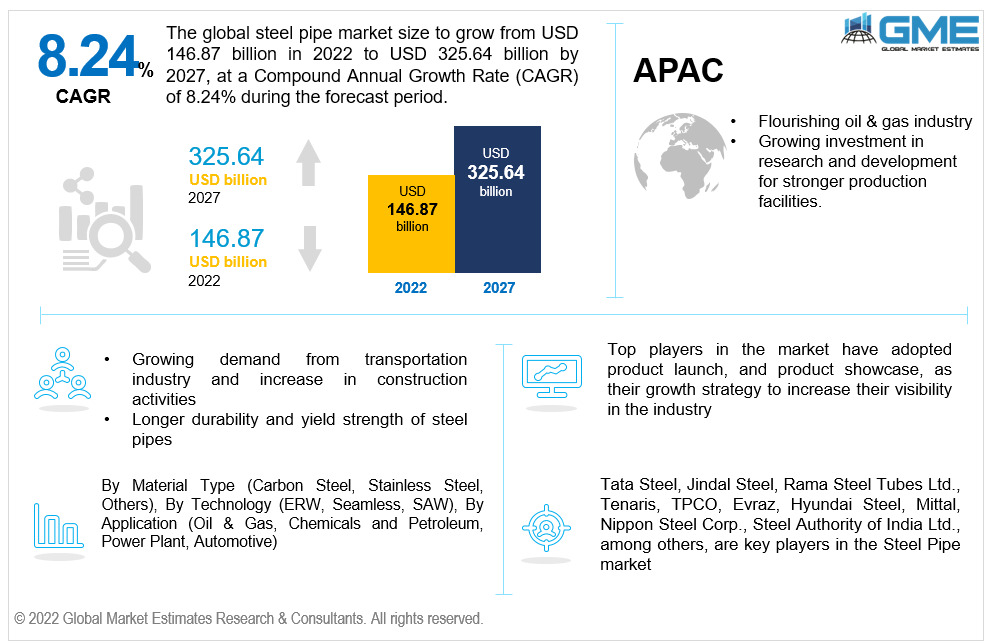

Global Steel Pipe Market Size, Trends & Analysis - Forecasts to 2027 By Material Type (Carbon Steel, Stainless Steel, Others), By Technology (ERW, Seamless, SAW), By Application (Oil & Gas, Chemicals and Petroleum, Power Plant, Automotive), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East & Africa), End-User Landscape Analysis, Company Market Share Analysis, and Competitor Analysis

The Global Steel Pipe Market is projected to grow from USD 146.87 billion in 2022 to USD 325.64 billion in 2027 at a CAGR of 8.24% from 2022 to 2027.

Steel pipes are used in various industries and infrastructural applications as cylindrical steel tubes. They are used widely for product formation and installation of equipment’s. The principal application of pipe is the subterranean transportation of liquids or gases such as oil, gas, and water. Carbon steel pipes are commonly employed in industrial operations that involve severe cold, intense heat, or the transmission of gases such as steam.

The major drivers of the global steel pipe market includes rising oil and gas demand, demand for steel pipes, across the globe, flourishing transportation industry and rising construction activities post pandemic. Growing investment in research and development for stronger production facilities is also one of the major factors to support the market growth.

The oil and gas sector record to have highest market share and revenue in the global steel pipe market. Most of the transfer of gas and liquid is done using steel pipes. They are often made from low alloy or carbon steel. Inside dimeter, ductility, yield strength, and pressure rating are all important aspects to consider when choosing pipes for certain purposes.

Some of the challenges of the market’s growth are installation of steel pipes, high installation cost and lack of availability of the right substitutes.

The COVID-19 pandemic hampered the growth of the global steel pipe market. Steel pipes and tubes are usually used in industries such as oil and gas, construction activities and petrochemical. The production stopped from 2020 to early 2021. As per GME’s secondary research analysis, various regions like Latin America, Europe and Asia-Pacific were affected in 2020 and are expected to go through the impact during the forecast period.

The steel pipe industry is extremely important and acts as one of the key factors in the infrastructure development. The pipes are used in household usage. During the pandemic, the global steel pipe industry did hit a stagnant stage. However, it picked up its pace post pandemic as most of the sites and petroleum manufacturing regions started lifting lockdown. The post pandemic’s rising demand for steel pipe will boost the market's growth opportunities between 2022 and 2027.

The on-going political tension between Russia and Ukraine shows evident impact on various sectors. Demand for the steel pipe market is hampered as well. The prices of steel have hit the highest range in Russia since January 2022. Both, Russia and Ukraine come under the major providers of steel and its raw materials. The blockage in their trade has hampered other nations and hence the global supply. The other European markets also witnessed high prices in the steel market. Costs of steel imports have inclined due to which domestic prices have raised. While Ukraine is a small market, Russia is one of the largest, so trade delays will have a significant impact. In both nations, the influence on the steel pipe sector is critical.

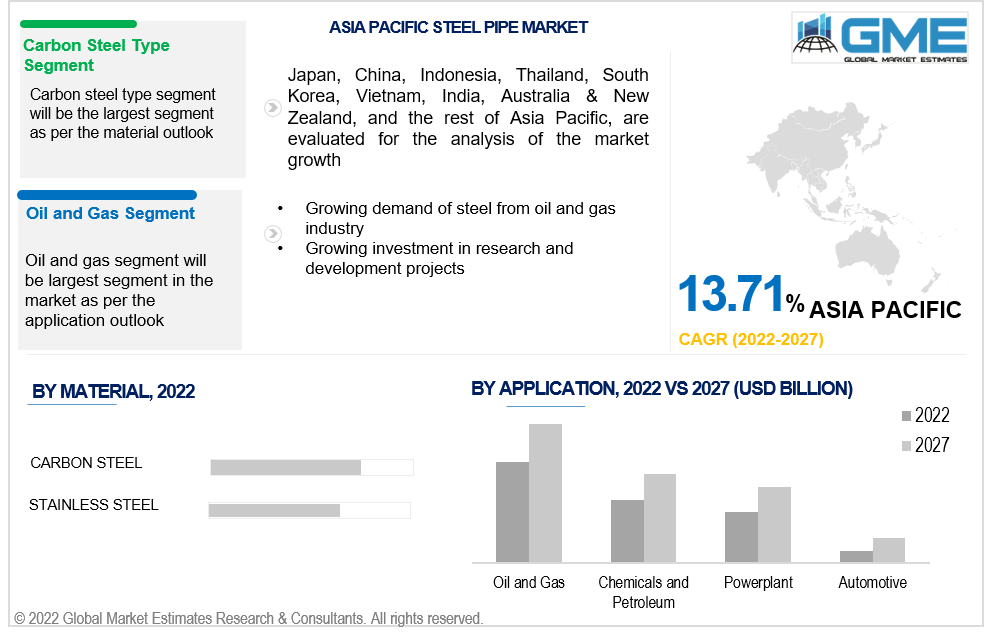

The carbon steel pipe segment is expected to have the largest share in the global steel pipe market during the forecast period of 2022-2027. Material types like iron and carbon are used for constructing steel alloy. This makes it long lasting material and is used for longer durability. Carbon steel pipe is employed in a range of heavy-duty sectors such as infrastructure, ships, distillers, and chemical fertiliser equipment due to its strength and capacity to endure stress.

Stainless steel is the fastest growing share in the global steel pipe market during 2022-2027. Stainless steel is a versatile material made up of a steel alloy and a trace of chromium- the inclusion of chromium improves the material's corrosion resistance.

Seamless steel pipes segment is expected to have the largest share in the global steel pipe market during the forecast period of 2022-2027. It is made from billets which are perforated and heated to form a tubular segment. This does not leave any seam welds which helps in installation.

ERW segment is expected to grow the fastest during 2022-2027. ERW pipes & tubes are gaining prominence in the market owing to their low prices and modest performance. Modern welding technologies, such as high-frequency welding, that are being increasingly integrated into the process of manufacturing ERW pipes & tubes act as a crucial factor supporting the segment growth..

The oil and gas sector is expected to witness the largest share in the global steel pipe market during the forecast period of 2022-2027. Due to diversified market conditions and increased demand industries with OCTG, this segment is expected to hold its dominant position throughout the forecast period.

The chemicals and petrochemicals segment is the fastest growing segment during 2022-2027. Steel pipes and tubes are being utilised tremendously in petrochemical facilities for process refining due to their corrosion and oxidation resistance. Furthermore, they can resist varied degrees of pressure.

Rapid industrialization and urbanisation, rising population, and expansion in manufacturing sectors, particularly in developing nations, are all predicted to boost the construction industry segment's growth.

North America has traditionally been a significant producer of oil and gas, and the country's oil reserves have risen to more than 76 billion barrels and natural gas reserves to 521 trillion cubic feet in 2021. Steel pipe demand in the United States has benefited from robust economic development, which has been fuelled by government-led fiscal stimulus, resulting in high corporate confidence. This led in an increase in oil and gas output as well as increased industry activity in the region.

United States is expected to have the largest share in the global steel pipe and tubes market during the forecast period of 2022-2027. In United States, the oil and gas sector has flourished exponentially. Further, the same product is used in upstream and downstream of crude oil processing. Furthermore, the steel pipe market in the Latin America have been leading and it is expected to rise throughout the forecast period too.

Asia-Pacific is expected to the fastest during 2022-2027. This is attributed to rising consumption volume. The majority of steel pipe providers want to expand in equipment’s market and hence manufacturers' supply chain management, increased transportation and trade has boosted market share in Asia-Pacific.

The markets in China, India, South Korea and Japan have become significant production centres due to strong development potential and their capacity to manufacture steel pipes and tubes.

The replacement of ageing pipelines in Europe is likely to rise rapidly in the next years. Due to expansion of oil and gas industries in the Middle East and Africa there has been increase in demand and market growth.

Tata Steel, Jindal Steel, Rama Steel Tubes Ltd., Tenaris, TPCO, Evraz, Hyundai Steel, Mittal, Nippon Steel Corp., Steel Authority of India Ltd., among others, are key pipe companies in the global market. The global steel pipe market has observed several strategic alliances between company to launch new products with added functionalities and maintain revenue share & profitability. Organic and inorganic growth strategies adopted by small players have been the highlight of this market. GME’s company profiles section will offer in-depth analysis for all the top players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Research Methodology

1.1 Research Assumptions

1.2 Research Methodology

1.2.1 Estimates and Forecast Timeline

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GME’s Internal Database

1.3.3 Primary Research

1.3.4 Secondary Sources & Third-Party Perspectives

1.3.4.1 Company Information Sources

1.3.4.2 Secondary Data Sources

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Data Visualization

1.6 Data Validation & Publishing

1.7 Market Model

1.7.1 Model Details

1.7.1.1 Top-Down Approach

1.7.1.2 Bottom-Up Approach

1.8 Market Segmentation & Scope

1.9 Market Definition

Chapter 2 Executive Summary

2.1. Global Market Outlook

2.2 Material Type Outlook

2.3 Application Outlook

2.4 Technology Outlook

2.5 Regional Outlook

Chapter 3 Global Steel Pipe Market Trend Analysis

3.1. Market Introduction

3.2 Penetration & Growth Prospect Mapping

3.3 Impact of COVID-19 on the Steel Pipe Market

3.4 Metric Data based on the industry

3.5 Market Dynamic Analysis

3.5.1 Market Driver Analysis

3.5.2 Market Restraint Analysis

3.5.3 Industry Challenges

3.5.4 Industry Opportunities

3.6 Porter’s Five Analysis

3.6.1 Supplier Power

3.6.2 Buyer Power

3.6.3 Substitution Threat

3.6.4 Threat from New Entrant

3.7 Market Entry Strategies

Chapter 4 Steel Pipe Market: Material Trend Analysis

4.1 Material: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

4.2 Carbon Steel Pipe

4.2.1 Market Estimates & Forecast Analysis of Carbon Steel Pipe Segment, By Region, 2019-2027 (USD Billion)

4.3 Stainless Steel Pipe

4.3.1 Market Estimates & Forecast Analysis of Stainless-Steel Pipe Segment, By Region, 2019-2027 (USD Billion)

4.4 Others

4.4.1 Market Estimates & Forecast Analysis of Others Segment, By Region, 2019-2027 (USD Billion)

Chapter 5 Steel Pipe Market: By Technology Trend Analysis

5.1 By Technology: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

5.2 ERW

5.2.1 Market Estimates & Forecast Analysis of ERW, By Region, 2019-2027 (USD Billion)

5.3 Seamless

5.3.1 Market Estimates & Forecast Analysis of Seamless Market Segment, By Region, 2019-2027 (USD Billion)

5.4 SAW

5.4.1 Market Estimates & Forecast Analysis of SAW Segment, By Region, 2019-2027 (USD Billion)

Chapter 6 Steel Pipe Market: Application Trend Analysis

6.1 Application: Historic Data vs. Forecast Data Analysis, 2022 vs. 2027

6.2 Oil and Gas

6.2.1 Market Estimates & Forecast Analysis of Oil and Gas Segment, By Region, 2019-2027 (USD Billion)

6.3 Chemicals and Petroleum

6.3.1 Market Estimates & Forecast Analysis of Chemicals and Petroleum Segment, By Region, 2019-2027 (USD Billion)

6.4 Powerplant

6.4.1 Market Estimates & Forecast Analysis of Powerplant Segment, By Region, 2019-2027 (USD Billion)

6.5 Automotive

6.5.1 Market Estimates & Forecast Analysis of Automotive Segment, By Region, 2019-2027 (USD Billion)

Chapter 7 Steel Pipe Market, By Region

7.1 Regional Outlook

7.2 North America

7.2.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.2.2 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.2.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.2.4 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.2.5.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.2.5.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.2.6.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.2.6.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.5.7 Mexico

7.5.5.1 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.5.5.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.5.5.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.3 Europe

7.3.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.3.2 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.3.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.3.4 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.3.5 Germany

7.3.5.1 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.3.5.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.3.5.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.3.6 UK

7.3.6.1 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.3.6.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.3.6.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.3.7 France

7.3.7.1 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.3.7.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.3.7.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.3.8 Russia

7.3.8.1 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.3.8.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.3.8.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.3.9.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.3.9.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.3.10.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.3.10.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.3.11 Rest of Europe

7.3.11.1 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.3.11.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.3.11.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.4.2 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.4.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.4.4 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.4.5 China

7.4.5.1 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.4.5.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.4.5.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.4.6 India

7.4.6.1 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.4.6.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.4.6.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.4.7.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.4.7.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.4.8.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.4.8.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.4.9.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.4.9.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.3.10 Rest of Asia Pacific

7.3.10.1 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.3.10.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.3.10.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.5 Central & South America

7.5.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.5.2 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.5.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.5.4 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.5.5.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.5.5.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.5.6 Rest of Central & South America

7.5.6.1 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.5.6.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.5.6.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.6 Middle East & Africa

7.6.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.6.2 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.6.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.6.4 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.6.5.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.6.5.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.6.6 United Arab Emirates

7.6.6.1 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.6.6.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.6.6.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.6.7 South Africa

7.6.7.1 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.6.7.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.6.7.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

7.5.8 Rest of Middle East & Africa

7.5.8.1 Market Estimates & Forecast Analysis, By Material, 2019-2027 (USD Billion)

7.5.8.2 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.5.8.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

Chapter 8 Competitive Analysis

8.1 Key Global Players, Recent Developments & their Impact on the Industry

8.2 Four Quadrant Competitor Positioning Matrix

8.2.1 Key Innovators

8.2.2 Market Leaders

8.2.3 Emerging Players

8.2.4 Market Challengers

8.3 Vendor Landscape Analysis

8.4 End-User Landscape Analysis

8.5 Company Market Share Analysis, 2021

Chapter 9 Company Profile Analysis

9.1 Tata Steel

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Strategic Initiatives

9.1.4 Product Benchmarking

9.2 JINDAL STEEL

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Initiatives

9.2.4 Product Benchmarking

9.3 Rama Steel Tube Ltd.

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Initiatives

9.3.4 Product Benchmarking

9.4 Tenaris

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Initiatives

9.4.4 Product Benchmarking

9.5 TPCO

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Initiatives

9.5.4 Product Benchmarking

9.6 Hyundai Steel

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Initiatives

9.6.4 Product Benchmarking

9.7 Mittal

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Initiatives

9.7.4 Product Benchmarking

9.8 NIPPON STEEL CORP.

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Initiatives

9.8.4 Product Benchmarking

9.9 Steel Authority of India Ltd.

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Initiatives

9.9.4 Product Benchmarking

9.10 Other Companies

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Initiatives

9.10.4 Product Benchmarking

List of Tables

1 Technological Advancements in Steel Pipe Market

2 Global Steel Pipe Market: Key Market Drivers

3 Global Steel Pipe Market: Key Market Challenges

4 Global Steel Pipe Market: Key Market Opportunities

5 Global Steel Pipe Market: Key Market Restraints

6 Global Steel Pipe Market Estimates & Forecast Analysis, 2019-2027 (USD Billion)

7 Global Steel Pipe Market, By Material, 2019-2027 (USD Billion)

8 Global Steel Pipe Market, By Application, 2019-2027 (USD Billion)

9 Global Steel Pipe Market, By Technology, 2019-2027 (USD Billion)

10 Regional Analysis: Global Steel Pipe Market, By Region, 2019-2027 (USD Billion)

11 North America: Steel Pipe Market, By Material, 2019-2027 (USD Billion)

12 North America: Steel Pipe Market, By Technology, 2019-2027 (USD Billion)

13 North America: Steel Pipe Market, By Application, 2019-2027 (USD Billion)

14 North America: Steel Pipe Market, By Country, 2019-2027 (USD Billion)

15 U.S: Steel Pipe Market, By Material, 2019-2027 (USD Billion)

16 U.S: Steel Pipe Market, By Technology, 2019-2027 (USD Billion)

17 U.S: Steel Pipe Market, By Application, 2019-2027 (USD Billion)

18 Canada: Steel Pipe Market, By Material, 2019-2027 (USD Billion)

19 Canada: Steel Pipe Market, By Technology, 2019-2027 (USD Billion)

20 Canada: Steel Pipe Market, By Application, 2019-2027 (USD Billion)

21 Mexico: Steel Pipe Market, By Material, 2019-2027 (USD Billion)

22 Mexico: Steel Pipe Market, By Technology, 2019-2027 (USD Billion)

23 Mexico: Steel Pipe Market, By Application, 2019-2027 (USD Billion)

24 Europe: Steel Pipe Market, By Material, 2019-2027 (USD Billion)

25 Europe: Steel Pipe Market, By Technology, 2019-2027 (USD Billion)

26 Europe: Steel Pipe Market, By Application, 2019-2027 (USD Billion)

27 Europe: Steel Pipe Market, By Country, 2019-2027 (USD Billion)

28 Germany: Steel Pipe Market, By Material, 2019-2027 (USD Billion)

29 Germany: Steel Pipe Market, By Technology, 2019-2027 (USD Billion)

30 Germany: Steel Pipe Market, By Application, 2019-2027 (USD Billion)

31 UK: Steel Pipe Market, By Material, 2019-2027 (USD Billion)

32 UK: Steel Pipe Market, By Technology, 2019-2027 (USD Billion)

33 UK: Steel Pipe Market, By Application, 2019-2027 (USD Billion)

34 France: Steel Pipe Market, By Material, 2019-2027 (USD Billion)

35 France: Steel Pipe Market, By Technology, 2019-2027 (USD Billion)

36 France: Steel Pipe Market, By Application, 2019-2027 (USD Billion)

37 Italy: Steel Pipe Market, By Material, 2019-2027 (USD Billion)

38 Italy: Steel Pipe Market, By Technology, 2019-2027 (USD Billion)

39 Italy: Steel Pipe Market, By Application, 2019-2027 (USD Billion)

40 Spain: Steel Pipe Market, By Material, 2019-2027 (USD Billion)

41 Spain: Steel Pipe Market, By Technology, 2019-2027 (USD Billion)

42 Spain: Steel Pipe Market, By Application, 2019-2027 (USD Billion)

43 Rest Of Europe: Steel Pipe Market, By Material, 2019-2027 (USD Billion)

44 Rest Of Europe: Steel Pipe Market, By Technology, 2019-2027 (USD Billion)

45 Rest Of Europe: Steel Pipe Market, By Application, 2019-2027 (USD Billion)

46 Asia Pacific: Steel Pipe Market, By Material, 2019-2027 (USD Billion)

47 Asia Pacific: Steel Pipe Market, By Technology, 2019-2027 (USD Billion)

48 Asia Pacific: Steel Pipe Market, By Application, 2019-2027 (USD Billion)

49 Asia Pacific: Steel Pipe Market, By Country, 2019-2027 (USD Billion)

50 China: Steel Pipe Market, By Material, 2019-2027 (USD Billion)

51 China: Steel Pipe Market, By Technology, 2019-2027 (USD Billion)

52 China: Steel Pipe Market, By Application, 2019-2027 (USD Billion)

53 India: Steel Pipe Market, By Material, 2019-2027 (USD Billion)

54 India: Steel Pipe Market, By Technology, 2019-2027 (USD Billion)

55 India: Steel Pipe Market, By Application, 2019-2027 (USD Billion)

56 Japan: Steel Pipe Market, By Material, 2019-2027 (USD Billion)

57 Japan: Steel Pipe Market, By Technology, 2019-2027 (USD Billion)

58 Japan: Steel Pipe Market, By Application, 2019-2027 (USD Billion)

59 South Korea: Steel Pipe Market, By Material, 2019-2027 (USD Billion)

60 South Korea: Steel Pipe Market, By Technology, 2019-2027 (USD Billion)

61 South Korea: Steel Pipe Market, By Application, 2019-2027 (USD Billion)

62 Middle East & Africa: Steel Pipe Market, By Material, 2019-2027 (USD Billion)

63 Middle East & Africa: Steel Pipe Market, By Technology, 2019-2027 (USD Billion)

64 Middle East & Africa: Steel Pipe Market, By Application, 2019-2027 (USD Billion)

65 Middle East & Africa: Steel Pipe Market, By Country, 2019-2027 (USD Billion)

66 Saudi Arabia: Steel Pipe Market, By Material, 2019-2027 (USD Billion)

67 Saudi Arabia: Steel Pipe Market, By Technology, 2019-2027 (USD Billion)

68 Saudi Arabia: Steel Pipe Market, By Application, 2019-2027 (USD Billion)

69 UAE: Steel Pipe Market, By Material, 2019-2027 (USD Billion)

70 UAE: Steel Pipe Market, By Technology, 2019-2027 (USD Billion)

71 UAE: Steel Pipe Market, By Application, 2019-2027 (USD Billion)

72 Central & South America: Steel Pipe Market, By Material, 2019-2027 (USD Billion)

73 Central & South America: Steel Pipe Market, By Technology, 2019-2027 (USD Billion)

74 Central & South America: Steel Pipe Market, By Application, 2019-2027 (USD Billion)

75 Central & South America: Steel Pipe Market, By Country, 2019-2027 (USD Billion)

76 Brazil: Steel Pipe Market, By Material, 2019-2027 (USD Billion)

77 Brazil: Steel Pipe Market, By Technology, 2019-2027 (USD Billion)

78 Brazil: Steel Pipe Market, By Application, 2019-2027 (USD Billion)

79 Tata Steel: Products Offered

80 JINDAL STEEL: Products Offered

81 Rama Steel Tube Ltd.: Products Offered

82 Tenaris: Products Offered

83 TPCO: Products Offered

84 Hyundai Steel: Products Offered

85 Mittal: Products Offered

86 NIPPON STEEL CORP.: Products Offered

87 Steel Authority of India Ltd.: Products Offered

88 Other Companies: Products Offered

List of Figures

1. Global Steel Pipe Market Segmentation & Research Scope

2. Primary Research Partners and Local Informers

3. Primary Research Process

4. Primary Research Approaches

5. Primary Research Responses

6. Global Steel Pipe Market: Penetration & Growth Prospect Mapping

7. Global Steel Pipe Market: Value Chain Analysis

8. Global Steel Pipe Market Drivers

9. Global Steel Pipe Market Restraints

10. Global Steel Pipe Market Opportunities

11. Global Steel Pipe Market Challenges

12. Key Steel Pipe Market Manufacturer Analysis

13. Global Steel Pipe Market: Porter’s Five Forces Analysis

14. PESTLE Analysis & Impact Analysis

15. Tata Steel: Company Snapshot

16. Tata Steel: SWOT Analysis

17. JINDAL STEEL: Company Snapshot

18. JINDAL STEEL: SWOT Analysis

19. Rama Steel Tube Ltd.: Company Snapshot

20. Rama Steel Tube Ltd.: SWOT Analysis

21. Tenaris: Company Snapshot

22. Tenaris: SWOT Analysis

23. TPCO: Company Snapshot

24. TPCO: SWOT Analysis

25. Hyundai Steel: Company Snapshot

26. Hyundai Steel: SWOT Analysis

27. Mittal: Company Snapshot

28. Mittal: SWOT Analysis

29. NIPPON STEEL CORP.: Company Snapshot

30. NIPPON STEEL CORP.: SWOT Analysis

31. Steel Authority of India Ltd.: Company Snapshot

32. Steel Authority of India Ltd.: SWOT Analysis

33. Other Companies: Company Snapshot

34. Other Companies: SWOT Analysis

The Global Steel Pipe Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Steel Pipe Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS