Global Single-use Bioprocessing Bags Market Size, Trends & Analysis - Forecasts to 2028 By Type (2D, 3D), By Application (Cell Culture, Media Storage, Bioreactor, Harvest And Clarification, Others), By Bioprocessing Stage (Upstream Processing And Downstream Processing), By End User (Biopharmaceutical Companies, Contract Manufacturing Organizations (CMOs), Academic Institutes & Research Laboratories), By Region (North America, Asia Pacific, Central & South America, Europe, the Middle East & Africa), End-User Landscape Analysis, Company Market Share Analysis, and Competitor Analysis

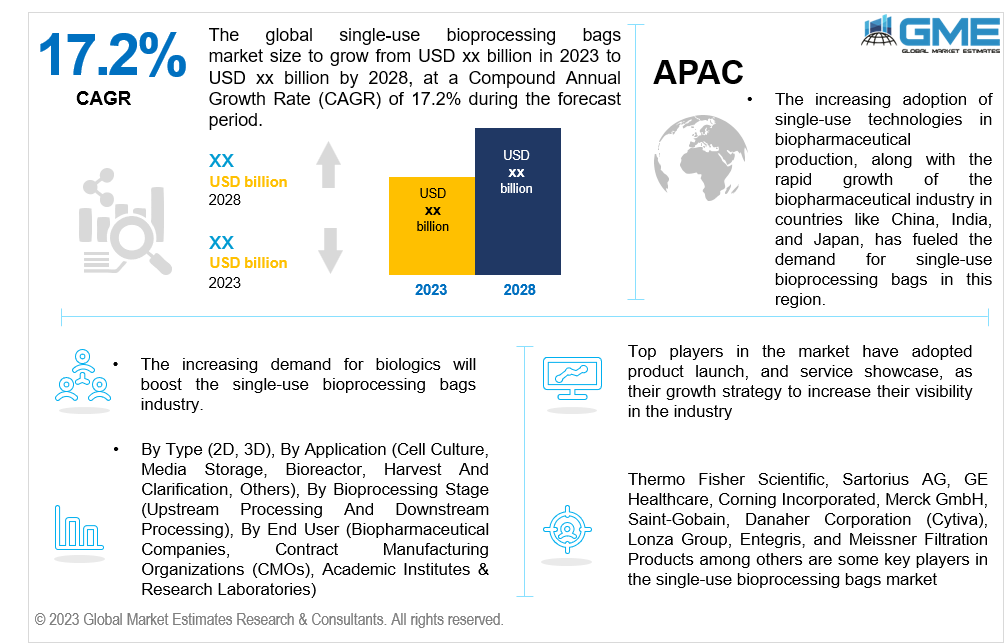

The global single-use bioprocessing bags market size is projected to grow at a CAGR of 17.2% from 2023 to 2028.The key driving forces propelling the market's expansion are the recognition of disposable bags as a commercially viable solution to accelerate end-to-end bioprocessing steps coupled with rising investment in biopharmaceutical production.

The global single-use bags market has experienced significant growth in recent years, primarily due to the widespread adoption of disposable bioprocessing equipment in the biologics manufacturing sector. These innovative solutions have proven to be highly advantageous, offering reduced contamination risks and cost savings for manufacturers.

In comparison to single-use bags, the utilization of stainless-steel containers in traditional production methods tends to be costly, requiring extensive maintenance for reusability. This results in substantial operational expenses over an extended period. The advent of single-use bags has brought about a significant transformation in biomanufacturing processes within biopharmaceutical facilities. It presents immense potential for enhancing cost efficiency by streamlining and tailoring various aspects of bioprocessing technology, consequently reducing the cost of goods.

Furthermore, strategic partnerships with reputable component suppliers enable biopharmaceutical producers to select processing materials that minimize extractable and leachable, ensuring compliance with industry standards and enhancing their overall confidence in product quality. Thus, the above-articulated factors are anticipated to significantly boost the adoption as well as revenue in single-use bioprocessing bags.

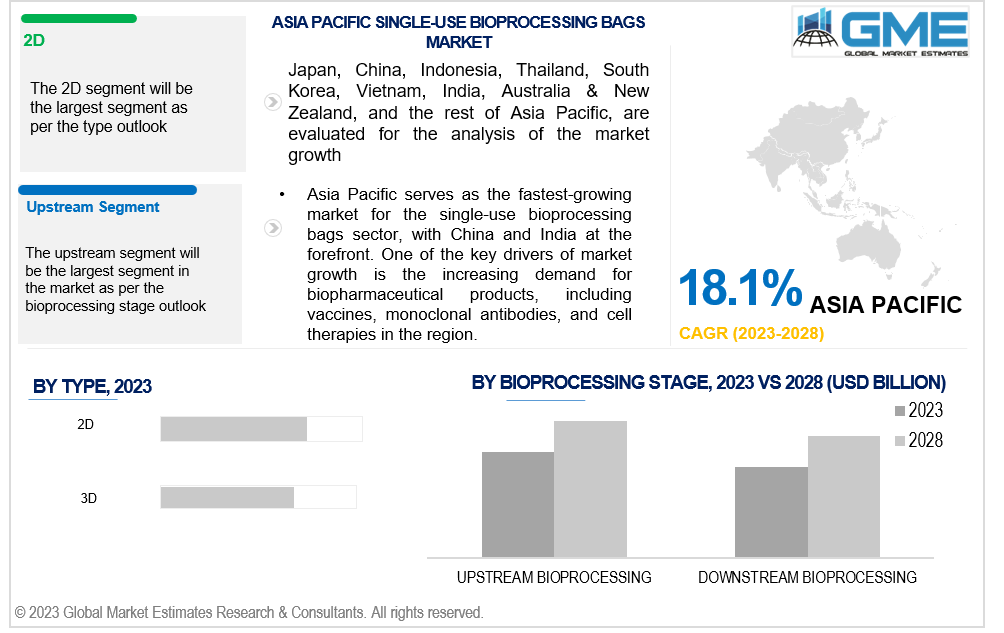

The 2D bags segment accounted for a substantial revenue share in the 2022 market and is expected to maintain its dominance in the coming years owing to its high penetration in terms of availability and application areas. These bags are frequently used for storage, mixing, and transportation operations and are typically flat with two-dimensional designs. Their popularity in diverse bioprocessing processes can be attributed to their straightforward design and ease of usage.

Several market players are actively engaged in the manufacturing and commercialization of both 2D and 3D bags. These companies undertaking constant effort on innovation and product development to improve the performance and functionality of their solutions. In addition, collaborations with biopharmaceutical companies and research institutions are helping these players expand their market presence and cater to the evolving needs of the industry.

Single-use bioprocessing bags are being used more frequently in bioreactors of all sizes. These bags' versatility in size allows for the effective mixing and aeration of the cell culture. They increase efficiency in bioprocess manufacturing by providing advantages such as simple installation, fewer cleaning and validation requirements, and quicker turnaround times between batches.

Furthermore, single-use bioprocessing bags are frequently used in cell culture applications to cultivate cells, tissues, and microbes in a controlled environment. These bags are ideal for biopharmaceutical and biotechnology research and manufacturing processes due to their benefits like flexibility, scalability, and lower risk of contamination.

Another essential application for disposable bags is media storage. these bags facilitate safe and sterile storage of cell culture media, such as growth factors, nutrition, and supplements, available. Single-use bags can replace typical glass or plastic storage containers, lowering the danger of cross-contamination and increasing the effectiveness of media preparation and handling.

With maximum usage in the upstream processing, single-use bags captured the maximum revenue share in this bioprocessing stage in the 2022 single-use bioprocessing bags market. Disposable bags are essential for creating a sterile and regulated environment for cell growth and production throughout the upstream bioprocessing stage, which includes cell culture and fermentation.

Furthermore, companies like Thermo Fisher Scientific, Sartorius AG, and GE Healthcare are offering a wide variety of disposable bags with various capacities and configurations to achieve effective and scalable upstream bioprocessing processes, thereby driving segment growth throughout the forecast period.

Although single-use solutions have been adopted across the entire bioprocess chain, their application in downstream processes is surrounded by various challenges. This has resulted in a less revenue share of this segment. Nonetheless, single-use bags offer several advantages in terms of filtering systems, buffer preparation systems, sampling & dispensing systems, and other downstream processing stages.

Single-use mixers can boost a downstream processing suite's throughput when used in conjunction with single-use bioprocess bags since they eliminate the need for resource-intensive cleaning processes like CIP and SIP. These factors are anticipated to significantly driver the segment growth during the forecast period. Key market participants including Pall Corporation, Merck KGaA, and Entegris provide a wide selection of single-use bags that have been tailored for applications in downstream bioprocessing.

In 2022, the biopharmaceutical companies end-use segment accounted for over 55% of revenue share in the global market. Biopharmaceutical companies have emerged as the largest end-user of the market owing to their capabilities to supplant a major portion of their stainless-steel -based manufacturing facilities with single-use technologies.

Implementation of disposable solutions to produce biologic drugs helps lower the risk of contamination, shorten scheduling times, improve operational effectiveness, and spend less on capital expenses, including consumables and fixed costs. These factors are driving the adoption of products by biopharmaceutical companies, resulting in the dominance of this segment.

Contract manufacturing organizations (CMOs) are emerging as a lucrative source of revenue generation owing to the growing popularity and acceptability of contract services by biomanufacturers. CMOs continue to maintain their competitiveness by producing biologics more effectively and affordably, especially for R&D and clinical trials. In order to keep pace with the changing market dynamics, CMOs are investing heavily in switching from conventional bioprocess solutions to single-use bioprocess solutions.

A confluence of factors such as the concentration of biopharmaceutical manufacturing facilities, technological advancements, regulatory landscape, and the presence of contract manufacturers play a vital role in shaping the market at the regional and global levels.

North America, with the U.S. at the forefront, is dominating the global market, primarily due to the presence of well-established biopharmaceutical companies, robust healthcare infrastructure, and favorable regulatory frameworks. Owing to the commercial advantages in terms of flexibility, cost-effectiveness, and reduced risk of cross-contamination offered by single-use solutions, this region has witnessed maximum adoption of single-use bioprocessing bags.

Moreover, the U.S.-based key market participants continue to undertake various measures to reinforce their market presence in the region. For instance, in August 2022, Thermo Fisher Scientific Inc. announced to open of its largest single-use technology manufacturing plant in Greater Nashville, U.S. to expand its bioprocessing production capabilities.

On the other hand, the market is witnessing lucrative growth in the Asia Pacific region, driven by rising biopharmaceutical manufacturing investment, rising contract manufacturing activities, and a booming biotechnology industry. Moreover, the production of biologics is expanding significantly in countries like China, India, and South Korea, which is fueling the demand for single-use bioprocessing bags. The rise of the industry is being aided by the region's increasing emphasis on the construction of healthcare facilities, rising disposable incomes, and beneficial government programs.

The global single-use bioprocessing bag market is a highly competitive market with a substantial number of market players contending for market dominance in the space. Thermo Fisher Scientific and Sartorius AG are recognized as the two major players in the market owing to their substantial market presence, customer-centric solutions, and wide selection of products.

Other players include GE Healthcare, Corning Incorporated, Merck GmbH, Saint-Gobain, Danaher Corporation (Cytiva), Lonza Group, Entegris, and Meissner Filtration Products among others, are some key players in the Single-use Bioprocessing Bags market.

Please note: This is not an exhaustive list of companies profiled in the report.

Furthermore, emerging players continue to expand their product offerings to boost their market presence in the future market. For instance, in March 2022, ILC Dover LP announced the launch of liquid single-use bioprocessing bags which is the first of many innovative solutions for handling and supplying sterile liquids for the biopharmaceutical industry. With this initiative, the company aimed at gaining a competitive edge in the market.

Similarly, in October 2022, Austria-based Single Use Support GmbH expanded its product portfolio through the launch of single-use bioprocess containers. This product was introduced under the brand name IRIS. Such initiatives by market players are anticipated to greatly benefit both companies as well as market growth in the coming years.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High-Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights Across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics on Feed Stocks

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL SINGLE-USE BIOPROCESSING BAGS MARKET, BY TYPE

4.2 Single-use Bioprocessing Bags Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 2D Market Estimates and Forecast, 2020-2028 (USD Million)

4.5.1 3D Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL SINGLE-USE BIOPROCESSING BAGS MARKET, BY APPLICATION

5.2 Single-use Bioprocessing Bags Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 Cell Culture Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.1 Media Storage Market Estimates and Forecast, 2020-2028 (USD Million)

5.6.1 Bioreactor Market Estimates and Forecast, 2020-2028 (USD Million)

5.7.1 Harvest And Clarification Market Estimates and Forecast, 2020-2028 (USD Million)

5.8.1 Other Applications Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL SINGLE-USE BIOPROCESSING BAGS MARKET, BY BIOPROCESSING STAGE

6.2 Single-use Bioprocessing Bags Market: Bioprocessing Stage Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4.1 Upstream Processing Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.1 Biostream Processing Market Estimates and Forecast, 2020-2028 (USD Million)

7 GLOBAL SINGLE-USE BIOPROCESSING BAGS MARKET, BY END USER

7.2 Single-use Bioprocessing Bags Market: End User Scope Key Takeaways

7.3 Revenue Growth Analysis, 2022 & 2028

7.4 Biopharmaceutical Companies

7.4.1 Biopharmaceutical Companies Market Estimates and Forecast, 2020-2028 (USD Million)

7.5 Contract Manufacturing Organizations

7.5.1 Contract Manufacturing Organizations Market Estimates and Forecast, 2020-2028 (USD Million)

7.6 Academic Institutes & Research Laboratories

8 GLOBAL SINGLE-USE BIOPROCESSING BAGS MARKET, BY REGION

8.2.5.1 U.S. Single-use Bioprocessing Bags Market Estimates and Forecast, 2020-2028 (USD Million)

8.2.5.1.3 By Bioprocessing Stage

8.2.5.2 Canada Single-use Bioprocessing Bags Market Estimates and Forecast, 2020-2028 (USD Million)

8.2.5.2.3 By Bioprocessing Stage

8.2.5.3 Mexico Single-use Bioprocessing Bags Market Estimates and Forecast, 2020-2028 (USD Million)

8.2.5.3.3 By Bioprocessing Stage

8.3 Europe Single-use Bioprocessing Bags Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.1 Germany Single-use Bioprocessing Bags Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.1.3 By Bioprocessing Stage

8.3.5.2 U.K. Presered Flowers Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.2.3 By Bioprocessing Stage

8.3.5.3 France Single-use Bioprocessing Bags Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.3.3 By Bioprocessing Stage

8.3.5.4 Italy Single-use Bioprocessing Bags Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.4.3 By Bioprocessing Stage

8.3.5.5 Spain Single-use Bioprocessing Bags Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.5.3 By Bioprocessing Stage

8.3.5.6.3 By Bioprocessing Stage

8.3.5.7.3 By Bioprocessing Stage

8.4.5.1 China Single-use Bioprocessing Bags Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.1.3 By Bioprocessing Stage

8.4.5.2 Japan Single-use Bioprocessing Bags Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.2.3 By Bioprocessing Stage

8.4.5.3 India Single-use Bioprocessing Bags Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.3.3 By Bioprocessing Stage

8.4.5.4.3 By Bioprocessing Stage

8.4.5.5.3 By Bioprocessing Stage

8.4.5.6.3 By Bioprocessing Stage

8.4.5.7.3 By Bioprocessing Stage

8.4.5.8.3 By Bioprocessing Stage

8.4.5.9 Vietnam Single-use Bioprocessing Bags Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.9.3 By Bioprocessing Stage

8.4.5.10 Taiwan Single-use Bioprocessing Bags Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.10.3 By Bioprocessing Stage

8.4.5.11.3 By Bioprocessing Stage

8.5.5.1.3 By Bioprocessing Stage

8.5.5.2 U.A.E. Single-use Bioprocessing Bags Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.5.1.3 By Bioprocessing Stage

8.5.5.3 Israel Single-use Bioprocessing Bags Market Estimates and Forecast, 2020-2028 (USD Million)

8.2.5.1.3 By Bioprocessing Stage

8.2.5.1.3 By Bioprocessing Stage

8.5.5.5.3 By Bioprocessing Stage

8.6.5.1 Brazil Single-use Bioprocessing Bags Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.5.1.3 By Bioprocessing Stage

8.6.5.2.3 By Bioprocessing Stage

8.6.5.3 Chile Single-use Bioprocessing Bags Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.5.3.3 By Bioprocessing Stage

8.2.5.4.3 By Bioprocessing Stage

9.1 Company Market Share Analysis

9.2 Four Quadrant Positioning Matrix

9.4.1 Thermo Fisher Scientific

9.4.1.1 Business Description & Financial Analysis

9.4.1.3 Products & Services Offered

9.4.1.4 Strategic Alliances between Business Partners

9.4.2.1 Business Description & Financial Analysis

9.4.2.3 Products & Services Offered

9.4.2.4 Strategic Alliances between Business Partners

9.4.3.1 Business Description & Financial Analysis

9.4.3.3 Products & Services Offered

9.4.3.4 Strategic Alliances between Business Partners

9.4.4.1 Business Description & Financial Analysis

9.4.4.3 Products & Services Offered

9.4.4.4 Strategic Alliances between Business Partners

9.4.5.1 Business Description & Financial Analysis

9.4.5.3 Products & Services Offered

9.4.5.4 Strategic Alliances between Business Partners

9.4.6.1 Business Description & Financial Analysis

9.4.6.3 Products & Services Offered

9.4.6.4 Strategic Alliances between Business Partners

9.4.7 Danaher Corporation (Cytiva)

9.4.7.1 Business Description & Financial Analysis

9.4.7.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.8.1 Business Description & Financial Analysis

9.4.8.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.9.1 Business Description & Financial Analysis

9.4.9.3 Products & Services Offered

9.4.9.4 Strategic Alliances between Business Partners

9.4.10 Meissner Filtration Products

9.4.10.1 Business Description & Financial Analysis

9.4.10.3 Products & Services Offered

9.4.10.4 Strategic Alliances between Business Partners

9.4.11.1 Business Description & Financial Analysis

9.4.11.3 Products & Services Offered

9.4.11.4 Strategic Alliances between Business Partners

10.1.2 Market Scope & SegOrchidtation

10.2 Information ProcureOrchidt

10.2.1.2 GMEs Internal Data Repository

10.2.1.3 Secondary Resources & Third Party Perspectives

10.2.1.4 Company Information Sources

10.2.2.1 Various APPLICATION of Respondents for Primary Interviews

10.2.2.2 Number of Interviews Conducted throughout the Research Process

10.2.2.4 Discussion Guide for Primary Participants

10.2.3.1 Expert Panels Across 30+ Industry

10.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

10.3.1.1 Macro-Economic Indicators Considered

10.3.1.2 Micro-Economic Indicators Considered

10.3.2.1 Company Share Analysis Approach

10.3.2.2 Estimation of Potential Product Sales

10.4.2 Time Series, Cross Sectional & Panel Data Analysis

10.5.1 Inhouse AI Based Real Time Analytics Tool

10.5.2 Output From Desk & Primary Research

10.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global Single-use Bioprocessing Bags Market, By Type, 2020-2028 (USD Mllion)

2 2D Market, By Region, 2020-2028 (USD Mllion)

3 3D Market, By Region, 2020-2028 (USD Mllion)

4 Global Single-use Bioprocessing Bags Market, By Application, 2020-2028 (USD Mllion)

5 Cell Culture Market, By Region, 2020-2028 (USD Mllion)

6 Media Storage Market, By Region, 2020-2028 (USD Mllion)

7 Bioreactor Market, By Region, 2020-2028 (USD Mllion)

8 Harvest And Clarification Market, By Region, 2020-2028 (USD Mllion)

9 Other Applications Market, By Region, 2020-2028 (USD Mllion)

10 Global Single-use Bioprocessing Bags Market, By Bioprocessing Stage, 2020-2028 (USD Mllion)

11 Upstream Processing Market, By Region, 2020-2028 (USD Mllion)

12 Biostream Processing Market, By Region, 2020-2028 (USD Mllion)

13 Global Single-use Bioprocessing Bags Market, By END USER, 2020-2028 (USD Mllion)

14 Biopharmaceutical Companies Market, By Region, 2020-2028 (USD Mllion)

15 Contract Manufacturing Organizations Market, By Region, 2020-2028 (USD Mllion)

16 Academic Institutes & Research Laboratories Market, By Region, 2020-2028 (USD Mllion)

17 Regional Analysis, 2020-2028 (USD Mllion)

18 North America Single-use Bioprocessing Bags Market, By TYPE, 2020-2028 (USD Million)

19 North America Single-use Bioprocessing Bags Market, By Application, 2020-2028 (USD Million)

20 North America Single-use Bioprocessing Bags Market, By Bioprocessing Stage, 2020-2028 (USD Million)

21 North America Single-use Bioprocessing Bags Market, By End user, 2020-2028 (USD Million)

22 North America Single-use Bioprocessing Bags Market, By Country, 2020-2028 (USD Million)

23 U.S Single-use Bioprocessing Bags Market, By TYPE, 2020-2028 (USD Million)

24 U.S Single-use Bioprocessing Bags Market, By APPLICATION, 2020-2028 (USD Million)

25 U.S Single-use Bioprocessing Bags Market, By Bioprocessing Stage, 2020-2028 (USD Million)

26 U.S Single-use Bioprocessing Bags Market, By END USER, 2020-2028 (USD Million)

27 Canada Single-use Bioprocessing Bags Market, By TYPE, 2020-2028 (USD Million)

28 Canada Single-use Bioprocessing Bags Market, By APPLICATION, 2020-2028 (USD Million)

29 Canada Single-use Bioprocessing Bags Market, By Bioprocessing Stage, 2020-2028 (USD Million)

30 CANADA Single-use Bioprocessing Bags Market, By END USER, 2020-2028 (USD Million)

31 Mexico Single-use Bioprocessing Bags Market, By TYPE, 2020-2028 (USD Million)

32 Mexico Single-use Bioprocessing Bags Market, By APPLICATION, 2020-2028 (USD Million)

33 Mexico Single-use Bioprocessing Bags Market, By Bioprocessing Stage, 2020-2028 (USD Million)

34 mexico Single-use Bioprocessing Bags Market, By END USER, 2020-2028 (USD Million)

35 Europe Single-use Bioprocessing Bags Market, By TYPE, 2020-2028 (USD Million)

36 Europe Single-use Bioprocessing Bags Market, By APPLICATION, 2020-2028 (USD Million)

37 Europe Single-use Bioprocessing Bags Market, By Bioprocessing Stage, 2020-2028 (USD Million)

38 Europe Single-use Bioprocessing Bags Market, By END USER, 2020-2028 (USD Million)

39 Germany Single-use Bioprocessing Bags Market, By TYPE, 2020-2028 (USD Million)

40 Germany Single-use Bioprocessing Bags Market, By APPLICATION, 2020-2028 (USD Million)

41 Germany Single-use Bioprocessing Bags Market, By Bioprocessing Stage, 2020-2028 (USD Million)

42 germany Single-use Bioprocessing Bags Market, By END USER, 2020-2028 (USD Million)

43 UK Single-use Bioprocessing Bags Market, By TYPE, 2020-2028 (USD Million)

44 UK Single-use Bioprocessing Bags Market, By APPLICATION, 2020-2028 (USD Million)

45 UK Single-use Bioprocessing Bags Market, By Bioprocessing Stage, 2020-2028 (USD Million)

46 U.kSingle-use Bioprocessing Bags Market, By END USER, 2020-2028 (USD Million)

47 France Single-use Bioprocessing Bags Market, By TYPE, 2020-2028 (USD Million)

48 France Single-use Bioprocessing Bags Market, By APPLICATION, 2020-2028 (USD Million)

49 France Single-use Bioprocessing Bags Market, By Bioprocessing Stage, 2020-2028 (USD Million)

50 France Single-use Bioprocessing Bags Market, By END USER, 2020-2028 (USD Million)

51 Italy Single-use Bioprocessing Bags Market, By TYPE, 2020-2028 (USD Million)

52 Italy Single-use Bioprocessing Bags Market, By APPLICATION Type, 2020-2028 (USD Million)

53 Italy Single-use Bioprocessing Bags Market, By Bioprocessing Stage, 2020-2028 (USD Million)

54 Italy Single-use Bioprocessing Bags Market, By END USER, 2020-2028 (USD Million)

55 Spain Single-use Bioprocessing Bags Market, By TYPE, 2020-2028 (USD Million)

56 Spain Single-use Bioprocessing Bags Market, By APPLICATION, 2020-2028 (USD Million)

57 Spain Single-use Bioprocessing Bags Market, By Bioprocessing Stage, 2020-2028 (USD Million)

58 Spain Single-use Bioprocessing Bags Market, By END USER, 2020-2028 (USD Million)

59 Rest Of Europe Single-use Bioprocessing Bags Market, By TYPE, 2020-2028 (USD Million)

60 Rest Of Europe Single-use Bioprocessing Bags Market, By APPLICATION, 2020-2028 (USD Million)

61 Rest of Europe Single-use Bioprocessing Bags Market, By Bioprocessing Stage, 2020-2028 (USD Million)

62 REST OF EUROPE Single-use Bioprocessing Bags Market, By END USER, 2020-2028 (USD Million)

63 Asia Pacific Single-use Bioprocessing Bags Market, By TYPE, 2020-2028 (USD Million)

64 Asia Pacific Single-use Bioprocessing Bags Market, By APPLICATION, 2020-2028 (USD Million)

65 Asia Pacific Single-use Bioprocessing Bags Market, By Bioprocessing Stage, 2020-2028 (USD Million)

66 Asia Single-use Bioprocessing Bags Market, By END USER, 2020-2028 (USD Million)

67 Asia Pacific Single-use Bioprocessing Bags Market, By Country, 2020-2028 (USD Million)

68 China Single-use Bioprocessing Bags Market, By TYPE, 2020-2028 (USD Million)

69 China Single-use Bioprocessing Bags Market, By APPLICATION, 2020-2028 (USD Million)

70 China Single-use Bioprocessing Bags Market, By Bioprocessing Stage, 2020-2028 (USD Million)

71 China Single-use Bioprocessing Bags Market, By END USER, 2020-2028 (USD Million)

72 India Single-use Bioprocessing Bags Market, By TYPE, 2020-2028 (USD Million)

73 India Single-use Bioprocessing Bags Market, By APPLICATION, 2020-2028 (USD Million)

74 India Single-use Bioprocessing Bags Market, By Bioprocessing Stage, 2020-2028 (USD Million)

75 India Single-use Bioprocessing Bags Market, By END USER, 2020-2028 (USD Million)

76 Japan Single-use Bioprocessing Bags Market, By TYPE, 2020-2028 (USD Million)

77 Japan Single-use Bioprocessing Bags Market, By APPLICATION, 2020-2028 (USD Million)

78 Japan Single-use Bioprocessing Bags Market, By Bioprocessing Stage, 2020-2028 (USD Million)

79 japan Single-use Bioprocessing Bags Market, By END USER, 2020-2028 (USD Million)

80 South Korea Single-use Bioprocessing Bags Market, By TYPE, 2020-2028 (USD Million)

81 South Korea Single-use Bioprocessing Bags Market, By APPLICATION, 2020-2028 (USD Million)

82 South Korea Single-use Bioprocessing Bags Market, By Bioprocessing Stage, 2020-2028 (USD Million)

83 South korea Single-use Bioprocessing Bags Market, By END USER, 2020-2028 (USD Million)

84 Middle East & Africa Single-use Bioprocessing Bags Market, By TYPE, 2020-2028 (USD Million)

85 Middle East & Africa Single-use Bioprocessing Bags Market, By APPLICATION, 2020-2028 (USD Million)

86 Middle East & Africa Single-use Bioprocessing Bags Market, By Bioprocessing Stage, 2020-2028 (USD Million)

87 MIDDLE EAST & AFRICA Single-use Bioprocessing Bags Market, By END USER, 2020-2028 (USD Million)

88 Middle East & Africa Single-use Bioprocessing Bags Market, By Country, 2020-2028 (USD Million)

89 Saudi Arabia Single-use Bioprocessing Bags Market, By TYPE, 2020-2028 (USD Million)

90 Saudi Arabia Single-use Bioprocessing Bags Market, By APPLICATION, 2020-2028 (USD Million)

91 Saudi Arabia Single-use Bioprocessing Bags Market, By Bioprocessing Stage, 2020-2028 (USD Million)

92 Saudi arabia Single-use Bioprocessing Bags Market, By END USER, 2020-2028 (USD Million)

93 UAE Single-use Bioprocessing Bags Market, By TYPE, 2020-2028 (USD Million)

94 UAE Single-use Bioprocessing Bags Market, By APPLICATION, 2020-2028 (USD Million)

95 UAE Single-use Bioprocessing Bags Market, By Bioprocessing Stage, 2020-2028 (USD Million)

96 UAE Single-use Bioprocessing Bags Market, By END USER, 2020-2028 (USD Million)

97 Central & South America Single-use Bioprocessing Bags Market, By TYPE, 2020-2028 (USD Million)

98 Central & South America Single-use Bioprocessing Bags Market, By APPLICATION, 2020-2028 (USD Million)

99 Central & South America Single-use Bioprocessing Bags Market, By Bioprocessing Stage, 2020-2028 (USD Million)

100 CENTRAL & SOUTH AMERICA Single-use Bioprocessing Bags Market, By END USER, 2020-2028 (USD Million)

101 Central & South America Single-use Bioprocessing Bags Market, By Country, 2020-2028 (USD Million)

102 Brazil Single-use Bioprocessing Bags Market, By TYPE, 2020-2028 (USD Million)

103 Brazil Single-use Bioprocessing Bags Market, By APPLICATION, 2020-2028 (USD Million)

104 Brazil Single-use Bioprocessing Bags Market, By Bioprocessing Stage, 2020-2028 (USD Million)

105 Brazil Single-use Bioprocessing Bags Market, By END USER, 2020-2028 (USD Million)

106 Thermo Fisher Scientific: Products & Services Offering

107 Sartorius AG: Products & Services Offering

108 GE Healthcare: Products & Services Offering

109 Corning Incorporated: Products & Services Offering

110 Merck GmbH: Products & Services Offering

111 Saint-Gobain: Products & Services Offering

112 Danaher Corporation (Cytiva): Products & Services Offering

113 Lonza Group: Products & Services Offering

114 Entegris: Products & Services Offering

115 Meissner Filtration Products: Products & Services Offering

116 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Single-use Bioprocessing Bags Market Overview

2 Global Single-use Bioprocessing Bags Market Value From 2020-2028 (USD Mllion)

3 Global Single-use Bioprocessing Bags Market Share, By Type (2022)

4 Global Single-use Bioprocessing Bags Market Share, By Application (2022)

5 Global Single-use Bioprocessing Bags Market Share, By Bioprocessing Stage (2022)

6 Global Single-use Bioprocessing Bags Market Share, By End User (2022)

7 Global Single-use Bioprocessing Bags Market, By Region (Asia Pacific Market)

8 Technological Trends In Global Single-use Bioprocessing Bags Market

9 Four Quadrant Competitor Positioning Matrix

10 Impact Of Macro & Micro Indicators On The Market

11 Impact Of Key Drivers On The Global Single-use Bioprocessing Bags Market

12 Impact Of Challenges On The Global Single-use Bioprocessing Bags Market

13 Porter’s Five Forces Analysis

14 Global Single-use Bioprocessing Bags Market: By Type Scope Key Takeaways

15 Global Single-use Bioprocessing Bags Market, By Type Segment: Revenue Growth Analysis

16 2D Market, By Region, 2020-2028 (USD Mllion)

17 3D Market, By Region, 2020-2028 (USD Mllion)

18 Global Single-use Bioprocessing Bags Market: By Application Scope Key Takeaways

19 Global Single-use Bioprocessing Bags Market, By Application Segment: Revenue Growth Analysis

20 Cell Culture Market, By Region, 2020-2028 (USD Mllion)

21 Media Storage Market, By Region, 2020-2028 (USD Mllion)

22 Bioreactor Market, By Region, 2020-2028 (USD Mllion)

23 Harvest And Clarification Market, By Region, 2020-2028 (USD Mllion)

24 Global Single-use Bioprocessing Bags Market: By Bioprocessing Stage Scope Key Takeaways

25 Global Single-use Bioprocessing Bags Market, By Bioprocessing Stage Segment: Revenue Growth Analysis

26 Upstream Processing Market, By Region, 2020-2028 (USD Mllion)

27 Biostream Processing Market, By Region, 2020-2028 (USD Mllion)

28 Global Single-use Bioprocessing Bags Market: By End User Scope Key Takeaways

29 Global Single-use Bioprocessing Bags Market, By End User Segment: Revenue Growth Analysis

30 Biopharmaceutical Companies Market, By Region, 2020-2028 (USD Mllion)

31 Contract Manufacturing Organizations Market, By Region, 2020-2028 (USD Mllion)

32 Academic Institutes & Research Laboratories Market, By Region, 2020-2028 (USD Mllion)

33 Regional Segment: Revenue Growth Analysis

34 Global Single-use Bioprocessing Bags Market: Regional Analysis

35 North America Single-use Bioprocessing Bags Market Overview

36 North America Single-use Bioprocessing Bags Market, By Type

37 North America Single-use Bioprocessing Bags Market, By Application

38 North America Single-use Bioprocessing Bags Market, By Bioprocessing Stage

39 North America Single-use Bioprocessing Bags Market, By End User

40 North America Single-use Bioprocessing Bags Market, By Country

41 U.S. Single-use Bioprocessing Bags Market, By Type

42 U.S. Single-use Bioprocessing Bags Market, By Application

43 U.S. Single-use Bioprocessing Bags Market, By Bioprocessing Stage

44 U.S. Single-use Bioprocessing Bags Market, By End User

45 Canada Single-use Bioprocessing Bags Market, By Type

46 Canada Single-use Bioprocessing Bags Market, By Application

47 Canada Single-use Bioprocessing Bags Market, By Bioprocessing Stage

48 Canada Single-use Bioprocessing Bags Market, By End User

49 Mexico Single-use Bioprocessing Bags Market, By Type

50 Mexico Single-use Bioprocessing Bags Market, By Application

51 Mexico Single-use Bioprocessing Bags Market, By Bioprocessing Stage

52 Mexico Single-use Bioprocessing Bags Market, By End User

53 Four Quadrant Positioning Matrix

54 Company Market Share Analysis

55 Thermo Fisher Scientific: Company Snapshot

56 Thermo Fisher Scientific: SWOT Analysis

57 Thermo Fisher Scientific: Geographic Presence

58 Sartorius AG: Company Snapshot

59 Sartorius AG: SWOT Analysis

60 Sartorius AG: Geographic Presence

61 GE Healthcare: Company Snapshot

62 GE Healthcare: SWOT Analysis

63 GE Healthcare: Geographic Presence

64 Corning Incorporated: Company Snapshot

65 Corning Incorporated: Swot Analysis

66 Corning Incorporated: Geographic Presence

67 Merck GmbH: Company Snapshot

68 Merck GmbH: SWOT Analysis

69 Merck GmbH: Geographic Presence

70 SAINT-GOBAIN: Company Snapshot

71 SAINT-GOBAIN: SWOT Analysis

72 SAINT-GOBAIN: Geographic Presence

73 Danaher Corporation (Cytiva) : Company Snapshot

74 Danaher Corporation (Cytiva) : SWOT Analysis

75 Danaher Corporation (Cytiva) : Geographic Presence

76 Lonza Group: Company Snapshot

77 Lonza Group: SWOT Analysis

78 Lonza Group: Geographic Presence

79 Entegris: Company Snapshot

80 Entegris: SWOT Analysis

81 Entegris: Geographic Presence

82 Meissner Filtration Products: Company Snapshot

83 Meissner Filtration Products: SWOT Analysis

84 Meissner Filtration Products: Geographic Presence

85 Other Companies: Company Snapshot

86 Other Companies: SWOT Analysis

87 Other Companies: Geographic Presence

The Global Single-use Bioprocessing Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Single-use Bioprocessing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS