Global Smart Rail Market Size, Trends & Analysis - Forecasts to 2029 By Service Type (Passenger Mobility and Services, Passenger Information System, Train Tracking and Monitoring Solutions, Automated Fare Collection System, IP Video Surveillance, Predictive Maintenance, Freight Management System, and Others), By Rolling Stock (Diesel Locomotive, Electric Locomotive, DMU, EMU, Light Rail/Tram Car, Subway/Metro Vehicle, Passenger Coach, and Freight Wagon), By Safety & Signalling System (Positive Train Control (PTC), Communication/Computer-based Train Control (CBTC), and Automated/Integrated Train Control (ATC)), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

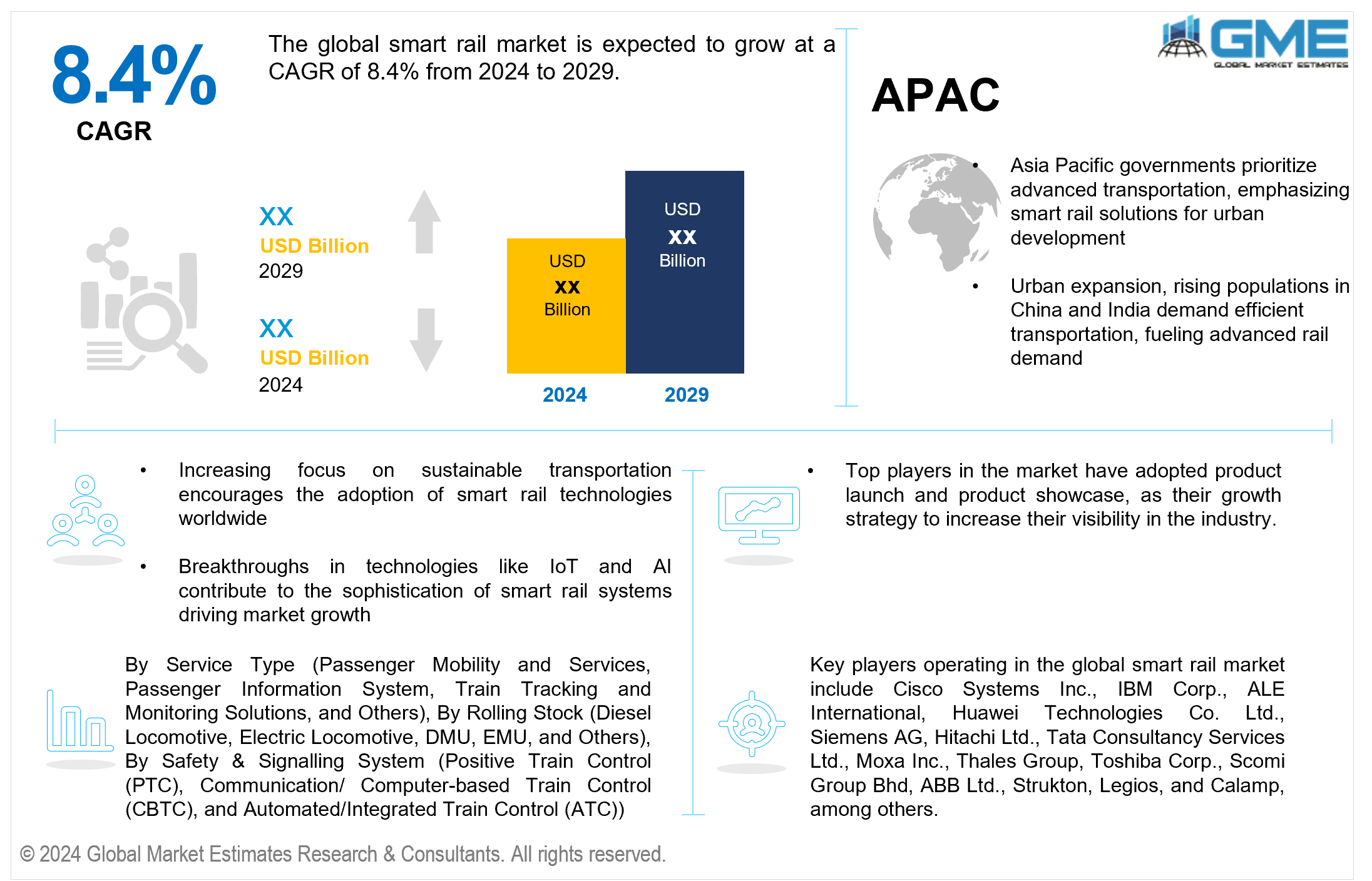

The global smart rail market is expected to exhibit a CAGR of 8.4% from 2024 to 2029. Smart railways represent a sophisticated integration of cutting-edge technologies and data-driven solutions within the railway industry to elevate operational efficiency, safety standards, and the overall passenger experience. By employing an array of sensors, robust communication networks, and analytical tools, these systems meticulously oversee and optimize diverse facets of rail operations, ranging from track conditions and train schedules to maintenance protocols. The incorporation of features such as predictive maintenance, real-time monitoring, and automation serves to enhance the system's reliability, minimize downtime, and ensure a seamlessly secure travel experience for passengers.

Many factors drive the growth of the global smart rail market. With cities growing and populations increasing, smart rail finds its stride, offering a modern solution to urban mobility challenges. Breakthroughs in technologies like IoT and AI add a layer of sophistication, while government backing and investments propel smart infrastructure projects forward. The increasing focus on sustainable transportation and a heightened awareness of safety and security drive the adoption of smart rail technologies. Operational efficiency takes center stage with features like predictive maintenance and real-time monitoring, responding to the demand for smoother and more reliable rail services. As passengers seek enhanced experiences, smart rail systems provide amenities like Wi-Fi and real-time information, creating a tech-savvy and connected journey. The expansion of high-speed rail networks and the pursuit of seamless intermodal connectivity not only drive market growth but also spark healthy competition, pushing the industry toward continuous innovation.

Despite the promising growth prospects, the global smart rail market faces certain restraints that hinder its growth. The upfront expenses required for upgrading infrastructure and deploying new technologies can be daunting for stakeholders considering the shift to smart rail solutions. Moreover, dealing with existing outdated systems adds complexity and expense, making the retrofitting or upgrading process both costly and intricate. Interoperability issues present another challenge, as integrating various smart rail components can prove challenging, leading to potential efficiency setbacks. These financial and technological obstacles, combined with concerns over cybersecurity and regulatory compliance, present formidable barriers to the widespread adoption of smart rail solutions on a global scale.

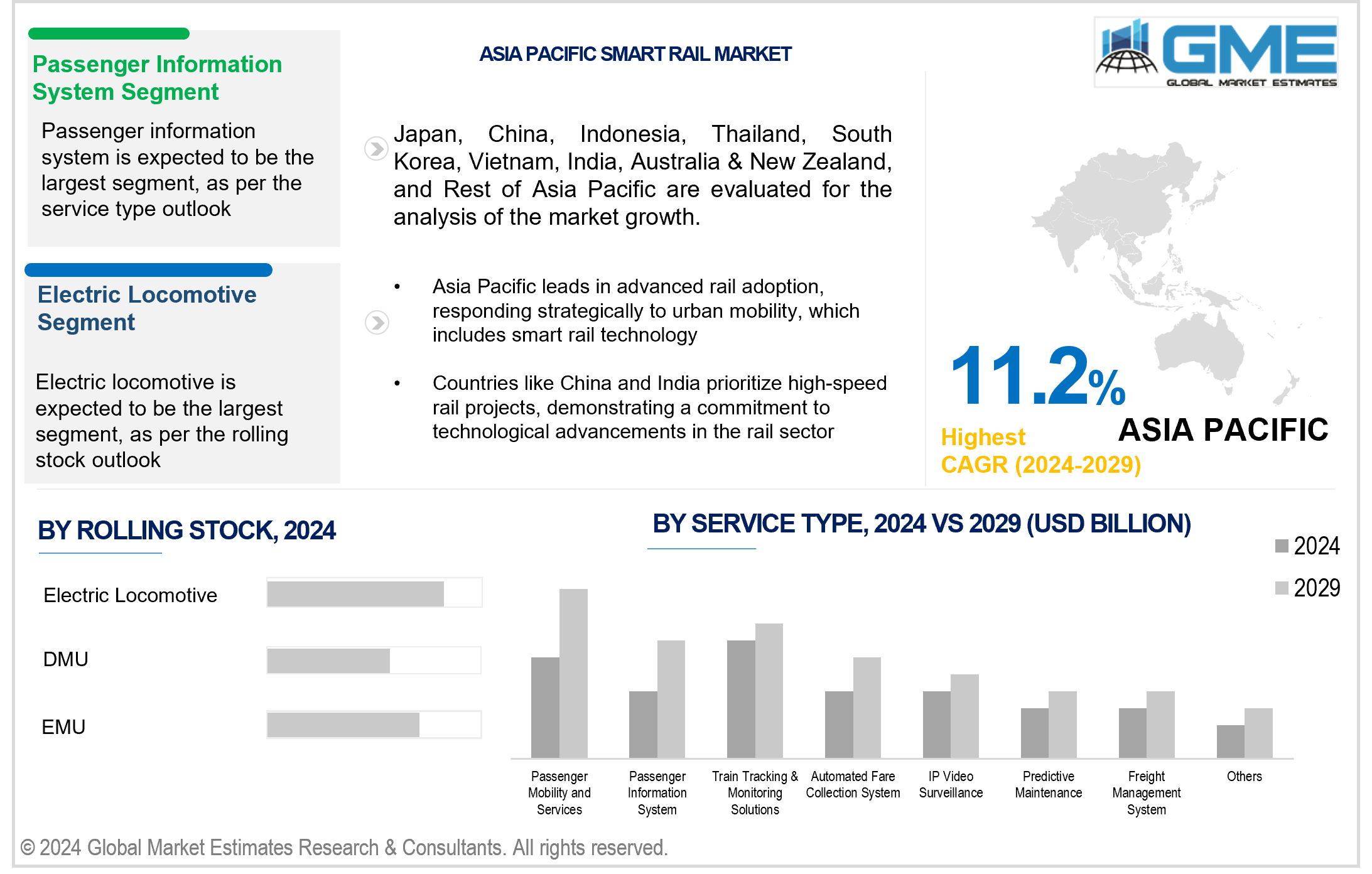

Based on the service type, the market is segmented into passenger mobility and services, passenger information system (PIS), train tracking and monitoring solutions, automated fare collection system, IP video surveillance, predictive maintenance, freight management system and others. The passenger information system segment is expected to be the largest during the forecast period. Providing real-time updates on train schedules, delays, and other critical information, PIS ensures commuters receive timely and accurate details, facilitating efficient travel planning. With growing expectations for seamless journeys, rail operators prioritize investments in PIS to meet evolving passenger demands, cementing its status as the market's largest segment.

The train tracking and monitoring solutions segment is expected to be the fastest-growing segment in the global smart rail market during the forecast period. These solutions optimize train schedules, track conditions, and maintenance activities with real-time monitoring and predictive analytics. As rail operators prioritize advanced technologies to streamline operations, the train tracking and monitoring segment experiences rapid growth, contributing significantly to the overall evolution of smart rail systems.

On the basis of rolling stock, the market is segmented into diesel locomotive, electric locomotive, DMU, EMU, light rail/tram car, subway/metro vehicle, passenger coach, and freight wagon. The electric locomotives segment is expected to be the largest and fastest-growing segment during the forecast period. Electric locomotives are superior to their counterparts, producing reduced emissions, improved energy efficiency, and lower operational costs. Integrating smart technologies enhances their performance, enabling features like predictive maintenance and real-time monitoring. Government's emphasis on sustainable transportation and the growing demand for environmentally friendly solutions contribute to the widespread adoption of electric locomotives, making this segment the largest in the evolving landscape of the smart rail market.

Based on safety & signalling system, the market is segmented into positive train control (PTC), communication/computer-based train control (CBTC), and automated/integrated train control (ATC). The positive train control (PTC) segment is expected to be the largest and fastest-growing segment during the forecast period. PTC systems leverage advanced technologies like GPS, communication networks, and automation to monitor and control train movements. Mandated by regulatory authorities in various regions, PTC helps prevent collisions and derailments, ensuring a safer railway environment. The emphasis on safety, coupled with regulatory compliance requirements, has driven substantial investments in PTC, making it the largest and indispensable segment in the evolving smart rail landscape.

Asia Pacific is expected to be the largest and fastest-growing region in the global smart rail market during the forecast period. The swift expansion of urban areas and the rising population in countries such as China and India have generated a need for transportation solutions prioritizing efficiency and sustainability. This has led to a focus on investing in railway infrastructure in the region. Governments in the Asia Pacific are actively allocating resources towards the development of cities with an emphasis on advanced transportation systems. For instance, as per the budget provided by the Indian government in 2024, the country is set to invest more than USD 84.33 billion into developing the railway system in the country.

Additionally, the Asia Pacific region is proactive in adopting cutting-edge technologies. Several countries like China and India are prioritizing high-speed rail projects. As a result, due to its economy and commitment to modernizing transportation infrastructure, the Asia Pacific region stands out as a leader in embracing advanced rail systems.

Key players operating in the global smart rail market include Cisco Systems Inc., IBM Corp., ALE International, Huawei Technologies Co. Ltd., Siemens AG, Hitachi Ltd., Tata Consultancy Services Ltd., Moxa Inc., Thales Group, Televic Group, Cyient Ltd., Toshiba Corp., Scomi Group Bhd, Woojin Industrial Systems Co. Ltd., ABB Ltd., Strukton, Legios, Deuta-Werke Gmbh, American Equipment Company, and Calamp, among others.

Please note: This is not an exhaustive list of companies profiled in the report.

In November 2023, Siemens Mobility launched its latest rolling stock product with its first electric Mireo Smart train at the rail technology company’s factory in Krefeld, Germany. The new train, designed for regional and commuter rail operators, forms part of the company’s attempts to capitalise on a growing desire for more sustainable rolling stock solutions. It is an electric version of its existing Mireo product.

In June 2023, Vodafone Spain and a Spanish industrial group, SEMI, closed a substantial five-year contract valued at USD 27.58 million from ADIF. The joint venture aims to bolster the high-speed train routes connecting Albacete to Alicante and Barcelona to Figueres by implementing robust and dependable 5G coverage. This strategic initiative will significantly enhance connectivity and contribute to high-speed rail services' overall efficiency and quality on these critical routes.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL SMART RAIL MARKET, BY SAFETY & SIGNALLING SYSTEM

4.1 Introduction

4.2 Smart Rail Market: Safety & Signalling System Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Positive Train Control (PTC)

4.4.1 Positive Train Control (PTC) Market Estimates and Forecast, 2021-2029 (USD Billion)

4.5 Communication/Computer-based Train Control (CBTC)

4.5.1 Communication/Computer-based Train Control (CBTC) Market Estimates and Forecast, 2021-2029 (USD Billion)

4.6 Automated/Integrated Train Control (ATC)

4.6.1 Automated/Integrated Train Control (ATC) Market Estimates and Forecast, 2021-2029 (USD Billion)

5 GLOBAL SMART RAIL MARKET, BY ROLLING STOCK

5.1 Introduction

5.2 Smart Rail Market: Rolling Stock Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Diesel Locomotive

5.4.1 Diesel Locomotive Market Estimates and Forecast, 2021-2029 (USD Billion)

5.5 Electric Locomotive

5.5.1 Electric Locomotive Market Estimates and Forecast, 2021-2029 (USD Billion)

5.6 Subway/Metro Vehicle

5.6.1 Subway/Metro Vehicle Market Estimates and Forecast, 2021-2029 (USD Billion)

5.7 Light Rail/Tram Car

5.7.1 Light Rail/Tram Car Market Estimates and Forecast, 2021-2029 (USD Billion)

5.8 DMU

5.8.1 DMU Market Estimates and Forecast, 2021-2029 (USD Billion)

5.9 EMU

5.9.1 EMU Market Estimates and Forecast, 2021-2029 (USD Billion)

5.10 Passenger Coach

5.10.1 Passenger Coach Market Estimates and Forecast, 2021-2029 (USD Billion)

5.11 Freight Wagon

5.11.1 Freight Wagon Market Estimates and Forecast, 2021-2029 (USD Billion)

6 GLOBAL SMART RAIL MARKET, BY SERVICE TYPE

6.1 Introduction

6.2 Smart Rail Market: Service Type Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Passenger Mobility and Services

6.4.1 Passenger Mobility and Services Market Estimates and Forecast, 2021-2029 (USD Billion)

6.5 Train Tracking and Monitoring Solutions

6.5.1 Train Tracking and Monitoring Solutions Market Estimates and Forecast, 2021-2029 (USD Billion)

6.6 Passenger Information System

6.6.1 Passenger Information System Market Estimates and Forecast, 2021-2029 (USD Billion)

6.7 Automated Fare Collection System

6.7.1 Automated Fare Collection System Market Estimates and Forecast, 2021-2029 (USD Billion)

6.8 IP Video Surveillance

6.8.1 IP Video Surveillance Market Estimates and Forecast, 2021-2029 (USD Billion)

6.9 Predictive Maintenance

6.9.1 Predictive Maintenance Market Estimates and Forecast, 2021-2029 (USD Billion)

6.10 Freight Management System

6.10.1 Freight Management System Market Estimates and Forecast, 2021-2029 (USD Billion)

6.11 Others

6.11.1 Others Market Estimates and Forecast, 2021-2029 (USD Billion)

7 GLOBAL SMART RAIL MARKET, BY REGION

7.1 Introduction

7.2 North America Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.2.1 By Safety & Signalling System

7.2.2 By Rolling Stock

7.2.3 By Service Type

7.2.4 By Country

7.2.4.1 U.S. Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.2.4.1.1 By Safety & Signalling System

7.2.4.1.2 By Rolling Stock

7.2.4.1.3 By Service Type

7.2.4.2 Canada Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.2.4.2.1 By Safety & Signalling System

7.2.4.2.2 By Rolling Stock

7.2.4.2.3 By Service Type

7.2.4.3 Mexico Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.2.4.3.1 By Safety & Signalling System

7.2.4.3.2 By Rolling Stock

7.2.4.3.3 By Service Type

7.3 Europe Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.3.1 By Safety & Signalling System

7.3.2 By Rolling Stock

7.3.3 By Service Type

7.3.4 By Country

7.3.4.1 Germany Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.3.4.1.1 By Safety & Signalling System

7.3.4.1.2 By Rolling Stock

7.3.4.1.3 By Service Type

7.3.4.2 U.K. Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.3.4.2.1 By Safety & Signalling System

7.3.4.2.2 By Rolling Stock

7.3.4.2.3 By Service Type

7.3.4.3 France Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.3.4.3.1 By Safety & Signalling System

7.3.4.3.2 By Rolling Stock

7.3.4.3.3 By Service Type

7.3.4.4 Italy Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.3.4.4.1 By Safety & Signalling System

7.3.4.4.2 By Rolling Stock

7.2.4.4.3 By Service Type

7.3.4.5 Spain Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.3.4.5.1 By Safety & Signalling System

7.3.4.5.2 By Rolling Stock

7.2.4.5.3 By Service Type

7.3.4.6 Netherlands Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.3.4.7.1 By Safety & Signalling System

7.3.4.7.2 By Rolling Stock

7.2.4.7.3 By Service Type

7.3.4.7 Rest of Europe Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.3.4.7.1 By Safety & Signalling System

7.3.4.7.2 By Rolling Stock

7.2.4.7.3 By Service Type

7.4 Asia Pacific Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.1 By Safety & Signalling System

7.4.2 By Rolling Stock

7.4.3 By Service Type

7.4.4 By Country

7.4.4.1 China Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.1.1 By Safety & Signalling System

7.4.4.1.2 By Rolling Stock

7.4.4.1.3 By Service Type

7.4.4.2 Japan Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.2.1 By Safety & Signalling System

7.4.4.2.2 By Rolling Stock

7.4.4.2.3 By Service Type

7.4.4.3 India Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.3.1 By Safety & Signalling System

7.4.4.3.2 By Rolling Stock

7.4.4.3.3 By Service Type

7.4.4.4 South Korea Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.4.1 By Safety & Signalling System

7.4.4.4.2 By Rolling Stock

7.4.4.4.3 By Service Type

7.4.4.5 Singapore Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.5.1 By Safety & Signalling System

7.4.4.5.2 By Rolling Stock

7.4.4.5.3 By Service Type

7.4.4.6 Malaysia Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.7.1 By Safety & Signalling System

7.4.4.7.2 By Rolling Stock

7.4.4.7.3 By Service Type

7.4.4.7 Thailand Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.7.1 By Safety & Signalling System

7.4.4.7.2 By Rolling Stock

7.4.4.7.3 By Service Type

7.4.4.8 Indonesia Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.8.1 By Safety & Signalling System

7.4.4.8.2 By Rolling Stock

7.4.4.8.3 By Service Type

7.4.4.9 Vietnam Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.9.1 By Safety & Signalling System

7.4.4.9.2 By Rolling Stock

7.4.4.9.3 By Service Type

7.4.4.10 Taiwan Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.10.1 By Safety & Signalling System

7.4.4.10.2 By Rolling Stock

7.4.4.10.3 By Service Type

7.4.4.11 Rest of Asia Pacific Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.11.1 By Safety & Signalling System

7.4.4.11.2 By Rolling Stock

7.4.4.11.3 By Service Type

7.5 Middle East and Africa Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.5.1 By Safety & Signalling System

7.5.2 By Rolling Stock

7.5.3 By Service Type

7.5.4 By Country

7.5.4.1 Saudi Arabia Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.5.4.1.1 By Safety & Signalling System

7.5.4.1.2 By Rolling Stock

7.5.4.1.3 By Service Type

7.5.4.2 U.A.E. Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.5.4.2.1 By Safety & Signalling System

7.5.4.2.2 By Rolling Stock

7.5.4.2.3 By Service Type

7.5.4.3 Israel Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.5.4.3.1 By Safety & Signalling System

7.5.4.3.2 By Rolling Stock

7.5.4.3.3 By Service Type

7.5.4.4 South Africa Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.5.4.4.1 By Safety & Signalling System

7.5.4.4.2 By Rolling Stock

7.5.4.4.3 By Service Type

7.5.4.5 Rest of Middle East and Africa Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.5.4.5.1 By Safety & Signalling System

7.5.4.5.2 By Rolling Stock

7.5.4.5.2 By Service Type

7.6 Central and South America Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.7.1 By Safety & Signalling System

7.7.2 By Rolling Stock

7.7.3 By Service Type

7.7.4 By Country

7.7.4.1 Brazil Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.7.4.1.1 By Safety & Signalling System

7.7.4.1.2 By Rolling Stock

7.7.4.1.3 By Service Type

7.7.4.2 Argentina Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.7.4.2.1 By Safety & Signalling System

7.7.4.2.2 By Rolling Stock

7.7.4.2.3 By Service Type

7.7.4.3 Chile Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.7.4.3.1 By Safety & Signalling System

7.7.4.3.2 By Rolling Stock

7.7.4.3.3 By Service Type

7.7.4.4 Rest of Central and South America Smart Rail Market Estimates and Forecast, 2021-2029 (USD Billion)

7.7.4.4.1 By Safety & Signalling System

7.7.4.4.2 By Rolling Stock

7.7.4.4.3 By Service Type

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 Cisco Systems Inc.

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 ALE International

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 IBM Corporation

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Huawei Technologies Co. Ltd.

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Siemens AG

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 Hitachi Ltd.

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.7.4 Strategic Alliances between Business Partners

8.4.7 Tata Consultancy Services Ltd.

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Moxa Inc.

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Thales Group

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Televic Group

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Cyient Ltd.

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

8.4.12 Toshiba Corporation

8.4.12.1 Business Description & Financial Analysis

8.4.12.2 SWOT Analysis

8.4.12.3 Products & Services Offered

8.4.12.4 Strategic Alliances between Business Partners

8.4.13 Scomi Group Bhd

8.4.13.1 Business Description & Financial Analysis

8.4.13.2 SWOT Analysis

8.4.13.3 Products & Services Offered

8.4.13.4 Strategic Alliances between Business Partners

8.4.14 Woojin Industrial Systems Co. Ltd.

8.4.14.1 Business Description & Financial Analysis

8.4.14.2 SWOT Analysis

8.4.14.3 Products & Services Offered

8.4.14.4 Strategic Alliances between Business Partners

8.4.15 ABB Ltd.

8.4.15.1 Business Description & Financial Analysis

8.4.15.2 SWOT Analysis

8.4.15.3 Products & Services Offered

8.4.15.4 Strategic Alliances between Business Partners

8.4.16 Strukton

8.4.16.1 Business Description & Financial Analysis

8.4.16.2 SWOT Analysis

8.4.16.3 Products & Services Offered

8.4.16.4 Strategic Alliances between Business Partners

8.4.17 Legios

8.4.17.1 Business Description & Financial Analysis

8.4.17.2 SWOT Analysis

8.4.17.3 Products & Services Offered

8.4.17.4 Strategic Alliances between Business Partners

8.4.18 Deuta-Werke Gmbh

8.4.18.1 Business Description & Financial Analysis

8.4.18.2 SWOT Analysis

8.4.18.3 Products & Services Offered

8.4.18.4 Strategic Alliances between Business Partners

8.4.19 Calamp

8.4.19.1 Business Description & Financial Analysis

8.4.19.2 SWOT Analysis

8.4.19.3 Products & Services Offered

8.4.19.4 Strategic Alliances between Business Partners

8.4.20 American Equipment Company

8.4.20.1 Business Description & Financial Analysis

8.4.20.2 SWOT Analysis

8.4.20.3 Products & Services Offered

8.4.20.4 Strategic Alliances between Business Partners

8.4.21 Other Companies

8.4.21.1 Business Description & Financial Analysis

8.4.21.2 SWOT Analysis

8.4.21.3 Products & Services Offered

8.4.21.4 Strategic Alliances between Business Partners

9 RESEARCH OFFERINGOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

2 Positive Train Control (PTC) Market, By Region, 2021-2029 (USD Billion)

3 Communication/Computer-based Train Control (CBTC) Market, By Region, 2021-2029 (USD Billion)

4 Automated/Integrated Train Control (ATC) Market, By Region, 2021-2029 (USD Billion)

5 Global Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

6 Diesel Locomotive Market, By Region, 2021-2029 (USD Billion)

7 Electric Locomotive Market, By Region, 2021-2029 (USD Billion)

8 Subway/Metro Vehicle Market, By Region, 2021-2029 (USD Billion)

9 Light Rail/Tram Car Market, By Region, 2021-2029 (USD Billion)

10 DMU Market, By Region, 2021-2029 (USD Billion)

11 EMU Market, By Region, 2021-2029 (USD Billion)

12 Passenger Coach Market, By Region, 2021-2029 (USD Billion)

13 Freight Wagon Market, By Region, 2021-2029 (USD Billion)

14 Global Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

15 Passenger Mobility and Services Market, By Region, 2021-2029 (USD Billion)

16 Train Tracking and Monitoring Solutions Market, By Region, 2021-2029 (USD Billion)

17 Passenger Information System Market, By Region, 2021-2029 (USD Billion)

18 IP Video Surveillance Market, By Region, 2021-2029 (USD Billion)

19 Automated Fare Collection System Market, By Region, 2021-2029 (USD Billion)

20 Predictive Maintenance Market, By Region, 2021-2029 (USD Billion)

21 Freight Management System Market, By Region, 2021-2029 (USD Billion)

22 Others Market, By Region, 2021-2029 (USD Billion)

23 Regional Analysis, 2021-2029 (USD Billion)

24 North America Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

25 North America Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

26 North America Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

27 North America Smart Rail Market, By Country, 2021-2029 (USD Billion)

28 U.S. Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

29 U.S. Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

30 U.S. Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

31 Canada Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

32 Canada Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

33 Canada Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

34 Mexico Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

35 Mexico Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

36 Mexico Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

37 Europe Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

38 Europe Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

39 Europe Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

40 EUROPE Smart Rail Market, By Country, 2021-2029 (USD Billion)

41 Germany Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

42 Germany Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

43 Germany Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

44 U.K. Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

45 U.K. Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

46 U.K. Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

47 France Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

48 France Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

49 France Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

50 Italy Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

51 Italy Smart Rail Market, By Rolling Stock Type, 2021-2029 (USD Billion)

52 Italy Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

53 Spain Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

54 Spain Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

55 Spain Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

56 Netherland Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

57 Netherland Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

58 Netherland Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

59 Rest Of Europe Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

60 Rest Of Europe Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

61 Rest of Europe Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

62 Asia Pacific Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

63 Asia Pacific Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

64 Asia Pacific Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

65 Asia Pacific Smart Rail Market, By Country, 2021-2029 (USD Billion)

66 China Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

67 China Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

68 China Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

69 India Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

70 India Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

71 India Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

72 Japan Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

73 Japan Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

74 Japan Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

75 South Korea Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

76 South Korea Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

77 South Korea Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

78 Australia Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

79 Australia Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

80 Australia Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

81 Thailand Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

82 Thailand Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

83 Thailand Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

84 Vietnam Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

85 Vietnam Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

86 Vietnam Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

87 indonesia Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

88 indonesia Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

89 indonesia Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

90 Malaysia Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

91 Malaysia Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

92 Malaysia Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

93 Philippines Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

94 Philippines Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

95 Philippines Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

96 Singapore Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

97 Singapore Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

98 Singapore Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

99 Rest of APAC Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

100 Rest of APAC Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

101 Rest of APAC Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

102 Middle East and Africa Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

103 Middle East and Africa Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

104 Middle East and Africa Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

105 Middle East and Africa Smart Rail Market, By Country, 2021-2029 (USD Billion)

106 Saudi Arabia Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

107 Saudi Arabia Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

108 Saudi Arabia Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

109 UAE Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

110 UAE Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

111 UAE Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

112 South Africa Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

113 South Africa Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

114 South Africa Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

115 Israel Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

116 Israel Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

117 Israel Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

118 Rest of Middle East and Africa Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

119 Rest of Middle East and Africa Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

120 Rest of Middle East and Africa Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

121 Central and South America Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

122 Central and South America Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

123 Central and South America Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

124 Central and South America Smart Rail Market, By Country, 2021-2029 (USD Billion)

125 Brazil Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

126 Brazil Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

127 Brazil Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

128 Argentina Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

129 Argentina Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

130 Argentina Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

131 Chile Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

132 Chile Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

133 Chile Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

134 Rest of Central and South America Smart Rail Market, By Safety & Signalling System, 2021-2029 (USD Billion)

135 Rest of Central and South America Smart Rail Market, By Rolling Stock, 2021-2029 (USD Billion)

136 Rest of Central and South America Smart Rail Market, By Service Type, 2021-2029 (USD Billion)

137 Cisco Systems Inc.: Products & Services Offering

138 ALE International: Products & Services Offering

139 IBM Corporation: Products & Services Offering

140 Huawei Technologies Co. Ltd.: Products & Services Offering

141 Siemens AG: Products & Services Offering

142 HITACHI LTD.: Products & Services Offering

143 Tata Consultancy Services Ltd. : Products & Services Offering

144 Moxa Inc.: Products & Services Offering

145 Thales Group: Products & Services Offering

146 Televic Group: Products & Services Offering

147 Cyient Ltd.: Products & Services Offering

148 Toshiba Corporation: Products & Services Offering

149 Scomi Group Bhd: Products & Services Offering

150 Woojin Industrial Systems Co. Ltd.: Products & Services Offering

151 ABB Ltd.: Products & Services Offering

152 Strukton: Products & Services Offering

153 Legios: Products & Services Offering

154 Deuta-Werke Gmbh: Products & Services Offering

155 Calamp: Products & Services Offering

156 American Equipment Company: Products & Services Offering

157 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Smart Rail Market Overview

2 Global Smart Rail Market Value From 2021-2029 (USD Billion)

3 Global Smart Rail Market Share, By Safety & Signalling System (2023)

4 Global Smart Rail Market Share, By Rolling Stock (2023)

5 Global Smart Rail Market Share, By Service Type (2023)

6 Global Smart Rail Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Smart Rail Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Smart Rail Market

11 Impact Of Challenges On The Global Smart Rail Market

12 Porter’s Five Forces Analysis

13 Global Smart Rail Market: By Safety & Signalling System Scope Key Takeaways

14 Global Smart Rail Market, By Safety & Signalling System Segment: Revenue Growth Analysis

15 Positive Train Control (PTC) Market, By Region, 2021-2029 (USD Billion)

16 Communication/Computer-based Train Control (CBTC) Market, By Region, 2021-2029 (USD Billion)

17 Automated/Integrated Train Control (ATC) Market, By Region, 2021-2029 (USD Billion)

18 Global Smart Rail Market: By Rolling Stock Scope Key Takeaways

19 Global Smart Rail Market, By Rolling Stock Segment: Revenue Growth Analysis

20 Diesel Locomotive Market, By Region, 2021-2029 (USD Billion)

21 Electric Locomotive Market, By Region, 2021-2029 (USD Billion)

22 Subway/Metro Vehicle Market, By Region, 2021-2029 (USD Billion)

23 Light Rail/Tram Car Market, By Region, 2021-2029 (USD Billion)

24 DMU Market, By Region, 2021-2029 (USD Billion)

25 EMU Market, By Region, 2021-2029 (USD Billion)

26 Passenger Coach Market, By Region, 2021-2029 (USD Billion)

27 Freight Wagon Market, By Region, 2021-2029 (USD Billion)

28 Global Smart Rail Market: By Service Type Scope Key Takeaways

29 Global Smart Rail Market, By Service Type Segment: Revenue Growth Analysis

30 Passenger Mobility and Services Market, By Region, 2021-2029 (USD Billion)

31 Train Tracking and Monitoring Solutions Market, By Region, 2021-2029 (USD Billion)

32 Passenger Information System Market, By Region, 2021-2029 (USD Billion)

33 IP Video Surveillance Market, By Region, 2021-2029 (USD Billion)

34 Automated Fare Collection System Market, By Region, 2021-2029 (USD Billion)

35 Predictive Maintenance Market, By Region, 2021-2029 (USD Billion)

36 Freight Management System Market, By Region, 2021-2029 (USD Billion)

37 Others Market, By Region, 2021-2029 (USD Billion)

38 Regional Segment: Revenue Growth Analysis

39 Global Smart Rail Market: Regional Analysis

40 North America Smart Rail Market Overview

41 North America Smart Rail Market, By Safety & Signalling System

42 North America Smart Rail Market, By Rolling Stock

43 North America Smart Rail Market, By Service Type

44 North America Smart Rail Market, By Country

45 U.S. Smart Rail Market, By Safety & Signalling System

46 U.S. Smart Rail Market, By Rolling Stock

47 U.S. Smart Rail Market, By Service Type

48 Canada Smart Rail Market, By Safety & Signalling System

49 Canada Smart Rail Market, By Rolling Stock

50 Canada Smart Rail Market, By Service Type

51 Mexico Smart Rail Market, By Safety & Signalling System

52 Mexico Smart Rail Market, By Rolling Stock

53 Mexico Smart Rail Market, By Service Type

54 Four Quadrant Positioning Matrix

55 Company Market Share Analysis

56 Cisco Systems Inc.: Company Snapshot

57 Cisco Systems Inc.: SWOT Analysis

58 Cisco Systems Inc.: Geographic Presence

59 ALE International: Company Snapshot

60 ALE International: SWOT Analysis

61 ALE International: Geographic Presence

62 IBM Corporation: Company Snapshot

63 IBM Corporation: SWOT Analysis

64 IBM Corporation: Geographic Presence

65 Huawei Technologies Co. Ltd.: Company Snapshot

66 Huawei Technologies Co. Ltd.: Swot Analysis

67 Huawei Technologies Co. Ltd.: Geographic Presence

68 Siemens AG: Company Snapshot

69 Siemens AG: SWOT Analysis

70 Siemens AG: Geographic Presence

71 Hitachi Ltd.: Company Snapshot

72 Hitachi Ltd.: SWOT Analysis

73 Hitachi Ltd.: Geographic Presence

74 Tata Consultancy Services Ltd. : Company Snapshot

75 Tata Consultancy Services Ltd. : SWOT Analysis

76 Tata Consultancy Services Ltd. : Geographic Presence

77 Moxa Inc.: Company Snapshot

78 Moxa Inc.: SWOT Analysis

79 Moxa Inc.: Geographic Presence

80 Thales Group: Company Snapshot

81 Thales Group: SWOT Analysis

82 Thales Group: Geographic Presence

83 Televic Group: Company Snapshot

84 Televic Group: SWOT Analysis

85 Televic Group: Geographic Presence

86 Cyient Ltd.: Company Snapshot

87 Cyient Ltd.: SWOT Analysis

88 Cyient Ltd..: Geographic Presence

89 Toshiba Corporation: Company Snapshot

90 Toshiba Corporation: SWOT Analysis

91 Toshiba Corporation: Geographic Presence

92 Scomi Group Bhd: Company Snapshot

93 Scomi Group Bhd: SWOT Analysis

94 Scomi Group Bhd: Geographic Presence

95 Woojin Industrial Systems Co. Ltd.: Company Snapshot

96 Woojin Industrial Systems Co. Ltd.: SWOT Analysis

97 Woojin Industrial Systems Co. Ltd.: Geographic Presence

98 ABB Ltd.: Company Snapshot

99 ABB Ltd.: SWOT Analysis

100 ABB Ltd.: Geographic Presence

101 Strukton: Company Snapshot

102 Strukton: SWOT Analysis

103 Strukton: Geographic Presence

104 Legios: Company Snapshot

105 Legios: SWOT Analysis

106 Legios: Geographic Presence

107 Deuta-Werke Gmbh: Company Snapshot

108 Deuta-Werke Gmbh: SWOT Analysis

109 Deuta-Werke Gmbh: Geographic Presence

110 Calamp: Company Snapshot

111 Calamp: SWOT Analysis

112 Calamp: Geographic Presence

113 American Equipment Company: Company Snapshot

114 American Equipment Company: SWOT Analysis

115 American Equipment Company: Geographic Presence

116 Other Companies: Company Snapshot

117 Other Companies: SWOT Analysis

118 Other Companies: Geographic Presence

The Global Smart Rail Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Smart Rail Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS