Global Sensor Market Size, Trends & Analysis - Forecasts to 2026 By Type (Radar Sensor, Optical Sensor, Biosensor, Touch Sensor, Image Sensor, Pressure Sensor, Temperature Sensor, Proximity & Displacement Sensor, Level Sensor, Motion & Position Sensor, Humidity Sensor, Accelerometer & Speed Sensor, Others), By Technology (CMOS, MEMS, NEMS, Others) By End-User (Electronics, IT & Telecom, Industrial, Automotive, Aerospace & Defense, Healthcare, Others), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

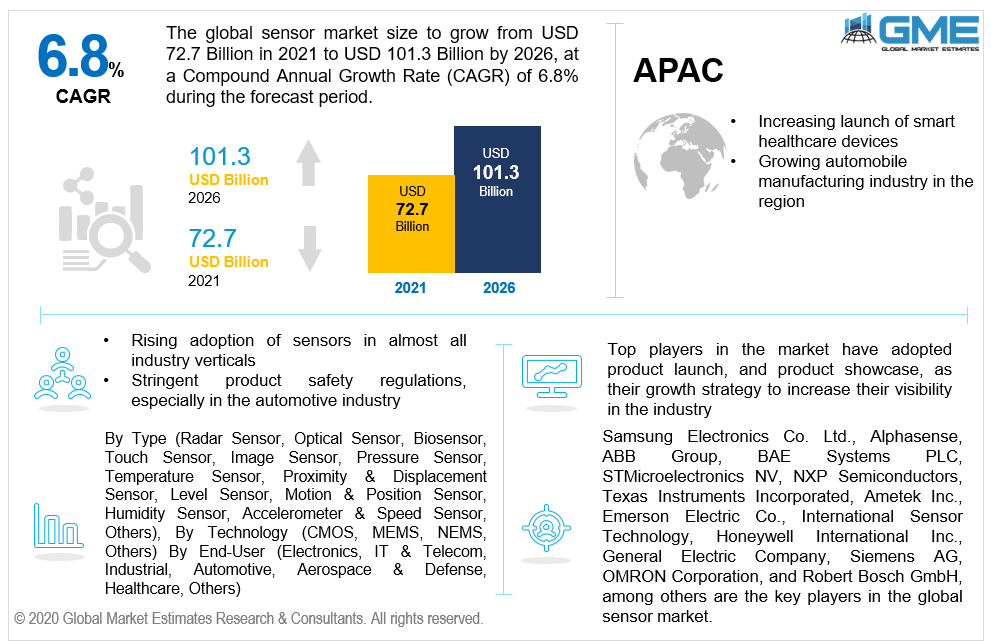

The global sensor market size is projected to grow from USD 72.7 billion in 2021 to USD 101.3 billion by 2026 at a CAGR value of 6.8% during the forecast period. The global sensor market is driven by the growing adoption of sensors in various industries like consumer electronics, healthcare devices, automobile devices, and IT & telecom. Technological advancements have made sensors cheaper, reduced power consumption, and made them smaller. This has increased the applicability of sensors in various industries.

The global sensor market forecast paints a positive picture for the sensor vendors as industries are beginning to recover from the impact of COVID-19. The global sensor market 2020 was impacted severely by COVID-19 as various manufacturing industries like the automotive industry and the smartphone industry had to suspend production. This led to delay in new product launches, disruption in raw materials procurement, and manufacturing which eventually had a negative impact on the growth of the global sensor market. Sensors enable external disturbances to be converted into electrical signals that can be read by electronic devices so that the necessary measures can be taken in response to the external stimuli.

With the advent of MEMs technology, sensors have become smaller and relatively cheaper which has significantly increased the applications of sensors across various industry verticals. The increased applications saw MEMs-based sensors being used in the healthcare industry, consumer electronics, weather forecast systems, automobile industry, and manufacturing sectors, among other applications. The demand for control and measure devices in the manufacturing industry as industries look to automatize production has had a positive impact on the demand for sensors. The sensor global market share has been steadily increasing in the security and surveillance industry. Increased demand for automated security systems has increased the demand for sensors that detect motion, weight, and environmental changes.

Government regulations like the US Government’s mandate on consumer vehicles to be able to alert drivers if the tires of the vehicle have not been inflated to the required levels and the deployment of airbags have had a positive impact on the global sensor market. The global sensor market is restrained by the competitive pricing by competing vendors.

Technology like MEMs has made sensors cheaper which has allowed vendors to produce sensors at cheaper rates which reduces the revenue size of the global sensor market. The introduction of IoT has transformed the way connected devices interact with one another, integration of sensors to IoT networks will increase the applications of IoT.

Based on the different types of sensors available in the market, the sensor market can be fragmented into the image sensor, optical sensor, temperature sensor, light sensor, biosensor, radar sensor, touch sensor, pressure sensor, among other sensors type-based segments.

The image sensor grasped the lion’s share of the global sensor market during the forecast period. Image sensors play an important role in various industry verticals like the automobile industry, the security, and surveillance industry, and the healthcare industry, among other applications, have been the major driver of the image sensor segment. The automobile industry uses image sensors to create state-of-the-art systems that assist the driver. With sensors becoming cheaper, image sensors are becoming common even among low-end consumer vehicles with automobiles employing upwards of ten cameras.

The light sensor market is envisaged to log the fastest growth rate among all the segments. Light sensors have become common in smartphones and handheld devices in recent years. The increased adoption of light sensors in home security systems and the automobile industry are expected to increase the demand for image sensors during the forecast period.

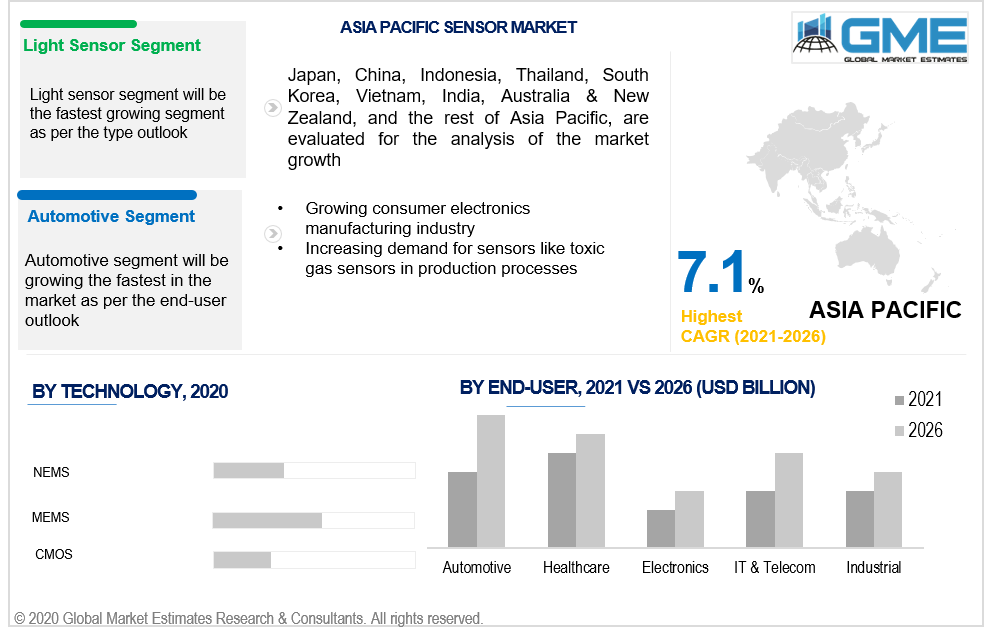

Based on the technology employed by the sensor, the global sensor market can be divided into NEMS, MEMS, CMOS, and others. The MEMs segment dominated the global sensor market based on technology. MEMs-based sensors are cheaper, reduce power consumption, and are significantly smaller than conventional sensors making them ideal for the consumer electronics industry. The growth of the consumer electronics industry has contributed to the monopoly of the MEMs segment.

With the increased applicability of sensors in recent years, the global sensor market can be split into healthcare, automotive, IT & telecom, industrial, electronics, aerospace & defense, and others. The healthcare segment held the largest share of the market due to the growing number of medical device manufacturers introducing smart medical devices. The automotive industry is envisaged to grow at significantly faster rates than the other segments. The growing application of image sensors and other sensors in automobiles by manufacturers to meet growing safety standards has been the major driver of the automotive segment.

Based on the geographical variations in the global sensor market, the market can be split into regions like North America, South American, Europe, Middle East & Africa, and Asia Pacific. The sensor market share was the highest for the North American region. The region has stringent regulations on safety standards for products which have had a hand in the growing applications of sensors in products, especially in the automotive industry. Along with product safety, the region has stringent workplace safety regulations. Workplace safety regulations have contributed to the large dominance of senors for production processes.

The APAC region is envisaged to grow significantly faster than the other regions during the forecast period. The growing automotive manufacturing industry in China, India, and Korea has been a major driver of the market in this region. The growing number of healthcare devices manufacturing vendors in the region and increased application of sensors in the manufacturing process have also contributed to the growth of the sensor market in the APAC region.

Samsung Electronics Co. Ltd., Alphasense, ABB Group, BAE Systems PLC, STMicroelectronics NV, NXP Semiconductors, Texas Instruments Incorporated, Ametek Inc., Emerson Electric Co., International Sensor Technology, Honeywell International Inc., General Electric Company, Siemens AG, OMRON Corporation, and Robert Bosch GmbH, among others are the key players in the global sensor market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Sensor Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Technology Overview

2.1.4 End-User Overview

2.1.6 Regional Overview

Chapter 3 Sensor Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing adoption of sensors in various industry verticals

3.3.2 Industry Challenges

3.3.2.1 Cheaper sensors have led to competitive pricing issue among vendors

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Technology Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Sensor Market, By Type

4.1 Type Outlook

4.2 Radar Sensor

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Optical Sensor

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Biosensor

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Touch Sensor

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

4.6 Image Sensor

4.6.1 Market Size, By Region, 2020-2026 (USD Billion)

4.7 Pressure Sensor

4.7.1 Market Size, By Region, 2020-2026 (USD Billion)

4.8 Temperature Sensor

4.8.1 Market Size, By Region, 2020-2026 (USD Billion)

4.9 Proximity & Displacement Sensor

4.9.1 Market Size, By Region, 2020-2026 (USD Billion)

4.10 Level Sensor

4.10.1 Market Size, By Region, 2020-2026 (USD Billion)

4.11 Motion & Position Sensor

4.11.1 Market Size, By Region, 2020-2026 (USD Billion)

4.12 Humidity Sensor

4.12.1 Market Size, By Region, 2020-2026 (USD Billion)

4.13 Accelerometer & Speed Sensor

4.13.1 Market Size, By Region, 2020-2026 (USD Billion)

4.14 Others

4.14.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Sensor Market, By Technology

5.1 Technology Outlook

5.2 CMOS

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 MEMS

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 NEMS

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Others

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Sensor Market, By End-User

6.1 Electronics

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 IT & Telecom

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Industrial

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Automotive

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

6.5 Aerospace & Defense

6.5.1 Market Size, By Region, 2020-2026 (USD Billion)

6.6 Healthcare

6.5.1 Market Size, By Region, 2020-2026 (USD Billion)

6.7 Other

6.7.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Sensor Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Type, 2020-2026 (USD Billion)

7.2.3 Market Size, By Technology, 2020-2026 (USD Billion)

7.2.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Size, By Type, 2020-2026 (USD Billion)

7.2.5.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.2.5.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.2.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.2.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Type, 2020-2026 (USD Billion)

7.3.3 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.5 Germany

7.3.5.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.5.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.5.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.6 UK

7.3.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.7 France

7.3.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.8 Rest of Europe

7.3.8.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.8.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.8.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Type, 2020-2026 (USD Billion)

7.4.3 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.5 China

7.4.5.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.5.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.5.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.6 India

7.4.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.8.2 Market size, By Technology, 2020-2026 (USD Billion)

7.4.8.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Type, 2020-2026 (USD Billion)

7.5.3 Market Size, By Technology, 2020-2026 (USD Billion)

7.5.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Size, By Type, 2020-2026 (USD Billion)

7.5.5.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.5.5.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.6 Mexico

7.5.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.7 Argentina

7.5.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Type, 2020-2026 (USD Billion)

7.6.3 Market Size, By Technology, 2020-2026 (USD Billion)

7.6.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Type, 2020-2026 (USD Billion)

7.6.5.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.6.5.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.6 UAE

7.6.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.7 South Africa

7.6.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Samsung Electronics Co. Ltd.

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Alphasense

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 ABB Group

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 BAE Systems PLC

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 STMicroelectronics NV

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 NXP Semiconductors

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Texas Instruments Incorporated

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Ametek Inc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Emerson Electric Co.

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Sensor Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Sensor Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS