global rapid medical diagnostic kits market is projected to grow from USD 14.1 billion in 2021 to USD 16.4 billion by 2026 at a CAGR value of 3.1% from 2021 to 2026.

Rapid medical diagnostic tests are used at healthcare centers with scarce resources for crisis or exploratory medical screening. These diagnostic tests also allow for point-of-care examinations in patient healthcare, which were formerly only possible with laboratory tests. The market for rapid medical diagnostic kits is expected to increase in the subsequent years, by rising adoption for point-of-care (POC) diagnostics and a burgeoning requirement for rapid medical evaluation of chronic conditions.

Growth is fuelled by an infusion of mobile rapid testing instruments available in the market, an uptick in the frequency of infectious illness cases, and a rising geriatric population. The implementation of rapid tests is expected to be supplemented by collaborative efforts between government agencies and local governments to establish total control of infectious disease treatment and management.

Consumer purchasing behaviour is influenced by a large group of domestic industry stakeholders and vigorous rivalry among players. The rising frequency of degenerative illnesses is increasing the demand for rapid disease diagnosis, which has a favourable effect on the purchasing behaviour of rapid essential aid for medical diagnostics. Furthermore, urban growth, genetic variety in carriers and infections, and climate degradation are some of the factors driving up need for rapid medical supplies, and boosting market growth.

Moreover, the COVID-19 outbreak has presented a huge potential for players to provide rapid diagnostic test supplies to stop COVID-19 illness from spreading. In both the domestic and international markets, government rules governing decontamination and COVID-19 examinations have resulted in a higher demand for these tests.

In contrary, as technological improvements such as lab-based PCR and molecular testing become more widely available, adoption for rapid diagnostic tests is projected to slow. Whereas rapid diagnostic methods for plasmodium detection have a high specificity and sensitivity, PCR and molecular diagnostic technologies have proven to be more accurate. As a result, advanced molecular techniques, such as PCR, have revolutionised contagious illness diagnostics, potentially posing a market threat.

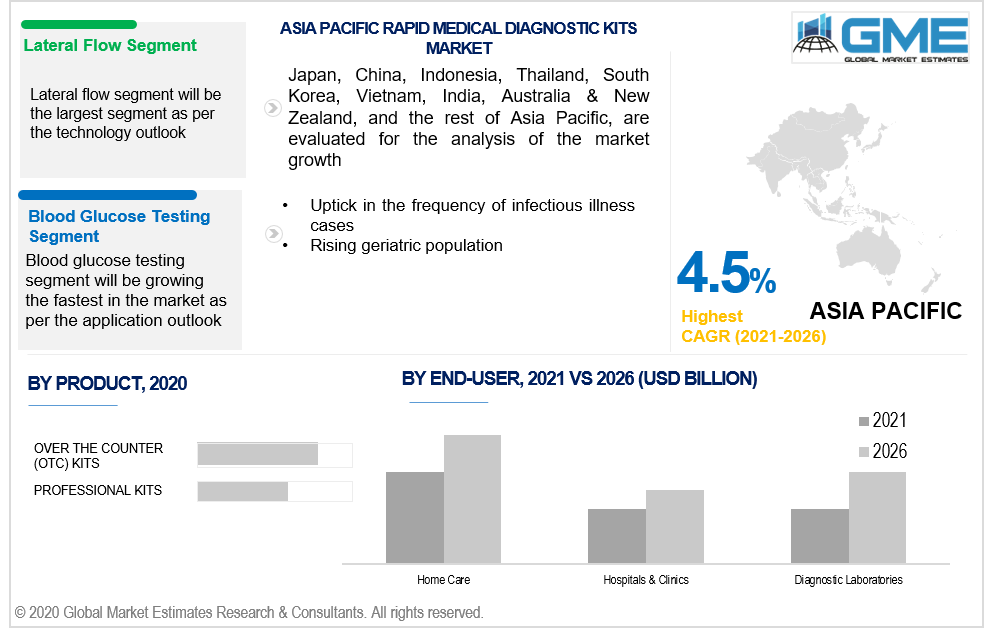

Based on the product, the market is segmented into over the counter (OTC) kits and Prescribed Kits. Over the counter (OTC) kits segment is expected to have the largest share in the market during the forecast period. This can be attributed to the fact that such tests are less expensive than sophisticated laboratory analysis and are straightforward to employ in the "point of care setting." These tests are typically used in home care settings, as they are a convenient and cost-effective alternative.

Based on the technology, the market is segmented into lateral flow, solid phase, agglutination, and other technologies. The lateral flow segment is anticipated to have the largest share in the market during the forecast period. The simple production process and lower operational cost of lateral flow tests has resulted in an increase in their use in a variety of quick testing applications.

Based on the application, the market is segmented into blood glucose testing, cardiometabolic testing, infectious disease testing, fecal occult blood testing, pregnancy, and fertility testing, coagulation testing, lipid profile testing, toxicology testing, and other applications.

The blood glucose testing segment is estimated to be the largest shareholder of the market from 2021 to 2026. The segment's growth is mostly driven by the sheer volume of blood sugar tests conducted across the globe. Furthermore, adequate implementation of these tests for the immediate analysis of elevated blood cholesterol levels throughout clinics, residential care, supportive housing centres, and laboratories is expected to fuel industry expansion.

Based on the end-use, the market is segmented into home care, hospitals & clinics, and diagnostic laboratories. The home care segment is estimated to be the largest shareholder of the market from 2021 to 2026. Home-use kits are being driven by horizontal flow fast antigens testing, which helps in diagnosing pregnancies at home. Serum glucose testing strips are also commonly used at household as a simple, secure, and cost-effective way of monitoring diabetes. These elements are all working together to help the home care end-use segment flourish.

As per the geographical analysis, the rapid medical diagnostic market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region will grow the fastest in the rapid medical diagnostic kits market from 2021 to 2026. Rapid medical diagnostic kits are fuelled by the participation of prominent players and the growing usage of medical test kits by key companies in the APAC region. The Chinese government is extending kits that may be used to efficiently and precisely diagnose variety of ailments. Increased awareness of such kits among individuals and rapidly evolving healthcare sector are also projected to fuel growth in this region.

Moreover, the North America (the United States, Canada, and Mexico) region is expected to be the largest shareholding segment in the rapid medical diagnostic market during the forecast period. Due to the rising adoption of rapid medical diagnostic kits to diagnose a variety of contagious diseases caused by viruses and microbes, this region is experiencing a significant increase in the growth of rapid medical diagnostic kits.

Abbott Laboratories, ACON Laboratories, Inc., Alfa Scientific Designs, Inc., Artron Laboratories Inc., Dickinson and Company, Becton, bioMérieux SA, BTNX, Inc., Bio-Rad Laboratories, Inc., Cardinal Health, Creative Diagnostics, Danaher Corporation, Zoetis, Trinity Biotech, among others, are few major market players in the rapid medical diagnostic kits market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Rapid Medical Diagnostic Kits Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Application Overview

2.1.3 Product Overview

2.1.4 End-User Overview

2.1.5 Technology Overview

2.1.6 Regional Overview

Chapter 3 Rapid Medical Diagnostic Kits Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 The rising frequency of degenerative illnesses is increasing the demand for rapid disease diagnosis

3.3.2 Industry Challenges

3.3.2.1 Technological improvements such as lab-based PCR and molecular testing are hampering growth

3.4 Prospective Growth Scenario

3.4.1 Application Growth Scenario

3.4.2 End-User Growth Scenario

3.4.3 Product Growth Scenario

3.4.4 Technology Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Rapid Medical Diagnostic Kits Market, By Application

4.1 Application Outlook

4.2 Blood Glucose Testing

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Cardiometabolic Testing

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Infectious Disease Testing

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Fecal Occult Blood Testing

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

4.6 Pregnancy and Fertility Testing

4.6.1 Market Size, By Region, 2020-2026 (USD Billion)

4.7 Coagulation Testing

4.7.1 Market Size, By Region, 2020-2026 (USD Billion)

4.8 Lipid Profile Testing

4.8.1 Market Size, By Region, 2020-2026 (USD Billion)

4.9 Toxicology Testing

4.9.1 Market Size, By Region, 2020-2026 (USD Billion)

4.10 Other Applications

4.10.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Rapid Medical Diagnostic Kits Market, By Product

5.1 Product Outlook

5.2 Over the Counter (OTC) Kits

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Professional Kits

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Rapid Medical Diagnostic Kits Market, By End-User

6.1 Home Care

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Hospitals & Clinics

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Diagnostic Laboratories

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Rapid Medical Diagnostic Kits Market, By Technology

7.1 Lateral Flow

7.1.1 Market Size, By Region, 2020-2026 (USD Billion)

7.2 Solid Phase

7.2.1 Market Size, By Region, 2020-2026 (USD Billion)

7.3 Agglutination

7.3.1 Market Size, By Region, 2020-2026 (USD Billion)

7.4 Other Technologies

7.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 8 Rapid Medical Diagnostic Kits Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2020-2026 (USD Billion)

8.2.2 Market Size, By Application, 2020-2026 (USD Billion)

8.2.3 Market Size, By Product, 2020-2026 (USD Billion)

8.2.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.2.5 Market Size, By Technology, 2020-2026 (USD Billion)

8.2.6 U.S.

8.2.6.1 Market Size, By Application, 2020-2026 (USD Billion)

8.2.4.2 Market Size, By Product, 2020-2026 (USD Billion)

8.2.4.3 Market Size, By End-User, 2020-2026 (USD Billion)

Market Size, By Technology, 2020-2026 (USD Billion)

8.2.7 Canada

8.2.7.1 Market Size, By Application, 2020-2026 (USD Billion)

8.2.7.2 Market Size, By Product, 2020-2026 (USD Billion)

8.2.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.2.7.4 Market Size, By Technology, 2020-2026 (USD Billion)

8.3 Europe

8.3.1 Market Size, By Country 2020-2026 (USD Billion)

8.3.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.3 Market Size, By Product, 2020-2026 (USD Billion)

8.3.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.5 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.6 Germany

8.3.6.1 Market Size, By Application, 2020-2026 (USD Billion)

8.3.6.2 Market Size, By Product, 2020-2026 (USD Billion)

8.3.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.6.4 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.7 UK

8.3.7.1 Market Size, By Application, 2020-2026 (USD Billion)

8.3.7.2 Market Size, By Product, 2020-2026 (USD Billion)

8.3.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.7.4 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.8 France

8.3.8.1 Market Size, By Application, 2020-2026 (USD Billion)

8.3.8.2 Market Size, By Product, 2020-2026 (USD Billion)

8.3.8.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.8.4 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.9 Italy

8.3.9.1 Market Size, By Application, 2020-2026 (USD Billion)

8.3.9.2 Market Size, By Product, 2020-2026 (USD Billion)

8.3.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.9.4 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.10 Spain

8.3.10.1 Market Size, By Application, 2020-2026 (USD Billion)

8.3.10.2 Market Size, By Product, 2020-2026 (USD Billion)

8.3.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.10.4 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.11 Russia

8.3.11.1 Market Size, By Application, 2020-2026 (USD Billion)

8.3.11.2 Market Size, By Product, 2020-2026 (USD Billion)

8.3.11.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.11.4 Market Size, By Technology, 2020-2026 (USD Billion)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2020-2026 (USD Billion)

8.4.2 Market Size, By Application, 2020-2026 (USD Billion)

8.4.3 Market Size, By Product, 2020-2026 (USD Billion)

8.4.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.5 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.6 China

8.4.6.1 Market Size, By Application, 2020-2026 (USD Billion)

8.4.6.2 Market Size, By Product, 2020-2026 (USD Billion)

8.4.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.6.4 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.7 India

8.4.7.1 Market Size, By Application, 2020-2026 (USD Billion)

8.4.7.2 Market Size, By Product, 2020-2026 (USD Billion)

8.4.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.7.4 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.8 Japan

8.4.8.1 Market Size, By Application, 2020-2026 (USD Billion)

8.4.8.2 Market Size, By Product, 2020-2026 (USD Billion)

8.4.8.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.8.4 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.9 Australia

8.4.9.1 Market Size, By Application, 2020-2026 (USD Billion)

8.4.9.2 Market size, By Product, 2020-2026 (USD Billion)

8.4.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.9.4 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.10 South Korea

8.4.10.1 Market Size, By Application, 2020-2026 (USD Billion)

8.4.10.2 Market Size, By Product, 2020-2026 (USD Billion)

8.4.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.10.4 Market Size, By Technology, 2020-2026 (USD Billion)

8.5 Latin America

8.5.1 Market Size, By Country 2020-2026 (USD Billion)

8.5.2 Market Size, By Application, 2020-2026 (USD Billion)

8.5.3 Market Size, By Product, 2020-2026 (USD Billion)

8.5.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.5 Market Size, By Technology, 2020-2026 (USD Billion)

8.5.6 Brazil

8.5.6.1 Market Size, By Application, 2020-2026 (USD Billion)

8.5.6.2 Market Size, By Product, 2020-2026 (USD Billion)

8.5.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.6.4 Market Size, By Technology, 2020-2026 (USD Billion)

8.5.7 Mexico

8.5.7.1 Market Size, By Application, 2020-2026 (USD Billion)

8.5.7.2 Market Size, By Product, 2020-2026 (USD Billion)

8.5.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.7.4 Market Size, By Technology, 2020-2026 (USD Billion)

8.5.8 Argentina

8.5.8.1 Market Size, By Application, 2020-2026 (USD Billion)

8.5.8.2 Market Size, By Product, 2020-2026 (USD Billion)

8.5.8.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.8.4 Market Size, By Technology, 2020-2026 (USD Billion)

8.6 MEA

8.6.1 Market Size, By Country 2020-2026 (USD Billion)

8.6.2 Market Size, By Application, 2020-2026 (USD Billion)

8.6.3 Market Size, By Product, 2020-2026 (USD Billion)

8.6.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.5 Market Size, By Technology, 2020-2026 (USD Billion)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Application, 2020-2026 (USD Billion)

8.6.6.2 Market Size, By Product, 2020-2026 (USD Billion)

8.6.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.6.4 Market Size, By Technology, 2020-2026 (USD Billion)

8.6.7 UAE

8.6.7.1 Market Size, By Application, 2020-2026 (USD Billion)

8.6.7.2 Market Size, By Product, 2020-2026 (USD Billion)

8.6.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.7.4 Market Size, By Technology, 2020-2026 (USD Billion)

8.6.8 South Africa

8.6.8.1 Market Size, By Application, 2020-2026 (USD Billion)

8.6.8.2 Market Size, By Product, 2020-2026 (USD Billion)

8.6.8.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.8.4 Market Size, By Technology , 2020-2026 (USD Billion)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Abbott Laboratories

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 ACON Laboratories, Inc

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Alfa Scientific Designs, Inc

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Artron Laboratories Inc

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Dickinson and Company

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Becton

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 BTNX

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Bio-Rad Laboratories, Inc.

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Cardinal Health

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Creative Diagnostics

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

9.12 Danaher Corporation

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info Graphic Analysis

9.13 Other Companies

9.13.1 Company Overview

9.13.2 Financial Analysis

9.13.3 Strategic Positioning

9.13.4 Info Graphic Analysis

9.14 VisiLean

9.14.1 Company Overview

9.14.2 Financial Analysis

9.14.3 Strategic Positioning

9.14.4 Info Graphic Analysis

The Global Rapid Medical Diagnostic Kits Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Rapid Medical Diagnostic Kits Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS