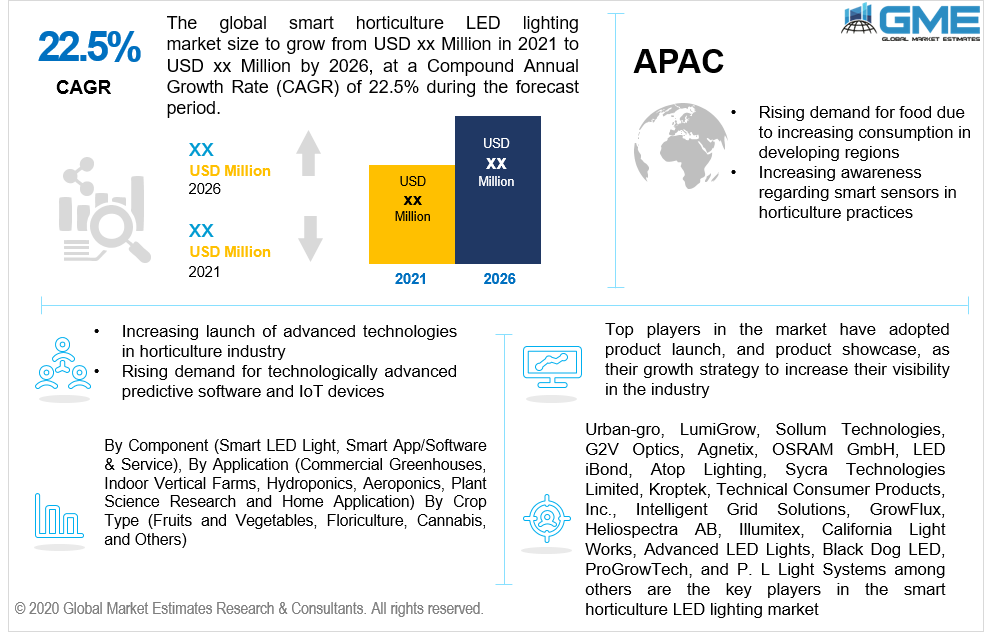

Global Smart Horticulture LED Lighting Market Size, Trends & Analysis - Forecasts to 2026 By Component (Smart LED Light, Smart App/Software & Service), By Application (Commercial Greenhouses, Indoor Vertical Farms, Hydroponics, Aeroponics, Plant Science Research and Home Application) By Crop Type (Fruits and Vegetables, Floriculture, Cannabis, and Others) Competitive Landscape Company Market Share Analysis, and Competitor Analysis

The global smart horticulture LED lighting market is projected to grow at a CAGR value of around 22.5% during the forecast period [2021 to 2026].

The major factors driving the growth of this market are increasing number of government initiatives to promote the adoption of CEA practices and smart technology for efficient indoor and outdoor farming, increasing demand for food & organic products due to rapidly rising global population, rising launch of funded projects in order to develop smart lighting systems, vertical farms and greenhouse systems, and legalization of cannabis cultivation in most of the countries.

Biopharmaceuticals and agriculture-based companies are taking a keen interest in monitoring and maintaining rare and seasonal plants & crops in all the seasons throughout the entire year. The prime parameter or factor in the horticulture process is the optimum source of light.

In smart farming, natural light is replaced with smart LED/ light-emitting diode lighting which has the ability to manipulate and control light to promote and improve plant growth, enhance the energy efficiency, and render sustainable farming.

Plants grown by indoor farming practices are highly dependent on optimum lighting. When LED lights are outfitted with smart sensors which are by Bluetooth and Zigbee technology, farmers and planters can optimize their lighting strategy for improved yields. Light sensors detect color, intensity, and duration, and by connecting to an on-site network, they can send data directly to the cloud for easy monitoring. Modules on smart LED lights also allow planters to automate changes over time or make manual adjustments to the light when necessary.

Smart LED lighting gives planters the ability to control the color and intensity of light, optimizing their impact on crops and monitor the real-time data on growth features. Smart sensors also constantly gather real-time data about light and growth conditions. Growers can use this data to inform best practices for future planting. The major applications of smart LED lighting are industrial and commercial greenhouse, vertical farming, plant and crop research, and private or home-based gardening.

However, lack of awareness regarding smart lighting for farming and planting in developing and third world countries, and cost constraints can act as challenges for the market to grow rapidly in these countries.

The COVID-19 impact was fairly positive and negative owing to nationwide lockdown rules and stringent norms related to priority farming. However, with the increasing demand for indoor plants and flowers, and rising research activities related to smart horticultural practices, the market will pick up the pace during the forecast period.

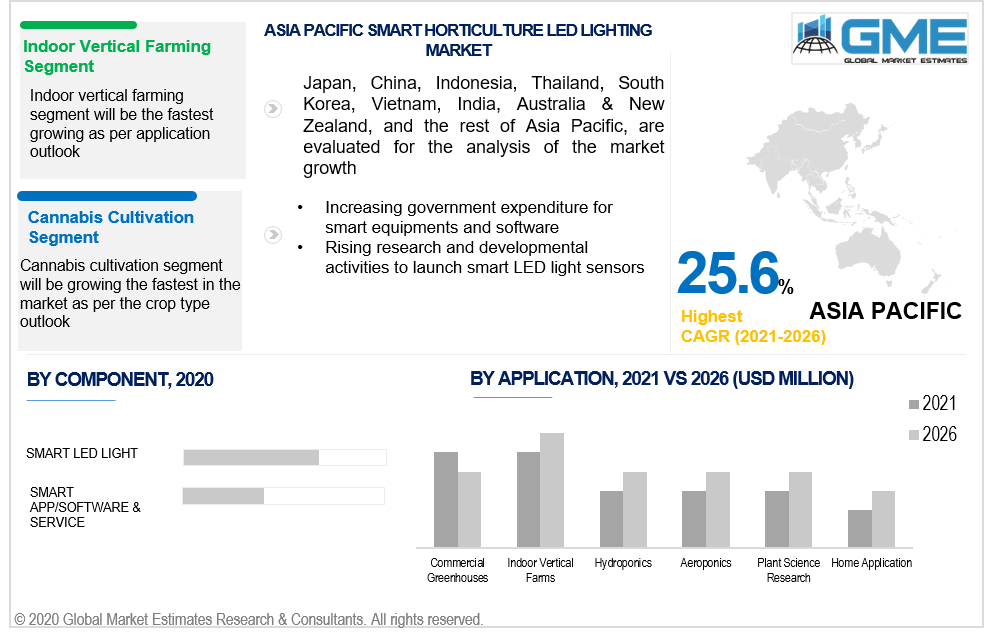

Based on component, the market is segmented into smart LED light, smart app/software & service. The smart LED light segment will be the fastest growing segment owing to the rising demand for efficient light energy for indoor and vertical farm plants. Also, rising awareness regarding the benefits of smart LED over natural light or general LED lights will support the growth of the segment during the forecast period of 2021 to 2026.

Based on the application, the market is segmented into commercial greenhouses, indoor vertical farms, hydroponics, aeroponics, plant science research and home application. The indoor vertical farm's segment is expected to register the highest CAGR during the forecast period. Rising investment in vertical farming across the globe, and the increasing launch of funded projects to establish and encourage vertical farms will help the segment grow rapidly. For instance, In May 2018, Signify (Netherlands) announced its collaboration with Travaglini FarmTech (Italy), in order to develop the first vertical farm plant research laboratory of Italy in Milan.

Based on the crop type, the smart horticulture LED lighting market is segmented into fruits and vegetables, floriculture, cannabis, and others. The cannabis cultivation segment will be the fastest growing segment during the forecast period owing to increasing demand for implementing laws and norms to legally use cannabis for medical purposes across both developed and developing regions, and increasing partnership and collaboration strategies amongst top players of the market to imitate cannabis cultivation.

As per the geographical analysis, the smart horticulture LED lighting market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe) will have a dominant share in the market from 2021 to 2026. The dominant share of Europe is mainly attributed to rising awareness regarding smart LED technology to manage light supply to vertical and indoor farming set-ups, rapidly growing horticulture industry, increasing launch of funded projects to promote cannabis farming using smart LED lighting and infrastructure and presence of large areas for greenhouse cultivation programs. However, the Asia Pacific segment will be growing the fastest owing to increasing food volume consumption due to the rapidly growing population.

Urban-gro, LumiGrow, Sollum Technologies, G2V Optics, Agnetix, OSRAM GmbH, LED iBond, Atop Lighting, Sycra Technologies Limited, Kroptek, Technical Consumer Products, Inc., Intelligent Grid Solutions, GrowFlux, Heliospectra AB, Illumitex, California Light Works, Advanced LED Lights, Black Dog LED, ProGrowTech, and P. L Light Systems among others are the key players in the smart horticulture LED lighting market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Smart Horticulture LED Lighting Industry Overview, 2021-2026

2.1.1 Industry Overview

2.1.2 Component Overview

2.1.3 Application Overview

2.1.4 Crop Type Overview

2.1.6 Regional Overview

Chapter 3 Smart Horticulture LED Lighting Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2021-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising awareness regarding smart LED lighting for smart farming and horticulture

3.3.2 Industry Challenges

3.3.2.1 Lack of adequate infrastructure and cost constraints in developing nations

3.4 Prospective Growth Scenario

3.4.1 Component Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 Crop Type Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Crop Type Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Smart Horticulture LED Lighting Market, By Component

4.1 Component Outlook

4.2 Smart LED Light

4.2.1 Market Size, By Region, 2021-2026 (USD Million)

4.3 Smart App/Software & Service

4.3.1 Market Size, By Region, 2021-2026 (USD Million)

Chapter 5 Smart Horticulture LED Lighting Market, By Application

5.1 Application Outlook

5.2 Commercial Greenhouses

5.2.1 Market Size, By Region, 2021-2026 (USD Million)

5.3 Indoor Vertical Farms

5.3.1 Market Size, By Region, 2021-2026 (USD Million)

5.4 Hydroponics

5.4.1 Market Size, By Region, 2021-2026 (USD Million)

5.5 Aeroponics

5.5.1 Market Size, By Region, 2021-2026 (USD Million)

5.6 Home Application

5.6.1 Market Size, By Region, 2021-2026 (USD Million)

5.7 Plant Science Research

5.7.1 Market Size, By Region, 2021-2026 (USD Million)

Chapter 6 Smart Horticulture LED Lighting Market, By Crop Type

6.1 Fruits and Vegetables

6.1.1 Market Size, By Region, 2021-2026 (USD Million)

6.2 Floriculture

6.2.1 Market Size, By Region, 2021-2026 (USD Million)

6.3 Cannabis

6.3.1 Market Size, By Region, 2021-2026 (USD Million)

6.4 Others

6.4.1 Market Size, By Region, 2021-2026 (USD Million)

Chapter 7 Smart Horticulture LED Lighting Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2021-2026 (USD Million)

7.2.2 Market Size, By Component, 2021-2026 (USD Million)

7.2.3 Market Size, By Application, 2021-2026 (USD Million)

7.2.4 Market Size, By Crop Type, 2021-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Component, 2021-2026 (USD Million)

7.2.5.2 Market Size, By Application, 2021-2026 (USD Million)

7.2.5.3 Market Size, By Crop Type, 2021-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Component, 2021-2026 (USD Million)

7.2.6.2 Market Size, By Application, 2021-2026 (USD Million)

7.2.6.3 Market Size, By Crop Type, 2021-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2021-2026 (USD Million)

7.3.2 Market Size, By Component, 2021-2026 (USD Million)

7.3.3 Market Size, By Application, 2021-2026 (USD Million)

7.3.4 Market Size, By Crop Type, 2021-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Component, 2021-2026 (USD Million)

7.3.5.2 Market Size, By Application, 2021-2026 (USD Million)

7.3.5.3 Market Size, By Crop Type, 2021-2026 (USD Million)

7.3.6 Netherlands

7.3.6.1 Market Size, By Component, 2021-2026 (USD Million)

7.3.6.2 Market Size, By Application, 2021-2026 (USD Million)

7.3.6.3 Market Size, By Crop Type, 2021-2026 (USD Million)

7.3.7 UK

7.3.7.1 Market Size, By Component, 2021-2026 (USD Million)

7.3.7.2 Market Size, By Application, 2021-2026 (USD Million)

7.3.7.3 Market Size, By Crop Type, 2021-2026 (USD Million)

7.3.8 France

7.3.8.1 Market Size, By Component, 2021-2026 (USD Million)

7.3.8.2 Market Size, By Application, 2021-2026 (USD Million)

7.3.8.3 Market Size, By Crop Type, 2021-2026 (USD Million)

7.3.9 Italy

7.3.9.1 Market Size, By Component, 2021-2026 (USD Million)

7.3.9.2 Market Size, By Application, 2021-2026 (USD Million)

7.3.9.3 Market Size, By Crop Type, 2021-2026 (USD Million)

7.3.10 Spain

7.3.10.1 Market Size, By Component, 2021-2026 (USD Million)

7.3.10.2 Market Size, By Application, 2021-2026 (USD Million)

7.3.10.3 Market Size, By Crop Type, 2021-2026 (USD Million)

7.3.11 Russia

7.3.11.1 Market Size, By Component, 2021-2026 (USD Million)

7.3.11.2 Market Size, By Application, 2021-2026 (USD Million)

7.3.11.3 Market Size, By Crop Type, 2021-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2021-2026 (USD Million)

7.4.2 Market Size, By Component, 2021-2026 (USD Million)

7.4.3 Market Size, By Application, 2021-2026 (USD Million)

7.4.4 Market Size, By Crop Type, 2021-2026 (USD Million)

7.4.5 Malaysia

7.4.5.1 Market Size, By Component, 2021-2026 (USD Million)

7.4.5.2 Market Size, By Application, 2021-2026 (USD Million)

7.4.5.3 Market Size, By Crop Type, 2021-2026 (USD Million)

7.4.6 China

7.4.6.1 Market Size, By Component, 2021-2026 (USD Million)

7.4.6.2 Market Size, By Application, 2021-2026 (USD Million)

7.4.6.3 Market Size, By Crop Type, 2021-2026 (USD Million)

7.4.7 India

7.4.7.1 Market Size, By Component, 2021-2026 (USD Million)

7.4.7.2 Market Size, By Application, 2021-2026 (USD Million)

7.4.7.3 Market Size, By Crop Type, 2021-2026 (USD Million)

7.4.8 Japan

7.4.8.1 Market Size, By Component, 2021-2026 (USD Million)

7.4.8.2 Market Size, By Application, 2021-2026 (USD Million)

7.4.8.3 Market Size, By Crop Type, 2021-2026 (USD Million)

7.4.9 Australia

7.4.9.1 Market Size, By Component, 2021-2026 (USD Million)

7.4.9.2 Market size, By Application, 2021-2026 (USD Million)

7.4.9.3 Market Size, By Crop Type, 2021-2026 (USD Million)

7.4.10 South Korea

7.4.10.1 Market Size, By Component, 2021-2026 (USD Million)

7.4.10.2 Market Size, By Application, 2021-2026 (USD Million)

7.4.10.3 Market Size, By Crop Type, 2021-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2021-2026 (USD Million)

7.5.2 Market Size, By Component, 2021-2026 (USD Million)

7.5.3 Market Size, By Application, 2021-2026 (USD Million)

7.5.4 Market Size, By Crop Type, 2021-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Component, 2021-2026 (USD Million)

7.5.5.2 Market Size, By Application, 2021-2026 (USD Million)

7.5.5.3 Market Size, By Crop Type, 2021-2026 (USD Million)

7.5.6 Argentina

7.5.6.1 Market Size, By Component, 2021-2026 (USD Million)

7.5.6.2 Market Size, By Application, 2021-2026 (USD Million)

7.5.6.3 Market Size, By Crop Type, 2021-2026 (USD Million)

7.5.7 Mexico

7.5.7.1 Market Size, By Component, 2021-2026 (USD Million)

7.5.7.2 Market Size, By Application, 2021-2026 (USD Million)

7.5.7.3 Market Size, By Crop Type, 2021-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2021-2026 (USD Million)

7.6.2 Market Size, By Component, 2021-2026 (USD Million)

7.6.3 Market Size, By Application, 2021-2026 (USD Million)

7.6.4 Market Size, By Crop Type, 2021-2026 (USD Million)

7.6.5 North America

7.6.5.1 Market Size, By Component, 2021-2026 (USD Million)

7.6.5.2 Market Size, By Application, 2021-2026 (USD Million)

7.6.5.3 Market Size, By Crop Type, 2021-2026 (USD Million)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Component, 2021-2026 (USD Million)

7.6.6.2 Market Size, By Application, 2021-2026 (USD Million)

7.6.6.3 Market Size, By Crop Type, 2021-2026 (USD Million)

7.6.7 UAE

7.6.7.1 Market Size, By Component, 2021-2026 (USD Million)

7.6.7.2 Market Size, By Application, 2021-2026 (USD Million)

7.6.7.3 Market Size, By Crop Type, 2021-2026 (USD Million)

7.6.8 South Africa

7.6.7.1 Market Size, By Component, 2021-2026 (USD Million)

7.6.7.2 Market Size, By Application, 2021-2026 (USD Million)

7.6.7.3 Market Size, By Crop Type, 2021-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Urban-gro

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 LumiGrow

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Sollum Technologies

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 G2V Optics

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Agnetix

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 OSRAM GmbH

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 LED iBond

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Atop Lighting

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Sycra Technologies Limited

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Smart Horticulture LED Lighting Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Smart Horticulture LED Lighting Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS