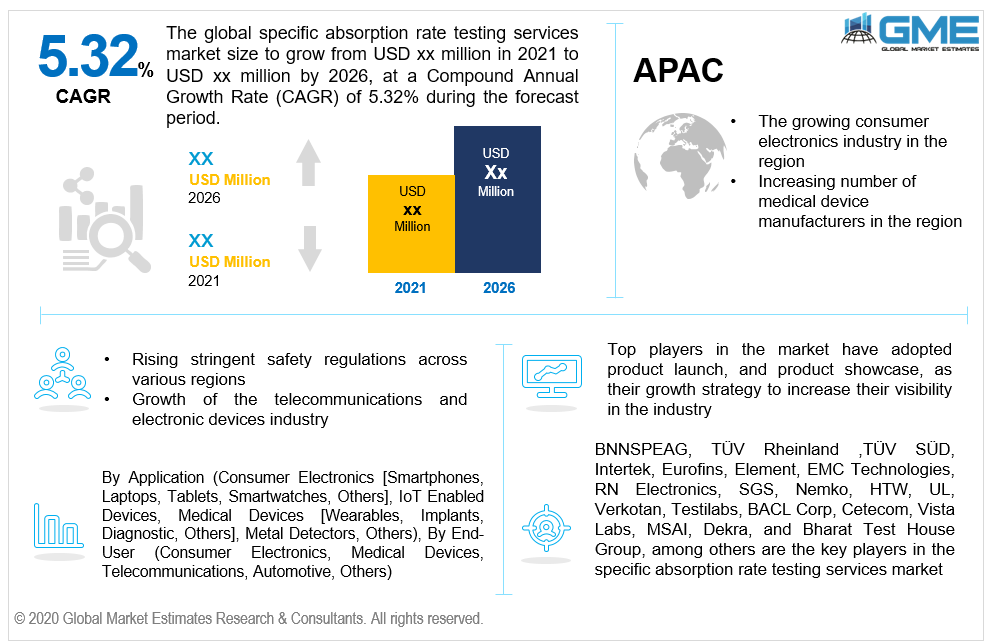

Global Specific Absorption Rate Testing Services Market Size, Trends & Analysis - Forecasts to 2026 By Application (Consumer Electronics [Smartphones, Laptops, Tablets, Smartwatches, Others], IoT Enabled Devices, Medical Devices [Wearables, Implants, Diagnostic, Others], Metal Detectors, Others), By End-User (Consumer Electronics, Medical Devices, Telecommunications, Automotive, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

The global specific absorption rate testing services market is projected to grow at a CAGR value of 5.32% during the forecast period [2021 to 2026]. Specific absorption rate testing (SAF) is carried out on all wireless devices which are mostly within twenty centimetres of distance from the human body. SAF is used to determine the amount of electromagnetic energy that is absorbed by the human tissue. This test is conducted to ensure that the electromagnetic energy absorbed is within the permissible range.

The specific absorption rate testing services market is driven by the increasing number of product launch strategies of products such as smartphones, tablets, laptops, and others in the consumer electronics sector.

Regulatory bodies across the globe have various regulations and norms with regard to permissible SAF levels for devices. Electronics manufacturers have to ensure that their devices meet the permissible criteria across various countries which have seen them outsource testing to laboratories. Hence, the market has been driven by the varying regulations for electronics devices across the globe.

In recent years, innovations in the medical devices industry have resulted in increased use of portable medical devices such as wearables, implants, and diagnostic devices. These devices are all scrutinized heavily by the regulatory bodies. The growing technological advancements to launch such innovative medical devices are expected to have a positive impact on the SAF testing services market during the forecast period.

Medical devices manufacturers are increasingly turning to outsource their testing requirements to meet regulatory standards. The growing trend of outsourcing safety testing is expected to further enhance the market for medical device SAF testing.

The rising adoption of 5G and 4G enabled devices are also expected to contribute to the growth of the market. The manufacturers have to test their devices at various stages to ensure that they can make the necessary changes before the product is launched. Hence, the growing number of smaller manufacturers who do not have the heavy capital investment and opt for in-house testing facilities are also expected to further increase the demand for the testing services during the forecast period. Furthermore, the automotive industry is introducing various technologies to improve safety features and location tracking devices which are also expected to have a positive impact on the market.

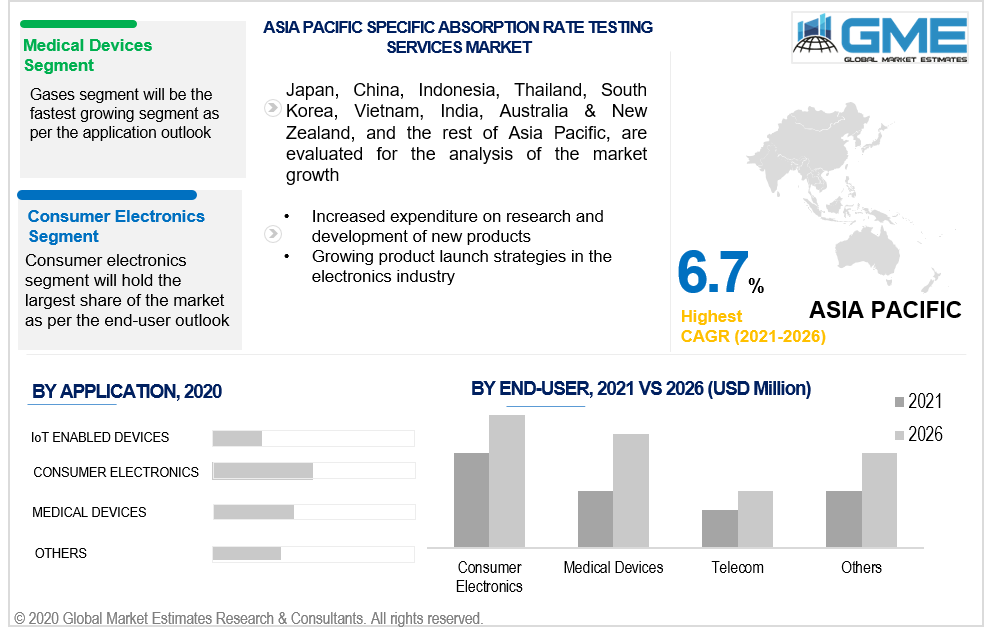

Based on the various applications, the market can be segmented into consumer electronics, IoT-enabled devices, medical devices, metal detectors, and others. The consumer electronics devices held the largest share of the market during the forecast period. Smartphone manufacturers release new models periodically, the launch and development of new products have been the major contributor to the dominance of the consumer electronics segment. Smartphones rely on various networks that are constantly receiving and emitting signals. The strong regulations placed on smartphones and other electronic device manufacturers have been also contributed to the growth of this segment.

The growing number of wearable and implant type medical devices are expected to culminate in the medical devices segment showcasing the fastest growth rates among all segments during the forecast period. Rising innovations in medical devices and growing demand for smartwatches are expected to be the major drivers of the medical devices segment.

Based on the end-users of specific absorption rate testing services, the market can be segmented as consumer electronics, medical devices, telecommunications, automotive, and others. The consumer electronics segment is envisaged to grasp the lion’s share of the market revenue. Consumer electronics like smartphones, laptops, tablets, and other devices have become increasingly demanding products in the market lately. The large demand for these products combined with the growing number of manufacturers of these devices in the market has contributed to the dominance of the consumer electronics segment.

The medical devices segment is expected to showcase the fastest growth rate among all segments. Growing innovations in the medical devices industry and stringent regulations are expected to be the major contributors to the growth of the medical devices segment. Rising dependency on outsourcing the SAR testing services by the large and medium-sized medical device manufacturers is also expected to have a positive impact on the segment.

Based on region, the market can be segmented into various regions such as North America, Europe, Central & South America, Middle East & Africa, and Asia Pacific regions. The North American region is expected to hold the largest share of the market as per revenue generated. The region has been the cradle of innovation for electronic devices in the last few decades. The region’s stringent regulations on safety have also been another factor for the continued dominance of the region. Medical device manufacturers in the region have been investing heavily in the research and development of new products in the region.

The growing medical device manufacturing industry in Europe has culminated in the European market holding the largest share of the revenue after North America.

The Asia Pacific region is envisaged to register the fastest growth rate compared to the other regions during the forecast period. The growing consumer electronics manufacturing industry, medical devices industry, and stricter regulations are all expected to be the major drivers of the Asia Pacific market during the forecast period.

BNNSPEAG, TÜV Rheinland ,TÜV SÜD, Intertek, Eurofins, Element, EMC Technologies, RN Electronics, SGS, Nemko, HTW, UL, Verkotan, Testilabs, BACL Corp, Cetecom, Vista Labs, MSAI, Dekra, and Bharat Test House Group, among others are the key players in the specific absorption rate testing services market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Specific Absorption Rate Testing Services Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Application Overview

2.1.3 End-User Overview

2.1.4 Regional Overview

Chapter 3 Specific Absorption Rate Testing Services Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing innovation in the medical devices industry

3.3.2 Industry Challenges

3.3.2.1 Heavy capital investment required for implementing SAR testing services

3.4 Prospective Growth Scenario

3.4.1 Application Growth Scenario

3.4.2 Technology Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Specific Absorption Rate Testing Services Market, By Application

4.1 Application Outlook

4.2 Consumer Electronics

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 IoT enabled Devices

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

4.4 Medical Devices

4.4.1 Market Size, By Region, 2020-2026 (USD Million)

4.5 Metal Detectors

4.5.1 Market Size, By Region, 2020-2026 (USD Million)

4.6 Others

4.6.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Specific Absorption Rate Testing Services Market, By End-User

5.1 End-User Outlook

5.2 Consumer Electronics

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Medical Device

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

5.4 Telecommunications

5.4.1 Market Size, By Region, 2020-2026 (USD Million)

5.5 Automotive

5.5.1 Market Size, By Region, 2020-2026 (USD Million)

5.6 Others

5.6.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Specific Absorption Rate Testing Services Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Million)

6.2.2 Market Size, By Application, 2020-2026 (USD Million)

6.2.3 Market Size, By End-User, 2020-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Application, 2020-2026 (USD Million)

6.2.4.2 Market Size, By End-User, 2020-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Application, 2020-2026 (USD Million)

6.2.5.2 Market Size, By End-User, 2020-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Million)

6.3.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.3 Market Size, By End-User, 2020-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Application, 2020-2026 (USD Million)

6.3.4.2 Market Size, By End-User, 2020-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Application, 2020-2026 (USD Million)

6.3.5.2 Market Size, By End-User, 2020-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Application, 2020-2026 (USD Million)

6.3.6.2 Market Size, By End-User, 2020-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Application, 2020-2026 (USD Million)

6.3.7.2 Market Size, By End-User, 2020-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Application, 2020-2026 (USD Million)

6.3.8.2 Market Size, By End-User, 2020-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Application, 2020-2026 (USD Million)

6.3.9.2 Market Size, By End-User, 2020-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Million)

6.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.4.3 Market Size, By End-User, 2020-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Application, 2020-2026 (USD Million)

6.4.4.2 Market Size, By End-User, 2020-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Application, 2020-2026 (USD Million)

6.4.5.2 Market Size, By End-User, 2020-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Application, 2020-2026 (USD Million)

6.4.6.2 Market Size, By End-User, 2020-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Application, 2020-2026 (USD Million)

6.4.7.2 Market size, By End-User, 2020-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Application, 2020-2026 (USD Million)

6.4.8.2 Market Size, By End-User, 2020-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Million)

6.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.5.3 Market Size, By End-User, 2020-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Application, 2020-2026 (USD Million)

6.5.4.2 Market Size, By End-User, 2020-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Application, 2020-2026 (USD Million)

6.5.5.2 Market Size, By End-User, 2020-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Application, 2020-2026 (USD Million)

6.5.6.2 Market Size, By End-User, 2020-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Million)

6.6.2 Market Size, By Application, 2020-2026 (USD Million)

6.6.3 Market Size, By End-User, 2020-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Application, 2020-2026 (USD Million)

6.6.4.2 Market Size, By End-User, 2020-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Application, 2020-2026 (USD Million)

6.6.5.2 Market Size, By End-User, 2020-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Application, 2020-2026 (USD Million)

6.6.6.2 Market Size, By End-User, 2020-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 BNNSPEAG

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 TÜV Rheinland

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 TÜV SÜD

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Intertek

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Eurofins

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Element

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 EMC Technologies

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 RN Electronics

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Other Companies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Specific Absorption Rate Testing Services Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Specific Absorption Rate Testing Services Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS