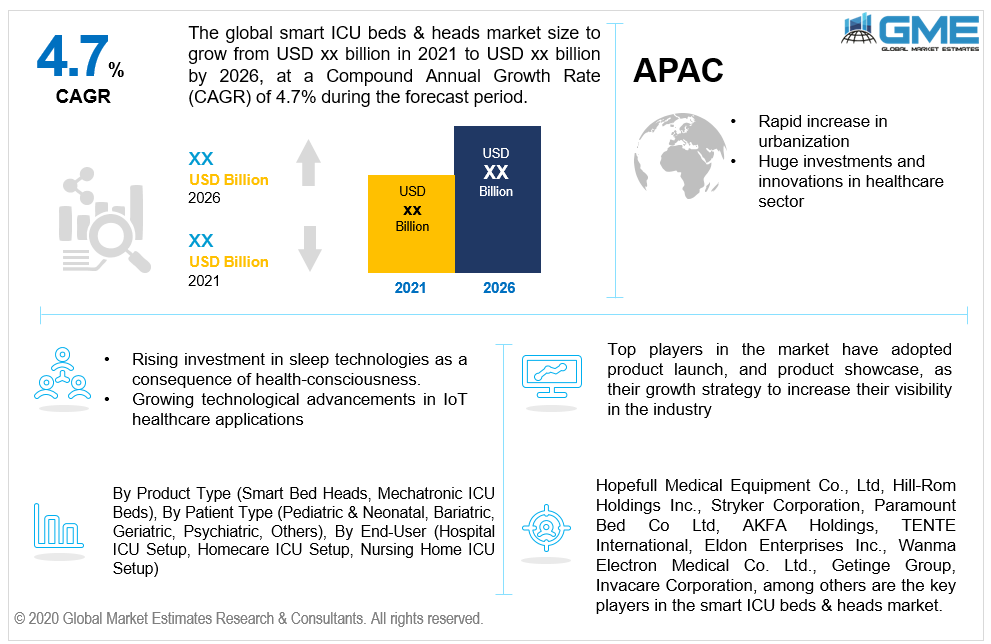

Global Smart ICU Beds & Heads Market Size, Trends & Analysis - Forecasts to 2026 By Product Type (Smart Bed Heads, Mechatronic ICU Beds), By Patient Type (Pediatric & Neonatal, Bariatric, Geriatric, Psychiatric, Others), By End-User (Hospital ICU Setup, Homecare ICU Setup, Nursing Home ICU Setup), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

The global smart ICU beds & heads market is projected to grow at a CAGR value of around 4.7% during the forecast period [2021 to 2026].

Rising number of surgical procedures, clubbed with increasing geriatric population, and rapidly growing prevalence of chronic diseases, such as diabetes, asthma, blood pressure, and others, are the prime factors supporting the growth of the market.

Moreover, rapidly rising technological advancements in offering smart, Bluetooth based, patient friendly ICU beds and surge in investments in healthcare infrastructure by governments and private sectors especially post COVID-19 outbreak, and rising patient admission to hospitals for life support services are anticipated to drive the market growth during the forecast period.

Rising launch of well-equipped and advanced infrastructure in hospitals, implementation of favorable reimbursement policies in developed countries, and increase in number of product launches are other factors that drive the growth of the market.

However, low demand in underdeveloped countries for smart ICU bed heads and ICU beds is expected to hamper the market growth during the forecast period.

Hospital beds are where patients spend their significant amount of time, and innovative "smart beds" assist in keeping patients secure while enabling nurses to analyze the data and optimize patient safety. Smart ICU beds & heads communicate with EMR networks, allowing nurses to track patient statistics such as mobility and weight fluctuations.

The need for smart ICU beds & heads is increasing due to rising investment in sleep technologies as a consequence of health consciousness. Smart hospital beds are part of the natural cycle of technology advancement that is extending through medical corridors due to their function in boosting medical care team collaboration, upgrading patient safety and care, and improving productivity.

Higher rates of sleep disorders among adults are a significant element driving interest in the notion of quality sleep and, as per CES data, 59% are interested in sleep technologies. Smart ICU beds & heads combine advanced features with technology that enables convenient modifications and communication while sleeping. Sleep tracking, autonomous mattress firmness adjustments, temperature controls, smart fabric innovation, flexible bases, anti-snoring function, IoT, and smart home networking are just a few of the amenities available.

Additionally, digitalization of the healthcare business coupled with growth in IoT healthcare applications, and advancements are expected to further propel the adoption of smart ICU beds & heads.

COVID-19's outbreak has had a substantial influence on the need for smart ICU beds. In lieu of the pandemic, the market for smart ICU beds & heads spiked as the number of new COVID-19 infections began to rise rapidly. Moreover, the health services prioritized ICU patient management cases on a daily basis due to the rapidly increasing respiratory cases. ICU capacity planning suddenly become a top priority, and there was a sudden increase in demand for smart ICU beds from health authorities. The market is expected to grow rapidly owing to the above mentioned trends and factors.

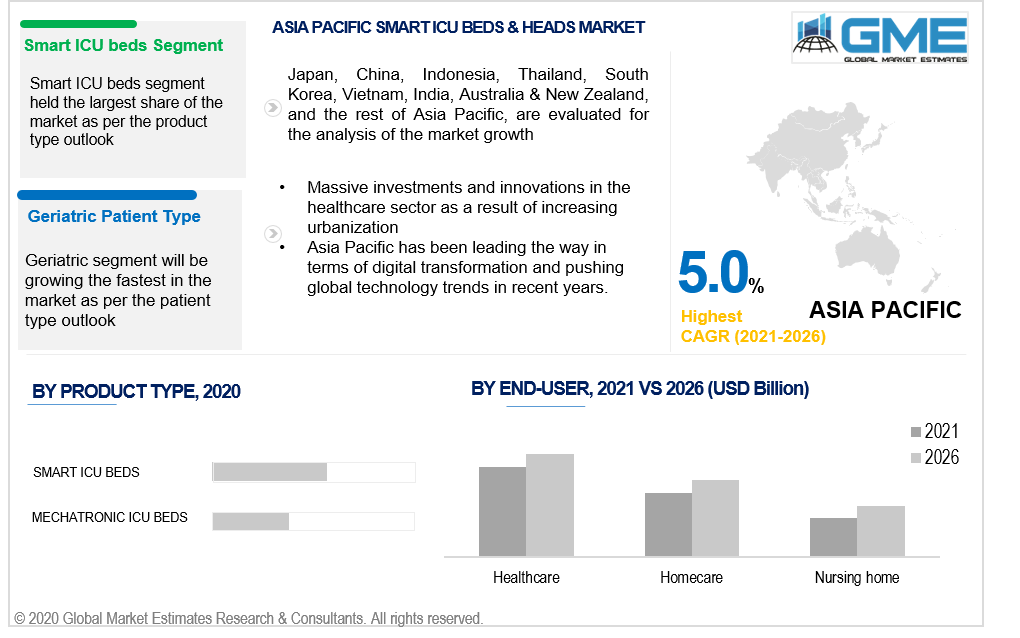

Based on the product type, the smart ICU beds & heads market is segmented into smart bed heads and mechatronic ICU beds. The mechatronic ICU beds segment is expected to have the largest share during the forecast period owing to unified patient care, aid, and surveillance solutions offered by this segment and the rising need for the same. These mechatronic ICU beds have features such as reverberation and vibration functions that are beneficial for patients who are sensitive to asthma or have respiratory symptoms. Hence, with the rising cases of asthma, and other lung diseases, the segment is ought to be growing rapidly.

On the other hand, the mechatronic bed design is likely the most comprehensive approach of conceiving around concurrent design activities, combining mechanical, electronic, informatics, and cognitive control mechanisms. Many computer-aided tools are used in the design phase, which plays an important part in modern optimization techniques and lower prototype costs.

Based on the patient type, the market is segmented into pediatric & neonatal, bariatric, geriatric, psychiatric, others. The requirement for mechatronic ICU beds and heads among geriatric patient types is expected to have a lion’s share in the market during the forecast period. Bedsores and fall accidents among geriatric patients are common concerns, which account for more than 80% of cases in medical facilities.

Based on the end-user, the market is segmented into hospital ICU setup, homecare ICU setup, and nursing home ICU setup. The hospital ICU setup will have the largest share in the market during the forecast period.

Mechatronic ICU beds & beds are part of a cycle of technology advancement that is spreading through hospital corridors due to their functional advantages that is boosting medical care team collaboration, elevating patient safety and care, and increasing operational efficiency. Advanced technologies and medical equipment are infiltrating hospitals, making the health sector one of the industries that have gained far more from successive improvements. This segment is expected to be the largest segment owing to increasing purchasing power of hospitals to adopt mechatronic ICU beds and heads and rising patient admission.

As per the geographical analysis, the smart ICU beds & heads market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the market from 2021 to 2026.

According to the Centers for Disease Control and Prevention (CDC), 1 out of every 3 Americans do not get sufficient rest, and 1 out of every 4 adults in the United States struggle from sleeplessness. Moreover, these patients are most likely to get admitted in the hospital. The dominant share of North America is mainly attributed to the widespread use of electronic beds and heads in hospital and nursing home set ups, growing infiltration of smart homes across Canada, and Mexico and rising chronic disease cases amongst geriatric patients.

During the forecast period, the Asia Pacific region is expected to have the highest CAGR owing to massive investments and innovations in the healthcare sector as a result of increasing urbanization and the region's growing aging population.

Hopeful Medical Equipment Co., Ltd, Hill-Rom Holdings Inc., Stryker Corporation, Paramount Bed Co Ltd, AKFA Holdings, TENTE International, Eldon Enterprises Inc., Wanma Electron Medical Co. Ltd., Getinge Group, Invacare Corporation, among others are the key players in the smart ICU beds & heads market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Smart ICU Beds & Heads Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Product Type Overview

2.1.3 Patient Type Overview

2.1.4 End-User Overview

2.1.6 Regional Overview

Chapter 3 Smart ICU Beds & Heads Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising investment and product launch strategies in smart ICU beds as a consequence of health-consciousness and COVID-19 outbreak

3.3.2 End-User Challenges

3.3.2.1 Lack of product reach in underdeveloped countries

3.4 Prospective Growth Scenario

3.4.1 Product Type Growth Scenario

3.4.2 Patient Type Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over End-User Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Smart ICU Beds & Heads Market, By Product Type

4.1 Product Type Outlook

4.2 Smart Bed Heads

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Mechatronic ICU Beds

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Smart ICU Beds & Heads Market, By Patient Type

5.1 Patient Type Outlook

5.2 Pediatric & Neonatal

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Bariatric

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Geriatric

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Psychiatric

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Others

5.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Smart ICU Beds & Heads Market, By End-user

6.1 Hospital ICU Setup

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Homecare ICU Setup

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Nursing Home ICU Setup

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Smart ICU Beds & Heads Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.2.3 Market Size, By Patient Type, 2020-2026 (USD Billion)

7.2.4 Market Size, By End-user, 2020-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By Patient Type, 2020-2026 (USD Billion)

7.2.4.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.2.7.2 Market Size, By Patient Type, 2020-2026 (USD Billion)

7.2.7.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.3 Market Size, By Patient Type, 2020-2026 (USD Billion)

7.3.4 Market Size, By End-user, 2020-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Patient Type, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Patient Type, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Patient Type, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Patient Type, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Patient Type, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.11.2 Market Size, By Patient Type, 2020-2026 (USD Billion)

7.3.11.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.3 Market Size, By Patient Type, 2020-2026 (USD Billion)

7.4.4 Market Size, By End-user, 2020-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Patient Type, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Patient Type, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Patient Type, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.9.2 Market size, By Patient Type, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.10.2 Market Size, By Patient Type, 2020-2026 (USD Billion)

7.4.10.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.5.3 Market Size, By Patient Type, 2020-2026 (USD Billion)

7.5.4 Market Size, By End-user, 2020-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Patient Type, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Patient Type, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Patient Type, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.6.3 Market Size, By Patient Type, 2020-2026 (USD Billion)

7.6.4 Market Size, By End-user, 2020-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Patient Type, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Patient Type, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By End-user, 2020-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Patient Type, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By End-user, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Hopefull Medical Equipment Co., Ltd

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Infographic Analysis

8.3 Hill-Rom Holdings Inc.

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Infographic Analysis

8.4 Stryker Corporation

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Infographic Analysis

8.5 Paramount Bed Co Ltd

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Infographic Analysis

8.6 AKFA Holdings

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Infographic Analysis

8.7 TENTE International

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Infographic Analysis

8.8 Eldon Enterprises Inc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.9 Wanma Electron Medical Co. Ltd.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.10 Getinge Group

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Infographic Analysis

8.11 Invacare Corporation

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Infographic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Infographic Analysis

The Global Smart ICU Beds & Heads Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Smart ICU Beds & Heads Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS